CHAPTER 10

WORKING CAPITAL

10.1 What is Working Capital?

Working Capital generally refers to the firm's system of assets and liabilities in their current status. Current assets include cash and all the assets that can be converted to cash within 1 year. These assets are the marketable securities, accounts receivable, and inventory. Current liabilities are all the obligations that have to be paid within a year such as the accounts payable, fixed payments that include rent and lease payments, utilities due, and insurance premiums, as well as the accrued payments of payroll and taxes, in addition to the due payments on any long-term debt.

Working capital (WC) concept could be used in terms of being gross and net. Gross working capital (GWC) is just another name for the current assets (CA), while net working capital (NWC) is the difference between current assets and current liabilities.

or

In this sense, the NWC is an analogous concept to the net worth on an individual level. It would indicate what the firm owns versus what it owes, all in a current timing. In other words, it would make a measure of the firm's liquidity and its ability to pay for its present obligations, and in that, it could be understood as the relationship between the firm's current outflows and inflows.

Another way of looking at working capital would categorize the concept into permanent and temporary. Permanent working capital refers to the amount of capital needed for the production of goods and services to satisfy the minimum demand on the firm's product. Temporary working capital is the capital that may not necessarily be gainfully employed although it can change its form from cash to inventory to receivable like the permanent, which makes it fit for seasonal or cyclical production (Walker and Petty, 1986).

Working capital is very important for any business firm but particularly crucial for small businesses which depend a great deal on cash. While working capital comprises, on average, between 40% and 50% of all assets in large corporations, it would go up to 70% in small firms. This is why working capital management takes a special significance for small firms. Working capital management is to efficiently maximize the value of current assets and minimize the current liabilities in a manner to strike the best possible balance between profit and risk that would optimize the firm's value. If a financial manager is to choose between operational efficiency and long-term effectiveness when drawing a working capital strategy, it would be a wiser managerial decision to choose the achievement of operational efficiency. Still, while operational efficiency is the managerial target, it should be only a phase implementation of a wider long-term working capital policy that strives to achieve a sustained operational efficiency along the firm's life time. In its simplest term, this can be summarized by saying that a firm has to maximize its NWC and increase its liquidity in order to reduce the risk of being technically insolvent or unable to pay its due bills. This, along with increasing revenue and reducing cost would assure the profit and firm's value maximization. Working capital can be an effective tool for the financial manager to determine both profit and risk level, as we will see next.

10.2 Working Capital and Profit-Risk Manipulation

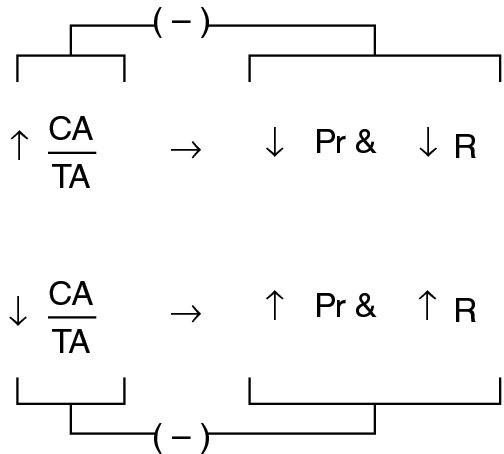

Both of working capital elements can be changed to impact the level of profit and level of risk as well. We can demonstrate that by taking the ratio of current assets to total assets (CA/TA), and the ratio of current liabilities to total assets (CL/TA). In Figure 10.1, we can observe that there is a negative relationship between current assets ratio and both profit level and risk level. This is to say that the higher the current asset ratio (CA/TA), the lower the profit (Pr), and lower the risk (R), and vice versa, the lower the ratio the higher the profit and higher the risk level.

Figure 10.1 The Negative Relationship Between Current Asset Ratio (CA/TA) and Both Profit (Pr) and Risk Level (R).

Example Let us suppose a firm has

- $110,000 total assets;

- $33,000 current assets;

- $77,000 fixed assets;

- $20,000 current liabilities;

- 4% annual profit on current assets;

- 16% annual profit on fixed assets.

Also suppose that a new management decided to take $8000 from current assets and invest it in a long-term fixed asset. Would this shift in working capital affect the firm's profit?

Looking at the numbers in the first row of Table 10.1, we see that the profit is $13,640 and NWC is $13,000.

