Chapter Eleven

Outside Insight for Risk Management

In 2004 Dr Philippa Darbre sparked widespread concern about parabens, man-made chemicals used as a preservative in cosmetics, moisturizers, deodorants, shampoos and tanning products. A paper published by Darbre in The Journal of Applied Toxicology, titled ‘Concentrations of Parabens in Human Breast Tumours’, suggested that the chemical could be carcinogenic.1 Dr Darbre’s research was challenged by a number of large beauty and cosmetic companies, but in 2005 the EU banned products above specific concentration levels, based on a risk assessment carried out by an independent advisory body, the Scientific Committee on Consumer Products.2

A company that approached this issue conscientiously was Reckitt Benckiser, a multinational consumer goods organization based in Slough in the UK, with sales in almost two hundred countries. The company owns a number of well-known household brands, including Vanish, Calgon, Nurofen and Finish. Given the complex nature of the ingredients in its products, the company uses Meltwater to monitor online conversations regarding chemicals and health that could affect the perception of its brands.

Reckitt Benckiser responded to public concern about parabens by deciding to reformulate, replace or discontinue the sixty-four products that contained the preservative. The initiative was completed by the end of 2015, by which time the company’s chemists and microbiologists had discovered viable alternatives.

This was no mean feat. Websites have been established listing the ingredients in each of the company’s products, and external data sources such as social media are monitored in order to predict which ingredients might become future topics of consumer concern. The cost of changing ingredients in mass-produced household cleaning products is significant from R&D all the way through the supply chain to processing plants in multiple territories. Before Reckitt Benckiser makes these changes, the threat to consumers and/or its reputation needs to be properly assessed.

The company established a task force comprising R&D, communications, legal and compliance specialists, sustainability representatives and experts in raw materials in order to use timely, external insights to make predictions for which ingredients might become hot topics and then create initiatives on education around them. The programme, Better Ingredients, was based on external insights mined from publicly available data, and established a governance model for ingredients that enabled the company to be more proactive in its actions.

As part of this, the company established a ‘Restricted Substances List’, which created a palette of alternative ingredients for the formulators to combine in order to create a product and act as a way for the company to communicate its work in the area.3 The group met quarterly to examine trends revealed by the external data sources and make recommendations. The initiative was partly future-proofing, partly an exercise in competitive advantage as, by understanding the online conversation around its ingredients, the company was able to make early decisions regarding any action that it might need to take.

The parabens controversy is just one of many issues that can flare up because of consumer concerns about ingredients. A controversy doesn’t have to be caused by a chemical that is directly harming consumers; it could be an ingredient that customers view negatively because of its impact on the environment. For instance, there is now an index that identifies companies that are using unsustainable palm oil.

Palm oil is a type of edible vegetable oil that is derived from the fruit grown on the African oil palm tree. Palm oil is estimated to be in around 50 per cent of all packaged items in supermarkets and is a common ingredient in margarine, biscuits, bread, breakfast cereal, instant noodles, shampoo, lipstick, candles, detergents, chocolate and ice cream.

