In La Quinta, California, Wolff Waters Place provides rental housing for low-income families. The project is certified LEED Silver and Gold.

Mark Davidson Photography

Few job descriptions are as varied as that of real estate developer. Development is a multifaceted business that encompasses activities ranging from the acquisition, renovation, and re-lease of existing buildings to the purchase of raw land and the sale of improved parcels to others. Developers initiate and coordinate those activities, convert ideas on paper into real property, and transform real property into urban fabric. They create, imagine, finance, and orchestrate the process of development from beginning to end. Developers often take the greatest risks in the creation or renovation of real estate—and they can receive the greatest rewards.

Developers must think big, but development is a detail business. Successful developers know that they must double- and triple-check everything. The clause overlooked in a title policy or the poorly done soils test can have serious consequences. Developers are ultimately responsible for their projects, and even if someone else is negligent, developers must deal with the consequences of an error or omission. A good developer is flexible, ready for the unexpected, and adaptable to rapidly changing conditions. During the approval process, for example, a developer must often negotiate with neighborhood groups that seek major changes to a proposed project. If the developer is unwilling to compromise or if the project has been conceived in a way that does not allow flexibility, the group could have the power to kill the project altogether. A developer must be able to address all stakeholders’ concerns without compromising the project’s economic viability.

Managing the development process requires special talents—not the least of which is common sense. Developers must have a clear vision of what they want to do; they must also demonstrate leadership to communicate and deliver that vision. Successful developers by nature often have strong opinions, but they must be good listeners and collaborators. They cannot possibly be authorities on the myriad fields of expertise involved in a project, so their success depends on their ability to coordinate the performance of many other parties—and on their judgment and skill in putting those inputs together in a coherent way.

Developers work with a variety of people and groups: most obviously, building professionals, including surveyors, planners, architects, and other designers; specialized consultants, contractors, and tradespeople; and tenants and customers hailing from many different businesses—sometimes with divergent goals. Developers must work closely with attorneys; bankers and investors; planners; elected and appointed officials at the city, regional, and state levels; and an increasingly complex network of regulators and inspectors. In addition to professionals, the developer must communicate effectively with citizens groups, homeowners associations, and community organizers with varying degrees of sophistication. Success comes from knowing the questions to ask and whom to ask, having a familiarity with best practices and rules of thumb, and being able to sift and evaluate conflicting advice and information.

The spark of creativity—in designing, financing, and marketing—can distinguish successful developers from their competitors. Management of an innovative project team is a balancing act. Too much guidance may stifle creativity; too little may lead to a chaotic process and unmanageable results. obtaining creative, cutting-edge work from the team without exceeding the budget is one of the fundamental challenges of managing the development process, and it requires the combination of a rigorous overall process along with room for flexible exploratory work within this regimen.

Real estate development is an organic, evolutionary process. No two developments are exactly alike, and circumstances in a project change constantly. For beginners, development often appears easier than it is. Most beginning developers have to work harder than seasoned professionals to keep a project moving in the right direction.

Solving problems as they occur is the essence of day-to-day development, but anticipating the unexpected and managing the risks are the keys to a satisfying career. Laying the necessary groundwork before an important meeting, arranging an introduction to the best prospective lender, creating the best possible setting for negotiations, and knowing as much as possible about the prospective tenant’s or lender’s needs and concerns before meeting with them will help ensure success.

Many developers say that it is better to be lucky than good. According to Phil Hughes, president of Hughes Investments, Inc., “In this business you’d better be lucky and good. Luck may be where opportunity meets preparation, but in our business the developer makes his own preparations and his own opportunities, and it is up to the developer to introduce the two.”1

This book is directed to beginning developers and other professionals who work in or around the real estate industry. Readers are assumed to be familiar with at least one or two segments of this industry, through their daily activities, academic training, or personal investment. Even seasoned professionals may gain a better understanding of the role they play in the development process: What are the rules of thumb concerning the way developers do business with them? What are the critical elements affecting the success of the development? Why does the developer, for example, care about the concrete contractor’s slump test? What type of certification enables a developer to close a permanent mortgage? In short, how does the detailed business of development make great places?

This book addresses in detail five major types of development that beginning developers are most likely to undertake: land subdivision, multifamily residential, office, industrial, and retail. Single-family housing is not addressed except insofar as land developers sell subdivided lots to homebuilders. Each of the five product types is described from start to finish: selecting sites; performing feasibility studies; evaluating alternative approaches; identifying markets and tailoring products to them; financing the project; working with contractors; and marketing, managing, and selling the completed project.

Understanding the Real Estate Industry

The real estate industry is divided into five main product types: residential, office, commercial, industrial, and land. The market for each product type can differ dramatically by region and by location relative to employment centers, transit stops, or other location factors. Interestingly, such historic correlations of value and location no longer necessarily hold across the board. Some suburban nodes, for example, boast office rents higher than their center cities, and examples abound of formerly blighted neighborhoods rapidly gentrifying as they become appealing to changing residential preferences. These kinds of shifting parameters illustrate the successful developer’s need for intellectual curiosity and openness to continuing improvement and education.

Building design and site density represent two other primary dimensions for categorizing different segments of the property market. Each combination represents a different building type, cost structure, and end-user profile. For example, high-rise apartments with structured parking cost much more to build and operate than do garden apartments. Rents must be higher, and to be successful, the market study must demonstrate sufficient unmet demand for units from higher-income people who want high-rise rental apartments in a given location. Choices made in development must continually balance market demands with project economics.

The development process, although similar for each product, is different in detail and emphasis. For example, preleasing is not necessary for apartment development and has no meaning for land development, yet it is critical for office and retail development. Likewise, market analysis for industrial buildings is highly specialized, versus residential or other commercial uses.

The book contains three main parts: an introduction to the development process, discussions of individual product types, and a look at trends in the industry. Chapters 1 and 2 contain an overview of the development process, paths of entry into the business, and strategies for selecting and managing the development team. Chapters 3 through 7 describe development of the five main product types. Chapters 3 and 4 also provide detailed step-by-step summaries of the core processes for development analysis and will serve as references for the other product types. Because many steps are the same for all income property types, chapter 4 describes in detail certain steps common to all product types, such as how to calculate financial returns for the overall project and for individual joint venture partners. After reading chapters 3 and 4, readers should then turn to the sections of the book that concern the particular product type in which they are interested. A final chapter discusses industry trends, emerging issues, and the developer’s social responsibility. Case studies at the ends of chapters 4, 5, 6, and 7 show how the principles discussed in the chapters are used to develop actual projects.

The breadth and detail of this book should not be considered a substitute for remaining up-to-date with market and regulatory conditions. No two communities, and no two projects, are alike, and despite the long history of real estate development, nearly everything is subject to change. New regulatory approaches, construction innovation, even Supreme Court cases can upend longstanding best practices and standards presented in this book. Although this book is intended to be a primer covering all aspects of development, it is no substitute for expert local advice from experienced developers and professionals involved in the process.

A wealth of information is available online to facilitate every step of development—from real-time market analysis and local demographics to government approvals and financing. Indeed, one of the most important trends today is the impact of technology on the conduct of the development process.

Developers take risks. At the low extreme of the risk spectrum, developers may work for a fee, managing the development process for other owners or investors. In this role, they might incur a small degree of risk from investing some of their own money in the venture or having an incentive fee that depends on their bringing the project in under budget or with faster leasing at higher rents. At the other extreme, developers can undertake all the risk, investing the first money in the project, taking the last money out, and accepting full personal liability. Failure could mean bankruptcy.

