CHAPTER SIX

Investing can be a daunting topic for beginners, but it’s really quite simple. The basic concept of investing is taking the money you have now and making it grow.

You can start with as little as $20 and can invest for many reasons—for the challenge, for the sense of owning something, or for the more practical purpose of making sure you have enough money in the future.

Generally, investments will earn you more than money sitting in a savings account will. Investments are designed for a time horizon that lasts years, not months. Some investments are riskier than others. Some investments are liquid, meaning it’s easy to get your money out of the investment relatively quickly. Others are illiquid, meaning your money will be tough to access.

The return on an investment—what you get for investing the time or money in the first place—is not always measured in an exact dollar amount. For example, your education is an investment. Research shows that a four-year college degree is worth an average of more than $1 million in earning potential.

Stocks allow people to buy small pieces, called shares, of a company. Companies sell stock to raise money for various purposes. The shares are bought and sold on a marketplace called an exchange. Most of the buying and selling a century ago took place on the stock market floor, but today most transactions occur electronically.

The value of stock shares can go up and down. It’s possible to lose all of your money invested in a stock. But on average the stock market has increased in value.

When you own stock in a company, you are called a shareholder. You have a vested interest in how well the company does. When a company does well, its stock tends to go up, which means your shares are worth more if you were to sell them that day. If a company doesn’t perform as well as expected, the value of the shares can go down, and your investment would be worth less. Since money invested in the stock market should have a longer time horizon, you should not worry if the market fluctuates. It only matters how much the stock is worth on the day you plan to sell it.

A bond is essentially an IOU given to you by the company that sells the bond. When you buy a bond, the company agrees to pay back the money you lent plus interest on a certain date in the future. Some bonds are riskier than others and depend on the overall health of a company’s finances. Bonds are considered safer than stocks, but it is possible to lose money on bonds.

A mutual fund is a collection of various types of investments. Think of it as a grocery bag that holds each of your financial food groups—a mix of stocks, bonds, and cash. Professional investors manage some mutual funds, charging fees to choose what goes in the grocery bag. They hope to fill it with investments that will grow the most over time. Other mutual funds track an index of stocks or bonds, buying a little bit of all the stocks or bonds on the index. Because these mutual funds, called index funds, don’t have professionals picking the stocks or bonds to buy, index funds have lower fees.

Chances are you’ve received a savings bond as a gift at some point in your life. The U.S. government sells the bonds to raise money. Savings bonds carry little risk, but their interest rate tends to be low.

Investing opportunities exist outside of financial accounts. It isn’t necessary to have millions of dollars in order to invest in a company or product. You could buy property. There are other types of property to buy besides a home or piece of land. You could invest in a snowblower and start a business clearing snow or renting the machine to neighbors. Or you can invest in a friend’s business, trading money for a piece of the profits or some other benefit.

Crowdfunding is a way for people to invest small sums in interesting projects and businesses. Websites such as Kickstarter.com allow people to contribute money to start-up projects such as making a film, starting a fashion company, or inventing a new app. Investors usually receive a gift of appreciation in return, which varies depending on the amount of the investment.

Don’t put all your eggs in one basket! That old saying is a favorite to dust off when talking about investing. It means that you should not put all of your money in a single investment. Doing so is risky because if something happens to that investment, you could lose everything.

For example, you might really love hamburgers from a certain restaurant chain and decide to become part owner of that company by purchasing shares of its stock. But you wouldn’t want to spend every penny you have on stock in this company. People may decide the burgers are unhealthy or don’t taste good. Or the price of beef could skyrocket.That would hurt the restaurant and cause its stock price, and your investment, to decline in value.

The concept of putting your money in multiple types of investments is called diversification. To stick with the egg metaphor, diversification prevents all of your eggs from breaking if you stumble or the bottom falls out of a basket. With eggs spread out in several types of baskets, you take less risk and increase the chance that your money will be there for you, no matter what happens.

