CHAPTER TEN

Without risk, there would be no need for insurance. Risk—the possibility that something bad will happen—is all around us, all the time.

It is impossible to erase risk from our lives. But there are ways to deal with it. You can:

Do you remember a time when you were taking a risk that made you feel uncomfortable? Maybe your palms were sweaty or you were sick to your stomach. Maybe you couldn’t concentrate on anything else or found your mind racing to the worst-case scenario.

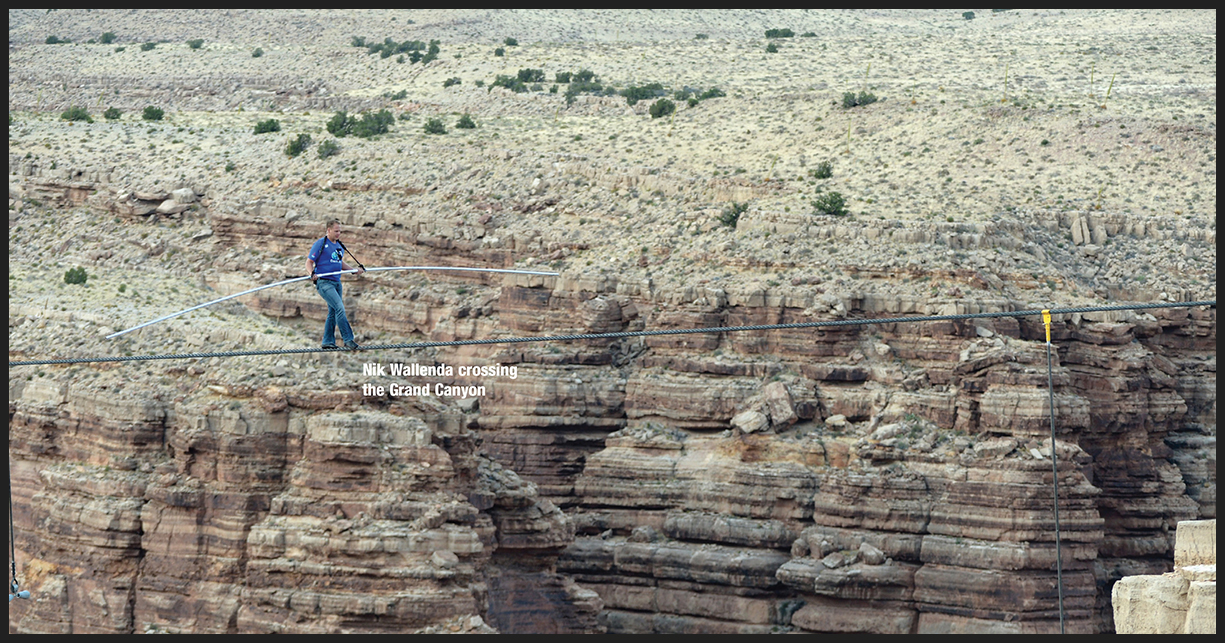

Various people have various risk tolerance levels. If you were about to cross the Grand Canyon on a high wire, you’d probably have all of the symptoms described above and then some. But daredevil Nik Wallenda, who has been walking on a wire since he was 2, would assess the risk of walking on a steel cable high above the Colorado River differently. In June 2013 he took just less than 23 minutes to successfully complete this incredibly risky stunt.

Risk tolerance also varies by situation. You may not be able to walk a high wire, but you might be comfortable with the risk of injury when playing your favorite sport or the risk of losing money in the stock market.

Scientists have learned that the frontal cortex—the part of the brain in charge of impulse control, judging risk, and making decisions—isn’t fully developed until a person is 25 years old. This is one reason car insurance costs more for teens and young adults. Unmarried men who are younger than 25 pay the most for car insurance.

Insurance is designed to protect you and your finances when something unfortunate and unexpected takes place. Its purpose is to mitigate (lessen) the risk. When you buy an insurance policy, you’re basically buying a contract that says if certain adverse things happen, the insurance company will cover agreed-upon costs for you, the policyholder. The contract explains what the insurance will and won’t cover. For example, health insurance won’t cover every medical procedure, and car insurance won’t cover every breakdown. Yet these policies will cover the major mishaps that could wipe out your savings or your parents’ or guardians’ savings.

There are many types of insurance—too many to list here. But the basic types of insurance cover people, such as yourself or your family, or property, including your car, home, or personal belongings. Life, disability, and health insurance fall in the first group. Car insurance and homeowners or renters insurance fall in the second. You can even purchase small insurance policies for your smartphone or to refund your airfare in case you have to cancel a vacation.

Insurance policies vary in price, based on many factors. For example, living in an area with a higher crime rate will result in more expensive renters insurance. Driving a sports car or simply being a new driver will cause higher car insurance rates. Smoking cigarettes will lead to costlier life insurance.

No one likes to think of paying for something he or she will never use. But some risks are too costly to cover on your own. When choosing whether to buy insurance, you need to ask yourself if you could afford to pay the costs of a health or property emergency up front. If the answer is no, you’d better buy insurance. If the answer is yes, then you need to set enough money aside in a savings account to cover any potential losses. Otherwise a loss could blindside you.

