CHAPTER 2

THE ECONOMICS OF BIG BANG DISRUPTION

WHY NOW? AND WHY SO LOUD?

We arrived in midtown Manhattan late one evening from San Francisco and Boston, respectively. Neither of us had had any dinner, and we knew that if we waited much longer we’d wind up falling asleep hungry. So we ventured out toward Times Square. Even late, there would likely be plenty of open restaurants to choose from, including well-known chains, New York–style pizza, and traditional diners and delis.

Within a hundred feet of our hotel, a small, street-level Thai restaurant caught our attention. Authentic Thai food suddenly sounded like a great idea to both of us, and the restaurant was still open. But was it any good? The posted menu looked fine, but it was too dark to see inside and, anyway, how much can you really tell about a restaurant from its decor or its clientele late on a weeknight?

We needed information—timely, local, and credible information—that would tell us whether, at that moment in time, we should choose a completely unknown restaurant offering the cuisine we wanted, or pick something less risky but possibly less enjoyable.

What to do? We could go back to the hotel and ask the concierge, who had likely never heard of the place and would, at best, look up some dog-eared guide or list of preferred restaurants—that is, restaurants that gave special consideration to the hotel or its concierge. We could rely on some yellowing newspaper clippings framed in the window, but it was too dark to read them and, in any case, problems of potential bias or obsolescence loomed.

Instead we instinctively pulled out a smartphone and clicked on the Yelp app. Yelp is one of dozens of consumer-generated review sites, where actual customers volunteer to evaluate all manner of product and service, anchored in this case by the familiar five-star- rating shorthand. Using the voice-recognition tool built into the phone, all we needed to do was say “Thai restaurants Midtown.” The phone used our location, which it knew from GPS satellite data, to pinpoint the restaurant we were standing in front of.

As we read through recent customer reviews, we noticed a young couple walk up, look at the menu, and pull out their own smartphone. From their deportment, we were confident that they were not natives. After a moment, we struck up a conversation. Sure enough, they were tourists visiting from Ohio and had logged onto TripAdvisor—another review site, one focused on travel destinations also populated with user-created reviews—to check out the restaurant.

We compared summaries and decided the place was worth taking a chance. As the reviewers had mostly agreed, the food was hot, appropriately seasoned, and served quickly and efficiently. We enjoyed a meal that went from enormous unknown to perfectly predictable. As we left, we saw the Ohio couple and flashed them the thumbs-up sign. They nodded in agreement.

A local restaurant with no technology beyond a computerized cash register might seem the least likely sort of business to be the target of Big Bang Disruption. But there it is. In this instance, exponential technology had meant the difference between four new customers and none. And that might have been enough to tip the balance between a profitable dinner service and a disappointing loss for the night.

The disruptor here was deceptively simple: aggregated customer opinions made available over the ubiquitous smartphone. Bringing the right data to the right place at the right time, however, depended on the convergence of several related technologies: mobile computing, crowdsourced information, and the integration of hardware, software, and the global Internet. Still, the ease with which entrepreneurs can now perform that miracle meant we had the choice of several different combinations of those technologies to help make our decision.

The restaurant had done nothing either to create or to control the disruptor. Indeed, it’s very likely the owners were never aware that our decision was so decisively affected by the availability of better and cheaper information sources.

All Yelp and TripAdvisor did was to reduce dramatically the obstacles between buyers and sellers trying to determine whether or not to conduct business with each other. The restaurant’s actual operations—its location, its staffing, its food ordering, its expertise in creating a menu—weren’t in any way affected. But that’s the point. They didn’t have to be.

How are Big Bang Disruptors working their magic on so many kinds of interactions, including many that may not have changed much since the Industrial Revolution? And why, after decades of computerization and other technological innovation, are disruptors suddenly arriving with such alarming frequency?

The short answer is that the continued application of exponential technologies has created a series of transformative changes in market economies. New technologies are now cheaper than old ones. Marketing is being driven by customers, not directed at them. And open innovation, which integrates suppliers, customers, and other collaborators, is increasingly more effective than internal efforts alone.

As a result, industrial-age principles and processes are giving way to radical new alternatives. Manufacturers no longer work in secret to develop new products and services. Nor do they source raw materials at arm’s length from suppliers, or market to consumers largely through broadcast media.

The one-way supply chain, in short, has been dismantled. What is emerging to replace it is something far more interconnected—the ecosystem of Big Bang Disruption. This chapter explores the economics of that transformation, revealed through the three characteristics introduced in Chapter One: undisciplined strategy, unconstrained growth, and unencumbered development:

