IT MAY COME AS A SURPRISE to you that there are some basic rules for putting together a sustainability portfolio you can absolutely love (or at least, not completely dislike!).

Choosing the basic sustainability criteria to guide your portfolio is relatively easy. That’s because only you know the social, environmental, or economic sustainability that is important to you, and no one can tell you different!

That’s the good news. The bad?

Assessing sustainability investment performance requires homework. There are guidelines, but the problem is, as with almost any aspect of investment, sustainability investment selection remains as much an art as a science. But unlike corporate financial performance, there is much less readily available sustainability performance data for the average investor. What is available, as you will see, can be a whole lot more subjective than definitive.

This chapter will help you sort it all out through a series of exercises. The underlying concepts I use are similar to those in financial asset allocation planning, except once done you will have undertaken a sustainable and responsible investment (SRI) asset allocation matched with your financial allocation.

This is going to be fun!

The first thing you need to do is list your sustainability passions, biases, pet peeves, nasties, and goodies.

Using your own words, write whatever comes to mind. We can match your thoughts to the terms used by the SRI industry later. What do you care about?

When I first did this exercise for my 2017 portfolio reallocation, the words that spilled out: energy, food, human rights, misleading advertising, and advertising that promotes sustainability. Figuring this part out isn’t rocket science. I wish it were, because maybe then I might sell many more books. But really, I can’t complicate things, so just get at it: What are the things you want to see change in the world? Or alternatively, what are the things you want to see less of, things you think are really messing up the place?

The list can be as short or as long as you want. No rules.

Don’t let your biases get in the way either. Use them as guidelines, not barriers. Your utopian sustainability vision for the world is valid and will be devastated if you don’t use it to guide your choices. I like to start with the positives. Others start with what makes their blood boil.

Either way, choose issues that grab you, engage you, make you passionate. As you may have guessed, mad can lead you to things you will never invest in (negative-screened investments). Happy themes will have you wanting investments that proactively impact your sustainability interests (positively screened investments).

Need ideas? Go to Appendix Four and you will find a list of social, environmental, and economic SRI categories used by SRI professionals. They include most of the common screens, negative and positive, discussed in Chapter Two. The list is helpful, not only because of the ideas it may offer you, but also for framing your thoughts using standard SRI terms. This can come in helpful when are exploring your SRI investment options or talking to an SRI financial adviser.

I have found that listing more general interests can also help guide me. Marta from Mexico, for example, is a tech and gadget gal. She knows tech can play a big part in changing the world for the better. She is always on the lookout for companies with interesting tech innovation providing sustainability solutions. Passionate about this, she is highly motivated to find companies she wants to invest in.

One company she likes for this reason is Ford Motor Company. Ford, she found, is using food waste to make bioplastics for car parts. The way Marta sees it, there is too much waste in food processing. “These things can’t be eaten, they are not economical to compost, so it goes to the landfill,” she told me. “Bioplastics are recyclable and a great way to avoid using petrochemicals!”

Applied in a best-of-sector approach (or as I call it, the “hold your nose and invest” approach), Ford might come out as an investment option for many of us. Even if you don’t like holding your nose, I guarantee you this: Your Ford food bumper will give you plenty of cocktail party bragging rights.

Investing in concepts, products, or services that grab your interest and you care about is nothing but good. You will want to stay on top of the trends, gaining knowledge to feed your capacity to assess the companies involved. The ultra-famous investor Warren Buffet uses this approach, telling us to invest in things we know, like, and understand.

Don’t like cars, but think transportation is a problem for sustainability? Try some other transportation stock. That’s me. Every day when I drive one of my two combustion engine cars, I get sad, then mad, then depressed. I am the problem. But in Mexico, where oil and natural gas fuels electricity production, and where there is literally no electric car infrastructure, buying electric is just as bad as putting gas in the tank and certainly less practical. So unless my city morphs itself into a futuristic all-things-walkable utopia with great public transportation, a car it is.

If you don’t study any companies, you have the same success buying stocks as you do in a poker game if you bet without looking at your cards.

— Peter Lynch

Now if you do like cars and can buy an electric or a hybrid, you can be like Sampriti, ILYGAD interviewee who has fueled up with gas just twice in two years! Think about leaders in electric: Tesla, Nissan, and Toyota, for instance, all have proven long-term commitments to hybrid or electric. Or you can explore up-and-coming hydrogen (BMW).

