CHAPTER 27

The Use of Creative Finance to Benefit Controlling Stockholders*

The Problems Faced in the Schaefer Corporation Deal

Discount Purchases of Restricted Corporate Stock

Corporation’s Acquisition of Brewing

Problems and Wealth Creation Potentials for the Parties in Interest

It is likely that more fortunes within the financial community are obtained through the discount purchase of securities in negotiated transactions than through brilliant analysis resulting in the purchase at market prices of securities that will appreciate dramatically. A discount purchase is one in which a stockholder obtains securities at a price below that which prevails or is to be created in a public market.

Only a small minority of the Wall Street success stories come out of an outside investor’s acting on a feeling about the growth of a particular industry, such as feeling in 1955 that “copying is going to be a great business; ergo, I shall buy and hold Xerox.” Rather, the more common method of amassing wealth in the financial community is to be involved in a deal that enables you to buy common stock at, say, $.42 or $1 per share, for which the public has paid or will pay, say, $26 per share. A large number of deals resulting in such discount purchases have been put together, including, to name a few, Eastman Dillon promoting Westcoast Transmission, American Securities promoting Western Union International, Ladenburg Thalmann promoting Guerdon Industries, and Lehman Brothers promoting Monterrey Oil. Discount purchases are not confined to investment bankers and brokers; other deals have included Albermarle Paper purchasing Ethyl Corporation, Malcolm McLean acquiring certain shipping interests, and Northwest Industries acquiring Velsicol Chemical.

In this chapter, we describe one set of discount-purchase transactions in detail; these culminated in the November 1968 public offering of the F. & M. Schaefer Corporation, parent company of the producer and marketer of Schaefer beer.

The reason for picking Schaefer as a case study is that it is one of the more complex transactions, so that many of the key elements that go into a discount-purchase transaction are covered. It should be noted, however, that an important element not covered in the Schaefer transaction is the use of tax-loss carrybacks and tax-loss carryforwards.

There are a number of valuable lessons to learn from the Schaefer case study. The first concerns the mechanics of such transactions. It is also important to have some appreciation of what goes into Schaefer-type transactions in order to understand Wall Street. Another equally important lesson has to do with understanding the problems and goals of the various parties to the transactions.

The transactions are examined from the points of view of eight different constituencies:

Like all things on Wall Street, everything in this transaction, including discount purchasing, had its problems. In some contexts, the public shareholder who was able to obtain stock at $26 in the initial offering had fewer problems and a more attractive holding than some of the other parties who purchased stock at $1 per share two months earlier.

THE PROBLEMS FACED IN THE SCHAEFER CORPORATION DEAL

The mechanical problems faced in this complex deal included the following:

- Tax problems, especially for the sellers and the purchasers of discount securities

- Accounting problems for the public company

- Commercial-bank borrowings

- Private-placement borrowings from institutional lenders, such as life insurance companies

- Warrants

- Convertible securities

- Senior loans versus subordinated loans

- Corporate tax shelter (TS)

- Public underwriting

- Rights of registration

- Rule 144

- Cash returns versus no cash returns

- Qualified stock options

- Significance of financial positions in deal making

- Significance of reported earnings for a public company

- NASD Rules of Fair Practice

All the information used here was obtained from publicly available documents, mostly from SEC files. There were no interviews or conversations with anyone associated with the transactions. There is no question that if fieldwork had been done, our work would be more complete. It is also possible that with the personal explanation of those involved in the transactions, certain of our concepts would be changed. This goes with our thesis that in security analysis, studying documents is no substitute for fieldwork and vice versa. However, the point of forgoing fieldwork is to demonstrate that vast amounts of information frequently are available, so that quite meaningful conclusions often can be obtained by trained analysts relying solely on publicly available documents.

THE BACKGROUND OF THE DEAL

On June 10, 1968, the F. & M. Schaefer Corporation (hereafter called Corporation) was incorporated in New York State. Corporation’s purpose was twofold:

Both of these events did in fact occur less than six months after incorporation. The market for new underwritings was favorable in June 1968. Market players were seeking a reprise of the 1961–1962 new issue spree, in which they had bought issues at the initial offering price and realized a profit when the shares sold at immediate premiums. They were looking for securities of companies in growth industries, especially those that were outperforming their own industries in terms of steadily increasing sales, market penetration and profits. The brewing industry was viewed by many as poised for relatively rapid growth, because the progeny of the post–World War II baby boom were reaching beer-drinking age and because higher profit package sales, especially cans, were taking over from draft beer, which was generally a brewer’s lowest-profit margin product.

Brewing, which had been in the beer business since 1842, was a strong, prosperous, family-owned business in mid to late 1968. It had Schaefer beer plants in Albany, Brooklyn, and Baltimore. Sales of Schaefer beer, marketed in the northeastern United States, had increased steadily from 2.8 million barrels in 1958 to 4.7 million barrels in 1967, and in 1968 barrel sales were running some 7 percent ahead of 1967. Market penetration, too, had been on the rise. Beer sales in barrels increased from an estimated 3.3 percent of the industry total in 1958 to about 4.4 percent in 1967. Brewing seemed bound to at least hold its market share in 1968, based on results for the first nine months of that year.

Brewing had been quite profitable and was growing rapidly. Net sales had increased steadily from $151 million in calendar 1963 to $181 million in 1967. Income before extraordinary credits was $2,546,000 in 1963 and had increased year by year to $5,127,000 in 1967, although operating profits had dipped modestly in 1964 because of a $1,349,000 pretax expense incurred in connection with promotions by the company at the New York World’s Fair. As is true of many private companies, Brewing’s profit figures seem to have been conservatively stated,1 and were reported, after tax accruals, at the approximate maximum income tax rates.

Moreover, the company was well financed. The Brewing balance sheet that would have been available before June 10, 1968, was not public information, but the July 31, 1968, audit statement showed that the company was quite comfortable. Cash and equivalent was $10,405,000, and current assets aggregated $40,468,000. Current liabilities were $19,970,000, leaving working capital of $20,498,000. The only other liabilities were $3,029,000 of employee benefits and $15,210,000 of long-term debt, $15 million of which was in the form of 5.17 percent notes held by the Prudential Insurance Company of America. These notes matured serially to 1983, but annual amortization during the next six years would be only a modest $500,000 for 1968 and 1969, and $825,000 for 1970, 1971, 1972, and 1973.

Tangible asset value was stated at $53,149,000, probably a conservative figure. Property, plant, and equipment—which included a malting plant in Buffalo, New York, and six distributing centers, as well as the three breweries—was carried at a net value of $44,877,000, after deducting accumulated depreciation of $38,841,000. This $44,877,000 amounted to only $8.56 per barrel of capacity, based on Brewing’s 1967 capacity of 5,240,000 barrels. In light of the fact that replacement costs were running about three times this per barrel of capacity,2 Brewing’s property, plant, and equipment seem to have been worth at least the amounts for which they were carried on the books.

DISCOUNT PURCHASES OF RESTRICTED CORPORATE STOCK

A week after Corporation was organized, R. W. Pressprich and Company purchased 160,000 newly issued shares of Corporation common for $66,667, or $.42 per share. This was the first discount purchase.

Pressprich, located at 80 Pine Street in New York City, was a medium-sized New York Stock Exchange member firm, which for many years had been highly regarded in the financial community. Pressprich was a principal, if not the principal architect of the Corporation-Brewing transaction and subsequent public offering, and also arranged the financing that gave Corporation the wherewithal to effect the purchase. Pressprich had agreed not to resell these 160,000 shares before March 15, 1971, without first offering them to Corporation at $.42 per share.

