CHAPTER 1

SMALL BUSINESS AND THE ENTREPRENEUR

1.1 What is Entrepreneurial Finance?

Finance, technically, refers to any transaction of money, or money-related medium of exchange and monetary measurement. More broadly, finance can be considered the art and science of money handling and capital management. Its significance lies in the understanding of how money works in a society, and how it is related to economic and legal systems, given the society's rules and regulations, and the structure of its financial institutions. The ultimate goal of finance is to achieve the highest efficiency in the way of using funds regardless of the nature and direction of the utilization of money. In this sense, and in the business domain, financial management would represent the firm's responsibility to plan, acquire, and manage capital to efficiently run the business as well as to grow it and further invest in its capital.

Entrepreneurial finance is the third major field of finance along with personal finance and corporate finance. It is all about applying the fundamental financial principles and basic theories in the domain of new and small-scale business firms. Furthermore, it is adapting those principles and theories for planning and developing, starting up, operating, growing and maturing, valuing, and harvesting entrepreneurial business projects. The nature, needs, and dynamics of a new venture and the entrepreneurial aspect are what primarily characterize and identify entrepreneurial finance and distinguish it from other finance fields. What remains common ground is the decision-making although it is different by nature and scope from finance field to another. In entrepreneurial finance, entrepreneurs and managers make decisions to finance, establish, and run a new business project, while in corporate finance, the chief financial officer and his team make decisions to generate, manage, and monitor the flow of public funds in a corporation. To a smaller and individual scale, a consumer would make all the financial decisions for himself and family, but the basic financial principles remain very close, and the field becomes personal finance.

The attention to the entrepreneurial aspects of a business project, especially during its planning phase, start-up, and early stages of production dictates the divergence in the application of the financial principles in a theoretical and practical mix with the concept of entrepreneurship. The following points highlight where entrepreneurial finance stands in comparison with other fields of finance:

- Entrepreneurial finance is directly related to a smaller scale and privately owned and managed business firms.

- Entrepreneurial finance focuses more on the establishment phase and continues to monitor the financial progress of the business project, build its value, and guide it through the end.

- In entrepreneurial finance, the investment value and gains are driven by the entrepreneur's own interests and incentives, while in corporate finance, investment value and returns are to reward the shareholders.

- Related to the previous point, entrepreneurial finance utilizes the managerial efforts of entrepreneurs, venture capitalists, angle investors, and other highly motivated investors who have high stake in building a new business and take it to its efficient performance. In corporate finance, investment and managerial decisions are made by professionals within the corporations, not by the shareholders.

- Another implication of the differences in investment nature and purpose is the weaker need for diversification for the entrepreneur in entrepreneurial finance tradition, and the reason is that the new venture takes a central importance for the entrepreneur, if not the only project that sucks in all investments. In corporate finance, diversification of investment is essential.

- Due to the differences in scale and nature of the operational business domains, some major financial theories in corporate finance may not fit well in entrepreneurial finance. Examples are Capital Asset Pricing Model (CAPM), efficient market hypothesis, and portfolio theory. Also, some concepts and operational terms may not be relevant in entrepreneurial finance such as those that are related to the stockholder's dividends like earnings per share, price-earnings ratio, some tax codes, and even some rules of the U.S. Securities and Exchange Commission.

- Other implied differences between entrepreneurial and corporate finance are manifested in the differences in the role and significance of cash, capital structure and ways of raising capital, capital market, project financing time frame, and on the impact of business downsizing on the owners and investors.

- Last but not least, entrepreneurial finance deals with a new venture that requires a different type of harvesting. Venture capitalists and entrepreneurs assess the potential value of investing in a project based on possible liquidity events that they expect to maximize their returns. Contrary to that, in corporate finance, investment projects are evaluated based on the calculated expected cash inflow throughout the life of the project, as well as the capital gains earned through the re-sold business shares.

