CHAPTER 4

FORMS OF BUSINESS OWNERSHIP

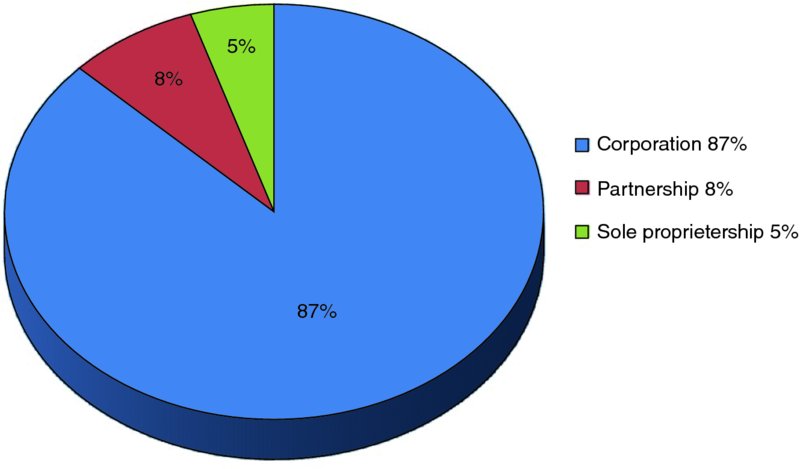

One of the basic and early decisions a new business owner has to make is choosing the legal form of business ownership and organization. The legal form of business is not only related to business nature or the owner's desire but also to its significance in terms of the long-term implications on business performance and survival. In the choice process, an owner has to be aware and knowledgeable of the pros and cons of each and every form of business, and preferably be assisted by a lawyer and business consultant. Among the issues that will be affected by the choice of the form of ownership are the taxes, liabilities, succession, capital raising, control, reinvestment, income-growth allocation, business fate and survival, and the like. The final decision would be in the owner's hands, and ultimately the right decision would be the one that results in choosing the form which is the most fitting to that particular business and the circumstances around it. The major forms of business, which we discuss here, are: the sole proprietorship, partnership, and corporation in addition to other hybrid or sub-forms that will be covered briefly too. Figure 4.1 shows the distribution of major forms of business.

Figure 4.1 Distribution

4.1 Sole Proprietorship

Sole proprietorship is the business owned and managed by a single person. The vast majority of American businesses (72%) is in the form of sole proprietorship. It is not only the most popular but also the simplest form. The following are the advantages and disadvantages of this form of ownership:

Advantages of Sole Proprietorship

- It is the easiest and least form to start up, with minimum efforts and paperwork.

- It does not require any formal or complicated organizational structure.

- It is not subject to any federal rules but only a few and simple state requirements and fees.

- It offers total freedom in decision making and full control over operations.

- It allows its owner to exclusively collect all profits.

- It has no business taxes other than the owner's income taxes. In this case, there is no double-taxation problem.

- It is perfect for the type of business that requires a high level of secrecy as all information is kept by one owner-manager.

- It is easy to dissolve.

Disadvantages of Sole Proprietorship

- Owner has unlimited liability. Sole ownership means sole responsibility.

- There is a limited capacity to obtain funding.

- There is a limited ability to hire highly skilled professionals.

- There is a limited possibility to expand.

- Fate of the business is attached to a single person. Business may be terminated if the sole owner dies or becomes, for any reason, unable to run the business.

- The sole responsibility would most likely weigh heavily on one person, which may cause the owner-manager to burn out.

4.2 Partnership

A business partnership is another legal form of business ownership. It is an entity for profit that is owned by two or more business partners. Usually it is formed by joint desire and willingness to combine resources and integrate abilities and skills. Partnership is not as common and popular as compared to other forms of business. Instability and conflict of personalities and interests that may develop later on among partners has been often cited as a reason for low survival rate and unpopularity of this form of business. Legal contracts between partners are not required by law but it is strongly recommended by experts. Drafting and signing a joint contract would minimize the potential conflict among partners. A standard contract would include the following information:

- Name, address, nature of business, and its location.

- Names of partners and their addresses and other defining information.

- Partners' contributions to the joint business.

- Duration of the contract.

- Terms of profit distribution and compensation of partners.

- Terms of liabilities.