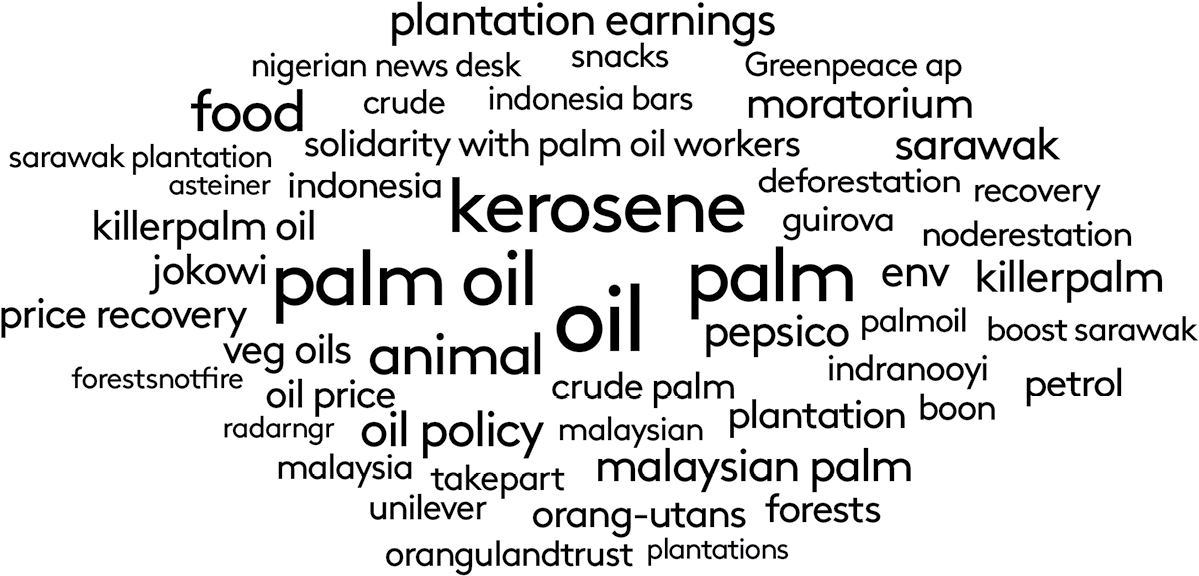

Today, 85 per cent of all palm oil is produced in and exported from Indonesia and Malaysia,4 but most of the time it is not produced sustainably, causing rapid deforestation, habitat loss and the destruction of communities. Many believe that palm oil plantations reduce orangutan populations and threaten other endangered species, such as tigers, rhinoceroses and elephants, indigenous to Malaysia and Indonesia. The World Resources Institute estimates that Indonesia lost more than 6 million hectares of primary forest – an area half the size of England – between 2000 and 2012.5 For this reason a lot of companies have been forced to consider alternatives to palm oil or to investigate producing palm oil in a more environmentally friendly way. A word cloud created by news and social media coverage in April 2016 of palm oil illustrates key areas of concern.

Assessing risk in real time

In the high-stakes world of hostage negotiation, one Meltwater client, Hazelwood Street, uses Outside Insight to quantify the risk in any longitude and latitude in the world, any city or state, any municipality, down to regions within cities, in order to help its clients stay out of trouble both in advance and on a real-time basis. ‘Nobody in our industry was doing that – they take the cases as they come and off they go,’ says Bruce Kaplan, the firm’s managing director. Hazelwood Street is a Miami-based company that provides crisis management, prevention and response services, as well as country and political risk management.

The organization is led by the former head of the Defense Intelligence Agency, General Pat Hughes, and its chairman is Cresencio S. Arcos Jr, the former Assistant Secretary of State under George H. W. Bush and then Assistant Secretary of Homeland Security under George W. Bush. The group is responsible for responding to kidnappings for ransom, extortion and terrorism threats across the globe on behalf of two Lloyd’s of London syndicates.

‘From our experience in the intelligence community we knew that human intelligence and electronic intelligence are the best indicators, so we wanted to develop a more real-time, more robust way of looking at data and measuring it through a proprietary algorithm in order to simplify it,’ Kaplan explains.

Kaplan and the team established a scale from 1 to 5 to describe the level of danger of a country. On this scale 1 is an extremely low risk – say, Switzerland – and 5 is a severe risk – for instance, Afghanistan. Once the score is determined, it’s then more straightforward for Hazelwood Street and its clients to evaluate and respond to risk by examining anecdotal data regarding recent events, both in social media and in mainstream news reporting, and to get an idea of metrics such as the threshold for ransom payments, in order to conduct cases accordingly.

‘We believe in prevention, and that is really where the data comes in handy,’ Kaplan says. ‘We are able to give clients factual and anecdotal real-time evidence that there is a problem.’

Every hour data analysts at Hazelwood Street combine data from Meltwater with their own database of multiple other sources – public and private, classified and unclassified. ‘Within the intelligence community the realization is that Open Source Intelligence is very, very valuable across the whole spectrum of messaging through news, sentiment and measurement,’ Kaplan says. ‘Combined with Human Intelligence and Signal Intelligence, it’s a really powerful predictive tool.’

Hazelwood Street’s software’s predictive capability first had a time frame of fifteen days. Then the horizon moved to thirty days, and it is now at six months. Data points include political stability, validity of contract, social justice, the criminal justice system and corruption, as well as low-level crime. A score of 5 means that clients should proceed with caution and allow Hazelwood Street to follow them during their journey.

