STRATEGY PLANNING AND RECORD SECTION

CONTENTS

- Portfolio at Start of 2016

- Additional Purchases

- Short-Term Transactions

- Long-Term Transactions

- Interest/Dividends Received during 2016/Brokerage Account Data 2016

- Weekly Portfolio Price Record 2016

- Weekly Indicator Data 2016

- Monthly Indicator Data 2016

- Portfolio at End of 2016

- If You Don't Profit from Your Investment Mistakes, Someone Else Will; Performance Record of Recommendations

- Individual Retirement Account (IRA): Most Awesome Mass Investment Incentive Ever Devised

- G.M. Loeb's “Battle Plan” for Investment Survival

- G.M. Loeb's Investment Survival Checklist

These forms are available at our website www.stocktradersalmanac.com.

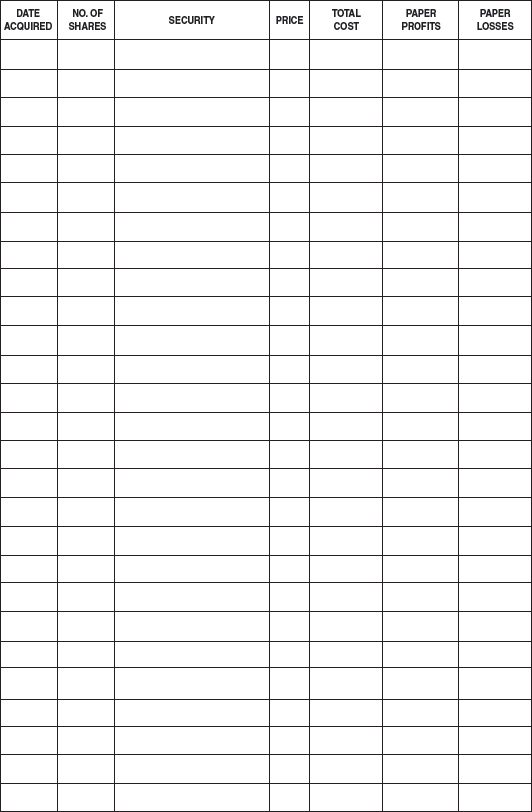

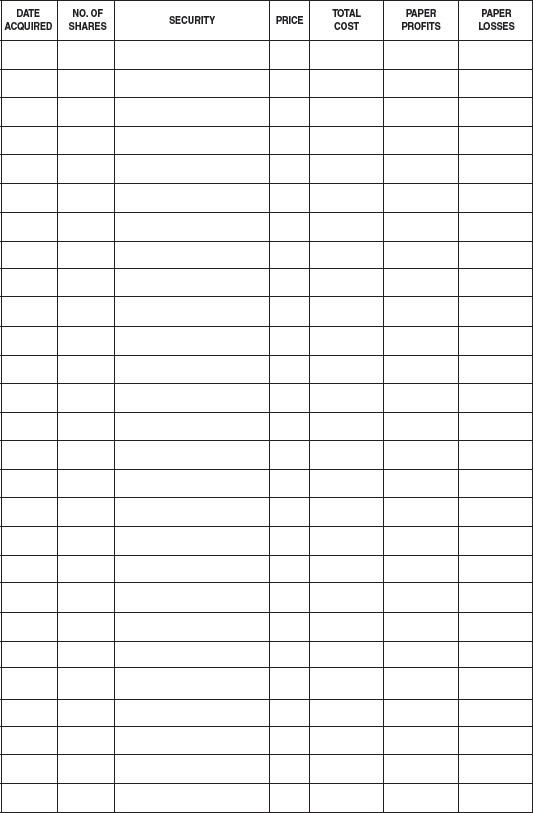