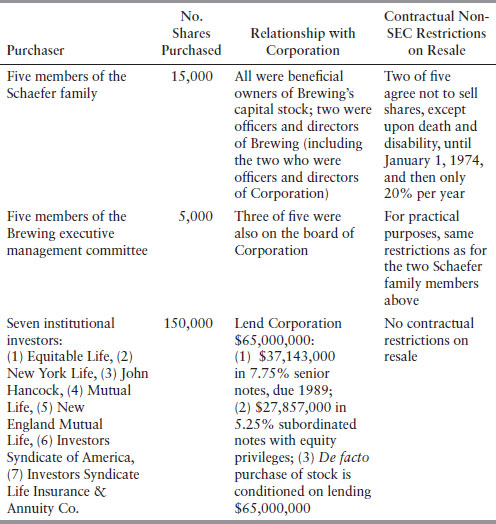

On September 20, 1968, the day Corporation signed a purchase agreement for the acquisition of all of Brewing’s capital stock, an additional 170,000 shares of newly issued Corporation common stock were sold at $1 per share. The purchasers of these shares included members of the Schaefer family, members of the Brewing executive management committee, and a group of institutional investors who were to lend Corporation funds for the acquisition of Brewing. Thus, all of them were providing other benefits for Corporation, either at present or prospectively. The purchasers, their relationship to Corporation, and the special terms of their purchases are shown in Table 27.1.

Table 27.1 Purchasers of 170,000 Corporation Common @ $1 per Share

As noted, all of the shares issued in these two discount purchase transactions, except the 150,000 purchased by the institutional investors, were sold subject to contractual restrictions on public resale. The shares could be sold privately to another sophisticated holder who would agree to be bound by the restrictions on resale agreed to by the discount purchasers. Such a resale would be unlikely, however, and even if accomplished, the price realized would be a substantial discount (probably 25 percent to 60 percent) from the current market price.

Apart from these contractual restrictions on resale, the 330,000 shares involved were restricted for Securities and Exchange Commission purposes. Accordingly, public resale was limited by law. Under the rules and regulations in effect in 1968, these shares could have been sold publicly only through a registered offering via a registration statement filed with the Securities and Exchange Commission, unless the Commission was to issue a no action letter or a holder was able to obtain a legal opinion that there had been a “change of circumstances.” As a practical matter, the chances of any of these purchasers’ getting a no action letter or change of circumstances opinion were slim at best.

Thus, at the time of the discount purchases, the only way for the purchasers to sell their Corporation equity securities publicly was by registration with the SEC for a new public offering in which their shares would be sold. As a result, registration rights—an agreement by Corporation to register with the SEC for the distribution of restricted shares—were crucial, at least to those discount purchasers who were not in a position of control in Corporation. Both the institutional investors and Pressprich negotiated fairly strong registration rights, which are discussed at some length later in this chapter.

Since April 1972, Rule 144 had provided holders of restricted stock purchased previously another mechanism for reselling their shares. Basically, under this rule such a holder who had held shares outright for two years might sell them in regular market transactions on the New York Stock Exchange. Back then, Rule 144 provided that the sales could occur only once every three months, however, and the number of shares that might be sold was limited to the greater of 1 percent of the outstanding stock of the company, or the weekly average traded for the four weeks preceding the filing of a Form 144 with the SEC. In this case, 1 percent of Corporation’s common stock at the time it went public would have been 18,000 shares.3

CORPORATION’S ACQUISITION OF BREWING

The Purchase Agreement

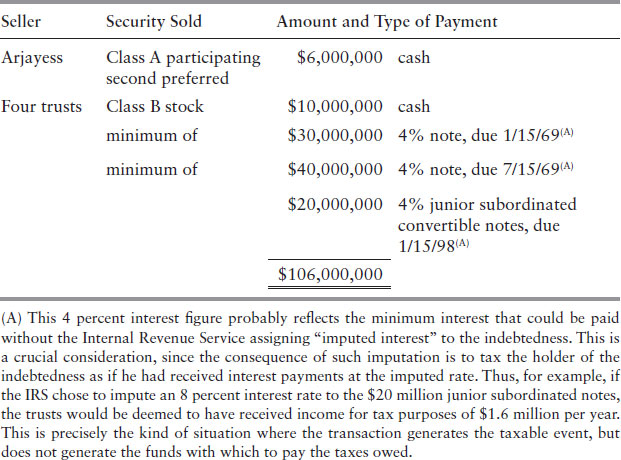

On September 20, 1968, Corporation signed an agreement under which it was to acquire all of Brewing’s outstanding capital stock for $106 million in cash and notes. This stock consisted of two issues. The Class A participating second preferred stock was owned by Arjayess, a corporation wholly owned by Rudolph J. Schaefer. The Class B stock was held by four trusts set up in 1944 for the benefit of various members of the Schaefer family.

Under the terms of the purchase agreement, Corporation was to acquire the Class A stock for a cash payment of $6 million. The remaining $100 million of the purchase price, paid to the holders of the Class B stock, was in the form of a cash payment of $10 million and various notes, detailed in Table 27.2.

Table 27.2 Consideration Given to Sellers of Brewing’s Capital Stock

The purchase was contingent upon Corporation’s receiving net proceeds of at least $35 million from a public offering of its common stock. The actual purchase was to take place simultaneously with Corporation’s receipt of these proceeds, but not later than December 31, 1968. In fact, the closing took place during the first week of December.

Brewing’s officers and employees were to remain in their positions after the acquisition, at the same or improved rates of compensation.

Financing the Acquisition

Corporation needed about $121.8 million to accomplish this acquisition; $106 million of this, of course, was the purchase price to be paid to Brewing’s selling stockholders. In addition, Corporation needed $15 million to prepay the 5.17 percent Brewing notes that were held by Prudential Insurance, and $800,000 to pay expenses incurred in connection with arranging this deal.

Two parties shared the bulk of the $800,000 expense item. The first was the eminent New York City law firm of White and Case, whose legal fees were around $350,000. White and Case had represented the Schaefers and Brewing for a long time. One partner, Glover Johnson, had been a consultant to Brewing, on a retainer, since 1955 and was a director of that company. He was also a successor trustee of the four Schaefer trusts, for which he was to receive an annual fee of 2 percent of trust income after 1968. The firm became counsel for Corporation, and Mr. Johnson and his partner, John C. Reed, became directors of Corporation.4

In addition to White and Case’s legal fees, Pressprich received a fee of $425,000, primarily for its work in connection with the placement of Corporation’s long-term notes. This $425,000 fee was separate from Pressprich’s discount purchase of 160,000 shares of Corporation stock. The bulk of the fee, of course, was conditioned on going public.

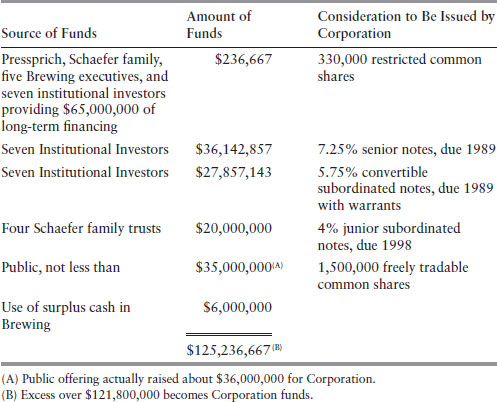

After its organization, Corporation obtained $236,667 in cash from the proceeds of its sales of common stock at a discount. It had also conditioned the acquisition of Brewing on the receipt of $35 million from its public offering, which would be available to it. Under the terms of the purchase agreement, Corporation had arranged to borrow $20 million from the Schaefer family trusts, to whom $20 million of junior subordinated debentures were to be issued. These funds, aggregating a little over $55 million, together with the $6 million surplus cash that Brewing had, still left it considerably short of its $121.8 million goal, however. To fill the gap, Corporation arranged to borrow $65 million from the seven institutional investors that had participated in the second discount purchase. Thus, Corporation’s sources of funds and securities issued or issuable would be as shown in Table 27.3.