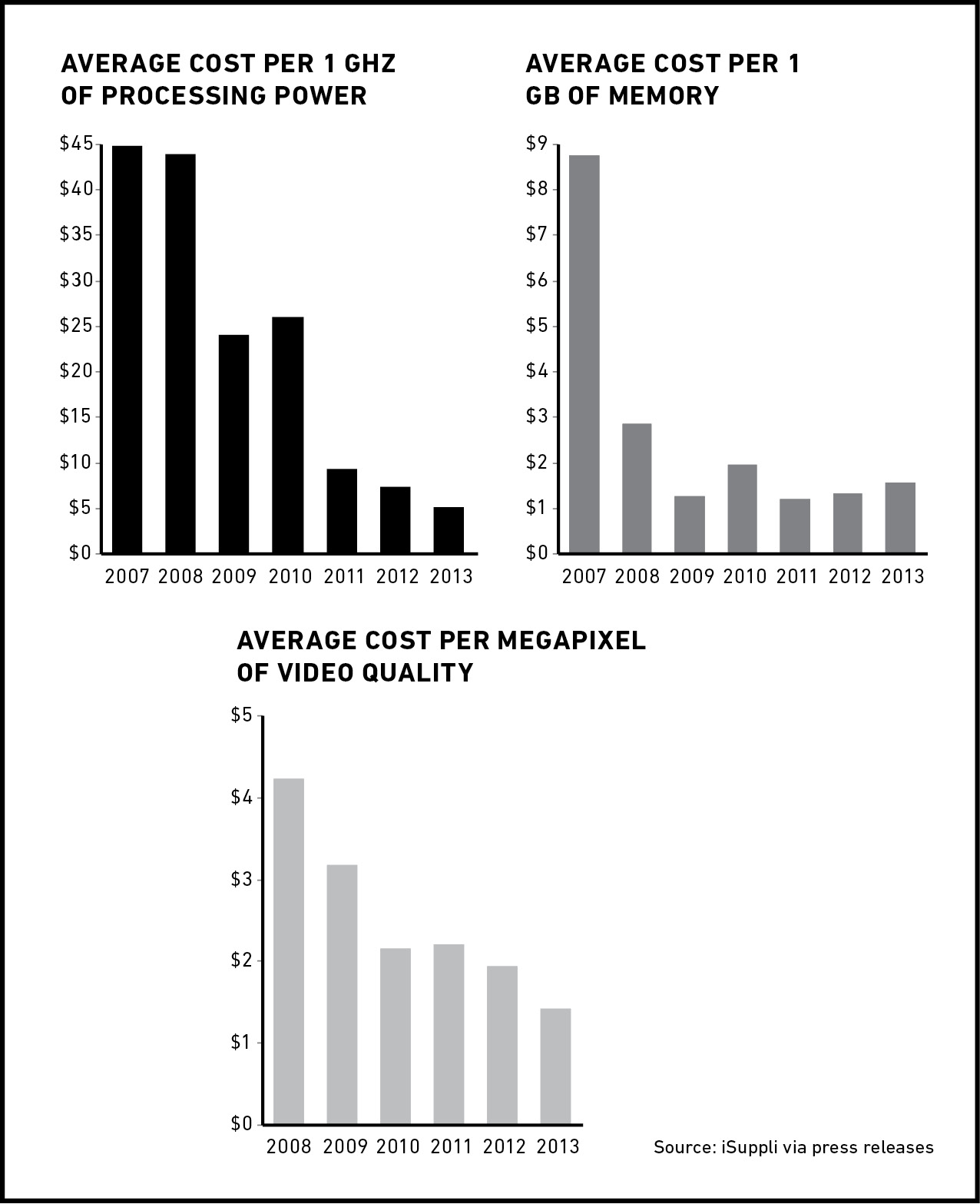

- Undisciplined Strategy: The Declining Cost of Creation. Steep declines in the cost of creating new goods allow innovators to compete on all three strategic dimensions at once. As Moore’s Law and its equivalents continue to drive core technology costs down, it is increasingly cost-effective to embed more and better components in everything, even products and services far from high-tech industries. Declining technology costs have important secondary effects as well. Global sourcing and delivery is now affordable. Stubbornly high costs for R&D are also falling, as idea generation, research, and even innovation funding migrate to the cloud and to new forms of incubation.

- Unconstrained Growth: The Declining Cost of Information. Thanks to nearly two decades of advances in Internet technologies and networks, vast databases of information are being created for consumers by consumers, making it easy and efficient to search for any kind of information—including quality and availability—for new products and services. This advent of “near-perfect market information” means successful market experiments can be discovered and adopted instantaneously. Companies no longer need to cater to “early adopters” to establish new markets. But neither can they charge extra for the privilege of being the first to use incomplete prototypes.

- Unencumbered Development: The Declining Cost of Experimentation. Global broadband networks and ubiquitous computing devices connect innovators and users in an environment optimized for collaboration. New products and services begin life as simple experiments, tested with real consumers at little cost or risk. This is especially true for software-based services that are built on reusable code, open standards, and non-proprietary interfaces. Yet even physical goods—from electronics to cars to power plants—are moving to a manufacturing model based on combinable off-the-shelf parts. Even as the “cost of design” for traditional research and development gets more expensive, the “cost of combine” is going down.

The dramatic impact of declining costs in all three Big Bang characteristics is visible even in our simple example of the Thai restaurant. The smartphone apps and mobile networks that enabled our search were created on and enabled by open standards, reusable components, and app stores, a powerful platform for better and cheaper innovation. The availability of purchase information delivered on that device—reviews by professionals and amateurs alike—lowered the costs of evaluating the restaurant, and it did so at the right time and the right place (now, standing in front of the door). Finally, the componentization of smartphone app development allowed multiple developers to cobble together restaurant and travel information services, each with its own unique organization, features, and functions.

The economics of Big Bang Disruption are powerful enough to change the very nature of industrial organization, competition, and strategy. To see how, let’s revisit the three unique characteristics of Big Bang Disruptors, focusing on the declining costs that make each one possible.

UNDISCIPLINED STRATEGY: THE DECLINING COST OF CREATION

According to the conventional wisdom of strategy and competition, trying to be better and cheaper at the same time is a recipe for disaster. Every dutiful MBA student will tell you that market leaders must exercise careful planning, laser focus on specific markets, and, above all, must exhibit unflinching discipline. New products and services can either be better, cheaper, or specialized to a particular segment. But they can’t be all three at the same time.

Or can they? Today, a growing range of goods—including televisions, tablet computers, and software-based services for music, travel, and other information sharing—compete on all three strategic dimensions at once. The disruptors also add new features, functions, and dependability with each new release, at prices that fall precipitously until, in some cases, they simply become free.

How is this possible? The answer is found in the counterintuitive economics of exponential technologies. As computing and other costs continue to fall, it becomes ever cheaper to embed digital components into new products and services. In a more indirect way, the same technologies are also reducing the internal cost of innovation, lowering the price of producing new goods.

Combining smaller but more powerful parts with lower costs of production and cheaper research and development means new products and services can enter the market both better and cheaper than existing offerings. With all types of costs being driven lower, in other words, you can invest in innovation and still sell the resulting product cheaper than its predecessor. Innovators can offer premium products at lower prices to all (or nearly all) market segments from the start.

The transformation of strategy isn’t just happening in high-tech industries. Most businesses now differentiate their wares by adding computing intelligence and information services. As they do, every industry approaches the strange behavior of consumer electronics, where both rapid improvement and declining price has been the norm for decades.

As we noted in Chapter One, computing gets predictably faster, smaller, and cheaper all the time. It has continued doubling its price and performance every few years for nearly half a century. There’s no end in sight to this remarkable phenomenon, the best example of what we call exponential technology.

The key to Moore’s Law is miniaturization. Shrinking the size of each transistor on a semiconductor (or “chip”) improves performance by reducing the distance that electrons need to travel to execute the instructions of computer software, making computers faster and more energy efficient. New chips of roughly the same size, at the same time, cost less per circuit for raw materials, fabrication, and shipping. So reducing the size of each circuit translates simultaneously to both better performance and lower price.