In conclusion, entrepreneurial finance and corporate finance are generally different domains, based on the size and nature of financial resources as well as according to the ways to acquire, grow, manage, and evaluate these resources. They also have different audience, while corporate finance deals mostly with the big and most powerful corporations, entrepreneurial finance deals with entrepreneurs and individual private investors.

1.2 Significance of the Small Business

According to the Small Business Administration (SBA), the term “small business” refers to an American entity operating primarily within the United States and is

- organized to pursue profit;

- contributing to the US economy through its use of material, labor, products, and its payment of taxes;

- owned and operated privately and independently;

- not dominant in its field on a national basis.

As for the size of business, the SBA has established numerical standards to define how small is a small business, depending on the type of industry to which the business belongs. The size standard is based either on the number of employees or on the dollar amount of annual sales. Table 1.1 shows a summary of the size standards for a small business according to the type of industry. When the number of employees is the criteria, a wholesale business would be considered small if it employs up to 100 employees, while in 75% of manufacturing and mining industries, a business is small if it employs up to 500 employees. For the minority of 25% of manufacturing, a small business would be the firm that employs up to 1500 employees. The rest of the categories in the table go by the volume of annual sales as criteria for being small business, starting from an annual sale of $750,000 in agriculture to $35,500,000 in some services. The primary purpose of these standards is to determine eligibility for SBA's financial assistance as well as for the federal government procurement programs to provide help for small businesses.

Table 1.1 Size Standards for Small Business

| Industry | No. of Employees | Annual Sales (in $) |

|

100

500 750–1500 |

750,000

7,000,000

7,000,000 14,000,000 20,000,000 33,500,000 7,000,000 25,500,000 35,500,000 |

Small business forms the backbone of the US economy and is credited for much of its strength and success. As shown in Figure 1.1, a little more than half of all small businesses in the United States are in the service sector while the other half is distributed on other sectors such as wholesales and retails 17%, construction 13%, real estate and insurance 9%, manufacturing 6%, and others 4%. They constitute more than 95% of the country's 25 million non-farm firms, employing about 53% of private non-farm workforce. They spend more than $100 million annually and are responsible for providing 52% of the private gross domestic product. As for new job creation, small businesses create 79% of the new jobs annually, as compared to large firms that provide only 21% of those new jobs in the economy. They also provide 67% of on-the-job training, and generate a significant number of patents per employee that is estimated as 17 times more than what the large firms create. Small businesses pay more than 45% of private payroll, and they are credited for most of the growth in income and employment. It has been observed that especially the very small businesses (25 employees or less) constitute about 94% of what is called the fast growing companies in terms of their growth rates in income and employment.

Figure 1.1 Small Business by Industry in the United States

Small businesses and entrepreneurial projects have proved that they initiate experimentations, elevate productivity, fuel innovation, and lead economic progress. Interest in small business has been rapidly growing, not only by entrepreneurs and business owners, but also by the public. It is probably in response to the growing trend of downsizing and outsourcing that have been widely practiced by large corporations. The growing interest in the self-employed style of business has been publicly considered safer and more rewarding. It can also be looked at as a commitment to the American ideal of free enterprise that cherishes freedom, independence, individuality, hard work, and creativity. Academic response has been matching the public interest for there has been a significant inclination by students and faculty to study entrepreneurship, and how to finance, start up, manage, and maintain a small business, as well as explore venture capital investment. These areas of business have grown rapidly in community colleges and public universities and even in increasing number of high schools.

Advantages of having a small business can be summarized as follows:

- offers opportunities for the entrepreneur, business owner, and manager to be free, innovative, and independent, as well as to earn more;

- helps maintaining closer and friendlier relationships with employees, customers, and suppliers, and motivating them to be more responsible;

- offers higher and direct control by owners;

- helps in community development;

- helps fostering and promoting local pride;

- offers opportunities for comprehensive and diversified on-the-job training for employees;

- indirectly forces large corporations to compete in doing better for their customers, employees, and communities;

- helps developing more creative, connected, responsible, and accessible leadership.

