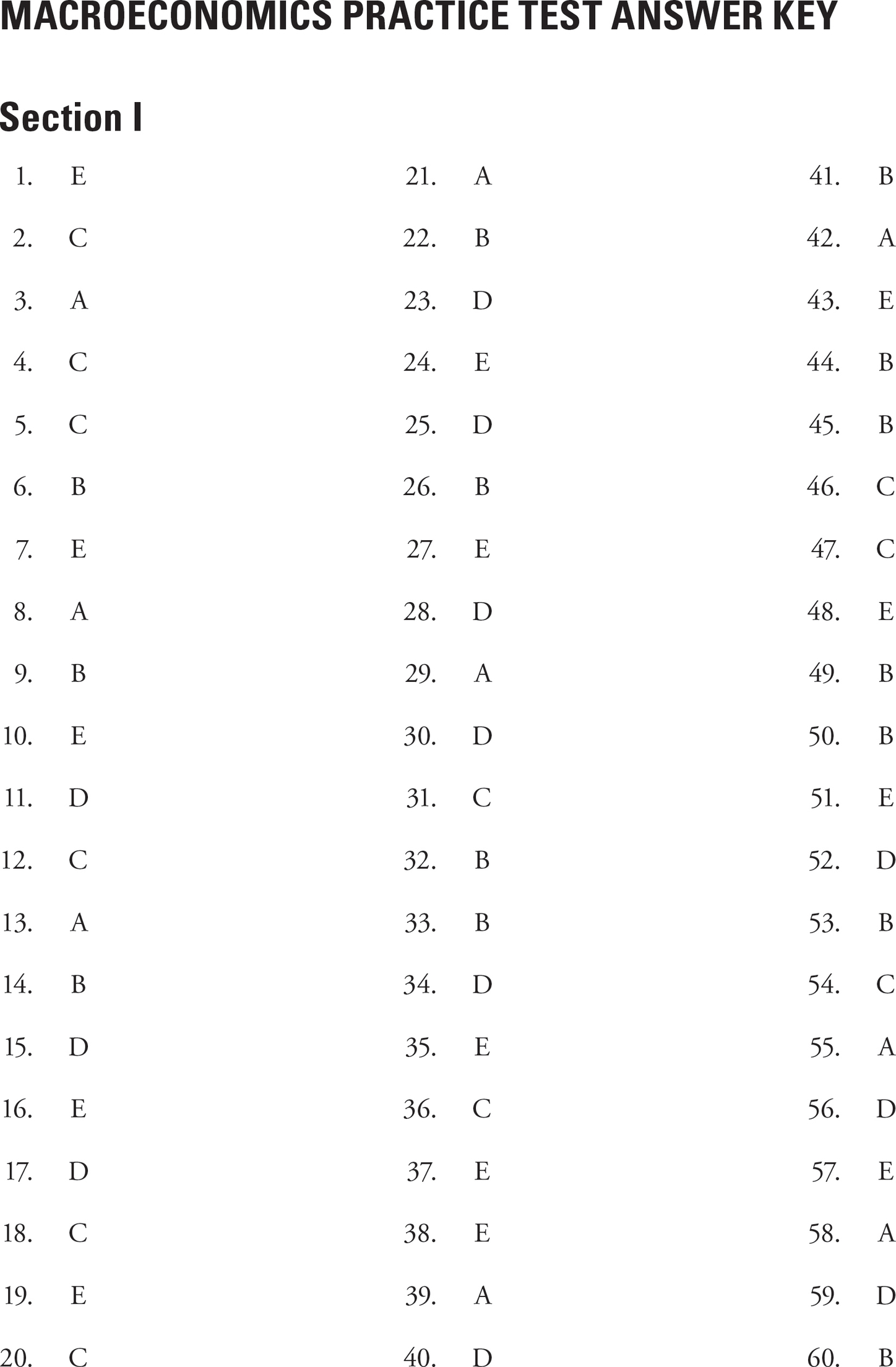

1. E

U.S. GDP is the total market value of all final goods and services produced in a year within the United States. Because the movies and olive oil were produced elsewhere, they can be ruled out. GDP includes net exports (exports minus imports), so even though they were exported, the blue jeans are included in GDP since they were made in the United States. The wine is included as well, because although Canadians make it, it fits the criteria of being produced within the United States.

