Chapter 18

Tax

Money saved is money earned.

—Benjamin Franklin

This chapter is about earning money through tax savings. It provides a practical overview of the credits, deductions, and dependents you may be able to claim as a person living with a challenging condition, as well as deductions other people may be able to take if they assist with your medical and/or living expenses. It does not cover the entire tax code, and no issue is treated exhaustively. If you think a deduction or credit may apply to you, confirm the details from a reliable source.

Tip. Even if you rely entirely on a professional to prepare your tax return, skim this chapter to identify the issues you should address with your preparer to minimize your taxes.

This discussion follows the order of the standard IRS tax form 1040 for individuals.

Section 1. Biographical Data

1.1 Filing Status

Each year, calculate tax liability in all the different “filing status” situations for which you might qualify to determine which is the most advantageous for you.

Married couples should calculate liability jointly and separately. Separate returns may result in a lower tax bill if both spouses have income and one spouse has the majority of deductible expenses. For example, if Willard has an Adjusted Gross Income (AGI) of $40,000 and has medical expenses of $5,000, and his wife, Lillian, has an AGI of $60,000, and they have the average amount of itemized deductions for their income bracket, there will be no medical deduction allowed if they file a joint return because medical expenses must equal 7.5 percent of AGI before they are deductible ($5,000 is only 5 percent of $100,000). However, if Willard and Lillian file separate returns, Willard will be able to claim some medical deduction because the $5,000 is applied against a lower AGI, having a net effect of lowering their combined tax liability.

A widower with a dependent can continue to file as married for two years after the death of a spouse.

On the other hand, if two people live together and one person has large medical expenses and little income, and other conditions are met:

• It may be worthwhile to get married to take advantage of the medical deduction.

• Even without getting married, it may be possible to file as head of household or to apportion deductions and credits that either person could take separately. The person to take them is the one to reap the greatest benefit. For example, if the couple owns real estate together, calculate which person would do better to take the interest deduction.

• One person may qualify as a dependent of the other for the purpose of assigning medical expenses to take advantage of the deduction.

1.2. Dependents

Claiming people as dependents is important because each dependent gains the taxpayer a deduction of $2,650 from AGI. In addition, claiming a person as a dependent may allow the taxpayer to claim credits for the medical and other expenses paid by the taxpayer for the dependent.

Dependents can be

• children.

• parents receiving over 50 percent of their support from the taxpayer.

• any person living with the taxpayer, including a friend, as long as

• the two lived together for the whole year;

• the taxpayer paid more than half of the person’s support; and

• the person had a gross income of less than $2,650. The person who can be claimed as a dependent does not have the option of claiming herself as a personal exemption if she files her own 1040.

Tip. Four very different definitions of dependent are contained in the Tax Code. Be careful to check the definition that relates to the relevant issue.

Section 2. Income

2.1 Taxable Income

Individual disability income policies. There is no tax on disability income paid by an insurance company if premiums for individual disability policies were paid with after-tax dollars.

Employer-sponsored disability income plans. The income is taxable if premium payments are made directly by the employer or if payments are attributable to employer contributions to a funded plan. Income benefits are not taxable if the employee pays the premiums with after-tax dollars. (For a further discussion, including a tip for a tax break, see chapter 8, section 2.)

Sickness and disability benefits. Sickness and disability benefits under employer-financed plans in which an employer rather than an insurance company pays health expenses or disability income are taxable income because they usually represent a substitute for taxable wages.

Indemnity payments. Money paid under an insurance contract for nonmedical services (such as indemnity for loss of income or for loss of life, limb, or sight) is taxable income.

Reimbursement for expenses. If you claim a deduction on your taxes for medical expenses and receive a reimbursement for those expenses from an insurance company in a subsequent year, that money received is taxable income in the year that you receive it.

Capital gains. You can have short- and long-term capital gains on investments, including your home. Short-term capital gains are always taxed as income. Long-term capital gains enjoy special treatment in that the maximum tax rate for these gains is 20 percent if the property has been held for more than eighteen months at the time of sale. Gains tax on sales of collectibles and of property held for more than one year but not more than eighteen months is 28 percent. If a taxpayer’s capital losses exceed capital gains for a year, the maximum amount of capital gains losses that can be claimed against other income is $3,000. If capital loss exceeds $3,000, you can carry over the unused part to later years until it is completely used up.

When a loss is carried over, it remains long-term or short-term. A long-term capital loss carried over to the next tax year will reduce that year’s long-term capital gains before it reduces that year’s short-term capital gains. Unfortunately a capital loss sustained by a decedent during his or her last tax year can only be deducted on the final income tax return filed for the decedent. It cannot be deducted by the decedent’s estate.

Sale of a home. See chapter 22, section 3.

2.2 Nontaxable Income

The following is a brief discussion of certain nontaxable forms of income, including employer benefits.

Health-related payments by an insurance company, Medicare, and Medicaid. Payments made to a third party by an insurance company, Medicare, or Medicaid are not taxable income to you.

Social Security Disability insurance (SSD). SSD payments are not subject to federal or state income taxes until you receive or earn a certain amount of other taxable income in the tax year. See chapter 8, section 8.1. For lump-sum retroactive payments, see the same section.

Supplemental Security Income (SSI). This is not taxable regardless of any other taxable income you earn or receive during the year.

State Social Security payments. Taxation varies by state.

Accelerated death benefit/Viatical settlement. Effective January 1, 1997, accelerated death benefits received from life insurance contracts on behalf of a “terminally” or “chronically ill” insured are exempt from income tax. In certain circumstances, amounts received on the sale to a qualified purchaser of a life insurance policy by an insured with a life-challenging condition are also tax free. See chapter 19, section 3 for details.

Sale of a life insurance policy does not affect taxability of SSD or SSI.

Workers’ compensation. Workers’ compensation payments are not taxable. If medical expenses were deducted in a prior year for an injury for which the employee receives workers’ compensation in subsequent years, an amount equal to the deduction is taxable.