Or jump cars altogether and go to freight. This what I did. I decided to vent my hate of combustion on rail, because if there is anything less troublesome than the sixteen million transport trucks in America, I am not sure what it is. Nothing personal, truck drivers, but your industry is hard, very hard on the climate. In mid-September 2015, I took advantage of a downward market swing and bought two rail car manufacturing stocks, which according to several research outfits had all the right buy signals. Then demand for coal plunged (yeah!). It turns out, transporting coal was a bigger part of rail car sales than I imagined! Ha! I should have gotten the coal signals better. Sad losses for some time, but rebounding nicely as I write.

Ironically, even though these stocks underperform my other less exciting sustainability stocks, I am still more revved up about rail than anything else. As the economy sorts itself out this year, rail will be back and these mid-cap value stocks will return.

Similarly, you may really dislike an industry, say the financial or chemical industry; completely understandable from a sustainability perspective. But from an investment allocation perspective, it may be important to include stocks from one or both sectors in your portfolio, if only for risk diversification purposes.

Or it may be that a mutual fund you own, or are looking at to buy, could include stocks from these sectors. There are many ways to structure your portfolio to balance the absence of one sector or another. In the end, you might have to face the fact some sustainability choices have overwhelmingly negative financial implication for your financial allocation strategy. Holding your nose works, and investing in something that is not perfect may result, at least until something better comes along!

I have developed a simple tool to help you find your best sustainable and responsible asset allocation while respecting your financial allocation needs. It has five steps. Do the exercise to become familiar with SRI investment selection, or do it to shape your SRI portfolio. You can also do it as a part of Chapter Fifteen, which provides a more comprehensive plan to get you off the couch and investing.

Take the list of SRI issues that make you mad, happy, or both. (If you still haven’t done this list, go back to the instructions above and do it!) Make sure you love it, and then finalize it. You can go to Appendix Four for example lists of SRI categories and issues.

Now imagine you have 100 Sustainable and Responsible (SRI) Impact Points to distribute among your listed SRI passions. The more passionate you are about an issue, the more points you give it and the potential impact you may have on a given issue.

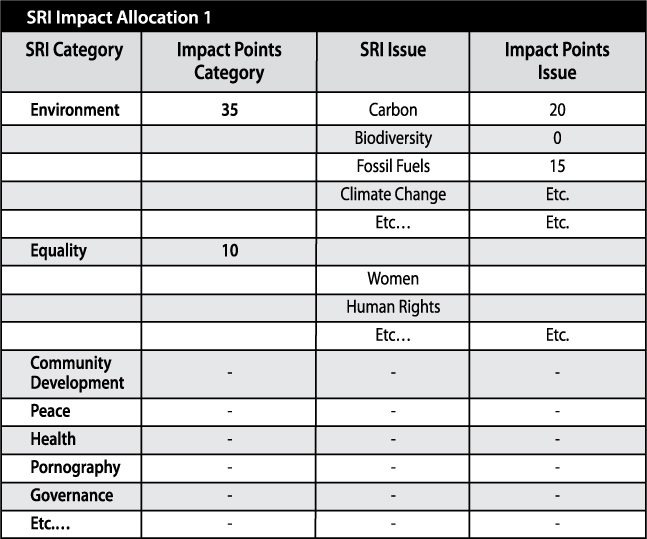

To get going, we start with broad SRI categories and issues. The table below is an abbreviated list that gives you a sense of how this step works. (The SRI Impact Points do not add up to 100 in this table because it’s not a complete list.) I put in two of my own points allocations as examples. Environment is a big issue for me, specifically carbon, so it gets 20 Impact Points. For similar reasons, I also decided to allocate 15 Points to help spell the end to fossil fuels.

Human rights are an issue for my soul. I’ve seen enough human rights abuses in developed and developing countries to boil my sustainability furnace for a thousand lifetimes. Everyone deserves the same high level of human rights. Treating each other poorly for reasons of class, race, gender, age, religion, or how you identify yourself is a fundamental cause underlying our very unsustainable world. From an economic perspective, it just makes sense to extend and respect human rights in business. Companies treating their workforces and stakeholders well have been shown to perform consistently better than those that do not.

This is true for all people, but particularly for women in business. With few exceptions, companies willfully or unintentionally insult women in innumerable ways, unjustly holding them back, putting them down, and paying them less, to the detriment of business performance and civilization generally. Based on this, women get five of my Impact Points and human rights five too. (Remember, all my SRI Impact Points should add up to 100, but because I am showing just a slice of my portfolio, only 45 are shown.)

Once you’ve identified your categories and gone through the necessary iterations to get the proportions by category and issue, you already have the broad outline of your desired SRI allocation. (The total should add up to 100 SRI Impact Points.) Shout Yeah! Dance around a bit, and celebrate your being two-fifths of the way there!

