Africa in World History

Series editors: David Robinson and Joseph C. Miller

James C. McCann

Stirring the Pot: A History of African Cuisine

Peter Alegi

African Soccerscapes: How a Continent Changed the World’s Game

Todd Cleveland

Stones of Contention: A History of Africa’s Diamonds

Forthcoming:

Laura Lee Huttenbach

The Boy Is Gone: Memoirs of a Mau Mau General

John M. Mugane

The Story of Swahili

Charles Ambler

Mass Media and Popular Culture in Modern Africa

Stones of Contention

A History of Africa’s Diamonds

Ohio University Press

in association with the

Ohio University Center for International Studies

Athens

To Julianna, Lucas, and Byers

Acknowledgments

First and foremost, I would like to thank Gillian Berchowitz, David Robinson, and Joseph Miller. After initially approaching me about this book project, they subsequently provided unwavering support and displayed boundless patience throughout the extended research and writing processes. The concrete forms of their support were myriad, but as this project concludes, I will remember particularly fondly (and miss) Dave’s steady provision of relevant readings and superb ideas, Gill’s sage and serene guidance, and Joe’s timely and innovative suggestions. The uniformly enthusiastic approach of this remarkable editorial team kept this project enjoyable at every turn. I’d also like to express my gratitude to the various staff members with whom I interacted at Ohio University Press; to a person, they were consistently helpful and highly professional. At Augustana College, I am grateful for the assistance of the Tredway Library staff, whose members handled my innumerable requests and orders for both on- and off-site materials promptly, always with a smile and often with a welcomed witticism. I would also like to thank former students Bryce Johnson, Anden Drolet, Jaron Gaier and, especially, Sarah Clement for their contributions during the process of compiling the requisite data for the story I’ve attempted to tell. Elsewhere, Richard Saunders was extremely helpful, and his writings and insights constituted a much-needed compass as I began to delve into Zimbabwe’s rapidly shifting diamond mining landscape. Chadia Chambers-Samadi, John Pfautz, and Odino Grubessi provided important assistance as I secured images to incorporate into the text. The inclusion of passages that outline the colonial-era history of diamond mining in Angola was only possible due to the efforts of a great many people on the ground in both Angola and Portugal during my years of fieldwork in those settings. In particular, I’d like to thank Drs. Rosa Cruz e Silva, Jorge Varanda, and Nuno Porto, as well as Carl Niemann, and also my many African informants in Angola, whose comprehension of the nature and experience of diamond mining—past and present—will forever outdistance my own. I’m also very grateful to the anonymous readers, whose comments and suggestions were instrumental as I proceeded through the manuscript revision. Finally, this highly edifying and enjoyable endeavor would never have reached fruition had it not been for the relentless support of my wife, Julianna, and the inspirational energy provided by our two sons, Lucas and Byers, the latter of whom joined us in the midst of this project.

Stones of Contention

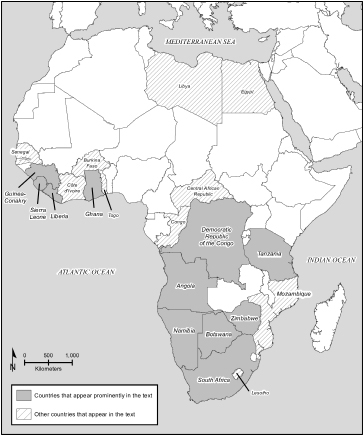

Map 1. Africa. Map by Brian Edward Balsley, GISP

1: An Introduction to Africa’s Diamonds

In America, it [a diamond] is “bling bling.” But out here [in Africa] it’s “bling bang.”

—“Danny Archer,” Leonardo DiCaprio’s character in the 2006 film Blood Diamond

Every time you purchase a piece of diamond jewelry there is a real probability that you will be contributing to the provision of schools, clinics, drinking water, or roads for a poor community in Botswana or South Africa or Namibia.

—Former Botswana president Festus Mogae, 2008 winner of the Ibrahim Prize, awarded to African heads of state who deliver security, health, education, and economic development to their constituents, and who democratically transfer power to their successors

After a recent talk I gave on the history of diamond production in Angola, an audience member posed the following questions: “Have you ever purchased a diamond? And, would you ever purchase an African diamond knowing what you know now?” The answer to the first question was easy. “Yes, I have purchased a diamond.” Before addressing the second question, though, I paused before responding. “Actually, I haven’t had the occasion to buy one since learning what I’ve learned.” After the audience both moaned and chuckled in response to my equivocation, they prodded me to answer more decidedly. After further deliberation, I finally replied. “Yes, I suppose I would.”

In the pages that follow, this book strives to enable you to formulate your own informed answers to that audience member’s second question. Most readers will come to this book with at least some knowledge of the continent’s diamonds, often gleaned from different forms of popular culture. This output includes Graham Greene’s famous novel The Heart of the Matter (1948), and, more recently, both Kanye West’s Grammy-winning single, “Diamonds from Sierra Leone” (2005), and the blockbuster film Blood Diamond (2006).[1] Other readers will have formed their impressions via the mainstream media, which has highlighted the African origins of many of the diamonds that consumers marvel at behind glass jewelry cases the world over. All of these sources, however, link African diamonds to unbridled chaos and, often, to unimaginable violence. What has been ignored is the much wider range of human experience associated with the extraction of diamonds from Africa’s soils.

For centuries, Africa’s diamonds and other minerals have piqued the interest of outsiders and shaped the lives of countless African men, women, and children. This mineral wealth has subjected the continent’s residents to carnage, exploitation, and widespread suffering. Yet, this wealth has also prompted Africans to pursue creative migration, livelihood, and household strategies; cooperate across potential divides; and acquire technical and managerial skills; and has even facilitated the construction of peaceful, democratic states. In other words, exactly the types of developments that you’ll never encounter in newspaper headlines or on TV news broadcasts.

This book explores the major developments in the remarkable history of Africa’s diamonds, from the initial international interest in the continent’s mineral wealth during the first millennium a.d., down to the present day. This narrative includes the discovery of diamonds in South Africa in 1867, which ushered in an era of unprecedented greed, manifested in exploitative mining operations. Following the ensuing “scramble for Africa,” during which European powers assumed control of virtually the entire continent, colonial regimes fashioned environments conducive to the commercial objectives of monopolistic diamond enterprises. These companies included, most famously, the industry giant De Beers (explored in detail in chapters 3 and 4). In the aftermath of the birth of independent Africa states, beginning at the end of the 1950s, both rapacious and more responsible regimes joined De Beers and other multinational corporations to oversee mining activity on the continent.

Beyond examinations of these commercial entities, the book also considers the stories of Africans who have been involved with the continent’s diamonds over the centuries. These individuals include artisanal miners, company mine workers, and the women who support(ed) them; the “headmen” who often furnished these laborers; armed rebels; mining executives; and premiers of mineral-rich states. Although the industrial literature on diamonds tends to render these individuals anonymous, this text explores the highly varied relationships and experiences that Africans have had with the continent’s diamonds. By exploring the multiplicity of the human experiences associated with the history of diamond production in Africa, I hope that you will “see” more than just a glittering accessory the next time you view a diamond in a glass jewelry case. Ultimately, the book aims to help you generate your own answers to the challenging question that the audience member posed to me.

The Global History of the Diamond

Diamonds have been around a long, long time and continue to possess an almost mythical quality. Well before their discovery in Africa, the global pursuit of these gemstones had destroyed the fortunes of innumerable individuals while enriching the lives of many others. Legends about the importance of diamonds going well back into the past abound, but most simply reflect a more recent fondness for these stones’ aesthetic brilliance projected onto earlier times. Yet, we can with some certainty trace the desirability of diamonds back at least two millennia. For example, diamonds featured in a treatise in statecraft prepared during the reign of the Indian general Chandragupta, who had driven the Greeks from India in 322 b.c.e.

