PART I

Trend Reversals: A Trend Becoming an Opposite Trend

One of the most important skills that a trader can acquire is the ability to reliably determine when a breakout will succeed or reverse. Remember, every trend bar is a breakout, and there are buyers and sellers at the top and bottom of every bull and bear trend bar, no matter how strong the bar appears. A breakout of anything is the same. There are traders placing trades based on the belief that the breakout will succeed, and other traders placing trades in the opposite direction, betting it will fail and the market will reverse. A reversal after a single bar on the 15 minute chart is probably a reversal that took place over many bars on the 1 minute chart, and a reversal that took place over 10 to 20 bars can be a one-bar reversal on a 120 minute chart. The process is the same on all time frames, whether it takes place after a single bar or many bars. If traders develop the skill to know which direction the market will likely go after a breakout attempt develops, they have an edge and will place their trades in that direction.

Reversal setups are common because every trend bar is a breakout and is soon followed by an attempt to make the breakout fail and reverse, as discussed in Chapter 5 of book 2. If the breakout looks stronger than the reversal attempt, the reversal attempt will usually not succeed, and the attempt to reverse will become the start of a flag in the new trend. For example, if there is a bull breakout of a trading range and the bull spike is made of two large bull trend bars with small tails, and the next bar is a bear doji bar, that bear bar is an attempt to have the breakout fail and reverse back down into a bear trend. Since the breakout is much stronger than the reversal attempt, it is more likely that there are more buyers than sellers below the bear bar, and that the entry bar for the short will become a breakout pullback buy signal bar. In other words, instead of the reversal succeeding, it is more likely that it will become the start of a bull flag and be followed by another leg up. If the reversal setup looks much stronger than the breakout, it is more likely that the breakout will fail and that the market will reverse. Chapter 2 in book 2 discusses how to gauge the strength of a breakout. In short, the more signs of strength that are present, the more likely that the breakout will succeed and that the reversal attempt will fail and lead to a breakout pullback setup.

Institutional trading is done by discretionary traders and computers, and computer program trading has become increasingly important. Institutions base their trading on fundamental or technical information, or a combination of both, and both types of trading are done by traders and by computers. In general, most of the discretionary traders base their decisions primarily on fundamental information, and most of the computer trades are based on technical data. Since the majority of the volume is now traded by HFT firms, and most of the trades are based on price action and other technical data, most of the program trading is technically based. In the late twentieth century, a single institution running a large program could move the market, and the program would create a micro channel, which traders saw as a sign that a program was running. Now, most days have a dozen or so micro channels in the Emini, and many have over 100,000 contracts traded. With the Emini currently around 1200, that corresponds to $6 billion, and is larger than a single institution would trade for a single small trade. This means that a single institution cannot move the market very far or for very long, and that all movement on the chart is caused by many institutions trading in the same direction at the same time. Also, HFT computers analyze every tick and are constantly placing trades all day long. When they detect a program, many will scalp in the direction of the program, and they will often account for most of the volume while the micro channel (program) is progressing.

The institutions that are trading largely on technical information cannot move the market in one direction forever because at some point the market will appear as offering value to the institutions trading on fundamentals. If the technical institutions run the price up too high, fundamental institutions and other technical institutions will see the market as being at a great price to sell out of longs and to initiate shorts, and they will overwhelm the bullish technical trading and drive the market down. When the technical trading creates a bear trend, the market at some point will be clearly cheap in the eyes of fundamental and other technical institutions. The buyers will come in and overwhelm the technical institutions responsible for the sell-off and reverse the market up. Trend reversals on all time frames always happen at support and resistance levels, because technical traders and programs look for them as areas where they should stop pressing their bets and begin to take profits, and many will also begin to trade in the opposite direction. Since they are all based on mathematics, computer algorithms, which generate 70 percent of all trading volume and 80 percent of institutional volume, know where they are. Also, institutional fundamental traders pay attention to obvious technical factors. They see major support and resistance on the chart as areas of value and will enter trades in the opposite direction when the market gets there. The programs that trade on value will usually find it around the same areas, because there is almost always significant value by any measure around major support and resistance. Most of the programs make decisions based on price, and there are no secrets. When there is an important price, they all see it, no matter what logic they use. The fundamental traders (people and machines) wait for value and commit heavily when they detect it. They want to buy when they think that the market is cheap and sell when they believe it is expensive. For example, if the market is falling, but it’s getting to a price level where the institutions feel like it is getting cheap, they will appear out of nowhere and buy aggressively. This is seen most dramatically and often during opening reversals (the reversals can be up or down and are discussed in the section on trading the open later in this book). The bears will buy back their shorts to take profits and the bulls will buy to establish new longs. No one is good at knowing when the market has gone far enough, but most experienced traders and programs are usually fairly confident in their ability to know when it has gone too far.

Because the institutions are waiting to buy until the market has become clearly oversold, there is an absence of buyers in the area above a possible bottom, and the market is able to accelerate down to the area where they are confident that it is cheap. Some institutions rely on programs to determine when to buy and others are discretionary. Once enough of them buy, the market will usually turn up for at least a couple of legs and about 10 or more bars on whatever time frame chart where this is happening. While it is falling, institutions continue to short all the way down until they determine that it has reached a likely target and it is unlikely to fall any further, at which point they take profits. The more oversold the market becomes, the more of the selling volume is technically based, because fundamental traders and programs will not continue to short when they think that the market is cheap and should soon be bought. The relative absence of buyers as the market gets close to a major support level often leads to an acceleration of the selling into the support, usually resulting in a sell vacuum that sucks the market below the support in a climactic sell-off, at which point the market reverses up sharply. Most support levels will not stop a bear trend (and most resistance levels will not stop a bull trend), but when the market finally reverses up, it will be at an obvious major support level, like a long-term trend line. The bottom of the sell-off and the reversal up is usually on very heavy volume. As the market is falling, it has many rallies up to resistance levels and sell-offs down to support levels along the way, and each reversal takes place when enough institutions determine that it has gone too far and is offering value for a trade in the opposite direction. When enough institutions act around the same level, a major reversal takes place.

There are fundamental and technical ways to determine support. For example, it can be estimated with calculations, like what the S&P 500 price earnings multiple should theoretically be, but these calculations are never sufficiently precise for enough institutions to agree. However, traditional areas of support and resistance are easier to see and therefore more likely to be noticed by many institutions, and they more clearly define where the market should reverse. In both the crashes of 1987 and 2008–2009, the market collapsed down to slightly below the monthly trend line and then reversed up, creating a major bottom. The market will continue up, with many tests down, until it has gone too far, which is always at a significant resistance level. Only then can the institutions be confident that there is clear value in selling out of longs and selling into shorts. The process then reverses down.

The fundamentals (the value in buying or selling) determine the overall direction, but the technicals determine the actual turning points. The market is always probing for value, which is an excess, and is always at support and resistance levels. Reports and news items at any time can alter the fundamentals (the perception of value) enough to make the market trend up or down for minutes to several days. Major reversals lasting for months are based on fundamentals and begin and end at support and resistance levels. This is true of every market and every time frame.

