13

The Fast Approaching Future: The Markets of Tomorrow Will Soon Be the Markets of Today

The further backward you can look, the farther forward you are likely to see.

—Winston Churchill

Many people will view my attempt to forecast the market over the next twenty years as the height of hubris. After all, most forecasters have dismal shorter-term track records, so why put any faith into what I have to say about the next two decades? If no one can get this year right, how can I expect to know what might transpire over the next twenty years?

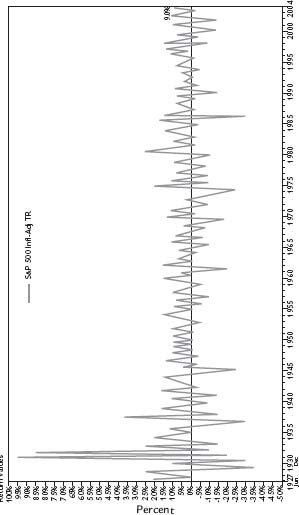

When it comes to predicting the market, I believe most forecasters have their priorities exactly backward. Warren Buffett has said that “in the short run the stock market is a voting machine, but in the long run it’s a weighing machine.” That is exactly why most prognosticators get their forecasts wrong—in the short term, there is too much noise caused by that short-term voting. When you graph real market returns on a rolling twelve-month basis, the results look chaotic: figure 13–1 would scare all but the most risk-seeking investors out of the market. Had you been unlucky enough to invest your money in the market in June of 1931, twelve months later you would have lost an astounding 64 percent of your portfolio! More recently, look at the results of putting your nest egg in the market on September 30, 2000—one year later, you’d have lost nearly 30 percent. Conversely, had you been gutsy enough to invest in the market near the horrifying lows of June 1932, twelve months later your account would have swelled by more than 182 percent!

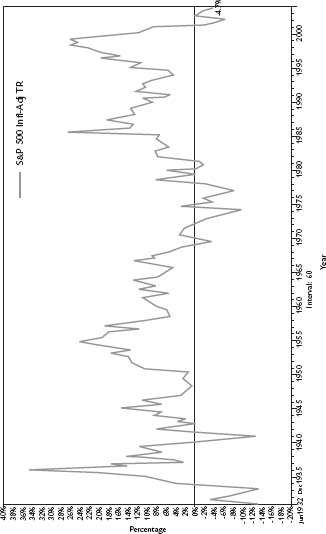

When focusing on the short term, all we see is meaningless, frightening, and mostly trendless volatility. That’s the historical backdrop for all of our fearless short-term forecasters. It’s no surprise that we usually get the short term wrong, since it exhibits the greatest volatility. The ups and downs of the market are crazier still when you shorten your time frame to three months, a typical review period for portfolio managers. Figure 13–2 shows the total real three-month returns for the S&P 500 between 1927 and 2004. There is no signal here, only noise.

The noise quiets down considerably when we extend our time frame. Figure 13–3 shows the rolling real returns for all five-year periods. The story the data tells now becomes much clearer and a narrative begins to emerge that was absolutely lost on a review of the shorter-term numbers. When we extend our time frame even further, to ten-, fifteen-, and the twenty-year periods we’ve been using in this book, the data really begin to paint a much clearer picture of how the market moves from being undervalued to overvalued over time. By focusing on the long term, we see the market moving from a voting machine to a weighing machine. What appears to be scary and volatile in the short term winds up being an excellent choice for most investors over the long term.

FIGURE 13–1 REAL ROLLING 12-MONTH RETURN FOR S&P 500, 1927–2004

FIGURE 13–2 REAL ROLLING 3-MONTH RETURNS FOR S&P 500, 1927–2004

FIGURE 13–3 REAL ROLLING 5-YEAR RETURN FOR S&P 500, 1927–2004

So Close and Yet So Far

The year 1986 feels like yesterday—yet it also feels like a long time ago. Movies like Top Gun and Ferris Bueller’s Day Off don’t seem that old. Most of us remember where we were when we learned of the space shuttle Challenger’s fiery demise or of the news that the Chernobyl nuclear power plant had melted down.

