CHAPTER 12

Final Thoughts

This is the first book that integrates mindfulness skills with performance psychology to present traders with a structured trading psychology process. Our focus has been on the mental and emotional challenges traders face and the cutting-edge psychology that can address and help the trader deal with the mental side of the game. Two things stand out. One is the importance of practicing mindfulness. The other is committing to the Before-During-After trading psychology process.

Although trading is replete with psychological challenges, if there is a secret to greater consistency and proficient performance in trading, it is developing the skill of mindful self-awareness. Mindfulness research reveals enormous benefits for traders. The practice of mindfulness trains the mind to be aware of ourselves and what our mind is telling us and, most importantly, mindfulness enables us to see that we have a choice in how we act in any given trading situation. Mindfulness helps us notice when we have become emotionally hooked by a demanding trading situation and also that we do not need to take action to appease the mind's chatter. Mindfulness, acceptance, and commitment help us remember and choose what is of value to us in our trading and perform the high-value activities that lead to optimum performance and profitable trading results.

The high-value mental skills and high-value actions (HVMS and HVAs) associated with optimal trading performance and profitable trading results are honed through the Before-During-After trading psychology process. Preparing for trading in a high-quality way, taking our preparation into trading to maximize our trading abilities, and assessing our trading performance and results with the intent to improve our preparation and execution is the royal road to developing, advancing, and enhancing our trading. It is a purposeful, systematic method that guides you in making attainable goals while at the same time helps you develop new skills so that you can actualize the trader you desire to be.

Whether or not you have been sampling the exercises presented in the book as you have been reading it, you need to understand that just reading the book and doing the exercises once will not equip you with competence in these skills. Mindfulness and other cutting-edge mental skills are skills and, as with acquiring any new skill, they require practice and effort. Engage in practicing mindfulness regularly and systematically follow the trading psychology process. Those who routinely do mindfulness, in fact, refer to it as “mindfulness practice,” and they do so for a reason: developing mindful self-awareness skills requires application, with an underlying sense of devotion. The same is true with the Before-During-After trading psychology process. Act on what you have learned and put it into practice for yourself. You can read all about swimming, for example. You can study how the body remains buoyant in water, how the legs and feet should kick to propel the body forward, how the arms move to direct and pull the body, and how the head rotates to allow breathing between strokes. You can study all of this diligently; even take a written test on the material and pass with flying colors. But you won't be able to actually swim until you get wet.

Both mindfulness and the trading psychology process require regular, preferably daily practice. It is wise to schedule time and practice various exercises described in the book and routinely follow the trading psychology process laid out in Part III. This requires effort and commitment. Resolve for yourself a level of commitment that is right for you, jump into the water, and start practicing mindfulness and the trading psychology process. The benefits can be enormous.

Expanding on this theme of actually doing, one of the intentions of this book is to go beyond the mere explanations of techniques and methods. The book provides a platform from which you can teach yourself something about yourself and your trading challenges. The exercises sprinkled throughout the book enable you to look deeper into your own trading situations. Take the time to do them. They require thought, a little diligence, and an open honesty with ourselves—exactly the same as in trading. Use these exercises to develop your own understanding of yourself within the context of trading. They will guide you as you develop your own personal trading psychology edge.

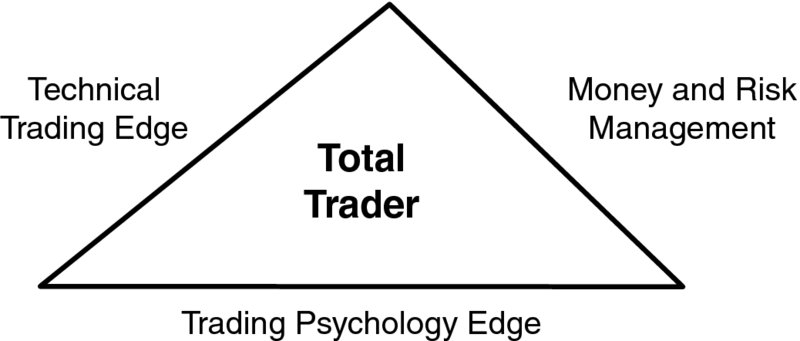

Trading psychology is only one aspect, though a crucial one, for success in trading. There are three fundamental aspects to trading well. A trader must: (1) unlock the secrets behind the technical aspects of the market, (2) develop an understanding of sound money management and risk practices, and (3) develop a trading psychology edge. This is depicted in Figure 12.1. By itself, psychology will not turn you into a great trader without technical and money management proficiencies. Consider a club-level tennis player, for example. She may have great mental skills and be as cool as ice on the tennis court. But if she hasn't developed the knowledge, skill, and ability to play professional-level tennis, she won't make it very far at Wimbledon. The same is true in trading. This being said, psychology is crucial. It underpins both technical skill and money management practice. Without a strong sense of one's psychology, which we define as a psychological edge, technical strategies can easily be compromised and money management practices may be left by the roadside. The mental side of the game and especially the trading process described in this book can help you both develop and use your technical skills to their greatest advantage.

FIGURE 12.1 Fundamental Abilities of the Competent Trader

■ Next Steps

As this book draws to a close, you will want to begin thinking about what to do next. Each individual is different. Although there are commonalities among traders, we each experience the trading world from our own unique perspective. This is the beauty and joy of being human. As we conclude, reflect on what you personally have learned from this book. What has changed or is beginning to change for you with respect to your emotions, your mind, and trading psychology? Has your perspective changed about your trading psychology? Do you see new opportunities for yourself in trading? If so, what are they?

Consider what has been most useful for you in reading and practicing what's presented in this book. Was it how intuitive and deliberative minds work? Mindfulness and defusion? Understanding what's of value to you in your trading and committing to what really matters to you? Maybe it was the idea that we can't really control our thoughts and emotions and it's time to stop the tug of war with them? How about the trading psychology process of Before-During-After? What can you now use in your trading?

Was there anything that surprised you? The mind is complex and its workings are relatively hidden from us all. Perhaps one of the paradoxes described within the book was an eye-opener and gave you some new insight into yourself and your mental world. Was there anything that stood out as an “ah-ha” moment for you? It is important to note that.

As you begin to think about what you will be using in your own trading, keep the trading psychology process firmly in mind. Prepare a plan of action, execute it, and evaluate how you did and how your plan is working, and then make adjustments. Start with small, incremental steps. They quickly add up. Keep your mind open and be willing to learn new things about yourself and about your trading. Above all else, have a little compassion for yourself when things don't go as planned or you fall short. No one gets to master it right off. And, remember what matters most to you. Keep your values as your beacon toward which you direct your actions and you will be tacking along the right course. Practice mindfulness and trade mindfully to achieve your optimum trading performance and reach excellence in your trading.