In fact, India had long been the epicenter of global diamond production, before yielding to Brazil, and then Africa in more recent times. For centuries, or perhaps even millennia, leading up to the exhaustion of deposits in the mid-1700s, the Indian region of Golconda had been yielding stones to adorn the local nobility and, eventually, European royalty. In fact, two of the most famous diamonds in the world today: the Hope and the Koh-i-Noor, came from the alluvial diggings around Golconda. The latter was so brilliant that it was said that whoever possessed it would rule the world. Given that the British forcibly seized the magnificent stone in the mid-eighteenth century, on their way to establishing the most significant global empire the world had ever seen, this prophecy seemingly contained an element of truth.

Europeans’ love affair with diamonds had actually started much earlier. Over two millennia ago, the Greeks began facilitating the importation of precious stones from India to a receptive audience in Europe. The famous historian Herodotus (c. 484 b.c.e.–c. 425 b.c.e.) was the first of the early Greek writers to note the displays of precious stones in the palaces and temples of Eastern kings. He mentions, for example, the signet rings of Darius and Polycrates and the emerald column in the Temple of Hercules in Tyre. Via these and other accounts, the mineral riches of both the Near and Far East became known to increasing numbers of Europeans, well beyond Greece’s borders.

The citizens of ancient Rome also valued diamonds, as well as other precious stones. Few gems initially reached mainland Europe during this period, as Middle Eastern rulers and nobles ensured that any stones that arrived in their territories did not travel any further west. However, following the Roman expansion into Asia Minor in the first century b.c.e., vast quantities of gems began to reach Rome, rendering them increasingly affordable. In fact, over time, gem ownership and the custom of incorporating precious stones into daily dress had become so excessive in Rome that the latter practice was eventually restricted by law.

For all the attention lavished on gems by the citizens of ancient Greece and Rome, roughly a thousand years would pass before the diamond became the preeminent gemstone. With the conclusion of the Crusades and the concomitant establishment of extensive trading networks linking Europe and the Levant, gems originating in the East once again began to circulate in Europe. This increased commercial access to the East, combined with the growing wealth of the European nobility, led to the proliferation of (increasingly affordable) precious stone ownership on the continent.

Europeans began using gems for all manner of things, including studding picture frames, ornamenting statuary, decorating arms, as well as for personal adornment. Yet, throughout this “creative explosion” in precious stone usage, rubies, emeralds, opals, and sapphires continued to rank above diamonds, as did pearls. Why? Well, anyone who has observed a diamond in rough form, that is, uncut and unpolished and, thus, aesthetically unspectacular, can answer that question. Moreover, the diamond’s legendary hardness actually limited its utility and, thus, its allure. At this time, consumers of precious stones valued a gem’s color and proportion much more than its hardness. Around the 1460s, however, the diamond’s position at the pinnacle of the gem hierarchy was set in motion by a Flemish lapidary (a person who cuts, polishes, or engraves precious stones) named Louis de Berguem. A rather unlikely historymaker, to be sure.

Although Indian lapidaries had long been working with diamonds, their techniques failed to reveal the stones’ brilliance. Even when these artisans began to revise their methods in the 1400s, the proportioning remained so poor that much of the stone’s latent brilliancy remained “unreleased.” Only after de Berguem’s re-cutting of the Beau Sancy diamond did the art of modern cutting begin. De Berguem demonstrated how to successfully cut facets on the face of a diamond, which became known as scientific faceting. This technique rendered the diamond a perfect reflector of light and unleashed its interior beauty and, thus, helped establish diamonds as the most coveted of all gems, which, in turn, further fueled demand.

The novel forms of aesthetic activity and appreciation that were central to the European Renaissance provided a perfect environment for the ascendance of the diamond. Two developments, in particular, thrust the diamond into its paramount position. First was the establishment of a reliable international trade network linking India’s diamondiferous Golconda region directly to Europe. Diamonds were procured and transported by intrepid merchant travelers to eagerly awaiting Europeans, who were now consuming these stones in unprecedented quantities. Perhaps the most famous of these merchants was the Frenchman, Jean-Baptiste Tavernier, who, in 1668, sold the legendary Hope Diamond to the French king Louis XIV. Second was the development of the “rose cut.” As European lapidaries gained experience working with ever greater numbers of stones, their elevated levels of craftsmanship enabled them to improve upon de Berguem’s work—a clear case of “practice makes perfect.” In turn, they further highlighted, or “revealed,” the diamond’s brilliance, which heightened demand for a stone whose post-cut beauty was quickly outpacing the aesthetics of rival gemstones.

The increased demand for Indian diamonds in Europe was further spurred on by the invention of the “brilliant cut,” an improvement on the rose cut. This rapidly expanding market was now supporting an industry that stretched across three continents. Caravans had once transported these stones across Arabia and offloaded them to traders waiting in Aden, Aleppo, and Alexandria (the initial extent of Africa’s involvement in the trade). However, ships were now increasingly employed to convey these stones to Europe, utilizing the Red Sea but otherwise largely bypassing the Middle East.[2] Upon reaching Europe, Jewish diamond merchants in places as far-flung as Lisbon, Venice and Frankfurt arranged to purchase these precious imports. Jewish involvement in the burgeoning diamond industry in Europe was logical for two main reasons. First, those Jews who served as moneylenders naturally concerned themselves with assessing, repairing, and selling gems that had been offered to them as collateral for loans. And, second, the cutting and polishing of diamonds, initially centered in Lisbon before shifting to Antwerp, was one of the few crafts in which guilds permitted Jews to participate.

Unfortunately for the European market, the supply of Indian diamonds required to meet the growing demand on the continent was unsustainable. Despite the bountifulness of the Indian mines, they were virtually exhausted by the eighteenth century. This dearth threatened to put an abrupt end to the global supply of these increasingly coveted—and affordable—stones. Yet, as if on cue, gold miners working in 1725 in the Province of Minas Gerais in Portuguese-controlled Brazil stumbled on a new source of diamonds. Virtually overnight, diamond focus shifted halfway around the world and the “rush” to Brazil was on. In response, within a decade of the discovery, the Portuguese crown had declared diamond mining in Brazil a state monopoly—a foreshadowing of future diamond developments in Africa. Meanwhile, overall Brazilian output had already exceeded India’s, thereby cutting the global price of a carat by two-thirds. Yet, by the middle of the following century, carat prices were again rising because of the multitude of wealthy consumers that the Industrial Revolution was spawning; these gems were now within their financial grasp. As with India, however, supply could not keep pace with the exploding demand.

And, then, just when it seemed that the global supply of diamonds had been exhausted, along came Africa. As the dwindling Brazilian supplies were generating panic in diamond circles, a fifteen-year-old named Erasmus Jacobs made a superbly timed, if entirely unintentional, find of the aptly named Eureka Diamond in the heart of South Africa. Once again, global diamond attention immediately shifted, this time to a heretofore virtually ignored, very small corner of the world.

The History of Diamonds in Africa

From these humble beginnings, Africa rapidly came to dominate the international diamond landscape, even if relatively few Africans benefited along the way. Although the Industrial Revolution had enabled increasing numbers of people to purchase previously cost-prohibitive diamonds, the South African discovery occurred at an even more propitious moment in global history. The unearthing of these deposits corresponded with the growth of the middle classes and their amplified consumption, especially in Great Britain and the United States, just as increased availability rendered Africa’s stones ever more attainable. By the end of the Second World War, the United States had overtaken Europe as the largest consumer of African diamonds, while shortly thereafter, postwar Japan emerged as an important new market. From Jacobs’s discovery of the Eureka to the subsequent creation and dominance of the industry behemoth De Beers, headquartered in South Africa, diamonds would become inextricably linked to Africa.

Although recent finds elsewhere in the world have cut into Africa’s diamond supremacy, the continent continues to supply the world with over half of its total supply and the African nation of Botswana remains the global leader. These stones have historically drawn African states, populations, and individuals—even from places on the continent that have no diamond deposits, or even any proximate ones—into their orbit, while also profoundly connecting the continent to the rest of the world. Indeed, if the continent’s soils did not harbor these stones, the political, social, and economic experiences of millions of Africans since Jacobs’s discovery would be drastically different. And, many would argue, far better.