And yet, 1986 also seems like another era altogether. IBM unveiled the first laptop computer, called the PC convertible. The Dow Jones Industrial Average hovered around 1,700. The Tax Reform Act of 1986 lowered the top tax rate from 50 percent to 28 percent and set the capital gains tax at the ordinary tax rate. Equity and bond markets were hardly the popular investments that they are today. For the twenty years ending January 1986, the S&P 500 had bumped along at a real rate of return of just 2.16 percent per year, and the long government bond had actually lost 0.39 percent per year over the previous twenty years.

The oldest baby boomers were turning forty in 1986, their peak spending years still several years off. The mutual fund industry was in its early adolescence—at the start of 1986, total mutual fund equity assets were approximately $117 billion spread across 579 equity mutual funds. Today, that figure is nearly $4.4 trillion spread across more than 4,500 funds! Simply put, although the bull market began in 1982, few investors expected it would last through March of 2000.

Brave New World

Whether it seems near or far, we’ve come a long way since 1986. Who could have predicted all that has happened in twenty years? In 1986 would you have believed me if I told you that the former Soviet Union would have collapsed and disappeared? That the former USSR satellite states including Poland, Estonia, Hungary, and the Czech Republic would be members of the European Union? Could you have imagined that Nelson Mandela, who was in a maximum security prison off the coast of Cape Town in 1986, would have been released and gone on to become the president of South Africa?

Of course, there are also the more frightening developments. Could anyone in 1986 imagine that terrorists would bring down the World Trade Center using our own planes as weapons? Or that the U.S. response would topple the regimes in Afghanistan and Iraq? Or that random bag checks on subways and planes and machine-gun-toting soldiers at major train stations and airports would become commonplace?

Could you have guessed at the mass proliferation of cell phones, wireless e-mail devices, and iPods? In 1986, when fax machines were still a novelty, could you even have imagined everyone with e-mail? Could you have imagined a movie like The Matrix? More important for investors, could anyone in 1986 have believed how ubiquitous the Internet and personal computers would be? eBay, Yahoo!, Amazon, and Google have a current combined market capitalization of nearly $172 billion and none of them were even ideas in 1986! Microsoft, with a current market capitalization of nearly $300 billion, was a privately owned software company issuing its first version of Windows. At its initial public offering in March of 1986, it had a market capitalization of $597 million. All of these events would have been virtually impossible to imagine twenty years ago, yet we take them for granted now and find nothing particularly extraordinary about them.

Investors of the mid-1980s had been trained by a lifetime of experience that stock rallies were quickly followed by declines. They knew from “personal experience” that if you wanted to make money, you invested in real estate, collectibles, or gold. If you were conservative, you simply kept your money in the bank earning interest. The majority of assets in 1986 still resided in banks and money market funds. Most investors simply couldn’t conceive of what was to come—the greatest bull market and the greatest twenty-year returns for long-term government bonds in history.

If an investor in 1986 had access to the information contained in this book and the foresight to focus on decades instead of days, do you think he or she would have acted upon it? We’ve seen that people are much more comfortable reacting to or trying to predict short-term trends, yet in the market the short term is mostly noise. Our day-to-day lives usually blind us to longer-term trends. The million-dollar question we must now address is whether we will actually use this long-term data to assist us in our investment choices, for what it tells us about the next twenty years will be the key to our portfolio’s health in the world of 2026.

The Likely Future

As all the political, social, and economic change that occurred between 1986 and 2006 has shown, it’s virtually impossible to know what the world will look like in 2026. In all likelihood there will be a host of new companies and industries that simply don’t exist today. Quantum computers may replace those we use now. Bioengineering may extend life expectancy to one hundred and beyond. Nanotechnology companies might replace Internet firms as the favorites of stock market speculators.

Along with many uncertainties, there are some trends in place now that can help us make some fairly good educated guesses about other things. The populations of all of the developed economies will be older—according to the Organization for Economic Development (OECD), by 2030 the number of people over age sixty-five across the developed world will have increased by 89 million, whereas the number of working-age adults will have decreased by 34 million. The number of workers supporting each retiree will also decline precipitously, from seven in 1960 to fewer than three by 2026.