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| TA | CA | FA | CL |  |

|

Pr | NWC |

| 2 + 3 | 1 – 3 | 1 – 2 | 2 ÷ 1 | 4 ÷ 1 | 0.04(2) + 0.16(3) | 2 – 4 | |

| 110,000 | 33,000 | 77,000 | 20,000 | 0.30 | 0.18 | 13,640 | 13,000 |

| 110,000 | 25,000 | 85,000 | 20,000 | 0.227 | 0.18 | 14,600 | 5000 |

| 110,000 | 30,000 | 80,000 | 20,000 | 0.373 | 0.18 | 14,000 | 10,000 |

The second row of the table shows that after transferring $8000 from current to fixed assets, the profit is increased to $14,600 and NWC is decreased to $5000 which refers to a reduction in liquidity that signifies an increase in the risk level. In other words, a reduction in the current asset ratio by 24.3% (from 30% to 22.7%) caused the profit to increase by 7% (from $13,640 to $14,600), and the risk level to increase by a percentage corresponding to the reduction in liquidity as it is shown by the reduction in the NWC by 61.5% (from $13,000 to $5000).

Now let us suppose that this firm decides to increase the current assets such as having more inventory for $5000. The third row on the table shows that the profit would drop to $14,000 and the NWC would increase to $10,000. In terms of the percentage changes, we can say that a 20.3% increase in the current asset ratio (from 22.7 to 27.3) resulted in a profit decrease of 4.3% (from $14,600 to $14,000) and a 100% increase in the NWC (from $5000 to $10,000) which again meant an increase in liquidity which reduces risk.

If the manipulation of working capital is done by the liabilities side, then profit and risk would be affected positively. That is when the current liability ratio increases, profit would increase due to the reduction in cost of financing (COF). Also, risk increases due to the reduction of liquidity as shown by the decrease in NWC and vice versa. This is shown on Table 10.2, given the following. Suppose that the firm wants to transfer $10,000 from the long-term liability to the current liability, given that the COF of the current liability is 5% and the cost of the long-term liabilities is 15% on average. This transfer would increase the current liability ratio (CL/TA) by 52% (from 18% to 27.3%). The COF would decrease by 6.9% (from $14,500 to $13,500) which means an increase in the profit. The NWC would decrease by 77%, reflecting an increase in risk. The third row on the table shows the opposite effect when the current liability ratio decreases. Suppose the firm decreases the current liabilities this time from $20,000 to $10,000, the current liability ratio (CL/TA) would decrease from 18% to a little more than 9%. That is a reduction by 50%. It would result in increasing the cost of finances from $14,500 to $15,500 or by 6.9%, which would reduce the profit and also reduces the risk through increasing the NWC from $13,000 to $23,000 or by 77%. The positive or direct relationship between the current liability ratio and both profit and risk as shown in Figure 10.2.

| 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 |

| TA | CA | CL | LTL |  |

|

COF | NWC |

| 2 ÷ 1 | 3 ÷ 1 | 0.05(3) + 0.15(4) | 2 – 3 | ||||

| 110,000 | 33,000 | 20,000 | 90,000 | 0.30 | 0.18 | 14,500 | 13,000 |

| 110,000 | 33,000 | 30,000 | 80,000 | 0.30 | 0.273 | 13,500 | 3000 |

| 110,000 | 33,000 | 10,000 | 100,000 | 0.30 | 0.091 | 15,500 | 23,000 |

Figure 10.2 The Positive Relationship Between Current Liabilities Ratio (CL/TA) and Both Profit (Pr) and Risk Level (R)

Table 10.3 shows that we can add up the effects on profit and risk to obtain a combined or total effect of the changes in the ratios of current assets and liabilities. It only shows the result of adding up the impacts of the first decrease in the current assets (from Table 10.1), and the first increase of the current liabilities (from Table 10.2) on both profit and risk. It is done in the same manner we did before, especially in representing risk by the decrease in liquidity or the networking capital, and representing profit increase by decreasing cost of finance.

| Change in Ratio | Absolute Change in Profit | % | Absolute Change in NWC | % |

|

+ $960 | + 7% | – $8000 | – 61.5% |

|

+$1000 | + 6.9% | – $10,000 | – 77% |

| Combined change | + $1960 | – $18,000 | ||

10.3 Working Capital and Financing Strategies

If we go back to the categorization of working capital as permanent and temporary, which was mentioned before, we can reiterate that the permanent component would include the fixed assets and whatever part of the current assets that can be considered permanent, in a sense that it would be needed throughout the year. The temporary part of working capital is the current assets that would serve temporary or seasonal needs and, therefore, would not have any permanency. In Table 10.4, we can observe that the fixed assets remain at $15,000 (column 3) while the permanent exceeded it by $950 throughout the year.