‘Kidnapping truly is a business and we try and keep it on that level,’ Kaplan says. Data is employed in every case in order to speed up the process. ‘We had a case in February 2015 where they took an entire bus load of shift workers that were coming out of an extraction industry site. There were nineteen hostages.’ The company received a phone call from the kidnappers, who identified themselves as part of a cartel. Operatives at Hazelwood Street considered this to be a good thing – the group are known as professionals who will negotiate.

‘We started using our data sources, tweets and intercepts of messaging and some news reports and all the other stuff that goes into our algorithms,’ Kaplan says.

We found that the cartel was saying, ‘Wait a minute, we got rid of [the kidnapper] years ago because he is a maniac, he is just a local thug.’ So with that information in our hands, we changed the paradigm immediately. We told the kidnapper that if he wanted something out of this situation he had better not harm anyone, so he immediately released twelve prisoners. Over the next three days he released everybody. We were able to save lives because we had data on a real-time basis.

Tracking the health of your key clients

Risk, of course, comes in many guises, and it’s not always as high-octane as hostage negotiation. One important task for many companies is to stay on top of their key clients. This is particularly important if a company is very reliant on a few cornerstone clients.

Outside Insight can be very valuable in tracking the health of your clients. Through news and social media, new developments on the client side, such as redundancies, changes of strategy and other important events, can be identified. By analysing job postings, your client’s pace of investment can be assessed. For example, a situation where job postings suddenly dry up is a pretty important warning sign. A concerning development could be that your client is being sued. Such developments can be detected through online news, social media or directly through online court documents.

Sometimes the risks to look out for are very industry-specific. The example of parabens above illustrates the risk of ingredients impacting consumer preferences. If the client is in the financial services sector, it may be important to track government regulations, as changes here can have an adverse effect on their competitive situation. Electronics companies are particularly vulnerable to consumer reaction, so getting an early read on, say, a new product launch can be a powerful gauge of future performance.

Using Outside Insight, one can keep tabs on concerning developments with key clients. By listening to external data, early warning signals can be detected, giving more time to react if an unfortunate situation should arise.

Supply chain and partners

Another area where Outside Insight can be used to detect risk is in the supply chain and other partnerships. Once again, vulnerability is possible if your organization is dependent on specific vendors for a substantial part of the supply chain. Tracking of third-party data – import–export data, for instance – can offer significant advantages in terms of ensuring that none of the companies in your supply chain is having an issue that might affect your own production. Estimates suggest that Apple has suppliers in more than twenty-two countries engaged in hundreds of different factories. That’s a highly complex ecosystem that’s finely balanced. Should there be a glitch – a shortage of the silicate mineral mica, say, which is crucial for the electronics industry as an electrical insulator in equipment – then the entire production process could be jeopardized. Being on top of critical players in your supply chain is therefore important in order to avoid expensive glitches. In this regard Outside Insight can be valuable in many situations by capturing information available on the open internet before it trickles through via the formal channels.

It is also important to keep a close eye on partners. One area that is undergoing increasing scrutiny from shareholders and lawmakers is working conditions, particularly in relation to child labour. Staying with Apple, in 2013 the company published an audit that revealed that, from 2006 to 2013, 349 child labourers had worked in factories in its supply chain.6 This kind of transparency can help enormously with corporate reputation, but it requires organizations to burrow deep into the supply chain in order to assess their second- and third-tier suppliers.

By way of compensation, Apple forces any of its suppliers discovered to be employing child labourers to fund their schooling and to continue to pay them until they finish their education. Many enterprises, including Walmart, Hanes, Puma, Adidas and Disney, have faced accusations that they have suppliers with poor working conditions. These third-party suppliers are, more often than not, located thousands of miles from corporate headquarters and issue statements regarding their practices that prove not to be true. Outside Insight can be used to track the reputations and practices of these suppliers and identify if workers are being treated anything other than fairly.

Aside from the ethical issues in themselves, these kinds of scandal can have a significant impact on the image of the company. If you were to end up in an unfortunate situation, you would want to know as soon as possible, and this is where Outside Insight can be invaluable.