Death benefit payments. A beneficiary of a life insurance policy is not taxed on the proceeds if the money is

• received under a life insurance contract, and

• paid, whether in a single sum or otherwise, by reason of the death of the insured.

It makes no difference who pays the premiums on the policy. A business as beneficiary of the life insurance policy may be an exception to this rule. Proceeds from a life insurance policy may be subject to tax in the insured owner’s estate.

Death benefit payments under workers’ compensation insurance contracts, endowment contracts, or accident and health insurance contracts are generally considered life insurance proceeds payable by reason of death for income tax purposes and are nontaxable.

Gift or inheritance. Cash or the value of property acquired by gift or inheritance is excluded from the gross income of all taxpayers. Gifts are subject to the unified tax payable by the person who makes the gift (see chapter 33, section 4). However, if a bequest actually constitutes payment for a taxpayer’s services prior to the taxpayer’s death, the bequest is included in the gross income of the recipient.

Employer-sponsored life insurance. Employees may exclude from taxable income the cost of group-term life insurance provided directly by their employers, only if the coverage is less than $50,000. The cost of group-term life insurance for purposes of this exclusion is not based on the employer’s actual cost of providing such coverage, but is determined under the uniform premium table method. The cost of any coverage that exceeds $50,000 is taxable income to the employee.

Nontaxable interest income. For purposes of both state and federal taxes, certain interest income is nontaxable.

Long-term care. Payments received from a long-term-care policy are tax-exempt up to $175 per day. See chapter 14, section 11.

2.3 Flexible Spending Accounts and Individual Spending Accounts

Flexible spending accounts (FSA) and individual spending accounts are benefit programs offered by employers that give an employee the opportunity to convert a portion of salary to a tax-free FSA that may be used to pay for eligible child- or dependent-care expenses, including medical expenses. FSA spending accounts are generally thought of as arrangements solely designed to benefit the two-earner nuclear family with small children. However, these arrangements are also available to married couples and sole wage earners who have dependents as defined for purposes of FSA, such as an ailing parent or even people who are not related. In certain cases, FSAs may work for an unmarried couple where one-half of the couple is ill and not a wage earner.

Under an FSA, a taxpayer may exclude up to $5,000 in income from taxation to provide reimbursement of health care expenses for the taxpayer and the taxpayer’s dependents, and expenses incurred to care for her qualifying dependents while she and her spouse are at work.

Because the taxpayer’s and dependent’s medical expenses, paid pretax through an FSA, are not statutorily subject to a medical expense limit, such accounts almost always generate greater tax benefits than deducting medical expenses since the taxpayer can only deduct those expenses if the total exceeds 7.5 percent of adjusted gross income.

Similarly, most middle-income taxpayers prefer to pay dependent-care expenses pretax through a dependent-care account, which has a $5,000 limit, than claim a dependent-care credit (discussed below).

Care of a friend. If a friend lives and maintains a home with the taxpayer throughout the year, receives over half of her support from the taxpayer, and is otherwise the taxpayer’s dependent under the rules described below, the taxpayer may pay the friend’s medical expenses through the taxpayer’s FSA. Similarly, if the taxpayer must pay for the provision of nursing care in the home for the dependent sick friend to enable the taxpayer to continue working, such care should qualify for reimbursement under an FSA.

Relationship/household member test. For purposes of applying the health-care or dependent-care FSA rules, a dependent must meet a “relationship” or “member of the household” test and must also meet a “support” test.

To be treated as a dependent of the taxpayer under the FSA rules, an individual must have a specified blood or legal relationship with the taxpayer and receive over half of her support from the taxpayer for the calendar year in which the taxable year of the taxpayer begins. An unrelated individual who was not the taxpayer’s spouse at any time during the taxable year may nonetheless be treated as a dependent if the individual’s principal place of abode was the taxpayer’s home and the individual was a member of the household. There is no limitation on the amount of the dependent’s gross income. Related or not, the term dependent does not include any individual who is not a U.S. citizen or national, unless such individual is a resident of the United States or of a country contiguous to the United States.

Support. The term support includes food, shelter, clothing, medical and dental care, education, and the like. It also includes such items as theater tickets, holiday presents, recreational expenses, transportation costs, and church contributions.

Death of the dependent. If the dependent dies during the year, the taxpayer is entitled to the deduction if the dependent lived in the household for the entire part of the year preceding death.

2.4 Medical Savings Accounts

Self-employed individuals and individuals employed by “small employers” who are covered under a high-deductible health plan are able to deduct contributions to a medical savings account (MSA) to fund uninsured medical expenses for themselves and their dependents. Income earned in an MSA is tax free, as are distributions to pay for medical expenses.

MSAs are like IRAs, except they are created to defray unreimbursed health care expenses. (If you are not familiar with an IRA, see chapter 12, section 7.) Contributions to the account by an individual are deductible when calculating gross income, and contributions made by an individual’s employer are excluded from gross income except if made through a cafeteria plan. A cafeteria plan is a separate benefit plan that an employer maintains under which all participants are employees and each participant has the opportunity to select among two or more benefits. These benefits are excludable from the income of the participant to the extent that qualified benefits are chosen.

Contributions may be made for a tax year at any time up until the due date of the return for that year without extensions (April 15 in most cases). Employer contributions must be reported on the employee’s W-2.

Distributions. At the time of distribution the similarity to an IRA ceases. Distributions for qualified medical expenses (unreimbursed expenses that would be eligible for the medical expense deduction) incurred for the benefit of the individual, a spouse, or dependents are generally excluded from income. Health insurance may not be purchased with distributions from the account (except for COBRA continuation coverage required by federal law, qualified long-term-care insurance, or a health plan purchased while the individual is receiving unemployment compensation). No exclusion is available if the medical care is rendered for an individual who, during the month the expense is incurred, is not eligible to participate in an MSA and whose contributions have been made to the MSA for that tax year.

Additional coverage. With an MSA, you cannot have two health coverages, unless the additional coverage is for accidents, disability, dental care, vision care, long-term care, medical supplemental insurance, liability insurance (including workers’ compensation), coverage for a specific disease or illness, or fixed per diem coverage for hospital stays.

