An informative way to understand and examine a cash-flow analysis is to follow a particular example. Once the logic and calculation methods are understood, you then can substitute your own estimate costs relative to the type of alternative energy system under consideration and determine your own economic analysis.

9.1.1. Solar Domestic Hot Water System

Suppose you purchase the solar DHW system proposed in

Chapter 7,

Section 7.6, in the amount of $10,891 before tax credits. The actual system costs were as follows:

SolarDHWsystemcost=+$10,891.00Federaltaxcredit(30%)=−$3267.30¯Actualsystemcostafterfed.taxcredit=$7,623.70Statetaxcredit(i.e.,billings,MT)¯=−$1000.00¯Finalsystemcostaftertaxcredits=$6,623.70

Assume you have enough cash to pay the difference of $4267.30, which is the combined dollar amount of the federal ($3267.30) and state ($1000) tax credits allowed, so that at the end of the tax year, you are borrowing only the cost of the system, after tax credits, in the amount of $6623.70. From that previously proposed example, the output from the solar energy system provides 14.19 million British thermal units (MBTUs) per year. Per the example of

Chapter 7, Section

7.5, we are heating water with electricity at $0.16/kWh at a cost of $665.22 for the first year.

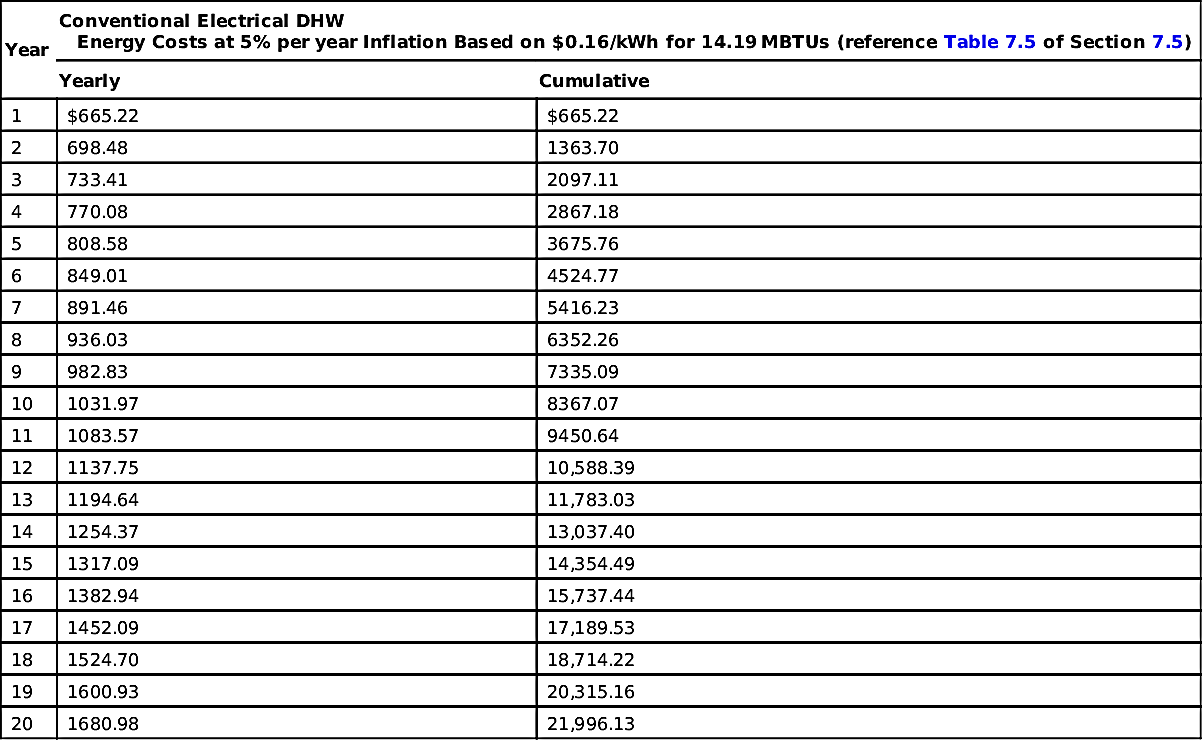

Table 9.1 illustrates the electrical energy cost with a 5% energy inflation factor. The cash needed to purchase 14.19

MBTUs of electricity at $0.16/kWh over a 10-year period, based on 5% energy inflation was calculated to be $8367.07. Average monthly payments for that amount of energy would be approximately $69.73 [$8367.07 (over 10 years)/120

=

$69.73].

