Chapter 12

Why So Few People Defer Their CPP Pension

To an actuary, Enhancement 2 represents a dream come true. It reduces investment and longevity risks and increases the actuarial value of the pension at the same time. So why do so few retirees postpone their CPP until 70? Equally curious, why do so few financial planners endorse it?

Based on the many comments from people who have read my articles on the subject in The Globe and Mail and the National Post, I think I know most of the reasons why the take-up rate is so low. These reasons fall into three categories:

- Just plain irrational

- Rational but not valid once you know all the facts

- Valid in special situations

I will start with the reasons that are most easily dismissed and work my way up from there.

Irrational Reasons Given for Taking CPP Early

The first reason is often mentioned by retirees and even by financial advisors. These people say that they start their CPP pensions early because they want to spend their money while they are still young. At first blush, this may sound reasonable but in fact it is totally bogus. Don’t get me wrong; I am all for people spending a little more money in their early retirement years when they are most likely to enjoy it. It’s just that those extra dollars do not need to come from CPP.

Instead of taking their CPP pension early, retirees could simply withdraw more money from their RRIF or some other source of income they might have. If people really want to spend more while they’re young and still have some money left over when they are much older, deferring CPP is the best way to make this happen.

Another irrational reason for not deferring CPP, and by far the one I hear most often, is the “bird in the hand” argument. People tell me they don’t want to postpone their CPP payments because they fear they might die early and not get full value from the Canada Pension Plan as a result. A comment I saw online following one of my articles said, “Imagine how mad you’d be if you died and the government kept your money.”

Allow me to point out the obvious: if you die early, you have bigger worries than getting shortchanged on your CPP pension. Like not breathing. Your bigger concern should be what happens if you live longer than you expected because you will still be around to regret a bad decision!

Rational but Not Valid

Some reasons for not wanting to defer CPP may seem quite rational to the layperson but ultimately prove not to be valid when the facts are fully laid out. The following reasons fit this description.

Many people are not even aware they can defer CPP or how deferral can help them. When you are approaching age 65, the CPP administration office will send you an impressive package that outlines your CPP pension entitlement and asks you to complete an application form to start your CPP payments. The wording of the form practically assumes that you will choose to start your CPP pension by age 65. Besides, when you get an official-looking, personalized document from the government, the knee-jerk reaction is to follow instructions and send back the completed forms. But that doesn’t make it right!

The second reason is more esoteric. We have a hard time envisioning a later starting age for our retirement benefits because society continues to reinforce the notion that age 65 is somehow magical. That used to be the age of mandatory retirement, the time when you could expect a gold watch and then be shown the door. Those days are gone, but the magic remains. Age 65 is still the age when (a) you pay less to get into the movie theatre or take public transit, (b) your prescription drugs are paid for by the government, and (c) you can start to receive OAS pension. It is also the latest age that pensions from defined benefit pension plans from an employer can start (assuming you stopped working). For all these intangible and somewhat irrelevant reasons, it is the age when you figure you should be starting your CPP pension.

Third, many financial advisors encourage their clients to start their CPP pension as soon as possible and to hold off on spending their own savings. The apparent reason for this advice is that the monies in an RRSP or a RRIF are not subject to income tax until they are withdrawn. It would therefore seem like a good idea to keep the RRSP or RRIF balance intact for as long as possible. As Figure 11.1 showed us, however, this reasoning does not stand up to closer scrutiny.

There is also a cynical explanation for such advice; it stems from the fact that most advisors are remunerated based on a percentage of assets. Understandably, they do not want to see those assets dwindling too quickly! While I wouldn’t want to presume this is what motivates your own advisor, you should at least be aware that your advisor’s compensation might be clouding their judgment, at least on a subconscious level.

I would like to think that most financial advisors genuinely try to do the best for their clients. If they are telling new retirees to start CPP early, it may be because they have underpriced the actuarial present value of deferring CPP pension until 70.

The second last reason in this category has been circulating for many years, and while it is mentioned less often these days, it still comes up from time to time. Some people want to start CPP early because they are afraid the Canada Pension Plan will not be around for them if they wait too long to collect.

For someone who doesn’t know how the governance of the CPP has evolved, this concern is understandable. The CPP was funded on a pay-as-you-go basis until 1997, which is not a stable way to fund a plan like this. In addition, some of the early investments made with CPP contributions were politically motivated and didn’t inspire confidence that the best interests of the participants were being taken into account. For these reasons, it was understandable that people in the 1990s worried about the long-term sustainability of the plan.

Fortunately, major changes were made to how the CPP is run. Contribution rates were increased from 6 percent of covered pay in 1997 to 9.9 percent in 2003. This increase built up the fund assets and stabilized the contribution rate over the longer term. At the same time, an independent body (known as the CPPIB) was established to ensure that fund investments were based on sound principles instead of politics.