Moore’s Law also relies on the economies of scale inherent in chip manufacturing. While the marginal cost of raw materials for each chip (including silicon, the most abundant resource on earth) is relatively low, the cost of new fabrication facilities can run to billions of dollars. The amortized cost of new facilities, therefore, dominates the actual price a manufacturer will charge for each chip. The more chips customers buy from the same plant, the faster the unit cost declines.

Doubling a small number, as Figure 5 makes clear, has a trivial impact. But keep doubling it for several generations, as anyone who has ever mastered the genius of compound interest can tell you, and you soon reach the stage where each doubling represents a dramatic change, one that has the potential to be as profound as all the others combined.

To make that proposition a little more concrete, compare the first commercial computer, the mid-1950s Univac, to today’s computing devices. Thanks to the regular doublings of Moore’s Law, the processor in the latest home game console has the equivalent power of nearly a billion Univacs. More remarkably, even in 1950s dollars the price of that many Univacs would exceed the total money supply of the world. Powering them would require massive amounts of energy. And storing them would require a space larger than all of Iceland.

Moore’s Law deflates the cost of everything made from or with semiconductors. We now have not only better and cheaper computing, but better and cheaper data storage and data transport. Improvements in computer memory, increasingly sold as solid state or “flash memory,” have driven the price of a terabyte of memory from $100 million to under $100 in thirty years.

Data networks, meanwhile, which transmitted information at 19.2 kilobits per second in the early 1990s, are rapidly accelerating toward gigabit-per-second speeds—an improvement of five orders of magnitude. The cost of data transit in the United States between 1998 and 2013 has also collapsed, from $1,200 per megabit to just $1.57. No surprise that in 2012 mobile data traffic in the United States reached nearly 1.5 trillion megabytes, an almost 70 percent increase over the previous year.

While the impact of Moore’s Law is most obvious in the falling prices for computers, communications, and consumer electronics, the costs of embedding computing power into other products has been falling too. Five years ago, we bought a color printer for $200. We recently replaced it with a new model from the same manufacturer, which was smaller, printed at higher speeds with better resolution, allowed more color combinations, and included a wireless antenna that eliminated the need to connect it to any particular computer. The new model cost $100.

The cost for key parts in a new cell phone, as Figure 6 shows, cost less today than they did ten years ago, and will cost even less after the next cycle.

Indeed, technology is driving down costs across the production and delivery life cycle of goods and services of all types. Labor costs are reduced through computer-enabled global outsourcing. Raw materials costs are falling through digitally improved siting and mining technologies—mining company Rio Tinto’s driverless trucks, for example, have already hauled over 100 million metric tons of earth. Sales, marketing, and service are made more efficient through online selling, turning some brick-and-mortar retailers into unprofitable showrooms. After-sales support and service are migrating to the cloud. Even financing costs, thanks to global capital markets, are declining.

Exponential technologies are also driving down the cost of research and development. Typically these costs, which include the price of conducting basic research, prototyping, and, where necessary, obtaining regulatory approval before market launch, are built into the price of each unit of the new goods that are sold. So developers must be careful to balance the need to recover research costs with the need to attract new customers. If the new offering is a big hit and millions of units are sold, recovering research costs will be easy. But to ensure the big hit, it often makes sense to charge a lower price at first to stimulate new markets, foregoing early profits.

For many enterprises, that’s a delicate balance, and a risk that’s hard to predict or to hedge. Fortunately, such pricing trade-offs are increasingly unnecessary. The same exponential technology drivers that are deflating the cost of components embedded in new products and services are also driving down the cost of basic research, from inception to product launch.

Has innovation really become that cheap? Consider the three main costs of innovation for most organizations, and how each is being transformed in the world of better and cheaper:

Idea Generation—Instead of relying exclusively on internal sources for innovation, companies are increasingly making use of information services, including social media, to crowdsource idea generation. In science and applied research fields, “open source” innovation, mimicking the long-standing trend in software development, has become the norm. Expensive professional journals are giving way to free Web-based alternatives. Some allow open posting and require free licensing of ideas and other intellectual property shared among a community of scholars—or anyone else.

InnoCentive, for example, runs a business-to-business exchange where companies can post their difficult research problems to wide-ranging, interdisciplinary teams of virtual experts who bid their best price to solve those problems. Since its founding in 2001, the company has registered almost three hundred thousand problem solvers in nearly two hundred countries. Companies have awarded millions of dollars in more than fifteen hundred successful projects. Using such exchanges is cheaper than hiring the experts as employees, and can lead to more and better ideas from which to choose.

Less formal mechanisms are also proliferating. In the growing community of consumers using 3-D printing devices, designs are regularly shared by users in forums hosted by manufacturers, such as MakerBot’s Thingiverse. Recently, a virtual team of researchers at Harvard University and the University of Illinois successfully designed a 3-D printed battery about the size of a grain of sand—small enough to be printed directly inside a 3-D printed hearing aid.

The falling price of interaction means that research can more often be performed by whoever is best suited or most motivated to do so. Increasingly, customers, especially early users, finish product designs and fine-tune the development of new services.

Technology products manufacturer Belkin has long involved customers in product design, and not just through focus groups and beta testing. In launching the WeMo, for example, the company took advantage of the power of the crowd in a remarkable way. WeMo is a simple, user-programmable device that adds digital cameras, switches, and sensors to create “intelligent” home networks that respond to remote commands and external data triggers.

Rather than pre-script the possible events and triggers, WeMo product developers point customers to a free visual programming service called “If This Then That” (IFTTT), which lets them design their own “recipes” for their WeMos. One novel use, for example, is a recipe that checks the Internet for the time of each day’s sunrise and sunset, and uses that information to automatically turn a lamp plugged into the WeMo on and off. Another sends the user an e-mail message when a WeMo motion sensor detects that the cat has used the litter box.

WeMo users not only determine what the devices can do, but can share their recipes with other IFTTT users. Belkin doesn’t try to control the process in any way. Instead, product managers closely monitor the IFTTT bulletin boards to see which recipes are most often being shared. The company then highlights the best ideas via social media services, such as Tumblr.

Research and Development—Forming virtual and often temporary research teams has become easier than ever. Thanks to cloud-based collaboration services and the proliferation of open-source and royalty-free application interfaces, teams can form quickly around a particular problem, develop a working design, and then disperse, leaving development and marketing to organizations better suited to those tasks.

