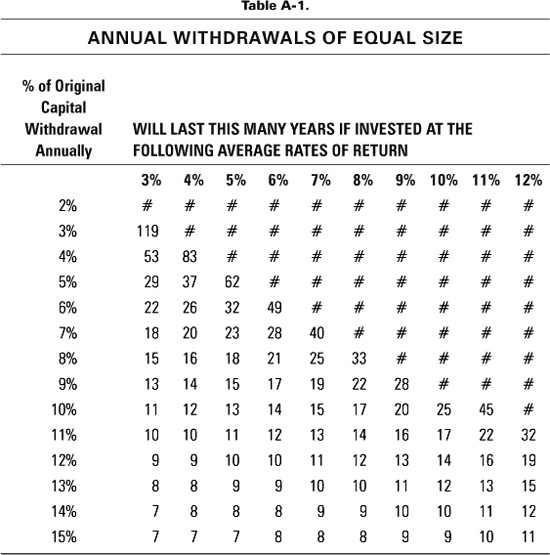

How Long Will Your Capital Last?

The following tables show how many years your capital will last at varying rates of withdrawal. For annual withdrawals of equal size, use the first table. The remaining tables assume that you’ll take enough extra money each year to keep up with the inflation rate. At 4 percent inflation, for example, a first-year withdrawal of $5,000 grows to $5,200 the second year, $5,408 the third year, and so on.

To use these tables, choose a likely inflation rate, up to 7 percent (the table showing 3 percent inflation is on page 1110). In the left-hand column, find the percentage of your capital that you will withdraw in the first year. If you withdraw $5,000 from a $125,000 nest egg, for example, you have taken 4 percent. Read across to the pretax rate of return that you’re expecting to earn on your money. Where those lines intersect, you will find the number of years your capital can last. I’ve assumed that the money is taken at the start of each year. The # symbol means that, at that rate of withdrawal, your capital will never be exhausted.

The source for all the tables in Appendix 2 is David Kahn, RSM McGladrey, New York City.