PORTFOLIO AT START OF 2016

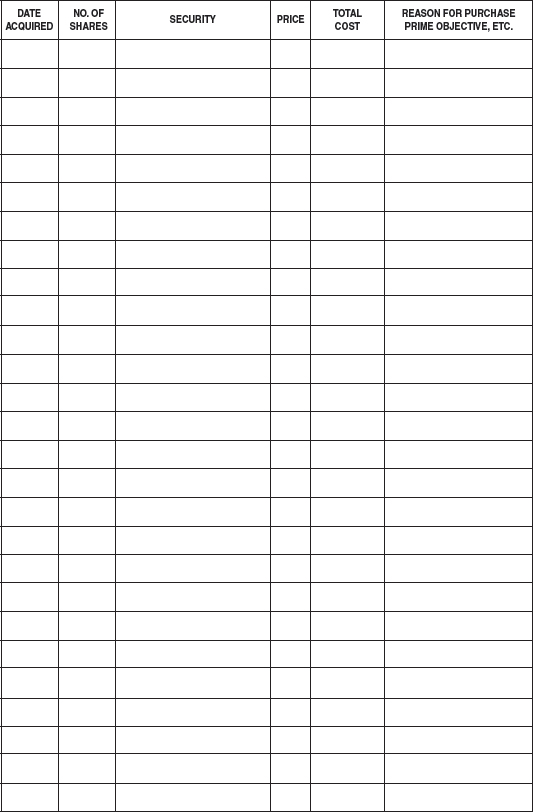

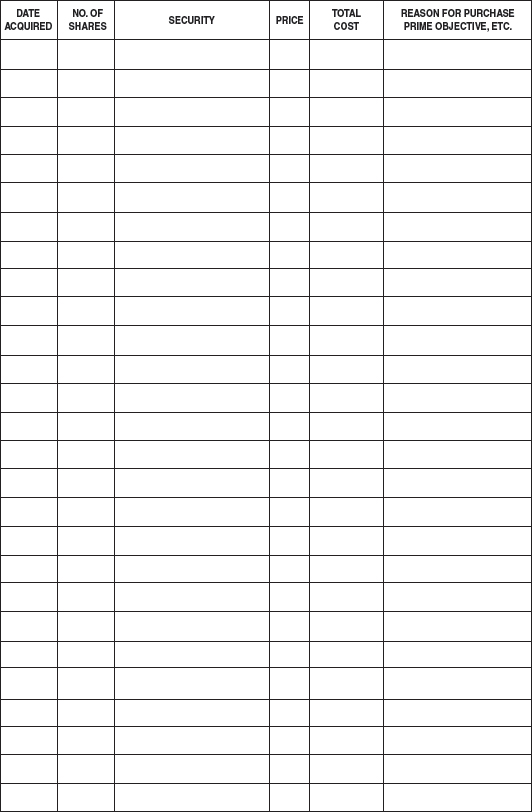

ADDITIONAL PURCHASES

ADDITIONAL PURCHASES

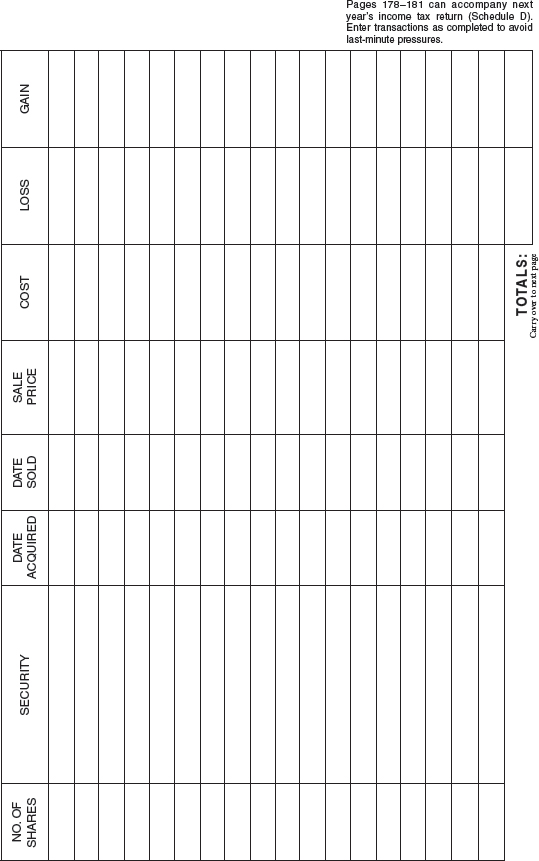

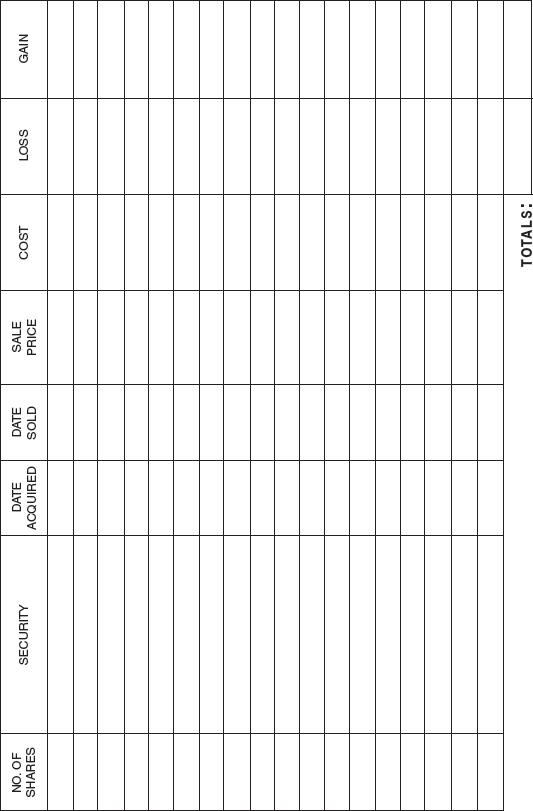

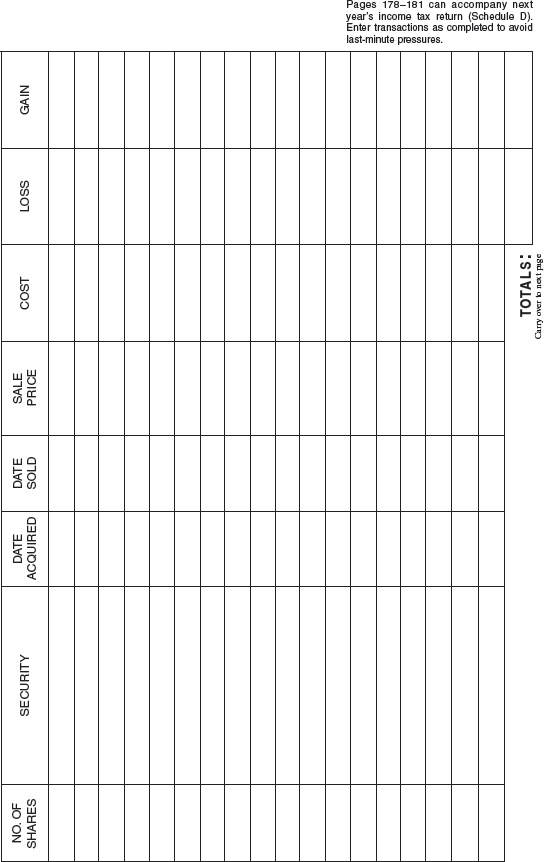

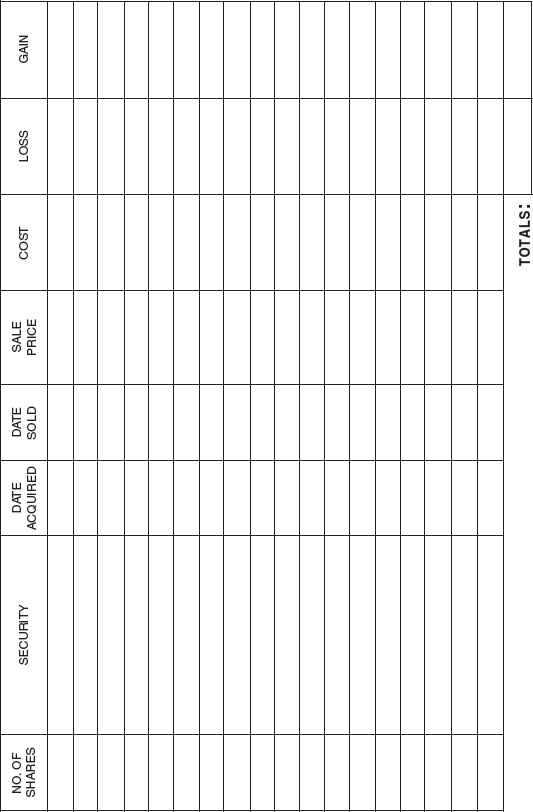

SHORT-TERM TRANSACTIONS

LONG-TERM TRANSACTIONS

INTEREST/DIVIDENDS RECEIVED DURING 2016