Developers also manage risk. They minimize, share, hedge, or eliminate risk at each phase of the development process before moving forward. They attempt to minimize the risk at an early stage to make sure that the risk of investment for upfront costs—when a project’s prospects are most uncertain—is balanced with the likelihood of success. Beginning developers must usually accept greater risk than experienced developers do, because beginners lack a strong bargaining position to transfer risk to others. They must often begin with projects that experienced developers have passed over. Beyond this basic truism, though, Phil Hughes argues that beginning developers often take on more risk than they have to. They need to look harder to find the right opportunity, but every project includes opportunities to reduce risk.

Many people are attracted to development because of the perceived wealth and glamour associated with the most successful developers. To be sure, development can offer enormous rewards, tangible and intangible. Besides the economic considerations, many developers relish the role of creating lasting contributions to the built environment. The feeling of accomplishment that comes from seeing the result of several years of effort is, for this type of person, worth the trouble and sleepless nights along the way.

Development’s risks, however, require a certain kind of personality. Individuals must be able to wait a relatively long time for rewards. Three or more years often pass before the developer sees the initial risk money again, not to mention profit. Generally, this delay is growing as projects and approvals become more complicated. Developers risk losing everything they have invested at least once, and sometimes several times during the course of a project. Events almost never go exactly as planned, especially for beginners or those moving into new product types or markets. Developers must be able to live with some level of constant risk.

Development can be extremely frustrating. Developers depend on a variety of people outside their own organization to get things done, and many events, such as public approvals, are not under the developer’s control. one developer recalls that when he started developing single-family houses, he often became frustrated when work crews failed to show up as promised. only after he learned to expect them not to show up and was pleasantly surprised when they did, did building become fun. The public approval process has become much more time-consuming and costly over the last two decades, greatly reducing the developer’s control over the process and adding considerably to risk, especially in the early stages when risk is already highest.

The impact of local politics on real estate development cannot be overstated, especially for a beginner. A project’s feasibility is a function not just of market demand but also of what the local jurisdiction demands. A project might work financially but if local officials, or neighborhood activists, don’t agree, approvals will not be granted, and the project will not go forward. It is crucial for the developer to build a good relationship with local officials and the community and to understand their interests.

Until beginners develop sufficient skill and self-confidence, they should probably work for another developer and learn about the process without incurring the risk. Even with experience, developers often start with a financial partner who bears most of the financial risk. one way to limit risk is to start on projects that involve leasing or construction risk but do not involve all the risks in a completely new development: an apartment renovation, for example. In any event, one should start on projects where the at-risk investment can be lost in its entirety without causing undue stress.

Even the smallest projects today typically require $50,000 to $100,000 cash up front, or “pursuit capital,” to advance it to the point where equity and debt funding can be raised. A developer should never begin a project without having at least twice as much cash on hand as seems necessary to get the project to the point where other funding is available. The upfront cash is only part of the total cash equity that a developer will need to complete a project. Most lenders today require a developer to invest cash equity to cover 25 to 40 percent of total project cost. Total cash equity need not be in hand or even sufficient to purchase the land, but it should carry the project through to a point where the developer can raise other funds from investors or lenders or has cash flow from operations.

Developers can limit risk substantially by taking care in their acquisition (see chapter 3). For example, closing on land should take place as late in the process as possible. If 60-day or 90-day closings are typical in a community, beginning developers should look first for a land seller who is willing to allow 180 days. The land might cost more, but the added time may be worth the difference. If public approvals such as zoning changes are necessary, developers can often make the necessary approvals a condition of purchasing the land. Doing so will allow developers to shift some of the risk of approval to the seller, and it will align seller and buyer interests in the approval process. If public approvals or financing falls through, the developer will avoid spending precious capital on sites that cannot be developed profitably. Purchase options on property that provide control over a site without having to purchase it immediately are one of the greatest tools for developers. They reflect the developer’s ability to negotiate and to satisfy the seller’s needs at the same time.

Raising equity for one’s first deal is perhaps the biggest hurdle for beginning developers. In general, developers want equity that is available immediately. If they have to raise it before they can close on a property, sellers become nervous about their ability to close and are less willing to let them tie up the property in the first place. Options may overcome many financial obstacles with creatively constructed purchase agreements, but sellers must have confidence that financing is available.

Beginning developers often do not have established sources of equity unless they have sufficient funds out of their own pocket or from family or business connections. Even if the equity funds are not guaranteed, one must have them at least tentatively lined up before entering into a purchase contract. In most cases, investors want to see what they are investing in before they commit funds. They should, however, be precommitted to the extent possible. The developer secures such commitments by speaking to potential investors in advance and soliciting their interest in investing in the type of property, location, and size that the developer plans to find. Investors are more eager to invest when it is clear that the developer has done the homework, that is, investigated the local market carefully to demonstrate in advance that demand for a certain product exists, and that costs and regulations will enable the developer to meet this demand. The message for prospective investors is straightforward and may even be formalized with a strategic partnership or memorandum of understanding: if the developer can find a property that meets certain already-identified specifications, then investors would be interested in supplying equity for the deal. Equity requirements and rules of thumb on terms for outside equity are discussed in detail in chapter 3, but this area is particularly prone to change. In particularly hot markets, developers may find a sense of urgency among potential equity partners, desiring to get in on a prospective deal. In a downturn, equity retreats, and equity terms will become dearer, or investment may not be available under any terms. Investor intent, even written intent, is never a guarantee.

Although problems are inevitable, they almost always have solutions. Fortunately, the development process becomes easier as developers gain experience and undertake successive projects. Beginners spend lots of time pursuing capital for projects, but once a track record is established, they may discover that lenders are calling them to offer to do business.

The most difficult project is the first one, and if it is not successful, a beginning developer may not get another chance. Thus, selecting a project that will not cause bankruptcy if it fails is imperative. Because of increasing difficulty in obtaining public approvals and financing, a developer should not be surprised if he has to attempt five or more projects before one gets underway.

No single path leads automatically to success in real estate development. Developers come from a variety of disciplines—real estate brokerage, mortgage banking, consulting, homebuilding, commercial construction, lending, architecture, planning, and legal services, among others. Academic programs that award master’s degrees in real estate development typically look for students who are already experienced in one field but who want to become developers.2

FIGURE 1-1 | The Partnership Continuum

Most people learn the business by working for another developer. Jobs with developers, however, are very competitive. Moreover, many jobs that are available with developers do not provide the broad range of experience needed. Although larger developers usually hire people for a specialized area, like property management, leasing, sales, or construction, the ideal entry-level job is to work as a project manager with full responsibility for one or more small projects, or to work for a small firm that provides the opportunity to see and do everything.

Some positions in the real estate industry make it easier to move into development. Many developers start as homebuilders, then move vertically into land subdivision or expand laterally into apartment or commercial development. Others begin by constructing projects for other developers. Developers might start as commercial brokers, using a major tenant-client as an anchor to develop a new office building or finding a site to develop for a build-to-suit tenant. Developers might also start as mortgage brokers; by controlling a source of funding, a mortgage broker could make the transition to development by overseeing the financial side of a joint venture with an experienced developer. Many experienced developers are willing to undertake joint ventures with a new partner if the partner brings a deal to the developer that strategically expands his current business.