It is important to realize that the news will report the fundamentals as still bullish after the market has begun to turn down from a major top, and still bearish after it has turned up from a major bottom. Just because the news still sees the market as bullish or bearish does not mean that the institutions still do. Trade the charts and not the news. Price is truth and the market always leads the news. In fact, the news is always the most bullish at market tops and most bearish at market bottoms. The reporters get caught up in the euphoria or despair and search for pundits who will explain why the trend is so strong and will continue much longer. They will ignore the smartest traders, and probably do not even know who they are. Those traders are interested in making money, not news, and will not seek out the reporters. When a reporter takes a cab to work and the driver tells him that he just sold all of his stocks and mortgaged his house so that he could buy gold, the reporter gets excited and can’t wait to find a bullish pundit to put on the air to confirm the reporter’s profound insight in the gold bull market. “Just think, the market is so strong that even my cabbie is buying gold! Everyone will therefore sell all of their other assets and buy more, and the market will have to race higher for many more months!” To me, when even the weakest traders finally enter the market, there is no one left to buy. The market needs a greater fool who is willing to buy higher so that you can sell out with a profit. When there is no one left, the market can only go one way, and it is the opposite of what the news is telling you. It is difficult to resist the endless parade of persuasive professorial pundits on television who are giving erudite arguments about how gold cannot go down and in fact will double again over the next year. However, you have to realize that they are there for their own self-aggrandizement and for entertainment. The network needs the entertainment to attract viewers and advertising dollars. If you want to know what the institutions are really doing, just look at the charts. The institutions are too big to hide and if you understand how to read charts, you will see what they are doing and where the market is heading, and it is usually unrelated to anything that you see on television.

A successful trend reversal is a change from a bull market to a bear market or from a bear market to a bull market, and the single most important thing to remember is that most trend reversal attempts fail. A market has inertia, which means that it has a strong propensity to continue what it has been doing and a strong resistance to change. The result is that there is really no such thing as a trend reversal pattern. When there is a trend, all patterns are continuation patterns, but occasionally one will fail. Most technicians will label that failure as a reversal pattern, but since most of the time it fails as a reversal and the trend continues, it is really more accurately thought of as just a continuation pattern. A trend is like a huge ship that takes a lot of force applied over time to change its direction. There usually has to be some increase in two-sided trading before traders in the other direction can take control, and that two-sided trading is a trading range. Because of this, most reversal patterns are trading ranges, but you should expect the breakout from the trading range to be in the direction of the trend because that is what happens in about 80 percent of cases. Sometimes the breakout will be in the opposite direction or the with-trend breakout will quickly fail and then reverse. When those events happen, most traders will label the trading range as a reversal pattern, like a double top, a head and shoulders, or a final flag. All of the reversal patterns listed in Part I can lead to a trend in the opposite direction, but they can also simply lead to a trading range, which is more likely to be followed by a trend resumption. In this case, the reversal pattern is just a bull flag in a bull trend or a bear flag in a bear trend.

When a trend reverses, the reversal can be sharp and immediate and have a lot of conviction early on, or it can happen slowly over the course of a dozen or more bars. When it happens slowly, the market usually appears to be forming just another flag, but the pullback continues to grow until at some point the with-trend traders give up and there is a breakout in the countertrend direction. For example, assume that there is a bear trend that is beginning to pull back and it forms a low 1 setup, but the market immediately turns up after the signal triggers. It then triggers a low 2 entry and that, too, fails within a bar or so. At this point, assume that either the market breaks out of the top of the bear flag or it has one more push up, triggering a wedge bear flag, the entry fails, and then the market has a breakout to the upside. A reversal at some point makes the majority of traders believe that the always-in position has reversed, and this almost always requires some kind of breakout. This is discussed in detail in Chapter 15, but it means that if you had to be in the market at all times, either long or short, the always-in position is whatever your current position is. The breakout characteristics are the same as with any breakout, and were discussed in the chapter on breakouts in Part I of book 2. At this point, there is a new trend, and traders reverse their mind-set. When a bull trend reverses to a bear trend, they stop buying above bars on stops and buying below bars on limit orders, and begin selling above bars on limit orders and selling below bars on stops. When a bear trend reverses to a bull trend, they stop selling below bars on stops and selling above bars on limit orders, and begin buying above bars on stops and buying below bars on limit orders. See Part III in the first book for more on trend behavior.

Every trend is contained within a channel, which is bordered by a trend line and a trend channel line, even though the channel may not be readily apparent on a quick look at the chart. The single most important rule in these books is that you should never be thinking about trading against a trend until after there has been a breakout of the channel, which means a break beyond a significant trend line. Also, you should take a reversal trade only if there is a strong signal bar. You need evidence that the other side is strong enough to have a chance of taking control. And even then, you should still be looking for with-trend trades because after this first countertrend surge, the market almost always goes back in the direction of the trend to test the old trend extreme. Only rarely is the trend line break on such strong momentum that the test won’t be tradable for at least a scalp. If the market fails again around the price of the old extreme, then it has made two attempts to push through that level and failed, and whenever the market tries twice to do something and fails, it usually tries the opposite. It is after this test of the old extreme that you should look for countertrend swing trades and only if there is a good setup on the reversal away from the old extreme.

It is very important to distinguish a reversal trade from a countertrend scalp. A reversal trade is one where an always-in flip is likely. A countertrend scalp is not a reversal trade; it usually has a bad trader’s equation and most often forms within a channel. Channels always look like they are about to reverse, suckering traders into countertrend trades using stop entries. These traders soon get trapped and have to cover with a loss. For example, if there is a bull channel, it will usually have a reasonable-looking bear reversal or inside bar after the breakout to every new high. Beginners will see that there is enough room to the moving average for a short scalp and will short on a stop below the bar. They will lose money on 70 percent or more of their countertrend scalps, and their average loser will be larger than their average winner. They take the shorts because they are eager to trade and most of the buy signals look weak, often forcing traders to buy within a few ticks of the top of the channel. The countertrend setups often have good-looking signal bars, which convince traders that they can finesse a short scalp while waiting for a good-looking buy setup. They see all of the prior bear reversal bars and pullbacks as signs of building selling pressure, and they are right. However, most short scalps will end up being just micro sell vacuums, where the market is getting sucked down to a support level, like around the bottom of the channel, or below a minor higher low. Once there, the strong bulls begin to buy aggressively. Many take profits at the new high, creating the next sell signal, which will fail like all of the earlier ones. High-frequency trading firms pay minuscule commissions and can profitably trade for one or two ticks, but you cannot. Although there are good-looking reversal bars, these are not tradable reversals, and traders should not take them. As long as the signal is not good enough to flip the always-in direction to short, only trade in the direction of the trend. The institutions are buying below the lows of those sell signal bars. If you want to trade while the channel is forming, you either have to buy with limit orders below prior bars, like the institutions, or buy above high 2 signal bars, which is where the bears usually buy back their losing shorts. However, this is difficult for many traders, because they can see that the channel has a lot of two-sided trading and know that buying at the top of a channel, where there is a lot of two-sided trading, is an approach that often has only a marginally positive trader’s equation.

A trend reversal, or simply a reversal, is not necessarily an actual trend reversal because the term implies that the market is changing from one behavior to any opposite behavior. It is best thought of as a change from a bull trend to a bear trend or vice versa, and that is the subject of Part I. Trading range behavior is arguably the opposite of trending behavior, so if a trading range breaks out into a trend, that is a reversal of the behavior of the market, but it is more commonly described as a breakout. A pullback is a small trading range and a small trend against the larger trend, and when the pullback ends, that minor trend reverses back into the direction of the major trend. Most trend reversals end up as higher time frame pullbacks in the trend, which means that most end up as large trading ranges; however, some become strong, persistent trends in the opposite direction. Even when the reversal leads to a trading range, the reversal entry will usually go far enough to be a swing trade.