A Geological Overview of Africa’s Diamonds

What is a diamond? Quite simply, it’s carbon that has been subjected to intense heat and pressure. The products of this process are thrust toward the earth’s surface from depths of more than a thousand miles, embedded within what is known as a kimberlite pipe—named after Kimberley, the city that sprung up in the midst of the South African diamond finds. In Africa, these kimberlite eruptions brought diamond deposits to the surface as recently as a million years ago. Over time, wind and rain have slowly eroded these eruptive pipes so that they now generally blend into the surrounding landscape. During this erosive process, stones are washed out of the once-protruding pipes and into the surrounding countryside, as well as into streams and rivers, which often carry them far from their original points of emergence. As such, upwards of a third of the diamonds harvested from Africa’s soils have come from far-flung alluvial fields, rather than from the subterranean portions of the original kimberlite pipes.

Kimberlite is a relatively “soft” rock, which over time breaks down into a mass of secondary clay minerals that contain resistant residual materials, including diamonds. The products of this process are found in both a superficial zone of “yellow ground” and a deeper one made up of more diamondiferous “blue ground,” which eventually transitions into “primary kimberlite.” During the weathering process, the diamonds contained in the pipe come to rest in both the yellow and blue grounds. Although fabulous riches are often extracted from both of these layers, the mining of the blue ground is ultimately the more lucrative undertaking.

Unfortunately for prospectors and others interested in tapping the earth for diamond wealth, not every kimberlite pipe is diamondiferous. In South Africa, for example, roughly only one pipe in two hundred is worth mining, though in other places, such as Botswana, the ratio can be as high as one in fifteen. Moreover, the surface diameters of payable pipes are often only a hundred yards across. Even the Mwadvi diamond mine in Tanzania, among the largest in the world, is only a mile and a half long and a mile wide. Prospecting for lucrative deposits can, therefore, be a time-consuming project.

In this respect, the case of Dr. John Williamson, who worked in colonial Tanganyika (Tanzania), comes to mind. Inspired by his find at Mwadvi in 1953, roughly three hundred prospecting engineers subsequently spent more than three years trying to identify additional regional deposits—almost entirely unsuccessfully! In order to avoid this type of inefficiency, contemporary prospectors now focus on what are known in the industry as “indicator minerals” that suggest the presence of diamond deposits.[3] Resistant and heavy, these minerals tend to work their way into drainage systems via processes such as downslope soil creep or rainfall runoff. They then radiate outward along drainage channels, trailing off the circular, superficial footprint of the kimberlite pipe.

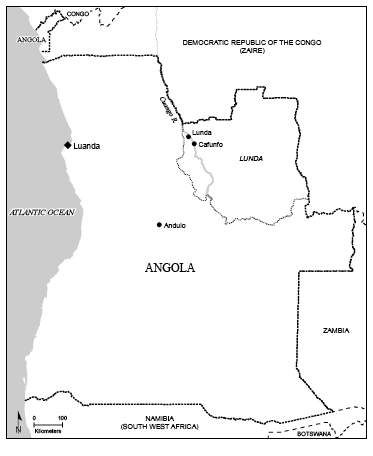

Diamond deposits are present throughout the continent. Although they are most abundant in Southern Africa, substantial lodes also exist in Central Africa, and to lesser degrees in Western and Eastern Africa. After the discoveries in South Africa in the 1860s, diamonds were subsequently discovered in a number of other locations on the continent, including the Congo in 1906; Namibia in 1908; Tanzania in 1910; Angola in 1912; the Central African Republic in 1913; Ghana in 1919; Sierra Leone in 1930; Guinea-Conakry in 1930; Liberia c. 1935; and Botswana in 1967, with lesser finds made in Zambia, Mali, Gabon, Lesotho, Mozambique, and Swaziland. Most recently, Zimbabwe has come online as a major diamond exporter. Both across and within these countries, diamond deposits can be located in drastically different terrain, such that a single country can feature both kimberlite and alluvial deposits, as well as an array of access conditions. In the case of Namibia, for example, many diamonds are “vacuumed” from the ocean shelf off the Atlantic coastline by workers operating behind massive walls that keep the powerful waters at bay. Although these stones constitute an extreme example, most onshore diamonds can be mined profitably even in the most remote and seemingly inaccessible locations, often with nothing more than a shovel and a sieve. This virtually guaranteed financial score is owing to the fact that bringing the product to a potential buyer does not require a vast or developed transportation infrastructure. Indeed, Hollywood constantly reminds us that a small pouch of stones can be easily moved around the world, often leaving a trail of cinematic intrigue, violence, and shadowy financial dealings in its wake.

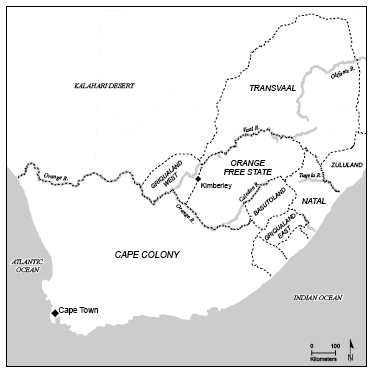

Africa’s Diamond Ascension and the Historical Importance of These Stones

Neither the role of diamonds in Africa’s history nor the importance of the continent’s stones in global history can be overstated. The discovery of payable deposits anywhere in the world invariably prompts an immediate response. Yet, in Africa’s case, the series of actions and reactions following the discovery of the Eureka Diamond were both exceptionally decisive and continue to have momentous implications for the continent’s residents. Virtually overnight, thousands of Africans, Europeans, Americans, and Australians, among others, descended on the dusty, dry, scarcely populated terrain where the South African fields were located. The trading post of Kimberley that sprung up in the midst of these discoveries quickly grew to become South Africa’s second-most-populated city, behind only the long-established port of Cape Town. Going forward, this diamond-driven, demographic phenomenon would recur across the continent as countless individuals, a range of imperial states, and dozens of mining enterprises vied for the stones embedded in Africa’s mineral-rich soils. Indeed, it is from the long history of contention for these coveted stones that the book draws its title.

One of the primary impetuses for the European colonization of Africa at the end of the nineteenth century was the continent’s storied mineral wealth. Following the diamond discoveries near Kimberley, Great Britain moved to consolidate its control of South Africa, fighting a series of wars against indigenous populations and Dutch descendant, or “Boer,” settlers. Other European powers subsequently mimicked this aggressive approach elsewhere on the continent, forcibly establishing control over previously sovereign African spaces. The particular geographical targets of these military advances were based on claims made leading up to, during, and following the 1884–85 Berlin Conference. In this fashion, the European imperial states literally mapped out the future occupation of Africa. Profound investment in and exploitation of the continent’s mineral riches marked the ensuing colonial period.

As investors poured more and more capital into the continent following a succession of diamond discoveries, Africa’s place in the global diamond industry rapidly ascended. As early as 1872, for example, South Africa was already producing six times the quantity of stones that Brazil had produced just a decade earlier. And with the emergence of South African–based De Beers in the 1870s, Africa was to become synonymous with diamonds. Legitimate rivals began to appear only in the middle of the twentieth century, following significant discoveries in the Soviet Union and, more recently, Canada. Yet, once these major non-African producers came online, De Beers strategically negotiated to purchase most of this new production and, thereby, maintain its legendary (near) monopoly. Meanwhile, during the colonial era in Africa, this type of supply-side manipulation of the market helped generate sorely needed funds for a number of white minority governments, including in Angola, Sierra Leone, and the Belgian Congo.

During the 1930s, as purveyors of the ultimate luxury item, the diamond industry naturally suffered due to the worldwide recession. Even De Beers was forced to cease production in a number of its mines for approximately five years in response to severely reduced global demand. However, following the outbreak of the Second World War, Africa’s diamonds regained their importance, though this time primarily in a martial rather than aesthetic sense. Indeed, you may be surprised to learn that these deposits were invaluable to the Allied powers’ war effort. During the peak years of the conflict, not only did Africa supply significant portions of the world’s gold, manganese, copper, cobalt, and uranium, but also 98 percent of the industrial diamonds, which were newly essential for the production of military hardware. The production of “industrial” diamonds—that is, small and/or low-quality stones and, thus, not “gem quality”—was centered on the Belgian Congo, from the mines of the Forminière company. With production soaring to 10,386,000 metric tons in 1945, the Congo alone supplied over 65 percent of the Allies’ industrial diamond and “bort” (low-quality industrial) needs during the war. Meanwhile, the Axis powers were forced to rely on prewar stocks and on a number of lesser sources, including French Guinea (Guinea-Conakry) in West Africa, which was controlled by France’s sympathetic Vichy government, and a much smaller stream of stones smuggled out of the Congo.[4]So, did Africa’s diamonds win the war for the Allies? Not quite. But, they did provide the victors with an important edge.