| 1 | 2 | 3 | 4 | 5 | |

| Total assets | Current assets | Fixed assets | Permanent financing | Temporary financing | |

| Months | 2 + 3 | 1 – 3 | 1 – 2 | 1 – 5 | 1 – 4 |

| 1 | 20,000 | 5000 | 15,000 | 15,950 | 4050 |

| 2 | 19,000 | 4000 | 15,000 | 15,950 | 3050 |

| 3 | 18,000 | 3000 | 15,000 | 15,950 | 2050 |

| 4 | 17,000 | 2000 | 15,000 | 15,950 | 1050 |

| 5 | 16,000 | 1000 | 15,000 | 15,950 | 50 |

| 6 | 17,200 | 2200 | 15,000 | 15,950 | 1250 |

| 7 | 19,100 | 4100 | 15,000 | 15,950 | 3150 |

| 8 | 19,800 | 4800 | 15,000 | 15,950 | 3850 |

| 9 | 20,400 | 5400 | 15,000 | 15,950 | 4450 |

| 10 | 19,000 | 4000 | 15,000 | 15,950 | 3050 |

| 11 | 21,000 | 6000 | 15,000 | 15,950 | 5050 |

| 12 | 18,000 | 3000 | 15,000 | 15,950 | 2050 |

| Average | 15,950 | 2437 | |||

| Cost of long-term financing = 0.15 × 15,950 = | 2392.50 | ||||

| Cost of short-term financing = 0.05 × 2437 = | 121.85 | ||||

| Total cost of financing = | 2514.35 | ||||

This $950 is that part of the current assets which is considered permanent or it stayed unchanged over the year. Its percentage out of the current assets varies from month to month. While the permanent part comprised 95% of the current assets in May ($950/$1000), it decreased to be only 15.8% in October ($950/$6000). The temporary part would be what is left after subtracting the permanent part from the total assets, which would be varied according to the change in total assets. It would not be a coincident that the minimum of the temporary part ($50) occurred in May and the maximum $5050 occurred in November! It is just because the permanent part took the most of the current assets in May and took the least out of the current assets in October.

Knowing the permanent and temporary needs would highlight how the firm uses its current liabilities to finance its current assets. In other words, how the firm manages its working capital. There are three approaches from which the firm can choose to finance its permanent and temporary capital needs.

The Aggressive Approach

In this approach, the firm would determine the type of capital needed to the appropriate type of debt. In this case it would pair the permanent financial need with the long-term debt, and the temporary capital need with the short-term borrowing, each according to its market cost of borrowing. Suppose that the firm faces 15% interest on long-term loans and 5% on short-term borrowing, then we can estimate the total annual COF by combining the cost of two borrowed funds while each has its own rate of interest. The end of Table 10.4 shows that the two individual interest rates on long-term (15%) and short-term borrowing (5%) are applied to the averages of the permanent ($15,950) and temporary ($2437) funds, respectively. The total annual COF is the summation of the two individual costs ($2514.35 = 2392.50 + 121.85).

The aggressive approach is usually associated with a high level of risk. We can see on the table that if we consider the permanent capital that is financed by the long-term debt at a higher interest rate of 15%, the NWC would be at minimum. Here it would equal the difference between the permanent requirements $15,950 and the fixed assets $15,000. That is $950, which would reflect a low level of liquidity and hence higher level of risk.

The Conservative Approach

This approach would not consider the short-term financing. It would be dropped all together from the financing plan, leaving all the capital needed to be financed at the long-term interest. Only special needs and emergencies can be financed at the short-term financing. This would obviously make the financing more expensive than the aggressive approach but the high COF is offset by a low level of risk. Looking at Table 10.4, we can observe that the maximum total assets of November ($21,000) would be, under this approach, financed by a long-term plan bearing 15% interest. The COF would be $3150 (.15 × 21,000), which is 25% more than the COF under the aggressive approach (2514). Judging by the larger NWC of $6000 (21,000 – 15,000), we can conclude that this approach offers more liquidity which reduces the level of risk.