In addition, the chief actuary of the Canada Pension Plan makes sophisticated long-term projections of demographics and assets, taking into account all the salient factors: investment returns, immigration, birth rates, employment rates, retirement ages, mortality rates, and so on. These projections show that the current contribution rate is sustainable over the next 75 years and more. Even if a funding deficit developed, the contribution increase needed to pay for it would be small enough to be manageable. Politicians would almost certainly act to increase contributions rather than cut benefits. With such a sound governance structure in place, I have no worries about the future of the CPP.

By contrast, if you were an American and were relying on Social Security benefits in 20 years’ time, I would say you have some reason to worry. US Social Security is funded on a pay-as-you-go basis, which requires ever-higher contributions as the working-age population matures and the number of retirees grows. Based on government projections of contributions and benefits, the amount of money left in the fund by 2034 will not be enough to make full payments. This is a real problem, given that Social Security does not have the legal right to borrow and American politicians do not seem to be able to bring themselves to increase taxes. It therefore seems the US Social Security system is on a collision course, but this doesn’t affect the CPP.

You would think that having a shorter-than-average life expectancy would be a good reason not to wait until 70 to collect CPP. This is true if both spouses have sound medical reasons why they expect to die young, but that is a rather rare situation. If just one spouse dies at a youngish age, it might still make sense to wait until 70 to collect CPP. This scenario is explored in Chapter 17.

Finally, there is a purely emotional reason why you may find yourself unable to wait until 70 to take CPP. If you are like many people, your sense of self-worth may be intertwined with your financial worth. For most of your working life, you were saving to improve your financial status. It would have been a comfort to watch your RRSP account balance growing steadily. Drawing down your personal assets in retirement is hard to do because it is a grim reminder not only of your dwindling influence in this life but also of your own mortality. Drawing down assets more quickly, as we would have to do under Enhancement 2, compounds the difficulty. This explains why people might be reluctant to adopt Enhancement 2, but it is not a good reason to reject it. We shouldn’t care whether one particular source of income gets depleted more quickly than another. We should care only about how much income we can count on from all sources combined.

Valid Reasons Not to Defer CPP in Special Cases

Having dismissed most of the reasons for not deferring CPP, I will concede that it is sometimes better to start your CPP pension when you retire rather than waiting until 70. Consider carefully whether any of the following situations apply to you.