Tip. If you have an MSA, keep a copy of your insurance policy, proof of your contributions to your account, and canceled checks or receipts for medical expenses.

Medicare. As of January 1, 1998, MSAs may be used as a Medicare+Choice. See chapter 15, section 1.4.

Section 3. Adjustments to Gross Income

3.1 Self-Employed Insurance Premiums

A significant adjustment to gross income for the self-employed is the deduction for health insurance premiums. In addition, self-employed people do not have to meet the 7.5 percent threshold normally required before medical expenses can be deducted. For tax years 1998 through 2002, self-employed persons are entitled to deduct 45 percent of the amounts paid for health insurance for themselves, their spouses, and their dependents when calculating their adjusted gross income. The deduction increases by 10 percent each year beginning in 2003, with the maximum percentage being 80 percent for the tax years beginning in 2006 and thereafter.

3.2 Medical Payments as Alimony

Medical expenses paid to a third party, such as to doctors or hospitals, on behalf of the spouse or former spouse at his or her request qualify as deductible alimony, assuming all other requirements are met.

Tip. If you pay medical expenses for your separated spouse under a separation agreement or for your former spouse, you should deduct the payment as alimony, not as medical expenses. Alimony is fully deductible from your adjusted gross income (whether or not you itemize your deductions), whereas only the portion of your medical expenses that exceeds 7.5 percent of your adjusted gross income will be deductible.

3.3 Dependency

An important discussion for some taxpayers is dependency. Dependency is important because

• you can claim your dependent’s personal exemption of $2,650.

• you can combine your itemized deductions, including medical expenses, to increase your overall itemized expenses. Otherwise, if the person does not have to file a return, her medical expenses are not used.

• you can claim a dependent-care credit if you are paying for her care while you are at work.

• you can take advantage of any tax-free benefits for dependent care your employer may offer.

• if you establish a Flexible Spending Account with your employer, you will be able to include the expenses of your dependents as reimbursable expenses.

3.4 Itemization of Deductions

Allowable itemized deductions include medical expenses, mortgage interest payments, real estate and state taxes, charitable contributions, and un-reimbursed business expenses, to name a few. If you itemize your deductions and they do not exceed your standard deduction as listed on the 1040, then take the standard deduction. Your filing status will determine your standard deduction.

Tip. The IRS has prepared manuals for use of its auditors to help find abuse in different professions. If you are a member of one of the professions, these manuals can be helpful in preparing your tax return. You can obtain a free copy by writing to the IRS Office of Disclosures, P.O. Box 795, Ben Franklin Station, Washington, DC 20044.

Average deductions. Each year the IRS publishes the average amount of deductions claimed by taxpayers in different Adjusted Gross Income ranges. While the information is free, you cannot obtain it just by calling the IRS. It is listed on the IRS’s Internet site at www.irs.ustreas.gov/prod/tax_stats. It is also available from various information services such as Commerce Clearinghouse (CCH) at 800-TELL-CCH. Taxpayers who claim itemized deductions cannot rely on averages by declaring a number within the averages without having made the expenditures. You must be prepared to substantiate your deductions if audited.

Tip. If your claimed deductions exceed the average amounts, the deductions may act as a flag for an audit. A statement from a doctor suggesting you purchase the item or incur the medical expense you want to deduct should be attached to your return to help forestall an audit.

3.5 Medical Deductions

Threshold. Medical expenses are deductible only if the total of all your medical expenses is at least equal to 7.5 percent of your Adjusted Gross Income. For example, if your Adjusted Gross Income is $60,000, your medical expenses must equal $4,500 or more before any of the expenses can be deducted. The more income you have, the higher your medical expenses have to be before any of them can be deducted.

You and dependents. Medical expenses include your medical and dental expenses and those of your spouse and all your dependents. You can include the medical expenses of any person who is your dependent even if you cannot claim an exemption for him or her on your return because the dependent received $2,650 or more of gross income or filed a joint return. If you paid for more than 50 percent of a person’s expenses for the year and that person lived with you for the whole year, then you are allowed to claim that person as a dependent and can treat their medical expenses as your own.

You cannot deduct medical expenses you paid for somebody else unless you can properly claim that person as a dependent.

What can be deducted—medical care. The medical expense deduction is specifically limited to amounts spent for medical care. Medical care is broadly defined to include amounts paid for the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any structure or function of the body, including amounts paid for accident or health insurance and certain travel expenses. An expenditure that is merely beneficial to general well-being or health is not an expenditure for medical care. Also, the term medical care does not include

• unnecessary cosmetic surgery.

• operations or treatments that are not legal whether rendered by licensed or unlicensed practitioners.

Tip. Avoid wasting medical expenses that could be deductions by accelerating or postponing paying them into a year when your expenses will at least equal 7.5 percent of your Adjusted Gross Income. If your income varies, shift expenses into the year in which you’ll make less money so you will exceed the 7.5 percent ceiling. Payments must be mailed by December 31 of the qualifying year.

What is “medical care” depends on the nature of the services rendered, not on the experience, qualifications, or title of the person rendering them. In general, medical care includes services of psychiatrists, psychologists, surgeons, dentists, ophthalmologists, optometrists, chiropractors, chiropodists, anesthesiologists, gynecologists, neurologists, obstetricians, dermatologists, pediatricians, podiatrists, osteopaths, and Christian Science practitioners. Payments made to a holistic healing center that prescribed only a change of diet would not be deductible as medical expenses.

Deductible medical expenses include wages and other amounts you pay for nursing services. Services need not be performed by a nurse as long as the services are of a kind generally performed by a nurse. This includes services connected with caring for a patient’s condition, such as giving medication or changing dressings, as well as bathing and grooming the patient. Only the amount spent for nursing services is a medical expense. If the attendant also provides personal and household services, these amounts must be separated.

Hospital fees, doctor bills, and other expenses reimbursed directly by insurance companies are not expenses that can be included as itemized deductions.

Tip. People tend to think, “If it is not reimbursable from an insurance company, it is not deductible.” As you see in this text, this is not necessarily the case.

