Democracy and capitalism have been struggling with each other for some time. Wouldn’t it be possible to invent a new, digitally upgraded kind of capitalism that is aligned with the values and foundations of democracies? How would such a capitalism look like? What would be its elements? In this connection, I will discuss the monetary, financial, and taxation system. I will also propose investment premiums, to allow for bottom-up projects. Last but not least, I will introduce a socio-ecological finance system, which would combine measurements of environmental impacts with new incentive systems. What I have in mind is a multi-dimensional real-time feedback system, which would allow one to manage complex systems more successfully, or even enable revolutionary self-organizing and self-regulating systems.

13.1 The Failing Financial System

In 2007/08, a shot was heard around the world. A real estate crisis in the USA had triggered a financial and banking crisis,1 which eventually turned into a world-wide economic and political crisis. More than 12 years later, we can still hear the echo of these events. Even worse, the crisis has not been resolved. Now, there are many countries with debt levels of the order of 100% of the Gross Domestic Product (GDP) or even higher.2

In order to allow countries to pay at least the interest rates on their debt, the central banks had to reduce them to almost zero. There have been even negative interest rates,3 such that those who make debts will have to pay less money back. This sounds like paradise, but an economy cannot work like this for long. It will not anymore reward the companies, which do a good job and perform well. Instead, it will reward business models that do not work. In many cases, these would even harm our planet.

Such developments did not come as a surprise. As interest rates for debts have been higher than interest rates for savings, debts increased more quickly over time. To compensate for this, new money had to be created, which—in the fiat currency system4 of today—happens literally at the push of a button. As the volume of money increases while the material resources on this planet are limited, products and services tend to become ever more expensive. The more money exists in the system, the lower becomes the value of the money in the savings account. This phenomenon is called inflation,5 and it requires us to work against it. As a consequence, economic growth is needed, but it makes the world economy less and less sustainable. It drives our planet closer and closer to an „abyss”, where the current financial system will ultimately fail.

There are at least three factors, which make things worse. First, the dollar is currently a „petrodollar”.6 It is not backed by gold, but by oil. Hence, when new money is created, new oil has to be extracted and consumed, which will eventually turn into CO2 and potentially add to climate change. Hence, the current monetary system makes a major contribution to the so-called “climate emergency” that we are now faced with.

Second, the dollar is the world’s lead currency,7 so that all the other countries have to buy dollars in order to buy certain kinds of goods (such as oil). Therefore, all countries that bought dollars contributed to the so-called “climate emergency,” even if they did not raise CO2 levels themselves.

Moreover, the lead currency system put the USA in a privileged position. They could import much more than they exported, and automatically enjoyed a higher standard of living. They could also spend more money on arms. In fact, for a long time the US military spending of the USA was as high as the military spending of all other countries on this planet together8 (according to other sources, that applies to the USA and China together9). This circumstance made the USA the “world police” and global superpower. The power was needed to keep and expand the privileged position, and it resulted in many wars.

Third, some central banks are private in part.10 This means that, when a country makes debts at the central bank, a few private individuals will make incredible amounts of money. Money creation works to their benefit, while tax payers will have to pay many years for the billions lent, maybe many generations.

The private “share-holders” of (central) banks are interested in a permanent increase of the debt level, because this generates new money for them. But their private interest is not aligned with public interest. If they want to get money, it is important that the government needs money, i.e. the situation in the country must be sufficiently bad. In fact, over the years the situation became so bad that it was claimed “quantitative easing”11 was needed to keep the economy afloat, thereby, channeling trillions of public property (such as government bonds12) into private hands. Some would say, with raising debt levels, companies, countries, and indebted people were increasingly “owned” by a small banking elite.

It is hard to imagine how much wealth and power could be accumulated in this way over hundred years or more. However, no matter whether you believe in private shareholders of central banks and in the above money creation mechanism or not, it is certainly correct to say that banks control the world to a much larger extent than most people know. But how much longer would this system work?

In the end of 2019, the REPO markets got in trouble.13 Apparently, some banks did not trust each other anymore, and they did not lend each other money as they used to. The central banks had to jump in.14 In 2020, they created insane amounts of new money.15 Market indicators reached levels comparable to those before the financial crisis back in 2007/08.16 The oil market, too, became unstable. Shortly, oil prices even dropped below zero.17 It became increasingly clear that the financial system was about to fail again, and there was no possibility to save it this time, given the accumulated levels of public debts. An entirely new system would be needed.