Incubators and accelerators have long existed at the borders of leading research institutions, but more than a decade into the Internet revolution, these organizations have found new purpose and methodologies that can quickly create successful products, services, or companies. Y Combinator, launched in 2005, brings entrepreneurs in-house for three-month intensive mentoring and development “classes.” Its approach has proven wildly successful, launching companies that include Reddit (social news), Dropbox (cloud storage), and Airbnb (peer-to-peer room rentals). Seventy-two percent of its start-ups have raised significant funding following graduation or “Demo Day.” (Y Combinator takes a 6 percent equity stake in the start-ups it launches.)

Even more transient forms of collaboration can be fruitful in a world of off-the-shelf components and free software. In the last decade, a wide range of organizations, for-profit and otherwise, have been staging internal and external product hackathons, in which teams of developers with access to the same tools and raw materials work on the same problem for a limited period of time, often just a day and a night.

Funding and Compensation—The funding of innovation has also become cheaper thanks to exponential technologies. In the last few years, new forms of technology-enabled sponsorship and investment have emerged, making it possible for small companies and even individuals to develop Big Bang Disruptors, without having to rely on expensive capital markets.

The best known of these new funding platforms is Kickstarter, which was born out of the frustration its founders experienced trying to determine ahead of time if their proposed art projects would find enough buyers to break even. Entrepreneurs of all kinds can now create Kickstarter campaigns and solicit “pledges” from communities of backers. If the target amount is reached, the project is funded, and the pledges are collected. Proposed products span the range of human activity, from gadgets to films, books, and even food.

As with charity fund-raising, backers don’t actually invest in the company or the product. Instead, in exchange for their contribution, campaigns offer increasingly valuable premiums. Depending on the level of pledge, premiums may include pre-release or final versions of the actual product all the way up to participation in launch events.

Even with contributions starting as low as a few dollars, there is serious money available from the crowd. Since 2009, Kickstarter has successfully raised $622 million for more than forty-one thousand funded projects. In 2013, developers of the Pebble, a networked, programmable wristwatch with a special low-power LCD display, made Kickstarter history by raising over $10 million from nearly seventy thousand backers—all in just three weeks.

Kickstarter is one of many Big Bang Disruptors blurring the lines between trial users, developers, and investors. Some services even engage contributors in the process of product design and testing. Peer-to-peer lending services, including Prosper and Zopa, have raised hundreds of millions of dollars that are loaned to individuals and small businesses.

Beyond contributing small sums to start-ups in exchange for premiums, entrepreneurs are also finding new ways to take on actual investors outside of traditional capital markers. Recognizing the potential of crowdsourced investing to accelerate innovation, U.S. lawmakers passed legislation in 2012 exempting capital campaigns seeking less than $1 million per year from SEC and other regulation that would otherwise divert money meant for innovation to legal and filing fees. Though the law doesn’t allow average consumers to invest in such limited campaigns until 2014, start-ups can already use the simplified process to solicit pre-certified investors with assets over $1 million.

In the United Kingdom, where individual consumers can already invest in start-ups, crowdfunding has moved from premium-based pledges to actual equity investment. Services such as Crowdcube are making it easy for entrepreneurs to develop a pitch page, offering to sell a percentage of their start-up if funding reaches a target amount. The site has helped almost fifty companies in every stage of development raise over $15 million from some forty thousand individual investors.

UNCONSTRAINED GROWTH: THE DECLINING COST OF INFORMATION

We have just seen how the declining costs for exponential technologies drive the undisciplined strategy of better and cheaper. But what accounts for the sudden adoption of Big Bang Disruptors across market segments—the characteristic we referred to as unconstrained growth?

Unconstrained growth is the result of large databases of standardized information on marketing, sales, and other transaction data, that is sometimes referred to as “big data.” While big data is often seen as a powerful tool with which businesses can refine product development, marketing, production, and pricing, it is equally valuable to consumers. According to research from IDC, Internet users created and shared nearly two trillion gigabytes of data in 2011, a ninefold increase over the previous five years.

As information sources about products and services are enhanced to capture user feedback, product performance, and comparisons of features, prices, and service, consumers use the Internet to shop with greater knowledge and therefore greater advantage. They can research, select, and respond to products and services with increased efficiency, giving them the ability to “pull” the market rather than having products, services, and advertising pushed onto them. Big data has given consumers remarkable new leverage—the leverage of near-perfect market information.

However they do their buying, consumers no longer have any excuse for making an uninformed purchase, whether of major assets such as real estate and durable goods or of everyday transactions including restaurants and service providers. It’s easy to discover what friends, relatives, and like-minded consumers really think of the things you buy, either through review sites or social media services such as Facebook, Twitter, Tumblr, and user-moderated message boards.

Information barriers keeping consumers from determining price, availability, or the quality of goods and of post-sales support have also been disrupted. Companies can’t easily hide behind slick marketing campaigns or the strength of established brands. Each product lives or dies on its own merits, including that of its customer service, and its fate is determined not in the past or future, but right now.

There’s no longer a significant risk of paying a premium price for a product that isn’t worth it, or of delaying a buying decision longer than necessary because you’re not sure if the features, price, or timing is right. The cost of search has fallen below the cost of regret.

To understand how near-perfect market information works, we need to travel back in time to 1931, when an undergraduate student from the London School of Economics named Ronald Coase made a life-changing visit to the United States.

Only twenty years old, Coase had a revolutionary agenda. Struggling to reconcile the socialism of his youth with the free market orientation of his professors, Coase saw big companies as proof that centrally managed activities could work on a large scale. If he could learn how big companies did it, Coase imagined, then perhaps the lessons could be applied to big governments as well.

Oddly enough, no one had ever asked why companies existed, and certainly no one had ever thought to ask the people who were running them. So Coase did just that. What he learned left him deeply skeptical about his faith in socialism. More important, it led to the publication of an article that changed economic thinking forever, contributing to Coase’s Nobel Prize in Economics sixty years later. (Coase died in 2013, at the age of 102.)

Companies were getting bigger, Coase discovered, because markets were too expensive for the kind of repeated, high-volume activity that went into making cars and other complicated goods. In the market, buyers and sellers had to find each other, and then negotiate deals and consummate them. There were costs, in other words, not only to whatever was being bought or sold but also to the activity of buying or selling it. None of this activity was especially easy, much less free.