Examples of medical deductions.

• Fees for medical services.

• Fees for hospital services.

• Insurance premiums you pay for medical and dental care.

• Long-term-care costs.

• Medicare Part B payments.

• If a taxpayer only qualifies for Medicare Part A because of age and therefore has to pay premiums for Part A, the premiums are deductible.

• Insurance on contact lenses for a person who requires them.

• Meals and lodging provided by a hospital during medical treatment.

• Special equipment, such as a motorized wheelchair, hospital beds, and other medical equipment for use in the home.

• Special items, including false teeth, artificial limbs, eyeglasses, hearing aids, crutches, and the like.

• Prescription drugs and insulin are the only medications that are considered medical expenses. Prescription drugs include those prescribed by a doctor and purchased and used in a location where the sale and use are legal—even if the sale is not legal in the United States. Over-the-counter drugs and medical remedies are not deductible, even if prescribed by a physician.

• Acupuncture, even though the state medical association does not recognize acupuncture as a form of medicine.

• The portion of a housekeeper’s salary that goes toward the medical care of a sick resident.

• Social Security taxes on the wages paid to a private nurse.

• Whiskey prescribed by a physician to relieve pain (but not marijuana under any circumstances, even though its use for medical purposes is legal in some states).

• The full cost of a wig prescribed by a physician for a patient who has had hair loss due to chemotherapy (because it is “essential to mental health”).

• Extra cost for salt-free or other special food prescribed by a doctor.

• A stereo for a person confined to the house by multiple sclerosis.

• Hand controls for the care of a handicapped person.

• A guide dog for a blind person.

• A car telephone for a person who may require instantaneous medical help.

• Treatment of alcohol and drug abuse.

• Lipreading instructions for a person who is hard of hearing.

• The extra cost of braille editions of books for the blind.

• A reader to assist a blind person at the job (this could also be considered a deductible job-related expense).

• The cost of electricity to operate medically necessary equipment such as whirlpools or central air-conditioning.

Transportation. Medical expenses include payments for transportation “primarily for and essential to medical care.” Taxicab fares and other local transportation expenses such as automobile or train incurred in traveling to and from a doctor’s, a psychologist’s, or a dentist’s office or a hospital are deductible, if substantiated as being primarily for receiving medical services.

Transportation costs incurred in attending meetings of an Alcoholics Anonymous group are deductible if your attendance is pursuant to medical advice that membership is necessary for the treatment of a disease involving the excessive use of alcohol. In addition, transportation expenses to attend support groups or other meetings on the advice of medical authorities are deductible.

Medical expenses do not include expenses that are, in fact, commuting expenses, even in the case of a disabled person.

Tip. If you use your car to travel for medical purposes, keep a record of the mileage in a diary in your glove compartment that shows where you went and how far you traveled, plus receipts for parking and tolls. You can deduct either actual expenses or ten cents a mile for the use of your car for medical reasons. Under either method, you can add parking and tolls to the amount you claim.

You cannot deduct transportation expenses if, for nonmedical reasons only, you travel to another city or country for an operation or other medical care prescribed by your doctor.

If a person is employed as a traveling companion for one who is too ill to travel alone. If the trip is for the sole purpose of alleviating a specific chronic ailment, the travel expenses of the companion qualify as a deductible medical expense as long as that person can give injections, medications, or other treatment “required by the patient who is traveling to get medical care and is unable to travel alone.”

Lodging. Amounts incurred for lodging, but not meals, while away from home on trips that are “primarily for and essential to medical care provided by a physician in a hospital or similar facility” are deductible as medical expenses. Lodging expenses are not deductible if there is “any significant element of personal pleasure, recreation, or vacation in the travel away from home.” The lodging cannot be lavish or extravagant—the IRS will allow no more than $50 per night per individual as a deductible medical expense.

Health insurance. Amounts paid as premiums for health insurance are deductible as medical expenses. Amounts paid entitling the taxpayer to receive medical care from a managed care company are also deductible. A taxpayer who is over age sixty-five and not entitled to Social Security benefits may deduct premiums voluntarily paid for basic (Part A) Medicare coverage. These payments are made solely at the option of the taxpayer and thus are similar to premiums paid for supplementary (Part B) medical insurance benefits, which are also deductible. Premiums paid for MediGap coverage are included in amounts paid for medical care, but amounts withheld from wages (or paid on self-employment income) for health insurance under the Social Security program are not deductible as medical expenses.

Long-term-care insurance. Premiums paid for long-term-care insurance are considered to be medical expenses for tax purposes. The federal law includes stringent standards for policies to qualify for deduction, and these standards are tougher than some state rules. Policies sold before 1997 remain eligible. Any plan after that should be checked to be sure it meets federal and state standards.

Household help. The expense for household help is not a deductible medical expense. However, a taxpayer may deduct household help expenses if the help is employed partly for the well-being and protection of a qualifying dependent person. This is achieved by filing a form 2441 for a dependent-care credit. Household services are ordinary and usual services done in and around the home that are necessary to run the home. They include the services of a housekeeper, maid, or cook. However, deductible services do not include the services of a chauffeur, bartender, or gardener.

Capital improvements. If you make a change in your home to accommodate your medical condition, your spouse’s, or a resident dependent’s, the extent to which the value of your property was not increased by the expenditure is the only amount that is deductible. When Gary B. paid over $10,000 to have the doorways in his house widened to accommodate his wheelchair, he could deduct all of the expenditure because it did not increase the value of his home at all. However, $75,000 of the $175,000 Jon N. spent to install an elevator in his town house was not deductible because the value of his house was increased to that extent.

Tip. Since the IRS tends to closely examine returns with medical deductions for capital improvements, obtain an appraisal of your home from a real estate appraiser or a valuation expert before and after the improvements as proof of the change in the value of the property due to the improvement. Keep the bills for the improvement and all canceled checks and the appraisals with your other tax data.

Examples of deductible residence expenses are

• construction of entrance ramps to the residence.

• widening doorways at entrances to the residence.

