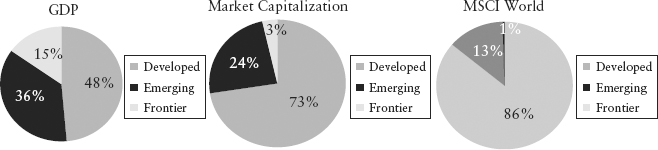

FIGURE 8.1 Frontier Market Representation Globally

Source: IMF, Bloomberg, MSCI.

The frontier markets classification includes some of the fastest growing, most populated, and least integrated economies in the world and, importantly, some of the most undervalued equity markets.

Recent economic development and implementation of investor-friendly policies in many of these countries has helped to begin integrating them into the global economy and has led to increased depth and liquidity in their stock markets.

However, frontier markets continue to be under-researched and are structurally underweighted by institutional investors, making these markets inefficient and undervalued. This offers astute active investors the opportunity to earn attractive, less-correlated returns.

In this chapter, we outline the key drivers of the frontier markets opportunity set and argue that combining a top-down and bottom-up approach to identifying and capturing key investment themes in frontier markets can produce attractive, low-correlation investment returns.

Frontier markets represent a large opportunity virtually ignored by the global investment community. In 2010, frontier markets accounted for 15 percent of global GDP (PPP-adjusted) but represented some 3 percent of current global market capitalization and less than 1 percent of the MSCI All Country World Index (see Figure 8.1).

Frontier markets combine a very attractive set of development factors that justify further analyses and consideration.

These advantages of frontier markets provide a compelling long-term investment opportunity set. In order to capture these opportunities, Everest Capital uses a top-down approach to identify attractive investment themes within our expanded frontier markets universe. We then employ fundamental, bottom-up, on-the-ground research and take advantage of inefficiencies in local company and market information to best express these themes.

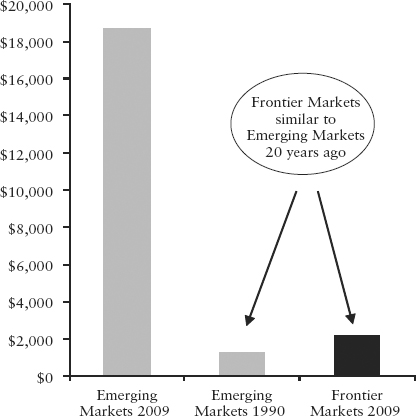

The term frontier markets was coined in 1992 by the World Bank’s International Finance Corporation (IFC) to describe the smaller, less liquid, “emerging” emerging markets. In the ensuing 19 years, these economies have become among the fastest growing in the world. The path of development of current mainstream emerging markets1 over the past two decades provides a road map for today’s frontier markets to become the next emerging growth story.

In the late twentieth century, emerging markets experienced a decade of reforms during which policy makers abandoned fixed exchange rates, adopted inflation targeting, increased foreign exchange reserves, and dramatically reduced external debt. Nearly the entire stock of Brady bonds2 were retired by 2006, and many emerging markets today are net creditors.

The share of global GDP of all emerging markets, on a purchasing power parity (PPP) adjusted basis, increased from 40 percent in 2000 to 51 percent in 2010. Emerging markets’ share of global trade increased sharply as well, from 43 to 55 percent, highlighting their integration into the global marketplace. The emerging markets consumer class has grown in step with GDP and trade, currently accounting for 44 percent of global household consumption compared to 26 percent for the United States.3

Indeed, as argued in our white paper, “The End of Emerging Markets?,”4 emerging markets have emerged. The long-held assumption that mainstream emerging markets are different than developed markets no longer holds: The fundamental distinctions between the sizes of their economies and financial markets, as well as corporate governance and government policies, have blurred. We concluded that the world will increasingly be shaped by the rapid growth of these economies, providing the impetus for greater investor allocations to emerging markets.