If current trends continue, by 2026 India will be the third or fourth largest economy in the world, with China close on its heels. Indeed, China is forecasted to be the second largest economy in the world by the middle of the century. The power base of the economic world has already begun to shift, but by 2026 many of the now nascent trends will be obvious to even the most casual observers. News stories that would seem bizarre to us now will be commonplace in twenty years.

Human Nature Will Not Change

But there are likely to be many constants along the way as well. First and foremost is human nature. As we’ve seen from analyzing nearly two hundred years of data, the rolling twenty-year real rate of return to financial markets ebbs and flows with a remarkable degree of consistency, primarily because human beings are responsible for the economic and stock market cycles. While the types of companies and industries that get us excited has and will continue to change over time, our reactions to them will remain the same—we’ll get unusually excited about the new and overprice it and be blasé about the old and underprice it.

Be it steamboats, railroads, telegraph and telephones, automobiles, motion pictures, radio, TV, aluminum, “space-age” technology, the first computer makers, Internet stocks, nanotechnology, or quantum computers, our human reactions to innovation are sure to persist. Just as in the past, we will more than likely drive their valuations to unsustainable levels. Our basic human nature is probably more responsible for the long-term ebbs and flows in the market than any single economic event or innovation. And since they are unlikely to change, we can infer that they will help us identify what will most likely happen over the next twenty years.

The Hard Facts

First, we must examine what the data tells us is the most likely future for stock and bond investors. Examining over two hundred years of financial data reveals that U.S. markets have a strong tendency to revert to the mean. In other words, in all of the rolling twenty-year periods we can study, the vast majority of twenty-year periods with strong performance were followed by periods offering meager returns. This can be explained from a valuation perspective, since we see that over the twenty-year periods that offered investors outstanding returns, there was a concurrent expansion of the market’s PE ratio and a decline in the dividend yield paid out to investors.

The twenty-year ebb and flow of the market can also be explained by the birthrate cycle and the number of peak spenders present in the economy. No matter what the exact explanation, the odds strongly suggest that we now face a twenty-year cycle of low expected returns. This will wreak havoc with all of our saving assumptions over the next twenty years. In the 691 observations we have for real twenty-year overlapping returns between 1947 and 2004, 98 percent of all returns following strong twenty-year returns were between 0 and 5 percent per year. Pretending these odds don’t matter and will not affect our investment results over the next twenty years is a foolish and potentially very costly assumption.

The Boomer Demographic Descends

To all of this, add the sobering fact that for the first time in history, 78 million Americans are approaching the traditional retirement age of sixty-five. If the government is unwilling or unable to offer solutions, this huge cohort of Americans will be like a tsunami crashing upon our fiscal shores. By 2018, Social Security payroll taxes will no longer cover payouts, and the government will be forced to begin drawing on the Social Security Trust Fund’s surplus. Worse, Medicare and Medicaid face looming shortfalls—Medicare alone will be saddled with deficits seven times larger than Social Security. According to the June 1, 2005, Budget and Tax News published by the Heartland Institute, the combined deficits of Social Security and Medicare will soar through the 2025–2030 period. According to the report, “Without changes in worker payroll tax rates or senior citizen benefits, the shortfall in Social Security and Medicare revenues compared to promised benefits will top more than $2 trillion in 2030…[T]hese estimates, which come from the latest Social Security Trustees report, do not include the growing burden of senior health care costs under Medicaid.” Note that these are nominal numbers, but even after inflation, they still top $1 trillion in real dollars. Finally, the report notes, “It shows that combined Social Security and Medicare deficits will equal more than 28 percent of federal income taxes by 2020. Roughly, this means that in just 15 years, if the federal government is to keep its promises to seniors, it will have to stop doing more than one-fourth of everything it does today. Alternatively, it will have to raise income taxes by one-fourth or borrow an equivalent sum of money.”

The stock market is coming off one of the highest relative PE ratio and lowest relative dividend yield environments in fifty years. Seventy-eight million baby boomers are marching inexorably toward retirement and the Social Security, Medicare, and Medicaid promises that our government will have a difficult time honoring. Marry this to two hundred years of mean reversion, and the picture becomes difficult to ignore. This doesn’t mean that we should hide all of our money under the mattress. On the contrary, the evidence shows us that certain types of equities will likely be among the best performing asset classes over the next twenty years, but we must be very particular about what we invest in.