The Chinese Credit Score system could potentially have replaced this monetary system. It would certainly be possible to run an economy on its basis. Say, there were a hundred thousand cars produced. Who would get one? The principle could be “just (virtually) raise your hand (on an Internet platform)”, and we will give cars to those with the highest Credit Scores, until we run out of cars. In other words, if you had a high Credit Score, you would get all sorts of goods and services—basically everything you wish. If you had a lower score, you would get some goods and services, but if you had a low Credit Score, you would have to live with what is left over. This is, what we call triage: some people would be “chosen” and some of them would be tolerated (they may be lucky sometimes), but some people would be doomed. There would possibly be a certain score below which one could not survive.

The Chinese Credit Score is largely behavior-based. He or she who does exactly what the government demands may hope to become a “chosen one” some day. However, as this is a neo-feudal pyramidal concept, there would not be a lot of them.

It is clear that the Chinese Credit Score is more a control system than a reward system. And it would be even more so, when the production capacity of the system was re-adjusted to meet sustainability goals.18 This would mean to reduce production by one third (at least). You can imagine that a lot of people would then be doomed, and the Citizen Score could very well decide about life and death. Given this perspective, it is high time to think about an alternative, fair monetary and economic system, which would work for all of us, or at least for most of us, and which would also make the planet more sustainable.

13.2 Democratic Capitalism

In the past, our society was run by several different operating systems: One was culture, one was law, and one was capitalism. Now, we have also algorithms (“code is law”).19 Unfortunately, these operating systems are not only mutually inconsistent many times—they are also often contradictory. It is therefore expected that these systems would not coexist for long. They would potentially interfere with and damage each other. Eventually, one of them may dominate or even destroy all others, and it may not necessarily be consistent with the legitimate foundation of our society: the constitution.

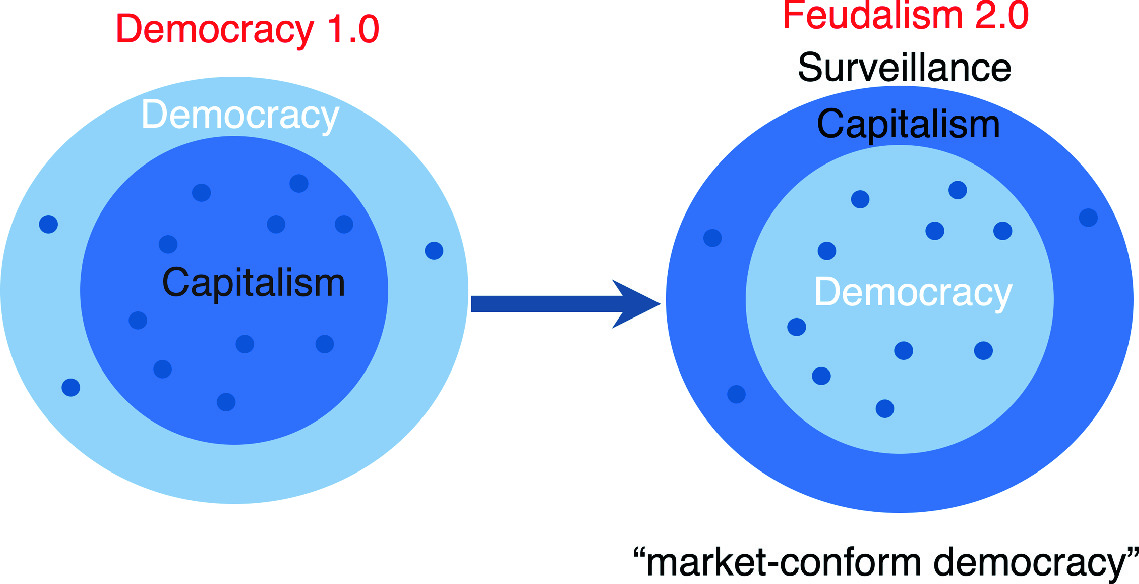

In many countries, the digital revolution has silently transformed democracies into a new kind of system that is often called “Surveillance Capitalism” (“Feudalism 2.0”)

With the invention and spread of “Surveillance Capitalism”,20 digital technology became ubiquitous, as is illustrated on the right of Fig. 13.1. Surveillance Capitalism was not restricted to new business models, products and services. It invaded our jobs, our consumption, our leisure time, our private homes, our friendship network, our thinking and our believes. It re-organized everything according to the principle of profit maximization, influence, or power (which are often largely aligned).