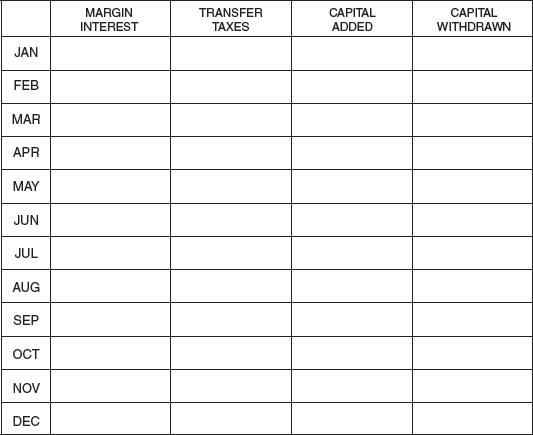

BROKERAGE ACCOUNT DATA 2016

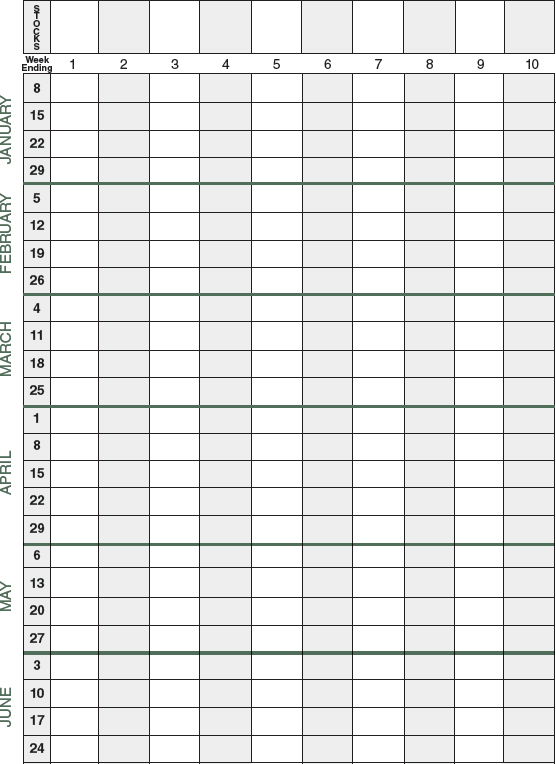

WEEKLY PORTFOLIO PRICE RECORD 2016 (FIRST HALF)

Place purchase price above stock name and weekly closes below.

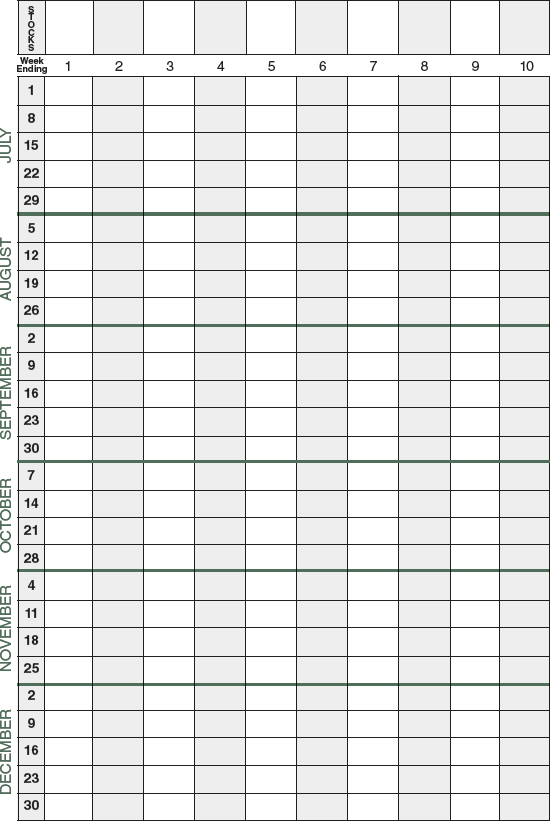

WEEKLY PORTFOLIO PRICE RECORD 2016 (SECOND HALF)

Place purchase price above stock name and weekly closes below.