- Terms of business termination.

- Terms of expansion.

- Partner's responsibilities, especially the designated responsibilities such as in the areas of accounting, finance, and taxes.

- Voting rights.

- Terms of modification and amendments to the contract.

In case there is no specific contract signed between partners, the appropriate guide would be the Uniform Partnership Act (UPA), which is the legal code for business partnership in the United States. This act states the partner's rights and responsibilities as they are listed briefly below:

Partners' Rights

- Partners share ownership, management of operations, and profits earned.

- Partners may earn interest on any additional advances to the business beyond the initial capital.

- Partners may receive compensation for certain work or expenses which are incurred by them for the business.

- Partners have full access to the business books and records.

Partners' Responsibilities

- Partners share the losses of the joint business.

- General partners share the liabilities carried by the business.

- Partners are obligated to share all the information related to the business.

- Partners are obligated to share the accounting and finance details of the business.

- Partners have to settle differences through majority vote or arbitration.

Any successful partnership would require all parties not only to work hard for the common good but also to have trust in each other, loyalty, commitment, care, understanding, and flexibility

Types of Partnership

General Partnership (GP)

In a general partnership, all partners are actively involved in the business operation and management. They share profits and liabilities.

Limited Partnership (LP)

In the limited partnership, limited partners still share capital and profits but they do not share the business liability nor do they participate in the business operation and management. Still, the limited partnership would involve one or more general partners in addition to a number of limited partners. The general partners would run the business and carry its liabilities, while the limited partners are just investors in the business. The classic example of this partner combination is the real estate agencies.

Limited Liability Partnership (LLP)

In this type of partnership, all partners in the business would have limited liabilities and can share the business operation and management. This type is not available in all states. Examples of this type of partnership may be found among professionals such as physicians, lawyers, and accountants.

Master Limited Partnership (MLP)

In this new type of partnership, the business ownership shares (or interests) are sold and traded on a stock exchange in the same manner of selling and trading stocks. However, this partnership is not allowed to sell more than the full (100%) ownership. It is usually operated and managed by the master partner, the one who owns 50% or more of the ownership interest in the partnership. It is characterized by limited liability to all partners and having a good level of liquidity. But the disadvantage is the double taxation except in the lines of business which are protected such as the real estate and natural resources.

Types of Partners

In addition to the types of partnerships, partners too have been classified into the following.

Secret Partner

An active owner in a partnership who chooses not to be known as a partner in that business.

Silent Partner

An inactive owner who happened to be not known as a partner in that business.

Nominal Partner

A person who is not actually an owner in a partnership but he/she seems to be a partner to the public.

Dormant Partner

An actual owner but neither active in the partnership nor known to the public as a partner.

Senior and Junior Partners

A common classification based on how long partners have been in that business.

Advantages of Partnership

- Like the sole proprietorship, business partnership is easy to establish with no complicated rules or procedures.

- Probably the best advantage of partnership could be the complementarity between partners. Their different abilities, skills, and personalities can complement each other for the best common services of the business.

- It offers the benefits of sharing efforts and bearing joint responsibilities.

- If partners are agreeable and compatible, effective decisions can be made at ease, and problems can be resolved better by using more than one mind.

- Higher capital can be raised with more than one contributor and individual credits can enhance each other for a better trust and higher confidence by lenders.

- Individual assets and resources can be pooled for a stronger collateral, higher security, and better chances for expansion and growth.

- Since partners would naturally check on each other, their business would most likely, and indirectly benefit from higher individual responsibility, elaborate work, and tight control.

- Just like sole proprietorship, no double-taxation problem with this form of business since partners' share of profit would become their personal income that is subject to income tax.

Disadvantages of Partnership

- Partnership has a tendency to be less stable than other forms of business due to the likelihood of developing disagreements and conflicts among the partners which may even end up in the business termination.

- The company may face a crisis of discontinuity if any one of the partners dies, or becomes incapacitated for some reason. The difficulty in this situation may stem from the likelihood of other partners trying to buy out the departed partner's share, or trying to impose a new partner who would replace the original partner.

- General partners would face unlimited liability for the business losses and law suits.

- Size and growth of partnership would be limited by the maximum amount of financing the partners can take. Although it is better, in this regard, than the sole proprietorship due to the credit capacity of more than one partner, capital raising would still be very much limited as compared to corporation.