Assume you borrow $6623.70 (

P) to pay for the remaining portion of the system after receiving your tax rebates, and assume a bank loan for the system is obtained at 3.5% interest (

i) compounded annually for a 10-year (

n) term. The

series of loan repayments for each year can be found using

Chapter 6, Eqn

(6.5) and the applicable capital recovery factor (CRF), obtained from

Table 6.1 under the applicable interest rate, as follows:

Where

R = repayment made at the end of each year,

P = $6623.70 (present sum),

R = ($6623.70) × (0.12024) = $796.43 (annual payments for 10 years).

Table 9.1

Example of Energy Costs and Savings Realized (System Output of 14.19 MBTUs at $0.16/kWh)

| Year | Conventional Electrical DHW

Energy Costs at 5% per year Inflation Based on $0.16/kWh for 14.19 MBTUs (reference Table 7.5 of Section 7.5) |

| Yearly | Cumulative |

| 1 | $665.22 | $665.22 |

| 2 | 698.48 | 1363.70 |

| 3 | 733.41 | 2097.11 |

| 4 | 770.08 | 2867.18 |

| 5 | 808.58 | 3675.76 |

| 6 | 849.01 | 4524.77 |

| 7 | 891.46 | 5416.23 |

| 8 | 936.03 | 6352.26 |

| 9 | 982.83 | 7335.09 |

| 10 | 1031.97 | 8367.07 |

| 11 | 1083.57 | 9450.64 |

| 12 | 1137.75 | 10,588.39 |

| 13 | 1194.64 | 11,783.03 |

| 14 | 1254.37 | 13,037.40 |

| 15 | 1317.09 | 14,354.49 |

| 16 | 1382.94 | 15,737.44 |

| 17 | 1452.09 | 17,189.53 |

| 18 | 1524.70 | 18,714.22 |

| 19 | 1600.93 | 20,315.16 |

| 20 | 1680.98 | 21,996.13 |

The series of payments (

R) means that you would pay monthly installments of

$66.37 during the 10-year period to repay the loan.