Several markets that were frontier in the 1990s, such as India, South Africa, and Russia, are now mainstream emerging markets.5 We believe that today’s frontier markets are poised to follow a growth and development trajectory similar to that which these and other former frontier markets experienced over the past 20 years. Indeed, with access to technology and information, today’s frontier markets will likely emerge even faster than did their predecessors.

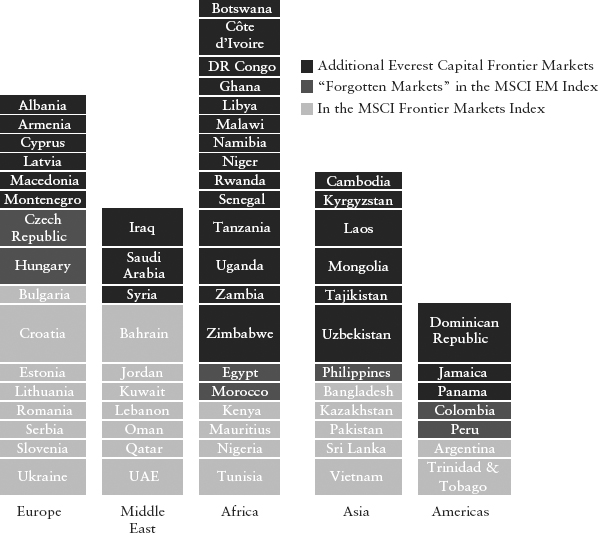

Traditional frontier markets indexes, typically comprising only 25 to 35 countries, do not capture the full frontier markets investable universe. At Everest Capital, we have what we believe is a better definition of the frontier markets universe that currently includes 65 countries (see Figure 8.2). In addition to the 26 members of the MSCI Frontier Markets Index, we incorporate in our universe the smallest, often ignored members of the MSCI Emerging Markets Index (the seven “forgotten” emerging markets that each constitutes less than 1 percent of the index, such as the Philippines and Colombia). We found that these latter countries, although considered emerging by MSCI, have more similarities with frontier markets than with traditional emerging markets. We also include 32 other markets that are typically not included in passive frontier market indexes, but which fit the definition of a frontier market and to which we have access (such as Iraq and Rwanda).

FIGURE 8.2 Everest Capital’s Expanded Frontier Market Universe

Everest Capital has been an active global investor over the past 21 years and has experienced the realignment of the global economy firsthand, investing through numerous market cycles across the spectrum of frontier, emerging, and developed markets. Since 1990, Everest Capital has invested in 95 countries, including 65 emerging and frontier markets. This unique perspective and experience reinforces our belief that many of the attributes of mainstream emerging markets seen over the past 20 years will recur in the smaller and faster-growing frontier markets of today.

While we continue to believe that mainstream emerging markets are an excellent place to invest for growth relative to developed markets, frontier markets can serve as an attractive addition to an existing emerging markets allocation. Figure 8.2 shows the expanded universe of frontier markets.

Developed markets were the first to achieve economic prosperity, followed by the mainstream emerging markets of today. By our count, these classifications account for less than one quarter of the world’s 184 countries for which the IMF keeps statistics. But many of the remaining countries have the same prospects for economic development as today’s mainstream emerging markets had when they were in a similarly underdeveloped economic state two decades ago.

From a top-down perspective, we believe that many of the 65 countries in our frontier markets universe are poised to benefit from:

Frontier markets as a whole are experiencing significantly faster economic growth than developed and mainstream emerging markets. Indeed, 39 of the 45 fastest growing economies in the world over the next five years, according to the IMF, fall within our frontier markets universe.

Of the remaining six, none is a developed market. Thirty nine of the 45 fastest growing economies through 2015 are frontier markets (see Figure 8.3).