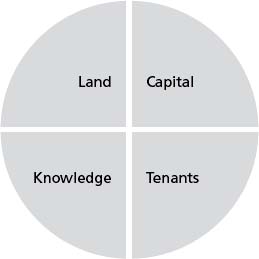

One of the most famous teachers of development, James Graaskamp, emphasized that to start, beginning developers must control at least one of four assets—land, knowledge, tenants, or capital. If they control more than one, the task becomes easier. If developers control land, then the task is driven by supply—a site looking for a use. If developers control knowledge or tenants, then the task is driven by demand—a use looking for a site. If they have capital, they have a choice.

Thin Flats, an infill condominium project in north Philadelphia, was developed by Onion Flats, LLC, a small, family-run firm. The eight-unit development is certified LEED Platinum, in part for its green roof, solar water heating, and rainwater harvesting that reduce energy and water consumption by an estimated 50 percent.

TIM MCDONALD

MARIKO REED

All development is ultimately driven by demand. Determining who needs space—potential buyers or tenants—and what type of space they need is the starting point for all development projects. The initial market analysis should define the gaps in the market and the product or products that will fill them.

Knowledge can take several forms. Many developers capitalize on their familiarity with a particular local market gained from their previous experience in the field. knowledge of the marketplace can give beginning developers the competitive edge they need—where space is in short supply and which tenants are looking for space, for example. The ability to convince potential lenders and investors that the market exists with supporting evidence in the form of market research data or letters of intent from prospective tenants is an invaluable asset for beginning developers, as they do not have a long track record to prove their capabilities.

For commercial developers, whether they are beginners or seasoned, finding the tenant/user is the most important task. Quality tenants can help draw lenders or investors and can overcome resistance from neighboring homeowners or government agencies. Their creditworthiness is the key to financing new development because it is the tenant that makes the property valuable, not the building itself.

Many developers enter the business through contacts with potential tenants, perhaps by developing a new building for a family business or for the company for which they work. knowing a particular tenant’s needs and controlling its decision about location might enable the beginning developer who works for a firm to participate as a principal in the deal. knowledge about sources of financing is another way to break into the business. Assisting an established developer who needs money or a friend who has control over a tenant to find a lender or investor can enable one to become a principal in his or her first deal. All these cases start with a use looking for a site, and the use defines requirements for the site. The developer’s task is to find the site that best fits the demand.

Another possible starting point is controlling a well-located piece of property. Many developers start by developing family-owned or company-owned land. Others begin by convincing a landowner to contribute the land to a joint venture in which the developer manages the development. In both cases, development is driven by supply.

The first question developers must answer is, “What is the highest and best use of the land?” Developers must not only consider what offers the highest return (office buildings, for example), but they must also study demand for that product. Unless demand is sufficient, the site will not produce an attractive return.

At a given point in time, every site has a highest and best use that will maximize its value. Every potential buyer analyzes a property’s highest and best use (and diligently compares it with other potential uses) before presenting an offer for a property, hoping to turn a profit. In fact, a property’s selling price is determined by many buyers deciding what the highest and best use is and bidding accordingly. The owner’s valuation of the site developed to its highest and best use at that time determines whether to go ahead with development or to wait.

Whether to develop immediately or to wait depends on an assessment of changes in use or density in the future. This calculation involves an understanding not only of market demand but also of town planning, infrastructure development, and the political and regulatory process. A tract at the corner of two highways on the edge of town, for example, might eventually make a good site for a shopping center; but if current demand for retail space does not justify a shopping center, the most profitable current use may be single-family lots. Waiting five years, however, would offer a higher profit because the shopping center could then be justified, but of course carrying costs, price changes, and regulatory risk might mitigate this differential. The apparently simple “highest and best use” analysis can quickly become dizzyingly complex, bearing on assumptions about timing, future value, and opportunity cost.

When the developer already owns the site, the market study should indicate what to build, how much to build, the expected sale price or rental rate, and the amount of time that sales or leasing will likely require. While the market study is underway, the developer should investigate site conditions (the area of land that is buildable, the percentage that contains slopes, environmental factors, flood and other safety issues, and so forth) and find out what public approvals are necessary.

The development strategy should be created once the developer has acquired information about the market, engineering, and environmental and public approvals needed. A large site does not necessarily need to be developed all at once. Financing capacity is usually limited by the combined net worth of the developer and his partners, including the unencumbered value of the land (land value net of loans).

Who Becomes Developers? How Do They Start?

ULI members who were identified as development professionals were surveyed about their experiences as beginning developers in August 2010. The following summary, based on the 239 completed surveys, gives an idea of the background of people in the development industry who are active in community development.

A PROFILE OF DEVELOPERS

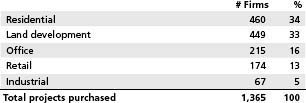

All respondents are actively engaged in real estate development. Figure A shows the breakdown of the types of firms represented.

Figure B breaks down respondents’ developments over the previous ten years by property type.

In addition to development activities, respondents had also been involved in the purchase of land and completed residential, office, retail, and industrial projects (figure C).

CAREER PATH TO DEVELOPMENT

Those surveyed identified their previous three positions. Respondents represented a broad range of experiences, including accounting, brokerage, construction, lending, real estate consulting, and law, among others (figure D). Other than development, project management was the most common step on the development career path. First jobs showed a wide range, indicating that brokerage and construction, among others, offer good entry points to development. Many respondents had spent time furthering their education, with 15 percent identifying it as a first step. Approximately 7 percent of respondents have held only one job on the way to their career, as indicated by the drop in responses as one moved from the first to the second job on the table.

The most popular product type for respondents’ initial project was residential development (figure E). Their second and third projects were more evenly split among land development, residential, retail, and office development. The most popular product type for the developer’s third project was evenly split between residential and office development. The increase in office development involvement likely occurred in part because by their third project, respondents had gained the greater experience required for office development.

In running their businesses, respondents devoted their primary attention to the front end of the development process: site acquisition, procurement of regulatory approvals, market analysis, and design (figure F). Site acquisition, the regulatory and approval process, and design and planning were most identified as the development phases developers had concentrated on.

LESSONS LEARNED

If they had the opportunity to redo their projects, most respondents would have done certain things differently. Many respondents highlighted mistakes made at the front end of their projects that came back to haunt them, such as team selection, due diligence, and the entitlement process. During planning and construction, the majority cited the importance of selecting competent, experienced team members and of effectively coordinating them. As James Ellison, cofounder of Mode Development, LLC, wrote: “Projects are very complex and are comprised of a very eclectic cast of characters. Your job as the developer is essentially the same as the director of a movie. You have to make the best of your location, get the best out of your actors, and stay within the budget of the studio all in a short period of time. Organization, accounting, relationships are all key.” Having partners that understand your operations and vision is essential, and many respondents highlighted the importance of thoroughly vetting team members and joint venture partners.

Another major concern was being skilled at the intricate details of the approval process to avoid resource-draining delays. Many spoke of the importance of forming strong relationships with local regulatory bodies and bringing in the community early in the process. Brian McCarl, vice president of acquisitions for Newland Communities, echoed this sentiment: “Real estate is a unique endeavor that often engages community and political structures in decision making about how to deploy private capital for private ownership. All real estate is in essence a public/private partnership. Failure to factor in the public decision-making process and values into decision making is a good recipe for failure. Do your homework at the neighborhood, city, and state level before you invest and start spending money.”