Coase called the price of doing a deal its “transaction cost.” The existence of transaction costs, he believed, explained why companies were internalizing more and more activities, especially repeated functions like buying raw materials and marketing. The firm was cheaper than the market.

Or at least it used to be. Over the last two decades, near-perfect market information has dramatically reduced transaction costs across the board, from the costs of marketing to determining creditworthiness. For more complicated transactions, it has made it cheaper to negotiate detailed proposals, purchase orders, insurance, contracts, and other documents. But in particular, near-perfect market information has lowered the cost of search—of buyers finding just the right goods from just the right sellers at just the right time, place, and price.

The source of this reversal, once again, is exponential technologies, including large-scale computing networks, cloud-based databases and software, and ubiquitous mobile devices. As new data sources for products, services, and companies come online and are combined with new tools for searching and acting on them, inefficiencies in markets for new products are disappearing, and sooner in their life cycles. Near perfect market information is lowering transaction costs in larger, more discontinuous leaps, spawning Big Bang Disruptors across industries.

That’s nothing new. Even in the 1930s Coase noted how the telephone led to a radical restructuring of business, making possible the first global, integrated firms, including General Motors and U.S. Steel. But the process has accelerated, and taken a dramatic turn. Where companies were once the first to adopt new technologies, consumers now embrace better and cheaper computing products and services more quickly than corporate users. As companies struggle to retire older computer equipment and integrated software systems, some economists believe transaction costs in the market are falling more rapidly than they are in large enterprises. The balance between the firm and the market is shifting toward the market.

A decline in the cost of search has been the most visible impact of the Internet, for example, which is breaking apart many of the firms that earlier technologies put together. That’s great for consumers, and for products and services they truly prefer. But for incumbents whose competitive advantage relied on incomplete information and even misinformation, a more efficient market can prove catastrophic. It’s no longer true, as Mark Twain once said, that “a lie can travel halfway around the world while the truth is putting on its shoes.” In the age of Twitter and other social networks, consumers tell each other everything, and do so immediately. Unearned reputations constructed over years can be destroyed in days as consumer reality catches up to market hype.

Chain restaurants, for example, invest heavily in brand awareness. The brand signals to consumers a consistent experience, with predictable if not excellent food, ambience, and service for a price somewhere between high- and low-end alternatives. But as our Midtown example suggests, near-perfect market information can level the playing field. Absent exponential technologies, the search and information costs associated with choosing an unknown restaurant would have been greater than the value we were likely to derive from choosing correctly. The potential cost of regret would have been high enough to steer us to the more familiar and predictable.

When search costs are high, in fact, some economically valuable exchanges simply don’t happen. We were able to find out information about a restaurant we’d never heard of, for example, making it possible to compare the trade-offs of eating there. But there was no way to find out if, in the building above the restaurant, a master chef was testing new recipes in her home kitchen, one who would gladly trade the results for our honest feedback.

So what happens when exponential technologies cause those very high transaction costs to suddenly disappear? Extrapolating from Coase’s observation, the number and type of market transactions that were once too expensive to organize will increase dramatically. The result could be an explosive expansion in economic activity as individuals safely and efficiently conduct business with each other in ways that might have previously been too expensive or risky to attempt. (Risk is just another name for high transaction costs.)

That, in any case, is the idea behind what is being called the sharing or peer-to-peer economy. While the term is new, the idea is not. The peer-to-peer economy encompasses long-standing Web-based services, including Craigslist and eBay, that make it possible for consumers to buy and sell used goods from each other. From its beginnings as a bulletin board for buyers and sellers of collectibles, eBay’s digital marketplace offered a better and cheaper alternative to physical auction houses, specialty conventions, and trade shows, lowering transaction costs with a virtual marketplace that could run day and night on a global basis.

The company continues to reduce transaction costs by adding new features and services to its platform, resulting in a continuous release of Big Bang Disruptors. For example, eBay has added secure third-party payment, verified seller ratings, and dispute mediation, dramatically reducing many of the transaction costs Coase’s research first identified.

The growing power of exponential technologies is making possible new applications that reduce stubbornly high transaction costs in less obvious exchanges. Consider BlueBee, a simple device you attach to frequently misplaced items such as keys, purses, and even your car—an example of what is known as “the Internet of Things.” When you can’t find the item, BlueBee communicates its location to your smartphone, literally reducing your search costs. The product will also tap into a network of other BlueBees and their users to find items that are out of range. When another user passes your missing item, the system will notify you. It’s a crowdsourced “lost and found.”

Discontinuous drops in transaction costs are also making it possible for consumers to lease, barter, or borrow the assets and services of other people. These were transactions for which search and other costs, until now, were simply too high to be practical. Now, using services such as City CarShare, Airbnb, and TaskRabbit, individuals can, respectively, loan out their vehicles, host visitors in their homes, and get paid for their unique expertise.

Historically, these assets spent much of their time sitting around when small but valuable exchanges might have been possible—possible but for the transaction costs. We may find that we have purchased items we use just a fraction of the time only because we couldn’t easily share the costs of ownership with everyone else. As Airbnb founder Brian Chesky recently told columnist Thomas L. Friedman, “Ordinary people can now be micro-entrepreneurs.”

According to Forbes, more than a hundred peer-to-peer start-ups have launched since 2009, some with funding from leading venture capitalists including Google Ventures. For 2013, these services are expected to generate more than $3.5 billion in revenue, at growth rates of 25 percent a year. Some experts believe these new markets could soon be worth as much as $26 billion.

The rapid rise of the peer-to-peer economy, however, could translate to devastating disruption for incumbent businesses that make money by mediating transaction costs that may soon disappear. The new services, after all, aim to provide better and cheaper alternatives to more established forms of asset sharing, including rental cars, hotels, and professional contractors. When assets can be easily subdivided by time and user, the value for companies to maintain permanent inventories of cars, hotel rooms, and employees may decline as quickly as the transaction costs involved in sharing them.

While some incumbents are using lawsuits and existing regulations to slow the spread of the peer-to-peer economy, others are investing. Leading rental car company Avis, for example, recently purchased Zipcar, a membership-based vehicle sharing service, paying half a billion dollars for a stake in the growing but still chaotic new market. Perhaps that’s because, according to research from Frost & Sullivan, car-sharing services are expected to generate $3.3 billion in revenue by 2016.