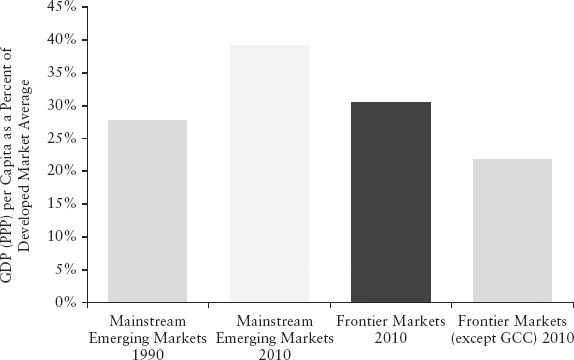

In 1990, although having comparatively insignificant purchasing power in the world, China had one of the world’s highest projected growth rates. By 2010, China had a per capita GDP (PPP) of $7,519, an increase of over 840 percent from two decades earlier.6 Over this same period, the mainstream emerging markets average per capita GDP rose to 39 percent of the developed markets average from 28 percent, similar to frontier markets’ current 30 percent of the developed markets average. Excluding the richer GCC (Gulf Cooperation Council) countries,7 frontier markets are at only 22 percent of the developed markets average (see Figure 8.4).

FIGURE 8.4 Economic Growth Produces Wealth over Time

Source: World Bank data; GCC includes Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates; author’s analyses.

In the past 20 years, China and India combined have increased their share of world GDP (PPP) 160 percent, from 7.5 to 19.5 percent.8 Other countries that emerged along with India and China over the past 20 years had differing competitive advantages in the global economy (e.g., ample natural resources) but the same end result: economic growth and greater accumulation of wealth over time.

Today’s frontier markets have the advantage of mimicking the development path of mainstream emerging markets where, when certain factors are aligned, the shift from an economically insignificant economy to a significant global market participant happened quite rapidly. From our on-the-ground experience, we know that countries like Bangladesh, Vietnam, and many in Eastern Europe are looking to the lessons learned from their successful neighbors India, China, and Western Europe, respectively.

Demographics play a large part in the potential economic success of a country. Not only do large and youthful countries have an economically attractive labor base for foreign investment, but youthful populations grow into consumers in subsequent years.

Today’s frontier markets have large, young populations, providing a demographic dividend in the coming years that we expect will promote increased foreign investment, employment, and consumption, which all lead to higher relative economic growth rates. Of the 20 most populous nations in the world today, 9 are frontier markets and only 3 are developed markets.

Today 9 of the 20 largest populations are frontier markets (see Figure 8.5).

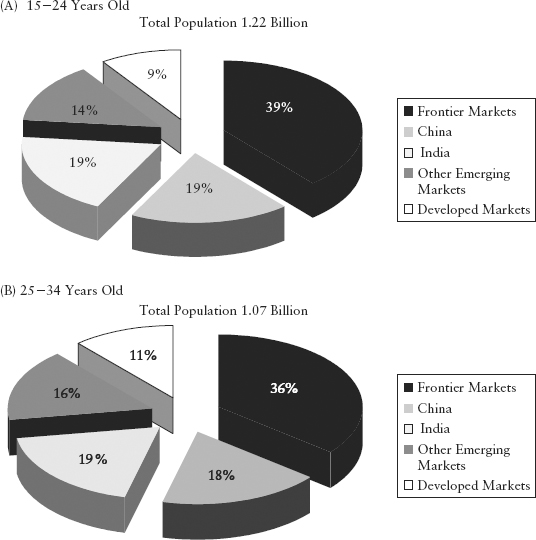

In 2010, frontier markets accounted for 39 percent of the world’s 15- to 24-year-olds and 36 percent of the world’s 25- to 34-year-olds, making frontier market populations as large in these age groups as China and India combined.

Large portions of the world’s young people are in frontier markets (see Figure 8.6).

FIGURE 8.6 Young Population in 2010

Source: United Nations, World Population prospects, 2010, author’s analyses.

Today’s large, youthful populations in frontier markets are positioned to become tomorrow’s producers and consumers, driving economic growth higher than in the aging developed markets for years to come.

Shrinking current account deficits, lower overall external debt, and growing foreign direct investment all contribute to the increasing stability and growth of frontier economies.