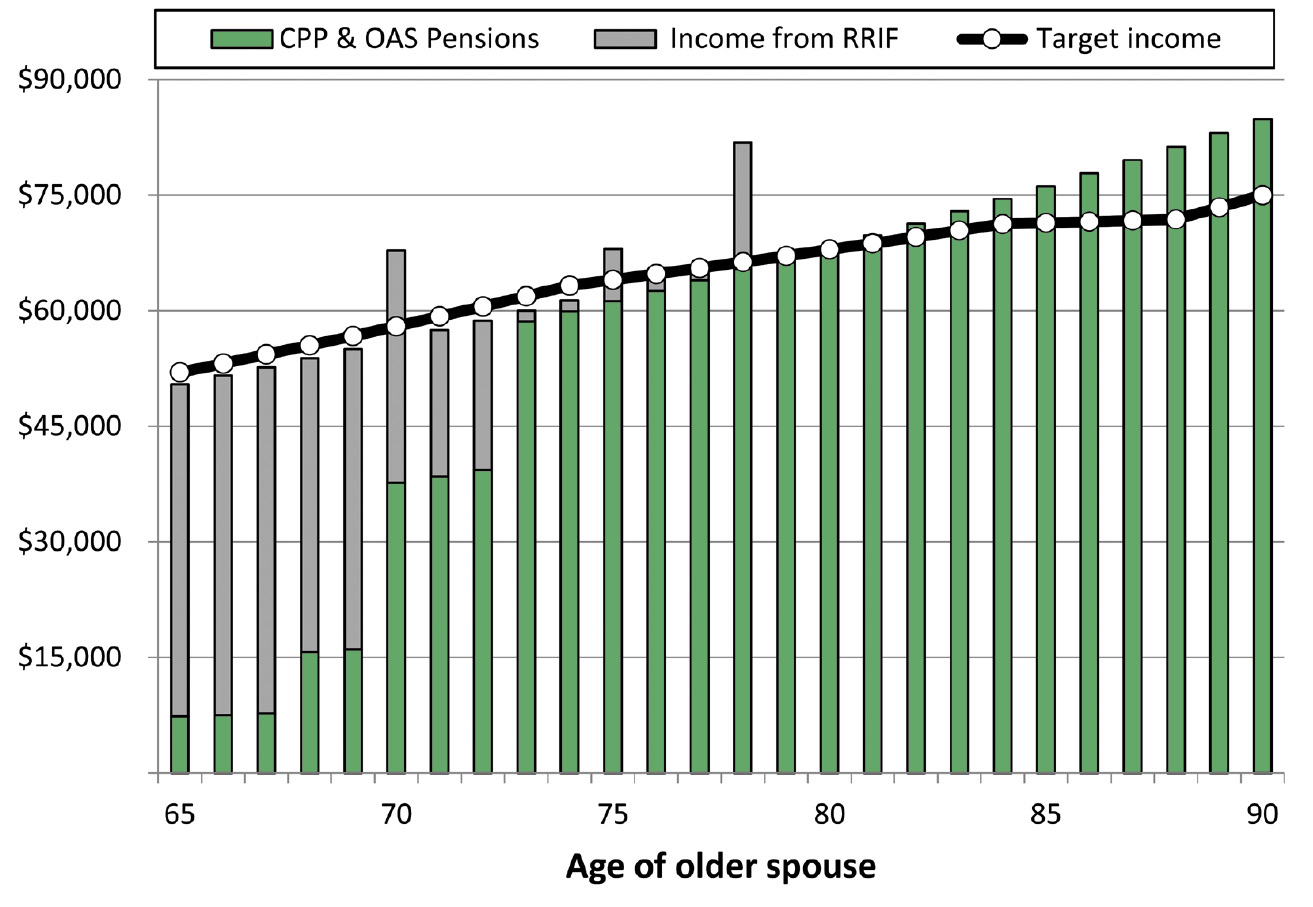

First, you need to have enough money to make Enhancement 2 work. Nick and Susan had a nest egg of $600,000, which turned out to be enough to tide them over until age 70. What if a couple had only $375,000, though? Figure 12.1 shows what would happen if they tried to defer their CPP until 70.

This couple is still better off deferring their CPP pension, but the situation is now less than ideal; by trying to stay on the target income curve in the early years, they end up having too much income from age 82 and on. You might think that more income is a good thing, but only if it comes at the right time. It would be better to have it earlier in their retirement when they are more apt to enjoy it. If they drew more income from their RRIF early in their retirement, however, they wouldn’t have enough money left over in their 70s.

Ultimately, Enhancement 2 is a strategy only for people with significant savings. What constitutes “significant” depends heavily on the age when they retire, whether they are single or married, and the amount of CPP pension they can expect. For the Thompsons, the threshold is about $400,000. For a single person aged 65 at retirement, it would be about half that. If the Thompsons were both just 60 when they retired (with the same CPP pensions), the threshold would be closer to $800,000.

This isn’t to say that deferral of CPP beyond age 65 is a complete mistake if you possess less than the threshold amount of assets. You just might not want to defer CPP all the way until age 70. A starting age for CPP pension after 65 but before 70 could make more sense in this case.

The final (good) reason for not wanting to defer CPP applies if you keep on working beyond age 65 and have already earned the maximum CPP pension. Deferring CPP is less effective in this case because of a quirk in the Canada Pension Plan. You are forced to keep on contributing to the CPP even if it doesn’t improve your pension.

By contrast, if you continue working past 65 but start CPP at 65, you are not forced to keep on contributing! The people who draft the rules for the Canada Pension Plan must know this can’t be right. After all, they did not insert the same anomaly in their own pension plan (the federal Public Service Pension Plan)! Appendix D sets out an example of just how unfair the CPP contribution rules are.

Figure 12.1. Deferring CPP to 70 with $375,000 in assets

Like Figure 11.1 except this couple has only $375,000 in assets and starting income is $52,000. By deferring CPP to 70, they have too much income at 90.

Why Not Defer OAS, Too?

If starting one’s CPP pension at age 70 is such a good idea, then why not start OAS pension at 70 as well? Many people don’t realize it, but you do have the option of deferring OAS commencement until 70. There are a couple of reasons why I generally don’t recommend doing it, though.

First, the actuarial adjustment you receive is lower than it is for CPP. In the case of OAS, the pension at age 70 is only 36 percent higher than at age 65, not 42 percent. The second reason is that starting CPP late is already forcing the average retiree to draw down their RRIF balance much faster than they bargained on doing. As we saw in the last section, the threshold amount of assets needed to take full advantage of CPP deferral is already rather high. It gets that much higher if the retiree decides to defer OAS pension as well.

Even if one has enough assets for deferral of OAS pension to make sense, it will make anyone with less than a million dollars in assets feel a little uncomfortable because of the accelerated drawdown of their personal assets.

The one exception applies in the case of very high earners. Those people with a six-figure income would see some or all of their entire OAS pension clawed back anyway. They might as well postpone the start date until 70 because they won’t receive any value from OAS before then.

Takeaways

- Enhancement 2 provides significant protection against investment risk as well as longevity risk.

- There are many reasons for not deferring CPP pension to age 70, but most of them do not hold up to close scrutiny.

- About the only good reason not to defer CPP to 70 is having insufficient assets to tide you over until CPP starts.

- You probably will not want to defer your OAS pension unless your income after 65 is high enough to be subject to the OAS clawback rules.