SECTION XVIII: FINANCIAL STRESS

Therapist’s Overview : PLAN A BUDGET

GOALS OF THE EXERCISE

1. Itemize and identify monthly income and expense, monthly totals by category.

2. Calculate any difference between budgeted projected expense and income amounts and actual amounts for each category.

3. Make a plan to reduce differences between projected and actual amounts in order to balance the budget and reduce financial stress.

4. Make a plan to reduce expenses or increase income in order to balance the budget.

ADDITIONAL PROBLEMS FOR WHICH THIS EXERCISE MAY BE MOST USEFUL

• Family Conflict

• Phase of Life Problems

SUGGESTIONS FOR PROCESSING THIS EXERCISE WITH THE CLIENT

Preparing a budget and tracking actual financial data takes considerable discipline that may require significant encouragement from the therapist. Review the client’s figures on a regular basis to reinforce the recording of data. Make decisions about a new financial plan based on how the budget amounts are different from actual amounts. Review the client’s budget as to reasonableness and completeness before he/she moves toward implementation and comparison with actual figures.

EXERCISE XVIII.A : PLAN A BUDGET

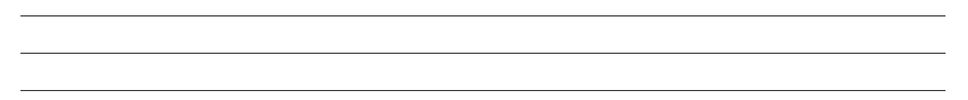

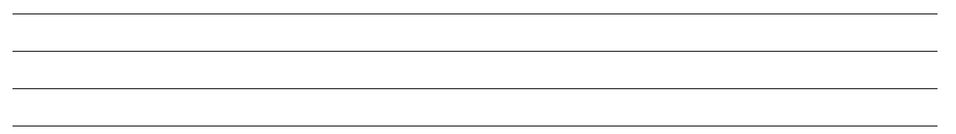

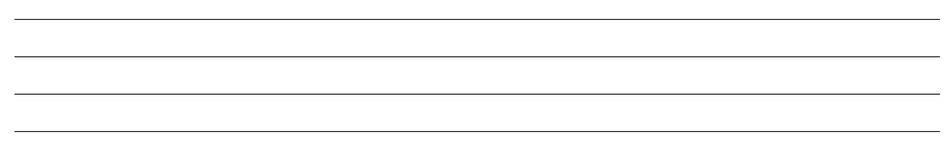

Preparing a structured budget allows for the tracking of cash flow into and out of your household. It is essential to resolving financial stress that a clear understanding is developed as to where money is being spent and what changes are possible to balance income with expense. The following basic budget allows you to enter monthly income and expense amounts that are projected and then enter the actual amounts that develop and evolve through the month. The final column allows you to calculate any difference between what was projected and what actually evolved for income and expense. Perhaps you would like to make several copies of the worksheet before you begin to fill in amounts so that expenses can be tracked for several months.

1. First enter monthly budget amounts for each category and then, after these have been reviewed thoroughly, begin to enter actual amounts spent or received in a month.

2. After reviewing the budget, what areas of expense do you feel have been out of control? Where does spending need to be cut back?

3. Can you think of ways to increase the amount of income that would help balance the budget?

4. If more than one person is living off of this budget, what agreements have been reached with the other parties as to sticking with the budget?

5. Now use your new input and track a second month. Note improvement or new areas of overspending.