Utility maximization21 took over. Basically, everything got a price tag, and human dignity was lost on the way. Democracy was hollowed out, and turned into a subroutine. Surveillance Capitalism became the new framework of society. A silent coup had happened. Most people had not noticed the coup, as it was gradual and slow. Politicians and courts were late—and basically let it happen. Democracy became increasingly an illusionary façade. Human rights were in retreat, as they did not produce profits in obvious ways. As they were not represented by numbers, optimization routines ignored them. Given this, it was no wonder that hate speech and conflict took over.

Such a collapse of a once thriving society should not surprise us. One should have demanded from the very beginning that algorithms follow a “Design for Values” approach.22 Constitutional and cultural values should have been built into the algorithms behind the platforms organizing our lives—those that were used in business, financial markets, social media etc. Then, a conflict between the different societal operating systems would have been avoided, and damage of the constitutional operating system underlying democracies would have been prevented. It did not have to happen.

It happened, nevertheless, because some people did not want to care about environment, people, and values, if it would reduce their profit. And so, the digital revolution undermined the constitution. It cannot be denied that disruptive innovators have tried to replace our previous societal operating system by another, digital one, and that they usually did not care much about democratic legitimacy.

In the meantime, we have seen where this can end. Some countries have implemented totalitarian police states, based on mass surveillance, behavioral control, censorship and propaganda. Moreover, the underlying algorithms can be easily transferred to other countries. As time passes, it becomes increasingly clear that similar principles are taking over in Western democracies as well. Sometimes, these principles are operated in grey zones, so most of the time, we do not know who is pulling the (digital) strings. Clearly, there is a lack of transparency.

a better tax system,

participatory steering boards,

an information ecosystem,

participatory budgeting,

universal basic income,

investment premiums,

asset-backed money, and

a socio-ecological finance system.

13.3 A Better Tax System

We are entering an age of Artificial Intelligence, where intelligent computer programs and robots increasingly do our work.23 However, while we have to pay massive income taxes, robots are getting away for free. This is not fair, and it cannot work for societies in the long run. It is a serious discrimination of humans, many of whom may get unemployed and then be considered a burden of the social insurance system. Moreover, they would probably have to be alimented by fewer and fewer people. It is likely that the social insurance system would break down at some point in time.

However, what would replace income taxes? Besides value added tax (VAT), there would be transaction fees (for financial transactions at stock markets). If more money were needed, one could also tax the storage and transaction of information. This would certainly lead to more environment-friendly IT business models. The current approach is not sustainable at all. The electricity share spent on digital technology is growing exponentially. A short time ago, it amounted to 3% of the overall energy consumption, but by the year 2030, the percentage is expected to be above 20%.24

if there was no inflation,

if we did not have to pay interest rates on government debts,

if we would not have to spend a lot of money on defense,

if the tax system would be simple and effective,

if administration would be digital and slim.

In such a system, the taxation level would drop dramatically. In fact, if we managed to establish world peace, military spending would drop and prosperity levels would raise significantly. A Tobin tax25 on financial transactions is already being discussed for a long time, and in some European countries, it seems to be on the way.26 When the next financial crises looms, a reset of the financial system would be unavoidable. Debts would have to be forgiven. And a simplification of administration would be surely possible, if we had a new social contract, including basic income.

13.4 Universal Basic Income

With the next wave of automation, based on robots and AI, many expect dramatic changes in the job market. Some even expect mass unemployment. This is often framed as dystopia. However, it could also be a chance to liberate humanity. Robots could do dirty, dull and dangerous work for us, and provide us with the basic goods and resources needed for our every-day life. This would allow humans to focus on social, environmental and cultural issues.

Many have proposed basic income as a means to take away the existential threats connected with the digital age. To some extent, it would be the “helicopter money” that the central banks have been talking about so many times, but never had the courage to introduce. Everyone would get it, so these payments would not have to be administered and approved.

The benefit for producers would be that there would be stable and predictable consumption patterns, while mass unemployment would mean serious recessions and bankruptcies of many companies.

The benefit for workers would be that they would have their backs free to re-orient and educate themselves for the new jobs of the digital age.

The benefit for politicians would be that the social situation would be stable, while mass unemployment would trigger protests and unrests, perhaps even a revolution.