• widening or otherwise modifying hallways and interior doorways.

• adding handrails or grab bars whether or not in bathrooms.

• lowering or making other modifications to kitchen cabinets and equipment.

• altering the location or otherwise modifying electrical outlets and fixtures.

• installing porch lifts and other forms of lifts (not generally including elevators, as they may add to the fair market value of the residence and any deduction would have to be decreased to that extent).

• modifying fire alarms, smoke detectors, and other warning systems.

• modifying stairs.

• modifying hardware on doors.

• modifying areas in entrance doorways.

• grading of grounds to provide access to the residence.

Weight control, smoking programs, etc. While the IRS will deny any deduction designed to improve your general health, it may approve a weight control program or other treatment that is related to a specific ailment such as high blood pressure. Your argument for specific treatment is improved if a doctor will put the recommended treatment in writing, in which case you should attach a copy with your tax return.

If, as a condition of employment, you need to treat a physical condition such as smoking or obesity, the expense is deductible because you need the treatment to keep your job.

“Medical expenses” that are not deductible. The following expenses that we may think of as medical expenses are not deductible:

• Bottled water or water filter systems, unless you have a documented medical need for treated water.

• Expenses to improve or sustain your general health such as health club dues or programs to stop smoking.

• Premiums for life insurance or income protection policies.

• Payroll withholding for FICA (although it is the equivalent of a premium for SSD and Medicare).

• Medicine or drugs you bought without a prescription.

• Funeral, burial, and cremation expenses (these expenses are deductible for estate tax purposes).

• Expenses for medical operations or treatments that are illegal in the United States. The transportation expenses associated with those treatments are also not deductible regardless of the source of the treatment or operation.

• Expenses of going outside the country for treatment that is locally available.

For a complete explanation of medical expenses from the IRS, ask for publication no. 502. Call 800-829-1040.

3.6 Charitable Contributions

Generally, you can deduct contributions of money or property that you make to a qualified charitable organization. A gift or contribution is also deductible if it is “for the use of” a qualified organization, such as when the donation is made by means of a legally enforceable trust or similar legal arrangement for the qualified organization.

Verifying tax status. If you’re uncertain whether a charity is qualified for tax purposes

• ask the organization for a copy of the IRS letter confirming the organization’s tax status.

• if you have access to the Internet, check at www.irs.ustreas.gov.

• call the IRS, Customer Service Division, at 800-829-1040.

Your deduction for charitable contributions. The deduction for charitable contributions is equal to the fair market value of the property at the time of the contribution, generally to a limit of 50 percent of your adjusted gross income. In some instances much lower limits apply, so check with a tax adviser if you are considering contributing more than $5,000 to any charity.

While you cannot deduct the value of the time you volunteer to a charity, you can deduct the costs related to volunteer work including

• actual travel and transportation costs going to and from meetings and events, or fourteen cents a mile.

• materials you supply in the normal course of volunteering such as stamps, postage, or refreshments.

• 50 percent of the cost of meals necessary to your volunteer work.

What you cannot deduct.

• Baby-sitting costs while volunteering.

• Rent-free use of your property by a charitable group.

• Raffle tickets you purchased or money spent at a charity bingo.

• The value of what you receive. For example, if you pay $75 to attend a charity banquet and the dinner is worth $30, you can only deduct $45 (the difference between what you paid and the value of what you received).

• Contributions to specific individuals, including

• contributions to fraternal societies made to pay medical or burial expenses of deceased members.

• contributions to individuals who are needy or worthy. This includes contributions to a qualified organization if you indicate that your contribution is for a specific person. But you can deduct a contribution that you give to a qualified organization that in turn helps needy or worthy individuals if you do not indicate that your contribution is for a specific person.

• payments to a member of the clergy that can be spent as he or she wishes, such as for personal expenses.

• expenses you paid for another person who provided services to a qualified organization.

Tip. If you purchase a ticket to a banquet or other event and cannot attend, tell the charity to give it to someone else. This way you can deduct the entire cost of the ticket, not just the amount in excess of the value of what you would have received if you had attended the dinner. Be sure to obtain a letter from the charity describing this gift.

Carryovers. You can carry over excess contributions that you are not able to deduct in the current year. You can deduct the excess in each of the five succeeding years until it is used up, but not beyond that time. Your total contributions deduction for the year to which you carry your contributions cannot exceed 50 percent of your adjusted gross income for that year.

Tip. If you have a life expectancy of less than one year, be aware that charitable contributions (as well as operating losses, capital loss carryovers, and suspended passive loss carryovers) terminate at death. Accelerate income into the current year to utilize these tax deductions. Otherwise, the income will be included on the following year’s fiduciary tax return with no offset for these items.

3.7 Interest Deduction

Loans are a nontaxable source of income, and in some cases the interest payments on loans are tax deductible. The general categories of deductible loan interest are:

• Home mortgage interest: Qualified residence interest is deductible by individuals as an itemized deduction as long as the mortgage debt does not exceed specified dollar limits. See chapter 22, section 2.2.

• Investment interest: Interest expenses on debts that can be properly allocated to property held for investment are generally deductible by individuals as an itemized deduction to the extent of net investment income. Note that a taxpayer can borrow money to put in an IRA and deduct the interest on the money borrowed.

• Trade or business interest: Interest expenses on debts incurred in a trade or business in which the taxpayer materially participates (other than a rental business) are generally deductible in full.

Personal interest is not tax deductible. Interest on credit cards, car loans, personal bank loans, and school loans is not tax deductible. Home loans, on the other hand, are usually the lowest-interest-rate loans an individual can get, and the interest is deductible.

Tip. For homeowners who need to borrow cash, the best borrowing vehicle is either refinancing an existing mortgage or taking a second mortgage.

3.8 Handicapped Expenses in the Workplace

Expenses incurred adapting your workplace to compensate for a disability or to enable a “disabled” person to do her job are deductible as “impairment-related work expenses” and are not subject to the 7.5 percent medical expense threshold or the 2 percent limit that applies to employee expenses and miscellaneous deductions. Attendant care at the place of employment is also deductible.