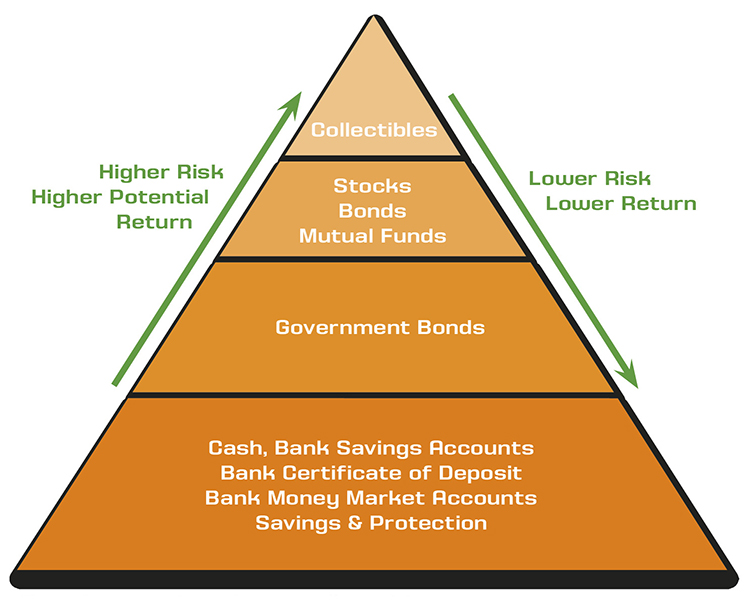

Investments have various degrees of risk. Stock in a new company that is based overseas is riskier than money saved in a savings account at a bank. Taking greater risks can yield greater returns. But the losses can be greater as well.

Risk is not always about losing money. There is also the risk that money will grow too slowly to keep up with inflation or to reach your goals within your desired time frame.

We’re used to a certain amount of risk in day-to-day life. How well each of us deals with risk depends on many factors. It’s smart before deciding how to invest your money to figure out what’s called your risk tolerance. There are many risk tolerance questionnaires you can try out online. One such quiz, developed by two university personal finance professors, asks such questions as:

Quiz source: http://njaes.rutgers.edu/money/riskquiz/

Investors can use diversification to reduce risk by varying the types of investments, such as stocks, bonds, cash, and property. When you’ll need to access your money is also important so you won’t need to take it out all at once.

Source: http://themint.org/kids/risk-and-rewards.html

It’s hard to figure out what funds to set aside for the future without mapping what the future might bring. Like a road trip, you don’t know exactly what you’ll encounter along the way. There could be an accident, unexpected costs from a car breakdown, or the cost of a coffee needed for a jolt of energy. But part of planning is making educated guesses about what your life will look like and what financial needs you can estimate.

You’ll need to figure out the right balance between saving, investing, spending, and donating. Finding this balance depends on your values, expenses, and goals.

Most experts suggest that if you have a retirement plan at your workplace, take advantage of it. Ideally, you’d be able to save 10 to 15 percent of your income. But if that’s too much, at least save enough so that you qualify for any matching money your employer gives you. Typically, that’s around 3 percent of your wages. Also save a small amount in an emergency savings fund. Experts suggest three to six months worth of bare-bones living expenses—think ramen noodles, not fancy restaurant meals. Or set a dollar-based goal, such as $10 per paycheck until you get to $100. Finally, think about opening a Roth IRA account, which is a great place to save for retirement because your money grows tax-free for life.

Both workplace retirement accounts and Roth IRAs give you incentives to save. If your employer contributes money to your workplace 401(k) plan provided you save a certain amount, that is an incentive.

The tax benefits of choosing to save in a workplace retirement plan, a Roth IRA account, or a 529 plan for college are incentives because the less money you owe the Internal Revenue Service, the more you get to keep. And it’s important both at the individual level and for society as a whole to have people who are financially secure and prepared for whatever comes their way.

If you have a chunk of money, should you invest it all at once or over time? Depends. The argument for investing all at once is that the total amount of your money is fully invested for a longer period of time. The argument for investing a little bit at regular intervals is that you will invest at different price points. Because markets and investment prices fluctuate, if you purchase a bit at a time, it will balance out the points when you pay more or less for a share. That is sometimes referred to as buying high or low. This idea of investing a little at a time is called dollar-cost averaging. It is the common method for investing in workplace retirement plans.

Is your head spinning yet? Investing overwhelms many adults, so don’t worry if it takes time to make sense of it all. Some people use a financial adviser to help them make financial decisions. Advisers go by various names—financial adviser, financial planner, broker, or wealth manager. Depending on their training and licensing, they may have special titles such as certified financial planner (CFP) or chartered life underwriter (CLU).

Financial advisers make investments and give financial advice, but they don’t work for free. Some advisers earn a fee based on how much money they invest. Others earn commission based on the types of products they sell. You need to understand the fees you are charged for advice, because fees can take a big bite out of your return.