The Congo (DRC) continues to be a leading producer of industrials, which constitute roughly 80 percent of all mined diamonds, and are nowadays used in a variety of commercial applications. Given a diamond’s unparalleled hardness, industrials are often used for cutting and grinding, including as drill bits and in various types of saws. In fact, every time you ride in a car, industrial diamonds have helped facilitate that journey, as they are used in highway construction and repair; in gas, mineral, and oil exploration; and in the production of every car made in the United States (the manufacturing process for each automobile consumes over one carat of industrial diamond).

Since their invention in the 1950s, synthetic diamonds have steadily replaced natural-forming industrials, but they perform essentially the same tasks. Today, synthetics annually account for some 98 percent of the industrial market, and the United States is both a major producer and a consumer of these stones. Synthetics are less expensive, can be produced in almost unlimited quantities, and can be customized for specific applications. Synthetic industrials also show great promise as semiconductors in the construction of microchips and as heat sinks, which are used to cool down electronics, such as laptop computers. Given all of the current and potential usages for synthetic industrials, this industry is fast rivaling the overall value of the gemstone market.

Although synthetic stones, which can cost as little as 40 cents per carat, dominate the industrial market, buyers still insist on the “real thing” when seeking diamonds for jewelry or other ornamentation. Global demand for gem-quality stones resumed soon after the Second World War ended. Facilitated by De Beers’s monopolistic buying and selling schemes, extractive colonial mining companies quickly resumed pumping the wealth out of the continent’s soils and back into European coffers.

As the political “winds of change” blew across Africa in the 1960s and 1970s, during which time virtually the entire continent achieved independence from its European colonial overlords, the African leaders of the newly independent states adopted various approaches to diamond revenues. In some cases, including Ghana, Sierra Leone, Angola, and the Democratic Republic of the Congo (DRC), novice statesmen aggressively moved to nationalize domestic output. Yet, these measures typically met with dismal results for a number of reasons, including a lack of technical knowledge; an inability to prohibit access to alluvial supplies; operational mismanagement and corruption; insufficient capital to replace aging or broken equipment; and even civil conflicts. Conversely, other governments, in Botswana and Namibia, for example, proceeded down a different path by establishing successful public-private mining enterprises. It should be noted, though, that the circumstances in these two cases are somewhat unique: in Botswana, diamonds were discovered only in 1967, one year after political independence, and, in Namibia, independence arrived only in 1990. Furthermore, in both cases, deposits were in hard to access/easy to cordon off locations, which allowed for easier governmental control.

While African states contemplated how to manage their diamond resources following independence, both formal and informal miners continued to pry, dig, dislodge, and remove in every other conceivable way, these precious stones. By the end of the first decade of the twenty-first century, Africa had endured a series of devastating diamond-related developments, including “resource conflicts” and the emergence of “blood diamonds”—an occurrence that threatened to spark a consumer backlash reminiscent of that against the fur industry in the 1980s. Well beyond Africa’s control, though, a series of global recessions had also reduced demand for both gem and industrial stones. Yet despite these formidable challenges, Africa continues to be the premier continent for diamond production, with Botswana leading the way (see table 1).

Table 1. Estimated production by value of top producers (in US dollars), 2011

Botswana 3,902,115,904

Russia 2,674,713,800

Canada 2,550,875,198

South Africa 1,730,323,570

Angola 1,163,625,471

Namibia 872,567,637

Zimbabwe 476,218,677

Australia 220,720,063

Congo (DRC) 179,608,541

Source: http://geology.com/articles/gem-diamond-map/. Data source is the USGS Mineral Commodity Summaries.

Regardless of the periodic headline-grabbing discoveries of diamond deposits made far from Africa’s borders, De Beers’s ongoing, if slightly eroded, dominance ensures that the continent retains its preeminence in the industry. In 2004, for example, De Beers sold $5.7 billion worth of rough diamonds—or 48 percent of the world’s total—and reported earnings for the year of $652 million. Via production from its own mines, as well as a series of strategic agreements and partnerships with other mining operations, De Beers currently controls roughly 45 percent of the global output of diamonds. Through its vast commercial network, which as of 2002 also newly included dozens of high-end retail stores located around the world, the enterprise and its practices affect millions of diamond-industry employees worldwide. This combination of De Beers’s high-profile, global impact and its historic and well-publicized South African roots ensures that Africa’s association with diamonds is continually highlighted and reinforced.

Diamonds in Africa: A Blessing or a Curse?

Much has been made about whether Africa’s natural resources constitute a “blessing” or “curse” for the countries (un)lucky enough to possess them. Have Africa’s diamonds been, as Leonardo DiCaprio’s character in the film Blood Diamond declares, all about “bling bang,” that is, death and destruction? Or, do these stones offer a viable means to economic development and social improvement, as suggested in the quote by Botswana’s former president, Festus Mogae, which also led off this chapter? In practice, the answer is probably: both. Or, perhaps: neither. In certain settings, including Angola, Sierra Leone, and the DRC, the presence of diamonds has resulted in significant harm for resident populations. This damage has been physical, measured by the thousands of casualties and millions of people displaced by the diamond-fueled conflicts that have raged in these countries. The damage has also been economic, as large inflows of foreign capital and the attendant inflation of local currency rates—the symptoms of so-called “Dutch Disease”—have either crippled or precluded the development of other potentially promising sectors of national economies and thereby deepened resource dependency.[5]Yet in other countries, such as Namibia and Botswana, diamond deposits have generally improved the overall standards of living, failed to critically distort national economies, and, if anything, helped keep the peace rather than disrupt it.

At first glance, these contrasting examples appear reasonably clear-cut. However, a closer look is warranted. Consideration of shifting historical contexts and particular subsegments of national populations tends to muddy these otherwise seemingly clear waters. For example, with the diamond-fueled conflicts now over in both Sierra Leone and Angola, local populations are increasingly benefiting from diamond revenues, whereas in Botswana, if one were to invite commentary about the country’s diamond industry from the “Bushmen,” many of whom were forcibly relocated in order to facilitate formal prospecting, it’s unlikely that they would share Festus Mogae’s sanguine assessment. Thus even if on balance diamonds may appear to constitute either a “blessing” or “curse” for Africa and its peoples, it is probably neither prudent nor analytically useful to spend too much time trying to shoehorn the broad range of Africans’ lived experiences into these types of binaries. After all, diamonds are just inanimate objects, as incapable of launching a violent rebellion as they are of establishing prudent ministerial resource management policy. In this book, I provide in-depth examinations of the individuals, enterprises, and countries involved in order to provide more insightful understandings than those attainable via the simplistic formulation blessing or curse?