Frontier markets on average have shrinking current account deficits, projected by 2015 to nearly match G7 current account deficits, which are growing larger as a percent of GDP.

Current account deficits are shrinking in frontier markets, growing in G7 (see Figure 8.7).

The macroeconomic foundations of frontier economies as a whole are not tainted with the large debt levels of developed economies. Developed markets have the largest per capita external debt levels in the world, at an average of 73 percent of GDP, versus frontier markets’ average of 44 percent (see Figure 8.8).

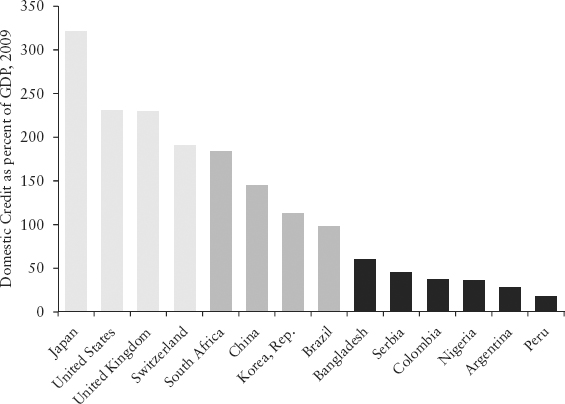

Further, low domestic credit penetration signals tremendous potential for consumption growth in the years ahead (see Figure 8.9).

FIGURE 8.9 Domestic Credit Provided by the Banking Sector, as Percent of GDP

Source: The World Bank, author’s analyses.

The low levels of debt and concomitant interest expense of frontier markets create greater domestic economic stability. These cleaner balance sheets also attract greater foreign investment. While historically underdeveloped, frontier markets have begun attracting foreign direct investment (FDI) at levels similar to those of emerging markets about 20 years ago. Over the ensuing two decades, FDI into mainstream emerging markets increased more than 13 times (see Figure 8.10), as foreign investors sought to capture the growth opportunities in these markets.

FIGURE 8.10 Foreign Direct Investment, Net Inflows (million current US$)

Source: World Bank, author’s analyses.

While the demographic and other macroeconomic advantages of frontier markets will lead to economic growth, the integration of these economies into a globalized world will be a crucial factor in attracting foreign investors. Frontier economies are able to integrate into the global economy more rapidly than did today’s emerging markets due to the availability of increasingly powerful technology, access to education at home and abroad, and transfers of knowledge and capital by expatriates.

Technology adoption by an economy has several benefits. It gives people a means for accessing local and world events, accelerating the rate at which local citizens become global citizens. It provides a solid communication network that can be a strong selling point to FDI providers. And communication infrastructures, comprised primarily of mobile phone and Internet technology, offer frontier market producers and consumers an accelerated entrée into the global marketplace.

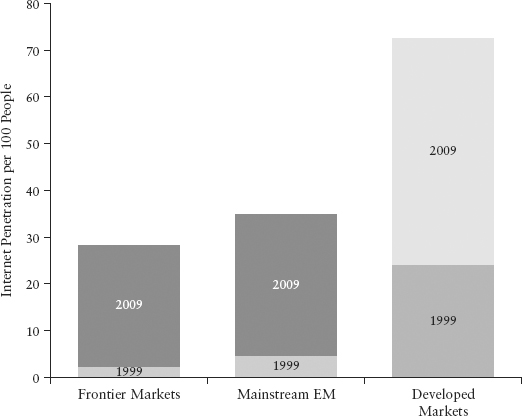

Frontier markets today have technology penetration rates similar to those of mainstream emerging markets. As Internet, mobile phone, and computer technologies become more cost efficient, they become more accessible to poorer countries. This phenomenon is enabling today’s frontier market economies to progress at a much faster pace than in the past. As a result, frontier markets have Internet penetration rates similar to developed markets in 1999, which tripled over the following decade (see Figure 8.11).

FIGURE 8.11 Internet Penetration of Frontier Markets Is Only Years behind Developed Markets

Source: World Bank data, author’s analyses.