- When more than one partner wants to raise the par too high to prove that they work hard for a higher standard, the quality of performance and product may become hard to achieve or become too demanding to the point that may exert too much pressure on business resources.

4.3 Corporation

A corporation is a legal business entity in which individual investors are collectively associated as owners of the business, where the extent of their ownership is determined by the number of shares of the business stock they buy. It is the most complex and powerful form of business. Although corporations in the United States comprise only 20% of all businesses, they are responsible for more than 90% of all business receipts and wages paid. It has been said that corporations have been significantly increasing goods, services, wages, and business stability, reducing capital risk, and revolutionizing managerial control. Under corporation, ownership of the business is transferrable as shareholders come and go continuously when they buy and sell their shares. Depending on any specific corporation, its business stocks are either publicly traded in a stock exchange or privately traded in a selected close circle. Corporations are chartered by the state in which it is incorporated but they can still do business in other states of their choice given that they comply with the rules and regulations of that state. Here we can distinguish among three terms. Domestic Corporation is the corporation that does its business in its home state. Foreign Corporation is the one that conducts its business in states other than its home state. Alien Corporation is the one that is incorporated abroad but doing business here. However, they are all required to report their financial statements to their home state where all the reported information becomes public records. Corporations are run by boards of directors which are elected by shareholders. By law, a corporation is considered a legal entity by its own, separate from its individual shareholders. This means that the corporation is treated apart from its owners in legal matters such as taxation, lawsuits, and contracts.

States are different in their requirements, rules, and regulations for dealing with corporations but we can generalize that all the secretary of state offices in the United States require a certificate of incorporation that would include the following information at minimum.

- Formal name of the corporation.

- Names, addresses, and other information on the incorporators.

- Nature of business and its intended purpose.

- Place of business.

- Duration of business if it is specifically different from the regular corporations that have open horizon.

- Capital stock and their types.

- Capital deposit.

- Preemptive rights for purchasing stock before offering them to the public.

- Share transfer provisions.

- Identities of the corporation officers.

- Corporation bylaws.

Justifications for the Creation of Corporations

As a form of business, corporation came to existence after a long history of having sole proprietorships and partnerships. In fact, it outgrew out of the need to deal with the major shortcomings of other types of business forms. The following three reasons justify the creation of corporation as a better form of ownership than both sole proprietorship and partnership.

Liability

Liability is limited for the individual shareholders, unlike the cases of proprietorship and partnership, where the burden of liability has to be carried directly by owners.

Capital

As compared to both proprietorship and partnership, corporation has a very high capacity to raise capital through the sale of stock and continuous recruitment of new shareholders. Also, the reinvestment and growth allocation are significantly high.

Longevity

Unlike proprietorship and partnership, where their fate is attached to the fate of the major owner, a corporation can exist in perpetuity. This is because ownership is open and shares are transferrable and the corporate organization outlasts all shareholders.

Organizational Structure and Management of Corporations

Under the corporation law of a given state, a corporation can be formed by filing the articles of corporation at the Office of the Secretary of State. Three to five incorporators are usually required to sign into the application. If the filing is complete, fees are paid and the state approval is obtained, a Corporate Charter would be issued. This charter would formally confirm the registration of the corporation and nature of business, and would cover in detail all other organizational and financial information that pertains to the corporation.

Initially the newly formed corporation would be operated by the original incorporators but eventually the real owners, who are the stockholders, would elect a Board of Directors to be the body with the ultimate responsibility of running and managing the corporation. The board members would elect a president who, in turn, would appoint the corporate officers who would form their different departments and appoint the appropriate staff they need.

Shareholders can control the affairs of their corporation through three major avenues:

- approving the bylaws

- choosing the board of directors, and

- monitoring the board's performance.

All of these tasks are exercised by voting. The power of the shareholders' vote is determined by how many shares they have. Each shareholder would have one vote per share, but only the shareholders who are listed on the corporate records are eligible to vote. This means all the shareholders who buy stocks after the closing day of the corporation books would not be allowed to vote until after the annual meeting. Shareholders can, if they choose, authorize somebody else with the power of attorney to vote for them. In this case, their vote is called a “proxy,” which can be revocable by the delegating shareholder. The regular meetings of the shareholders are the times of exercising the shareholder's managerial authority. However, they can also do that at special meetings. Those special meetings can be called for by the corporation board of directors, the president, or even by those shareholders who own one-tenth of all shares or more. The board of directors holds the highest fidelity in the corporation. It would perform its duties through the following.