2. C

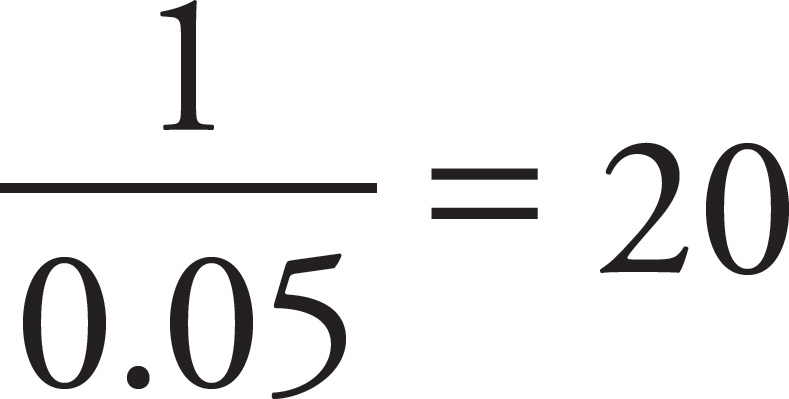

This bank must keep 20 percent, which is $200, and can lend out the remaining $800. The answer is (C), because the money multiplier is the reciprocal of the reserve requirement, or  = 5. When the money multiplier takes effect, $800 × 5 = $4000.

= 5. When the money multiplier takes effect, $800 × 5 = $4000.

3. A

Robin’s nominal income is the number of dollars he received, which increased from $30,000 to $60,000. Robin’s real income is the buying power of the dollars he receives. Because prices have tripled while his nominal income doubled, prices have increased by more than income. He will be able to buy less with his $60,000 now than when he received half of this income but prices were one-third what they are now. Thus, real income has decreased.

4. C

Choice (A) explains the horizontal section of the AS curve. Choice (B) explains the vertical section of the AS curve. Inaccurate information within firms about how their prices compare to the overall price level can fool firms into producing more at higher prices if they don’t realize that the prices for everything else are going up at the same time. Higher price levels will not allow sellers to purchase more output from other sellers because an increase in the price level means that, on the average, prices for output in general have increased. Thus, just as sellers are receiving more for their goods, they must also pay more for goods that they purchase. Wages and other input prices that adjust more slowly than output prices can provide a profit incentive for firms to produce more at higher price levels because their revenues increase by more than their costs. When output and price level increase at the same time, this results in an upward sloping section of the AS.

5. C

As illustrated in the circular flow diagram, goods and services are exchanged for dollars in the product markets. Wages and rents are exchanged for inputs in the factor markets. Household income funds expenditures, which result in revenues via the product markets. And firms exchange revenues for goods and services. The correct answer is that household expenditures do result in revenues for firms via the product markets.

6. B

Fiat money has no intrinsic value, and its value in exchange comes as the result of government order, or “fiat.” Cigarettes, gold, arrowheads, and chickens all have value beyond their usefulness as money, so they cannot be considered fiat money. A dollar bill, on the other hand, is a piece of paper that has value as money only because the government says it does.

7. E

Because Astobia’s interest rate is now lower than Bonavia’s, it would be more profitable for investors to invest in Bonavia’s economy. Therefore, there would be an inflow of capital as more money comes into the country. This will cause Bonavia’s currency to appreciate, which will increase the demand for Bonavia’s currency. However, as Bonavia’s currency appreciates, it will be more expensive for people from other countries to buy products from Bonavia, and therefore their exports will decrease. The answer is (E).

8. A

Expansionary fiscal policy will increase aggregate demand and aggregate expenditure. It is thus likely to increase the price level and the interest rate, and cause crowding out. It will cause an inflationary gap to get bigger, but will help to eliminate a recessionary gap.

9. B

The curve describing the relationship between inflation and unemployment is called a Phillips curve. A demand curve would have price or dollars on the vertical axis and quantity on the horizontal axis. The other curves listed will have different shapes and different axes.

10. E

The aggregate demand curve is not a simple aggregation of individual demand curves for goods or firms. These demand curves indicate what happens when the price of one good changes relative to the price of other goods. The AD curve reflects changes in demand when the average price level for all goods increases or decreases.

11. D

A trade surplus occurs in the merchandise balance of trade, which is part of the current-account balance. It must be offset elsewhere in the current-account or financial account balances.