In addition to these advantages, small businesses have a number of disadvantages too. They can be summarized as facing the difficulties of

- finding adequate funding for development, expansion, and research;

- coping with fierce competition;

- hiring high professionals;

- bearing sole and full liabilities;

- complying with tedious and costly government regulations;

- adapting to times of economic hardship;

- adapting to the explosive and costly technological advancement and modern trends;

- dealing with the limited credit and non-flexibility of major suppliers;

- affording the tax burden.

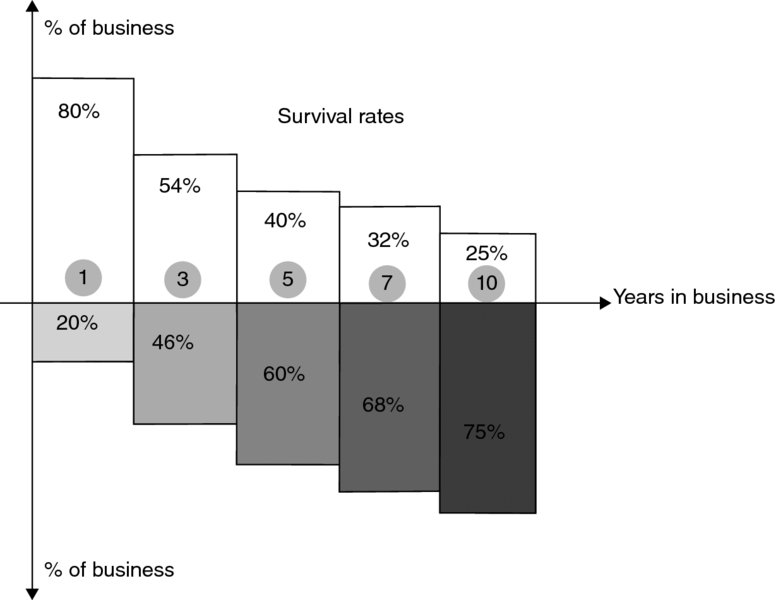

There is no doubt that the above difficulties would increase the risk of failure for small business. Failure possibilities would increase due to the accumulative effect of many problems faced by a small business. Figure 1.2 shows that as years go by, the percentage of businesses that survive would decrease from 80% in the first year of operation to only 25% for those which can last up to 10 years. Naturally, the reciprocals of those percentages can be read as failure rates. As shown, these rates seem to increase over the years, from 20% of businesses that cannot make it through the first year to 75% for those that would not make it to the tenth year.

Figure 1.2 Survival Rates of Small Business by Year of Operation

Furthermore, it seems there is a reverse relationship between failure and firm size in terms of the number of employees. This is to say that the larger the size of the firm, the lesser the failure rate. Figure 1.3 shows that firms with less than 10 employees would have a chance of failure equal to 22%. But this chance would decrease by 7–8% for every extra 10 employees up to 30 employees. But for firms with 100–240 employees, the chance of failure would drop to 5% and it would significantly decline for larger firms with 250 and more employees.

Figure 1.3 Failure Rates of Small Business by Number of Employees

Away from the size of business, small firms can increase the possibilities of success by simply trying as much as it is possible to reverse the aforementioned disadvantages, in addition to

- having a comprehensive, realistic, and doable business plan;

- knowing well everything about their business and their market;

- maintaining strong and trustworthy ties to customer, employees, and suppliers;

- maintaining comprehensive and precise records, adequate and effective bookkeeping, and good accounting;

- maintaining good management of financial and human resources and especially avoiding the pitfalls of nepotism that can be common in family business;

- maintaining a healthy degree of flexibility and striving to be positively different from competition;

- keeping the market diversified;

- last but not least, a great deal of influence on the success of small business would be linked to the personality and qualifications of the owner-manager who could ideally be the rod of all success if he/she is committed, enthusiastic and energetic, hardworking, competent, patient, and reasonable; also significant is to be a restrained person who uses good judgment and effective communication, and practices firm and fair leadership.