- Stating and approving the major objectives of the corporations.

- Appointing the right officers and granting them the right authority to act and serve the corporation interest.

- Overseeing and controlling the execution of the corporation plans.

On the other hand, the board members can be held responsible and be punished by law if there is sufficient evidence of their negligence, waste, fraud, secret profits, and any other unlawful or unauthorized acts.

As for the corporate officers, the bylaws of the corporation would usually set forth their number, qualifications, duties, and compensations. They usually do not have any corporate authority unless it is delegated by the specific charter, bylaws, or board of directors.

S-Corporation

The common corporations we know are called C-corporations. In 1954, a new corporate tax code known as subchapter was created by the United States Internal Revenue Services (IRS) to relieve the small corporations from the burden of double taxation. S-corporations were born and named after the subchapter of the IRS corporate tax code. The primary and most important improvement over the C-corporation is the tax benefit. This is why S-corporations are called the tax-improved corporations. This improvement is summarized by allowing the small corporation earnings to be taxed as partnership income to stockholders whose individual income tax is replacing the corporate tax. Any small corporation can apply to be considered under the subchapter if it is qualified for the IRS requirements. The following criteria must be met in order for any small corporation wishing to be transferred to an S-status.

- It has to be incorporated in the United States.

- All of the stockholders have to be United States citizens or permanent residents of the United States.

- Maximum number of the stockholders is 100. It was 75 until the recent amendment.

- Stockholders have to be none other than individuals, estates, certain trusts, and some other tax-exempt entities, pension plans, and employee stock option plans (ESOPs).

- No more than 25% of the corporate gross revenue from 3 successive years can come from passive investment such as dividends, rent, and capital gain.

- No more than one type of common stock to be issued.

The choice of S-corporation can be especially appropriate and rewarding to those corporations which:

- distribute their earnings primarily as dividends for its shareholders.

- project net loss at the startup stage, and

- anticipate to be sold in order to reduce the taxes on capital gains.

Table 4.1 compares C-corporations to S-corporations on selected major issues. The table shows that in addition to the aforementioned characteristics of S-corporation, such as the tax on the individual earnings instead of on the corporation, and the limitation on shareholders, product, and place of operation, the S-corporation stock cannot be traded publicly and the voting right is granted to all registered shareholders.

Table 4.1 Comparison Between C-Corporation and S-Corporation

| C-Corporation | S-Corporation | |

| Voting | Partial | Full |

| Taxes | Double | Single |

| Range | Public | Private |

| Availability | Everywhere | Certain states |

| Size | Unlimited | Up to 100 shareholders |

| Product | Unlimited | One type of common stock |

Advantages of Corporation

- A corporation has a permanent life. It will exist separate from and beyond the lives of its owners.

- It offers limited liability to shareholders, where the magnitude of liability is determined by how much the shareholders own of the corporation.

- It has an exceptional capacity to raise capital and facilitate financing for new projects and expansions simply by selling additional shares of stock.

- It has a transferrable ownership through stock trading and inheritance.

- It offers the ability to have a highly skilled and experienced management that can stay separate from the corporation owners.

Disadvantages of Corporation

- Double taxation: in the case of C-corporation, taxes would be paid twice. First is the business tax on corporation earnings before dividend distribution and second on the individual shareholder earnings as income tax.

- Corporations require lengthy, complicated, and costly procedures and paperwork.

- Corporations are restricted by federal and state rules and regulations as well as by the many provisions of their own charters.

- Out of the big advantages of the higher ability to raise capital through the sale of more shares comes a big disadvantage. That is the loss of control because for every new share sold there will be new voting rights acquired. So, when the corporation raises its capital, it would automatically relinquish part of its control on the decision making. This mechanism could cause a power change when once majority ownership becomes minority, which would gradually lose their voice of change. Sometimes the original shareholders would end up holding a marginal portion of shares that they could be voted out of any decision-making status.