People don’t typically start working with a financial adviser until their financial lives become more complicated and they have more money to invest. Many adults choose to manage their own financial affairs throughout life. It’s common for teens to turn to people they know, such as their parents or guardians, for help with money matters. Websites and books can also help. But you need to understand the investments you are buying, even if you have someone knowledgeable helping you. Smart people have lost life savings to smooth-talking salespeople who have promised too-good-to-be-true returns from investments.

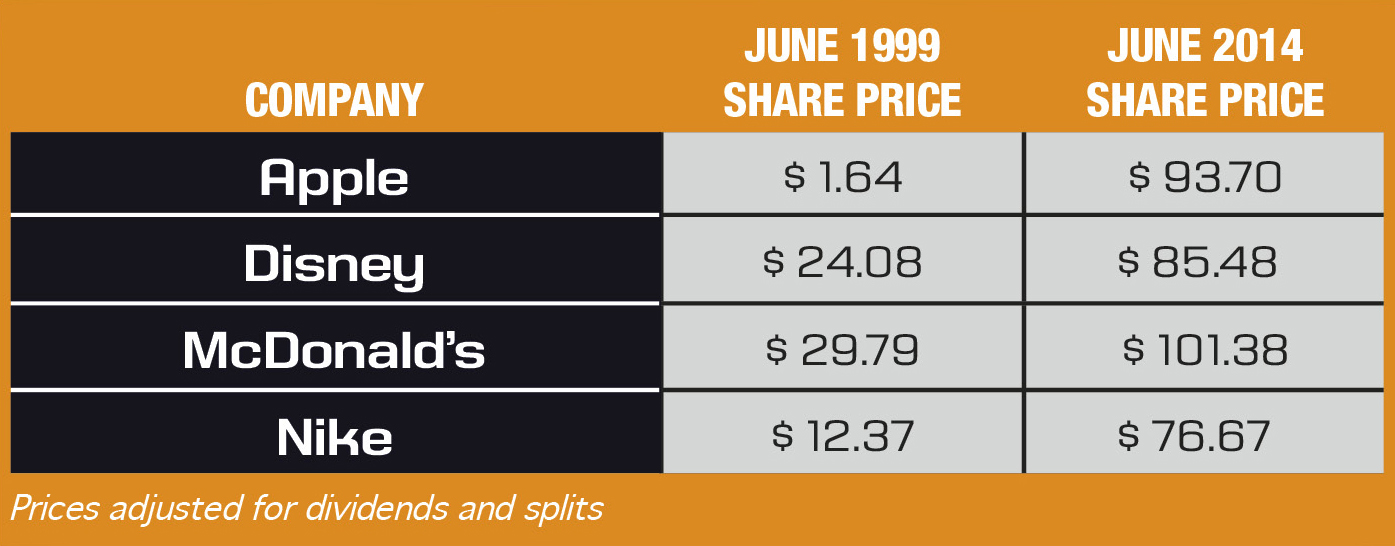

If you invested some of your money in companies instead of spending it on the goods they make, you could make big bucks.

If you’re not careful, you can be “fee’d” to death. OK, that’s an overstatement, but fees do take a big bite out of your portfolio.

Assume that you are an employee with 35 years until retirement and a current 401(k) account balance of $25,000. If your returns during the next 35 years average 7 percent, and fees and expenses reduce your average returns by 0.5 percent, your account balance will grow to $227,000 at retirement, even if there are no further contributions to your account.

If fees and expenses are 1.5 percent, however, your account balance will reach only $163,000. The 1 percent difference in fees and expenses reduces your account balance at retirement by 28 percent.

Source: http://www.dol.gov/ebsa/publications/401k_employee.html

Figuring out how long it will take for your investment to double is easier than you think, thanks to a mathematical rule named The Rule of 72. Here’s the calculation:

Years to double = 72 divided by the interest rate (compounding annually)

For example, if you want your money to double in eight years, you need to earn an interest rate of 9 percent (8 equals 72 divided by 9). If you are earning 6 percent interest, it takes 12 years for your money to double.

Are you curious about the stock market but lack funds to invest? The Stock Market Game gives you a virtual windfall of $100,000 to build a mock portfolio that you manage online. Schools usually sponsor the game, which lets you team up with friends to build your portfolio and market knowledge.

Other stock market simulators are available outside of school. Check out Wall Street Survivor online.

If you were a kid years ago, you’d head to Woolworth’s for the latest toy or school clothes. Wool-what? Exactly. There is risk in owning stock of a company. Even the seemingly most secure companies can be taken over by other companies or can file for bankruptcy. Nothing is forever, as this list of once-prominent companies shows. That’s one reason why diversification is so important.