I believe that these conditions also reinforce the ascendancy of those asset classes for which we have the highest forecasts, that is, higher dividend yield stocks. When baby boomers realize that they must be more responsible for their own retirement incomes, it is easy to see them flocking to higher dividend stocks as a way to improve their portfolios’ returns. Investor demand pushes prices higher, which would make the forecasted returns for large-cap value stocks with higher dividend yields consistent with our forecasts. But the story is not enough—without the long-term data showing the cyclic nature of twenty-year returns, these too would be nothing but stories. But married to the data, they begin to explain why the market might indeed favor small-cap stocks and large stocks with high dividend yields in the coming two decades.

What Might Go Wrong

While our twenty-year forecast is well supported by historical fact and current valuation and demographic conditions, I can almost guarantee that at some point over the next twenty years it will appear to be exactly wrong. Time and again, history has shown how willing investors are to completely ignore the facts in the face of short-term emotions and stories. It may be a brand-new technology or industry or the reemergence of an existing industry, but it will happen again. When it does, large-cap growth stocks will soar in the short term, perhaps to the detriment of small-cap stocks and large-cap value names. The press, no doubt, will issue breathless stories about why it is “different this time,” and why the current hot companies are not subject to the same laws of economics that have asserted themselves throughout history. And since we humans habitually overweight the short term, it will be extremely tempting to use that short-term performance to dismiss the longer-term forecasts presented in this book.

Sadly, this behavior is also consistent with our long-term forecasts, which require that investors’ irrationality will continue to persist. If it didn’t, something fundamental about human nature would have to change. If people stopped behaving irrationally, if hope stopped trumping experience, if emotion and fact sat equal on the scale, markets would cease their mean-reverting ways and become rational. In purely rational markets, fads would disappear and investors would price securities consistent with their true value, relegating irrational exuberance, outsized despondence—and twenty-year cycles—to the dustbin of history. Lucky for us, the chances of that happening any time soon are remote.

The Markets of Tomorrow

It could turn out that the next twenty years will be the first and only time that markets fail to revert to their mean. There is an infinitesimal chance that large-cap growth stocks could outperform small-cap and large-cap value stocks. But the odds of that happening are decidedly small. Even if it were to transpire, how bad could our recommended allocation do versus other investing options?

One of the great things about my recommended allocations is that they offer exposure to all styles and capitalization categories. The majority of the allocation is to large-cap value names, which typically have higher dividend yields and lower risks. Even if large-growth stocks go on to dominate, we’d still have a portfolio allocation favored by the odds and supported by all of the historical fundamental facts that suggest that paying the moon for a security leads to poor performance. And because we are explicitly rejecting the idea that you can time styles and markets, we will also have an allocation to whatever style or capitalization happens to be performing well.

Blink and It’s 2026

Another very human characteristic is that time seems to move more quickly as we age. My son will be twenty-one when this book is published, but his first steps don’t seem that long ago. The same is true for his younger sisters, who are now lovely young women, not the babies I so vividly remember. Time will pass differently for all of us, but the future will be here for us all sooner than we can imagine. What that future will be is up to us today.

Throwing our hands in the air and deciding that the future is unknowable may sound like an easy way out. But I am quite sure that sticking with the status quo and leaving your portfolio invested in large-cap core and growth stocks will leave you profoundly disappointed twenty years from now. Doing nothing is making a choice; it’s just a bad one. Fanciful thinking will not make our futures happy and secure, nor will it ameliorate the hopes for what you will have to provide for your retirement. It may ease your anxieties today, but it will profoundly increase your anxieties tomorrow. Unless you save and invest your money today, being very careful as to what types of stocks and bonds you invest in, your investment future may be perilous.

If you decide to put the advice from this book into practice, you will at least be putting the odds on your side in what is sure to be a challenging market environment. Remember to rebalance your portfolio at least annually, ignore the day-to-day movements in the market, and keep your eye on the long-term ball. If you can do that, you’ll be well ahead of the majority who failed to act. Act now, and the markets of tomorrow might be able to fulfill your dreams.