Section 4. Credits

For people who are disabled and for those who pay dependent care, two important credits are available. Credits are a direct reduction of tax and should be taken advantage of whenever possible.

4.1 Dependent-Care Credit

Working taxpayers who pay for dependent care in order to work are allowed a tax credit for these expenses. For lower-income taxpayers the highest dependent care credit is at most 30 percent of $2,400 of qualifying dependent care expenses (or $4,800 if there is more than one qualifying dependent). For middle-income taxpayers it is often as low as 20 percent of such expenses. The dollar limits are reduced by any amount an employer pays for such dependent care to the extent that amount is excludable from the taxpayer’s gross income for child and dependent care. (See below, section 4.3.)

Expenses for dependent care may also qualify as deductible medical expenses. In such a case, that part of the amount for which the dependent-care credit is allowed will not be taken into account as an expense when computing the allowable medical deduction. Similarly, when an amount is taken into account for purposes of the medical expense deduction, it cannot be included for purposes of the dependent-care credit.

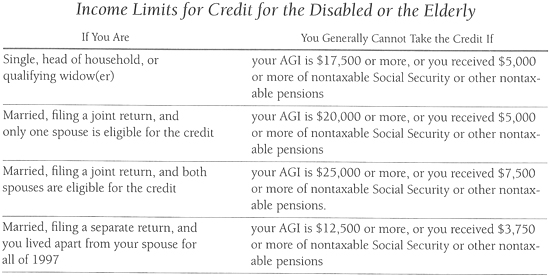

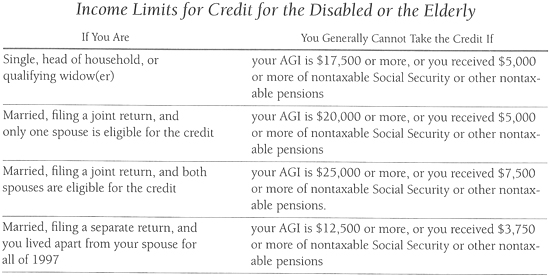

4.2 Disability Credit

Qualified individuals under age sixty-five who have retired with a permanent and total disability, and who have taxable disability income from a public or private employer, may claim a credit against taxes equal to 15 percent to a maximum of $7,500 a year, depending on the amount of Social Security and disability income received during the year. The table below outlines eligibility for the credit per filing category. Individuals must be a citizen or resident of the United States or a nonresident alien (except for certain nonresident aliens who are married to U.S. citizens where both spouses elect to be treated as U.S. citizens and to be taxed on worldwide income for the year).

For purposes of the credit, an individual is permanently and totally disabled if he or she is unable to engage in any substantial gainful activity by reason of a medically determinable physical or mental impairment that can be expected to result in death or that has lasted or that can be expected to last for a continuous period of at least twelve months. If the taxpayer is under age sixty-five, a doctor or the Veterans Administration must certify that the taxpayer is totally and permanently disabled. Gainful activity is considered to be the performance of significant duties over a reasonable time for pay or profit. This does not include work the taxpayer does to take care of herself or her home.

4.3 Employer-Provided Dependent-Care Credit

An employer can provide tax-free dependent care to an employee.

• The value of dependent care provided under an employer’s nondiscriminatory plan generally is not includible in an employee’s gross income.

• The amount excludable from gross income cannot exceed $5,000 ($2,500 in the case of a separate return by a married individual).

• An employee who excludes the value of child- or dependent-care services from income may not claim any income tax deduction or credit with respect to the amounts.

• There is an earned income limitation on the amount that may be excluded. For an unmarried employee, the amount excluded cannot exceed the employee’s earned income for the tax year involved. In the case of married employees, the exclusion cannot exceed the earned income of the lower-earning spouse for the tax year.

• A spouse who is incapacitated or who is a student is deemed to have received monthly earned income of $200 if there is one child or dependent, or $400 if there are two or more children or dependents.

Section 5. Retirement Plans

5.1 Early Withdrawal of Retirement Funds

Any funds withdrawn prematurely from a retirement account have to be included as income. There is also a 10 percent penalty tax for the early withdrawal, but this may not apply—for example, when a taxpayer is disabled. See chapter 12.

5.2 Employee Stock Ownership Plans

To discourage taxpayers from using an Employee Stock Ownership Plan (ESOP) as a tax-free savings account for purposes other than retirement, Congress has imposed a special 10 percent tax on early distributions paid to a participant who is not yet 59½. The tax does not apply to distributions that are made to a beneficiary (or to the estate of the plan owner or participant) after the death of the owner or participant. Distributions made to a participant because he or she is totally and permanently disabled are not subject to the tax either.

Section 6. Strategic Recognition of Income and Deductions

Not all income and deductions are created equal. In some cases you can accelerate or defer income and deductions across tax years to maximize the benefits of deductions or minimize your tax bracket. Ideally, income should be claimed in years when it will be subject to a lower tax rate, and expenses should be claimed in years when they will offset income subject to a higher tax rate. Even small changes can prove beneficial, especially if you are close to the bracket thresholds.

Most people keep their finances on a cash basis, which means income and expenses are recognized when you actually receive or pay them. Prepaying an expense in December or delaying payment to January can help to minimize taxes, as can a similar manipulation of when you receive income.

Income. A basic tenet of tax planning is to defer as much income as possible to a later tax year. While this is not always the best approach, it is a good place to begin your year-end strategy. Keep in mind that income received on December 31, 1998, is includable on your April 15, 1999, return, while income received on January 1, 1999, is not includable until the April 15, 2000, return.

If next year’s tax bracket will be lower than this year’s, defer your income—provided a deferral will not jeopardize the actual collection of the income.

Some techniques to consider:

• As the end of the year draws closer, delay year-end billings until late December. This will ensure that payments will not be received until the next year. Bear in mind, however, that if you are an accrual-method taxpayer, rather than a cash-method taxpayer, income must be accounted for in the year in which the legal obligation to make payment is incurred.

