CHAPTER 19

Opening Patterns and Reversals

Institutional traders have orders to fill before the day opens, and they want to fill them at the best possible price. For example, if they have mostly buy orders and the market opens with a large gap down, they will buy immediately if they feel that the lower open represents a great value that won't last long. If they believe that the market will trade down a little, then they will wait to buy lower. If the market instead opens with a gap up, they might decide that the market should pull back. If that is their belief, there is no incentive for them to buy now because they expect that they will soon be able to buy lower. This creates a sell vacuum, and the market can move down quickly since the institutional bulls are simply waiting to buy at a more favorable price. Invariably, they will wait until the market reaches a support level like the moving average, a trend line, a measured move, or a swing high or low. If enough institutions have order imbalances to the buy side and if they all begin their buying at around the same level, the sharp sell-off can reverse up strongly. The sell-off wasn't as much due to strong bears as it was due to strong bulls who were simply waiting for the market to fall to a support level, whereupon they bought relentlessly and overwhelmed the bears. This is the vacuum effect; the market got sucked down quickly to a level where there were lots of strong buyers waiting.

The opposite happens on days when the institutions have a lot of sell orders going into the open. There will often be a buy vacuum that sucks the market up quickly and then suddenly the bears appear and drive the market down hard. They were bearish from the open, but if they believed that the market was going to trade up to some resistance level, they would refrain from shorting until the market reached the point where they thought that it would not go higher. It does not make sense for them to short if they think the market will go a little higher. At that point, they begin shorting and they overwhelm the bulls. The result is an opening reversal down.

These sharp reversals up and down are opening reversals and often become either the high or the low of the day. If traders understand what is going on and do not get tricked into believing that all sharp moves are just spikes that will be followed by channels, they will be ready to swing trade on the reversal and sometimes can hold part of their position for most of the day.

Although most days have an opening reversal or trend from the open where there is a 50 to 60 percent chance of making at least twice the size of the risk, beginners struggle to determine which of the often several setups is that best one. The exact probabilities of any setup cannot be known with a high degree of certainty because there are so many variables, and this is especially true of setups in the opening range, but the ones that I am using are reasonable guidelines. On most days, there are several reasonable reversals in the opening range, but they have only about a 30 percent chance of leading to a swing trade where the reward is at least twice as large as the risk (although many have about a 60 percent chance of making a reward that is as large as the risk). Also, the earliest is sometimes the best one, but the several reversals that follow often pull back beyond the entry price and scare beginners out of their positions. Beginners can either take one that they feel is strong and then simply rely on their protective stops and allow for pullbacks, waiting for the ultimate breakout, or they can scalp for a reward that is equal to their risk and then trade in the opposite direction if the next reversal setup looks good. Most traders have a better chance of becoming profitable if they take what they believe is a good setup, rely on their protective stops, and allow the pullbacks, exiting only if a strong signal in the opposite direction forms.

The first bar of the day has about a 20 percent chance of being either the high or the low of the day for all markets. If it is a strong trend bar without big tails, it has a 30 percent chance. Either the high or the low forms within the first five bars or so in 50 percent of days, and it forms within the first hour or two in 90 percent of days. Even though most reversals do not lead to a profit that is at least twice as large as the risk, if a trader held them for a swing, most would end up as scalps. The profits from the winning trades are usually at least as large as the losses from the losing trades, and the occasional big winner makes this approach worthwhile. Alternatively, a trader can simply look to scalp for a reward that is at least as large as the risk. The high of the day usually comes from some kind of double top, even though the two highs are often not at the same price, and the low of the day usually comes from a double bottom. In general, if the day is having reversals, a trader should wait until there is a double top or bottom before looking for a swing trade. Once one forms, it has about a 40 to 50 percent chance of leading to a swing, depending on the context and the setup, and an extreme of the day.

Most traders should work hard to become experts at spotting and trading the best opening reversals, and make these swing trades the cornerstone of their trading. For example, when the average range in the Emini is about 10 to 15 points, the probability of a four-point swing on a reasonably good-looking opening reversal (one where the context is good and there is a decent signal bar) is often only about 40 percent (it can be 50 to 60 percent when the setup is very strong). However, the chance of a two-point stop being hit before either the profit target is reached or a reversal signal develops, where the trader can exit with a smaller loss or a small profit, is often only about 30 percent. This makes the trader's equation very favorable for this type of trade. If traders win four points in four out of 10 trades, they have 16 points of profit off of their swing trades. If they then have maybe three losses of two points or less and three wins of about one to three points, they will end up about breakeven on those trades. This is fairly typical when a trader picks appropriate setups. The trader then has about 16 points of profit on 10 trades, and averages 1.6 points of profit per trade, which is good for a day trader.