Another dominant concern was thorough due diligence in acquisitions. Many agreed that a bad acquisition is almost impossible to rectify, although many successful deals made their profits in the acquisition and entitlement phases. Land value comes through entitlements so developers should ensure that their acquisitions have approval strings attached. Understanding the market through extensive preliminary study will alleviate the risk of getting stuck with an unworkable project. As Michael Brodsky, CEO of Hamlet Companies, summed it up, “Time spent planning lessens time spent fixing.” Many highlighted that developers should use the market to shape their decisions, think about the end user, and not seek to impose a use on a site. “Focus on what the market is and wants, not what you want or what zoning allows,” wrote George Casey, president of Stockbridge Associates.

It is crucial to recognize which obstacles are immediate, short term, and temporary, and which ones are deal breakers. Many respondents addressed the importance of maintaining a critical distance from the project and allowing research and a conservative pro forma to generate a commitment to the deal—not an emotional excitement for building or site. As Chris Squier, vice president of mixed-use development for Crosland Development, LLC, wrote, “Don’t fall into the trap of entering into a project with a ‘best case’ pro forma that only gets worse as time goes on.”

Many discussed the importance of knowing when to walk away. Although it is difficult to let go of a project, knowing when to cut losses differentiates successful developers. Stephen Arms, managing member of Marthasville Development, LLC, gave the following advice: “Don’t be afraid to walk away from a project if conditions change. Believe in ‘sunk cost’ accounting (also known as the more common phrase ‘don’t throw good money after bad’).”

Looking forward, a number of those surveyed commented on the increased importance of urban, mixed-use, and infill projects, as well as sustainable development. “Sustainable development practices are not optional. A balance between economic, environmental, and social objectives must be planned into every 21st-century project,” advised Elias Deeb, president and owner of Cedrus, LLC.

FIGURE A | Firm Characterization

FIGURE B | Projects Built by Respondents, Past Ten Years

FIGURE C | Projects Purchased by Respondents, Past Ten Years

FIGURE D | Most Typical Career Paths to Development

FIGURE E | First Three Projects (%)

FIGURE F | Primary Areas of Focus (%)

FIGURE 1-2 | You Must Control One of These to Get Started

Selecting the location and type of the first development project should not be left to serendipity, nor should beginners necessarily grab the first opportunity they see. Failure will make it that much harder to obtain backing for another opportunity. The first deal (1) establishes the developer’s track record; (2) sets the tone for the quality of future developments; (3) establishes an image in the marketplace; (4) creates a network of consultants, brokerages, and other business relationships for future deals; and (5) builds relationships with bankers and investors. Still, every beginning developer makes mistakes. One should get the best advice possible but not be afraid to make a decision and move on.

A maxim of development is that it takes just as long and is just as difficult to undertake a small deal as it is to undertake a large one. By this logic, developers should look for the largest deal they can confidently execute. Although the maxim is true to a degree for experienced developers and for large companies with overhead to amortize, it is not true for beginning developers.

A principal objective of the developer’s first deal is to establish a track record, the absence of which is perhaps the beginning developer’s greatest handicap, so the right size project is critical. A rule of thumb is to look for a project that can be put together in about six months; one that is within the developer’s financial capabilities—personal resources plus those that can be raised through family, friends, or other currently identifiable partners. A general rule of thumb is that the combined financial net worths of the partners must be at least as large as the project’s total cost. In times of tight money, net worth requirements may be even greater.

Most projects today require substantial cash equity, which is often the determinant of a “doable” project: If lenders require 40 percent equity, for example, raising $400,000 equity for a $1 million project is much easier than raising $4 million equity for a $10 million project. If the developer has created value over and above the project cost, it may be possible to reduce the amount of cash equity required by the bank. Value is a function of signed leases and market rental rates. If the appraised value for a project costing $10 million to build were, say, $12 million, then a 70 percent loan would provide $8.4 million, leaving only $1.6 million of required cash equity.

In addition to preferring smaller deals, beginning developers should search for simple deals—deals that require fewer steps and a shorter time to bring to fruition.3 Although small buildings can be just as complex as larger ones, the criteria for selection should emphasize projects that do not require a lengthy and uncertain process of public approvals.

One exception is that smaller “problem” deals may offer an opportunity that experienced developers have passed over. For example, larger developers may decide that a site requiring special attention to curing problems with easements, boundaries, or flooding is not worth the necessary time and effort. A beginner, however, might be able to tie up the property at little cost while working out the problems. Another opportunity can be found with sites owned by local and state governments and redevelopment agencies, because large developers may prefer to avoid government red tape. Unless the site is simply put up for auction, however, the beginner might need to demonstrate a track record to convince government officials to work with him. Nonetheless, keeping officials aware of continuing interest in a project as the government works through various procedures and public hearings can give the beginner an edge when the agency finally issues a request for proposals or advertises the property for sale.

In most cases, beginning developers must give personal guarantees to secure financing. Banks typically look at the net worth of the developers and partners in the deal before granting a construction loan. In some instances, however, the tenant’s credit on a long-term lease or letter of intent may take the place of the developer’s credit.

One advantage of developing a small part of a larger tract of land is that the rest of the land can be used as collateral for financing the first project. Defaulting on the loan, however, might entail loss of the entire site: once the land is pledged as collateral, the bank can foreclose on it after default to collect any balance owed.

Development projects that begin with a site looking for a use provide an attractive way for beginning developers to start, because they will not be required to locate and tie up land until a deal can be put together. Although such projects are perhaps the easiest way to get into development, the parcel in question may not be the best site to develop at a given time. Nevertheless, many properties can be developed profitably. Skillful developers can identify the most marketable use, determine a development strategy, and then implement it.

When money is more readily available, it becomes much easier for beginning developers to find financing. In such times, there is often more money available than there are “good deals.” Another successful strategy for beginning developers who have extensive local relationships, especially brokers, is to meet in advance with potential financial partners (especially local private investors) to determine what kinds of deals they are looking for. Armed with this information, developers can look for deals that meet the investor’s preferences. If a suitable property is found, the developer can tie it up and present it to the financial partner quickly for a “go” decision. Time is critical: often the developer must “go hard” on the land purchase within 30 to 60 days, so having the financial partner ready and waiting to look at deals quickly is very important. When money is widely available, the market is likely to be hot, with lots of activity. In such times, sellers are more likely to demand shorter closing times and shorter free-look periods during which the buyer does feasibility studies before putting up a nonrefundable deposit (“going hard”). The customary amount of deposit, or terms of diligence, may increase in severity as well.

The Concept of Present Value

An understanding of present value is essential for developers.a Present value analysis equalizes the time value of money. Because one can earn interest on money, $100 today will be worth $110 in one year at 10 percent interest and $121 in two years with annual compounding. Ten percent interest represents the opportunity cost if one receives the money in, say, two years rather than now, and meaningful comparison of sums accruing at different times requires discounting each to comparable present values.

The present value of $121, received in two years, is $100. That is, the discounted value of $121 at a 10 percent discount rate, received in two years, is $100 today. If the discount rate (opportunity cost rate) is 10 percent, then it makes no difference whether one receives $100 today or $121 in two years.

The formula for calculating present value is as follows:

where PV is present value; FV is future value; r is the discount rate; and n is the number of years. Thus, the present value of $121 received in two years at a 10 percent discount rate is

The landowner’s dilemma about developing the land immediately into single-family lots or waiting for five years to develop a shopping center is solved by applying present value analysis. Suppose, for example, that land for single-family development today is worth $100,000 per acre ($1,076,400/ha), whereas land for a shopping center would be worth $200,000 per acre ($2,152,800/ha) in five years. If the personal discount rate is 10 percent, then $200,000 to be received in five years is worth $124,184 today—clearly more than the value of the land if it is developed for single-family houses. The best option is to wait. In this example, if the discount rate is 20 percent rather than 10 percent, then the present value of $200,000 is only $80,375. At the higher discount rate, the best decision is to develop the land for single-family lots today.