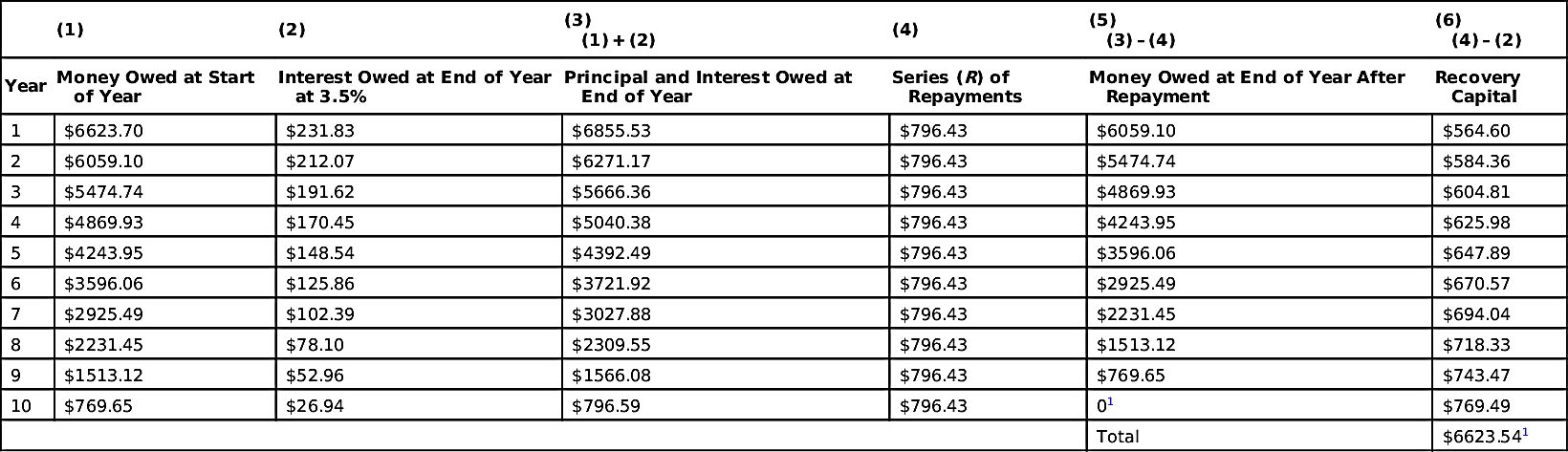

Table 9.2 shows that the amount of money borrowed at the start of the year (column 1) has interest due at the end of the year (column 2), and the payment at the end of the period (column 4) repays this interest plus some of the principal (column 6). For example, the unpaid principal at the beginning of year 3 is $5474.74, the interest owed that year at 3.5% is $191.62, and the payment at the end of the year of $796.43, consists of $191.62 in interest and $604.81 in principal.

Table 9.2

Visualizing the Capital Recovery Factor

| (1) | (2) | (3)

(1) + (2) | (4) | (5)

(3) – (4) | (6)

(4) – (2) |

| Year | Money Owed at Start of Year | Interest Owed at End of Year at 3.5% | Principal and Interest Owed at End of Year | Series (R) of Repayments | Money Owed at End of Year After Repayment | Recovery Capital |

| 1 | $6623.70 | $231.83 | $6855.53 | $796.43 | $6059.10 | $564.60 |

| 2 | $6059.10 | $212.07 | $6271.17 | $796.43 | $5474.74 | $584.36 |

| 3 | $5474.74 | $191.62 | $5666.36 | $796.43 | $4869.93 | $604.81 |

| 4 | $4869.93 | $170.45 | $5040.38 | $796.43 | $4243.95 | $625.98 |

| 5 | $4243.95 | $148.54 | $4392.49 | $796.43 | $3596.06 | $647.89 |

| 6 | $3596.06 | $125.86 | $3721.92 | $796.43 | $2925.49 | $670.57 |

| 7 | $2925.49 | $102.39 | $3027.88 | $796.43 | $2231.45 | $694.04 |

| 8 | $2231.45 | $78.10 | $2309.55 | $796.43 | $1513.12 | $718.33 |

| 9 | $1513.12 | $52.96 | $1566.08 | $796.43 | $769.65 | $743.47 |

| 10 | $769.65 | $26.94 | $796.59 | $796.43 | 01 | $769.49 |

| Total | $6623.541 |

1 Actual value calculates to $0.16 due to rounding to the nearest cent.

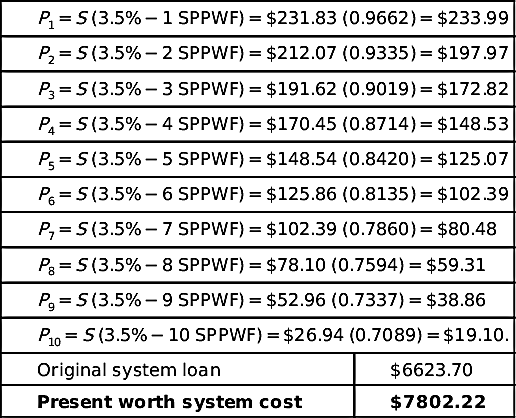

The actual cost of the solar DHW system in terms of present worth money at 3.5% compounded annually is the sum of the initial amount of money borrowed plus the present worth of the interest due at the end of each repayment period. In this case, using

Chapter 6, Eqn

(6.4) and

Table 6.1, you can determine the actual cost of the system at 3.5% over a period of 10 years, as follows:

Where

P = present worth of interest due,

S =

amount of the interest due

=

$231.83 (year 1) (column 2,

Table 9.2),

SPPWF = single payment present worth factor,

(i − n SPPWF) = (0.035 − n SPPWF), resulting in the following tabulation:

P1 = S (3.5% − 1 SPPWF) = $231.83 (0.9662) = $233.99 |

P2 = S (3.5% − 2 SPPWF) = $212.07 (0.9335) = $197.97 |

P3 = S (3.5% − 3 SPPWF) = $191.62 (0.9019) = $172.82 |

P4 = S (3.5% − 4 SPPWF) = $170.45 (0.8714) = $148.53 |

P5 = S (3.5% − 5 SPPWF) = $148.54 (0.8420) = $125.07 |

P6 = S (3.5% − 6 SPPWF) = $125.86 (0.8135) = $102.39 |

P7 = S (3.5% − 7 SPPWF) = $102.39 (0.7860) = $80.48 |

P8 = S (3.5% − 8 SPPWF) = $78.10 (0.7594) = $59.31 |

P9 = S (3.5% − 9 SPPWF) = $52.96 (0.7337) = $38.86 |

P10 = S (3.5% − 10 SPPWF) = $26.94 (0.7089) = $19.10. |

Original system loan | $6623.70 |

Present worth system cost | $7802.22 |

In a loan repayment scenario of $6623.70 at 3.5% compounded interest with end-of-period repayments, the present worth of money actually invested, taking into account the present worth of the interest paid each year, would be $7802.22. The additional $1178.52 for the cost of the system (i.e., $7802.22 − $6623.70) essentially would be paid for by the cost savings of the energy produced. In approximately 9.5 years, the solar DHW system would begin to accumulate savings and decrease your monthly energy costs to heat water. In addition, during the 10-year loan period, the amount of money you pay for the energy produced would remain the same because the sun’s energy is not affected by energy inflation costs, fuel availability, or politics.

Because the payments for the solar DHW system are $66.37 each month, based on the series of repayments (R) calculated, you conservatively would be saving a few dollars over that period of time as well as pay for the cost of the system. The energy savings attributed to the operation of the solar installation would offset the interest paid on the loan. After that period of time, you would have a net positive savings of cash flow each month. Essentially, you have lost no more money than you otherwise would have spent, simply by paying the same monthly amount for your current hot water energy needs.

9.1.2. Solar Photovoltaic System

Calculating savings for electricity is fairly straightforward because efficiencies are calculated at 100%, and you are comparing costs using the same form of energy. Payback evaluations for PVs therefore are more definitive because you are comparing the cost of electricity production from a solar PV array with the cost of electricity from a power company. Analogous to the solar DHW system just discussed, suppose you purchase the PV system proposed in

Chapter 8, Section

8.3, Example 1, in the amount of

$19,012 before tax credits. The actual system costs after tax credits were as follows:

(Cost of system installed)=$19,012.00Federaltaxcredit(30%)=−$5703.60¯Actualsystemcostafterfed.taxcredit=$13,308.40Statetaxcredit¯=−$2000.00¯System cost after tax credits=$11,308.40

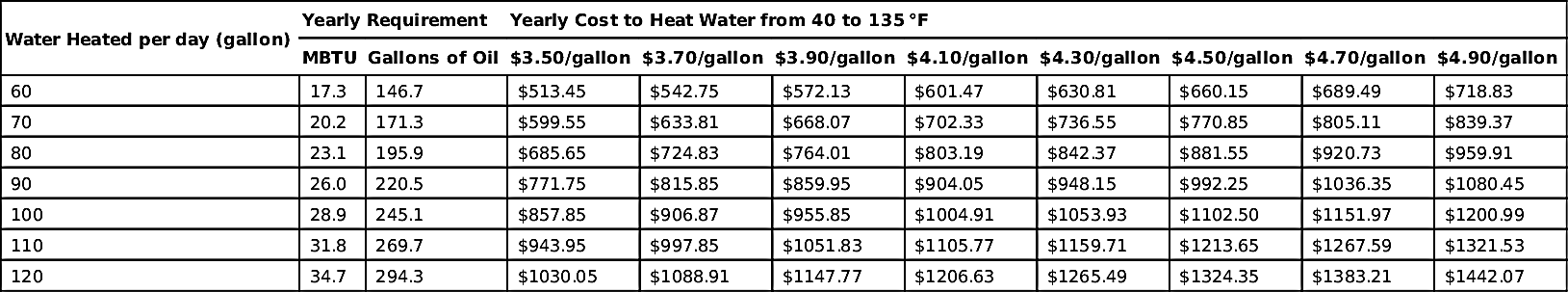

Assume you have enough cash to the pay the difference of $7703.60, which is the combined dollar amount of the federal ($5703.60) and state ($2000.00) tax credits allowed. At the end of the tax year, you are borrowing the actual cost of Example 1, after you receive your tax credits, in the amount of $11,308.40. From that previously proposed example, you are producing 5336

kW at a value of $0.16/kWh for the first year.