When there is not a reversal, the spike in fact can be followed by a channel and the day can become a spike and channel trend day. If there is a reversal, but it lasts for only a few bars and then reverses back in the direction of the spike, the reversal attempt has failed and has become a breakout pullback setup that will usually be followed by some type of channel. For example, if the market rallies up strongly on the first three bars of the day but then has a bear reversal bar, many traders will reverse to short below that bar. However, if the spike is strong and the reversal bar is weak, more traders will assume that the reversal attempt will fail. They will place buy stop orders above the high of the prior bar in any pullback, including the high of the bear reversal bar if there is no pullback. If the market trades up, the small sell-off becomes a breakout pullback and the reversal attempt will have failed. Some bulls will place buy limit orders at and below the reversal bar if they are especially confident of the strength of the up move.

The open always leads to a breakout or a reversal, and sometimes to both. Other than gap openings, common patterns on the open are the same as patterns occurring at any other time of the day and include:

- Trends from the open, which were discussed in Part I in the first book.

- Breakouts and reversals, which are failed breakouts. Look for reversals at support or resistance areas like the moving average, trend lines, trend channel lines, swing highs and lows (especially the high and low of yesterday), breakout areas, trading range tops and bottoms, and measured move targets.

- Breakout pullbacks (a failed breakout that failed to reverse the market).

On most days, either the high or low of the day is formed within the first hour or so. Once one of the day's extremes is formed, the market reverses toward what will become the other extreme of the day. Obviously, there is no reversal on a trend from the open day, but the market still works toward the other extreme, which will usually be near the close of the day. The opening reversal is often recognizable and can be a great trading opportunity for a swing trade. The first move on the open is often fast and covers many points, and it is hard to believe that it could suddenly reverse direction, but this is a common occurrence. The turn is usually at some key point like a test of the high or low of yesterday, a swing high or low of yesterday or today, a breakout of a trading range of yesterday or today, a trend line or trend channel line, a moving average, or any of the above on a different time frame chart or on the Globex chart. Even if the best setup is on a 60 minute or daily chart, there will almost always be a price action reason to take the trade based entirely on the 5 minute day session chart, so traders adept at chart reading only need to watch the one chart that they are using for trading.

The initial price action often reveals the character of the day. If the first bar is a doji bar in the middle of yesterday's closing range, then the bar is a one-bar trading range, and the odds of a trading range day are increased. If the first hour has many overlapping bars with big tails and multiple reversals, the odds of a trading range day are also increased. In contrast, if there is a gap up or down and then a three- or four-bar bear spike within the first hour and the trend bars are large with little overlap and only small tails, the odds of a bear trend day increase. Traders often look for a pair of consecutive bull trend bars in the first hour or so. If they are present, traders would see them as a sign that the market is always-in long, at least for a scalp. This means that they think that the market might be in the early stages of a bull trend. Until there is enough follow-through for traders to believe that a measured move of some kind is likely, many traders will scalp most or all of their position. This leads to the many reversals that are common in the first hour or so. If instead there were consecutive strong bear trend bars, they would assume that the market was always-in short and that the day was trying to become a bear trend day. For example, if there have been consecutive strong bear trend bars and then a bar trades above the high of the prior bar, many traders will short below the low of that pullback bar for a scalp. If the context is right, they might think that the pullback is the start of a large trend and they will swing most or all of their trade.

The opening range often gives clues to how the day will unfold, provides support and resistance for the rest of the day, and leads to measured move projections. There are almost always several choices for the top and bottom of the opening range, so there will rarely ever be perfect agreement as to the exact bars that contain it or the length of time that it takes to form. In general, it is the height of either the trading range, if there is one, or the largest leg of the first 30 to 90 minutes. Sometimes the leg will have two or three smaller legs within it, and sometimes there will be a pullback and then a brief higher high or low or lower high or low. If there is that new extreme, some traders will use that to enlarge the opening range, and others will continue to use the original range and will view the new extreme as a meaningless overshoot.

