CHAPTER THREE

Earning money is not just about an hourly wage, where you receive a certain amount of money for each hour on the job. There are various types of compensation. For example, you could earn a salary, which is a fixed amount of money you earn no matter how many hours you work per week. A salary is paid at regular periods, usually every other week or twice each month.

You may also work on commission, which means you are paid for completing certain tasks or reaching a goal. Commission is often tied to a sales goal.

Service workers often receive tips, which is money earned on top of a base wage because of a job well done or because of social convention. The consumer—the person being served—pays the tip. In some occupations, such as restaurant server and taxi driver, tips tend to be given regardless of the quality of the work. But remember that tips aren’t mandatory and can fluctuate based on whether the consumer thinks you did a lousy job or a lovely one.

Is there a certain amount an employer must pay you? It depends. The United States has a minimum wage for most workers. That amount is currently $7.25 an hour. Congress must pass legislation to change it, although states can require businesses to pay a higher minimum wage. For example, workers making minimum wage in the state of Washington earn $9.32 per hour.

Not all workers are paid minimum wage. Employers can pay workers who are younger than 20 a minimum wage of $4.25 per hour during their first 90 days on the job. Teens who babysit or are full-time students don’t have to be paid minimum wage. If you receive tips on the job, you might not be paid minimum wage, depending on the amount of tips received. The U.S. Department of Labor website at http://www.dol.gov has all of the details.

Who wants to earn some money without lifting a finger? Who wouldn’t raise their hand? The good news is that there are ways to watch your money grow over time without having to do much.

How? One of the best ways to earn money is by saving money in an account that earns interest.

Interest is money paid to someone who has agreed to let another party put their money to use for whatever purpose. When you open a savings account at a bank or credit union, you will be paid a small amount of interest for giving them your money and allowing them to use it for lending or other purposes. The interest paid is calculated as a percentage based on how much money you’ve deposited.

Where can you earn interest? In savings accounts, for sure. But there are also interest-earning options in college savings plans called 529 plans and tax-free individual retirement accounts (IRAs), which are designed to save for retirement.

Banks aren’t the only places you can earn interest. You can act as the bank yourself, lending money to your family members, friends, or even complete strangers through peer-to-peer lending. Peer-to-peer lending is just what it sounds like. It’s been happening for centuries, but the Internet makes it possible to bring together strangers living in various parts of the world to help each other reach their financial goals. This marketplace has grown a lot in recent years, as banks made it tougher for consumers to borrow money and also cut interest rates paid on savings accounts. The conditions forced consumers looking for loans and consumers looking to earn interest to seek alternatives outside of banks. Peer-to-peer lending was born.

Websites such as prosper.com and lendingclub.com act as marketplaces for people looking for money and people looking to earn interest by lending money. Lenders who have money to offer browse the website. They read descriptions of borrowers—people who need a loan. Lenders learn who the borrowers are, where they live, why they’re asking for cash, and how likely it is that they will be able to pay back the loan. Lenders will receive a certain amount of interest in return for lending their money to borrowers.

Money isn’t the only thing that you can lend in return for cash. Think about how many items you can rent in this society—apartments, cars, lawn equipment, bikes, prom dresses, movies, and TV shows. If you own property people would pay to use, that’s another way to earn money without doing a job or waiting for interest to build.