Most trend reversal attempts do not result in a strong, opposite trend and instead lead to trading ranges. Strictly speaking, the behavior has reversed into an opposite type of price action (from one-sided trading to two-sided trading), but the trend has not reversed into an opposite trend. A trader never knows in advance if there will be a reversal into a new trend, and a reversal into a trading range often looks the same as a reversal into a new trend for dozens of bars. Because of this, a trader does not know until much later whether there has been a reversal into the opposite trend or just a transition into a trading range. This is why the probability of most trades, where the reward is many times greater than the risk, is so small at the outset. As the moves becomes more certain, the reward gets smaller, because there are fewer ticks left to the move, and the risk gets larger because the theoretically ideal stop for a swing trade goes beyond the start of the most recent spike (below the most recent higher low in a bull or above the most recent lower high in a bear, which can be far away). From a trader’s perspective, it does not matter because traders are going to trade the reversal the same way, whether it evolves into a strong new trend or simply into a couple of large countertrend legs. Yes, they would make more money from a huge swing that does not come back to their breakeven stops, but they can still make a lot of money if the market stalls and simply becomes a large trading range. However, in a trading range, traders will usually make more money if they look for scalps rather than swings. Trading ranges and pullbacks were discussed in book 2. In a true trend reversal, the new trend can go a long way and traders should swing most of their position.

If the market does reverse into an opposite trend, the new trend may be either protracted or limited to a single bar. The market may also simply drift sideways after a bar or two, and then trend again later, either up or down. Many technicians will not use the term reversal except in hindsight, after a series of trending highs and lows has formed. However, this is not useful in trading because waiting for that to occur will result in a weaker trader’s equation, since a significant pullback (a greater drawdown) in that new trend becomes more likely the longer the trend has been in effect. Once a trader is initiating trades in the opposite direction to the trend, that trader believes that the trend has reversed even though the strict criteria have not yet been met. For example, if traders are buying in a bear trend, they believe that the market will likely not trade even a single tick lower; otherwise they would wait to buy. Since they are buying with the belief that the market will go higher, they believe the trend is now upward and therefore a reversal has taken place, at least on a scale large enough for the trade to be profitable.

Many technicians will not accept this definition, because it does not require some basic components of a trend to exist. Most would agree on two requirements for a trend reversal. The first is an absolute requirement: the move has to break a trend line from the prior trend so that the old trend channel has been broken. The second requirement happens most of the time, but is not required: after the trend line break, the market comes back and successfully tests the extreme of the old trend. Rarely, there can be a climactic reversal that has a protracted initial move and never comes close to testing the old extreme.

The sequence is the same for any reversal. Every trend is in a channel and when there is a move that breaks the trend line, the market has broken out of the channel. This breakout beyond the trend line is followed by a move back in the direction of the trend. The trend traders want this to be a failed reversal attempt and for the old trend to resume. If they are right, the new trend channel will usually be broader and less steep, which indicates some loss of momentum. This is natural as a trend matures. They see this trend line break as simply leading to another flag that will be followed by an extension of the trend.

The countertrend traders want this reversal back in the direction of the old trend, after the breakout, to be a breakout test and then be followed by at least a second leg against the old trend. In a successful breakout, instead of resuming the trend, the test reverses once more and the test becomes a breakout pullback in the new trend, or at least in a larger correction. For example, in the breakout above the bear trend line in a bear trend, at some point the reversal will attempt to fail and then sell off to a lower low, a double bottom, or a higher low, which is the test of the bear low. If that test is successful, that test becomes a breakout pullback in the breakout above the bear trend line and the new bull trend resumes for at least one more leg. When the reversal up results in a reversal into a new trend, the rally that broke above the bear trend line is when the bulls began to take control over the market, even if the pullback from this bull breakout falls to a lower low. Most traders will see the lower low as the start of the bull trend, but the bulls often take control during the spike that breaks above the bear trend line. It does not matter if you say that the bull began at the bottom of the bull spike or at the bottom of the lower low reversal, because you trade the market the same. You look to buy as the market is reversing up from the lower low (or double bottom or higher low). The rally that follows could become a large two-legged correction, the start of a trading range, or a new bull trend. No matter what the end result is, the bulls have a good chance of a profitable trade. If the test is unsuccessful, the market will continue down into a new bear leg and traders have to look for another breakout above the new bear channel and then another test of the new bear low before looking to buy a bottom. The opposite is true when there is a bull trend that has a bear spike below the bull trend line, and then a higher high, double top, or lower high pullback from the breakout. The bears began to take control over the market during the spike. The test of the bull high, even if it exceeds the old high, is still simply a pullback from the initial bear breakout below the bull trend line.

Once there has been a strong countertrend move, the pullback will be a test for both the bulls and the bears. For example, suppose there was a strong downward move in a bull market, and the move broke through a trend line that had held for 20 to 40 bars; it then continued down for 20 bars and carried well below the 20-bar moving average, and even beneath the low of the last higher low of the bull trend; in this case the bears have demonstrated considerable strength. Once this first leg down exhausts itself, bears will begin to take partial profits, and bulls will begin to reinstate their longs. Both will cause the market to move higher, and both bulls and bears will watch this move very carefully. Because the down leg was so strong, both the bulls and the bears believe that its low will likely be tested before the market breaks out into a new high. Therefore, as the market rallies, if there is not strong momentum up, the new bulls will start to take profits and the bears will become aggressive and add to their shorts. Also, the bulls who held through the sell-off will use this rally to begin to exit their longs. They wanted to stay long until they saw strong bears, and since the bears demonstrated impressive strength, these bulls will look for any rally to exit. This represents supply over the market and will work to limit the rally and increase the chances of another leg down. The rally will likely have many bear bars and tails, both of which indicate that the bulls are weak. A sell-off down from this rally would create the first lower high in a potential new bear trend. In any case, the odds are high that there will be a second leg down, since both the bulls and the bears expect it and will be trading accordingly.

There will still be bulls who bought much lower and want to give the bull trend every possible chance to resume. Traders know that most reversal attempts fail, and many who rode the trend up will not exit their longs until after the bears have demonstrated the ability to push the market down hard. Many longs bought puts to protect themselves in case of a severe reversal. The puts allow them to hold on to give the bull trend every possible chance to resume. They know that the puts limit their losses, no matter how far the market might fall, but once they see this impressive selling pressure, they will then look for a rally to finally exit their longs, and will take profits on their puts as the market turns back up. Also, most of their puts expire within a few months, and once expired, the traders no longer have downside protection. This means that they cannot continue to hold on to their positions unless they keep buying more and more puts. If they believe that the market will likely fall further and not rally again for many months, it does not make sense to continue to pay for ongoing put protection. Instead, they will look to sell out of their positions. Their supply will limit the rally, and their selling, added to the shorting by aggressive bears and the profit taking by bulls who saw the sell-off as a buying opportunity, will create a second leg down.