We expect a similar or faster trend in frontier markets in the coming decade.

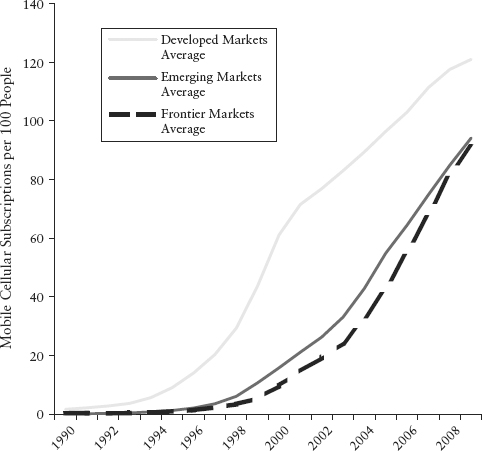

Since most frontier and many emerging markets did not have the wealth to participate in the land-line telecom build-outs of the twentieth century, they were able to skip a generation of technology and implement the more efficient cellular technology that is available today at a relatively low cost. As a result, when traveling through several frontier markets in the past few years, we have noticed that the locals rely completely on their cellular phones for personal and business communication. Most are also able to run e-mail and connect to the Internet via their low cost cellular devices. Indeed, frontier markets on average have mobile phone penetration rates nearly as high as mainstream emerging markets, and both are catching up to developed markets (see Figure 8.12).

FIGURE 8.12 Frontier Markets Mobile Penetration Nearly Equals Mainstream Emerging Markets

Source: World Bank data, 2010, author’s analyses.

Instead of building on legacy technologies, frontier markets are able to skip generations and use today’s most efficient technologies, which were underwritten by decades of research and development by developed economies. This has enabled frontier markets to close the mobile phone penetration gap with developed economies and create a robust communication infrastructure to support their future growth.

Education helps countries integrate their populations into the globalized world, sustain growth and development over the long term, and stay competitive and innovative in the global marketplace. Higher educational attainment not only helps to attract foreign investment but is also a catalyst for domestic technological innovation and creation of new industries and businesses.

Increasing literacy rates is a crucial first step in achieving higher educational development. Frontier markets are experiencing increases in primary education enrollments, which in turn promote higher literacy rates.

As students increase their educational attainment, many look to continue their education at overseas institutions that are often in developed markets. Economic and business management skills, among others, are learned by frontier markets students in developed nations and are then brought back to their native countries.

This trend can have two positive effects. First, students often bring back the skills learned overseas to their native country where they will start businesses of their own. These future leaders add significant value as they create local jobs and provide accelerated development to their home economies.

Second, if a student secures a job and earns a living in a developed country, remittances back to his or her native country can become a source of capital into the local economy.

In addition to their top-down advantages, frontier markets have advantages that make them attractive from a bottom-up perspective as well. Current market valuations and fundamentals are compelling: Many publicly listed companies in frontier markets are considerably undervalued given their strong balance sheets and economic growth potential.

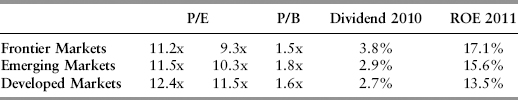

Looking at current valuation metrics, frontier markets are undervalued relative to developed and emerging markets on a price-to-earnings (P/E), price-to-book (P/B) and dividend yield basis, despite higher returns on equity (see Table 8.1).

TABLE 8.1 Financial Returns by Markets 2010 and 2011

Source: Bloomberg, based on MSCI Frontier Index, MC+SCI EM Index and MSCI World, author’s analyses.

Holding these ratios constant, prices will rise as earnings and book values grow. Over time, we expect these ratios to expand as well, further boosting prices.

