The housing policy measures introduced on 30 August 2010 have sidelined many buyers, including owner-occupiers who have outgrown their current apartments and are seeking newer, bigger or better-located homes.

A typical case: Mr and Mrs Tan have lived in their five-room HDB flat for 12 years. They have worked hard, invested wisely, and their three children are doing well in primary school. The flat is worth about $500,000 and there is a loan of $100,000 remaining. Having accumulated over $200,000 in cash and CPF (Central Provident Fund), the couple is ready to buy a larger-sized condominium — with three bedrooms and a maid’s room — up to about $1 million in value. Their children would love the facilities and they would be nearer to school. That was their plan — up till August.

Now, under the new policy, the Tan’s options are:

These are tough decisions for the couple to make as the children are growing and the family’s needs are changing. They would just have to make do with staying a while longer in their HDB flat.

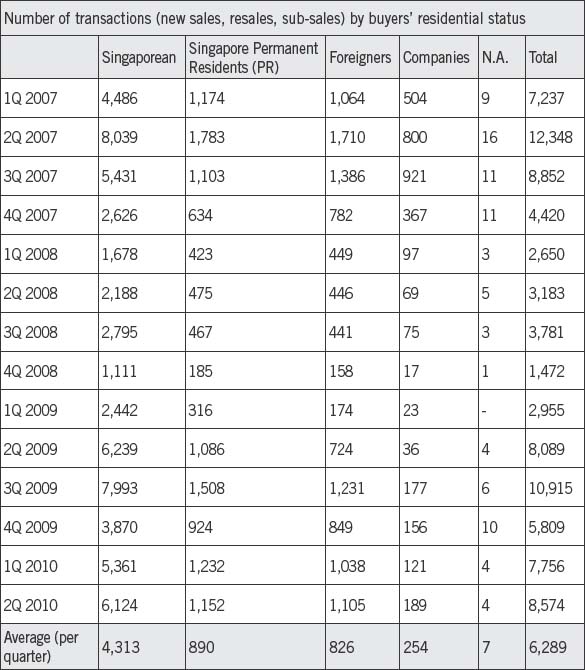

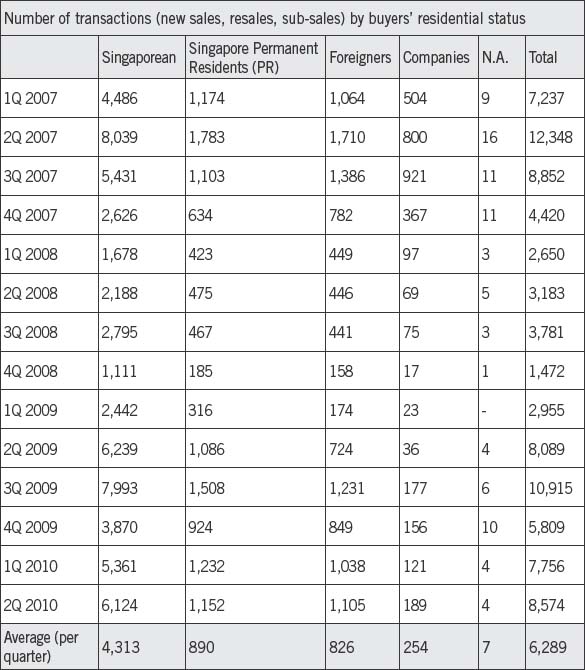

This segment of the market is not small. The new policies affect mainly Singaporeans because foreigners do not qualify for the 80 per cent LTV, nor do most of the permanent residents buying residential properties. Data from January 2007 to date show that an average of about 4,300 private residential transactions per quarter are classified as purchased by Singaporeans (see Table 3).

If we conservatively assume that a mere 20 per cent of these Singaporeans bought the properties to stay in and require a second loan for the interim period till they sell their first property, then we can expect that, going forward, about 860 transactions per quarter, or 3,440 per year, may not happen. Not at least until their savings accumulate and, hopefully, grow faster than the pace of price increases for private homes.

Table 3 Sale of non-landed properties

(Source: URA)

The market has felt the impact of these measures. Immediately after the announcement, some buyers chose not to exercise their options. And across the month of September, there were fewer transactions and enquiries as active investors retreated into the sidelines. Now, only those buying a property to stay in and investors who have sufficient equity are looking. And, of course, the foreign investors.

The prices of HDB and mass market segments will cool somewhat. But as the 12- to 18-month outlook on interest rates remains soft, holding costs should remain low and current owners will not be in a hurry to sell. Therefore, I expect prices to stagnate at current levels; sellers do not need to lower prices as they can hold, while affordability for buyers has gone down as they are strapped for the 30 per cent of equity required. Let’s see who blinks first.

With the market being directionless, residential prices should trend sideways, maintaining around the current index level of 184.2 until the end of 2010. While sellers may be more accommodative to price bargaining, particularly in the mass market and mid-tier segments, prime property prices should remain stable as the proportion of foreign owners is high and foreign investors do not take more than 70 per cent LTV. Landed housing prices will continue to increase, as this segment rarely gears up to 80 per cent LTV and there is negligible new supply of landed homes.

The likelihood of a price decline in 2011 will be higher but that will not be attributed to the new policy measures, but rather to the increase in residential supply outstripping demand. The price decline should not be broad based as many gems await those who are diligent with their house search homework.