These persistent bulls will each have a price level on the downside that, if reached, will make them want to exit on the next rally. As the market keeps working lower, more and more of these bulls will decide that the bull trend will not resume anytime soon and that the trend might have reversed into a bear trend. These remaining die-hard longs will wait patiently for a pullback in the bear swing to exit their longs, and their positions represent a supply that is overhanging the market. They sell below the most recent swing high because they doubt that the market will be able to get above a prior swing high and are happy to get out at any price above the most recent low. Bears will also look for a pullback from each new low to add to their shorts and place new shorts. The result is a series of lower highs and lower lows, which is the definition of a bear trend.

Typically, the initial move will break the trend line and then form a pullback that tests the end of the old trend, and traders will look to initiate countertrend (actually with-trend, in the direction of the new trend) positions after this test. Most traders will want the leg that breaks the trend line and the one that tests the trend’s extreme to have more than just two or three bars. Is five enough? What about 10? It all depends on context. A trend line break that has just one or two exceptionally large bars can be enough to make traders expect at least a second leg. Is a two-bar pullback enough of a test of the old extreme? Most traders prefer to see at least five bars or so, but sometimes the trend line break or the pullback can be only two or three bars long and still convince traders that the trend has reversed. If one of the two legs is just a couple of bars, most traders will not trade the new trend aggressively unless the other leg has more bars. Because of this, the new trend will rarely begin after just a two-bar trend line break and then a two-bar test of the old trend. Even when one does, the odds are high that there will be a larger pullback within the next 10 bars or so.

The test after the trend line break may fall short of the prior extreme or it may exceed it, but not by too much. With any countertrend trade, traders should insist on a strong signal bar, because without it the odds of success are much less. For example, if there is a bear trend and then a sharp move upward that extends well beyond the bear trend line, traders will look to buy on the first pullback, hoping for the first of many higher lows. They will want a strong bull reversal bar or two-bar reversal before taking the trade. However, sometimes the pullback extends below the low of the bear trend, running stops on the new longs. If this lower low reverses back up within a few bars, it can lead to a strong swing up. If, in contrast, the lower low extends too far below the prior low, it is better to assume that the bear trend has begun a new leg down, and then wait for another trend line break, upward momentum surge, and a higher or lower low pullback, before going long again.

Although traders love to buy the first higher low in a new bull trend or sell the first lower high in a new bear trend, if the new trend is good, there will be a series of pullbacks with trending swings (higher highs and higher lows in a bull trend or lower highs and lower lows in a bear trend), and each of these pullbacks can provide an excellent entry. A pullback can be a strong bear spike, but as long as traders think the trend is now upward, they will buy around the close of the strong bear trend bar, expecting no follow-through and looking for the bear reversal to fail. The bulls see the strong bear spike as a brief value opportunity. Beginners unfortunately see it as the start of a new bear trend, ignoring all of the bullishness of the prior bars and focusing on only this one- or two-bar bear spike. They short exactly where the strong bulls are buying. The bulls will expect every attempt by the bears to fail, and therefore look to buy each one. They will buy around the close of every bear trend bar, even if the bar is large and closes on its low. They will buy as the market falls below the low of the prior bar, any prior swing low, and any support level, like a trend line. They also will buy every attempt by the market to go higher, like around the high of a bull trend bar or as the market moves above the high of the prior bar or above a resistance level. This is the exact opposite of what traders do in strong bear markets, when they sell above and below bars, and above and below both resistance and support. They sell above bars (and around every type of resistance), including strong bull trend bars, because they see each move up as an attempt to reverse the trend, and most trend reversal attempts fail. They sell below bars (and around every type of support), because they see each move down as an attempt to resume the bear trend, and expect that most will succeed.

The first pullback after a reversal up into a new bull trend is usually a test of the bear low, but it may not even get very close to the bear low. It, like all subsequent pullbacks in the new bull trend, can also be a test of a breakout of a key point like the most recent signal bar high or entry bar low, a trend line, a prior swing point, a trading range, or a moving average. After the market moves above the high of the first leg up, bulls will move their protective stops up to just below this higher low. They will continue to trail their stops to just below the most recent higher low after every new higher high until they believe that the market is becoming two-sided enough to start having two-legged corrections down. Once they believe that the market will have a second leg down that will likely fall below the low of the first leg down (the most recent higher low), they will look to exit their longs on strength, like around the close of a bull trend bar that is at, above, or slightly below the trend’s high, or below the low of the prior bar. It does not make sense for them to exit below the most recent higher low once they believe that the market will get there. Instead, they will exit higher and look to buy again around that higher low. If this bull flag is sideways, it could be a simple high 2, a triangle, or a double bottom; it could also form a lower low and be a traditional ABC correction.

All trends are in channels, and most trends end with a breakout of the trend channel, which may not be obvious on the time frame of the chart in front of you. For example, a bull trend typically ends in one of two ways. First, there can be a breakout above the channel in an attempt to create an even steeper bull trend. This only rarely succeeds and usually fails within one to five bars. The market then reverses back down below the trend channel line and into the channel, and then the minimum target is a poke below the trend line at the bottom of the channel. This will usually have at least a two-legged sideways to down correction and may lead to a trend reversal or a trading range. The pullback from the first leg down usually becomes a lower high, and the second leg down will usually extend to some measured move target, like a leg 1 = leg 2 move or a projection based on the height of the bear spike or of some trading range within the bull channel.

Alternatively, the market can break below the bull trend line without first overshooting the trend channel line. The breakout can be a sharp spike down or a sideways drift into a trading range. In either case, the pullback that tests the bull high can be either a higher high or a lower high; they occur about equally frequently. Since at least two legs down will happen in about two-thirds of cases, a higher high should be followed by two legs down, and a lower high may be followed by a single leg, since the first leg down already occurred just before the lower high formed. In the other third of cases, the reversal attempt fails, and the bull trend resumes or a trading range forms.

If the market forms a higher high in its test of the old bull high, one of the best trades is to look for a short setup on the first lower high, which is a test of the higher high. In a bear trend where there is an upward momentum surge that breaks above a major bear trend line, traders will buy the first higher low. Their buying lifts the market and reinforces everyone’s belief that a new bull trend might be beginning.

An important point is that trends last much longer than most traders would ever imagine. Because of that, most reversal patterns fail and evolve into continuation setups, and most continuation patterns succeed. Traders have to be very careful when trading countertrend based on a reversal pattern, but there are price action setups that greatly increase the chances of a profitable trade.

Since most reversal attempts fail, many traders enter in the opposite direction. For example, if there is a bull trend and it forms a large bear trend bar closing on its low, most traders will expect this reversal attempt to fail, and many will buy at the close of the bear bar. If the next bar has a bull body, they will buy at the close of that bar and above its high. The first target is the high of the bear trend bar, and the next target is a measured move up, equal to the height of the bear trend bar. Some traders will use an initial protective stop that is about the same number of ticks as the bear trend bar is tall, and others will use their usual stop, like two points in the Emini.

If you find yourself drawing many trend channel lines during a trend and seeing lots of wedge reversal setups, then you are too eager to find a reversal and are likely missing many great with-trend trades. Also, since most trend channel line overshoots and reversals are minor in a strong trend and fail, you will be trading loser after loser and wondering why these patterns are failing when they are supposed to be so good. Wait for a strong trend line break before looking for a countertrend trade; look at all those minor trend channel line overshoots as the start of with-trend setups, and enter where the losers are exiting on their protective stops. You will be much happier, more relaxed, and richer, and you will be entertained by how well they work when intuitively they should not.