Which discount rate—10 percent or 20 percent—is appropriate? The answer depends on risk. Generally, land development (except for single-family houses) is considered the riskiest form of development because of uncertainties about entitlements and market absorption, which are exacerbated by the length of the approval process. Development risk for buildings depends on local market conditions. Office development is considered riskier than industrial or apartment development because the lead time is longer and space has been oversupplied in many markets.

Because of the high rates of return and high risk associated with development, most developers have personal discount rates of at least 20 percent.b That is, they expect to earn at least 20 percent per year on their investment.

Discount rates consist of three components:

Real return rate + Inflation + Risk = Discount rate premium

If inflation increases to 10 percent, then a developer’s required return increases to 25 percent. The risk premium depends on the particular property and might range from as low as 4 percent for a completed office building to 15 to 20 percent for a recreational land development.

aFor further discussion of present value, see Mike E. Miles, et al., Real Estate Development: Principles and Process, 4th Ed., Washington, D.C.: Urban Land Institute, 2007, pp. 207–209.

bTechnically, the target discount rate is the rate for which the net present value of a project is greater than or equal to zero. When the NPV => 0, then it delivers a rate of return on equity that is => the discount rate. This discount rate is also known as the target internal rate of return.

In the final analysis, a developer’s strongest assets are a reputation for integrity and an ability to deal in good faith with a multitude of players. A large developer may be able to outlast the opposition in a contentious deal, but the best advice for a beginning developer is to avoid such situations altogether.

Development is distinct from investment in income-producing properties, because it involves much more risk. Many firms and individuals invest in operating properties, buying existing properties and managing them for investment purposes. Investors often incur some risk in leasing and may make minor renovations that entail some construction risk. Developers, on the other hand, take on a set of additional development risks. Most developers also hold on to properties, at least until liquidity is required, after they are developed—that is, during the operating phase—thus incurring the ongoing risks associated with operations.

Developers may take on different degrees of ownership and risk depending on their ownership structure and the complexity of the project. Developers who operate alone and invest only their own money are said to be 100 percent owner/developers. They furnish all the cash equity, accept all the risk and liability, and receive all the benefits. The concept of a 100 percent owner/developer is useful for quickly analyzing development opportunities, because if a project does not make economic sense in its entirety (as viewed by someone who has all the risks and rewards), it will make even less sense as a joint venture or other form of partnership.

No generally accepted definition exists to determine who is a developer and who is not, but a developer can be defined as the person or firm that is actively involved in the development process and takes the risks and receives the rewards of development.4

Many people involved in a development project incur risk. Those who design, build, and lease a building for a fee are agents of the owner and are developers insofar as they are engaged in the processes of development, but they incur no risk if the fee is fixed. If, however, the fee depends on the project’s success, the individual accepts some performance risk associated with development. Development risk is associated with delivery of the entire project and thus may be distinguished from performance risk associated with individual tasks (such as contractors who accept construction risk when they have a fixed-price contract). Most rewards in development are proportional to the risk one takes on. Experienced developers are able to transfer some or most of the risk to others by using other people’s money or by finding a lender who will give them nonrecourse financing (lending without personal liability). They still carry the burden of delivering a successful project, however. In almost all cases, developers will have something at risk, such as front money for feasibility studies, investment in preliminary designs, earnest money, or personal liability on construction financing.

Development companies increasingly serve as development managers for major institutions. In this role, they perform all the normal functions of developers except that they bear little or no risk. The institution—a bank, an investment group, an insurance company, a foreign corporation, or a major landowner—bears the risk. The developer works for a management fee and usually a percentage of the profits (10 to 20 percent) if the project is successful.

Historically, developers have preferred to own real estate rather than to manage it for others, because ownership has enabled them to leverage completed projects into new deals as they amass wealth. Nevertheless, major developers have increasingly accepted roles as managers, either to keep their staffs busy during slow periods or to enter new markets with minimal risk. Firms that succeeded in finding these scarce roles in the Great Recession of 2007–20095 have benefited from steady, though modest, cash flow.

Property management, brokerage, tenant representation, construction management, and other tasks in the skill set of developers can become, at any time, valuable, or at least sustainable, as service businesses. Developers building an organization should know, however, that in times of distress, competition for these service contracts increases dramatically, and banks and other property owners will find themselves in excellent bargaining positions for these services. Truly outstanding or niche businesses stand a better chance of providing cash flow in these periods.

The adage “timing is everything” is especially applicable to real estate development. The importance of real estate cycles cannot be overemphasized. Like other large, capital-intensive purchases, real estate is highly sensitive to changes in interest rates and macroeconomic conditions like employment and migration. Income properties provide insufficient cash flow to be financed when interest rates move above certain levels. For-sale developments, such as housing subdivisions, office buildings, or residential condominiums, suffer from higher financing costs and from the effect of rising interest rates on the amount of money that potential purchasers can borrow. When rates are high, buyers tend to wait for them to come back down before buying a property. The development industry is further affected by high interest rates because development firms typically are smaller than most corporate bank customers. When money is scarce, lenders tend to prefer their non–real estate customers. Even very sound projects can be difficult to finance because lenders fear the unknown development risks.

The supply as well as the demand side moves up and down. Lenders often appear to exhibit a herd mentality, all seeming to prefer the same type of product or geographic area at the same time. Supply of investment capital follows product types through cycles. Successful residential subdivisions will draw additional investment, as they did in the Sunbelt in 2002 through 2005, until the moment when demand indicators, such as median home prices, begin to falter. Sensing, correctly or not, that the sector is overbuilt, lenders tighten underwriting standards for these projects. The resulting “credit crunch” can be sudden and, to the developer, overly drastic. Larger and multiphase projects, in particular, may find that tightening credit can affect even their performing loans, which may have been in place for many years.

One unintended consequence of the widespread availability of market data and business news seems to be that such turns in opinion can happen faster than ever before, with the shift from robust growth to pullback turning on a few indicators or opinion leaders, and on timescales that may not align with project funding needs.

Selecting the right time to enter development is crucial. Most beginning developers plunge ahead, regardless of the general economic climate, and often their success in financing the first project depends on their timing with respect to the cycle. Ironically, financing a project toward the end of a positive market cycle (when many lenders are enthusiastic about a particular geographic area and product type) is often easier. Toward the end of the positive cycle, however, risk increases as the competition for tenants or buyers intensifies. If supply becomes excessive, those who were the last to enter the market are usually the first to get in trouble, because their costs are higher and competition is fierce for tenants.