WEEKLY INDICATOR DATA 2016 (FIRST HALF)

WEEKLY INDICATOR DATA 2016 (SECOND HALF)

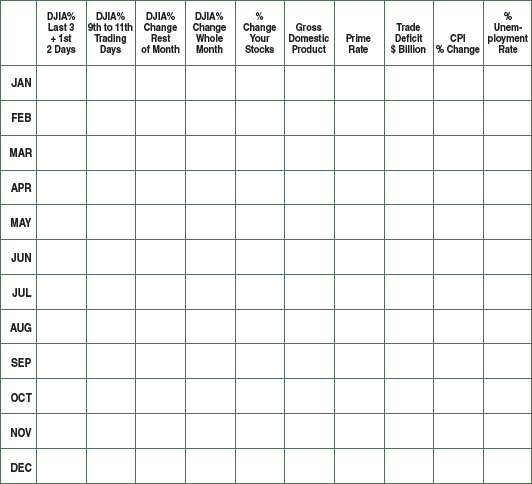

MONTHLY INDICATOR DATA 2016

INSTRUCTIONS:

Weekly Indicator Data (pages 185–186). Keeping data on several indicators may give you a better feel of the market. In addition to the closing DJIA and its net change for the week, post the net change for Friday's Dow and also the following Monday's. A series of “down Fridays” followed by “down Mondays” often precedes a downswing (see page 80). Tracking either the S&P or NASDAQ composite, and advances and declines, will help prevent the Dow from misleading you. New highs and lows and put/call ratios (www.cboe.com) are also useful indicators. All these weekly figures appear in weekend papers or Barron's. Data for 90-day Treasury Rate and Moody's AAA Bond Rate are quite important for tracking short- and long-term interest rates. These figures are available from:

- Weekly U.S. Financial Data

- Federal Reserve Bank of St. Louis

- P.O. Box 442

- St. Louis MO 63166

- http://research.stlouisfed.org

Monthly Indicator Data. The purpose of the first three columns is to enable you to track the market's bullish bias near the end, beginning, and middle of the month, which has been shifting lately (see pages 92, 145, and 146). Market direction, performance of your stocks, gross domestic product, prime rate, trade deficit, Consumer Price Index, and unemployment rate are worthwhile indicators to follow. Or, readers may wish to gauge other data.

PORTFOLIO AT END OF 2016

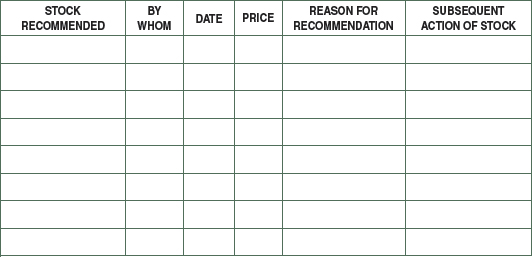

IF YOU DON'T PROFIT FROM YOUR INVESTMENT MISTAKES, SOMEONE ELSE WILL

No matter how much we may deny it, almost every successful person in Wall Street pays a great deal of attention to trading suggestions—especially when they come from “the right sources.”

One of the hardest things to learn is to distinguish between good tips and bad ones. Usually, the best tips have a logical reason in back of them, which accompanies the tip. Poor tips usually have no reason to support them.

The important thing to remember is that the market discounts. It does not review, it does not reflect. The Street's real interest in “tips,” inside information, buying and selling suggestions, and everything else of this kind emanates from a desire to find out just what the market has on hand to discount. The process of finding out involves separating the wheat from the chaff—and there is plenty of chaff.