Book Content and Chapter Outline

The book features a series of loosely chronological chapters that seek to highlight the significance of Africa’s diamonds during different historical periods. To tell this story, I have drawn upon a wide range of primary source materials, oral interviews, African and international newspapers and other popular media sources, as well as the significant body of existing literature dedicated to diamonds the world over. The text attempts to weave these disparate sources together to highlight the key developments in the global history of the continent’s “stones of contention” up through the present day and, whenever possible, to place Africans at the center of this narrative. This approach entails consideration of Africans situated in an assortment of historical and geographical contexts, but does not include systematic coverage of every diamond-generating venue on the continent. Rather, specific examples are drawn from a variety of settings to illustrate broader themes and trends; consequently, some sites receive more attention than others. The chapters unfold as follows:

Chapter 2 examines external notions of Africa as a treasure trove of mineral wealth in the pre-Kimberley period, as well as some of the mining endeavors in which Africans were engaged that helped fuel these impressions. For centuries, Europeans understood that the provenance of the gold that appeared on the southern shores of the Mediterranean lay somewhere in the uncharted lands beyond the Sahara. In turn, this speculative knowledge helped prompt the first interactions between Europeans and sub-Saharan Africans, as Portuguese sailors steadily made their way south along Africa’s Atlantic shores in the fifteenth century. Following the resultant cross-cultural encounters, Europeans learned a great deal about Africans’ mining endeavors—alternately exciting and disappointing these interlopers depending on the existence and availability of the minerals they coveted. Yet for centuries Africans remained in firm control of their mineral resources, even when interacting with the most aggressive foreigners. This chapter explores the often divergent ways that Africans and outsiders regarded these resources and how, over time, these valuations shaped Africans’ encounters with those Europeans and Asians who reached the continent’s shores.

Chapter 3 considers the explosion of mining in South Africa following the Eureka discovery and the identification of significant diamond concentrations in the late 1860s in and around what became the commercial center of Kimberley. If Europeans had previously imagined Africa as a repository of precious minerals, these finds surpassed even their most optimistic estimations. Virtually overnight, these bountiful deposits precipitated a “rush” that resembled gold prospectors’ assault on California two decades earlier. In spite of this influx of both foreigners and international capital and the enactment of rac(ial)ist laws, African diggers held their own for some time following the discoveries; many even fared better than their white counterparts. Yet, following new legislation that permitted the amalgamation of individual claims, astute (and well-funded) businessmen such as Barney Barnato and Cecil Rhodes began to consolidate their holdings, ultimately leading to the emergence and eminence of De Beers. Africans were soon pushed to the margins to make way for foreign capital and local white mining interests, eventually limited to manual labor positions at the very bottom of the pecking order.

Chapter 4 explores the means by which De Beers revolutionized the diamond industry and over time became internationally synonymous with these stones. Africans, perhaps ironically, suffered the most in the wake of this development. The increasingly oppressive, racist South African state implemented policies that ensured that De Beers enjoyed a steady flow of indigenous labor to its mines. Once on site, the company monitored workers by requiring that they live in restrictive housing compounds. De Beers was motivated to introduce this form of housing in order to inhibit diamond theft, control allegedly “unruly” Africans, and draw a distinction between white and black miners. In turn, compound inhabitants experienced some of the worst conditions on mines anywhere in Africa, characterized by acute overcrowding and a variety of violent, intracompound antagonisms. Meanwhile, under the decades-long leadership of the Oppenheimer family, De Beers expanded its interests beyond South Africa, gaining exclusive control of output from South West Africa (Namibia), Angola, and the (Belgian) Congo. The company also reorganized itself into a vertical enterprise by introducing “single-channel marketing.” This aggressive arrangement saw an international cartel of producers, including De Beers, funnel all rough stones through its selling arm, the Central Selling Organization. In turn, the company was able to control supply and, eventually, demand—in great part by convincing global consumers that naturally occurring diamonds are rare, when, in fact, De Beers’s practice of limiting and stockpiling rough output is responsible for producing this artificial scarcity. For all of the enterprise’s success, though, its meteoric ascension was not without problems. In fact, acute mismanagement and catastrophic miscalculations in the 1920s saw the famed firm absorbed by the better-managed Anglo American conglomerate. Only because Anglo opted to retain the De Beers name for this portion of its diverse business is it possible to say that “De Beers” dictated the fate of the vast majority of the world’s diamonds from the 1920s to the 1990s.

Chapter 5 traces the establishment of diamond-mining operations across the continent as Africa came under European colonial rule. Unlike the “wild west” of the early Kimberley days or the violent chaos depicted in films such as Blood Diamond, most diamond-mining settings during the colonial period were actually highly organized and reasonably orderly affairs. Yet they also featured a host of disagreeable conditions for the African laborers who toiled on them. These employees’ experiences were further shaped according to whether a mine’s diamonds were located in superficial, alluvial deposits or buried deep in kimberlite pipes. The particular colonial master involved in local recruitment also played a major role in differentiating employees’ experiences. African headmen also influenced matters by compelling young male followers to engage with mining operations, typically in exchange for corporate or governmental compensation. Exceptionally, in the British colony of the Gold Coast, traditional African authorities themselves retained control of diamond deposits, renting out access to foreign mining companies and thereby playing a central role in the regional development of the industry. This chapter explores the diverse diamond-mining environments that colonial states, extractive companies, and African headmen collaboratively created. I examine the series of early twentieth-century discoveries of deposits scattered across the continent and trace the subsequent developments in these settings through the conclusion of the process of African political independence, which extended from the 1950s until the 1990s.

Chapter 6 continues the examination of colonial-era diamond mines, but adjusts the angle of approach away from states, corporations, and indigenous authorities in order to consider the motivations, strategies, and experiences of African laborers. Irrespective of whether forceful measures or attractive incentives brought Africans to diamond mines, it was on the backs of these workers that mining enterprises generated prodigious profits. Africans engaged with their respective employers in different ways, with some cyclically migrating for work, often according to the agricultural season(s), and others permanently relocating to take advantage of the wage-earning opportunities that increasingly urbanized mining environments offered. In certain settings, family members accompanied adult male laborers, but in most cases these men departed alone. Once on the mines, workers endured long, taxing days before returning to typically modest housing. In response to these challenging conditions, laborers creatively shaped their plights by employing an array of strategies. More aggressive measures included diamond theft, flight, and work slowdowns and stoppages, though most workers opted for less risky undertakings such as sharing tasks, singing songs, and befriending fellow employees. Only with the end of the colonial era in the 1960s and the dissolution of the apartheid regime in South Africa in the early 1990s, would mine workers come to enjoy significantly improved conditions and wages.

Chapter 7 explores the ways that a range of Africans have utilized diamond revenues to prop up oppressive governments, to destabilize others, and, in both of these scenarios, to precipitate widespread displacement and death. Arguably, the most notorious development of this nature was the emergence of “blood” or “conflict diamonds,” which helped fuel civil conflicts in Sierra Leone, Angola, and the DRC in the 1990s. In fact, it is now widely understood that even if social and political grievances may have originally precipitated these conflicts, rebel leaders eventually fought these wars (or, in the case of the DRC, fight them) primarily for the profits available rather than for any coherent political purpose(s). In other cases, dictators such as the DRC’s Mobutu Sese Seko, and, more recently, Liberia’s Charles Taylor and Zimbabwe’s Robert Mugabe, have used diamond sales to purchase arms in order to brutally perpetuate their regimes and deeply enrich themselves. Although the era of “blood diamonds” is arguably over, the industry is still struggling to contain the violent legacy of these stones and striving to change consumers’ perceptions about the relationship between Africa and these precious resources.

Chapter 8 offers refreshing counterexamples to those that appeared in the previous chapter via an examination of the ways that the leaders of independent African governments, namely Botswana and Namibia, have used diamond profits to build democratic states characterized by pacific foreign and domestic policies. These stable, transparent nations have distributed the revenues from their prodigious mineral wealth in a reasonably equitable manner and have also generated meaningful local employment opportunities within their mining sectors. Although their diamond industries are not completely problem-free, Botswana and Namibia, the first and sixth largest producers (by value) of stones, respectively, offer hope for African nations still struggling to effectively manage their diamond resources. Today, Botswana is classified by the UN as an “upper-middle-income country”; clearly, diamond profits are reaching the country’s inhabitants, even if inequity issues continue to trouble the nation.

Finally, a concluding chapter reflects upon the material introduced over the preceding chapters in order to consider what the continent’s diamond future might look like. Although there have been a number of promising recent developments in the industry, including the creation of managerial opportunities for women and the emergence of black mining executives, many Africans are still operating on the fringes of the industry, barely eking out a living. In many settings, Africans without high-level connections or significant firepower survive as artisanal miners, and thereby enjoy little in the way of personal or financial security. Traditionally ignored by both mining corporations and local governments alike, these highly vulnerable individuals are only now beginning to receive attention and support. This encouraging development, combined with the successful implementation of the Kimberley Process Certification Scheme (KPCS), which has helped stem the flow of “conflict diamonds”; the cessation of civil wars in Angola and Sierra Leone; increased employment opportunities; heightened corporate responsibility, which has included the allocation of diamond profits to fight HIV/AIDS; and the growing demand for good governance across the continent, suggests that diamonds are poised to play a positive role in shaping Africa’s future.