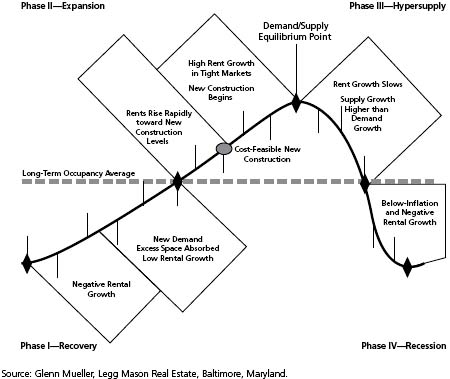

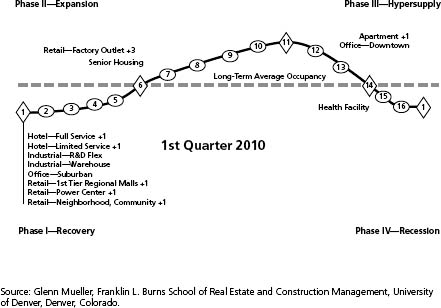

Even in a period of relatively stable overall economic growth, real estate markets are cyclical, as a result of the lagged relationship between demand and supply for physical space. Glenn Mueller, professor of real estate at the University of Denver, divides the market cycle into four distinct phases: recovery, expansion, hypersupply, and recession (see figure 1-4). Each phase is characterized by different changes in vacancy and new construction, as well as changes in rent. The position of property in the market cycle differs by property type and location. This type of analysis is helpful for understanding market timing—when the market is most favorable for new development.

A project launched early in the positive cycle means less competition for the developer, but it also means financing is likely to be scarcer. Long lead times required for finding the right site, designing the project, and receiving zoning and other public approvals mean that developers must be able to perceive new market opportunities before others do—often before they have become popular among lenders. The developer, then, will often have to convince lenders of an opportunity that is not obvious to all market players.

During the early stage of the development cycle, land is cheaper, terms are softer, and there is less entitlement and market risk. During later stages, landowners push more risk onto the developer. Developers may be required to take land down outright, with increased entitlement and market risk, as well as carrying costs. Closing times are shorter, and free-look periods are shorter or even unavailable for due diligence before contingencies are removed on purchase contracts.

How does a developer determine where a city is with respect to the economic cycle? General economic indicators, such as unemployment rates and business failures, provide information on general economic conditions. Although national conditions determine fluctuations in interest rates and credit availability, local data are more relevant. As the local market starts to approach the top of the economic cycle, rent increases slowly, if at all, and the supply of new space increases faster than absorption of that space. The peak of the cycle passes when new supply exceeds absorption, causing vacancy rates to increase.

FIGURE 1-3 | Physical Real Estate Cycle Characteristics

FIGURE 1-4 | National Property Type Cycle Locations

Starting in Phase I—Recovery at the bottom of a cycle, the marketplace is in a state of oversupply from previous new construction or negative demand growth. At this bottom point, occupancy is at its trough. As excess space is absorbed, vacancy rates fall and rental rates stabilize and even begin to increase. Eventually, the market reaches its long-term occupancy average where rental growth is equal to inflation.

In Phase II—Expansion, demand growth continues at increasing levels, creating a need for additional space. As vacancy rates fall, rents begin to rise rapidly, pushing rents to cost-feasible levels. At this stage, demand is still rising faster than supply, and there is a lag in the provision of new space. Demand and supply are in equilibrium at the peak occupancy point of the cycle.

Phase III—Hypersupply commences after the peak/equilibrium point when supply is growing faster than demand. When more space is delivered than is demanded, rental growth slows and eventually construction slows or stops. Once the long-term occupancy average is passed, the market falls into Phase IV.

Phase IV—Recession begins as the market moves past the long-term occupancy average with high supply growth and low or negative demand growth. The extent of the down cycle is determined by the difference between supply growth and demand growth. The cycle eventually reaches bottom as new construction and completions slow or as demand begins to grow faster than new supply added to the marketplace.

Real estate cycles create windows of opportunity for financing and strong market demand in advance of a large supply. If developers can synchronize their development efforts with the cycle, they can greatly improve their chances for success. The odds against beginners increase if they try to develop against the cycle. The biggest problem that beginners face is completing a suitable project within the window of time for which the market is favorable. The favorable window (Phases I and II in figure 1-4) may extend two to three years, but the chances for success decline significantly in Phase III, and financing may be almost impossible in Phase IV.

The first step in the development process for beginning developers who do not already own land is to select a target market, in terms of both geographic area and type of product. Staying close to the area where a developer has done business for a number of years is a major advantage, for success often depends as much on personal relationships as on skill. All real estate is local, and knowing the market is critical to getting started. On the other hand, having a specific tenant or ultimate buyer is a powerful way to begin—anywhere. Except for major projects (high-rise office buildings, shopping malls, major business parks) for which nationally recognized developers compete, local players have major advantages over outsiders. They understand the dynamics of the local area. They know the direction in which the area is growing and how buyers, tenants, and lenders feel about various neighborhoods. They know a good price and where prices have been changing rapidly. They know whom to call when they need information or need something done. It may take a year or longer for a newcomer to begin to understand these factors.

Newcomers can become insiders, however, even if they are recent arrivals. The best way is to bring in a local partner who is well connected in the community—an especially important move if public approvals are required. Another way is to use banking connections from home to open doors in the new community. Whatever the approach, newcomers have to work harder to overcome the natural suspicion of outsiders and to equalize the competitive advantage of local developers who have better information and more contacts.

After deciding where to do business, the next question is what to develop. For beginning developers, the answer is simple: develop a product with which you are familiar—provided that lenders will make the money available. Even developers with no experience can sell potential investors and lenders on their knowledge of the product type if they study the local market to determine rents, competition, the regulatory environment, local tastes, local construction methods, and the types of units or buildings in greatest demand. Although beginners can successfully branch out into a new product type, they lack the background to fine-tune information about design and construction costs or to predict potential pitfalls. Beginners who do branch out cannot work alone; they will probably have to bring in an experienced partner to get financing.

Identifying a product that the market lacks can make a project successful: finding that niche is the developer’s challenge. Market niches are defined geographically and by product type. They can be as narrowly defined as, say, an apartment complex that has more two- and three-bedroom units than do other projects in the area or a multitenant warehouse building with front-loaded garages.

Designing for a specific market is how developers create a competitive advantage. Finding that special market, however, usually requires more than a good market study. It requires a perception of the market that other developers do not have, because if a market opportunity is obvious, another developer is probably already building to satisfy the demand. Thus, the beginner must understand the market well enough not just to act, but to do so before other developers see the opportunity.

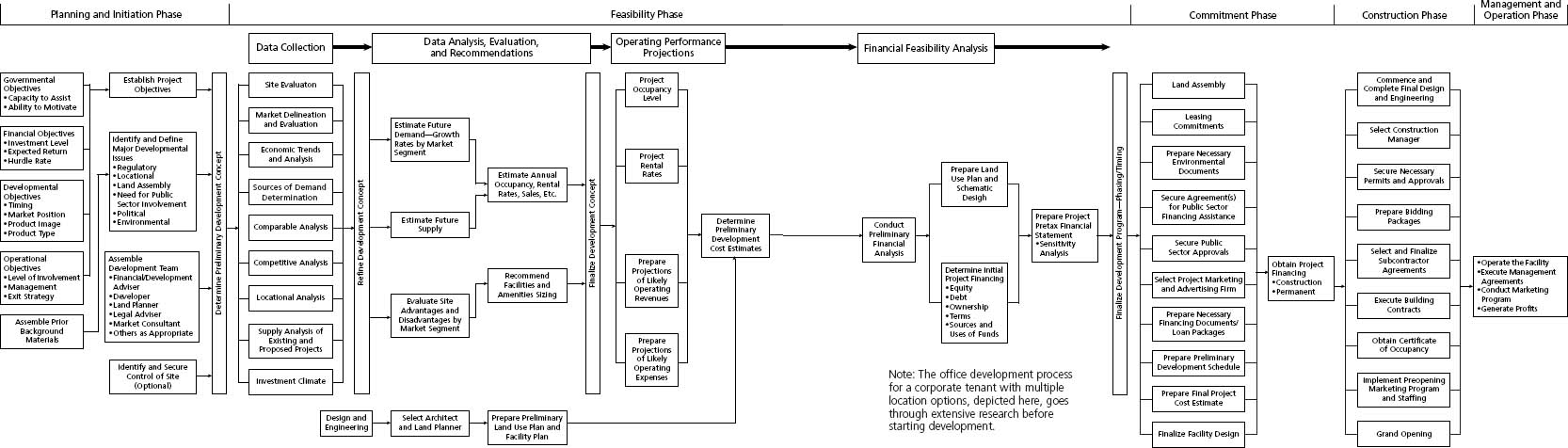

The six main stages of development—feasibility and acquisition, design, financing, construction, marketing and leasing, and operations and management—are described for each major product type—land, apartments, offices, industrial space, and retail space—in chapters 3 through 7.