12. C

The difficulty of this situation is that there is not a double coincidence of wants. That is, no one can get what he or she wants by simply exchanging his or her product for another’s product. Although money serves all of the functions listed, their problem will be solved directly by the use of money as a medium of exchange. They can each purchase what they want from one person and sell what they have to another person using money without concern for the mismatched product interests of the people they are dealing with.

13. A

The liquidity trap concept is a concern of Keynesian economists. Classical economists worry that efforts by the government to fine-tune the economy will backfire. They believe that aggregate supply is vertical, and that an increase in the money supply has a significant and direct effect on total spending. Classical economists do indeed believe in the quantity theory of money.

14. B

The aggregate supply curve will shift to the right when inputs become cheaper, more productive, or more plentiful. This would result from an increase in the labor force, an increase in education and training, or an increase in investment. With more investment in capital, workers have more equipment to work with and more output can be produced, shifting the AS curve to the right. Natural disasters and government policies that increase production costs will shift AS to the left.

15. D

If output in the long run is fixed at full employment output, this implies that the unemployment rate is the same regardless of the price level. Thus, the Phillips curve is vertical.

16. E

The value of the next-best alternative foregone when a choice is made is called the opportunity cost. Accounting costs do not include opportunity costs. Switching and inferior costs are not common terms in economics, and the average cost is the total cost of producing a number of goods or services divided by that number.

17. D

When the price level increases, the value of cash decreases and imports become relatively less expensive. Exports decrease because they become relatively more expensive. The real quantity of money decreases, thus increasing the interest rate and decreasing investment and real GDP.

18. C

When the U.S. dollar appreciates relative to other currencies, this means that each dollar will purchase more of other currencies and it takes more of other currencies to purchase a dollar. Thus, imports into the United States are less expensive and will increase. Exports from the United States become more expensive and will decrease. Trips to the United States and U.S. securities also become relatively more expensive. On the other hand, because dollars buy relatively more in other countries, U.S. residents will take more vacations in foreign lands.

19. E

Borrowers with fixed interest rates are actually helped by inflation because the value of what they must pay back goes down. Individuals on fixed incomes are hurt by inflation, because the purchasing power of their income decreases. Savers earning fixed interest rates are hurt because the value of their holdings and interest income goes down. Finally, restaurant owners are among those hurt because they incur menu costs—the cost of printing new menus with higher prices.

20. C

M1 and M2 are different but overlapping measures of the money supply. M1 is the sum of currency, checking deposits, and travelers’ checks. M2 is M1 plus savings deposits and some other less-liquid assets. Because M1 is part of M2, M1 cannot be larger than M2. At the same time, there is no reason why M2 would always be double M1.

21. A

Decreases in taxes, increases in government spending or foreign income, or expectations of future inflation will shift the AD curve to the right. If consumers expect surpluses of goods in the future, they will purchase less now—shifting AD to the left—and purchase more in the future when the surpluses are expected to lead to lower price levels.

22. B

Keynesian economists believe that investment demand is relatively inelastic, and thus unresponsive to changes in interest rates. They believe the economy is inherently unstable, that inadequate demand is largely to blame for periods of stagnation, and that real GDP needs a boost to reach the full-employment level. They also believe that the money supply has little effect on interest rates due to a relatively flat money demand curve, and that changes in interest rates have little effect on investment due to a relatively inelastic investment demand curve. For these reasons they see little use for monetary policy and prefer fiscal policy instead.

23. D

Stagflation results from the aggregate supply curve shifting to the left, which increases unemployment and the price level and decreases real GDP. Because unemployment increases for a given inflation rate, the Phillips curve shifts to the right.

24. E

Speculation that the peso will increase in value will increase the demand for the peso, shifting the demand curve to the right. If Mexico offers higher interest rates, investors will demand more pesos in order to put their funds in Mexican financial institutions. A lower rate of inflation in Mexico will draw additional consumption of Mexican goods, thus increasing peso demand. An increase in incomes elsewhere will lead foreign consumers to spend more and demand pesos. But a decrease in the international demand for Mexican-made textiles will decrease the demand for pesos used to purchase those textiles.

25. D

Stagflation is the combination of a rising price level, rising unemployment, and stagnant or falling real GDP. This results from cost-push inflation, which is also called supply-side inflation because it results from a shift in the AS curve to the left. The figure in the question illustrates demand-pull inflation, which does not result in stagflation. With demand-pull inflation, the AD curve shifts to the right, raising the equilibrium price level and fueling inflation.