One of the reasons it is so tempting for a beginner to sell rallies in a strong bull trend is that the market spends so much time near the high of the leg, and one gets impatient waiting for a pullback that never seems to come. Also, there does not seem to be enough room to the top of the screen for the market to go any higher, so it is easy to imagine that it has to go lower. The market is so overdone that there surely has to be an imminent regression to the mean in the form of a reversal that will fall far enough to make at least a scalper’s profit. Traders begin to believe that they have to do something in the meantime while they wait for the market to pull back, and as traders, they assume that they must trade. Instead, they should think of themselves as traders who must make a lot of money, not a lot of trades. Since they are afraid to buy at the high and they believe that a pullback is overdue, they short, expecting that they will make money as the market begins to pull back. Most of the time, the market will pull back a little but then reverse back up. It does not fall far enough for them to make a profit on their countertrend short scalps, and they are stopped out with a loss. The bull trend then resumes again in a quick breakout, and they are on the sidelines, watching, feeling sad, and a little bit poorer. Experienced traders take the other side of this trade. Many place limit orders to buy at the low of that weak bear signal bar, and others place stop orders to get long at one tick above the high of the prior bar in the small pullback. When the pullback sets up a long, beginners are still fixated on that top that led to the pullback, and they are afraid that the market might fall further. Or they are still short, hoping for the market to drop just a little more so that they can make a profit on their short scalp. Surely one of their short scalps has to work. They just lost on their last four shorts, and the market has to realize how unfair it has been, and will now make up for it by giving them a profit. They do not accept that it is all math and has nothing to do with fairness or emotion. After several months or years of losing, they decide that when they see a bull trend, they will not take a single short all day. That is the day when they stop losing money. After many months, they decide that when there is a bull trend, they are only going to buy pullbacks and take no other trades. That is the day that they begin to make money.

In a bull trend, buyers continue to buy until they decide that the trader’s equation is no longer as favorable as they would like it to be, and at that point they begin to take partial profits. As the market continues to rise, they continue to take more profits and are not eager to buy again until there is a pullback. Also, shorts are being squeezed out of the market as the market continues upward, and they are being forced to buy back their short positions. At some point, they will have covered all that they wish to cover, and their buying will stop. There will also be momentum traders who will continue to buy as long as there is good momentum, but these traders will be quick to take profits once the momentum slows. The market will continue up until it overshoots the directional probability of an equidistant move. The bulls and bears are never sure when that probability is 50 percent, and the trend will continue until the math clearly favors a move down. Neutrality is never clear, and excess is much easier to spot. It will always occur at some magnet area, but since there are so many to choose from, it is difficult to know which will work. Usually, there has to be a confluence of magnets before a pullback will develop. Some firms will be placing trades based on one or more magnets, and other firms will use different ones; but once there is a critical mass of firms expecting a pullback, the market will turn. The critical mass comes when the selling pressure becomes greater than the buying pressure and is due to more dollars being traded by traders expecting a pullback. There will no longer be a shortage of offers, requiring the market to go higher to find traders to take the other side of the bull trades. Instead, traders will be quick to place shorts at the offer. In fact, they will start shorting at the bid and the market will have to go lower to find enough buyers to fill the large number of sell orders. Those sellers will be a combination of bulls selling out of their longs and bears establishing shorts.

So who is buying that last tick at the top of a bull trend or selling the low of a bear trend? Is it the accumulation of countless small traders who are getting caught up in the panic and either are on the wrong side and being forced to liquidate in the face of rapidly growing losses or are flat and impulsively entering late in a rapidly moving trend? If only we could be so influential! That might have been the case long ago, but not in today’s market. If there is so much volume at the high and low of the day and the institutions make up most of that volume, why would they buy the high tick of the day if they are so smart? The majority of the day’s volume is driven by statistically based mathematical algorithms, and some of those models will continue to buy until there is a clear trend change, and only then will they reverse to the short side. These momentum programs will buy right up to the last tick of a bull trend and short to the very low of a bear trend because the designers of the systems have determined that this approach maximizes their profit. Remember, there is inertia in a trend and trends are very resistant to ending, so betting on them continuing is a good bet. Because they trade such huge volume, there is an ample supply of buying at the high to take the other side of the huge volume of shorts that is coming in at the top (and vice versa at the bottom).

Just because they are very smart and trade huge volume does not mean that they are making a 5 percent profit a day. In fact, the best of them are netting a fraction of a percentage point each day, and some of them have determined that their profit is maximized by continuing to buy, even including the high tick of the day, because they believe that the market might go at least a tick or two higher. Many high-frequency trading (HFT) algorithms are designed to make very small profits on each trade, and if these quant firms have done tests that tell them that they can make a couple more ticks by buying at the high, they will continue to buy. Many firms also have complex strategies involving options and other products, and it is impossible to know what all the factors are at play at the extremes of the day. For example, they might be expecting a reversal down and be entering a delta-neutral spread where they would buy 200 Emini contracts and buy 2,000 SPY at-the-money puts. They lose only if the market goes sideways in a very tight range for several days. If the market goes up, the puts will lose money at a slower rate than the rate at which the Eminis gain in value. If the market falls, the puts will increase in value faster than the long Eminis will fall in value, and their neutral spread becomes increasingly more of a bear play. This will allow them to profit, even though they bought the Eminis at the high of the day. All that you need to know is that there is huge volume at the extremes, and it is coming from institutions, some of which are buying the high while others are selling it.

Incidentally, there is one other common sign of just how active mathematical, computer-generated trading is. Just look at correlated markets, like the Emini and all of the related exchange-traded funds (ETFs) like the SPY, and you will see that they basically move tick for tick. This is also true for other related markets. This could not be taking place so perfectly all day long if it was being done manually. Also, chart patterns would not be as perfect as they are on all time frames, even down to tick charts, unless a huge volume of the trading was computer generated. People simply cannot analyze and place orders that quickly in so many markets simultaneously, so the perfection has to be the result of computer-generated trades, and they must make up the majority of the trading volume.

When there is a strong trend with no significant pullbacks, it is common to start looking for a small reversal because common sense dictates that the market will eventually have to pull back as traders begin to take partial profits and enough countertrend traders take new positions. Regression to a mean logic works everywhere in life and it should in trading as well. And it does, but it usually occurs after the market has reached a far greater extreme than most traders could imagine. A trader will have to decide if it is better to look for a countertrend scalp or to wait for the pullback to end and then enter in the direction of the trend. If the trend is strong, it is usually better to trade countertrend only if there are clear signs of a trend reversal, such as a prior strong trend line breakout and then a test that ends with a strong reversal bar. However, the temptation is great to do something, and many traders will begin to look at smaller time frame charts, like a 1 minute or 100 tick chart. Smaller time frame charts continue to form reversals as the trend progresses, and the vast majority of the reversals fail. A trader can rationalize taking the countertrend trade by thinking that a 1 minute chart has small bars so the risk is only about four ticks, and if this turns out to be the very top of the market, the potential gain is huge. Therefore, taking a few small losses is worth it. Invariably, the few small losses turn into six or seven and their combined effect is a loss that cannot be recovered later in the day. When traders get lucky and pick the exact end of a trend, they will scalp out with a few ticks of profit instead of riding the trade for a long way, as they originally had planned. This is death by mathematics. It’s great to feel smart enough to buy the low of a bear trend or short the high of a bull trend, but if you lose in nine out of 10 attempts, you will slowly go broke. In general, buying pullbacks in bull trends and selling rallies in bear trends is a much better approach for most traders. There are far more trades, and the winning percentage is higher.