Of course, a flat income structure would be somewhat like communism, which is known to work badly for people. For an innovative and thriving economy, incentive systems are needed. Hence, while the universal basic income would be just enough to cover food, shelter, and basic needs, a job would add income for a comfortable life. For sure, there would be well-paid jobs for specialists, but ordinary people would like to contribute to society as well. So, how can this be organized?

13.5 From Participatory Budgeting to Crowd Funding for All

For some time already, various cities have been experimenting with participatory budgeting,28 which apparently was a response to the financial crisis. In these cities, citizens take part in the decision process how to spend tax payers’ money. The most well-known example is perhaps the city of Barcelona.29 Over there, with more than 600 citizen-based proposals, experiences with participatory budgeting have been quite positive. Accordingly, other cities have started to copy this approach. The innovative measure has increased collective action, the effectiveness of public spending, transparency, and trust. It helps people to perceive the city to be “their city”, which comes with identity, care, and commitment.

However, we could even go a step further, by allowing citizens to run their own projects. This would have at least two benefits: First of all, citizens could locally contribute to the improvement of their city quarter and living conditions, in places, which political attention and economic investments did not reach. Second, citizens could earn some money for the projects they are running and engaging in.

It is important to realize that the capacity of any centralized structure is limited. Neither politics nor bosses of companies nor the military knows the exact local living conditions everywhere—and even less so can they take locally fitting action everywhere. Accordingly, in a country, there are lots of “forgotten places”, which could be best upgraded by locals, if they had access to the necessary means.

“Guerilla Gardening”,30 i.e. the distribution of seeds of colorful plants in public spaces, is a little example showing how easy it can sometimes be to turn a depressing city landscape into a colorful paradise.

As described in the chapter on Digital Democracy, it does not have to stay there. Hackathons, Make City Festivals, and Urban Source Urbanism have taken things big steps forward. Why shouldn’t it be possible to lift this to a professional level?

In the future, I imagine that people would engage in economic, social, environmental, and cultural projects. In some of these projects, they would take a coordinating role, in others they would contribute. Digital assistants,31 using augmented reality and other digital technologies, would provide supportive tools for organizing such projects (from recruiting project staff over budget planning and organization to detailed instructions for a state-of-the-art implementation). In this way, citizen-based projects could be run on a professional or semi-professional level. Of course, it is conceivable to include experts with a special education and city representatives as well, to achieve high standards and a coordination with other projects.

The citizen-run projects would be financed by means of crowdfunding.32 If there was just enough money for crowd funding, in perspective one could even imagine to build a sports arena or develop a new medical drug using community-based funding.

So, here is the idea: What if everyone got a special budget every month, which would be reserved for crowd funding. Such an “investment premium”33 would allow ordinary people to chip money into local projects that they consider important. This could be official projects or citizen-run projects. People could donate their investment premiums (or parts of them) to whatever seems to be good economic, social, environmental or cultural engagements. Projects that manage to attract enough money for their realization would go forward. Other projects, which lack maturity or popularity, would be dropped. The competition for funding should make sure that primarily high-quality projects would be realized.

13.6 A New Monetary System

How should we pay for all of this? In principle, in the same way as in the past: Let money work! However, in the future, it should work for everyone, not just for a few people or private entities. For this, we should have the equality principle in place. Everyone should have the same fair chance to benefit from the money system. In other words, we should democratize capitalism. Then, it would probably work much better for the world.

- 1.

all money would be gold-or asset-backed,

- 2.

all money would be property of The People,

- 3.

one would pay a regular basic income for everyone,

- 4.

one would pay a regular investment premium to enable “crowd funding” for all,

- 5.

the basic income, investment premium and fundamental public services would be paid from a flat tax (VAT), transaction fees, a proper inheritance tax, and, if necessary, a flat tax on company revenues. Then, we would have a circular flow of money.

Should all of this not be enough, one could think about creating money with a time stamp. This would allow one to introduce “artificial ageing” of money. In other words, such money would be most valuable when handed out, but it would lose its value exponentially over time. However, the same amount of money that would be lost in this way would be newly generated for the payment of basic income and investment premiums.

In a sense, such a system would infuse fresh money at the bottom of society, on everyone’s bank account. By spending it, it would “evaporate” and rise to the top. Today’s money system instead creates money on the top and claims to benefit everyone through a “trickle-down effect”.34 Unfortunately, the trickle-down effect does not work well, as the growing inequality shows. Therefore, money concentrates in less and less hands, which eventually makes the monetary system dysfunctional (as one immediately understands by imagining that, one day in the future, all money would be in the hands of one person or company—as we know it from the game of “Monopoly”35).