Discontinuous drops in transaction costs are not only disrupting markets for commodity products. Artisans are using the same technologies to find buyers for ultra-premium bespoke goods, contributing to a renaissance in cottage industries for everything from knives and tools to shoes and clothing, accessories, art, and even pet food. Individual craftsmen can offer their wares to a global market with little or no investment in distribution or sales infrastructure, relying instead on low-cost third-party services that handle the noncreative part of running a business for them.

As these examples suggest, the increased availability of near-perfect market information is also redrawing the classic technology adoption bell curve. Distinct segments with different buying habits have collapsed, as we noted in Chapter One, into just two: trial users and everyone else. As a result, traditional marketing practices are being radically altered.

One important change has been a de-emphasis on the once-crucial role played by early adopters, who are rapidly disappearing as an identifiable group. In the days when customers could not rely on near-perfect market information to find out if a new product measured up to its marketing hype, early buyers had little confidence in what they were buying. Knowing this, sellers, especially in high-tech markets, often pitched new products to consumers who valued being the first to have the next new thing more than they feared dealing with bug-ridden or incomplete goods.

Indeed, the extra value to early adopters of having the first compact disc player, hybrid car, or Internet-connected home appliance was assumed to be so significant that it allowed producers to charge more for early versions than the price to mass-market consumers once the product was perfected. That higher price has sometimes been referred to as the “early adopter tax.”

For fast-cycling products and services enabled by exponential technology, however, there’s rarely the time or the need for early adopters. The life and death of new products is accelerating, translating to faster adoption and faster obsolescence. There is no longer much real value to having early adopters, or being one, and little opportunity to charge extra for early releases.

Cannibalizing your own products with better and cheaper replacements is no longer a strategy of last resort—now it’s inevitable. Consider Apple’s first-generation iPhone, which offered its buyers dramatic improvements in design and capability over existing smartphones. At $599, the iPhone established a premium price point for a new kind of mobile device, encouraging companies such as Samsung and BlackBerry to up their game as quickly as possible.

That pressure, in turn, has compelled Apple to offer next-generation models nearly every twelve months, not only to satisfy the market’s insatiable desire for better and cheaper, but to keep ahead of its competitors, who are starting to beat the company at its own strategy. That pressure quickly erased Apple’s premium. The price for an iPhone 5 starts at just $199.

With Big Bang Disruption, for better and for worse, growth is unconstrained. Either the new thing is a hit and captures the bulk of its profits quickly, or it never does. It’s no longer possible to fund the development of a full-featured product—3-D televisions, electric cars, e-book readers—by selling incomplete and expensive prototypes to a forgiving early market. Consumers will simply wait until the right combination of product and business model appear, and will know immediately when it does.

Early adopters are either part of the development and funding of the product’s research and development, or they are simply part of the initial product launch. There’s no “early” anymore. Big Bang Disruption has repealed the early adopter’s tax.

UNENCUMBERED DEVELOPMENT: THE DECLINING COST OF EXPERIMENTATION

Steve Jobs was an inveterate borrower. He realized early that developing innovative new products didn’t mean you also had to reinvent the wheel—nor commission specialized parts—when existing solutions would do just as well. As former Atari founder Nolan Bushnell writes in his book, Finding the Next Steve Jobs, “almost all the early Apple parts came from Atari, without markup. The Apple modulator, a very tricky device that allowed the Apple II to connect to a television set, was based on our off-the-shelf design.”

Jobs’s insight is key to understanding the economic improvements driving the third characteristic of Big Bang Disruptors—the declining cost of experimentation. Exponential technologies have led to an explosion of off-the-shelf component parts that can be easily combined and tested directly in the market with actual users. Thanks to economies of scale, moreover, the price for components continues to fall as more innovators combine them into new things. Product developers in a growing number of industries find combinatorial innovation is both faster and less expensive than having new parts custom-built to specification.

Rather than designing from scratch, the developers of Big Bang Disruptors take the cheaper and less risky route of reusing existing components, sometimes adding only a few specific product or service elements to distinguish them. Their development is no longer limited by long lead times for designing and fabricating new parts and testing them internally. The market tests your parts before you even know you need them.

Today, mass-produced components for everything from cars to prefabricated homes are increasingly easier to design, manufacture, and source. This means new entrants and even lone inventors can cobble together and test new combinations directly in the market at little cost or risk. Failed efforts die quickly and cheaply, while the right combination of components coupled with the right business model triggers Big Bang Disruption.

With combinatorial innovation, development is unencumbered. Given the wealth of available parts—hardware, software, and other infrastructure—reuse in the open market has become faster, cheaper, and less risky than in-house research and development, which relies on strict secrecy and proprietary resources. While the cost of combinatorial innovation continues to decline, internal development in many industries has become more expensive. In a growing number of markets, the return on combine is now higher than the return on design.

The urge to combine parts and technologies in new and different ways, however, is more than just an evolutionary step in product engineering. The Internet, open-source software, and content sharing platforms including YouTube, Facebook, and Tumblr have tapped into a deeply rooted instinct for humans to collaborate with and improve on the work of others. That instinct has generated a culture of “mash-ups,” “remixes,” and collaborative do-it-yourselfers getting together at events called Maker Faires.

Combinatorial innovation makes it easy to prototype new disruptors, unleashing orders of magnitude more experiments, and from a wider range of potential entrepreneurs. Many are trying to solve the same problems. Most will fail. But if only by sheer numbers, sooner or later someone finds the winning combination, and launches not just a successful experiment but a Big Bang Disruptor.

This unencumbered development is being driven by advances in both technologies and globalization, including widespread access to commodity components that only a few years ago were the high-end parts made for specialized uses. As economies of scale drive down the prices of these parts, standardized interconnections and efficient global delivery networks get them into more things faster.

Consider the falling cost of once-expensive sensors. Microelectromechanical systems (MEMS), which include pressure sensors, accelerometers, actuators, and gyroscopes, began life in specialized automotive applications, including safety systems and airbag controls. As MEMS get smaller and cheaper, they are being stuffed into low-cost consumer electronics, including smartphones, personal computers, and even fitness monitoring bracelets. Industry estimates expect the market for MEMS will double from 2010 to 2015, reaching $12 billion.

A similar revolution is taking place in optical technology. 3-D depth-sensing chips, for example, power the most exciting features of Microsoft’s Kinect, an add-on device for its Xbox video game console. Tel Aviv–based PrimeSense, which developed the chip, has created a new version, the Capri, which is ten times smaller.

