Taxable Versus Tax-Free Bonds

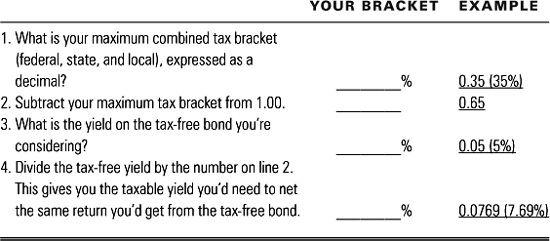

This worksheet helps you calculate which bond yields more in your personal tax bracket—a taxable bond or a tax-free municipal. On the left are the instructions, on the right an example of how the numbers work. I’ve picked an investor in the 35 percent federal and state bracket, looking at a tax-exempt bond yielding 5 percent. It turns out that he’d need a 7.69 percent taxable yield to equal his return from the tax-free bond.

When using this calculation, always use bonds, or bond funds, of equivalent credit quality and maturity. Otherwise, you won’t have the right information. All percentages should be expressed as decimals.

Here’s how to calculate the taxable equivalents of tax-free bonds, for interest rates and tax brackets not illustrated on the table on page 941.

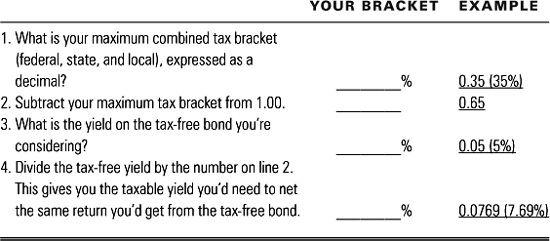

Here’s how to calculate how much you’d need from a tax-free bond in order to match a taxable bond that you’re considering:

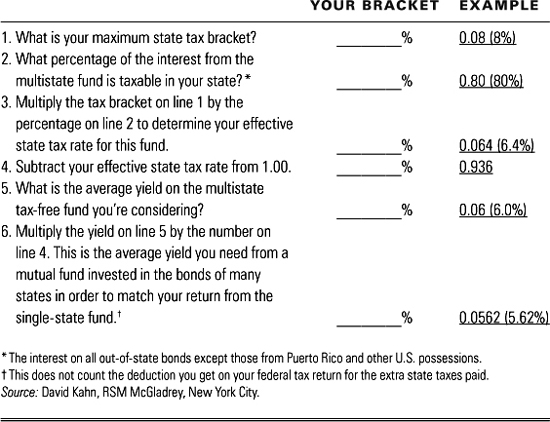

Here’s how to decide between a mutual fund specializing in the bonds of your state and a mutual fund containing the bonds of several states. You might assume that the single-state fund is always best because it’s entirely tax exempt, but that’s not necessarily so. If a multistate fund offers a higher yield, it might net you more despite the state tax on the out-of-state bonds. A multistate fund also carries less risk because its managers can diversify.