2: Africa’s Mineral Wealth

Material and Mythical

Off their coast . . . lies an island . . . and there is in the island a lake, from which the young maidens of the country draw up gold-dust, by dipping into the mud birds’ feathers smeared with pitch. If this be true, I know not; I but write what is said.

—Herodotus, in his account of the peoples of the west coast of Africa, c. 500 b.c.e.

The men of this land are ruddy in color and of good physique. . . . Their clothes are of very thin linen and cotton, of many colors . . . ; they are rich and embroidered. They all wear toques on their heads with piping of silk worked with gold thread. They are merchants, and they trade with white Moors . . . carrying gold and silver, cloves, pepper and ginger, rings of silver with many pearls. . . . Men of this land wear all these things.

—Vasco da Gama, describing Mozambique Island, 1498

Imagine how enticing the prospect of accessing Africa’s mineral riches might have seemed to you after reading Herodotus’s alluring depiction or Vasco da Gama’s sensational observations as the Portuguese “discovered” Africa, some two millennia later. Although the lapse in time between these two passages is significant, it is clear that Africa’s minerals were long valued by both insiders and outsiders. For their part, Africans had been tapping the continent’s vast mineral wealth well before Erasmus Jacobs discovered the Eureka Diamond in 1867. The metals and alloys that African societies valued included copper, iron, bronze, lead, and tin. Yet it was Africa’s gold that was primarily responsible for thrusting the continent into a series of durable engagements with the global community. Africans widely treasured this metal, using it domestically for both personal and architectural ornamentation, but they also introduced it into regional and long-distance trade networks. For example, African gold figured prominently in Trans-Saharan and Indian Ocean commerce, reaching destinations around the globe. In turn, the provenance of this precious metal helped foster external notions of Africa as a treasure trove of mineral riches. Coupled with powerful myths of the continent’s magnificent mineral endowments, foreigners aggressively attempted to locate the suspected sources of this prodigious wealth. European sailors and explorers had myriad motivations to investigate Africa in da Gama’s day, but the most compelling was the desire to access the continent’s legendary gold deposits.

For all of the enthusiasm that these maritime merchants displayed, misguided as it may have been, persistence turned out to be their most important attribute. For centuries prior to finally “hitting the jackpot” in South Africa, European commercial missions typically ended in disappointment rather than bonanza. On Africa’s Atlantic shores, for example, European merchants correctly identified the West African sources of gold that featured in the Trans-Saharan trade. And, after initiating commerce with African littoral communities, they were even able to redirect supplies of this commodity southward, to what they named—not surprisingly—the “Gold Coast.” However, local African leaders retained control of the trade between the inland producers and these foreign merchants, effectively denying the Europeans direct access to the gold deposits. Further south, European explorers’ and merchants’ dreams of additional, substantial mineral deposits proved to be illusory. The centuries that these foreigners spent fruitlessly searching along Africa’s south-central and southwestern coasts confirmed that their grandiose notions of significant mineral deposits in these areas were unfounded. Meanwhile, along Africa’s eastern coast, Middle Easterners, Asians, and, eventually, Europeans were unable to penetrate deeply enough, or for any sustained period of time, into the interior to gain access to the gold mines that fed the Indian Ocean trade. Regardless, by the middle of the eighteenth century this desire to access the continent’s gold was eclipsed by the insatiable demand for an even more lucrative African commodity: slaves.

This chapter examines the pre-Kimberley period and considers the ways that Africans engaged with the minerals buried in the continent’s soils and the manner in which outsiders sought to exploit this wealth. Despite foreigners’ relentless efforts to gain direct access to these real and imagined mineral deposits, Africans successfully safeguarded their endowments with relative ease and thereby largely dictated the terms of trade. Africans’ sustained dominance is explained by their superior force; the location of most mineral deposits far into the interior, rendering them hard to access; and outsiders’ acute vulnerability to an array of tropical diseases. But the outsiders never fully abandoned their dreams of deriving financial fortune from Africa’s mineral wealth. Rather, these aspirations merely went dormant for a time.

Domestic Utilization of Africa’s Minerals

It is impossible to pinpoint exactly when Africans began to value and mine the array of minerals with which the continent is endowed. We do know, however, that the ancient Egyptians believed that gold was a divine, indestructible metal associated with the sun and also that the skin of their gods was golden. Moreover, during the earliest periods of dynastic Egypt (beginning c. 3100 b.c.e.), only the pharaohs were permitted to use gold for personal adornment, while the chamber that held a pharaoh’s sarcophagus was known as the “house of gold,” owing to these leaders’ propensity to include large quantities of this metal in and around their tombs. The grave robbers of later years did not, after all, go to all of the trouble that they did just to marvel at the intricacy of a sarcophagus or to catch a glimpse of a mummified body. Yet, for all of the local reverence associated with this prized metal, gold did not possess great importance as either a currency or commodity. Instead, it was used primarily for funerary and ornamental purposes, most likely due to the limited deposits located within the Egyptian kingdom. Although gold may well be the most aesthetically appreciated of the minerals that Africans have historically mined, others, such as iron, were valued mainly for their functionality. African communities smelted iron ore in order to make weapons and cooking utensils, and even employed it as currency in certain settings in Western and Central Africa. Archaeological evidence suggests that Africans were mining and working iron ore from at least 1500 b.c.e., though scholars are continually revising the dates, exact locations, and patterns of knowledge transmission related to ironworking on the continent. Although Africans did not value iron for its aesthetic qualities in the same way that they did gold and other minerals, they did greatly revere the smiths who oversaw the complex process of producing ironware. It was widely believed that these individuals’ esoteric knowledge meant that they also possessed mystical powers.

If Africans, in the main, valued gold for its aesthetic appeal and iron for its utility, copper was considered both attractive and functional. Copper was utilized on the continent earlier than iron and in much greater quantities than gold. Africans appear to have embraced the metal so strongly due to its durability and malleability, but also for its unique color, luminosity, and even sonorous qualities. As such, Africans employed copper and its alloys (bronze, which is composed of copper and tin, and brass, which is made from copper and zinc) in a variety of ways. Copper was incorporated into various forms of artistic expression; it was also used as a medium of exchange when shaped into rods, as ingots in the form of crosses, and even as basins of varying size and weight. Beginning sometime before 2000 b.c.e., Africans began mining and smithing copper, bestowing on it an importance that far exceeded continental valuations of gold. In fact, when Africans began to trade gold as a commodity to outsiders, they often sought copper in exchange. Consequently, for some time Europeans believed that the continent did not feature significant copper deposits.

African Minerals as Export Commodities

Although Africans valued iron, copper, and a number of other metals and alloys, their willingness to export gold was responsible for sparking the global interest in the continent’s mineral endowments. By the first millennium a.d., gold was exiting the continent via both Trans-Saharan and Indian Ocean trade networks, ultimately reaching distant locations in Europe and Asia via a series of intermediary merchants.