It is helpful to classify the size of the opening range into three categories. If the range is only about 25 percent of the size of the range of recent days, traders will enter on a breakout of the range in either direction. A couple of times a month, this will become a trend from the open day with small pullbacks and relentless progression.

If the opening range is about a third to a half the size of the range of recent days, traders will assume that the range will grow to about the size of an average day. The day will usually have some trading range activity and then break out up or down. About two-thirds of the time it will become a trend day, which will usually be a trending trading range day, although any type of trend day is possible. The breakout will typically reach about a measured move based on the height of the opening range. It will usually come back and test the breakout point later in the day, and it often then breaks back into the earlier range. If the reversal back into the opening range is strong and the market closes at the opposite side of that earlier range, the day becomes a reversal day. This is in fact the most common way that reversal days form. In the other third of cases, the day just trades a little beyond the opening range, then reverses and breaks out of the opposite side of the range, and then trades back into the range. When this happens, the day usually becomes a small trading range day, but sometimes that second breakout can lead to a trending trading range day in the opposite direction.

The third possibility is when the opening move is large. This is usually due to a strong spike and the day often becomes a spike and channel trend day, but sometimes it leads to a climactic reversal, usually after a small final flag.

An important point to recognize is that if the market makes a strong move on the open and then reverses, that initial strong move indicates strength, and it may return later in the day. For example, if the market sells off strongly for the first four bars of the day and then reverses up into a strong bull trend, you should remember the initial bear trend and not assume that the bulls will control the market until the close. That initial downside strength indicates that bears were willing to aggressively short the market earlier in the day and may look for another opportunity later in the day, despite the bull trend. So if there is a strong correction in the bull trend, do not ignore the possibility that it could be another trend change taking place, this time back to a bear trend.

The patterns in the first hour are the same as those later in the day, but the reversals are often more violent and the trends tend to last longer. An important key to maximizing trading profits is to swing part of any position that could be a high or a low of the day. If the trade looks particularly strong, swing all of the position and take partial profits on a third to a half after the trade has run one to two times your initial risk. If you bought what you think could be the low of the day and your initial stop was below the signal bar, which was about three points below your entry price, take about a quarter to half off at around two to four points and maybe another quarter to half off at four to six points. Alternatively, instead of using fixed limit orders, take some off at the first pause after two points of profit and some more off at the first pause after four points. Hold the remaining contracts until there is a clear and strong opposite signal or until your breakeven stop is hit. Look to add to your position at every with-trend setup, like a two-legged pullback to the moving average in a strong trend. For these additional contracts, scalp most or all of the position, but continue to swing some contracts.

Some reversals start quietly, trend only slightly for many bars, and appear to be just another flag in the old trend, but then the market forcefully breaks into an opposite trend. For example, a bear flag can break out to the upside and the market could reverse into a bull trend. Other reversals have strong momentum from the entry bar. Be open to all possibilities and try to take every signal, especially if it is strong. One of the difficulties is that reversals often are sharp and traders might not have enough time to convince themselves that a reversal setup could actually lead to a reversal. However, if there is a strong trend bar for the signal bar, the chances of success are good and you must take the trade. If you feel like you need more time to assess the setup, at least take a half or a quarter position because the trade might suddenly move very far very fast and you need to be involved, even if in only a small way. Then look to add on at the first pullback.

Unlike a double bottom pullback that is a reversal pattern, a double bottom bull flag is a continuation pattern that develops after the bull trend has already begun. Functionally, it is the same as a double bottom pullback, since both are buy setups.

The same is true for a double top bear flag, which is a continuation pattern in an ongoing bear trend and not a reversal pattern, like the double top pullback. Both, however, are short setups. After a strong down move and a pullback, the bear trend resumes, and then the market pulls back again to about the same level as the first pullback. This trading range is a double top bear flag, and it is a short entry setup. More often than not, the second pullback will be slightly below the first, as would be expected in a bear trend (each swing high tends to be below the prior one). The entry is on a stop at one tick below the setup bar.

Sometimes the market forms a trading range in the first three to 10 bars or so, with two or more reversals. If the range is small compared to the average daily range, a breakout is likely. After the first bar, if there is both a reversal up and a reversal down, some traders will enter a breakout of this small range, looking for a measured move. Traders could enter on a breakout from the range, but the risk is smaller if they are able to fade small bars at the top or bottom of the range, or wait until after the breakout and enter on a failed breakout or a breakout pullback, just as they would with any trading range.