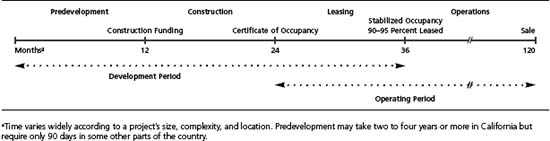

Figure 1-5 shows the timeline of development for an apartment building or small office building. The development period runs from the signing of the purchase contract for the land through lease-up of the building (Month 36). The development period covers all the major development risks, including financial, construction, and marketing. The operating period technically runs from the certificate of occupancy (when the building is ready for occupancy) until the building is sold. The stabilized operating period runs from the time the building is fully leased until it is sold. The stabilized operating period is the time frame used for standard appraisals of the building’s value.

How Four Developers Got Started

CHICKIE GRAYSON

Chickie Grayson is the president and CEO of Enterprise Homes, Inc., where she has been for 23 years. Her interests in problem solving and “seeing something happen” originally attracted her to the profession. She says, “Seeing ‘sticks and bricks’ and knowing you’re providing people with a great place to live, but also seeing homeowners and renters and how meaningful the development or new home is to them,” are all very rewarding aspects to her job. She describes developments as “one big puzzle” and relates the need to have a lot of balls in the air; she enjoys keeping them moving in the right direction. Developers are the ones who coordinate all the players and really make the communities happen, she notes. She defines a good developer as someone who knows “a little about everything, not a lot about anything, but knows where to get it.” Her secret to success is to constantly move things forward and not let any problems stop her.

Grayson’s first development was four communities in Baltimore City, Maryland, for a total of 176 for-sale homes. The development and construction schedule was aggressive. The interest level was so high that the company was able to presell all the homes. The homes were modular and constructed in a factory, which helped with the fast-paced construction timeline. The funding for the development was a mix of federal (one of the last Urban Development Action Grants), state, city, and other resources. This mix remains typical of Enterprise’s approach to financing developments today. Grayson has received many compliments from homebuyers. “I didn’t buy a home; I bought a community,” said one resident, reflecting the pride felt by both owners and renters, and the energy and hard work that the residents contributed to making a great place to live. Grayson feels that this is a sign of a successful partnership: “Enterprise provides the material; the community provides the pride. Enterprise works hard with the community beforehand to make sure they’re providing the right product, then follows up afterward to learn about what the residents liked and what could be improved for the next project.”

Typically, Enterprise’s projects come in under budget. The staff works hard in the beginning to make sure that they have the numbers right; 50 percent of the work they do is up front, before they even close on a property. Grayson keeps a list of lessons learned and opportunities for future projects and shares advice from this experience. She says that utility companies can be challenging to coordinate but are essential to the project, so building good relationships with them is key for future developments. Soil problems can also slow projects down—they had significant problems in the Baltimore City development—and she recommends performing as many advance soils tests as possible.

Grayson offers advice for those starting out: “You don’t need a lot of expertise; that will come on the job. You do need to be really curious and always learning.” She identifies the challenge of always having enough capital as the most difficult part of getting started. “It typically takes two to four years to see revenue; meanwhile, you need to make money to stay in business, which requires capacity and expertise.” Her approach to developing housing is twofold: “To develop, you need land, money, will, and perseverance. For success, you need a great product at a very competitive price.”

TARA HERNANDEZ

Tara Hernandez is president of New Orleans–based JCH Development where she specializes in adaptive use of historic buildings for mixed-income and mixed-use projects. Public/private partnerships and complex financial structures are part of her expertise and competitive advantage.

After earning her master of science in real estate development from MIT in 1992, she returned home to New Orleans and began her own real estate development and consulting firm. She assisted the community development departments of several financial institutions and local nonprofits with their redevelopment efforts. Their primary mission was to redevelop blighted housing and restore neighborhoods in many historic districts in the city, through homeownership initiatives. Many of these efforts focused on Community Reinvestment Act goals. Additionally, she developed her own projects, with a similar strategy of restoring blighted housing into homeownership opportunities for market-rate households. She redeveloped in several neighborhoods throughout the city. The strategy was based on the results of her graduate thesis work on redeveloping neighborhoods. She was hired by a financial institution whose strategy included the redevelopment of a historic neighborhood adjacent to a credit union it had recently acquired. They targeted a 16-square-block area and acquired all the vacant and blighted residential buildings for redevelopment as single-family homes for first-time homebuyers. A pool of people were waiting to move in, she recalls, so the homeowners were actually able to participate in certain decisions, such as color selections for their units. These buildings were laid out in a “double-shotgun style” with one room adjacent to another and little privacy. She converted the old layout into single-family dwellings and created privacy for the future owners.

Hernandez looked for ways to collaborate with HRI Properties, whose owners she met while in school. On breaks from MIT, she would return to New Orleans and meet with members of the real estate community—from all aspects of the profession, including development, finance, and consulting. In this way, she began building relationships within the New Orleans real estate community that still continue today. The principals at HRI continued to reach out to her for an opportunity to work together. Timing worked out well with an opportunity to redevelop a project in Shreveport that HRI was starting. That was a transitional time for her as she was expecting her first child and had an increasing desire to work on larger projects. She went on to redevelop several large conversions of historic industrial buildings into mixed-income lofts in Shreveport and New Orleans, Louisiana, as well as in St. Louis, Missouri. She also became a member of the executive team and worked at the firm for almost eight years.

After Hurricane Katrina, Hernandez decided to capitalize on opportunities for creative redevelopment. Creativity is one of the top traits that a developer must possess, she asserts, along with patience, persistence, and attention to detail. Above all, she believes the two keys to successful development are teamwork and communication. Her strategy has been to involve all team members early in the process (including investors, architects, and contractors) and to take a collaborative approach. Often, this approach manages time, minimizes errors, and provides an outlook of potential obstacles or challenges that the team may face.

As a result, all her projects have been completed on or ahead of schedule and on or under budget. On one project, a particularly effective aspect of this collaborative approach involved bringing in a facilitator every three months to mediate with key people on the team (including subcontractors) and to keep clear, honest communication. This process raised issues that may have otherwise gone unmentioned. “The culture and environment are better if you lay the cards on the table and keep everyone’s interests aligned,” she explains.

Another key element to her success is being proactive. She tries to anticipate as many unforeseen conditions as possible, and historic buildings often have many. “You’re not going to think of everything,” she cautions, “but if there’s anything you’re uncomfortable about, look into it and minimize the risk as soon as possible. You will never cover everything, but trying will help.”