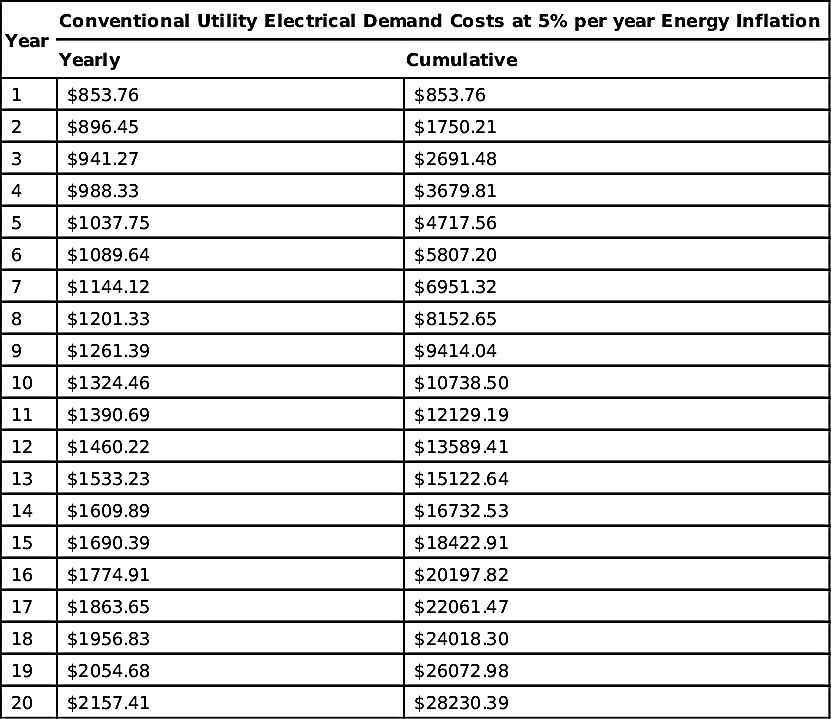

Table 9.3 illustrates the electrical energy cost with a 5% energy inflation factor as represented previously in

Chapter 8, Section

8.3,

Table 8.3. The cash flow to purchase 5336

kW of electricity at $0.16/kWh over a 10-year period, based on 5% energy inflation was calculated to be $10,738.50. Average monthly payments for that amount of electricity would be approximately

$89.49.

Table 9.3

Example of Annual Electrical Energy Costs (Electricity Demand of 5336 Kwh at $0.16/kWh)

| Year | Conventional Utility Electrical Demand Costs at 5% per year Energy Inflation |

| Yearly | Cumulative |

| 1 | $853.76 | $853.76 |

| 2 | $896.45 | $1750.21 |

| 3 | $941.27 | $2691.48 |

| 4 | $988.33 | $3679.81 |

| 5 | $1037.75 | $4717.56 |

| 6 | $1089.64 | $5807.20 |

| 7 | $1144.12 | $6951.32 |

| 8 | $1201.33 | $8152.65 |

| 9 | $1261.39 | $9414.04 |

| 10 | $1324.46 | $10738.50 |

| 11 | $1390.69 | $12129.19 |

| 12 | $1460.22 | $13589.41 |

| 13 | $1533.23 | $15122.64 |

| 14 | $1609.89 | $16732.53 |

| 15 | $1690.39 | $18422.91 |

| 16 | $1774.91 | $20197.82 |

| 17 | $1863.65 | $22061.47 |

| 18 | $1956.83 | $24018.30 |

| 19 | $2054.68 | $26072.98 |

| 20 | $2157.41 | $28230.39 |

Let’s perform the same type of analysis for this PV system as we did previously in Section

9.1.1 for a DHW system. Assume you borrow $11,308.40 (

P) to pay for the remaining portion of the system after receiving your tax rebates, and assume a bank loan for the system is obtained at 3.5% interest (

i) compounded annually for a 10-year (

n) term. The series of loan repayments for each year can be found using

Chapter 6, Eqn

(6.5) and the applicable capital recovery factor (

CRF), obtained from

Table 6.1 under the applicable interest rate, as follows:

Where

R = repayment made at the end of each year,

P = $11,308.40 (present sum),

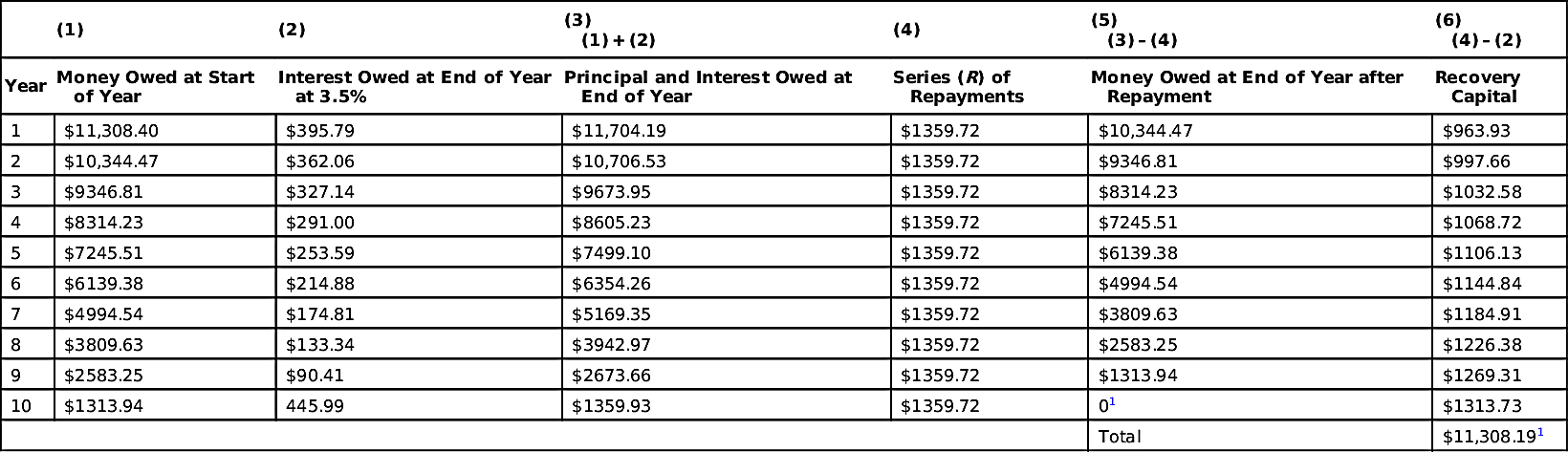

R = ($11,308.40) × (0.12024) = $1359.72 (annual payments for 10 years).

The series of payments (

R) means that you would pay monthly installments of

$113.31 during the 10-year period to repay the loan.

Table 9.4 shows that the amount of money borrowed at the start of the year (column 1) has interest due at the end of the year (column 2), and the payment at the end of the period (column 4) repays this interest plus some of the principal (column 6).

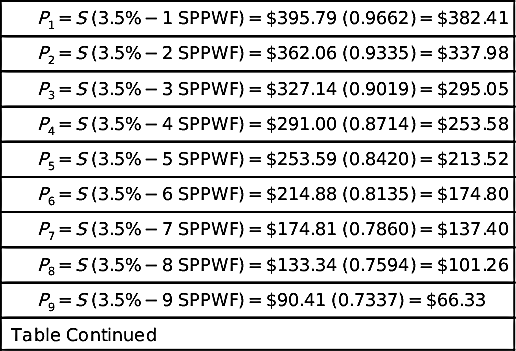

The actual cost of the PV system in terms of present worth money at 3.5% compounded annually is the sum of the initial amount of money borrowed plus the present worth of interest due at the end of each repayment period. Using

Chapter 6, Eqn

(6.4) and

Table 6.1, you can

determine the actual cost of the system at 3.5% over a period of 10 years, as follows:

Where

P = present worth of interest due,

S =

amount of the interest due

=

$395.79 (Year 1) (column 2,

Table 9.4),

(i − n SPPWF) = (0.035 − n SPPWF), resulting in the following tabulation:

P1 = S (3.5% − 1 SPPWF) = $395.79 (0.9662) = $382.41 |

P2 = S (3.5% − 2 SPPWF) = $362.06 (0.9335) = $337.98 |

P3 = S (3.5% − 3 SPPWF) = $327.14 (0.9019) = $295.05 |

P4 = S (3.5% − 4 SPPWF) = $291.00 (0.8714) = $253.58 |

P5 = S (3.5% − 5 SPPWF) = $253.59 (0.8420) = $213.52 |

P6 = S (3.5% − 6 SPPWF) = $214.88 (0.8135) = $174.80 |

P7 = S (3.5% − 7 SPPWF) = $174.81 (0.7860) = $137.40 |

P8 = S (3.5% − 8 SPPWF) = $133.34 (0.7594) = $101.26 |

P9 = S (3.5% − 9 SPPWF) = $90.41 (0.7337) = $66.33 |

| Table Continued |

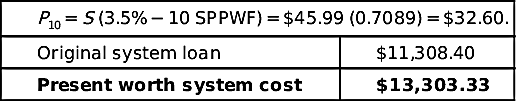

P10 = S (3.5% − 10 SPPWF) = $45.99 (0.7089) = $32.60. |

Original system loan | $11,308.40 |

Present worth system cost | $13,303.33 |

Table 9.4

Visualizing the Capital Recovery Factor

| (1) | (2) | (3)

(1) + (2) | (4) | (5)

(3) – (4) | (6)

(4) – (2) |

| Year | Money Owed at Start of Year | Interest Owed at End of Year at 3.5% | Principal and Interest Owed at End of Year | Series (R) of Repayments | Money Owed at End of Year after Repayment | Recovery Capital |

| 1 | $11,308.40 | $395.79 | $11,704.19 | $1359.72 | $10,344.47 | $963.93 |

| 2 | $10,344.47 | $362.06 | $10,706.53 | $1359.72 | $9346.81 | $997.66 |

| 3 | $9346.81 | $327.14 | $9673.95 | $1359.72 | $8314.23 | $1032.58 |

| 4 | $8314.23 | $291.00 | $8605.23 | $1359.72 | $7245.51 | $1068.72 |

| 5 | $7245.51 | $253.59 | $7499.10 | $1359.72 | $6139.38 | $1106.13 |

| 6 | $6139.38 | $214.88 | $6354.26 | $1359.72 | $4994.54 | $1144.84 |

| 7 | $4994.54 | $174.81 | $5169.35 | $1359.72 | $3809.63 | $1184.91 |

| 8 | $3809.63 | $133.34 | $3942.97 | $1359.72 | $2583.25 | $1226.38 |

| 9 | $2583.25 | $90.41 | $2673.66 | $1359.72 | $1313.94 | $1269.31 |

| 10 | $1313.94 | 445.99 | $1359.93 | $1359.72 | 01 | $1313.73 |

| Total | $11,308.191 |

1 Actual value calculates to $0.21 due to rounding to the nearest cent.

In a loan repayment scenario of $11,308.40 at 3.5% compounded interest with end-of-period repayments, the present worth of money actually invested, taking into account the present worth of the interest paid each year, would be $13,303.33. The additional $1994.93 for the cost of the system (i.e., $13,303.33 − $11,308.40) essentially would be paid for by the cost savings of the energy produced. In approximately 12 years, the PV system would begin to provide accumulative savings and decrease your monthly electricity bills.

Since the payments for the solar PV system are

$113.31 each month, based on the series of annual repayments (

R) calculated for this scenario, you would be paying slightly more per month ($113.31

− $89.49

=

$23.82) over this 10-year period to pay off the loan based on the conservative energy inflation percentages utilized. These monthly payments can be fine-tuned by your banking lender to actually result in the same amount of money spent for energy each month as the repayment of the loan. As discussed in

Chapter 8, the breakeven and payback over the life of this system will produce a positive cash flow. By considering the energy output over the lifetime of a solar energy system, you can determine whether the overall benefits exceed the costs of a conventional system. This type of analysis has been presented in

Chapter 7 by determining the payback or breakeven period discussed in regard to solar DHW systems and in

Chapter 8 in regard to PV systems.