26. B

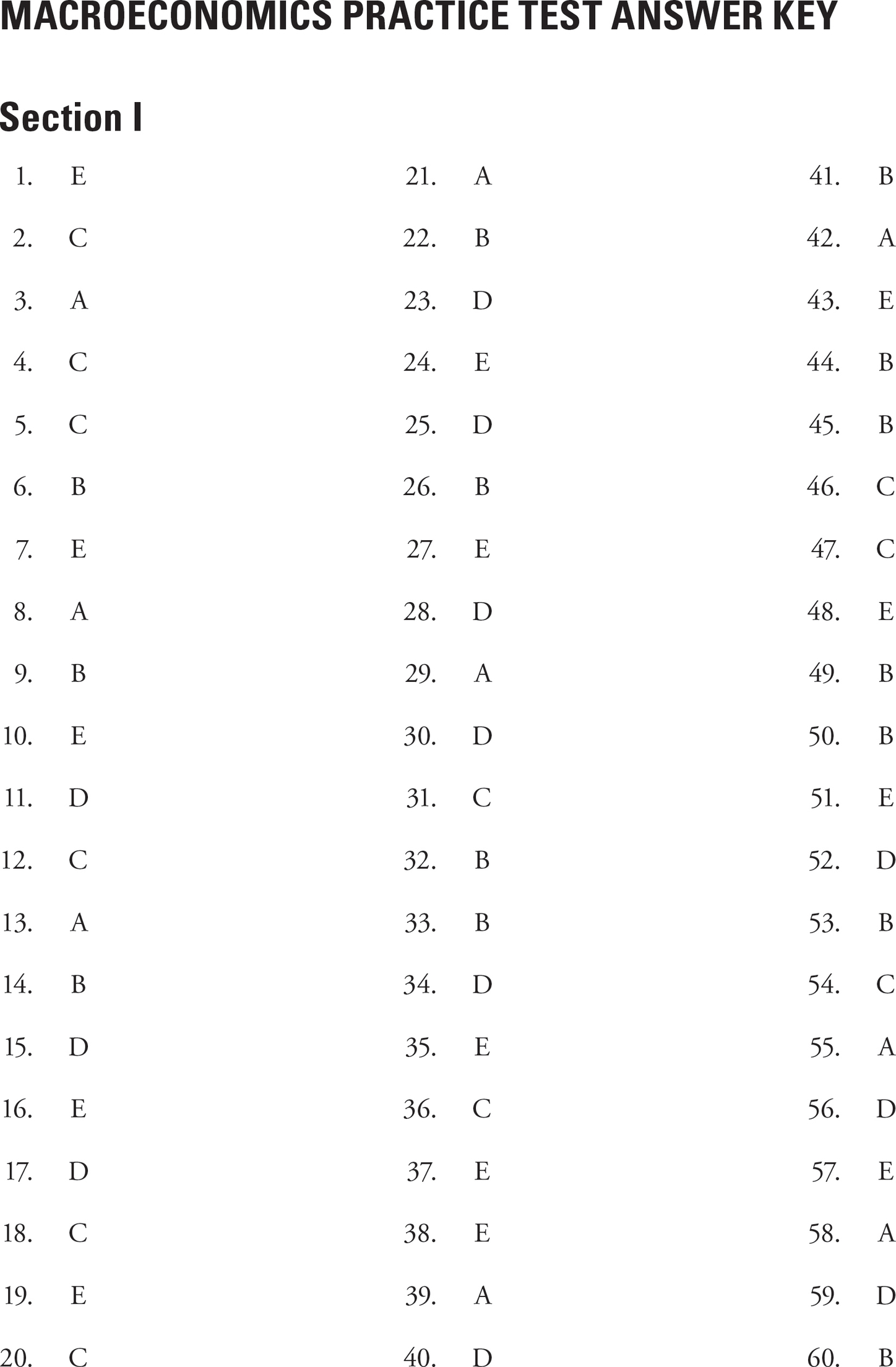

Increasing government spending is expansionary; however, the increase in taxes is contractionary. Government spending is a component of aggregate demand/aggregate expenditure, and therefore a change in government spending will change aggregate expenditure by that amount. The increase in taxes will cause a decrease in consumption; however, consumption will not change by the same amount as the tax increase, as people will change their consumption based on the MPC. In this case the MPC is 0.75, so consumption will change only by 75 percent of the amount of tax change. Thus, the overall effect in this situation is expansionary. Cross out (C), (D), and (E). The equation for the expenditure multiplier is  , which equals

, which equals  , or 4. The tax multiplier is always one less than the expenditure multiplier and negative, so it is –3. The answer is (B).