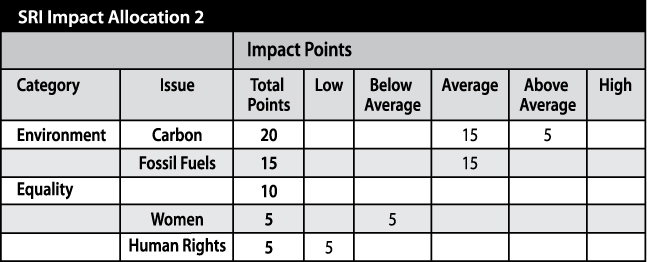

After you divvied up your Impact Points, you need to apportion points at the SRI Impact Level you want for each issue. This step provides the basis for selecting investments, which will define your SRI asset allocation while meeting your financial asset allocation needs.

Let’s walk through a couple of examples to see how this works in practice.

Do you want carbon out of the air? Me too. That’s why it got 20 of my 100 Impacts Points. But how big of an impact do I want? A very big one or to just avoid the very bad things type of impact?

In the table below, you see five levels of impact. These levels are subjective, but you will get how they work once you start to compare SRI opportunities. You will also likely change allocations as you find investment opportunities you like but which upend your initial allocations. That’s okay, it’s an iterative and learning process.

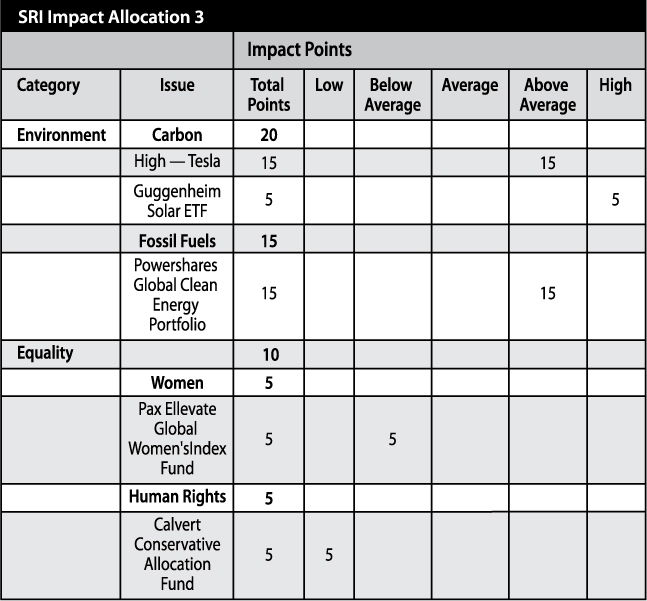

Once you have your desired SRI Impact Points allocated, you need to match your allocation with investment vehicles.

To show you how this step works in action, I found five securities that match up (more or less) with the allocation table we just completed above. There are many sources you can use to find these SRI investments, including the Sustainable and Responsible Investment Forum (USA) and Morningstar investment information service (see box below). In Canada, you can go to the Responsible Investment Association.

For carbon, I found Tesla (of Elon Musk fame). Tesla is a mid-cap company listed on the NASDAQ stock exchange. It has a focus on personal transport but also does batteries and some solar power (via ownership of SolarCity). I am not naive when it comes to getting rid of personal transportation vehicles, which, in my mind, severely impair the prospects for urban sustainability, but I dislike carbon emissions from combustion engines even more. I judge Tesla’s sustainability rating as Above Average as a result.

I gave the Guggenheim Solar Exchange-Traded Fund a High SRI impact allocation as it invests throughout the solar sector in all sorts of great companies innovating carbonless energy sources and entire carbonless energy systems.

For Fossil Fuels, I like Powershares. I rated it this as Above Average SRI Impact as the companies in its portfolio produce several types of energy, some limiting carbon emissions, others with none. This is more of a transition out of fossil fuels investment, one that is more proactive than the divest-from-fossil-fuels approach, which I do not find all that satisfying.

On Morningstar Sustainability Ratings: Semi-dry but important background information…

Just so you know, the SRI Impact categories used in Invest Like You Give a Damn correspond to the five globe symbols used by Morningstar to rate the sustainability of funds and stocks.

Morningstar is an investment information service providing individuals with information similar to that available to financial professionals. It has a sustainability rating system for many of the stocks and funds it covers. Morningstar data and information is clear and simple to interpret and, importantly, is independent of any fund or fund manager. Best of all, basic information is free, and some public libraries subscribe to the more detailed Morningstar data.