Table 27.3 Sources of Funds and Securities in the Transaction

This was not the picture as of the time of the public offering, however. The institutional investors would not lend any funds before January 15, 1969, and their investment was to be phased in over 18 months, according to the following schedule:

| Date | Amount to Be Invested at This Date |

| 1/15/69 | $31,845,357 |

| 7/15/69 | $8,222,500 |

| 1/15/70 | $13,510,714 |

| 7/15/70 | $11,421,429 $65,000,000 |

The reason for this phasing is not clear, especially since Corporation was obligated to pay the entire $106 million purchase price to the Brewing shareholders by July 15, 1969. It may have been due to the investment scheduling requirements of individual lenders, all of which have schedules of cash inflows and outflows, or it may have involved things peculiar to these transactions. In any event, the arrangement left Corporation with a temporary shortfall, which it covered by arranging a short-term loan from First National City Bank of New York at the prime rate.5

Corporation’s Debt Securities Described

The financing scheme outlined above called for the issuance of $85 million worth of debt by Corporation. A little over $36 million of this was in the form of 7.75 percent, 20-year senior notes. The balance was in subordinated notes of varying terms, all of which had equity privileges.

The $20 million of 4 percent, 30-year notes issued to the Schaefer trusts carried conversion rights. Beginning January 15, 1971, they were convertible into Corporation common at a price of $40 per share. This conversion price could be reduced on January 15, 1972, to the average price of the stock on the New York Stock Exchange for the 60 trading days prior to January 15, 1972, but in no event could it fall below the initial offering price at which Corporation went public ($26). Thus, if for the 60 trading days before January 15, 1972, the average price for Corporation common stock was $40 or better, the 4 percent notes would be convertible into 500,000 common; if the average price was $35, the 4 percent notes would be convertible into 571,429 Corporation common; and if the average price was $26 or less, the 4 percent notes would be convertible into 769,231 common.

The 5.75 percent, 20-year subordinated notes issued to the institutional investors were structured somewhat differently. Approximately $1.2 million of the $27,857,143 issue was convertible into Corporation common at prices ranging from $10 to $6.50 per share (one quarter of the respective maximum and minimum conversion prices for the 4 percent notes), based on the same timetable and the same sixty-day average price formula used for the 4 percent notes.

The remainder of the issue was not convertible. Instead, the seven institutions received warrants, exercisable beginning January 15, 1971, to purchase 84,866 Corporation common at $10 per share. Like the conversion rights, the warrants could be adjusted on January 15, 1972, depending on the 60-day average New York Stock Exchange price of the stock, into warrants to purchase as much as 130,563 Corporation common at $6.50 per share. These warrants were detachable from the 5.75 percent notes, and were transferable upon compliance with SEC registration requirements. The institutional holders had registration rights in connection with both the warrants and the common stock, issuable upon conversion of the notes.

The equity privileges of all of these subordinated securities were protected by antidilution provisions similar to those usually found in publicly held convertible securities and warrants. For example, in the event of a two-for-one stock split, the conversion price would be reduced by 50 percent, so that the holder of the notes or warrants would receive the same proportionate equity share on conversion or exercise as it would have before the split. Assuming, as actually happened, that in 1972 the conversion and warrant prices were reduced to the minimum allowed, then in the event of such a split, the 4 percent notes would be convertible at $13, and the 5.75 percent notes or warrants at $3.25.

While the antidilution protections accorded these subordinated notes are fairly standard, other features of the subordinated notes are quite different from those commonly associated with publicly held senior securities with equity privileges. Particularly noteworthy in this regard are the provisions for mandatory and voluntary redemption, and the various protective provisions granted the holders of these notes.

Mandatory Redemption Provisions

The conventional public issue of senior securities with equity privileges has only very small amortization, or sinking fund, provisions that operate in the early years after issuance. For example, a typical 20-year publicly owned subordinated debenture might have a sinking fund provision that becomes operative after 10 years and provides thereafter for annual redemptions of 3 percent of the issue at par.

A relatively small sinking fund provision does, of course, operate to the benefit of the public holder of a convertible note. Rapid payback of debt to such an investor would diminish the value of his conversion privilege by “forcing conversion” whenever the market price exceeds the conversion price at the time of redemption.

This phenomenon of forced conversion is best explained by a concrete example. Assume that Corporation calls for redemption $1 million of debentures convertible at $6.50 at a time when its stock is selling for $8 a share. The holder of the debentures can redeem them at par, realizing $1 million. But his conversion privilege entitles him to receive 153,846 shares of common stock. If he sells these shares short at $8 when the redemption is announced, converting the debentures to make delivery against the short sale, he will realize $1,230,769 before commissions and other trading costs of the short sale. The economic benefit of this latter strategy—in this case, $230,769—is what forces conversion. Such forced conversion will, of course, occur whether the redemption of the convertible notes is pursuant to a mandatory sinking fund provision or to a voluntary (by Corporation) call.

In the context of this deal, the interests of the Schaefer family trusts in terms of sinking fund provisions were essentially the same as that of a public holder of a convertible note. Accordingly, the mandatory redemption provisions governing the 4 percent notes were similar to those for a typical public issue: The sinking fund was not to become operative until January 15, 1979, about 10 years after issuance; thereafter, annual redemptions at par would amount to $500,000, or 2.5 percent of the original issue, until the debt held by the institutional investors was to be retired in 1989; annual redemptions would then double for the last 10 years, leaving a $6 million unamortized balance, payable at maturity.

The interest of the institutional investors involved in this deal was somewhat different: a steady and relatively rapid payback of their loans, rather than a straight conversion privilege, was their primary goal. Accordingly, the 5.75 percent notes issued to them had sinking fund provisions requiring annual redemption at par of 6.25 percent of the debt outstanding, beginning January 15, 1974, five years or less after issuance. In dollar terms, this amounts to annual redemptions of $1.7 million for 16 years. This redemption scheme does not diminish the value of the institutional investors’ equity privileges, because of the way in which those privileges were structured. The great bulk of the 5.75 percent notes were accompanied by warrants that, as noted above, were detachable from the notes. As to the $1.2 million of debt that was in the form of convertibles, the institutional investors were protected by a provision that in the event of prepayment, warrants to purchase would be issued in lieu of, and on the same basis as, the conversion privileges. These warrants were to expire in 1989.

Voluntary Redemption Provisions

Typically, the issuer’s right to voluntarily call a publicly held subordinated debenture with equity privileges is pervasive. The issue is callable in whole or in part anytime after issuance at par. Thus, the issuer is in a position to force conversion if the price at which the common stock is selling is above the price at which the senior security is convertible.6 Corporation’s voluntary call provisions were quite different from those typically found in connection with a public issue.

The 5.75 percent notes carried a five-year call protection, so that Corporation could not voluntarily redeem the notes until January 15, 1974. After that, Corporation could voluntarily redeem $1,740,884 of notes at par each year. No additional calls were permitted until January 15, 1979; thereafter, such calls were permitted, but only at a premium. The prepayment premium was 105.75 percent of par in 1979, declining gradually to par in 1988.

The 4 percent notes carried an eight-year call protection. Thus, there could be no voluntary call before January 15, 1977. After that date, the notes were callable at a premium—104 percent of par in 1977, gradually declining to par in 1998. In addition, Corporation was granted rights to voluntarily call $500,000 of notes per year at par beginning January 15, 1979, and $1 million of notes per year beginning January 15, 1988.

Protective Provisions

The usual public issue of subordinated debentures or notes, or even preferred stock, tends to have protective provisions that are few and generally not too meaningful. The protective provisions of the 4 percent notes issued to the Schaefer family trusts were similarly skimpy. Indeed, if anything, these notes were less well protected than the typical public issue, since they were fully subordinated not only to the senior notes, but also to the subordinated notes held by the institutional investors.