1.3 Entrepreneurship and the Entrepreneur

Entrepreneur is originally a French term, which historically meant the person who could organize and direct resources into production. It was Jean-Baptiste Say, the French economist and businessman who, in the early nineteenth century, elaborated on the role of entrepreneur in creating new values by simply knowing when and where to employ economic resources and have them yield higher returns. As the role of entrepreneur gained even more popularity in both public and academic arenas in recent decades, entrepreneurship started to be recognized as the field of creating economic values through turning business ideas into viable and commercial opportunities. The entrepreneur, therefore, meant to be the person who has the ability to see through the transformation of thoughts into action. This ability would entail recognizing what is or is not feasible; knowing the odds and estimating the risk; having access to the required resources and knowing their right mix; and finally having the drive to start up a project and oversee it until it can stand up on its own feet. In this sense, an entrepreneur needs to have a special personality with certain traits in order to become efficient in what he does. Successful entrepreneurs would possess the following characteristics:

- Ability to foresee the right opportunity at the right time as well as perceive the dynamics of the related conditions.

- Capacity to come up with, or seize a chance for a new venture. That is, an ability to spot a new idea and the ability to turn it into a successful and profitable business project, which would summarize the crucially required characteristics, creativity, and innovation. It should be noted here that a new idea does not necessarily mean creating a completely new product or service from scratch! It could very well be a different way of utilizing a product, or a reconfiguration of product elements, or modifying a method or rearranging a different way of service, and reaching a new market or different customers, or anything in this vein.

- Strong drive and attitude of confidence, energy, and optimism to get into action and actually start up a project and live to see it up and running.

- Capacity to recognize the odds and count for the risk, and yet have the courage to go ahead and take the project all the way in its execution phase.

- Spirit of commitment, flexibility, and tenacity, coupled with tolerance and ability to try, and willingness to learn from mistakes.

- Talent to line up and organize the right resources and utilize them as efficiently as they can yield the highest possible outcomes.

- Ability to explore the market and know its needs, and spot what can be feasible, practical, marketable, and profitable in pursuing the products and services that would satisfy those market needs.

- Burst of passion to work hard, and a strong desire to see results, coupled with genuine perseverance and persistence to keep trying if failed. Finally, a significant characteristic of a successful entrepreneur is being a “doer,” a person who acts more than he talks, and certainly do more than he dreams.