Morningstar uses a solid methodology to assesses how companies manage environmental, social, and governance factors relevant to their industries and relative to their peers. I recommend you read the information available on their website. You don’t have to recreate their system for your own use. But understand that it is similar to those of many SRI advisories and funds. And, like many SRI firms, Morningstar bases its ratings on data provided by Sustainalytics (an independent SRI data company, that covers more than 4,500 companies globally).

Am I biased? Yes! Is Morningstar perfect? No. But I will tell you this: Their information can reduce the amount of work you need to do to complete your sustainability and financial asset allocations. Full disclosure: Sustainalytics was founded and is led by my former office mate and friend, Michael Jantzi, a globally renowned corporate sustainability analyst.

For Equality, Women Issue, I chose the Pax Ellevate Global Women’s Index Fund. The fund focuses on women in management and on boards of directors. This is a very important strategy if you are interested in promoting and rewarding women’s participation in the corporate world. It is clearly demonstrated that women are a highly underdeveloped competitive asset in many companies. This fund makes a very strong statement, hopefully inspiring not only investors but also women in business and the aspirations of young women and girls. Because the fund primarily focuses on women in management and board of directors positions, and doesn’t go into the theme deeply (e.g., remuneration, work conditions etc.), it has a below average impact.

For Equality, Human Rights Issue, I chose the Calvert Conservative Allocation Fund. This is a great but low-impact fund, as it has multiple positive and negative screens, focusing on respect, promotion, and commitment to fundamental individual and community rights.

Once you have your Sustainability Impact Allocation sorted, you are going to have to categorize investments by their risk class to ensure you are getting a basket of assets called for by your financial asset allocation. This can be a bit tricky, and you will likely need a few iterations to get the mix right.

Environment, Carbon: While I love Elon Musk and all he does to power change, Tesla is a company with more financial risk than, say, GM or Apple, which are here-to-stay, large-cap companies. Tesla is far from a proven commodity and a bit dependent on Elon Musk. It is a medium financial risk.

Guggenheim Solar Exchange, Traded Fund is an index fund that tracks the MAC Global Solar Energy Index. It includes all sorts of companies in the solar industry, from manufacturing to financing to operating and project development. Good company diversification is offset somewhat by the relatively young clean-energy subsector. The fund, as a result, is a medium financial risk.

As mentioned, for the Fossil Fuels issue I picked Powershares. This index fund is based on the Wilder Hill New Energy Global Innovation Index and holds over 100 companies from around the world representing a range of energy technologies. This is a medium risk investment because, while geographically diverse, the fund has many small and some micro-cap companies in its portfolio.

Pax Ellevate Global Women’s Index Fund focuses on women in management and on boards of directors. Developing paths for women in business is a competitive corporate asset development advantage in my mind. Because the fund invests primarily in large capital firms and is an index fund, it is rated a low risk.

For the Human Rights issue, I chose the Calvert Income Fund, which held over 58% of funds in U.S. corporate bonds and asset-backed securities. It has competitive returns compared to peer indices.

To be honest, this last step is a bit of a discovery process rather than a linear activity. And you will find that a perfect alignment of your financial and SRI asset allocations is not necessary for you to feel good about your portfolio. There is no rule saying you absolutely must align perfectly (unless, of course, you are a Virgo like me). If you like a given SRI issue for financial reasons, then over-allocate. I would not recommend seriously dislocating your financial risk allocation, however.

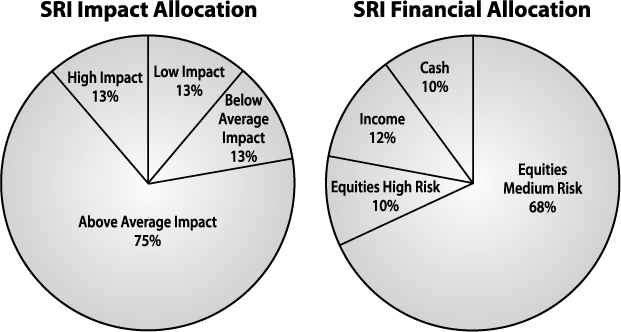

The result of this exercise is an Above Average SRI Impact Allocation, with a mix of impacts. Most impact is Above Average and High, given the energy and carbon investment selected. Lower Impacts are in the Women and Human Rights investments. The trade-off is that most of these investments are in larger companies with good potential branding of women and human rights issues in global and large national companies.