The most difficult part of starting a development company is the uncertainty. Funding predevelopment for an uncertain amount of time can be challenging, and nothing ever goes as anticipated. “There are usually one to two years of predevelopment; then you break ground and need time to lease it up,” she explains. These prolonged periods can add up before one realizes any revenue. Often a new developer is required to pay out of pocket for all aspects of the predevelopment process, including funding approvals.

JCH Development has incorporated many sustainable aspects into its practice. The focus on historic adaptive reuse is a major element, since no demolition is required. One current example is the redevelopment of a former mayonnaise-manufacturing facility into Blue Plate Artist Lofts, comprising 72 mixed-income residences. The lofts will offer a preference for artists and will be built with sustainability in mind. JCH is also working with the local university to provide faculty housing close to campus, to place a priority on energy efficiency, and to sponsor a central recycling program for all its properties, helping to minimize waste, reuse materials, and recycle materials, such as extra wood and mulch. Through these commitments, JCH is able to implement some component of sustainability into every property. In addition, it is working on several retail projects that will help create urban mixed-use districts that employ innovative aspects of the urban environment. From the beginning, the team considers everything. “We build to a standard: would I want to live there and shop there myself?” Hernandez notes. Beyond that, they consider what might make each property a unique experience and a standout from other developments. She concludes, “Historic buildings create opportunities to take advantage of things that are already in place…. You have to think through the future.”

DON KILLOREN

A founding principal of Celebration Associates, based in Virginia, Don Killoren has been involved in the development of master-planned communities since 1979. He has served as general manager of award-winning communities throughout the Southeast and has been chair of ULI’s Community Development Council.

After graduating from Georgia State University in 1972, Killoren began as an assistant property manager for John Portman in Atlanta and transitioned to the company’s development team, focusing for four years on the development of Atlanta’s Peachtree Center. Killoren counsels those entering development to work first for someone else, seeking out a capable and inspiring individual, and to worry about the specific job later. “Find a leader, someone who is nurturing and who lights a fire under people. It helps if the organization is small … allowing the beginner exposure to all aspects of the business, rather than to a limited administrative, analytical, or marketing role.”

Having gained property and project management skills, Killoren left to work with Thomas E. Lewis, former legal counsel of Portman Properties, managing a 2,500-acre (1,012 ha) community in Florida and broadening his expertise to residential land development and homebuilding. As president of Lewis-Killoren Properties, Killoren says he began to discover his real talent for process management, organization, and coordination of the entitlement, development, and construction process. “Many people in the real estate business misdiagnose their skills,” says Killoren. He counsels beginning developers to consider their strengths and weaknesses, as the diversity of project types and job descriptions in real estate means there are lots of opportunities for individuals to do jobs they are only mediocre at. He advises young developers to focus on the parts of development where they excel and to find partners, staff, and consultants to do an equally good job on the tasks outside your “sweet spot.”

Joining community developer Erling Speer, Killoren helped develop the ULI-award-winning Mariner Sands golf course community and country club, where he began to understand the increasing importance of “software,” or community organizations and programming. Increasingly integrated and sophisticated structures for clubs, community governance, and educational functions have grown from their beginnings in golf course development to become a part of most master-planned communities, and Killoren foresees the trend continuing. “Education, health care, and community-based volunteerism are all becoming a more integrated part of the community development toolkit, and real estate project managers must manage these entities with the same intensity they apply to physical planning and construction. We’re moving from building stuff to building community.”

Following his tenure at E. Speer & Associates, Killoren joined the Walt Disney Company as director of community development. As part of Disney’s expansion from core entertainment and hospitality businesses into community development, Killoren was tapped for a leading role in the development of large retail and mixed-use residential projects, including the new town of Celebration, Crossroads Shopping Center, and the Magnolia Creek community. Celebration, particularly, served as a laboratory for refinement of new urbanist ideas, and the architectural precedents and controls there have informed Killoren’s efforts to shape identity in subsequent projects. Lessons learned on these Florida projects were exported, as Killoren assisted in the shaping of residential development strategy for EuroDisney, near Paris.

In addition to development projects, Killoren spearheaded a company-wide environmental strategy, culminating in the creation of the Disney Wilderness Preserve. This 12,000-acre (4,856 ha) preserve is essentially a giant wetland mitigation project, offsetting impacts from Disney’s and other entities’ development activities, which has been managed according to state-of-the-art resource management plans. The result is a national model for ecological restoration and sustainable land management and a crown jewel in the Florida Nature Conservancy.

With several major projects under their belt, Don Killoren and Charles Adams left Disney in 1997 to found Celebration Associates (CA), a development and advisory firm. The decision to strike out on their own was difficult, but Killoren recalls, “Development at Celebration was winding down, several of the key players in the division had left, and we found ourselves knowing a lot about building the types of projects others wanted to build, and wanted to see built in their communities.” CA’s first client was its former employer, the Walt Disney Company.

Assembling a partnership, CA assessed its strengths and divided tasks into financial (primarily Adams), planning and development (primarily Killoren), and sales and marketing (shared responsibility). Building a team, the partners looked for “smart, energetic, and intelligent utility players” who could manage many different kinds of activities. In the early years of the partnership, they focused on consulting, requiring less capital investment, and structured deals to work toward sweat equity positions. To maintain a lean structure, they depended on consultants for virtually all nonexecutive functions. They still prefer to staff projects, rather than the central office, but have expanded to a group of partners that oversees particular areas of expertise, such as sales and marketing or design, in all CA projects, even as these individuals may take a particular role within one or more project teams.

The firm has built strategic alliances with a major landowner-investor and developed several linked communities in Clear Springs, South Carolina, as well as the Governor’s Club community in Chapel Hill, North Carolina. It has also partnered with Crosland, Inc., a diversified development and construction firm in Charlotte, to develop the award-winning Homestead Preserve and Bundoran Farm communities in Virginia, and more recently the redevelopment of the Mount Washington Resort in New Hampshire.

As the extended recession has slowed development projects across the Southeast, Killoren has come to appreciate the lessons learned in prior downturns over his career. CA’s early and necessary emphasis on consulting, which the partners have maintained over the years as a means of “keeping sharp,” has become an essential strategy of survival for firms like Celebration Associates. The company’s relatively lean corporate structure and dependence on consultants and strategic partners have enabled it to adapt more nimbly than most, and its facility with financial reporting and investor communication, honed in a large organization, has preserved its reputation in a time when all developers are having unpleasant conversations with lenders and investors.

Reflecting on his nearly 40-year career, Killoren says his most important lesson has been that for an individual to succeed in development over the long haul, his interest cannot be solely financial. “It has to be about more than money. A good developer is giving an enduring gift to the community. Find something you like, do it well, and make that amount of money adequate.”

Jair Lynch is the president and CEO of JAIR LYNCH Development Partners, “an urban regeneration company that specializes in the responsible transformation of urban markets.” His career inspiration began at Stanford during his undergraduate years, where he studied urban design and civil engineering. He started there two months before a significant earthquake shook San Francisco. Lynch recalls that this event turned the city “into a laboratory for urban designers and civil engineers. Questions arose, such as what happens when you remove a highway from a city? Highways had been dividing the community for years, and it was fascinating to watch the city rebuild.” Travel also influenced Lynch’s passion for urban environments. As a world-class athlete (his impressive résumé includes winning a silver medal on the parallel bars as captain of the U.S. Olympic gymnastics team in 1996), he has enjoyed traveling to many cities across the globe. What fascinates him most? “How cities and places have evolved over time, and how things work,” he shares.