The Balanced Approach

The lower COF of the aggressive approach allows for higher profit and the lower NWC leads to higher risk. On the other hand, the higher COF of the conservative approach lowers the profit and the higher NWC lowers the risk. If a firm wants to follow a compromised and balanced approach, it would have to combine the high profit, high risk approach with the low profit-low risk approach. For the permanent capital, this approach would take the midpoint between the highest and lowest level of total assets to finance it at the long-term COF. Since the highest level is $21,000, occurring in November, and the lowest is $16,000 occurring in May, the midpoint would be $18,500 ([21,000 + 16,000] ÷ 2). As for the temporary part, it would be the difference between the total asset and that midpoint, as it is shown in Table 10.5.

| 1 | 2 | 3 | 4 |

| Total assets | Permanent financing | Temporary financing | |

| Months | 3 + 4 | 2 – 4 | 2 – 3 |

| 1 | 20,000 | 18,500 | 1500 |

| 2 | 19,000 | 18,500 | 500 |

| 3 | 18,000 | 18,500 | / |

| 4 | 19,000 | 18,500 | / |

| 5 | 16,000 | 18,500 | / |

| 6 | 17,200 | 18,500 | / |

| 7 | 19,100 | 18,500 | 600 |

| 8 | 19,800 | 18,500 | 1300 |

| 9 | 20,400 | 18,500 | 1900 |

| 10 | 19,000 | 18,500 | 500 |

| 11 | 21,000 | 18,500 | 2500 |

| 12 | 18,000 | 18,500 | / |

| Average | 18,500 | 733 | |

It should be noted that whenever the permanent financing is larger than the total assets, there would be no need to the short-run funds. The table shows that in the third to sixth month as well as in the last month.

The long-term COF would be obtained by the same way we did before. Here we apply the long-term interest of 15% on the average permanent fund, $18,500, and the short-term interest on the average temporary fund, and add them up to get the total COF.

Note that this total cost is between the aggressive cost of $2514 and the conservative cost of $3150, as they are shown in Table 10.6.

Table 10.6 The Three Approaches to Manage Working Capital and Risk

| Approach | Short-Term Cost | Long-Term Cost | Total Cost of Financing | NWC | Risk |

| Aggressive | 121.85 | 2392.50 | 2514.35 | 950 | High |

| Conservative | 3150 | 3150 | 6000 | Low | |

| Balanced | 36.65 | 2775 | 2811.65 | 2500 | Moderate |

As for the risk level that would be resulting from applying the balance approach, we can again look at the NWC. It is equal here to $2500 (18,500 – 16,000). It indicates a risk level that is lower than the risk level of the aggressive approach (950), but higher than the risk level of the conservative approach (6000).

10.4 Summary

Chapter 10 was to define working capital and clarify the several terms related to it such as the GWC, NWC, net worth, and owner's equity, as well as permanent and temporary working capitals. Also addressed is how working capital is related to profit-risk management where numerical examples were given. The next topic was working capital and financing strategies where three major strategies were discussed: the aggressive approach, the conservation approach, and the balanced approach. In the aggressive approach, the firm would match the permanent financial need to the long-term debt, and match the temporary capital to the short-term borrowing, where each financing would be taken at its own market cost of capital. In the conservative approach, the firm would drop the short-term financing altogether, and rely on the long-term debt to finance almost all of its capital needs. In the balanced approach, the firm would compromise the previous two approaches. It would combine the high-profit high-risk strategy with the low-profit low-risk strategy. This would mean taking the midpoint between highest and lowest levels of total assets to finance the permanent capital at the long-term COF. It would also mean that the difference between total asset and that midpoint would serve as the basis for the temporary capital financing.

Key Concepts

- Working capital

- Current assets Current liabilities

- Gross working capital

- Net working capital Net worth

- Owner's equity

- Permanent working capital

- Temporary working capital

- Working capital management

- Aggressive approach

- Conservative approach Balanced approach

Discussion Questions

-

Define working capital with an example.

-

What is gross working capital? And what is net working capital?

-

What is the difference between permanent and temporary working capital?

-

What can a firm do to manipulate its risk versus its profits?

-

What would happen to the profit and risk if a firm shifts some capital from its current assets to its fixed assets?

-

What would happen to the profit and risk if the firm decides to buy more incentives?

-

What would happen to the profit and risk if the firm shifts capital from the long-term liability to the current liability?

-

List and briefly explain three common strategies for the firm to finance its permanent and temporary capital needs.

-

Can the firm satisfy its needs by only depending on its long-term borrowing while not using any short-term debt? And what would we call such a strategy?

-

Give a practical example of how a firm can use its balanced approach for financing its capital needs.