The notes held by the institutional investors, by contrast, contained protective provisions that were far stronger than those found in any publicly traded subordinated debenture of which we are aware. These included both negative covenants (things Corporation was prohibited from doing) and positive covenants (things Corporation was required to do). For example, the terms of the purchase agreement under which these notes were issued required Corporation to maintain a certain minimum working capital at all times, and limited amounts that could be borrowed by Corporation and by its subsidiaries, depending on certain earnings and net tangible assets tests. It also imposed restrictions on rental charges incurred, dividend payments, the repurchase of shares and the voluntary redemption of senior securities. Further, the agreement contained prohibitions against sale and lease-back transactions and against investment in the securities of other companies or entities, other than subsidiaries and the U.S. government.

Other Distinguishing Features

Although, as noted, the 4 percent notes contained fairly insignificant protective provisions, they contained a very interesting and unusual control provision. The holder was given the right to accelerate payment of the entire amount in the event that one person acquired beneficially 30 percent or more of Corporation’s voting securities, or two or more holders acquired voting stock of Corporation for the purpose of exercising control. This should have effectively discouraged anyone from seeking to oust the Schaefer family from control of Corporation.

One final difference between Corporation’s subordinates and similar publicly held issues that is worthy of note is that they were private placements. Although this statement may seem to belabor the obvious, in fact the status of the notes as the product of purchase agreements between Corporation and the acquirers is significant in terms of the protection afforded the holders. A public debt issue is issued under a trust indenture, which is an agreement, conforming to the SEC-administered Trust Indenture Act of 1939, between the issuer and a large-bank-designated trustee for the debt securities holders. In the event of default or breach of the agreement, the individual holder of a public debt issue is not usually in a position to take action against the issuing company on his own unless he and others represent not less than 25 percent of the outstanding debt issue. Rather, the debt holder has to wait for the trustee to take action. The trustee will take action only in strict conformity with his interpretation of the indenture. Thus, the public debt security holder may be less protected than the public common stockholder, who tends to be free to take legal actions on behalf of all stockholders or the company itself. The institutional investors involved in this deal have an advantage not possessed by public investors, in that they can themselves move rapidly against Corporation in the event of default or breach of the purchase agreement.

Conversely, there may be situations in which the very fact that this issue is held by only a handful of owners places the institutional investors in a less favorable position than that enjoyed by a public investor. For example, if the issuer wants to modify the terms of a loan agreement without recourse to the bankruptcy statutes, it is in a position to negotiate changes with a few private lenders. The issuer cannot, as a practical matter, do so with a trustee for indebtedness or with individual public investors, however. Thus, the private investor may be forced to agree to changes adverse to his interests in order to avoid bankruptcy of the issuer, whereas full service may be continued on subordinated debentures because they are publicly held.7

Arranging the Public Offering

On September 26, 1968, a little over three months after its incorporation, Corporation filed a preliminary registration statement with the SEC, showing an intent to offer 1 million shares of common stock at a maximum price of $26 per share. At the time of the filing, Pressprich was to manage the syndicate that would underwrite the offering, but that firm was soon replaced by White, Weld and Company, a leading New York City investment banking firm prior to its merger in 1978 into Merrill, Lynch, Pierce, Fenner and Smith. Although White, Weld did not actually execute a written agreement with Corporation or with any of the proposed members of the underwriting group until just before the registration statement became effective on November 27, 1968, it was busy putting together an underwriting group during the incubation period in which the SEC was reviewing and commenting on Corporation’s filing. In all, the underwriting group included 128 firms—117 U.S. firms and 11 European businesses. White, Weld, as manager, underwrote 218,000 of the 1.5 million shares offered. The underwriting group also included Dillon Read; Halsey Stuart; Kidder, Peabody; Kuhn Loeb & Co.; Lazard Freres; Paine, Webber, Jackson and Curtis; and Paribas.

The issue was offered for sale at $26 per share on November 27, 1968, and was an immediate success. The warning in the prospectus that Corporation’s large debt load and negative tangible net worth made the issue highly speculative certainly did not depress the price, and may even have been the reason the issue went to a premium. In any case, the stock closed at 31 bid on the date of the issue.8

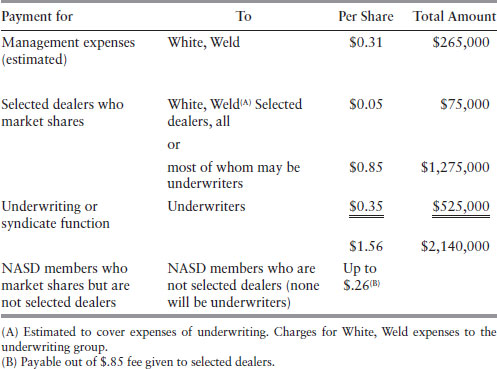

Of the $39 million gross proceeds from the offering, 6 percent (amounting to $1.56 per share), was retained as underwriting discount;9 $1,065,000 of this (amounting to $.71 per share) went to White, Weld for its management fee and for the legal, advertising and other expenses incurred in connection with the underwriting. The balance was paid to certain dealers, including the underwriters, as a sales commission.10

Corporation incurred expenses of about $330,000 in connection with the underwriting, over and above the underwriting discount. These included such items as legal fees ($100,000), accounting fees ($75,000), printing costs ($75,000), SEC and blue sky (state security regulation) fees ($30,000), liability insurance ($35,000), and transfer agent fees ($15,000).

Contemporaneously with the public offering, Corporation granted options to its employees to purchase 98,134 Corporation common shares. These were granted pursuant to a qualified stock-option plan covering 200,000 shares of Corporation common, which had been approved on October 30, 1968. These options, which were granted at 100 percent of market value on the date of grant, were good for five years if the holder remained employed by Corporation or a subsidiary. Upon the exercise of the qualified option, Corporation would lend the employee 90 percent of the exercise price at 4 percent interest; 20 percent of the outstanding amount was to be repaid annually for the first four years, the balance in the fifth year. These options enabled the holder to profit on a tax-sheltered capital gains basis from appreciation in the market value of Corporation’s stock.

PROBLEMS AND WEALTH CREATION POTENTIALS FOR THE PARTIES IN INTEREST

The Selling Stockholders

The selling stockholders were Arjayess, a corporation wholly owned by Rudolph J. Schaefer, and four trusts for members of the Schaefer family.

There are a number of things that motivated the Schaefers to follow the course of action they did rather than the alternative opportunities that might be summarized as follows:

The Schaefer family, through these transactions, obtained by July 15, 1969, some $86 million in cash on a tax-sheltered (capital gains rather than dividend income) basis, after which they were still left in control of the company. The company, too, was now public, with a huge stock market value in which the Schaefers expected to participate, at least to some extent. Unlike the other stockholders’ holdings, though, the Schaefers’ security holdings would provide the four trusts with an $800,000 annual cash return, because the four trusts held $20 million of 4 percent convertible debentures, rather than common stock on which it was likely that no dividends would be paid. Assuming that the average price for Corporation’s common stock for the 60 trading days before January 15, 1972, was 40 or more, the Schaefer family interests would own 19.6 percent of Corporation’s equity on an all-converted, all-exercised basis. Assuming, on the other hand, that the average price for Corporation’s common stock for the sixty trading days before January 15, 1972, was 26 or less, the Schaefer family interests would own 26.1 percent of Corporation’s equity on an all-converted, all-exercised basis. In either event, the Schaefer family would control Corporation. The Schaefer family ownership interests are computed as shown in Table 27.4.