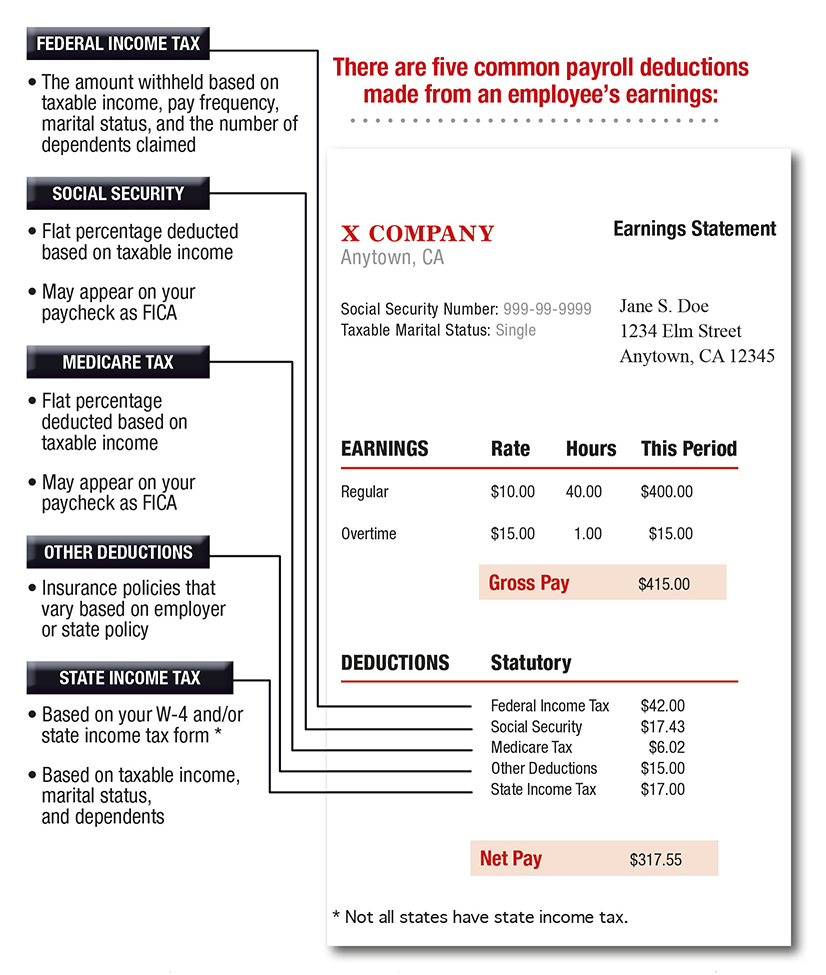

That first paycheck is a thrill. But wait—why does it look so small? Taxes. Social Security. Medicare. The cost of benefits. It doesn’t take long to realize that your hourly wage and your take-home pay are not the same thing. The actual amount in your paycheck that you get to spend? That’s your net pay. It’s what you have left after your employer withholds all of the mandatory stuff such as federal and state income taxes, and the voluntary deductions such as retirement savings and some types of insurance premiums. Your pay before all of the deductions is called your gross pay—as in, bigger than it was before all of those deductions kicked in, or isn’t it gross that my paycheck is so much smaller?

In all seriousness, taxes benefit society by raising money to fix roads, keep parks beautiful, and protect citizens during wars and at home. Taxes are mandatory, and you must pay taxes on the income that you earn. If you’re an employee of a company, the company will take a percentage of your salary each month to pay for state and federal taxes and programs such as Social Security and Medicare. Think of Social Security as a government-sponsored plan that gives retirees and select others a small monthly paycheck. Medicare is the government-sponsored health care plan for those 65 years old or older. If you see the term FICA (Federal Insurance Contributions Act) on your paycheck, it’s referring to these programs.

Your paycheck may also have deductions that aren’t required by the government. The voluntary deductions include health, disability, and life insurance; benefits that reduce the cost of child care or work-related parking expenses; and company retirement plans.

Source: http://nerdgraphics.com/wp-content/uploads/2012/02/payroll_and_tax_deductions.png

If you’ve used allowance or birthday money to buy toys, clothes, or video games, or even eaten at a restaurant, you’ve likely paid sales tax. Sales tax is a set rate, no matter who you are or how much money you make. Depending on the state where you live, some items, such as groceries or clothes, might not be subject to sales tax. But most things you buy in a store are taxed.

Income tax is different. The amount of money withheld from your paycheck for taxes depends on how much you earn. It generally increases as you earn more. When you start your job, your employer will have you fill out a W-4 form, which tells your employer how much money to withhold from your paycheck and send to the IRS. Your parents or guardians or your employer can help you fill out that short form.

Teens don’t always earn enough to have to file an annual income tax return. But it’s worth considering, because a refund may be waiting from the government.