Know your client (KYC)

In 2012 HSBC and Standard Chartered, the UK’s largest banks by market value, agreed to pay US$2.6 billion in fines as part of a settlement with US authorities over money-laundering allegations.7 Standard Chartered’s fine of $667 million and HSBC’s fine of $1.9 billion were the largest ever penalties to US authorities by any financial institution for allegedly breaching sanctions policy.

HSBC was alleged to have stripped details from transactions that would have identified Iranian entities, which could have put the bank in breach of US sanctions. The bank was also said to have moved billions of dollars in cash from its affiliate in Mexico to the US, despite concerns raised with HSBC by the authorities that such sums could only involve proceeds from illegal narcotics.

Stuart Gulliver, HSBC’s chief executive, said: ‘We accept responsibility for our past mistakes. We have said we are profoundly sorry for them, and we do so again. The HSBC of today is a fundamentally different organization from the one that made those mistakes.’8

Around the world banks have been fined for not complying with anti-money-laundering regulations. In some instances such violations have been due to dishonest behaviour; in other cases they have been due to failures in the vetting processes for the client in question. To vet a client according to the strict regulations for anti-money-laundering (AML) and Know Your Client (KYC) is a costly and time-consuming job. Outside Insight can be used to automate a lot of the research required for new clients as well as to produce mandatory annual reviews. Analysis of news, social media, corporate accounts and trading information can be used to identify suspicious sources of wealth and find an associate that is a politically exposed person.

Activist investors

On 6 January 2016 Starboard Value LP, an activist investor, sent a stern third letter to Yahoo’s board of directors, stating that ‘investors have lost all confidence in the management and the board’.9 Starboard CEO Jeff Smith argued that the leadership of Yahoo ‘continues to destroy value’ and called for new executive leadership and a new board which ‘can approach the situation with an open mind and a fresh perspective’.

Starboard Value LP is a prominent activist shareholder and hedge fund known for a heavy-handed approach. At Darden, the parent company of Olive Garden restaurants, Jeff Smith won a proxy contest at the company’s annual shareholder meeting to replace every member of the board and installed himself as chairman.

In April 2016 Yahoo was forced to agree to give four director seats to Starboard,10 ending the activist investor’s campaign to unseat the entire company board. Yahoo was later forced to look for an acquirer, and in July 2016 it announced that Verizon would pay $4.8 billion in cash to acquire the former internet behemoth.11

Olive Garden and Yahoo are not the only companies to have been targeted by activist investors. Public companies are increasingly pressured by investors who want to set a new agenda or direction for the company. A quick search on Google brings up the following activist investor news:

- ‘Seaworld needs fresh board members, activist investor says.’

- ‘Valeant replaces CEO and adds activist investor Bill Ackmann to board.’

- ‘Activist investor keeps Amazon in hot seat over gender equity, targets Microsoft and Expedia as well.’

- ‘Autodesk chooses peace with activist investor.’

- ‘Rolls-Royce caves in to pressure and grants activist investor a seat on the board.’

- ‘United Airlines facing nasty fight with activist investors.’

- ‘Will Macy be able to stave off activist investor?’

In June 2014 the Financial Times quoted Leo Strine, the chief justice of Delaware, where most large US companies are registered, as saying that some shareholder meetings have become ‘a constant “model UN” where managers are repeatedly distracted by referendums on a variety of topics proposed by investors with trifling stakes’.12

Nobody is insulated from the risk of activist investors. Outside Insight can be used, however, to help assess the risk and flag worrying activities as soon as possible. One way to do this is to keep a close tab on discussions in social media and online news. Another way can be to track share trades by known activist investors so that you are warned if they should come knocking on your door.

Risk management is a practice that often focuses mostly on internal processes. Outside Insight is a powerful tool that can also be used to understand risk related to external factors. Crises relating to brand, trouble with key clients or issues with supply chain or other critical partners can all be detected at an early stage with Outside Insight. This gives a company time to prepare and to do what it can to side-step impending difficulties.

|

Scan the code using the companion app for more case studies and video interviews on this topic. Download at OutsideInsight.com/app. |

| For further reading visit OutsideInsight.com. |