, or 4. The tax multiplier is always one less than the expenditure multiplier and negative, so it is –3. The answer is (B).

27. E

Under a fractional reserve banking system, a fraction of total deposits must be held on reserve and the rest can be lent out. This prevents a bank from lending out all of its deposits.

28. D

The improvement in technology will shift the AS curve to the right, which decreases the price level and increases real GDP. The decrease in exports will shift the AD curve to the left, decreasing the price level and decreasing real GDP. Because the two events have opposing influences on real GDP, the net result is uncertain. However, both events decrease the price level, so it is certain that the price level drops.

29. A

Neither an absolute advantage nor increasing marginal returns in the production of a good are necessary to allow mutual benefit from specialization and trade. The opportunity for two countries to benefit from specialization and trade rests only on the existence of a comparative advantage in the production of a good or service.

30. D

The CPI uses base year quantities, is favored by the U.S. government, and is thought to slightly overestimate the inflation rate. Both indexes incorporate both current year and base year prices. The GDP Deflator differs from the CPI in its use of current year quantities in its calculations.

31. C

Monetarists suggest that the use of monetary policy to fine-tune the economy could be destabilizing. They also believe that the crowding out of private investment due to increased interest rates substantially weakens fiscal policy. They see velocity and the economy in general to be relatively stable. Monetarists favor steadily increasing the money supply at a rate equal to the growth in real output rather than active fiscal or monetary policy.

32. B

People with fixed money incomes will suffer because the purchasing power of their fixed incomes will fall as the price level rises. Debtors will benefit because the purchasing power of the money they must pay back falls as the price level rises. Investors in gems, coins, stamps, and property can expect the prices of the items they own to increase with the price level. Lenders of adjustable-rate mortgages are protected from inflation because the interest rates they receive increase with the price level.

33. B

Each of these events would shift the AS curve to the left, increasing inflation and unemployment. A vertical Phillips curve implies that unemployment is constant, so that is ruled out, as is deflation. Demand-pull inflation is caused by an increase in aggregate demand, not a decrease in aggregate supply. Structural shocks result from changes in the structure of aggregate demand. These events described are all sources of supply shocks.

34. D

Reserves are assets of the bank, as are loans, which must be repaid to the bank. Because depositors and not the bank own deposits, deposits are liabilities that must eventually be returned to the owners.

35. E

Because the euro is now worth more in dollars, it has appreciated. The correct answer is (E).

36. C

Crowding out occurs when an increase in government spending (which constitutes expansionary fiscal policy) increases the interest rate and decreases investment. Thus, an increase in government spending, a decrease in investment, or an increase in the interest rate would all make the problem continue. Contractionary monetary policy would only increase the interest rate more, but expansionary monetary policy could relieve upward pressures on the interest rate and diminish the crowding out effect.

37. E

Depreciation expenses are subtracted from corporate profits before the NI calculation, so they must be added to capture the value of output needed to replace or repair worn-out buildings and machinery. Indirect taxes are part of the expenditure on goods and services (GDP) but they do not become income for suppliers of productive services (NI) so they must be added to NI to find GDP. Subsidy payments are part of NI but are not made in exchange for goods and services so they must be subtracted from NI to find GDP. Finally, GDP includes the income of foreigners working within the country whose GDP is being calculated but not the income of citizens working abroad. Thus, the net income of foreigners must be added to NI to obtain GDP.

38. E

The Phillips curve depicts a trade-off between inflation and unemployment—when one increases, the other decreases. Shifts in the aggregate supply curve result in inflation and unemployment both increasing or both decreasing. An increase in input costs will shift AS to the left and increase the price level; the corresponding increase in unemployment creates a positive relationship between inflation and unemployment, not a trade-off. An increase in output decreases unemployment. When this is accompanied by a decrease in the price level, again no trade-off between inflation and unemployment results. It is a shift in the AD curve that causes inflation to increase and unemployment to decrease or vice versa.

39. A

The natural rate of unemployment, which historically in the United States has been around five percent, is the sum of structural and frictional unemployment.

40. D

Classical economists believe in Say’s law, which suggests that when supplying goods, workers earn money to spend or save, and savings end up being borrowed and spent. Thus, they say that supply creates its own demand.