FIGURE 19.1 Measured Move after Breakout of Small Opening Range

When the opening range is about half the size of the range of recent days, the market usually has a breakout of the opening range and an attempt to approximately double it. Sometimes there are many choices for the opening range. Which one is right? They all usually are because different traders will make decisions based on different ones, but on the day shown in Figure 19.1 none led to a precise guide for profit taking or reversals. Most support levels, like measured move projections, do not lead to reversals, because the market has inertia and therefore a strong tendency to continue to do what it has been doing. This means that most reversal attempts fail. However, when the market finally reverses, it is always at a support level. If there is a strong reversal setup at a support level, it is more likely to lead to a profitable trade. By bar 5, the range of the day was still only about half the average range of recent days, so the odds favored a significant increase in the range. With each new reversal, the opening range expanded, but the sell-off down to bar 6 was strong, so the breakout was likely to lead to an approximate measured move down.

The day became a trending trading range day and broke back into the upper range at the end of the day, which is common. Here, the day closed near the top of the upper range and became a reversal day. Most reversal days begin as trending trading range days. If traders understand this, they can look to swing part of their trade off the reversal up from the bottom of the lower range.

Only about 25 percent of reversals in the first hour or so result in swings, so it is better to scalp until there is either a double bottom or top or a clear always-in setup, where the odds are good for a swing. Today was an ordinary day where the first many setups were only scalps. Bar 3 was a double top with bar 1 and therefore had about a 50 percent chance of being the high of the day. It was also a breakout pullback to the moving average. Bar 4 was a double bottom with bar 2 and had a 50 percent chance of being the low of the day. Neither was the high or low of today. The high or low occurs within the first couple of hours in 90 percent of the days, and it usually comes from some type of double top or bottom. Bar 5 formed a double top with bar 3, a small wedge top, and a moving average gap bar, and it became the high of the day.

When retail investors controlled a bigger part of the daily volume, they contributed more to opening gaps and reversals by placing orders before the open, based on the daily chart. For example, if there was a bull reversal bar, traders would see that after the close and place orders before the open to buy above the high of that bar. They were so afraid of missing the buy that they were willing to buy on the open, even if they bought above the high of the bar. This often resulted in the market gapping up to find enough sellers willing to take the other side of the trade. Once these overly eager buyers were filled at the inflated price, the market would trade down to where the institutions thought there was value. They then bought heavily, reversing the market up to a new high, creating the opening bull reversal. The small, brief sell-off on the open creates a tail on the bottom of the bull trend bar on the daily chart, which is common on bull trend days. The opposite happened after bear days where desperate longs were so eager to exit on the open that they were willing to sell the first trade of the day. The market often had to gap down to find enough buyers. Once their sell orders were filled, the market traded up to where institutions felt there was value in selling, and this reversed the market back down to a new low of the day, often creating a bear trend day.

FIGURE 19.2 The Size of the Opening Range Is Important

As shown in Figure 19.2, the size of the opening range often gives a clue to what will happen later in the day. The opening range on this 5 minute chart of Freeport-McMoRan (FCX) was about a quarter of the average daily range of recent days. After several bars, when traders saw that the range might be small, most would have ignored the first bar and then looked for a spike up and a spike down. As soon as the market traded below bar 3, it became a spike up (a reversal down). Once the market traded above bar 4, it became a spike down (a reversal up). At that point, many traders treated those two spikes as a breakout mode setup and placed buy stops at one tick above the top spike and sell stops at one tick below the bottom spike. Once one order is filled, the other becomes the initial protective stop. If after entering, the market reverses direction, a trader will often double the size of the protective stop and plan to reverse the position if the stop is hit.

Traders can often enter before the breakout. Here, for example, there was a large gap up open (the steep moving average shows this) and a bull trend bar for the first bar, so there was a good chance of a bull trend day. Once bar 4 reversed up from a one-tick breakout below the bar 2 ii pattern, many traders went long above the bar 4 double bottom bull flag signal bar (remember, the low of the day often comes from a double bottom of some type). Others bought as soon as bar 5 went above the small bear inside bar, and others bought on the breakout above bar 3.