Deciding whether to purchase insurance is up to you—to some degree. For example, you must have health insurance or face a penalty. And you are required to have auto insurance in most states, but no one will force you to buy insurance for your smartphone.

You can buy insurance online, through a site that collects information from multiple insurance companies to make it easier to compare policies and prices. Or you can buy directly from an insurer’s website or mobile app. You also can buy insurance through an insurance agent, who will help determine the right policy for you and take care of the paperwork. Some agents are independent, meaning they can sell policies from more than one insurance company. Others are captive agents, selling policies from only one company. You will have more choices with an independent agent. Insurance agents make their money through commissions earned from the company selling the policy.

Whether you choose a website or an agent for insurance shopping, you’ll receive an estimated price called a quote for the type of policy you’re considering, based on information you’ve given them about yourself and your insurance needs. If you choose to buy the insurance policy, your cost is called a premium.

If you ever need to use an insurance policy, known as making a claim, you will usually pay a deductible. This amount is what you are responsible to pay before the insurance company will make a payout. Deductibles vary in amount. Generally, the higher the deductible, the lower the premium. Always set aside enough money in a savings account to pay your deductible so that your deductible doesn’t become debt.

You’ll usually have several options for paying your insurance premiums. You often have the choice to pay monthly, quarterly, or annually. Sometimes paying a lump sum instead of monthly payments will net you a decent discount. You can have the money automatically withdrawn from your bank account or be billed for the premium. If you receive health insurance through an employer, your premium will be deducted from your paycheck. Homeowners often automatically pay their house insurance along with their mortgage payment from what’s called an escrow account.

If you forget to pay your premium or don’t have the funds to cover it, most insurers will give you about 30 days to pay before canceling your policy. Letting your insurance policy lapse is a pain. If it’s a life insurance policy, you may have to go through another health examination and could end up paying more for your policy.

If the policy is for auto insurance, the consequences are even more serious. A lapse of even one day could raise your rate once you buy a new policy, because uninsured drivers are considered higher risk. Not only that, but driving without at least liability insurance is illegal in every state but New Hampshire. And if you have a car loan, you are required to have insurance. If you don’t buy your own policy, the lender will buy a policy for you at a very steep rate. In an extreme case, the lender might repossess your wheels.

If you take out a loan to buy a home, you’ll also need insurance. Mortgage holders require homeowners to have insurance and will purchase extremely expensive insurance for the homeowner if the situation isn’t corrected right away. For those with renters insurance, if your policy lapses and the rental unit experiences a fire or other disaster, you’re out not only the cost of a policy you never used, but also the replacement cost of every one of your possessions.

Before an insurance company decides whether to offer you an insurance policy and at what premium, the company assesses how risky it will be to insure you. There are many ways that the insurance company will assess a potential customer’s risk. It will look at past behavior—have you been in previous car accidents, do you lose a lot of items, or are you known to jump out of airplanes? It will take into consideration what you are insuring and where. For example, a sports car in a city with a high crime rate will typically cost a lot more to insure than a minivan in the suburbs.

An insurer will also look at your financial behavior, particularly how you handle credit. Insurers have found that a person’s credit behavior can predict how likely it is for that person to have an insurance loss. Some states have restrictions on how credit-based insurance scores are used. But the bottom line is that the way you handle credit can affect other areas of your life, so it is important to use credit responsibly.

Life changes a lot when you’re young. Think of all the scenarios. You might buy a car, move to a different state, switch jobs, or get married. Each time your life changes, you’ll need to look at whether your insurance needs have changed as well.

Even in years when you don’t have a major life event, it pays to reevaluate your policies. Premiums fluctuate based on market conditions and can go down. As you get older and exhibit responsible behavior such as paying your premium on time, you may be offered a lower premium. Check your policy and its premium every couple of years.

You might wonder if you really need to worry about insurance. After all, you’re just a teen—you probably don’t have much to protect. And some of the insurance policies your parents have will protect you as well. For example, federal law requires health care companies to allow young adults to stay on their parents’ policy until they turn 26, even if they are married and financially independent.

If you’re living at home, you can stay on your parents’ car insurance as well, regardless of how old you are. Usually you can stay on your parents’ policy when you’re in college too, because your dorm room is not considered your permanent residence.

Sometimes your parents’ homeowners insurance policy will also cover your belongings at college. Be sure to have them contact their agent or read the details of their policy. Otherwise you should find the money in your budget to buy a renters insurance policy, even in a dorm room. Bottom line, you should always have health insurance, disability insurance, renters or homeowners insurance, and auto insurance, whether it’s your parents’ policy or your own.

Social media can be a great way to keep in touch with the companies that have your business. The companies’ Facebook pages and Twitter feeds can contain a lot of valuable and entertaining information. But you should be careful about the types of posts and photos you place on your social media pages. What you share via social media could be considered by insurance companies when evaluating your policy or examining a claim.