41. B

The total amount that the government owes at a given time has to do with the national debt, not the balance of the budget. Exports compared with imports have to do with the trade surplus or deficit. Whether a budget deficit exists is based on the difference between government spending and tax collections for a given period (usually a year). If the government spends more than it collects in taxes, there is a deficit. If it spends less than it collects in taxes, there is a surplus. If it spends the same amount that it collects, then the budget is said to be “balanced.”

42. A

A decrease in the required reserve ratio will allow banks to loan out more of their deposits and increase the money multiplier, thus increasing the money supply. Each of the other actions will decrease the money supply, with the exception of the income tax increase, which results in a transfer of money from individuals to the government.

43. E

The expenditure multiplier is found by dividing the change in income by the change in spending, so 500 ÷ 100 = 5. The multiplier says that when a component of aggregate expenditure is increased, the real national income/output will increase by more, according to the multiplier. The answer is (E).

44. B

Structural unemployment occurs when someone cannot find a job because his or her type of labor is no longer demanded. Structural unemployment is usually related to outdated technologies (such as telegraphs, typewriters, etc.) or jobs that are no longer as common (such as switchboard operators and typists).

45. B

Current account and financial account must always be balanced; therefore if one is positive, the other must be negative by the same amount. The answer is (B).

46. C

Spending on education and training leads to skilled and productive workers that help the economy grow. Increases in capital give workers more equipment to work with and enable them to expand output. Research and development leads to improvements in technology that assist in the production process. Increased capacity utilization brings production levels from within the production possibility frontier to points closer to the frontier itself, increasing output and growth. Increases in the interest rate, however, deter investment in capital among other sources of growth.

47. C

After an increase in the price level, a given amount of a currency will purchase fewer goods and services, so its purchasing power has decreased. The purchasing power is thus inversely related to the price level.

48. E

Julia’s autonomous consumption is $30 and she spends half of each additional dollar she earns, so she spends a total of $30 + $500 = $530. This leaves $1,000 – $530 = $470 for her savings.

49. B

Classical economists believe in Say’s law. They also believe that wages and other input prices fluctuate quickly to stay in line with output prices. For both of these reasons, they feel that the economy is inherently stable and the government does not need to intervene in order to influence aggregate demand.

50. B

When a bank has excess reserves, it can make additional loans because the bank’s actual reserves are greater than its required reserves. In other words, it has exceeded the required reserve ratio. The amount by which actual reserves exceed required reserves can be lent out to bank customers.

51. E

What one sees in bank literature is the nominal interest rate. The effective annual yield, which accounts for compound interest, is also a nominal rate. The real interest rate is the nominal interest rate minus anticipated inflation.

52. D

The money multiplier does not involve the marginal propensity to consume, which rules out (A), (C), and (E). The correct answer is  .

.

53. B

Depreciation in the international value of the dollar will decrease imports and increase exports as American goods are now less expensive and imports are now more expensive, thereby shifting aggregate demand to the right (which constitutes an increase in aggregate demand). Changes in the price level cause movements along a fixed aggregate demand curve rather than a complete shift of it. An increase in personal income taxes would decrease consumption spending, a component of aggregate demand. An increase in interest rates would decrease investment, which is also a component of aggregate demand.

54. C

Expansionary fiscal policy will increase interest rates by increasing the transaction demand for money in money market accounts, or decreasing the supply of loanable funds in the loanable funds market while increasing the demand for loanable funds. The interest rates, in that case, will remain constant. The answer is (C).

55. A

An inflationary gap exists when the short-run equilibrium of aggregate supply and aggregate demand falls to the right of full-employment output. Starting in long-run equilibrium, an increase in government spending would increase aggregate demand and bring the short-run equilibrium to the right, thus creating an inflationary gap.

56. D

The autonomous spending multiplier is the number by which an initial amount of new autonomous spending (spending that does not depend on income) should be multiplied to find the resulting increase in real GDP. The autonomous spending multiplier is  , which in this case is

, which in this case is  . Thus, Tiger Woods’s $1 purchase will result in an increase in England’s real GDP of 4 × $1 = $4.

. Thus, Tiger Woods’s $1 purchase will result in an increase in England’s real GDP of 4 × $1 = $4.