When the opening range is small like this, the pullbacks within that range are small; and when the day breaks out and trends, the pullbacks often remain small, as they did here. There is usually a pullback in the final couple of hours that is about twice the size of the earlier pullbacks, and that happened on the sell-off from bar 14.

Traders often look for two consecutive trend bars in the first hour, and when they are present, many traders conclude that the market has an always-in position. For example, there were consecutive bull trend bars at bar 2. Since their bodies were small and the tails were large, most traders needed more verification before concluding that the always-in direction was up. This came with the two bull trend bars that followed bar 4. At that point, many traders assumed that the always-in direction was up and they therefore were swinging longs with a stop below the bottom of the two-bar spike. Bar 5 was a strong bull breakout bar and further evidence that the day was a bull trend day, and the several bull bodies that followed gave additional evidence. Notice that there were three bear trend bars before bar 4 and each was followed by a bar with a bull body. The bears were unable to create follow-through selling, which meant that they were weak. The bulls saw each of those bear trend bars as buying opportunities instead of sell setups, and this was strong evidence that the market was likely to go up, especially on a day with a large gap up.

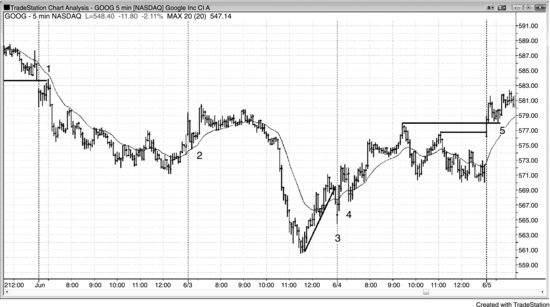

FIGURE 19.3 Breakout Pullbacks on the Open

As shown in Figure 19.3, Google (GOOG) had several breakout pullbacks on the opens of these four days. Bar 1 was a low 2 short at the steep moving average and closed the gap below yesterday's low by 6 cents, setting up a reversal down that formed the high of the day.

Bar 2 was a moving average pullback after breaking above a swing high from yesterday. The bull ii pattern was the setup for the long. The bar after the bar 2 bull bar formed a double top with the first bar of the day, and this was the high of the day.

Bar 3 was a reversal up (a failed breakout) from breaking the bull trend line from the rally into the prior day's close. Bar 4 was a higher low and an approximate double bottom with bar 3.

Bar 5 was a high 2 double bottom bull flag (the first bottom was two bars earlier) that also was the first pullback after the breakout above yesterday's high. This could have turned into a trend from the open day.

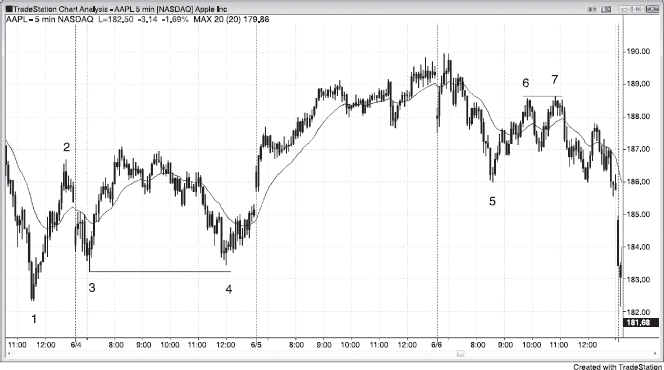

FIGURE 19.4 Early Failed Breakouts

As shown in Figure 19.4, Apple (AAPL) had several failed breakouts on the open during these three days, and they led to opening reversals. Bar 1 was a second entry (low 2) for an opening reversal off a trend channel line overshoot.

Bar 2 was a reversal down from a breakout (a failed breakout) above the trading range in the final hour of the prior day and of the bear trend line (not shown) going into the close of the prior day. The market then reversed up from the moving average, forming the bar 3 higher low, which was also a breakout pullback.

Bar 4 was a reversal down from a higher high on a day that was not yet a bull trend day, and therefore a good short. It also had a wedge shape and was the top of a channel after the gap spike up on the open.

Bar 6 was a lower high final flag reversal down after the bar 5 break below the bull channel. Traders expected a test of the bar 3 bottom of the channel.

Bar 7 was a high 2 breakout pullback in a day with a large gap up, but the market reversed back down at the bar 8 higher high and final flag breakout. Since this was not a bull trend day at this point, this was a good short.