• Bonuses given at the end of the year do not have to be paid out at year’s end. Try to arrange to receive your bonus in January. Employers will not lose their deduction for the current year by delaying the payment, as long as the obligation is fixed before the end of the tax year and is paid within two and a half months of the close of the employer’s tax year.

• Make sure that you are contributing the maximum allowable amount to your pension plan.

• If you must sell property this year, you can delay receipt of part of the proceeds by having the payments made in installments.

On the other hand, it may be beneficial to accelerate income into the current year, such as when you anticipate a change in filing status or income level that places you in a higher tax bracket next year. Some of the strategies for acceleration are the opposite of those used for deferring income. For example, you can bill early in December rather than January and try to collect as many receivables as possible before the end of the year.

Deductions. When planning on what year to take deductions, keep in mind that

• some deductions may be reduced if your AGI is too high. For example, itemized deductions and personal exemptions are phased out based on the excess of AGI over established threshold levels.

• any increase of AGI results in a corresponding decrease to AGI-sensitive deductions.

• certain deductions may be claimed only if they exceed a certain percentage of AGI—2 percent for miscellaneous itemized deductions, 7.5 percent for medical expenses, and 10 percent for casualty losses. Therefore, an acceleration of income into the current year may also operate to lower your allowable deductions.

Tip. Every year, individuals are forced to pass up either legitimate itemized deductions or the standard deduction amount. If your deductions exceed the standard deduction, you will itemize, but if they do not, if you claim the standard deduction, you lose the itemized deductions.

A technique called bunching can help resolve this dilemma. The concept of bunching is to carefully plan your expenses so that in one year you have a large amount of itemized deductions and in the next you have a low amount but claim the standard deduction. The two-year total of high itemized deductions plus the standard deduction should exceed the two-year total of deductions that are not bunched and/or standard deductions. For example, a single individual with $4,500 of itemized deductions each year may be able to bunch the expenses so that $2,500 are paid in 1995 and $6,500 in 1996. The same amount is paid over the two years ($9,000), but combining the 1995 standard deduction of $3,900 with the $6,500 of expenses in 1996 results in a two-year total of $10,400 of deductions.

Practical adjustments you can make:

• Prepay January mortgages or property taxes in December of every other year.

• Stagger medical and dental checkups so that more are in one year than the next (for example, January, June, and December of one year and June of the following year).

• Plan to give larger charitable gifts every other year.

Section 7. Audits

7.1 Avoiding an Audit

The best audit is no audit.

To lower chances of an audit, deductions should not exceed the guidelines of average deductions (see section 3.4 above). The research of Amir Aczel of Waltham, Massachusetts, a Bentley College statistics professor who published a study in 1995, indicates that 90 percent of audits are determined by the size of your deductions relative to your income level. If your deductions or claims exceed the averages, it is advisable to provide details and supporting evidence, such as an attending physician’s statement or other amplifying information to make your health position as clear as possible. The IRS doesn’t ask for additional information—but you may avoid questions if you include it.

The IRS computers also look for inconsistencies such as when it records that you have received income, but you don’t report it, or that your calculations are not correct. While these issues may be easy to respond to and correct, anything that requires an IRS agent to give a return extra attention increases the risk that the agent will look for other irregularities or items that seem worth investigating. To minimize the risk of an audit, you want the return to be processed as smoothly as possible.

To minimize chances of an IRS inquiry:

• Professional tax preparers: If you use a tax preparer, avoid all preparers who do not seem reliable. The IRS keeps track of preparers and may call into question all returns submitted by certain ones.

• All questions: Complete all questions on the tax return, even if they don’t seem to apply to you.

• Math: Double-check your math to be sure the numbers add up. If you have medical expenses that are deductible, consider attaching a letter from your primary physician describing your condition. The worse she makes it sound, the better. If your return does come under scrutiny, the reviewer will have a reason to pass it through.

• Old returns: Compare this year’s proposed tax return to last year’s. If the numbers are very different, double-check to make sure you didn’t make a mistake.

• Form 1099: If you receive a 1099, be sure to report it on your return, even if it is a tax-free event. The IRS has a computer that matches 1099s to returns. Check the 1099 to be sure it is correct. If the 1099 is issued in error or is incorrect, try to have the issuer correct it or attach an explanation with the form when filing your return. Make sure you have all the 1099s you’re supposed to have by comparing the 1099s you received this year against last year’s batch. List the amount shown on each 1099 separately.

• Forms: File all required forms.

• Dependents: If you declare dependents, include their Social Security numbers.

• Charity: Attach to your return receipts from each charity acknowledging all contributions over $250.

• Household employees: If you have household employees, find out if you have to pay employment taxes. If so, you’ll need to include an employer identification number on your tax return. You can request an employer identification number from the IRS on form SS-4. While this takes four to six weeks, the IRS does have a procedure by which you can obtain an employer ID number instantly by calling a specific number at the location where you file your tax return and then faxing the appropriate form to the person with whom you speak. Call the IRS for the phone number in your area.

• Refunds: Avoid claiming large refunds. A return requesting a large refund draws attention. Adjust wage withholding and estimated tax payments to balance out your final tax liability for the year, so you don’t owe a large tax or receive a large refund.

• Rollovers of retirement fund proceeds: Report rollovers. If you received a form 1099-R concerning a rollover of retirement-plan proceeds into an IRA, you have to report the amount shown on your tax return even though the rollover is tax free.

• Amended returns: If you have to file an amended return, attach detailed proof of items that prompted the amendment.

Tip. Be sure to make a copy of your return and all attachments before forwarding it to the IRS. Store the return and supporting evidence as discussed in chapter 5. Keeping the documentation together will save you Life Units if you are audited and will be critical to your personal representative and/or heirs if you become incapacitated or die.

7.2 Delaying an Audit

Delaying an audit can be an effective means of saving you money. Agents are given time limits to close cases. The longer a case is open, the more likely the auditor will want to reach an agreement. The time delay will also give you time to ask your team members, including people in your support group, whether they have encountered questions about similar matters, and if so, how they handled the situation.