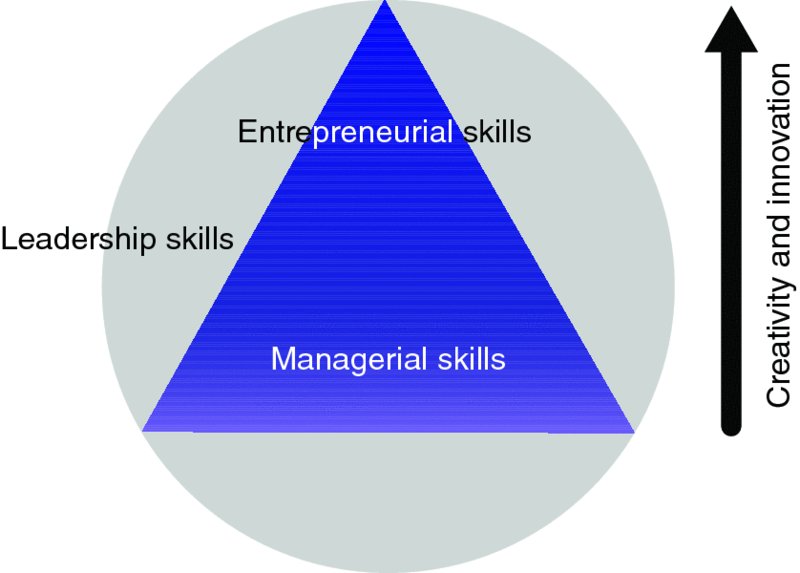

An entrepreneur must be distinguished from a manager/owner, although the two terms are sometimes used interchangeably. They are different in their qualifications, objectives, perspectives, and their connection to the production process. Entrepreneurs and financiers are often more aggressive and driven by innovative tasks that would yield financial gain in the intermediate term. This term is defined by the first phase of production that includes preparing for, starting up, and establishing the project. The second phase of the business project is the phase of production, growth, and earning, which would start when the project can stand on its own feet and continue for the long term. This phase would need managerial skills that are different from the entrepreneurial skills. Managers and owners would seek stability and steady profits over a long run. They would prefer balanced and more modest over aggressive growth, and they would entertain moderate level risk and avoid higher risks. Their primary concern would be to achieve efficiency along the way and into the future, which may squeeze the room for innovation and would remain as the most striking function of the entrepreneurial business, where the innovative ideas are generated and creatively put into action. Figure 1.4 shows that the entrepreneurial skills require a more concentrated and pointed level of creativity and innovation as compared to the managerial skills which require a moderately broad level of them, while leadership contains both skills and control their overall shape. It is represented by the circle that includes all.

Figure 1.4 Entrepreneurial, Managerial, and Leadership Skills by Creativity and Innovation Requirements

While management is distinguished from entrepreneurship (Figure 1.5), management should also be distinguished from leadership. Management can be defined as the effective and efficient use of resources to accomplish certain economic and administrative objectives for the managing unit during the production and growth phase and throughout the life of the project. It would involve five integrative functions: planning, organizing, staffing, directing, and controlling.

Figure 1.5 Entrepreneurship and Management Phases

Although leadership of business is very much related in principle to management, it can be distinguished in its focus and scale. The focus in leadership is on the capacity and quality of making strategic decisions, oversee operations, and bring about the aspired changes. It is required in both phases of the project and along the way throughout the project life. While management is concerned about the structure, details, timing, execution, standards, quality, and efficiency of the production, leadership would be general in providing a certain vision, direction, and strategies to achieve the vision. It would work through communication, motivation, and energizing the project and its constituents and setting the right example.

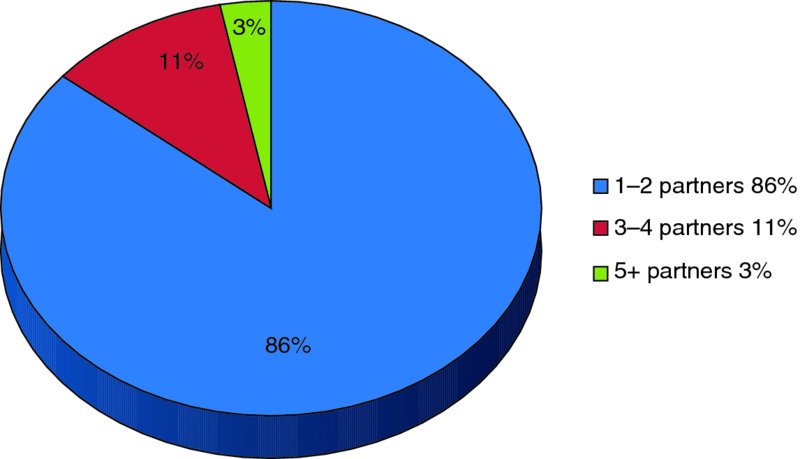

The vast majority of entrepreneurs who start up new businesses are either by themselves or having another partner (86%). This percentage decreases dramatically for more partners as it is shown in Figure 1.6. It would become 11% for three to four partners, and 3% for five and more partners. More than half of the entrepreneurial businesses (53%) are owned by partners who have family ties.

Figure 1.6 New Business Start-Up by Number of Partners

An increasing number of entrepreneurial business projects are owned by women, racial minorities, and by young owners. Women own about 30% of all businesses, in addition to the 17% owned by women in partnership with men. But it is noteworthy to observe that those women get only 4% of the earnings. The primary reason is that women tend to be in lower value and lower risk businesses that would naturally generate lower earnings.