Like its predecessor, Capri uses near-infrared beams to sense depth and color in a three-dimensional space, making it possible to identify people, movements, and gestures, as well as distinguishing furniture and other features of a room. By shrinking the device and improving its embedded algorithms, the new version will find a larger market in tablets, laptops, smartphones, and consumer robotics. Mass production will also make the Capri cheaper, expanding the range of applications even further.

Exponential technologies are at the heart of this transformation. After nearly fifty years of Moore’s Law, nearly every device with a power source now has some degree of computing power embedded into it—and soon that distinction will also disappear. A few more cycles and every one of roughly a trillion items in commerce—the Internet of Things—will be intelligent, if only marginally.

Exponential technologies don’t just make computers less expensive, in other words; they make it economically efficient to introduce computing capacity into more things that aren’t computers. As components become more standardized and more plentiful, developers will be able, with little regard to cost, to outfit even disposable goods with wireless transmitters and receivers, sensors, signal processors, cameras, and memory. That’s the power of combinatorial innovation.

In the Internet of Things, every item on the planet will have some measure of computing power and a network connection to make it part of the global Internet. Roads and bridges, miniature satellites, personal devices, plants, animals, and even our own bodies will be tagged with tiny, low-cost sensors. The information these devices will generate will make today’s “big data” seem trivial by comparison.

The standardization of information exchanges in the Internet of Things triggers another important economic driver of Big Bang Disruption: the increasing returns to scale that are known as “network effects.” Unlike scarce goods, such as crude oil and beachfront property, many intangible goods, such as standards, software, and digital information, become more valuable the more they are used.

How valuable? According to the calculation of networking pioneer Robert Metcalfe, the value of network goods increase as a factor of the number of connected nodes they contain. As Metcalfe put it, the value of a network is the square of the number of its uses.

To understand Metcalfe’s Law, imagine a network of just one telephone. Without anyone to call, its value is essentially zero. But add a second phone, and each person can call the other, meaning two new connections were added with one extra phone. Each additional phone thereafter doubles the number of potential calls that can be made. (Add the possibility of three-way and conference calling, and network value increases even faster.)

The best example of Metcalfe’s Law, of course, is the Internet, a set of unified data transit and access protocols that bind together nearly every computing device in the world into a single, seamless network. The more computing devices that are connected, the more valuable those protocols become, driving an organic standardization and convergence that has already brought together once-separate networks for telephone, television, and data communications.

While a small network of devices is of limited value, a network of billions of them sharing information in digital form is, as we now know, immeasurable. According to Cisco, nearly nine billion devices currently share information using the Internet’s nonproprietary, open standards.

In the future, as billions or even trillions of new devices share data with each other, Metcalfe’s Law will produce network effects of unprecedented size and value. Anticipating continuing cycles of better and cheaper, in fact, the current Internet numbering standard has the capacity to uniquely identify 2128—or 340 undecillion devices.

Network effects aside, combining is by its nature inexpensive, and getting cheaper all the time. As opposed to custom-designed parts, off-the-shelf components are pretested, and they benefit in price from economies of scale. A growing trend toward modular design over the last few decades has made it easier for manufacturers of other products, including appliances and other durable goods, to offer customized versions for different markets.

For Siemens, modularization has made it possible to outsource all but the core components of large wind turbines, simplifying manufacturing to the point where no factory is even needed to assemble the finished product. Appliance maker Electrolux, which has been modularizing across product lines since 2009, anticipates its efforts will cut the time from new product idea to launch by 30 percent.

With combinatorial innovation, designers can also cobble together a production pipeline and provide their product at whatever scale the market demands. This is relatively easy for software-driven goods that never take physical form, but the return on combinatorial innovation is also growing for manufactured goods. For its 2013 Galaxy S4 smartphone, for example, Samsung planned for the sale of one hundred million units, absorbing so much of the worldwide capacity of display and chip producers that it may affect the ability of rivals including Apple to maintain the schedule for their next-generation products. Control of component production is becoming the new competitive battleground.