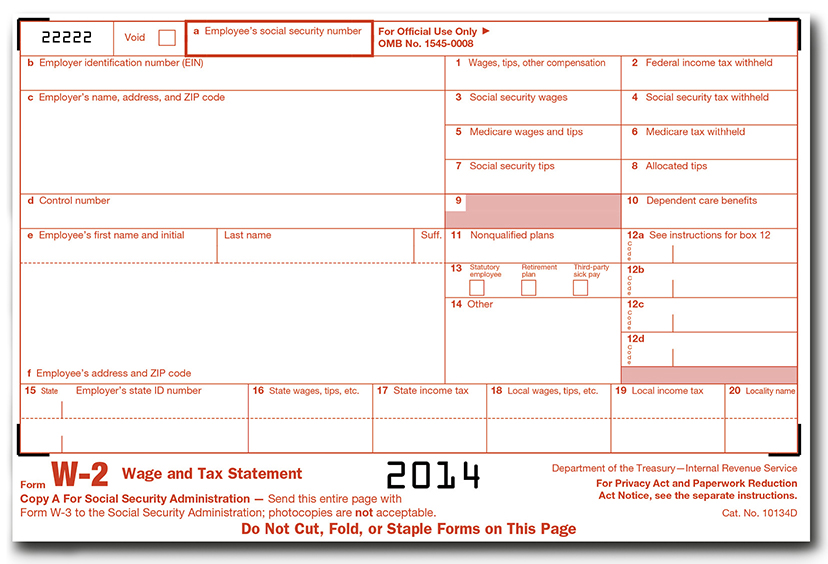

Source: http://www.irs.gov/pub/irs-pdf/fw2.pdf

The income tax form is called a 1040. Young people can typically use the simpler 1040EZ form to file. To help you prepare that form, your employer will send you a W-2 Wage and Tax Statement at the beginning of each year. The W-2 includes the wages and tips you earned during the previous year, as well as the taxes withheld.

Want to earn more money? Who doesn’t? As you get older and expenses rise, you’ll need to steadily increase your salary to maintain your investment goals and standard of living. Sometimes you’ll be offered a raise or promotion for working hard and gaining more experience. Other times you’ll have to make a case for why you should earn more money.

People who don’t negotiate their first salary could lose more than $500,000 in earnings from the time they start their career until they reach age 60, according to statistics compiled by Linda Babcock, author of Women Don’t Ask.

Negotiating a salary or raise can be nerve-wracking, especially the first time. If you’re still receiving an allowance from your parents or guardians, you can test your negotiating skills by asking for an increase in the amount you receive.

When you’re ready to ask for more money at work or at home, follow these tips:

The term “gig economy” refers to the growing number of Americans who are working on a per-project or freelance basis. Often in the gig economy, a person has mini-jobs. The worker might work a few hours on one project and perform an entirely different task for another project.

Some people work in the gig economy by choice. Working on multiple projects can keep work interesting and help develop a variety of useful skills. The gig economy is flexible, giving workers more freedom to work when and where they want. But there are also many workers in the gig economy who would like a full-time permanent job but can’t find one.

More people joined the gig economy during the Great Recession of 2007–2009, when employers reduced costs by laying off workers or hiring temporary help. New businesses such as TaskRabbit popped up. TaskRabbit.com matches people who need help with odd jobs with people who are looking to earn a little cash.

In better economic times, fewer workers tend to work on a per-project basis as companies start hiring permanent employees again. However, advances in technology that make it easier for workers to work remotely, and a growing number of people who want a better work-life balance, point to the gig economy’s permanent place in the work world.

Most of us have many ideas about what we want to be as we grow older and our interests change. Picking a career that we like and that will allow us to earn a good income is the key to success. Do well in high school and earn a college degree in a major with good job prospects, and you’re likely to find more career opportunities.

If you are itching to be your own boss, there are many resources out there to help you, from Junior Achievement to the volunteer mentors of the Small Business Administration’s SCORE Association. Just think, all major corporations once started with the kernel of an idea.

An idea, an entrepreneurial spirit, perseverance, and hard work can take you far. And always remember that millionaires who spend more than they make are worse off than average people who live within their means. Saving money and making savvy decisions about the money you spend are just as important as earning it.