In principle, it should not be too difficult to create a system that works for the environment and us. “Vested interests” seem to be the main obstacle, i.e. the people who profit over-proportionally from today’s system and do not want to give up their exceptional wealth, power and privileges. But are “vested interests” really legitimate in times of “over-population”, where millions or even billions of lives are at stake? I don’t think so.

From an ethical point of view, it is not acceptable to sacrifice one life for another one, not even for two or more. Mathematically, this means that the value of a life is considered to be infinite. It cannot be bought for money. That would be immoral.

From an insurance point of view, the value of a “statistical life”36 is not infinite, but it is officially still of the order of several million dollars, at least in various industrialized countries.37 From a capitalistic point of view, the value of a billionaire would correspond to the lives of about 150 ordinary people. So, why are we paying so much attention to what billionaires want, when having to solve the existential problems of this planet? We should just do the right thing! Otherwise we would all be responsible for the deaths of millions or even billions of people. Who could take such responsibility?

13.7 Participatory Steering Boards

An economic system, where companies could largely do what they wanted and where profit maximization and competition were driving the economy into an unsustainable state.

A system, in which over-consumption was encouraged, as it increased the main performance indicator “Gross Domestic Product per capita” (GDP per person).

A system, in which non-sustainable business models were exported to developing countries in the context of “globalization”.

A system, in which the maximization of profit and power got more attention than solving existential problems, particularly if this did not translate into highly profitable business models.

A system, in which one could earn more money on harm, wars and disasters than on avoiding them.

A system, which was largely built on the exploitation of others and the environment.

It would not have to be this way. For example, China has decided to introduce a measurement-based company score,38 which would reflect to what extent a company meets the expectations of the government. If the value would be too low, a company could simply be closed down.

Perhaps, less drastic measures would be effective as well. Assume, for example, that companies would be judged, to what extent they contribute to achieving societal goals (not just economic, but also environmental, social, and cultural ones). Based on this, the one third best performing companies would get a large reduction in taxation, the next 33% quantile would benefit from a moderate reduction, and the remaining 33% would get no reduction in taxation. This would be a more liberal way of guiding economic activities towards satisfying the needs of humanity and the planet.

There is also a participatory, democratic approach. Specifically, I would like to argue for steering boards of companies and institutions that are composed not only of managers, but also of representatives of various groups that bring in views of people who are affected by their decisions. In other words, the steering boards should contain representatives of owners and shareholders, but also of workers, suppliers, customers, users or patients, and of local citizens as well. People representing environmental and ethical issues should be included, too. If every company would (have to) do this, products and services would fit consumer interests better, supply chains would be improved, and the environmental footprint reduced.

Would it really work? The answer is: Yes! The company Caterpillar, for example, has experimented with the above participatory approach.39 In this way, it managed to increase not only customer satisfaction and the approval of the citizens, but also the company’s revenues.

The question is: Why is it working so well? In a sense, the answer is “collective intelligence”. By adding representatives of other affected groups, the overall business approach becomes better adjusted to the various expectations and needs. Interfaces are created with other businesses and institutions, and with citizens and the environment. In this way, the activities of different companies and institutions become more coordinated, integrated, context-sensitive and balanced.

Note that a very similar approach has been successfully applied to the self-control of traffic lights.40 This produces astonishing performance gains, if local traffic flow optimization is combined with a coordination between neighboring intersections.41

Bringing the needs of all beings into a sustainable balance may be less difficult than one may think. To allow it to happen, one needs to give sufficient weight to the needs of others. In fact, game-theoretical studies have shown that giving a 40–50% weight to the utility of others will establish a high level of cooperation42 in many social dilemma situations, in which otherwise a “tragedy of the commons”43 would result. Such an approach can dramatically increase the expected success or, as game theorists would say, the “average payoff”.44 It does so by weighting different goals in a fair way, thereby getting different interests aligned. This is actually the reason why the principle “Love your neighbor as yourself” is so incredibly powerful.

The above principle could be the basis of a thriving, symbiotic information, innovation, production and service “ecosystem” or, as some people would say: prosperity and peace. Additional success principles will be described in the following section.

13.8 Socio-Ecological Finance System

As we talk about ecosystems: have you ever wondered what makes them so surprisingly sustainable as compared to our own economy? After all, ecological systems are based on an almost perfect “circular economy”:45 there is basically no resource that is not being recycled46 and reused. This is partly due to the modular, organic organization of nature. All elements are decomposable, and there is a shared genetic code with the same basic components.