On the downside, keep in mind that if you lose the audit, you have to pay interest on all money due. So while delays may be an effective tactic, they could cost you more money in the long run. Also, if you delay when your life expectancy is short, your heirs will have lost the best witness against the IRS, namely you.

Tips for delay:

• Respond to all inquiries within the time limit, but do not rush into it.

• Ask for as much time as you can to prepare for the audit because auditors can lose interest or focus.

• A day or two before the audit, ask to reschedule it.

• Ask for clarification and amplification on issues. Generating paperwork and responses delays the audit.

7.3 Other Tips to Survive an Audit

Representation. Consider being represented by your tax preparer or other professional. If you are not looking well, it may pay to muster the energy, if possible, to be with your professional at the audit. Auditors are human and have a great deal of discretion.

Handling the audit yourself. If you do handle the audit yourself

• get professional help before you go in for the audit or respond to inquiries. Know the full extent of your possible tax liability and penalties before you argue your case, as well as the plausibility of your arguments. It is a lot harder to backtrack than it is to take the right course from the start.

• prepare for it by assembling all information you have on your income, deductions, and credits. Try to anticipate questions and be ready with answers, but don’t lead the interview.

• don’t volunteer anything. What you say to help in one area may hurt you in another unexpected area. The only exception is that it may be in your interest to tell the IRS auditor about your physical condition, even if the audit is for a period before your diagnosis. Theoretically at least, IRS auditors are human beings too.

Section 8. Other Matters

8.1 Getting Help with the Tax Code

There is plenty of expert opinion available to help you plan your tax position.

The Internal Revenue Service. The quickest source of information with respect to the Tax Code is to call the IRS at 800-829-1040. Advice from a person at the IRS is no defense if the information is incorrect. However, it will at least help you avoid penalties if at the time of the call you make a note of

• the name of the person with whom you speak;

• the date; and

• the substance of the conversation, including a notation of the source of their information (such as the title and date of a tax ruling).

You can also E-mail specific tax questions to the IRS at www.ustreas.gov. You should have a response within forty-eight hours. As with oral advice, the IRS must eliminate any penalties that result from inaccurate advice the IRS gives you in writing.

You can obtain user-friendly tax guides from your local IRS office, at the public library, or by calling the above 800 number. There are more than ninety free IRS publications on particular subjects. A good general guide is publication 17, “Your Federal Income Tax,” which is an in-depth discussion of most tax topics of interest to the general public. If you have a computer, you can also access any IRS publication on the IRS Web site: www.ustreas.gov.

Other assistance. For a different slant on taxes:

• Talk to a tax preparer, a CPA, an enrolled agent, an accountant, or a tax lawyer.

• An excellent and inexpensive source of assistance is one of the popular tax-software programs such as TurboTax (800-446-8848) or TaxCut (800-235-4060). The programs give tutorials and guide you through the tax process, highlighting all the options you may have for saving on your taxes. Both programs also offer audit alerts, which indicate whether any of your itemized deductions exceed the average. TurboTax Deluxe even includes more than thirty IRS tax publications.

• Another source that signals when deductions exceed the norm is on the Internet at www.securetax.com. SecureTax prepares your return on-screen at no charge. You can then copy the information onto your own paper forms. If you decide to print a copy from the site or use other services, there is a charge.

Tips on using a tax preparer. If you use a tax preparer

• select a professional with expertise in your thorniest tax areas. Ask friends and colleagues whose finances are similar to yours for references and talk to several preparers before choosing one. Find out how the person keeps up with the tax law. Also discuss your “tax temperament.” You may want to push the envelope to its limits or you may feel more secure only with safe returns.

• Ask for a letter with your completed return explaining any judgment calls that were made in gray areas of the tax law.

• Be sure to review your completed return carefully. Ask any questions you have. You’re the person who will bear the ultimate responsibility for what is on your return.

8.2 General Considerations

State and local taxes. Almost all state income tax systems allow an exemption or credit to people who are “disabled” when determining an individual’s tax liability. If you are on disability, be sure the state law is checked before filing your income tax return.

A number of states and localities reduce home property taxes for people who are “disabled.” If you own a residence, check with your local real estate tax department.

Filing returns and paying taxes. If you don’t file returns when they are due, the IRS can impose a penalty equal to 5 percent of the amount of the tax due per month, to a maximum of 25 percent of the tax due.

There is also a penalty if you file your tax return on time but do not pay the money when due. This penalty is one-half of 1 percent per month. Over twelve months, the total penalty is 6 percent. Once the IRS notifies you about the payment due, the penalty increases to 1 percent a month.

Any money owed the government, including accumulating fines and penalties, incurs interest at the rate of 3 percent above the federal short-term interest rate, compounded daily. During 1997, that meant that money owed the IRS accumulated interest at the rate of 9.42 percent annually.

Before you get creative with your tax liability, you should know that failure to pay taxes is a misdemeanor and can cost up to $25,000 and a year in jail. Attempting to evade or defeat a tax liability is a felony and can cost up to $100,000 and five years in jail. Filing a false return with the intent to evade taxes is a misdemeanor and can cost up to $10,000 and a year in jail.

Tip. Tax time is a good time to review many of your financial arrangements and be sure they are up-to-date. For example, check

• the beneficiaries on your retirement plans, life insurance policies, and the like.

• your will and advance directives. Has there been a substantial change in the value of your estate? A change in assets you specifically listed in the will? A change in the people you want to receive your assets?

• your financial plan. Consider changes since the last time you visited the plan.

• your List of Instructions. Are things still stored where you listed? Are there other changes?

• your various property and casualty policies to be sure they reflect current assets and values.

8.3 Cheating

The penalties for tax fraud are stiff, whether you’re sick or not. Your estate will be liable for any taxes, interest, or penalties for which you would have been liable. If fraud is involved, there is no statute of limitations so the government has all the time in the world to learn about the situation and take action against you, your estate, and/or your heirs if the assets were distributed.

Bottom line. Tax avoidance is legal. Tax evasion is not. Do everything you can to avoid and thus minimize your taxes.