If you are becoming agitated because you are not in the market during an extended trend and you feel like you need to trade so you begin to look at a 1 minute chart, those 1 minute reversals offer a very profitable way to make money. However, it is by doing the opposite of the obvious. Wait for a 1 minute reversal to trigger a countertrend entry, which you do not take, and then determine where you would place a protective stop if you had taken the trade. Then, place a stop order to enter with trend at that price. You will be stopped into a with-trend position just as the countertrend traders are getting stopped out. No one will be looking to enter countertrend at that point and likely not until the trend has moved far enough to make a profit before the next countertrend setup begins to form. This is a very high-probability with-trend scalp.

The single most reliable countertrend trade is actually a with-trend trade on a larger time frame. A pullback is a small trend against the larger trend, and when you enter against the trend of that pullback, you are entering in the direction of the larger trend. Once the pullback traders have exhausted themselves and the trend traders have again demonstrated their resolve by breaking the trend line that contained the pullback, any small pullback to test this breakout is a great breakout pullback entry. This entry is counter to the trend of the pullback, but in the direction of the major trend, and will usually lead to at least a test of the major trend’s extreme. The more momentum that is present in the trend line break, the more likely it is that trade will be profitable. For example, if there is a bull flag, you can buy the bottom of the bull flag, the breakout of the bull flag, or on a small pullback from that breakout for a test of the high of the bull trend.

Momentum in a reversal can be in the form of a few large trend bars or a trending series of average-looking bars. The more signs of strength, the more reliable the reversal will be. These are discussed in more detail in Chapter 2 of book 2 on the strength of breakouts and in Chapter 19 of book 1 on the strength of trends. Ideally, the first leg of the reversal will extend for many bars, break well beyond the moving average, have the majority of the bars be trend bars in the direction of the new trend, and extend beyond swing points in the prior trend (if the prior trend was a bull trend, then it is a sign of strength if the first leg of the new bear trend drops below and closes below one or more of the higher lows of that prior bull trend).

Big traders don’t hesitate to enter a trend during its spike phase, because they expect significant follow-through, even if there is a pullback immediately after their entry. If a pullback occurs, they increase the size of their position. For example, if there is a strong bull breakout lasting several bars, more and more institutions become convinced that the market has become always-in long with each new higher tick, and as they believe that the market will go higher, they start buying. This makes the spike grow very quickly. They have many ways to enter, like buying at the market, buying a one- or two-tick pullback, buying above the prior bar on a stop, or buying on a breakout above a prior swing high. It does not matter how they get in, because their focus is to get at least a small position on and then look to buy more as the market moves higher or if it pulls back. Because they will add on as the market goes higher, the spike can extend for many bars. Beginning traders see the growing spike and wonder how anyone could be buying at the top of such a huge move. What they don’t understand is that the institutions are so confident that the market will soon be higher that they will buy all of the way up, because they don’t want to miss the move while waiting for a pullback to form. Beginners are also afraid that their stops would have to be below the bottom of the spike, or at least below its midpoint, which is far away. The institutions know this, and simply adjust their position size down to a level where their dollars at risk are the same for any other trade. At some point, the early buyers take some profits, and then the market pulls back a little. When it does, the traders who want a larger position quickly buy, thereby keeping the initial pullback small.

Although the best reversals have strong momentum and go a long way, they often are very slow to start and can have several small bars before the sharp moves begin. The result is that most trend reversal setups have a less than 50 percent chance of success. For example, a reversal up in a new bull trend often starts as a low-momentum rally with overlapping bars and pullbacks, making many traders believe that another bear flag is forming. The first pullback is a low 1 short setup. However, traders should not short a low 1 unless the market is in a strong bear spike in a clear bear trend, so this low 1 is likely to fail. Aggressive traders will instead buy at the bottom and below the low 1 signal bar, expecting it to fail. There is often then a low 2 short setup. However, if you believe that the trend has reversed up, this is also likely to fail and again aggressive bulls will buy with limit orders at and below the low of the low 2 signal bar. Once it does fail, traders will see this failed low 2 as a failed bear flag, and it often leads to a strong breakout to the upside. That bear flag becomes the final flag in the bear trend, even though it never broke out to the downside by more than a tick or so. Sometimes the market has one more push up into a wedge bear flag before the upside breakout forms.

You can think of the bear flag as an attempt by the market to trap you out of the long trade that you entered a few bars earlier on the first reversal up so that you will have to chase the move up and add fuel to the new bull trend. One of the failed short entries often quickly becomes a strong outside up bar. This happens so quickly that many bulls who were looking to buy the failed low 1 or low 2 become paralyzed. They were hoping for a quiet buy signal bar with a high near the bottom of the low 2 signal bar, and instead they are being forced into a quick decision. Do they want to buy an outside up bar at what could be the top of a bear flag? Most traders will hesitate and wait for a pullback to buy, but at this point everyone believes that the bears have lost and that the market is going higher. They don’t know if there will be a pullback in the next several bars, but they do know that if there is, it will be followed by a new high to the bull leg. When that kind of clear always-in mentality is present, there usually will not be a pullback until the market is much higher. That is why it is important to buy at least a small position. The mathematics of bull spikes is discussed in Part I of book 2 on breakouts and even more so in Chapter 25 in book 2 on the mathematics of trading, but the important thing to remember is that if you are trapped out of the market, enter at least a small position at the market or on a one- or two-tick pullback, and place a very wide stop. The mathematics of this trade is strongly in your favor.

The low 1, low 2, or wedge bear flag will trap weak new bulls out and force them to reenter the new bull trend at a much worse price. Some of the strongest trends come from these traps because they tell traders that the last bear trend trader just got burned and there is no one left from the old trend. Also, they tell us that weak bull traders just got out and now will be chasing the new bull trend, adding orders in the new direction. This gives traders confidence. When this kind of agitated reversal happens after a trend line break and on the test of the trend’s extreme, the new trend will usually last for at least 10 bars and it will retrace a good portion of the most recent part of the old trend.

Even if there are no pullback bars on the 5 minute chart, it is common at the very start of a trend to find pullbacks on 1 and 3 minute charts, which also trap traders out. Sometimes traders will enter based on a 5 minute signal and think they are clever by using a stop based on a smaller time frame chart. When the 5 minute signal is strong, this will usually be a mistake. It is better to suffer through a few bars of anxiety than to exit on a smaller time frame chart, because you will get trapped out of too many great trends.

If a trader enters early but the move is hesitant (for example, with overlapping bars) for a few bars, this should not be a concern, especially if those bars are mostly trend bars in the right direction. This is a sign of strength, and everyone is watching and waiting for the momentum to begin before entering. A good price action trader can often get in before that happens and then is able to move her stop to breakeven soon after the momentum starts, allowing her to make a lot of money with minimal risk. If you are confident in your read, take your trade, and don’t worry that no one else sees what you see yet. They eventually will. Make sure to swing part or even all of your position even though you sometimes will get stopped out on your breakeven stop once or twice before the trend begins its run.