Table 27.4 Schaefer Family Ownership Interests Computed under Two Different Price Scenarios

| At Price of 40 or More | At Price of 26 or Less | |

| No. shares outstanding after public offering | 1,830,000 | 1,830,000 |

| No. shares owned by Schaefer family interests of outstanding | 15,000 | 15,000 |

| % owned by Schaefer family interests | 0.80% | 0.80% |

| No. shares issuable upon conversion of debt, exercise of warrants and exercise of qualified options | 798,134 | 1,175,057 |

| No. shares issuable to Schaefer upon conversion of 4% notes | 500,000 | 769,231 |

| No. shares to be outstanding on all-converted, all-exercised basis | 2,628,134 | 3,005,057 |

| No. shares to be held by Schaefers | 515,000 | 784,231 |

| % owned by Schaefer family interests | 19.60% | 26.10% |

Each of the alternative opportunities had special disadvantages. The Schaefer family interests could have contemplated, and may well have studied, merely offering some of the Brewing stock held by Arjayess and the four trusts in a so-called underwritten secondary offering. Such an offering would have resulted in the sellers’ realizing cash on a capital-gains basis and would also have left the Schaefer interests in control of a public company. Furthermore, this public company, unlike Corporation, would enjoy considerable financial strength. However, it would have been virtually impossible for a secondary underwriting to be arranged on such a basis that the Schaefer family interests would be able to realize $86 million in cash. Indeed, Corporation’s $39 million gross proceeds from its underwriting was relatively large for an issue of this type. Not only were the Schaefer family interests able to realize $86 million of cash from doing what they did, but also they may well have achieved a much better aftermarket for their remaining holdings in Brewing’s parent than would have been the case on straight underwriting. Because certain influential Wall Street entities (Pressprich and the seven institutional investors) were important shareholders, Corporation may well have become a better-sponsored security in 1969 and 1970 than would otherwise have been the case. Corporation’s stock price rose almost steadily after the initial offering in November 1969, reaching a peak in February 1970, when the shares sold at a price of $59, equal to 25 times 1969 earnings of $2.30 per share.

Had Brewing remained a private company, its ability to borrow from lending institutions would have been considerably poorer than as part of a public vehicle. One crucial factor that made the $65 million borrowing by Corporation attractive to the seven institutions was their obtaining discount purchases of equity interests—that is, 150,000 common at $1 per share, and rights to obtain between 200,000 and 307,692 common shares at between $10 and $6.50 per share, depending on where the stock (which was to go public at 26) would be selling three years later.

It is possible that the Schaefer family interests could have received maximum tax shelter by remaining private and by having borrowed funds flow into Brewing. Since the family owned 100 percent of Brewing, the funds might have been usable by them without any, or any appreciable, amounts being distributed to Arjayess or the four trusts. However, such a course of action could raise tax problems for Brewing, namely, a Section 531 problem on the unlawful retention of surplus, even though this probably would have been vitiated by Brewing’s plans to spend at least $38 million to construct a new facility in eastern Pennsylvania. In any event, we have no information about the amount of tax shelter available to Arjayess on its receipt of $6 million. Also, it is probable that the four trusts have obtained more tax shelter from returns on their investments than would have been feasible if the same funds had been invested in Brewing. There is no question that with the considerable planning that went into the transactions, they were designed so that the combined tax impacts on Arjayess and the four trusts were minimized.

Had Brewing chosen to sell out to a larger company, it is extremely unlikely that the Schaefer family interests could have retained the same type of control over Brewing that became available to them through the creation of Corporation, which alone may have discouraged this approach. In addition, it probably was difficult to find an acquirer with whom an agreement could be reached that would result in the Schaefer family interests’ receiving $86 million in cash (either from the acquirer’s treasury or from the sale of shares received), plus a meaningful equity interest in the common stock of the acquiring company. It is possible, but not probable, that an acquirer with a usable tax-loss carryforward might pay out that much cash for Brewing (for example, see the Northwest Industries acquisition of Buckingham Corporation in 1971). If the Schaefer interests were to receive $86 million cash either directly from the acquirer or through the sale of common stock of the acquirer received, the acquiring company in all probability would have had to account for the Brewing acquisition on a purchase basis rather than a pooling-of-interests basis. In addition, the sale of Brewing to a larger company could easily have been stopped or made difficult because of antitrust proceedings of the U.S. Department of Justice or the Federal Trade Commission.

Had Brewing remained as it was, a private, relatively debt-free corporation, there would have been no large-scale cash distributions to Arjayess or the four trusts. In addition, assuming there was no intention to ever go public, Brewing’s business might have suffered because of the difficulty of offering key personnel meaningful equity interests in the enterprise.

On balance, the transaction that did take place did have many advantages for the Schaefer family interests. This does not mean that there were not a considerable number of disadvantages that ensued. First, the Schaefers were now in control of a highly leveraged public company with new sets of obligations to important outside interest groups. The seven institutional investors placed restrictions on operations and financing in accordance with the terms of the various purchase agreements. Both Corporation and the Schaefers were now subject to SEC requirements as to reporting and corporate conduct.

Also, lawyers representing minority interests would be very ready and able to seek redress for what they believed were wrongs to stockholders. If Brewing had remained closely held and if the Schaefer family interests desired to acquire for themselves, say, a beer distributor, there would have been no need to offer this distributor first to Brewing; however, as a public entity, Corporation would find that such a transaction would be extremely suspect, and quite possibly impossible to do as a practical matter.

Furthermore, as a result of going public, corporate objectives changed. As a private company, Brewing would strive to maximize economic profits, whereas, as a public entity, Corporation tends to strive to maximize immediate accounting profits. Frequently, the maximization of economic profits is in direct conflict with the maximization of immediate accounting profits. As a private company, Brewing would take as much depreciation as it could in order to reduce income taxes and accounting profits, and Brewing would be more willing to launch expensive programs—say, very large-scale advertising—the benefits of which may not be apparent for many years.

The Schaefer family interests were left with a large ownership interest in and control of a financially weakened company that was not as well prepared to meet competitive onslaughts as it might otherwise have been. As a matter of fact, in the early 1970s the principal national companies, Anheuser-Busch, Schlitz, and Miller’s, commenced raiding regional markets with programs consisting of price-cutting and other forms of aggressive merchandising. Such programs were relatively successful for the nationals. Corporation’s accounting earnings per share peaked at $2.30 in 1970 and declined to $1.75 in 1971. Corporation suffered a deficit of in excess of $1 million in 1972, and deficit operations continued through 1973. The business was nominally profitable in 1974, 1976, and 1977, reported a massive deficit in 1975, and suffered a large loss in 1978.

Although the Schaefer family interests did create a large market value for their holdings in Corporation, such value was not readily realizable. Unlike the outside stockholders’ shares, shares in Corporation held by the Schaefers were “tainted”—that is, they were not freely salable. As a practical matter, sales of large amounts of stock by them probably could only be accomplished by having another registered secondary or by selling the shares privately at a very substantial discount from market. A registered secondary might be accomplishable only via an underwriting, the cost of which might run from 7 to 10 percent of the gross proceeds, and at that, might be accomplishable only during periods when both the new-issue market was doing well and Corporation itself was prospering.

Brewing’s Executive Employees

Two principal changes occurred for Brewing’s executive employees. First, they received a new financial incentive in the form of discount purchases of Corporation stock, which theoretically could be disposed of by public sale in whole or in part at some future date. Second, Brewing’s executive employees were now managing a consolidated enterprise that was heavily in debt and publicly owned, rather than a private company with excess financial resources.

The discount purchases by these executives were of two types. The first was the aggregate of 5,000 shares of Corporation common purchased at $1 per share by five members of Brewing’s executive management committee two months before Brewing went public at 26. On a gross valuation basis, this transaction resulted in a windfall of $25 per share, or $25,000 for each of the five individuals. Such a calculation, though, would be misleading. The reasons why the difference between a $1 purchase price and a $26 market price was something less than $25 can be summarized as follows:

By having the opportunity to purchase Corporation shares at $1 per, the five executives did receive something of value, although for income-tax purposes this was not construed to be a discount or bargain purchase. The reasons why the purchase was not so construed was that based on what the tangibles were in Corporation’s business on September 20, 1968 (the purchase date), the shares were not even worth $1. Also, others also paid the same price at that time. Had IRS considered the shares a bargain purchase, these executives would have had to treat the difference between the fair value of the shares received (26, for tax purposes) and the $1 per-share cost as employment compensation to be taxed at ordinary income rates. If that had been the case, it is very probable some or all of the executives would have considered the right to buy shares at $1 per share on September 20, 1968, as something with a negative value.