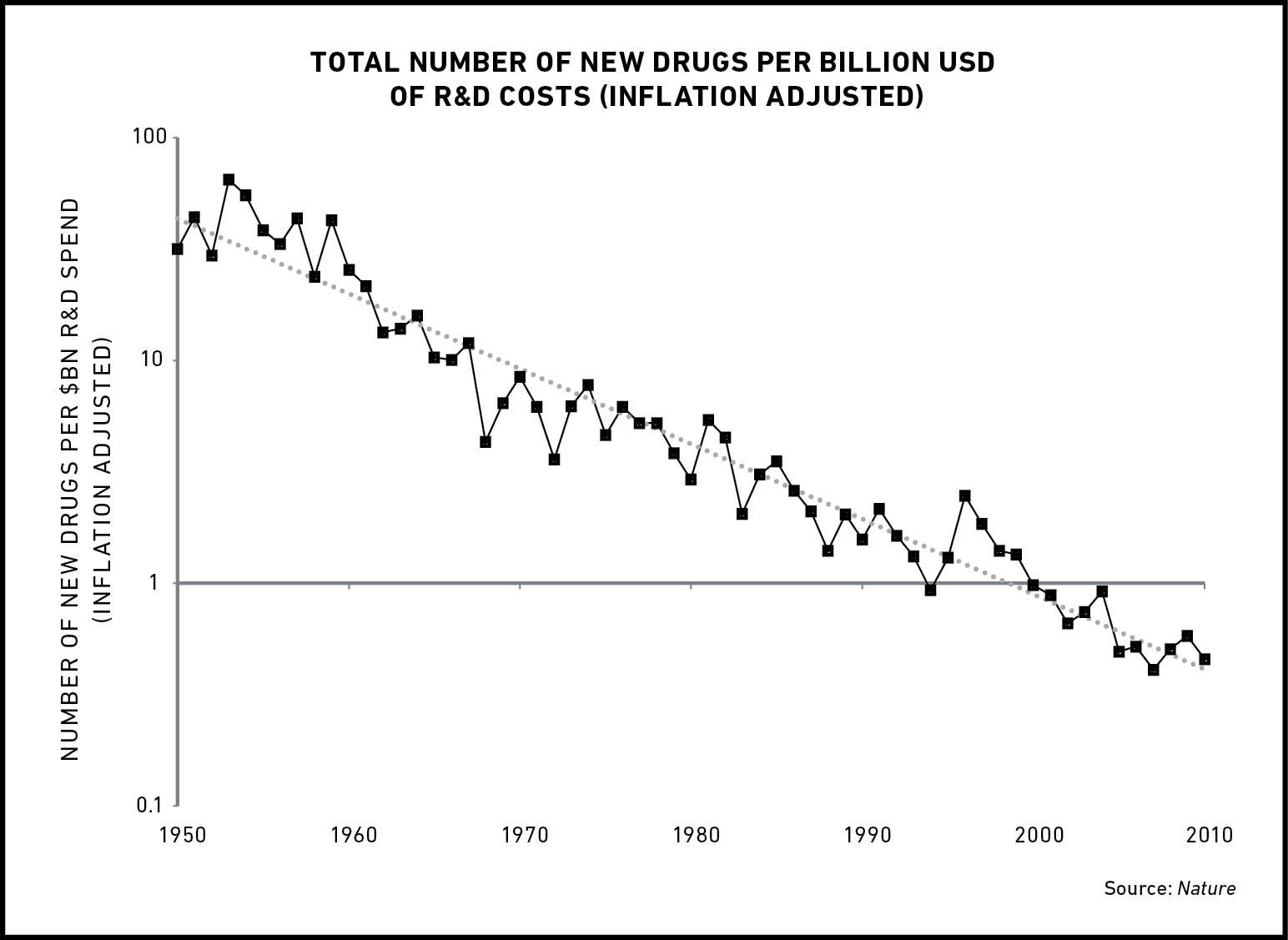

Not all industries, however, are as closely tied to exponential technologies. For enterprises with research costs that do not decline dramatically, the potential for combinatorial innovation remains largely unexplored. Incumbents and entrepreneurs are still stuck with innovation by design.

The pharmaceuticals and biotech industries, for example, benefit as everyone else does from cheaper technology components and the ability to syndicate research and development as transaction costs fall. Still, given the comparatively massive costs of custom design, testing, and approval for new drugs, treatments, and medical therapies, these productivity improvements have had little impact on consumer prices for many new medical products.

In these industries, disruptive innovation still arrives in the older form of better, but by no means cheaper, new products and services. In pharmaceuticals, research and development efficiency, measured by the number of new drugs brought to market, has actually declined relative to the amount of money invested. Some in the industry refer to this phenomenon as Eroom’s Law—literally and figuratively, Moore’s Law backward. (See Figure 7.)

In many industries operating under Eroom’s Law, the unavailability of combinatorial innovations is not so much technological as it is regulatory. While regulation plays a role in the development of most consumer goods and services, legal rules don’t often stop high-tech and consumer electronics products from reaching their customers.

That’s not the case in heavily regulated industries, where the cost and other limits imposed by regulation loom large in the design, testing, and deployment of new innovations. Companies that produce foods, drugs, energy, and automobiles, for example, along with professional services such as education, medicine, and law, require regulatory approval before introducing new products and services, or before substantially modifying existing offerings.

At the extreme, industries regulated as public utilities—closer to government agencies than private enterprises—must first obtain permission just to experiment with new technologies. They also need approval to pass the cost of research and development projects along to ratepayers.

That process is complicated by the fact that, for a variety of historic and political reasons, governments are often the last to recognize the value of disruptive technologies, whether embedded in new goods or utilized in research and development.

The degree of government oversight often translates to limits on the methods regulated industries employ to pursue disruptive innovation. In pharmaceuticals, for example, nineteenth-century research methods are effectively baked into the regulatory environment. These include carefully designed experiments, close monitoring and reporting, control groups, and testing on animals and other proxies before human testing is allowed. Drug trials must follow government-approved protocols, resulting in long delays as regulators review findings and peer-reviewed studies.

Some controls are essential for safe and effective new products, but the regulated research model unintentionally excludes the possibilities of more efficient, technology-driven alternatives in risk management. Crowdsourced design and testing, for example, which could speed the development and release of new drugs with lifesaving consequences, are effectively banned. Whether they want to or not, regulated industries must continue to design rather than combine.

Regulated industries, at the same time, appear to be protected from Big Bang Disruption. The very same rules that constrain the speed and nature of innovation in these industries also make it difficult for new entrants to disrupt the incumbents, regardless of the quality of their innovations. Banks must be licensed, drugs must be approved, and new vehicles must be proven safe. Heavily regulated industries cannot, in some sense, be disrupted regardless of new technologies that become suddenly available.

But executives who rely on regulatory costs as barriers to more efficient forms of research and development are lulling themselves into a dangerous slumber. In health care, finance, energy, and other heavily regulated industries, consumer pressure for Big Bang Disruption is building to dangerous levels.

In every field in which research and development costs are governed by Eroom’s Law, there is already parallel experimentation going on based on the open, user-funded, crowdsourced tools and techniques that have become the norm for high-tech products and services. Although the practice of medicine is still a highly restricted profession, for example, health and fitness monitoring technologies are being launched around the closed borders of the health care industry, searching for gaps in the rules that can be forced open with Big Bang Disruptors.

Often such experiments skirt the law, or openly ignore it. The AIDS epidemic, for example, has pushed advocates to demand more streamlined drug testing and early human trials sooner. The life-extending potential of other disruptive technologies, including cloning and stem cells, has likewise generated growing demands for faster and more efficient processes.

Increasingly, it is consumers who are taking up the charge and demanding more open approaches. Whether or not they understand the economics of combinatorial innovation, users have become conditioned to believe that technology has created better ways of doing things. There is also growing concern that some regulations designed to protect consumers have erected unnecessary barriers to innovation. Many believe that better and cheaper products are more likely and possible through combinatorial innovation than from traditional design. If they are wrong in that belief, it is usually only a matter of timing.

A few more cycles of exponential technology improvement and they’ll certainly be right. Meanwhile, pent-up demand is already attracting entrepreneurs, who are launching experiments at the regulated edges of markets as different as taxicabs, health care, and alternative fuel. Sooner or later, they’ll deliver Big Bang Disruptors in spite of regulations prohibiting them.

When that happens, it will be too late for incumbents to respond effectively. Regulators will be left unable to justify limits that no longer have economic, social, or political rationales. The devastation, when it comes, will be that much more dramatic.

As we’ll see in the next chapter, the greater the pressure, the bigger the bang.