Companies, in contrast, don’t favor such compatibility of their products, and they often do not pay attention to building easily decomposable and repairable products. Legal regulations to promote recycling and a circular economy have been frustratingly inefficient so far. It’s about time for an alternative approach: empowerment instead of regulation! What would this require?

I think, we would need a multi-dimensional real-time coordination system. Why multi-dimensional? Because nature is not controlled by a one-dimensional quantity such as money. Instead, the self-organization of an ecosystem (or of our body) is based on multiple feedback loops regulating the use and distribution of water, proteins, carbon, vitamins, minerals etc.

In many cases, there are symbiotic relationships.47 For example, plants may exchange nutrients with each other. The situation for our own body is even more spectacular, because we are actually not an individual, but an ecosystem!48 In our gut, there are thousands of different kinds of bacteria. This is called the “microbiome”,49 and it seems to contain more cells than our body! The bacteria in it are responsible for the decomposition of the food we eat, i.e. the powering and regeneration of our body. In addition, however, they are also an important part of our immune system.50 All of this would not work, if there was not a symbiotic relationship and reasonable balance in the microbiome.

What can we learn from this? How to build a bio-inspired economy!51 I believe, for this we would need multiple incentive systems, not just one kind of money. Today’s economy is based on optimization52 and utilitarian thinking,53 while nature is based on (co-)evolution.54 Utilitarian thinking means that everything would be compared (or made comparable) with each other, e.g. measured in money. This also calls for a seamless convertibility of different kinds of currencies and values.

Optimization is based on a one-dimensional goal function that allows one to apply “>” or “<” operations to determine which solution is better. However, a precondition for this is that the system under consideration must be mapped onto a one-dimensional function, which is often a gross over-simplification, as I have pointed out before. Consequently, one can only move up or down, while a society needs to be able to do more than profit maximization. For example, it wants to simultaneously improve education, health, and environmental conditions as well. This calls for a multi-dimensional control or coordination system.

In a complex non-linear system, whatever goal function we choose, we would often find one optimum solution, while there are often multiple solutions that reach 95% of the maximum performance. Among these solutions, there will typically be solutions that also perform well from the perspective of other goal functions. We are interested in these solutions with multiple high performance, which are usually eliminated by classical optimization.

Therefore, I propose to introduce multiple currencies, which are not seamlessly exchangeable against each other. These currencies would, in a sense, be administered through separate bank accounts. Each currency would be defined by a particular measurement procedure. In other words, a measurement would define a new kind of currency, which could be used to establish a new kind of incentive, or just an additional feedback effect.

The “Finance 4.0” system (or shorter: “Fin4+” system) we have developed does exactly this.55 It combines Internet of Things and Blockchain technology in order to turn measurements into currencies, which can then be used to create feedback effects. Such multiple feedback effects enable the control of complex systems, or even the design of self-organizing or self-regulating complex systems, as I have discussed them before.

In this way, it would be possible, for example, to separately incentivize the reuse of different kinds of resources. One could separately account for CO2, noise, and various other environmental impacts, but also positive effects such as health and education. One could furthermore reward environmental-friendly production, socially responsible management, and cultural engagement.

While today, those companies often grow the fastest that neglect good working conditions and the protection of the environment, a socio-ecological finance system such as “Fin4+” could promote profitable production that would also generate social, environmental, and cultural benefits for our society.

By the way, having multiple currencies would dramatically expand the space of possibilities. Say, we are faced with a win-lose situation, where one person would make a lot of profit, if the interaction took place, but the other person would suffer from a loss. Such an exploitative situation could be turned into a symbiotic win-win situation, if the first person would make a compensation payment.56 Indeed, a currency transfer would create a profitable situation for both.

Having multiple currencies, there would be a lot more situations in which such interactions between multiple parties, which today would be lossful for some, could be turned into a symbiotic, beneficial situation for all in the future.57 Hence, a multi-currency system could act like a catalyst, creating new opportunities, where they did not exist before. In this way, our current economy, which is based on the exploitation of nature and people, could be turned into a system that is based on the creation of new opportunities for all. It could very well be the underlying principle for a new economy, characterized by more sustainability and new participatory opportunities. It could be the formula for future prosperity and peace. Why not give it a try?

This work was partially supported by the European Research Council (ERC) under the European Union’s Horizon 2020 research and innovation programme (grant agreement No. 833168). The support is gratefully acknowledged.