Bar 9 was a new low, but it came with strong momentum, making a second leg down likely. The gap up was a bull spike, and the move from bar 8 to bar 9 was a bear spike. This was a climactic reversal setup and was followed by a trading range, as is often the case. During the trading range, both the bulls and the bears were adding to their positions in an attempt to get follow-through in the form of a channel. The bears won and the bulls had to sell out of their longs, adding to the selling pressure.

Bar 10 was a low 2 and a two-legged lower high.

Bar 11 was a second entry into the short based on a failed high 2 after the bar 10 lower high. The bulls made two attempts to reverse the bearish implications of the lower high and they failed twice. When the market tries to do something twice and it fails both times, it usually will go in the opposite direction.

FIGURE 19.5 Both a Gap Down and a Gap Up Can Lead to an Opening Rally

As shown in Figure 19.5, bar 4 was a strong bear reversal bar and a moving average test in a strong bear trend, setting up a breakout pullback short for the breakout below bar 1. The gap up to the moving average was the pullback.

The move from bar 2 to bar 3 was a spike and channel bear trend, and bar 4 was a test near the top of the channel. The test is often followed by trading range price action. Also, the gap up broke above the steep bear trend line of the final hour of yesterday, and bulls were looking for a breakout pullback long setup. When there are reasonable arguments for both the bulls and the bears, there is uncertainty, and uncertainty usually means that the market is at the start of a trading range, as it was here.

Bar 5 was not a reversal bar, but was a breakout pullback from the break above yesterday's bear channel, and a high 2 variant (bar 4 was a bear bar, there was then a bull bar, and then a second small leg formed down to bar 5). This was a possible higher low after a climactic close, and after a climax (the strong bear into the close had virtually no pullbacks, and since it was likely not sustainable, it was therefore climactic) there is often a two-legged countertrend move. The bull trend bar that followed bar 5 was a two-bar reversal with both bar 5 and the bear bar before it, and with the move down from bar 4. Remember, a sharp move down followed by a sharp move up, like that bull trend bar, is a sell climax, which is a two-bar reversal on a higher time frame chart and a bull reversal bar on an even higher time frame chart.

Bar 8 was a wedge top and a two-legged move up from the bar 5 higher low.

The day was a trending trading range day, and the rally up from bar 20 tested the bottom of the earlier upper trading range.

Bar 24 was a double bottom bull flag. The first bottom was bar 20 or the inside signal bar following the bar 18 low. It was also a reversal up from a test of yesterday's low and a failed breakout of the large two-legged bear flag from bar 18 to bar 23.

Bar 25 was a strong outside up bar in the first 30 minutes of the day, so traders thought that the always-in position might have become long. They wanted any pullback to stay above the bar 25 low, and when bar 26 turned up, they thought that the low of the day could be in.

Bar 26 was a higher low and led to a breakout from an ii setup. The second bar of the ii pattern had a strong bull close, which increased the chances of a move up. It was also a failed low 2 in a bear flag, which trapped bears who saw the big gap down and shorted the second entry (low 2 gap pullback). This was a small final bear flag. It was a second attempt to reverse the attempt to move below yesterday's low and a second attempt to reverse back up after gapping below yesterday's two-legged bear flag.

FIGURE 19.6 Two-Legged Pullback after Gap Opening

A large gap down often has a two-legged pullback to the moving average and then a breakout into a bear trend, as seen in Figure 19.6.

Bars 2 and 3 formed a double top bear flag on a big gap down day (the gap was the flagpole), and a triangle with bar 1 (three tops and a contracting pattern is a triangle).

Bar 3 was the first bar of a two-bar reversal, and a low 2 short setup. It was safer to short below the bear bar that followed bar 3 rather than shorting below the bar 3 bull trend bar, because there was too much risk that the market might go sideways and then make another attempt to break out above the bars 1 and 2 double top. Shorting below a bear bar at the top of a trading range is more reliable than shorting below a bull trend bar.

Although most traders think of the opening range as lasting only an hour or two, the market often begins a trend around 8:30 a.m. PST, as it did here. Whether the bar 3 double top should be considered to be an opening reversal or just a double top is irrelevant. What is important is that a trend often begins or reverses around 8:30 a.m.