Despite frontier markets’ large share of global GDP, strong top-down economic foundations, and attractive fundamentals, their equities are under-owned by institutional investors (who are still overweight developed markets) and under-followed by the equity analyst community. We estimate that fewer than 20 percent of the over 2,500 listed equities in Everest Capital’s frontier markets universe are covered by global sell-side investment research firms, leaving those investors without on-the-ground research capabilities at a distinct disadvantage.

The market capitalization-to-GDP ratio quantifies the size of a market in relation to the size of its economic activity. As economic output increases, so does market size and liquidity. In countries like Brazil and India, for example, market capitalization-to-GDP ratios increased from about 10 percent in 1989 to over 70 percent by 2009. Today, many frontier markets’ market capitalization-to-GDP ratios are at low starting points similar to those of mainstream emerging markets two decades ago.

Many frontier markets are at the same market capitalization to GDP starting points as mainstream emerging markets two decades ago (see Figure 8.13).

As these economies grow, their market capitalizations as a percent of GDP should expand, producing a multiplier effect on their equity markets.

Notwithstanding their attractiveness, fund flows into frontier markets are a small fraction of mainstream emerging markets flows, albeit growing substantially on a percentage basis.

Frontier market flows are dwarfed by emerging markets flows (see Figure 8.14).

The benefit of portfolio diversification (i.e., the reduction of risk) is often considered the only free lunch in the investment world. However, risk is reduced only to the extent diversified portfolio assets are not correlated to each other. Investing in two assets with a correlation of 1.0 provides no diversification benefit.

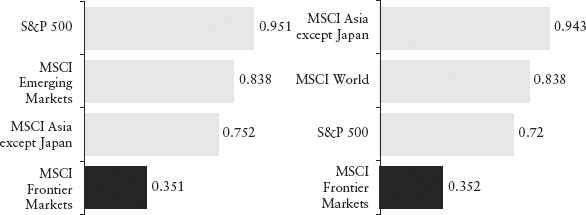

Because they have low correlation to developed and emerging markets as well as to each other, frontier markets can provide significant diversification benefits to a portfolio. In contrast, the mainstream emerging markets have significantly higher correlation to each other.

Frontier markets are less correlated to developed and emerging markets (see Figure 8.15).

FIGURE 8.15 Market Index Correlations

Source: Bloomberg, correlations of weekly returns June 2002–April 2011, author’s analyses.

Individual frontier markets are less correlated to each other (0.16 on average) than are individual emerging markets (see Figure 8.16).

FIGURE 8.16 Country Market Correlations

Source: Bloomberg, correlations of weekly returns June 2002–April 2011, author’s analyses.

Investing in frontier markets is not without risks. We address five of the more commonly cited risks here.

With a few exceptions, frontier markets are less liquid than developed or mainstream emerging markets. Illiquidity risks can range from negative price impacts on trades of size on single securities, to complete market shutdowns, as was the case during the Egyptian uprising in early 2011. These risks cannot be hedged but can be mitigated through country and company diversification. At Everest Capital, we typically invest in 25 to 30 frontier markets at any given time. Frontier market volumes, and thus liquidity, are generally increasing.

Maintaining low inflation levels during periods of high growth can be difficult. While inflation in frontier markets has been more moderate recently, inflation will need to be analyzed and monitored carefully on a country by country basis.

Inflation in frontier markets is moderate now (see Figure 8.17).

As frontier markets endeavor to integrate themselves into the global economy, the political environment is improving. However, while the majority of frontier markets are generally facing a positive trend of advancement, political crises can and do erupt. In many cases the negative pressures may be pure noise and rather short-lived; in other cases, the political risk is much greater and value destroying (e.g., Egypt, Ivory Coast, and Zimbabwe). Many of these markets have a non-democratic form of government, so an investor does bear the risk of unfavorable government action toward its investment. These political events can have a damaging impact on the equities of the affected country and, by association, its neighbors.

From a portfolio construction standpoint, one of the greatest attributes of frontier markets is the low correlations that these markets have to each other. This highlights the importance of being global rather than regional as well as being invested in more countries rather than fewer. The best portfolio hedge against political risk is country diversification.