57. E

Expectations about inflation are self-fulfilling. If individuals expect price levels to rise more slowly, they will build these expectations into their wage and price demands and thereby cause prices to rise more slowly. Because inflation will decrease for any given unemployment rate, the Phillips curve will shift to the left. If the government were to carry out contractionary fiscal policy, price levels would increase even more slowly.

58. A

Crowding out occurs when the demand for funds to finance government purchases increases the interest rate and thereby decreases real investment. The resulting decrease in aggregate demand is typically smaller than the increase due to the government spending, so the intended fiscal policy is not fruitless.

59. D

According to the theory of rational expectations, people learn to anticipate government policies designed to influence the economy, and build the policies’ effects into their wage and price demands. Thus, anticipating the AD shift and the subsequent increase in the price level, people will demand higher prices and wages and shift AS back to the left. The net result of the government policy is thus inflation with no increase in real GDP.

60. B

Expansionary monetary policy will decrease interest rates, which will induce a capital inflow and increase investment and consumption. As a result, there will be increased inflation, which will cause the relative price to be high for foreign nations, which will decrease net exports, so the answer is (B).

Below are the fully correct answers; however, remember that you can still earn points on the free-response questions if you give only a partially correct answer. So, use the responses below to see how much you got right to estimate how well you would do on the real AP exam.