FIGURE 19.7 Double Bottom and Top Flags

As shown in Figure 19.7, double bottom bull flags and double top bear flags are common. Bars 3 and 4 formed a large double bottom bull flag after the rally to bar 2. Bars 6 and 7 formed a double top bear flag after the strong move down to bar 5.

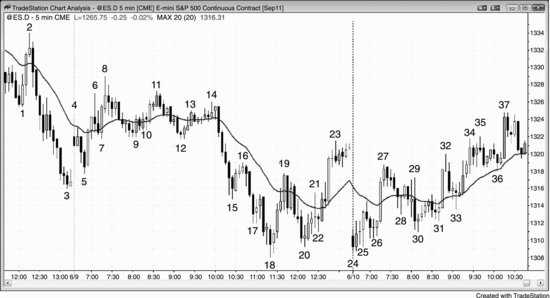

FIGURE 19.8 Two Failed Attempts and Then a Reversal

When the market tries to break out to the upside twice and fails, it usually will then try to break out of the bottom. As shown in Figure 19.8, GOOG went sideways in a small trading range into a 7:00 a.m. PST report and was therefore in breakout mode. Since there were three tops in a convergent trading range, it was a triangle. A trader could have entered on a stop below the trading range low, but it was less risky to short the low 2 below bar 5. This was a low 2 because bars 3 and 5 were two legs up. Since the day was in a trading range at this point, both a high 2 and a low 2 could coexist, as they did here. The high 2 long failed and became a low 2 short. Since the trading range was below the moving average, it was a bear flag and therefore likely to have a downside breakout.

Bar 2 was the second consecutive bear trend bar, and both bars had large bodies and small tails. This led traders to think that the always-in direction was down and that any pullback would set up a short that was likely good for at least a scalp. The low 2 short entry below bar 5 was the first opportunity, and it is clear from the large bear entry bar and follow-through bar that most traders believed that the sell-off was going to extend far enough for a swing, and not just become a scalp and a reversal up. Bar 5 was a double top with bar 3 and led to a swing short.

It does not matter whether a trader calls the double bottom an opening reversal or thinks that it occurred too late in the day to be thought of as part of the opening range. However, the trader needs to be aware that the market often reverses around 8:30 a.m. PST, and be prepared to take the trade.

FIGURE 19.9 Barbwire on the Open

As shown in Figure 19.9, some days open with a flat moving average, big overlapping bars, and just no safe setups (no small bars near the top or bottom where a fade trade could be placed). This is barbwire and should be traded like all barbwire; it requires patience. Wait for one side to be trapped with a trend bar breakout and then look to fade the breakout. Because breakouts from barbwire usually fail, barbwire is often a final flag. Here, the breakout fell below the low of yesterday. The market often reverses a breakout of the high or low of the prior day. This tendency increased the odds that the barbwire would become a final flag. The pattern had three pushes up and was sideways. Some traders saw it as a triangle, which is easier to visualize if you use only the bodies of the bars.

Bar 7 was a reversal up after a breakout of the bottom of the barbwire, but it followed four bear trend bars. That was enough bear strength for traders to wait for a second buy signal. Even though some traders saw it as a high 2 where the high 1 was the high of bar 6, bar 6 was a strong outside down bar, and most traders considered it to be the start of the down move. It was the bar when traders thought that the market might be breaking out of a trading range and into a trend, and they expected at least a second leg down after the outside down bull trap bar. This made most traders see bar 7 as a high 1 since the down move began at the top of bar 6 and not at the top of bar 5.

Bar 7 broke a micro trend line and then bar 9 was a lower low breakout pullback buy setup. Its close was above its midpoint, which is the minimum requirement for a reversal bar. At this point, the price action was mostly two-sided with many reversals and prominent tails, so a second-entry long at a new low of the day did not even need a reversal bar.

The long above bar 9 was a second reversal attempt of the earlier low of the day and of yesterday's low. The market then trended up through the other side of the opening range and gave a high 2 breakout pullback long at bar 12. Bar 12 was a bull reversal bar at the moving average, which was a strong buy signal at the end of a bull flag. The market became always-in long for many traders on the strong bull trend bar that followed bar 9, and other traders became convinced that it was always-in long on the strong bull trend bar breakout above bar 10 and again on the bar 11 strong bull trend bar that broke out of a high 2 buy setup.