PERFORMANCE RECORD OF RECOMMENDATIONS

INDIVIDUAL RETIREMENT ACCOUNT (IRA): MOST AWESOME MASS INVESTMENT INCENTIVE EVER DEVISED

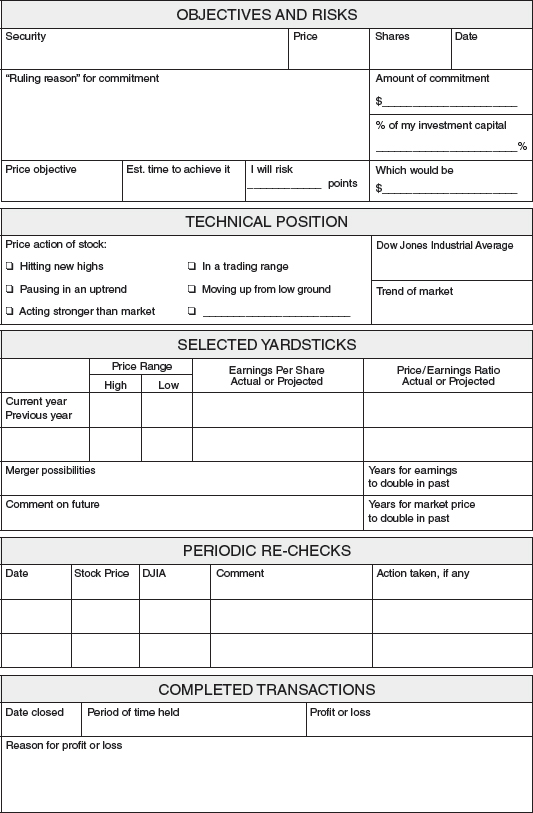

G. M. LOEB'S “BATTLE PLAN” FOR INVESTMENT SURVIVAL

LIFE IS CHANGE: Nothing can ever be the same a minute from now as it was a minute ago. Everything you own is changing in price and value. You can find that last price of an active security on the stock ticker, but you cannot find the next price anywhere. The value of your money is changing. Even the value of your home is changing, though no one walks in front of it with a sandwich board consistently posting the changes.

RECOGNIZE CHANGE: Your basic objective should be to profit from change. The art of investing is being able to recognize change and to adjust investment goals accordingly.

WRITE THINGS DOWN: You will score more investment success and avoid more investment failures if you write things down. Very few investors have the drive and inclination to do this.

KEEP A CHECKLIST: If you aim to improve your investment results, get into the habit of keeping a checklist on every issue you consider buying. Before making a commitment, it will pay you to write down the answers to at least some of the basic questions—How much am I investing in this company? How much do I think I can make? How much do I have to risk? How long do I expect to take to reach my goal?

HAVE A SINGLE RULING REASON: Above all, writing things down is the best way to find “the ruling reason.” When all is said and done, there is invariably a single reason that stands out above all others, why a particular security transaction can be expected to show a profit. All too often, many relatively unimportant statistics are allowed to obscure this single important point.

Any one of a dozen factors may be the point of a particular purchase or sale. It could be a technical reason—an increase in earnings or dividend not yet discounted in the market price—a change of management—a promising new product—an expected improvement in the market's valuation of earnings—or many others. But, in any given case, one of these factors will almost certainly be more important than all the rest put together.

CLOSING OUT A COMMITMENT: If you have a loss, the solution is automatic, provided you decide what to do at the time you buy. Otherwise, the question divides itself into two parts. Are we in a bull or bear market? Few of us really know until it is too late. For the sake of the record, if you think it is a bear market, just put that consideration first and sell as much as your conviction suggests and your nature allows.

If you think it is a bull market, or at least a market where some stocks move up, some mark time, and only a few decline, do not sell unless:

You see a bear market ahead.

You see a bear market ahead. You see trouble for a particular company in which you own shares.

You see trouble for a particular company in which you own shares. Time and circumstances have turned up a new and seemingly far better buy than the issue you like least in your list.

Time and circumstances have turned up a new and seemingly far better buy than the issue you like least in your list. Your shares stop going up and start going down.

Your shares stop going up and start going down.

A subsidiary question is, which stock to sell first? Two further observations may help:

Do not sell solely because you think a stock is “overvalued.”

Do not sell solely because you think a stock is “overvalued.” If you want to sell some of your stocks and not all, in most cases it is better to go against your emotional inclinations and sell first the issues with losses, small profits, or none at all, the weakest, the most disappointing, etc.

If you want to sell some of your stocks and not all, in most cases it is better to go against your emotional inclinations and sell first the issues with losses, small profits, or none at all, the weakest, the most disappointing, etc.

Mr. Loeb is the author of The Battle for Investment Survival, John Wiley & Sons.

G. M. LOEB'S INVESTMENT SURVIVAL CHECKLIST