So what is the best reversal setup? It is the end of a pullback when the short-term countertrend move is ending and reversing back into the direction of the major trend. In other words, the best reversals are a bull flag in a bull trend just as it is breaking out to the upside and a bear flag in a bear trend just as it is reversing back down. Major reversals are less common since most reversal attempts fail and become flags. A reversal trade can be based on a traditional reversal after a trend line break and then a test of the extreme, followed by a very strong countertrend spike that leads to an always-in flip to the opposite trend. If it comes after a trend line break, there is often a second entry. If the trend was strong, it is usually better to wait for that second entry; but if it does not come, the market will likely create a strong enough countertrend spike to make most traders believe that the always-in position has reversed. For example, if there is a bull trend and traders are looking for a reversal but the setup is not particularly strong, they should wait to see if the market will give a second entry in the form of a lower high or a higher high within the next five bars or so. If it does not and it instead sells off for four or five bars, breaks out of a pattern, and then has follow-through on the next bar, this will be enough bear strength to convince most traders that the always-in position has flipped to short. They will sell either at the market or on pullbacks.

Much of this material is in book 2 on trading ranges, but it is relevant here as well because of the widespread misconception that reversal patterns are reliable. Since trends are constantly creating reversal patterns and they all fail except the final one, it is misleading to think of these commonly discussed patterns as reversal patterns. It is far more accurate to think of them as continuation patterns that rarely fail, but when they do, the failure can lead to a reversal. It is a mistake to see every top or bottom as a great reversal setup, because if you take all of those countertrend entries, the majority of your trades will be losers and your occasional wins will not be enough to offset your losses. However, if you are selective and look for other evidence that a trend might reverse, these can be effective setups.

All head and shoulders tops and bottoms are really head and shoulders continuation patterns (flags) because they are trading ranges, and like all trading ranges, they are much more likely to break out in the direction of the trend and only rarely reverse the trend. The same is true for double tops and bottoms. For example, if there is a head and shoulders top in a bull market, a breakout below the neckline will usually fail and the market will most likely then reverse up and have a with-trend breakout to the upside, above the right shoulder. The pattern is a triangle, a triple bottom, or a wedge bull flag, and the three pushes down are the down legs after the left shoulder, the head, and the right shoulder. Other bulls see the move down from the head to the neckline as a bull flag, and the rally that forms the right shoulder as the breakout above the bull flag. The sell-off from the right shoulder to the neckline is then either a lower low or higher low pullback from that breakout, and if the market reverses up, the bulls see the reversal as a buy setup.

Since the right shoulder is a lower high, the bears see it as the first pullback in a new bear trend, and therefore the rally to the right shoulder is a bear flag. If the market trades above the right shoulder, the bear flag will have failed, and the market usually rallies for a measured move up based on either the height of the right shoulder or the entire head and shoulders top. Also, if there is a bear market that is forming a trading range and that trading range assumes the shape of a head and shoulders top, a break below the neckline is a with-trend breakout of a bear flag and is likely to lead to lower prices.

Similarly, head and shoulders bottoms are also with-trend setups. A head and shoulders bottom in a bear trend is usually a triangle or a wedge bear flag and should break out to the downside, below the right shoulder. A head and shoulders bottom in a bull market is a bull flag and should break out to the upside, above the neckline. The right shoulder itself is a smaller bull flag, and if the market trades below it, it has failed, and a sell-off usually ensues.

The vast majority of reversals are related to trading ranges. Since trading ranges are flags and usually break out in the direction of the trend, most reversal patterns do not lead to reversals. Therefore, there are no reliable (high probability) reversal patterns. For example, when there is a bull trend, most double tops, triple tops, head and shoulders tops, and triangle tops break to the upside instead of the downside, and are bull flags and do not lead to reversals. Occasionally, one will instead break to the downside and lead to a reversal. When that happens, traders apply one of the reversal pattern names to refer to the trading range; they select the name that best describes the shape of the range. Many upside breakouts of bull flags soon reverse down and then the market breaks to the downside, creating a reversal. When that happens, the bull flag becomes the final flag in the bull trend (discussed in Chapter 7). Most climactic reversals are usually variations of final flag reversals. The opposite is true in bear trends where most reversal patterns are bear flags and lead to bear breakouts. When one instead leads to a bull breakout (whether or not it first breaks to the downside, reverses up, and becomes the final flag in the bear trend), traders then apply the name of the reversal pattern that best describes the shape of the trading range.

When a reversal is gradual, like when it comes from a trading range, the trading range is traditionally called an area of distribution at the end of a bull trend or an area of accumulation at the end of a bear trend. When there is a trading range top, the bulls are said to be distributing their longs, which simply means that they are selling out to take profits. When there is a trading range bottom, the bulls are said to be accumulating their longs, which means that they are buying as they build a long position. Since short selling has become so common, it is logical to refer to the trading range at the top of a bull trend as an area of distribution by the bulls and an area of accumulation for the bears, who are building a short position. Likewise, when there is a trading range bottom in a bear trend, it is an area of accumulation for the bulls and an area of distribution for the bears who are taking profits on their shorts.

Many days that become reversal days on the daily chart are trending trading range days on the 5 minute chart. For example, if there is a bear trending trading range day and later in the day it breaks back into the upper trading range, which is common, and rallies to the top of that upper trading range and closes near the high of the day, the day will be a bull reversal day on the daily chart (discussed more in Chapter 22 of book 1).

Typically, entries in trend pullbacks look bad but are profitable, and entries in reversals look reasonably good but are losers. If you are looking to buy a reversal in a bear trend or sell a top of a bull trend, make sure that it is perfect. Trends constantly form reversals that somehow don’t look quite right. Maybe there is too much overlap with the prior bars or too many dojis, or the reversal bar is too small or pulls back several ticks in the seconds before it closes, or there is no prior break of a significant trend line, or there has been no failed breakout of a trend channel line. These almost perfect reversals sucker you in and trap you, so you should never take a reversal trade unless it is clear and strong. Most of the time, you should wait to buy after there is a higher low in a new bull trend and wait to sell after a lower high in a new bear trend.

Many traders look for countertrend scalps. They become impatient as they wait for a strong reversal that should have at least two legs and they instead take a weak signal. For example, they might buy a bull reversal bar at a swing low in a bear trend. However, if they believe that the trend is still down and they are only looking for a scalp, they need to have a plan to get out if their trade fails. Many traders will allow the market to trigger a low 1 short if they believe that there should be a second leg up. They will hold long and hope for the low 1 short to fail and form a higher low. If the market then does not go up much and instead forms a low 2 short setup, most traders would exit if the low 2 triggers. If the low 2 does not trigger and there is one more small push up, this is a low 3 setup, which is a wedge bear flag. Bulls must exit if it triggers, because it is a strong sell signal in a bear trend. They don’t want a trend to attempt to resume twice, and many will correctly reverse to short as the low 2 or 3 triggers. They needed the higher low to hold if the market was going to turn up and if it is now forming a low 2 or 3 short, they don’t want to risk to below that higher low. Rather than wait for a protective stop below the higher low to be hit, they will exit their long on the low 2 or 3 short entry because they know that the bears will begin to short aggressively there, and many more shorts will come in below that higher low. They know that in about 80 percent of cases, a low 2 or 3 short in a strong bear trend will hit the stops below the higher low, and they want to minimize their losses. This is one of the reasons why low 2 and 3 shorts are so reliable in strong bear trends and high 2 and 3 longs are reliable in strong bull trends. The trapped countertrend scalpers will take their losses there and not look for another countertrend trade for at least a couple more bars. This makes the market one-sided in favor of the trend traders.