-

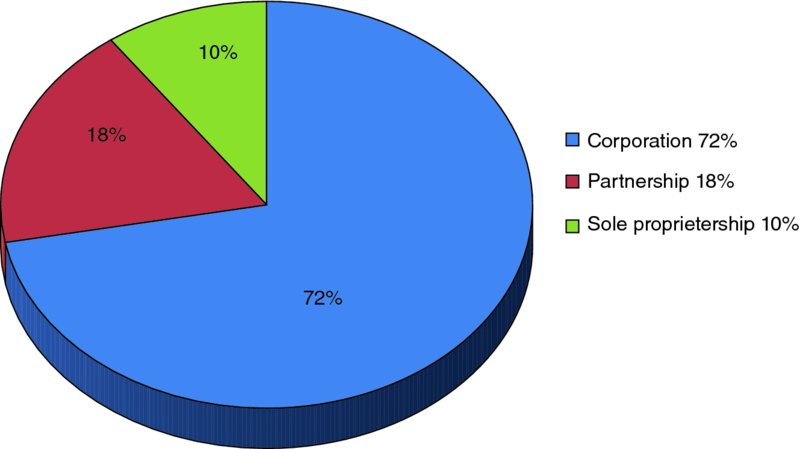

Since corporations are required by law to report detailed financial reports to the federal and state authority as well as to its individual shareholders, a great deal of business secrecy can be spilled out in this transparent process of monitoring. Much valuable information could be leaked to competition and can potentially jeopardize the corporation stand. Figures 4.2 and 4.3 show the revenue and profit distribution in corporations versus sole proprietorship and partnership.

Figure 4.2 Revenue

Figure 4.3 Profits

4.4 Other Forms of Business Ownership

Limited Liability Company (LLC)

This is a hybrid form of business combining the best features of partnership and corporation. From partnership, the tax advantage is taken. The limited liability company (LLC) does not pay business taxes but its members pay income taxes on their earnings. From corporation, the limited liability advantage is taken, where members of the LLC are liable as much as they own. In this case, the LLC seems like the S-corporation except that it is not limited by the S-corporation requirements. This form of ownership is now permitted in all states.

One of the conditions to form an LLC is that the company must not have more than two of the four defining features of a corporation. These features are:

- limited liability

- permanency

- free transferability of ownership, and

- centralized management.

Another condition is to include the words of “Limited Liability Company” or the initials “LLC” in their formal name. Sometimes only the words “limited company or LC” is sufficient. Because of the many advantages, this form of business is becoming increasingly popular in spite of its complex and expensive procedures to form. Its bylaws are spelled out in a document called the LLC Operating Agreement. The LLC is usually owned by many owners called “members,” although it can also be owned by only one person. This type should not be confused with the LLP, which we mentioned earlier as one of the partnership types.

Table 4.2 shows a comparison of characteristics among five forms of ownership: sole proprietorship, partnership, C- and S-corporations, and LLC.

Table 4.2 Comparison Between the Five Forms of Ownership

| Forms of Business Point of Comparison | Sole Proprietorship | General Partnership | Limited Partnership | C-Corporation | S-Corporation | Limited Liability Company |

| No. of owners | One | Two or three | Two or more (at least one general) | Unlimited | Up to 100 | One or more |

| Liability | Unlimited | Unlimited | Limited | Limited | Limited | Limited |

| Tax burden | Single | Single | Single | Double | Single | Single |

| Maximum tax rate (%) | 35 | 35 | 35 | 39 | 35 | 35 |

| Longevity | Connected to the sole owner | Connected to an owner | Connected to an owner | Perpetual | Perpetual | Perpetual |

| Extent to raise capital | Small | Medium | Medium | X-large | Large | Large |

| Ownership transferability | Full by owner | Full by all owners | Full by all owners | Full | Full | Full by all members |

| Ease of creation | Easy | Relatively easy agreement recommended | Relatively easy agreement recommended | Complex | Complex | Relatively easy |

| Cost of formation | Low | Moderately low | Moderately low | High | High | High |

| Ultimate power | Sole ownership | Partners | General partners | Shareholders | Shareholders | Shareholders |

Professional Service Corporation (PSC)

This form of business is also restricted to companies that render professional services such as in the fields of medicine, law, and financial counseling and planning. The difference between PSC and LLP is that this is a corporation not a partnership and the professionals themselves are the shareholders but they are licensed in their own professions.