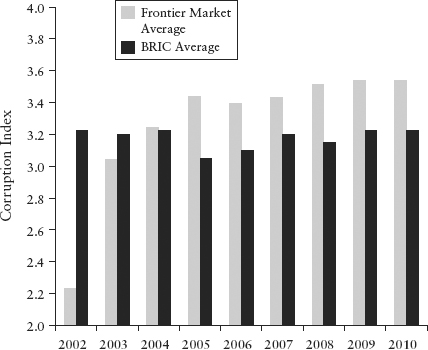

To many, frontier markets represent the Wild West of investing. However, frontier markets on average are perceived to be less corrupt than today’s BRIC markets (see Figure 8.18) and have garnered improving investor protection ratings that nearly match BRIC levels (see Figure 8.19).

FIGURE 8.18 Corruption Perception Index (0 = most corrupt, 10 = least corrupt)

Source: Transparency International, author’s analyses.

As growth in developed markets slows, global investors are allocating more capital to emerging markets in an effort to capture their larger relative growth opportunities. If concerns of corruption or lack of investor protection are not a fundamental deterrent to investing in today’s most popular emerging markets (i.e., the BRICs), they should pose no greater deterrent to investing in a diversified portfolio of frontier markets.

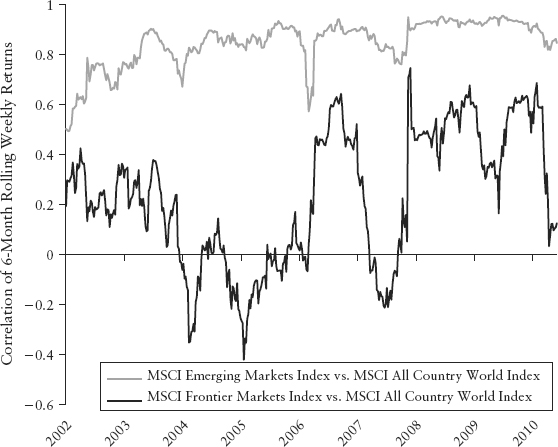

Although they do offer a significant diversification opportunity, frontier markets—like all other markets—are not immune to increased correlation with other markets during global systemic risk shocks. Global economic and financial integration can provide growth and development opportunities for frontier markets, but integration can also mean the economic problems of one economy or region becomes a problem for others.

Although the MSCI Frontier Markets Index has shown lower correlation than other indexes to developed and emerging markets since its inception in 2002, there was a sharp increase in correlations during the 2008–2009 financial crisis (see Figure 8.20).

FIGURE 8.20 Market Correlations Increase during Times of Stress

Source: Bloomberg, author’s analyses.

However, Everest Capital’s frontier markets universe is more diversified than the MSCI Frontier Markets Index, and adding these countries to an investor’s portfolio may result in even lower volatility.

The advantages of frontier markets—faster growth; young, growing populations; strong macroeconomic foundations; accelerated integration with the global economy; and attractive market fundamentals—provide a compelling long-term investment opportunity. Our experience with investing in the now-mainstream emerging markets over the past two decades has taught us that investing in today’s less developed economies, with similar growth potential and mispriced assets, may be rewarding over the long term.

We believe an allocation to frontier markets can serve as an attractive, complementary investment opportunity to an existing global or emerging markets portfolio, and that a top-down thematic and bottom-up fundamental investing approach applied to an intelligently expanded frontier markets universe is the best framework for taking advantage of this compelling growth story, which is still in its early stages.

1. Defined as those countries representing 1 percent or more of the MSCI Emerging Market Index.

2. US dollar-denominated bonds, named after US Treasury Secretary Nicholas Brady, issued in the 1980s to replace defaulted bank loans to emerging market sovereign borrowers.

3. World Bank data (2009).

4. November 2009.

5. These countries entered the MSCI Emerging Markets Index in 1994, 1995, and 1997, respectively.

6. World Bank data.

7. Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the United Arab Emirates.

8. IMF data.