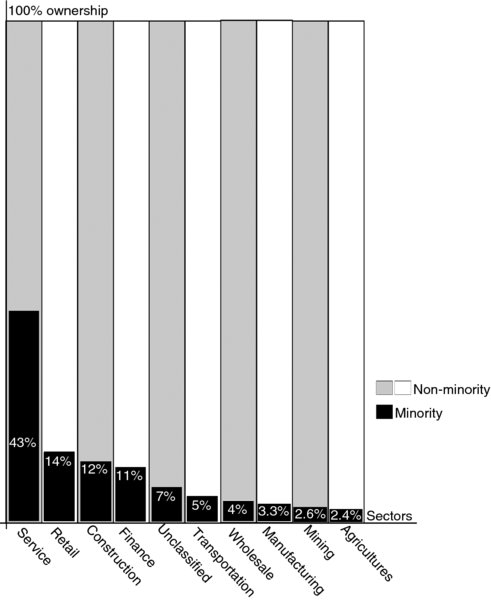

As for the number of racial minorities who own entrepreneurial businesses, there has been a lot of improvement but there will be a long way to go. Figure 1.7 shows the percentage of businesses owned by racial minorities in 10 selected sectors of the economy. Forty-three percent of the service sector is owned by minorities, which is the highest percentage of minority ownership among all sectors. As shown in Figure 1.7, this ownership share would drop rapidly across the ten major sectors until it reaches the smallest percentage of 2.4% in the agricultural sector.

Figure 1.7 Small Business Owned by Minorities in Selected Sectors

1.4 The Idea and the Opportunity

The essence of entrepreneurship is the new idea and the marketable business opportunity it would present. New ideas have to be found and prepared. They do not exist in separation of a creative and driven entrepreneur as well as they cannot emerge, live, and be worthwhile in isolation of their right atmosphere. New business ideas for the market do not necessarily mean only a product or technology that has never existed before. They naturally include a variety of applications in addition to the new inventions and advanced technologies. They could include an existing product that has been modified or improved or reused somewhere else; a service that has been altered or expanded to a new domain, a segment of consumers that needs to be specified and utilized, a sub-market that may be discovered, a synthesis of products or combination of services, an international need that has been appearing on the radar, and so on. However, regardless of the nature of the idea, it has to:

- Be ripe at the right time and fit to the current conditions and circumstances.

- Satisfy some or all consumers in order to gain its own market share.

- Be cost-effective to assure that it is going to be profitable.

- Be viable and feasible as well as distinctive and unique enough to justify a relative level of exclusiveness to its creator. That would serve as a natural barrier against being copied by anybody else.

Sources of New Business Ideas

One of the most basic and essential characteristics of successful entrepreneurs is their talent and ability to recognize and capture the promising ideas. Those ideas can spark in many sources such as

- Workplace and previous experience. A great number of successful business ideas come from the knowledge gained and the experience accumulated by entrepreneurs in their past employment. They become familiar with the product, service, consumers, market, suppliers, and all problems and difficulties which may lead them to spot that specific gap or capture that particular need to form a new business idea. This source is probably the most common and most safe way to success since most of the ideas would come from a more familiar territory. However, entrepreneurs have to be extra careful in dealing with the legal commitments and ramifications related to their previous employers in order to avoid the charges of product infringement or any breach of business contracts and agreements which restrict the previous employees in their business activities after departing their employment.

- Family's business tradition. Many entrepreneurs follow their family's history and tradition in carrying on the same or related business for generations. They would have a significant opportunity to know all about that business and its market, and also gain a growing base of faithful consumers and suppliers, and from that vantage point, they may find their own niche in a new aspect of the business.

- Changes in economic, social, and political norms. Many significant changes in our economic, social, and political perceptions, needs, and norms would open the opportunities door wide and lead into a world of ideas. The classic example would be the creation and development of the advanced level of automation and use of robots that was a result of labor force shortages in Japan. Our departure from what used to be an acceptable social activity, such as hunting or smoking or our newly found high interest and obsession with efficient energy, physical fitness, vegetarian diet, environment protections, and owning and living with pets, have all created millions of ideas and lucrative business opportunities. Also, the change in the political realities, such as having to deal with terrorism, necessitated the creation of many new products, services, and ways of doing things as well as resulted in inventing new technologies.