Also, these five executives received, in the form of equity ownership incentive, qualified stock options as part of a program under which designated employees, including certain officers and directors of Brewing, received options to purchase 98,134 Corporation common at 26. The options were granted at fair market value (26 per share) on the date the underwriting agreement was signed. These options were to expire five years from the date of grant or earlier in the event of termination of employment, disability, or death. In the case of some of the options, if they were not exercised during the first four years after grant, the exercise price could be payable by borrowing 90 percent of the required funds from Corporation. Such borrowings would bear interest at 4 percent, and the notes would be repayable at the rate of 20 percent per year. Put simply, these qualified options permitted the holders’ potential profit, on a tax-sheltered basis, from appreciation in Corporation’s stock price, without any cash outlay at all for five years and with very attractive financing terms for the next five years.

The tax shelter existed because the options were, for IRS purposes, “qualified.” If the employees had received nonqualified or nonstatutory stock options, then the excess of the fair value of those options over their cost would, in the majority of cases and unless carefully structured, be taxable as employee compensation in the year of receipt. The worst tax posture a taxpayer can find himself in would result from such a nonstatutory stock option.

As the operating heads of Brewing and its parent, Corporation, the officers and directors of the public company now found themselves influenced by a different discipline from when they were officers and directors of a private company with excess financial resources. The different discipline was not necessarily better or worse, but it was different.

The Commercial Bank Providing Bridge Financing

First National City Bank provided $24.9 million of loans to Corporation with interest at the prime rate. In addition, the bank received a commitment, or standby, fee equal to an annual rate of 1/8 percent of the unused balance (that is, the portion of the $24.9 million not borrowed) from September 26, 1968, to the closing or December 31, 1968, whichever was earlier. Subsequently, the commitment fee on the unused balance was increased to ¼ percent. These loans, in the form of short-term notes, were issued in July 1969 and were retired within one year as the seven institutions invested their funds into Corporation in the form of long-term senior notes and subordinated notes. Corporation did have the right to prepay the bank loan at any time, but would have incurred a ¼ percent prepayment penalty if it used funds obtained by borrowings at a lower interest cost than First National City’s prime rate.

From the bank’s point of view, the loan in the form of bridge financing seemed reasonably safe. First, there was the take-out by the permanent lenders, the seven institutions who were committed to invest further sums on January 15, 1970, and July 15, 1970, the first proceeds of which were to be used to repay these short-term notes. Second, Corporation consolidated with Brewing was a profitable, growing business with operating earnings in excess of $1 million per month, a substantial balance-sheet cushion behind these notes in the form of about $12 million of subordinated notes, $20 million of junior subordinated notes and a stockholder’s equity (including over $50 million of nonamortizing good will) of about $37 million. Also, Corporation was managed by a highly reputable and successful group.

Returns to the bank exceeded merely interest at the prime rate. The loan itself probably required compensating balances of 10 percent to 20 percent of the notes outstanding to be kept on deposit. First National City may also have become the bank of deposit, as well as the lending bank, in connection with other Corporation activities, and the transactions may have resulted in creating trust business for the bank. As far as corporate trust activities are concerned, First National City did become the registrar for Corporation common. As far as personal trust is concerned, First National City could conceivably have obtained investment management and/or custodian business from the Schaefer family in connection with the handling of their portfolios.

Although the financing of acquisitions is attractive, banks view it as the least productive part of their lending activities. These are virtually the first loans to be cut out in periods when money is tight or generally unavailable, as in 1966, from 1969 to 1970, and again in 1973 and 1974 and 2008–2009.

The Wall Street Promoters

Pressprich, then a prestigious New York Stock Exchange member firm, appeared to have profited handsomely from the transaction under which Corporation purchased Brewing’s equity securities simultaneously with Corporation’s going public. Off the top, Pressprich received fees of $425,000 for arranging Corporation’s financing; and for $.42 per share, or a total of about $67,000, Pressprich purchased 160,000 common five months before the public subscribed to freely tradable shares of the same issue at 26 per share (equal to $4,160,000 for 160,000 shares). The 160,000 common held by Pressprich were, for SEC purposes, unregistered, or restricted, shares; in any event, Pressprich had agreed with Corporation not to sell the shares to anyone before March 15, 1971, without first offering the shares to Corporation at $.42 per share. Even with these restrictions on resale, the 160,000 share acquisition seemed to have been quite a bargain for Pressprich from any point of view except that of the Internal Revenue Service.

Less visible and less tangible were other benefits to Pressprich. First, the firm gained two seats on Corporation’s board of directors, which probably resulted in small fees and elements of control over important assets. “Control,” a many-faceted concept, could extend, for example, to having Pressprich’s directors influence the company in registering shares for distribution with the SEC, including the 160,000 shares held by Pressprich. In the normal situation, however, the Pressprich directors would be outside directors, and their de facto control over the affairs of Corporation would be manifestly less than would the inside directors’ and management members’, whether directors or not. The liabilities of the outside directors, however, could easily be just as large as anyone else’s in the case of judicial or administrative findings of wrongdoing that harmed Corporation or its stockholders. (This is why many people are reluctant to serve on boards, especially since neither corporate indemnification provisions nor directors’ liability insurance can give a director assured insulation from liabilities. Yet, on balance, most people probably feel there is a net benefit to them and to their organization from serving as outside directors on the boards of public corporations.)

Another benefit that may well have been available to Pressprich was future business from happy clients. The happy clients were of two types, both of whom had enormous amounts of investible funds (the sort of clients that investment bankers and stockbrokers like Pressprich like best). The first set of clients were the shareholders of Brewing who received $86 million in cash, namely, the corporation controlled by Rudolph Schaefer, Arjayess, and the four trusts for the benefit of various members of the Schaefer family. The second set of happy clients were the seven institutions that purchased corporation senior and subordinated notes with equity privileges, which by themselves seemed a reasonable investment. These institutions also split amongst themselves 150,000 shares of Corporation common purchased for $1 per share.

Finally, the successful completion of Corporation’s public underwriting and subsequent favorable market action for Corporation stock unquestionably enhanced Pressprich’s reputation, both within the financial community and with others of means who were seeking the creative finance that the Schaefer case had demonstrated. The success of the transactions, therefore, could easily result in Pressprich’s gaining access to much more new investment banking business unrelated to the Schaefer transactions than would have been the case had Pressprich not concluded successfully the Schaefer deal.

One footnote is that Pressprich was a member of the National Association of Securities Dealers, commonly known as the NASD. All New York Stock Exchange member firms are also NASD members. The new (since 1970) NASD Rules of Fair Practice that relate to corporate financing would have prevented Pressprich from doing what it did in 1968. First, Pressprich would have had to have held its $.42 stock for at least six months and in all probability one year before Corporation could have gone public. If it did not, the NASD probably would rule under current regulations that the $.42 purchase price was integrated with the $26 public offering and resulted in Pressprich receiving unreasonable compensation. Also, if the transactions were to be undertaken now, it is quite possible that the NASD would rule that Pressprich’s purchase of stock would be limited to 10 percent of the public offering. The Corporation public offering was for 1.5 million shares, which would limit Pressprich’s prior purchase to 150,000 shares.

In any event, Pressprich’s discount purchase of 160,000 shares appears to have been perfectly legitimate in 1968 and was certainly not then an uncommon transaction within the investment community.

The Underwriters of the Public Issue and Their Securities Salesmen

When Pressprich became involved with the Corporation-Brewing transactions, it was contemplated that R. W. Pressprich and Company would manage the underwriting of 1 million Corporation common at around 26, which later increased to 1.5 million shares. In fact, when the preliminary registration statement was filed with the Securities and Exchange Commission on September 26, 1968, R. W. Pressprich and Company was listed as the managing underwriter.