Joint Venture (JV)

Joint venture is a short-term partnership between two or more companies aiming to jointly achieve a specific business project for profit. Its active duration is determined by the life of that project. Once the project is completed, the partnership can be dissolved. These companies are often noncompeting but can be integrated for a specific purpose. They would pool resources, work jointly, share risks and collect profits, and execute their predetermined exit strategy. A joint venture between a real estate company and a construction company can be formed to develop a residential area or shopping center. When the project is done and sold, both would reap their profits and end the partnership. This form is becoming popular both domestically and globally.

Non-Profit Corporation (NPC)

These are corporations which do not issue stocks and do not distribute dividends. They are altruistic organizations which are formed for specific charitable, educational, civic, environmental, or religious services to the public. They are funded by donations, gifts, bequests, and grants, and operated by volunteers and some hired employees. Upon satisfying some detailed IRS requirements, they can get a tax-exempt status. Their operating members have limited liability to protect their interests. They are managed by a board of directors or trustees and usually are subject to exceptional scrutiny which requires a great deal of paperwork and monitoring.

Cooperatives

A cooperative is a business by its users and for its users. It is just like any traditional business except that it is distinct by being user-owned, user-operated, and user-profited. Historically, it was a rural form of business associated mostly with farmers, but it gained some acceptance in other fields of business too. It can be consisted of producers, consumers, wholesalers, or retailers who can collectively do business to serve their own clients. The organization elects a board of directors and hires a managerial staff. Management usually follows a democratic style and it can, therefore, be voted out.

4.5 Summary

In this chapter, we went over the major forms of business ownership from a legal and structural perspective. We discussed sole proprietorship, partnership, C-corporation, S-corporation, LLC, LLP, PSC, joint venture (JV), NPC, and cooperative. It was pointed out that in the United States, 72% of all businesses are sole proprietorships, 8% partnerships, and 20% corporations split between 7% C-corporations, and 13% S-corporations. It was also revealed that 87% of business revenue comes from corporations, 8% from partnership, and only 5% from sole proprietorship. These statistics have a significant implication that corporations are the money makers despite the small percentage they constitute among all businesses. It is an implication that is enhanced and supported by other statistics such as that of the profits made by businesses. Seventy-two percent of all profits made is by corporations and only 10% of it is made by sole proprietorships, and 18% by partnerships.

Advantages and disadvantages were discussed for the first four major forms of business. These were sole proprietorship, partnerships, corporations, and S-corporations. We also discussed types of partnership and types of partners, why corporations were created on top of other forms of business that existed prior to corporations. Discussed also were the organizational structure and management of corporations, and comparison between C-and S-corporations, as well as a comparative analysis among sole proprietorship, partnership, C- and S-corporations, and LLC.

Key Concepts

- Sole proprietorship

-

Partnership C-corporation

- S-corporation

-

Uniform Partnership Act (UPA) General Partnership (GP)

- Limited Partnership (LP)

-

Limited Liability Partnership (LLP)

- Master Limited Partnership (MLP)

-

Master Partner Secret Partner

- Silent Partner

-

Nominal Partner Dormant Partner

- Domestic Corporation

-

Foreign Corporation Alien Corporation

- Certificate of Incorporation

-

Subchapter

- Tax-improved Corporation

-

Double Taxation Limited Liability Company (LLC)

- Professional Service Corporation (PSC)

-

Joint Venture (JV)

- Non-Profit Corporation (NPC)

-

Cooperative

- LLC Operating Agreement

Discussion Questions

-

Why is it important for an entrepreneur or owner to determine the legal form of business ownership?

-

What are the areas in which choosing the legal form of business would make a difference?

-

What are the four major forms of business? Define them briefly.

-

List at least five advantages of sole proprietorship.

-

Discuss at least four disadvantages of sole proprietorship.

-

What are the partners' rights and responsibilities?

-

Define at least three different types of partnership.

-

What are the differences between C-corporation and S-corporation?

-

What justified the creation of corporation? Briefly discuss three justifications.

-

Define at least three of the other forms of business.