- Many entrepreneurs follow their personal interests, natural talents, and hobbies to establish successful business projects that are directly related to products and services that they have passion for, whether it is cars, ball games, food, travel, art or anything they love. An example that has been cited in Corman et al. (2009) is about celestial tea, a multimillion-dollar industry of manufacturing and packaging herbal tea, which grew out of Mo Siegel's passion for tea and his hobby for collecting and mixing herbs and creating different tea mixtures.

- Savvy entrepreneurs identify and follow the changes in consumer taste and consumption trends, and they have the ability to predict the commercial responses to those changes. They would also know what is in and what is out, what is hot and what is not, and where the market would be stronger or weaker. The best current example is to look at the wide shift in our consumption pattern to computers and their use in everyday need through the increasingly computerized goods and services. Probably the most recognized shift now is toward the iPhone and its endless applications. This small device is currently in the process of replacing many other important tech gadgets that we need and use every day. This is a good example of a powerful source of new ideas and the tremendous business opportunities that may stem from them.

- Knowing and counting for the demographic trends and projected demand would also mean knowing a wide variety of business opportunities. For example, statistics on birth rates, death rates, life expectancies, gender distribution would allow better projections of all needed goods and services at a certain time, and open the door for more ideas and more opportunities.

- Accidents, incidences, and failures. Many innovative ideas sprang from personal or workplace accidents that pushed to finding different ways and solutions. We can say most or all personal safety products and services we are familiar with today were direct results of the need to prevent or minimize harmful or fatal accidents. The automatic machine shutoff and air bags are examples of hundreds of the safety measures ideas that became commercially successful. Many coincidences and unexpected results in lab experiments or in the application of a method or introducing a new product resulted in new ideas being sparked. Sometimes even failing to have a certain result may lead to a new idea or a new way of thinking. An example of the incidental discovery was cited in Katz and Green (2014) about the technology of the laser eye surgery that was developed by the IBM scientist who worked with lasers and organic plastics and was casually contemplating, at a Thanksgiving dinner, the effectiveness of laser in slicing a turkey leg.

- Last but not least, the classical and most traditional source of new ideas and new entrepreneurial opportunity is the necessity and need to change, modify, complete, or improve something or make it more efficient by making it work better, faster, or with less cost of money, energy, or time. The old saying of “the necessity is the mother of all invention” is totally true and more fitting in the area of finding new business ideas and opportunities.

Figure 1.8 shows the distribution of five sources of new ideas as they were identified by the National Federation of Independent Business Foundation (Longenecker et al. 2013). The largest source is work, experience, and education, which helped provide 51% of all new business ideas. It is followed by large distances by the rest of the four sources: family, friends, and relatives (18%), hobbies and interests (16%), chances and accidents (11%), and all other sources (4%).

Figure 1.8 Sources of New Business Ideas

1.5 From an Idea to Reality

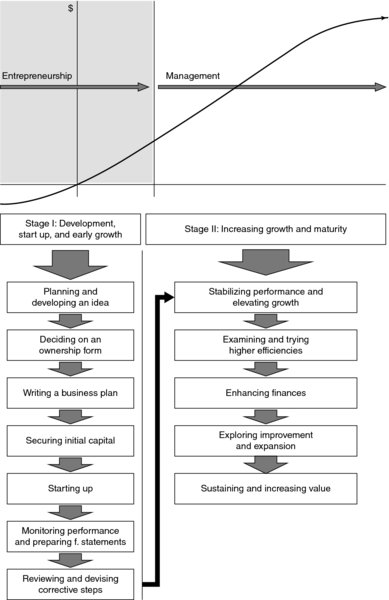

In order for any viable business idea to materialize into reality, and become a commercially marketable product, it has to go through a systematic process of development that may be described as the project life cycle. Earlier, we went over the distinction between the entrepreneurship stage and management stage where both were described against a revenue curve. Now, we can use that idea and the same graph to detail these stages and illustrate their contents as a project develops from a mere idea into a tangible product. Figure 1.9 shows that the two stages of entrepreneurship and management can further be detailed and renamed by the following stages:

Figure 1.9 Steps for Entrepreneurship and Management Phases

Stage I: Development, Start Up, and Early Growth

This stage starts with articulating the idea, collecting views and perspectives from family and friends, and better yet, getting informed reactions from related business professionals, if possible. It would also include producing a product prototype or presenting a trial service to further test the feasibility and marketability of the idea-product. Next step would be to decide on the appropriate form of business ownership, considering what would better fit into the proposed project while going over all the advantages and disadvantages of all the available forms of ownership. After that, it would be a time to write a serious, detailed, and comprehensive business plan that would not only help secure the needed funding, but also to become a roadmap for the rest of the project life. The business plan should lead to the next step, which is securing the needed capital, and initiating the startup process. Once the project stats operating, the entrepreneur, owner, manager needs to observe vigilantly, and monitor the entire operation and oversee the firm's performance. The major purpose of being vigilant is to confirm what is working and what is not, and to device and implement the appropriate corrective actions.

Stage II: Increasing Growth and Maturity

In this stage, production continues to run and generate revenue, but in the beginning of the stage, it is expected to see the revenue lagging behind all the expenses. This situation may refer to the need for further investment, operational modifications, and managerial changes to confirm that the project is still promising. A series of improvement in investment, production, management, and marketing can significantly increase the sales, embolden consumer confidence, expand the market, and actually can lift the project from this survival phase into safety. Once the project passes through the survival phase, cash inflow would most likely can exceed the cash outflow, and the project value would rise in an increasing rate. This would be the classic mark for the project's rapid growth. It would also mean that the firm needs to continue in examining its performance and validate its high efficiencies. Higher growth may encourage for more development and expansion, which may require further enhancement for the existing capital in order to maintain and increase the earned project value. Here, we can say that the project is in its maturity stage, and the mere idea has really been transformed into not only an actual product that can generate increasing revenue but also has been turned into a full success.

1.6 Summary

This chapter presented an introduction on the small business and the entrepreneur. It started with a discussion on the nature of entrepreneurial finance and its differences from both corporate finance and personal finance. Eight major characteristics of entrepreneurial finance were presented to distinguish this field from other fields of finance. The discussion then was shifted to the significance of the small business, its definition, and its effects on both the entrepreneur and the economy. As for the individual's benefits, nine advantages and nine disadvantages were introduced, followed by a discussion of the potential success and failure of the small business as a new venture. The entrepreneur and entrepreneurship were fully discussed where a full profile of an entrepreneur was presented, and the distinction was made between the entrepreneur and the business owner or manager. This discussion led to an explanation of the differences between entrepreneurship, management, and leadership. The business idea and business opportunity was the next topic of discussion. The chapter provided a comprehensive account of all the common sources of ideas that may be generated for a new business, and how the mere idea can be transformed into a real product or service that is viable, commercial, and marketable.

Key Concepts

- Finance

-

Entrepreneurship

- Entrepreneurial finance

-

Management

- Corporate finance

-

Leadership

- Personal finance

-

Small business

- Entrepreneur

-

Small Business Administration (SBA)

- Financial management

-

Business idea

- Rapid growth and maturity

-

Startup and early growth

- Survival stage

-

Project life cycle

- Product infringement

Discussion Questions

-

What is entrepreneurial finance, and how different is it from the other fields of finance?

-

How does the Small Business Administration (SBA) define the small business and determine its size?

-

How does the small business contribute to the economy?

-

What are the advantages of owning a small business?

-

If you are an owner of a small business, what would be the disadvantages that you may face?

-

List at least five possible ways that you may do to improve the possibilities of success in a small business.

-

Make a distinction between an entrepreneur and manager, and between entrepreneurship, management, and leadership.

-

List at least five characteristics of a successful entrepreneur.

-

What is the survival phase in a project life cycle?

-

Briefly describe Stage II of turning a business idea into a real product.