We do not know the reasons why White, Weld and Company was substituted as managing underwriter for Pressprich, and why Pressprich was not a member of the Corporation’s underwriting group in any capacity when the 1.5 million shares were marketed on November 27, 1968. The probabilities are that the National Association of Securities Dealers, under its Rules of Fair Practice as they then existed, frowned on Pressprich or any Pressprich affiliate participating in the Corporation underwriting, because only a few months previously Pressprich had purchased 160,000 shares at $.42 per share. When the preliminary registration statement was filed with the SEC, the maximum filing price was 26.

The switch from Pressprich to White, Weld brings to light three important points. First, in putting together complex transactions, things rarely, if ever, go smoothly, and all sorts of changes are usually made in midstream. Second, it is likely that the part of the compensation to Pressprich consisting of financial fees and bargain purchases of Corporation stock were in economic fact payments for arranging the public underwriting.

Third, it would appear as if White, Weld, as managing underwriter, was undercompensated, compared with what was received by certain other insiders and quasi-insiders, namely the selling stockholders, Pressprich and the lending institutions. After all, the achievement of the public distribution and the raising of over $30 million was a sine qua non. Yet, White, Weld purchased no discount stock and received no special fees: it participated only in its share of the underwriting spread, or discount, of $1.56 per share, or $2,340,000.

Under the NASD Rules of Fair Practice, as well as in connection with certain blue sky laws, it may have been inappropriate for the underwriters to seek materially greater amounts of compensation. Even so, the transaction probably was a reasonably profitable one from White, Weld’s point of view. White, Weld obtained by far the largest participation in the underwriting, 218,000 shares, or 14.5 percent of the 1.5-million-share issue. The next-largest participation for a firm in the underwriting group was 33,000 shares, taken down by Dillon, Read and Kuhn, Loeb. The next-lowest bracket was 22,000 shares, and firms participating at this level were Halsey, Stuart; Kidder, Peabody; Lazard Freres; Lehman Brothers; Paine, Webber, Jackson and Curtis; Paribas; Shields; Stone and Webster Securities; and G. H. Walker. Since the issue was in demand, these underwriters and their sales forces were able to realize their allotted compensation both for performing the underwriting function and as selected dealers.

Compensation to White, Weld, other underwriters and members of the selling group, most or all of whom were also underwriters, was spelled out in three agreements that had been prepared previously but that were executed on November 26, 1968, the day the offering was declared effective by the SEC and the day before the actual offering. The first agreement was the Underwriting Agreement (sometimes called the Purchase Agreement), entered into between White, Weld and Corporation. The second agreement was the Agreement Among Underwriters (sometimes simply called the Agreement Among) between White, Weld as representative of all the underwriters and each individual firm that became a party to the underwriting. The third agreement was the Selected Dealer Agreement between White, Weld as representative of the underwriter and each selected dealer.

The Underwriting Agreement spelled out in specifics the various terms between White, Weld and Corporation, including the representations and warranties each gave to the other, the conditions of closing, indemnifications, and so on. Briefly, Corporation agreed to sell to each of the underwriters, and each of the underwriters agreed to purchase, the specified number of Corporation shares allotted to them (218,000 for White, Weld) at $24.44 per share. Payment was to be made to Corporation on December 4, 1968, one week after the offering, but in no event more than eight business days after December 4.

The Agreement Among as well as the Selected Dealer Agreement gave White, Weld strong control over how the issue would be marketed and by whom. One of the matters in the Agreement Among was that the underwriters were to act severally, not jointly, so that default by one member of the group would not make all other members liable. In economic terms, the Agreement Among and the Selected Dealer Agreement outlined how the $1.56 underwriting discount (the difference between the $26 public offering price and the $24.44 to be paid to Corporation) was to be split. In tabular form, the split was to be as shown in Table 27.5.

Table 27.5 Composition of the Spread between What Corporation and Others Get

The $.85 concession to selected dealers is basically sales compensation, equal to about a triple commission over the standard New York Stock Exchange commission rates. The extra promotional consideration available to salesmen, some of whom might obtain close to 50 percent of the then $.85, goes a long way toward explaining why the financial community has such a vested interest in promoting new-issue booms. It also explains why the securities laws are so written that the SEC tries to make its rules and laws on conditioning markets so much stricter when underwritings are involved.

Handling a good-grade hot issue such as Schaefer brought other benefits to White, Weld. First, it unquestionably brought profit contributions and overhead coverage to its underwriting department. Second, it benefited White, Weld’s sales force by giving them attractive merchandise to sell and at rates that allowed them high compensation for an easy sell. Third, it enhanced White, Weld’s ability to participate in underwritings managed by others: The odds are that because Kuhn, Loeb and Lehman were invited by White, Weld into important positions in Corporation’s underwriting, Kuhn, Loeb and Lehman would be more desirous of inviting White, Weld into their underwriting groups for attractive issues than would otherwise have been the case. Also, in the event White, Weld was to find itself in the type of promotional position that Pressprich was in, in these transactions, Pressprich or others might be more sympathetic to managing an underwriting of a White, Weld deal than it would otherwise.

The Institutional Lenders Providing Long-Term Financing

The seven financial institutions had two reasons for investing $65 million into Corporation’s senior notes and subordinated notes. First and—at least in the case of the six insurance-company investors—foremost was the thesis that these were reasonably safe long-term loans affording a cash return in the form of interest income close to what good-grade bonds were then paying. Second, the seven institutions obtained very significant equity kickers in the form of the discount purchase of 150,000 common at $1 and of warrants to purchase between 84,866 and 130,563 common at a price that could be 75 percent below the market price three years later; they also gained the right to convert $1,151,340 of subordinated notes into common stock at a price that could be 75 percent below the market price three years later (or $6.50 a share).

It should be noted, however, that on conservative analysis the total $65 million investment could at best be called only fairly safe. It was far from risk-free, since $27,857,143 (or 42.9 percent) of the $65 million commitment was in the form of subordinates. Thus, in the event Corporation suffered serious financial reverses, the subordinates could be junior in payment not only to these senior notes, but also to other senior notes that might be issued in the future. On an overall basis, these issues failed four of the seven safety tests promulgated by Graham and Dodd in Security Analysis (4th Edition, McGraw-Hill 1962). (Graham and Dodd advise forgoing investing in any senior security that ever fails one test.) Corporation’s senior securities seemed to have qualified under the following three tests:

Tests where these $65 million of securities were found wanting were

Interestingly enough, Graham and Dodd do not have an eighth test, which may be the single most direct test of senior security safety—the relationship of cash flow to debt service, or the cash flow available to meet both interest and principal payments.

Although the institutional investors would hardly consider the $65 million loans top drawer from a safety angle, they were good enough. The important aspect was the equity kicker. In appraising the equity kicker, the institutions looked at three things:

Rights of registration were more important to the seven institutions than they were to the other purchasers of discount stock, namely, the selling stockholders, Brewing executives, and Pressprich. These purchasers were all represented on the board and might be in a position to influence the company to register the shares they held with the SEC. The seven institutions, in contrast, could only be assured of registration rights in contractual provisions.

Registration rights are extremely valuable to purchasers of unregistered discount securities, especially those who acquire large amounts of restricted securities. For those acquiring small blocks of restricted securities, the use of the SEC’s Rule 144, in effect since April 15, 1972, is practical.

Just how valuable registration rights are depends on the various contractual rights embodied in the agreements that relate to the stock market situation for the particular securities. The contractual provision can be quite diverse, ranging from very strong to almost meaningless. (Registration rights also encompass matters not discussed here but that are essentially legal, such as indemnification provisions and agreements to supply documentation.) We think the registration rights received by the seven institutional lenders were very strong. Briefly reviewed, the principal economic provisions of the registration rights to the institutional investors were as follows:

The Public Investors

Those of the investing public who were fortunate enough to get in on a new hot issue at the time of the initial offering paid 26 per share for Corporation common on November 27, 1968. Pressprich had paid $.42 per share five months before for Corporation common, and others had paid $1 per share just two months before. And the public stood in line for the privilege!