There is a rhythm to the market as it forms alternating trends. One trend will often end with a trend channel line overshoot and reversal followed by a two-legged move that breaks the trend line. The two legs then allow for the drawing of a channel for the new trend. Some trends end with simply a trend line break and then a test, followed by a second leg. Again, these two legs form a new trend channel that may be the start of a new trend or simply a flag in the old trend. If the new trend is weak, it will usually just result in a pullback and then a resumption of the old trend. Traders should always be drawing or at least visualizing trend lines and trend channel lines and watching how the market reacts when it tests these lines.

Major reversals from bear markets are often volatile with large bars and several pushes up and down creating one to several sell climaxes. People think that the worst is over but then realize “Oops, I’m too early,” and they are quick to sell out. This can happen several times before the final bottom is in and accounts for why so many major reversals end with large range bars and either a failed flag or a three-push pattern. Climactic reversals with big bars and huge volume are more common at bottoms than at tops. More often, a top comes from a trading range, like a double top or a head and shoulders top, followed by a downside breakout in the form of a strong bear spike. However, tops can be climactic, and bottoms can be trading ranges.

When the market is in a bull trend on the higher time frame charts, the 5 minute chart often has a rally into the close, and the bar of the daily chart has a higher chance of being a bull trend bar. If the market has started to sell off into the closes of recent days, the market might be transitioning into a bear trend or at least into a bigger pullback. Pay attention to what the market does in the final 30 to 60 minutes, because it often is a reflection of the higher time frame trend. That sell-off into the close can be from mutual fund redemptions, from long liquidation by day traders, and obviously from programs, which make up most of the day’s volume. The programs are based on math and if the math is indicating that the market should fall into the close, the market might be in the process of transitioning from a trend into a trading range or even a bear trend. Those low closes create weak bars on the higher time frame charts, and traders will see them as a sign of building selling pressure. This will make them hold off buying until the pullbacks are deeper, and it will encourage bears to short more aggressively. This is not good for the bulls. The opposite is true of a bear trend on the 60 minute or daily charts. Strong rallies into the close of the day on the 5 minute chart often mean that the next rally might be large and that it might be the start of a bull reversal.

Significant tops in the S&P are often presaged by a big down day or two in a bellwether stock like Apple (AAPL). If the market leaders are selling off, the market might be topping. Traders usually take profits on their big winners if they expect a bigger correction in the overall market. In a strong stock market, some stocks tend to rise faster than others. At these times, traders look for “risk-on” trades and invest heavily in these stocks (and currencies, like the Australian dollar, the New Zealand dollar, the Canadian dollar, the Swedish krona). Once they believe that the stock market is going to turn down, they sell their risk-on stocks and buy “risk-off” stocks and currencies, like Johnson & Johnson (JNJ), Altria Group (MO), Procter & Gamble (PG), the U.S. dollar, the Swiss franc, and the Japanese yen. They also invest in risk-off currencies, gold, and Treasury notes and bonds when they are afraid of some international event and want to make sure that their money will be safe and readily available whenever they need it. When a strong bull trend begins to top out, the institutions transition from overweighting to regular weighting of their stocks, and this often causes the market leaders to turn down several days before the overall market. For example, if AAPL is up 40 percent over the past year and the S&P is overbought, and then Apple loses 3 percent in one day, it might be a sign that big traders think that the market might turn down in the coming days. There is a natural tendency to take profits where you have them, and if you have a lot in a major tech stock like Apple and you are expecting the overall market to pull back 5 to 10 percent, you might first take profits in the stocks where the profits are the greatest. If many funds do this in one day, Apple can fall 3 percent at the top. This might be a sign that the funds are ready to start taking profits in their other stocks as well. If they do, the overall market might correct. As the overall market falls, traders get margin calls, and they tend to sell out of the stocks where they have the most profits, which are the market leaders. This can cause the stocks that rose the fastest in the bull trend to fall the fastest in the correction.

The mathematics of reversals is similar to that of breakouts. In general, if the setup is strong, you believe that there is at least a 60 percent chance of a minimum of a two-legged move that will last at least 10 bars. In most cases, your profit target will be two or more times greater than your risk, and that great risk/reward ratio, combined with the high probability of success, makes reversal trades so appealing to traders. The trick is to know when a setup is good, and the problem is that trends are constantly creating reversal setups that are almost good enough, but aren’t quite right. These weak setups constantly trap overly eager reversal traders, and as they are forced out with losses, they add fuel to the growing trend. However, there are many signs that traders can use to identify reliable setups, and these signs of strength are detailed in the next chapter.

Most initial entries have relatively low probability (about 40 to 50 percent) of success. Some traders prefer a higher probability, and they wait for strong follow-through and a clear always-in flip. The trade-off is a smaller reward for a higher chance of success. Both approaches can be mathematically sound, and traders should choose the approach that best suits their personalities. For example, when the average range in the Emini is about 10 to 15 points, the probability of a four-point swing on a reasonably good-looking reversal (one where the context is good and there is a decent signal bar) is often only about 40 percent (it can be 50 to 60 percent when the setup is very strong). However, the chance of a two-point stop being hit before either the profit target is reached or a reversal signal develops, where the trader can exit with a smaller loss or a small profit, is often only about 30 percent. This makes the trader’s equation very favorable for this type of trade. If traders win four points in four out of 10 trades, they have 16 points of profit off of their swing trades. If their other trades consist of maybe three losses of two points or less and three wins of about one to three points, they will end up about breakeven on those trades. This is fairly typical when traders pick appropriate setups. They then have about 16 points of profit on 10 trades, or an average of 1.6 points of profit per trade, which is good for a day trader. Remember, most traders will not take any reversal trade, no matter how minor, unless there is at least a double top or bottom, a micro double top or bottom, or a final flag.

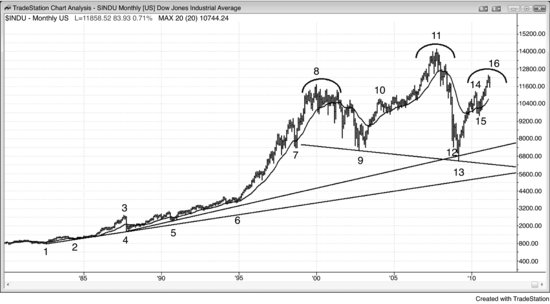

FIGURE PI.1 Dow Jones Industrials Monthly Chart

Most reversal patterns fail at least 80 percent of the time, and the large head and shoulders top on the monthly Dow Jones Industrials chart shown in Figure PI.1 will likely fail as well and become a large wedge bull flag or some other type of bull flag. With the spike down to bar 13 as strong as it was, it will probably get tested by a lower low, where the pattern will probably form a wedge bull flag and be followed by a new high a decade or two later. At the moment, the rally from bar 13 is a rally from the double bottom with bar 9.

Bar 8 is the top of the left shoulder, bar 11 is the head, and the right shoulder is in the process of forming at bar 16, but it may extend higher before the market reverses down, if it reverses down. It might reach a new high and form an expanding triangle top, or it might break out into a new bull leg and then continue up for a measured move based on the height of the trading range. This could be from the bar 9 low to the bar 8 or bar 11 high, or the bar 13 low to the bar 11 high.