The north-south trade that flowed back and forth across the Sahara was barely feasible until the domestication of the camel, which occurred sometime after 100 a.d. Starting as early as the third century, gold was one of the trade goods that these beasts of burden carried north across the desert in the form of dust, bars, nuggets, and sometimes jewelry. Mines controlled by the inland West African kingdoms of Ghana and Mali initially supplied virtually all of this gold. Over time, this output was supplemented, and eventually surpassed, by the production of the Akan mines located in the forest regions of what is the contemporary state of Ghana—mines that continue to generate mineral wealth to this day. In the tenth century, al-Masudi, the peripatetic, Baghdad-born “Herodotus of the Arabs,” described the form of “silent” or “dumb bartering” that these miners preferred—and also the extent to which they would go not to reveal the source(s) of this gold, thereby perpetuating the mysteriousness of its provenance:

Their donkeys, ladened with grains, leather, cloth and salt, and traders arrived . . . where men lived in holes (no doubt, mines). There, the traders spread out their goods along a stream or near a thicket. Then they announced their presence by beating on a special drum. . . . The merchants went away. The shy . . . miners crept from their hiding places and laid out a measure of gold dust. They, too, departed. Sometime later the traders returned, and, if the amount of gold dust was acceptable, they took it and left. If not, they went away again and the miners came back and made a counteroffer. Each group went back and forth until an agreement was satisfactory to both sides. Through years of experience, both sides had a general idea of what exchange would be acceptable, so the system generally moved quickly and smoothly. The silent miners inspired a lot of curiosity by trading in this manner. But, even if they were captured, as sometimes they were, the . . . miners chose death over betraying the location of the mines.[6]

Whether or not al-Masudi’s account was accurate, these miners’ alleged “death before divulgence” approach further deepened the intrigue associated with Africa’s mineral wealth. To be sure, the commitment to secrecy that these miners displayed would be considered extreme in any era. Meanwhile, almost a millennium earlier, Herodotus had described a similar form of silent, gold-centered commerce between West Africans and the Carthaginians, while also claiming that the Ethiopians located far up the Nile were so rich that they bound their prisoners in gold fetters. No less an individual than the so-called “Father of History” himself can, thus, be counted among the contributors to the powerful illusions and delusions associated with Africa’s mineral wealth.

The gold that was exchanged in this rather unconventional form of commerce eventually reached the southern shores of the Mediterranean. Upon arrival on Africa’s northern coast, it was either retained and used, for example, to mint local currency, or was shipped across the sea to Europe. In exchange, Berber and Arab merchants transported salt, copper, and, to a lesser extent, food southward. Although the journeys across the Sahara were arduous and the prices of goods going in both directions quite high, demand was unremitting, and many of the items that survived the trip south, including different styles of cloth, became favorites within African elite circles. In order to protect the gold mines—the engine that drove this cross-desert luxury trade—the kingdoms that emerged on the northern edge of the West African savannah, such as Mali, Ghana, and Songhay, featured large armies that effectively blocked attempts by North Africans to gain direct access to the deposits. Thus, just as sub-Saharan Africans successfully fended off foreigners’ efforts to make direct contact with the producers of coveted minerals elsewhere on the continent, so too did these West African states prevent their intracontinental neighbors to the north from wresting control of valuable gold deposits.

Along the East African coast, gold also played an important role in local commerce, as well as in long-distance, transoceanic trade. In this region, the Swahili city-states that had sprung up along the Indian Ocean coast from present-day Somalia to Mozambique resembled the termini located on either side of the Sahara due to their geographical and commercial importance.[7]And, similar to the way that Saharan traders linked the populations lying to the north and south of the desert, merchants operating out of these coastal centers acted as the commercial bridge between the mineral wealth emanating from the African interior and the buyers who came from as far as East Asia.

Just as Muslim writers were familiar with the trade in West African gold, they also knew of the existence of gold on Africa’s eastern coast. And, as we saw earlier, they didn’t hesitate to craft, and perhaps embellish, depictions of it. These accounts date as far back as to the time of al-Masudi (871–957), who mentioned in his writings that the source of this precious export was located in the region that is now Zimbabwe. Some centuries later, in 1225, Zhao Rukua, the superintendent of customs at the Chinese port of Quanzhou, also mentioned the presence of gold on the Swahili Coast in his work The Description of the Barbarians, an account of the countries where Chinese merchants traded and the goods that the populations of these nations offered. In fact, the production of this volume may very well have coincided with the emergence of gold as a significant commodity in the Indian Ocean trade, initially along the coast of present-day Somalia. By the fifteenth century, following the ascendancy of the city-state of Kilwa and its control of Sofala, the Swahili Coast polity through which this mineral was exported, gold had become the chief source of wealth of the southern portion of the East African coast.

As al-Masudi had correctly noted, the African goldfields that fed this expansive, transoceanic network were located in present-day Zimbabwe. These mines were managed by a succession of regional states, one of which was known as “Great Zimbabwe” (c. 1100–1450), whose kings allegedly lived surrounded by locally mined gold and copper ornaments and ate off of plates imported from Persia and China. Positioned at the head of the Sabi River valley, this kingdom was ideally situated for exploiting the long-distance trade between the goldfields of the plateau to its west and the (Indian) oceanic coast to the east. Not coincidentally, Great Zimbabwe’s ascendance corresponded with the rise of the coastal city-state of Kilwa. The inland kingdom supplied the coast with the gold and ivory that, from roughly 1300 to 1450, made Kilwa the richest in the array of these coastal polities. Duties imposed by the leader of Great Zimbabwe upon goods traveling overland to the coast also constituted a major source of wealth for the kingdom. So too did the tribute that regional, ethnic Shona chiefdoms offered in the form of ivory, gold, and food. Craftsmen resident at the capital of Great Zimbabwe worked this gold into fine jewelry, both for local, royal consumption and for trade with coastal communities, often in exchange for iron, cloth, or beads. Swahili merchants would typically then introduce this gold into the wider Indian Ocean trade. Eventually, Monomotapa (the Kingdom of Mutapa) replaced Great Zimbabwe, but this succession only bolstered the flow of gold to the coast. Unlike the rulers of Great Zimbabwe, who imported from further west the gold that they sent onward to the coast, Mutapa’s regents could rely on readily available, alluvial gold from the streams of the Mazoe region of the plateau.

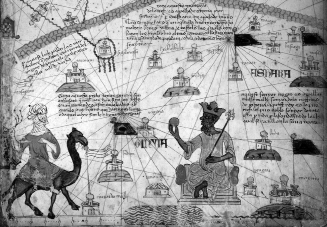

Undoubtedly, the most sensational broadcast of Africa’s mineral wealth was the pilgrimage of Mansa Musa, the ruler of the Mali Empire (c. 1230–1600), to Mecca in 1324–25. En route to the Arabian Peninsula, he and his massive entourage arrived in Cairo, in a procession of five hundred slaves, each carrying a six-pound staff of gold; one hundred camels, each carrying three hundred pounds of gold; and another one hundred carrying food, clothing, and other supplies. Just imagine the impact that this spectacle must have had! Moreover, Mansa Musa spent so abundantly in Egypt and gave away so many gifts of gold that the value in Cairo of this precious metal fell and failed to recover for some time thereafter. Over the ensuing decades, and then centuries, Mali’s fame continued to spread—no doubt as a consequence of Mansa Musa’s profligate trip. Indeed, as early as the fourteenth century, European geographers and cartographers began to grant the kingdom particular attention, regularly featuring it on maps. For example, in the Catalan map produced by Abraham Crepques in 1375, the king of Mali is shown seated on a throne in the center of West Africa holding a rather sizable nugget of gold in his right hand (see figure 1).[8]

Figure 1. Abraham Crepques’s map, c. 1375. Bibliothèque nationale de France.

For all of the attention that Africa’s minerals were generating, the continent’s diamonds played no part in this global fervor. This seeming implausibility can be quite easily explained: Africans bestowed no value on these stones, and foreigners were completely unaware that the continent was endowed with diamond deposits. Hence this immense mineral wealth remained embedded, untapped. As stated in the previous chapter, anyone who has seen a rough, uncut diamond can comprehend the lack of interest in these stones. Even centuries later, as rumors began to abound within European communities resident on the continent that this or that African society utilized diamonds to adorn their homes, or employed them to weigh down their hunting sticks, or just revered them for their hardness and indestructibility, no evidence exists that suggests Africans had developed any aesthetic appreciation or functional utilization for these stones. In fact, it appears that whenever one of these claims circulated, Europeans were responsible for generating them, perhaps out of incredulity that Africans seemingly had no interest in a mineral that these outsiders treasured so greatly.