The Corporation common stock bought by the public was not, in economic fact, the same Corporation common purchased by insiders and quasi-insiders. For one thing, any public shareholder was free to dispose of his shares at any time. Indeed, any public purchaser who obtained his shares on the initial offering could have disposed of his stock at a profit at any time from the afternoon of the offering through April 1971, a period of almost 30 months. The purchasers of discount-priced securities, however, were prevented from selling any stock before January 1971 at the earliest. In each instance, the purchasers of discount securities were subject to a number of constraints or were required to perform special services; the public investors, though, were purely passive and assumed no obligations. This is not to say that the public received a highly advantageous position compared with the Schaefer family, Brewing executives, Pressprich, or the institutional lenders; that would be silly. It is to say that the public investors were marching, or do march, to the beat of a different drummer from the promoters’ and insiders’. As a consequence, by the standards used by the public the $26 issue price was a bargain.

The public in 1968 tended to be uninterested in things that contributed to value if they did not also contribute to market performance. The public stockholders acquiring Corporation common stock sought, above all, immediate stock market performance. New issues such as Corporation’s offering gave great promise in 1968 of immediate performance for the following reasons:

It would have been difficult, if not impossible, to have Brewing or Corporation go public via an offering if the business was not one with a favorable industry identification and a “growth story.” In 1968, virtually all the companies in the new-issue boom had growth-industry identifications in areas such as computers, electronics, franchises, and nursing homes. There were little or no sales of common stocks of companies going public for the first time in industries such as railroads, textiles, or general-line fire and casualty insurance.

Yet there are things other than positive industry identification and growth prospects that contribute to value. For example, in Brewing itself one of the great elements of value to others than the public was the fact that Brewing had unused financial resources; this was one of the bases giving Corporation the ability to borrow $65 million from the seven institutions. Other elements of value that the public would not normally consider include usable tax-loss carryforwards (or better yet, creatable tax losses) in companies unencumbered by other obligations, and large asset values, whether reflected in accounting figures or not.

In fact, the trick in underwriting is that if an equity security is discount-priced based on business standards, it probably cannot be underwritten. The public that buys new common-stock issues tends to want instant performance, which cannot be gotten out of an issue that is not susceptible to being made popular. If an issue is popular, it is unlikely to be discount-priced based on business standards. However, once an issue has an identification that makes it susceptible to popularization, the underwriter will (a) popularize it and (b) try to price it at a discount based solely on stock market standards—that is, it will be priced at a P/E ratio moderately below the P/E ratio at which the stocks of similar companies that are already public sell.

In giving the public a discount in new issues based on stock market standards, the underwriter tends to be moderate, not gross in his relative underpricing. The public, after all, tends to buy new-issue sizzles, not steaks, in the form of ephemerals (sponsorship, P/E ratios, growth, and so on) that they believe should contribute to immediate performance. Purchases are not based on any fundamental bedrock of real knowledge about the business. Thus, suspicions are easily aroused. Too low a price—say, offering Corporation stock at 10 times earnings when Anheuser-Busch is selling at 20 times earnings—would detract from the salability of the Corporation common-stock issue, whereas an offering at 16 times earnings probably would contribute to it.

The New Public Company

As mentioned previously, the Brewing operation has been transformed into a new one with a different discipline—not better or worse, but different. The differences are outlined in Table 27.6.

Table 27.6 Transformation of Old Brewing into a Different Discipline

| New Corporation | Old Brewing |

| Heavy debt load | Excess financial resources |

| More attuned to immediate results | |

| Requirements for public obligations including filings | |

| A common stock usable for employee incentives | |

| A common stock usable for acquisitions | |

| Emphasizes AFF—accounting fudge factor—reported earnings. (Especially pronounced is failure to write up assets to reflect Corporation’s $106 million purchase price for Brewing’s equity securities.) | Emphasis on tax shelter |

SUMMARY

Deals are not like a chess game, where by definition if one side wins, the other loses; they are not zero sum. A well-structured deal has something in it for everyone. Few readers of or writers on finance will ever be involved in the design and architecture of a deal of the dimensions described here. But an understanding and appreciation of its structure should help to provide some insights into the realities of a world of finance rarely seen but always present.

* This chapter is an updated reproduction of Appendix I in The Aggressive Conservative Investor by Martin J. Whitman and Martin Shubik (© 2006 by Martin J. Whitman and Martin Shubik). This material is reproduced with permission of John Wiley & Sons, Inc.

1 One indication that Brewing’s accounting practices were conservative was that Brewing, which was charging over $4 million per year against the income accounts for depreciation, used the same depreciation methods (the 200 percent, double-declining-balance method) for book purposes as it did for tax purposes. Nor does the fact that Brewing flowed through investment credits, which amounted to $275,000 in 1967, indicate otherwise; the amount involved was small, particularly compared with depreciation charges. The company’s five-year statements had been audited by Price Waterhouse and Company, and certified clean.

2 Brewing had plans to construct a new 1.7-million-barrel facility in eastern Pennsylvania. The initial phase of the Pennsylvania construction was to provide an 850,000-barrel annual capacity at an estimated cost of approximately $38 million, or $44.71 per barrel, some five times as much as the net book value of existing plant. Even assuming that the remainder of the proposed Pennsylvania plant could be built for a relatively small sum, the total cost was unlikely to be less than $25 per barrel, or some three times the net book carrying value of the existing plant. Notwithstanding any other factors, such as labor-saving innovations and other efficiencies in new plants, Brewing’s property, plant, and equipment do not seem to have been overvalued on the books.

3 Parenthetically, restricted shares issued after the passage of Rule 144 in April 1972 could only be sold publicly pursuant to that rule or via registration. No action letters and change-of-circumstances opinions no longer existed in such cases. From 1972 until late 1978, when resale restrictions were liberalized, sales under Rule 144 could occur only once every six months, and the number of shares that could be sold was limited to the lesser of 1 percent of the outstanding stock of the company, or the weekly average traded for the four weeks preceding the filing of a Form 144.

4 The other members of Corporation’s twelve-man board of directors were three Schaefer family members, three executives of Brewing, two executives of Pressprich, and two outside directors—the chief executive officer of United Aircraft and a vice-chairman of the board of the First National City Bank.

5 Corporation also entered into an agreement with First National City on November 25, 1968, under which the bank would provide any interim funds that might be needed to meet the payments due the four Schaefer trusts by July 15, 1969. This was estimated at under $25 million.

6 In some instances, warrants can be exercised by the surrender of senior securities valued, for purposes of exercise, at par. If the senior security has a market value of less than par, then the senior-security-warrant package becomes the equivalent of a convertible security.

7 This phenomenon reached its peak in recent years with the debt restructuring of a number of troubled real estate investment trusts. In certain instances, such as Chase Manhattan Mortgage and Realty Trust, senior lenders even invested new funds in the real estate investment trusts, part of which were in fact used to continue to fully service the subordinated debentures.

8 At year-end, its price was 30 bid. Corporation’s stock was listed for trading on the New York Stock Exchange on January 24, 1969.

9 This gross spread was about standard for a fairly large new-issue offering of an industrial issuer going public. Although there have been new issues of common stock marketed at a smaller gross spread when a company was going public (most notably Communications Satellite Corporation, or Comsat, whose gross spread was 4 percent when it went public in 1965), this is unusual. Smaller, unseasoned issuers call for higher gross spreads, frequently as high as 18 percent, exclusive of other considerations—such as continued financial consulting fees, board representation, and rights of first refusal on future company offerings— granted to the underwriter.

10 This sales commission of $0.85, or $85 per 100 shares, was considerably higher than $0.32 per share or $32 per 100 shares selling at 26, the standard commission prevailing in 1968 for round lots (usually 100 shares) of outstanding stock listed on the New York Stock Exchange.