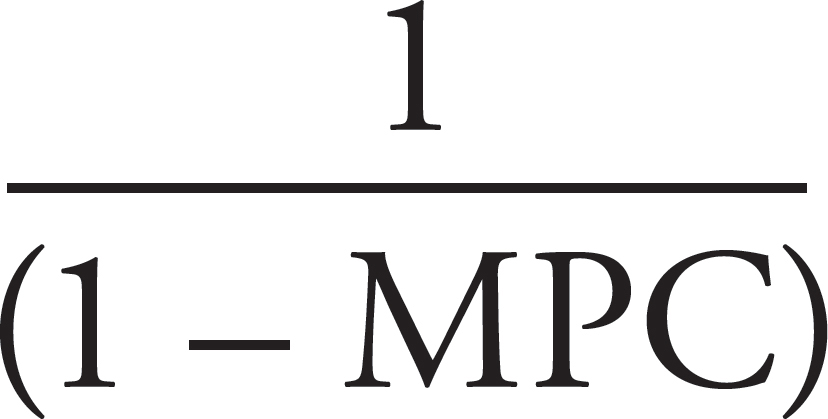

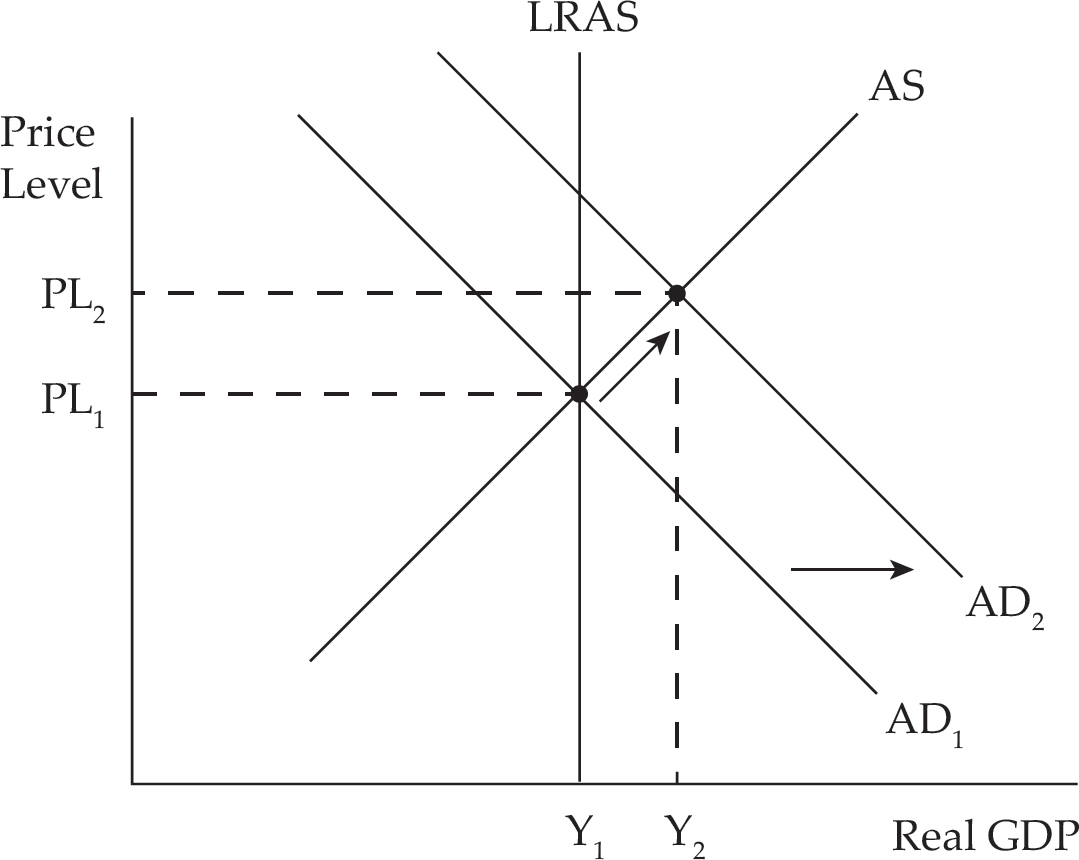

(a)–(b)(ii): Answers are shown on the graph above.

(b) (iii) Because prices have risen, this is an inflationary gap.

(iv) The unemployment rate will fall because it will take more employment to produce the new, higher level of real GDP. The full-employment level of output produced in the beginning corresponded with the natural rate of unemployment. Thus, after the change, the unemployment rate will fall below the natural rate.

(c) Contractionary fiscal policy, meaning some combination of a decrease in government spending, an increase in taxes, and a decrease in transfer payments, would help the economy move back to the full-employment output level.

(d) (i) As possible elements of contractionary fiscal policy, an increase in taxes or a decrease in transfer payments will dampen consumption—a component of aggregate demand—and shift the aggregate demand curve to the left. A decrease in government spending will shift aggregate demand to the left as well.

(ii) The decrease in aggregate demand will lead to a lower equilibrium price level.

(iii) The decrease in aggregate demand will also lead to a lower equilibrium level of real GDP.

(e) (i) Deficit spending creates the need for the government to borrow funds, which increases the overall demand for loanable funds, increases the interest rate, and decreases, or “crowds out,” investment spending. With contractionary fiscal policy, higher taxes or lower government expenditures decrease the need for government borrowing, thus reversing the crowding out effect. Interest rates decrease, allowing investment and therefore aggregate demand to increase. This increase in aggregate demand will offset some of the decrease in aggregate demand that is the direct result of contractionary fiscal policy.

(ii) Net exports will increase, because the lower interest rate will deter foreign investment and cause the domestic currency to depreciate. Exports will rise and imports will fall as the result of a depreciated currency.

2. (a) When customers make deposits into banks, a fraction defined by the reserve requirement, in this case 10 percent, becomes required reserves and cannot be lent out. The remainder is excess reserves and can be lent out. When a bank makes a loan, new money is created, because both the amount of the first customer’s deposit and the amount of the second customer’s loan are part of the M1 money supply. As the money from the loan is deposited, part of that can become a second loan, and the process continues with successive deposits and loans until the entire amount of the initial deposit is held as required reserves in banks.

(b) Ten percent of the deposit, or $100, becomes required reserves. The remaining $900 can be lent out.

(c) The money multiplier is  .

.

(d) With a money multiplier of 10, Alexandra’s $1,000 deposit can result in a total of $10,000 in deposits, $1,000 of which is Alexandra’s deposit and $9,000 of which is created as the result of Alexandra’s deposit.

(e) The Federal Reserve sets the reserve requirement for banks, which determines the money multiplier. By lowering the reserve requirement to 5 percent, the Fed would cause the money multiplier to become  .

.

(a) The widespread cost savings in the production of goods and services will translate directly into an increase (shift to the right) in the aggregate supply curve, as illustrated in the figure above. That is, firms will be willing to supply more goods and services at any given price level because they are cheaper to produce. Output will increase and the price level will decrease.

(b) The decreased price level resulting from the shift of aggregate supply from AS1 to AS2 in the figure shown in part (a) will make prices in the United States relatively less expensive than prices elsewhere. This will lead to an increase in exports and a decrease in imports, both of which shift the AD curve to the right as illustrated in this figure:

(c) The increase in exports will lead to an increase in the demand for dollars with which to purchase those exports. The increased demand for dollars will shift the dollar demand curve to the right and increase the value of the dollar relative to foreign currencies. This effect is illustrated in the following figure in the context of the dollar-euro market. The effect will be similar in other currency markets.