The resulting financial asset allocation is a balanced allocation appropriate for either a late Millennial or early Gen Xer. It has some solid growth potential with a mix of mostly medium- and low-growth equities but some higher-growth as well. It has some solid income generating from competitive funds and a bit of cash for biting into more investment opportunities as they come along.

One type of investment opportunity you will not easily find on Morningstar, or any other investment information service for that matter, is high-impact SRI opportunities.

You may recall, I refer to these investments as HUGs, or Huge Uncomplicated Gratification investments. Like the glowing tentacles of the Tree of Souls in the movie Avatar, HUGs viscerally connect you directly to the change you deeply care about. You may know them: They are local cooperative farms, community electrical grid enterprises, women-owned construction companies, organic breweries, mixed-income housing projects, microfinance investments in Africa, and much more.

By their very nature many but not all HUGs also have rather high financial risk. That does not make them undesirable investments — quite the opposite. Millennials with their long-term investment horizon and Gen Xers with disposable income can both consider these types of investments within a well-allocated portfolio.

Careful, though; not only do HUGs often have venture-capital –type risks, they are often highly illiquid. If you need your capital out in a hurry there can be fee penalties, or you may have to wait until the company has cash to give your money back, or both.

My wife and I went looking for HUGS in the early 1990s when we were in our mid-thirties. We decided to invest in a venture capital fund operated by the labor union movement. We put a few thousand dollars into the fund, which invested in labor-friendly, tech-type start-ups. Others, like ILYGAD interviewee Jen and her husband in San Francisco, invest in a restaurant-foodie-brewery company where they are customer-owners. And remember Jesse in Geneva, mentioned earlier, who has money in Oiko Credit, which invests in microfinance organizations, small-scale renewable energy, agricultural producer cooperatives, and much more in over thirteen developing countries.

Every year more deals like these are created. Many offer equity or quasi equity — as in, you get to be an owner of a project — or long-term debt certificates with fixed or variable interest.

Given the nature of these deals, many are highly attractive for their sustainability impact. There is a catch for investing, though, as most HUGs can be sold only under two conditions. The first is that the purchaser must be an accredited or sophisticated investor, a euphemism for people with so much money they can afford to lose some.

Non-accredited investors can invest too but only under specific rules of the recently enacted JOBS (Jumpstart Our Business Startups) Act. The Act allows equity crowdfunding platforms to permit non-accredited investors to privately invest in companies meeting several different offering criteria, including being offered through a Security and Exchange Commission-regulated intermediary (a broker dealer or a registered funding platform). An individual investor making less than $100,000 annually can invest up to $2,000 (or 5% of yearly income), while those making $100,000 or more per year can go up to 10%. Other investor and company criteria apply.51

Some lower-time cost, lower-risk options also exist. Calvert Foundation is one; it offers a Community Investment note for as low as $20. Notes invest in affordable housing projects, community economic and social development, some education, innovative local climate change solutions, and even some international fair trade and microfinance (among other great things). Notes are priced below market but have reasonable liquidity considerations.

If you want something a bit more “hands-on” in your neighborhood, you can look for community development financial institutions (CDFIs). These are registered financial institutions that aim to fill capital needs in underserved markets and populations. They can include community development corporations, community banks or credit unions, and local loan or venture capital funds. Like the Calvert Foundation, CDFI investments can offer below market returns, but the environmental and social returns typically more than compensate.

When you are in your twenties or thirties you can go for HUGs with the confidence that if they don’t fully work out, or pay so well, your Great Long Slowdown (aka retirement) will not be any worse off financially, only better for the sustainability impact you might have had. If you have cash to spare, I would recommend an investment of this type. More than this, if you have time to spare, volunteer — many of these ventures benefit from responsible, active owners and promoters!

HUG investments are harder to find than, say, a Vanguard, Fidelity, or even a Domini social fund. So no matter how much of a HUG you want, you may not be able to find one. Check out Impactspace or the Global Impact Investing Network for more information on HUGs. Also check out the CDFI Coalition, which has a convenient CDFI locator tool on its website.

• Listed SRI passions to guide your portfolio SRI impact allocation.

• Allocated 100 SRI Impact Points to each of your SRI passions.

• Allocated SRI Impact Points by SRI issues by Low, Below Average, Average, Above Average, and High impact (the same system used by the free Morningstar investment information service).

• Researched securities (stocks, funds, etc.) to meet your SRI impact classification.

• Matched SRI allocation of select securities to match your financial asset allocation.

• Considered if you can get a typically higher-risk and/or lower-return HUG — Huge Uncomplicated Gratification — investment.

• Speaking of HUGS, go find someone and give/get one now!