External Imaginations of Africa’s Mineral Wealth

European curiosity regarding Africa’s mineral wealth mounted considerably over time. But access to these minerals would require more than mere desire or intrigue. Prior to the fifteenth century, despite Europeans’ comprehension that the gold that reached the Mediterranean originated somewhere south of the great Saharan expanse, they possessed neither the military nor the technical means (nor perhaps the necessary appetite) to impose themselves much beyond the northern African coastal regions. Only after the Portuguese developed the navigational technology necessary for oceanic journeys and the military technology necessary to ensure that they could return home safely, did the prospect of foreigners reaching Africa’s gold mines become a possibility and, eventually, a reality.

Fueling Europeans’ unrelenting desire to reach these lands to the south was a series of long-standing, powerful myths that colored their imaginations of Africa’s mineral wealth. In many respects, the illusions that these myths helped engender were merely the latest examples in the long history of gold-generated fantasies, from Jason and the Golden Fleece to Coronado’s Seven Cities of Cíbola. In this case, however, Catalan, Italian, and Jewish merchant communities operating in North Africa were supplying firsthand accounts of Africa’s significant mineral exports, which lent these myths an aura of authenticity. These traders also suggested that the African gold that was reaching Europe constituted just a minute fraction of what would be available if the sources of these mineral commodities could be located. These European merchants believed that the gold for which they were trading derived from the mythical “Island of Gold,” a recurring site in the history of external imaginations of West African mineral wealth. In fact, many European maps of the period featured the “River of Gold,” which was probably the Senegal River. According to the myth, the “mouth of the river was large and deep enough for even the biggest ship,” and although the actual gold fields lay far upstream, by the early fourteenth century the allure had propelled a Catalan merchant to attempt to reach this legendary source. Indeed, the many unsuccessful efforts to find this deposit, which was most likely composed of the gold-producing regions of Bambuk (on the upper Senegal) and Bure (on the upper Niger), preoccupied both Muslim and Christian rulers alike for hundreds of years. As one scholar has soberly commented, this enduring obsession ultimately “cost kings their thrones, peoples their freedom, and thousands their lives.”[9]

Arab and European written accounts further stimulated these ill-advised quests. Authors regularly referred to the elusive, mythical commercial centers of the gold trade in the West African interior as the “Lands of Gold,” of which the aforementioned “Island of Gold” was often an integral component. The initial provocateur was probably the Arab writer, al-Fazari, who first referred to a “Land of Gold” (most likely the incipient kingdom of Ghana) sometime prior to 800 a.d. Numerous Arab authors would subsequently echo him, though none, as far as is known, ever actually traveled to the region. A number of learned Arab and European writers also surmised—mostly incorrectly—that the major West African trading centers for gold were situated near the sources of this precious metal. Speculation of this nature, coupled with geological ignorance, led the Persian geographer Ibn Khurdadhbih to assert in the ninth century that in the kingdom of Ghana’s capital city gold “grew in the sand like carrots” and was gathered each morning at sunrise! Displaying similar license, three centuries later the Arab geographer and historian al-Bakri described the kingdom of Ghana’s court as follows: “The king . . . sits in a pavilion around which stand his horses caparisoned in cloth of gold; behind him stand ten pages holding shields and gold-mounted swords; and on his right hand are the sons of princes of his empire, splendidly clad and with gold plaited into their hair. . . . The gate of the chamber is guarded by dogs of an excellent breed, who never leave the king’s seat; they wear collars of gold and silver.”[10]Although these sorts of literary speculation were obviously fanciful, the Portuguese and other Europeans would later discover that this West African land of “golden carrots and gold-collared canines” was, in fact, quite tangibly bountiful.

Legendary accounts of Africa’s mineral wealth were not limited to West Africa. Further south, the Zimbabwean output was so profuse that many Europeans were convinced that its origins must be the biblical land of Ophir, from which the illustrious Queen of Sheba allegedly procured the copious gold that she traded with King Solomon of Israel. This durable myth, fed by the actual gold that these interior states were furnishing for the coastal trade, over time compelled countless foreigners to brave the African hinterland in search of the famed source.

Perhaps the most provocative of the many myths that circulated was that of Prester John. This fabled Christian priest-king allegedly oversaw an immensely wealthy kingdom, which propelled innumerable journeys seeking his/its location. Although early notions of Prester John’s kingdom placed it in Asia, Europeans later believed his realm lay in Africa, in great part due to the Abyssinian King Wadem Ar’ad’s decision in 1306 to dispatch an embassy to the Papal Court at Avignon. Its arrival in Europe seemingly corroborated the Prester John myth and prompted the Holy See to send legates to Abyssinia (Ethiopia) to seek an alliance with the king, who was now perceived to be the elusive monarch. Subsequently, African and European envoys were sent with some regularity between Ethiopia and Rome. In this respect, Africans were fueling outsiders’ delusions, even if unintentionally. Down through the centuries, Prester John fantasies persisted, periodically reinvigorated by fantastical European accounts, including the following by the Italian poet Ludovico Ariosto in 1516:

The castle in which the Ethiopian sovereign resided was in an opulence far in excess of its strength: the chains on the drawbridges and gates, every hinge and bolt from top to bottom, indeed everything for which we use iron, here was made of gold. Even though this finest metal was in such abundance, it was not disdained. The great loggias of the royal palace consisted of arcades in limpid crystal. Rubies, emeralds, sapphires, and topaz, spaced out proportionately, provided a glittering frieze of red and white, green, blue, and yellow beneath the fine ceilings.[11]

In the wake of Mansa Musa’s trek, there were even some who believed that the Malian ruler was, in fact, the legendary Prester John. Regardless of the particular “speculation du jour,” though, Europeans’ perpetuation of the Prester John myth continued to shape their interactions with and beliefs toward Africa long after the legend should have been dismissed and taken its rightful place in history, somewhere near the final resting spot of Jason and his Golden Fleece.

Actively Seeking Africa’s Treasures

Despite Europeans’ commitment to gain unmediated access to Africa’s mineral resources, neither Portugal nor any of its immediate imperial imitators were able to capture areas of significant mineral wealth. Indeed, for centuries following their initial encounters, Africans successfully prevented Europeans from gaining access to the continent’s mineral deposits. Only following the Kimberley diamond finds, the subsequent discovery of gold on the South African Rand, and the contemporaneous onset of formal European colonization, would foreigners enjoy direct access to Africa’s mineral endowments. Having waited patiently for these opportunities, these covetous outsiders wasted no time in exploiting the riches about which they had been dreaming, literally, for centuries.

In addition to the allure of Africa’s mineral wealth, a number of other motivations drove the initial European ships southward. Primary among these impetuses was the search for a sea route to Asia and, in particular, India, so as to circumnavigate the hostile Ottoman Empire, which had expanded from western Asia into southeastern Europe. Merchants were also energized by the possibility of establishing new markets for a range of European goods and then returning home to sell exotic wares from distant lands. An aspiration to spread Christianity to new domains also played a role, as did the desire to replenish dwindling monetary reserves and to secure the various metals used in specie. Yet, of all the factors that encouraged the European navigation of the southern Atlantic, the prospect of a short route to the West African goldfields was arguably the most influential. While the immense profits that could be generated if this objective could be met undoubtedly played an instigative role, so too did Europeans’ desire to disengage commercially from Muslim North Africa and thereby reduce their reliance on a people who held antagonistic religious beliefs. Bypassing the middleman is, of course, a time-honored business strategy, but it’s even more appealing when you truly dislike him. Ultimately, Europeans believed that by gaining direct access to the West African goldfields they could finance further exploration, which would eventually reveal a sea route to India.

By the early fifteenth century, Portuguese sailors began to reach points south of the Sahara. Along the West African coast they began interacting and trading with, for example, the rulers of the Senegambia region, offering salt, cloth, and especially horses in exchange for slaves and limited quantities of gold. They also brought back to Lisbon alluring stories about the continent, including the practice of silent barter that al-Masudi had described some centuries earlier. The demonstrable availability of gold, in turn, whetted the appetites of metropolitan Portuguese and helped render commercial voyages less speculative and more assuredly profitable. The greater likelihood of financial success generated significant interest within Portuguese noble and merchant circles, and also among Castilians and Italians, including one Christopher Columbus, prior to his “sailing the ocean blue.”