Our research process involves selecting cases to study based on objective, set criteria. We do not decide which companies we want to study and then look to find a time frame during which their data meets a pattern. Rather, we lay out the criteria for the study-set selection before we see the data and systematically eliminate companies from consideration based on whether they meet the criteria. The following is a summary of the steps we went through to arrive at the final study set of fallen companies. (Cumulative stock-return calculations determined using data from the following source: ©200601 CRSP®, Center for Research in Security Prices. Graduate School of Business, The University of Chicago. Used with permission. All rights reserved. www.crsp.chicagobooth.edu.)

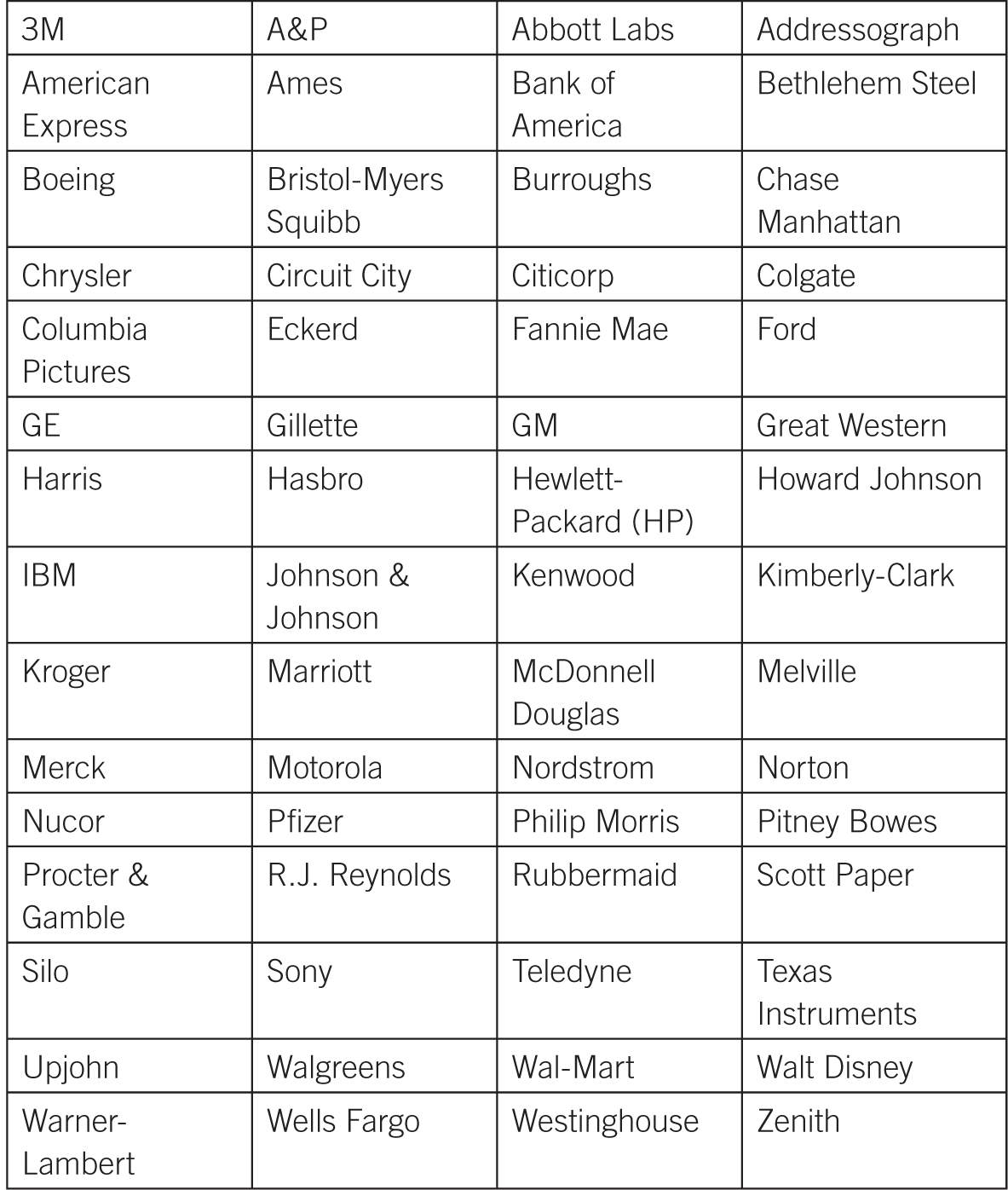

STARTING UNIVERSE

Sixty corporations representing more than thirty industry sectors, drawn from the research database used for the Good to Great and Built to Last research efforts.

CRITERION 1: CANDIDATES FOR BEING A GREAT COMPANY AT SOME POINT IN HISTORY

A company qualifies as a candidate if it meets any one of the following conditions, a, b, or c:

a) Selected as a visionary company in Built to Last or a good-to-great company in Good to Great.

b) Selected as a comparison company in Built to Last or Good to Great, and had a fifteen-year period of cumulative stock returns that exceeded the general market by 3X at some point in the company’s history. Note that our research method involves studying companies during specific eras in history when they met particular performance criteria. Companies can achieve high performance during one era and fall during a later era (the subject of this study); similarly, companies can deliver subpar performance during one era and then make a leap to exceptional performance during a later era (the subject of the good-to-great study).

i. Exception: if the candidate met Criterion 1b only in the final twelve months before being acquired, it should be excluded because its stock returns may have been artificially driven upward due to takeover speculation.

ii. Exception: if the candidate attained its above-3X performance over fifteen years only as a “spike pattern” rather than a sustained run of performance, it should be excluded. The test for a “spike pattern” over any given fifteen-year period is as follows: (1) Calculate the percentage increase in cumulative returns relative to the general market over the fifteen-year cycle during which the company beat the market by more than 3X; (2) Calculate the percentage increase in cumulative returns from the start of the fifteen-year performance run to exactly ten years into the run; and (3) If the ratio of calculation 2 divided by calculation 1 is 0.20 or lower, then the cycle counts as a “spike pattern.” The table below illustrates the spike pattern calculations.

| Example Case 1 | Example Case 2 | |

| Start of 15-year, above-3X run | 1.0X the market | 1.0X the market |

| 10 years into 15-year run | 1.25X the market | 1.75X the market |

| 15 years into 15-year run | 4.0X the market | 3.1X the market |

| Calculation 2 | 25 percent | 75 percent |

| Calculation 1 | 300 percent | 210 percent |

| Ratio of 2 divided by 1 | 0.08 | 0.36 |

| Conclusion | Spike Pattern | Not a Spike Pattern |

iii. Exception: if the candidate showed more negative years than positive years during the 3X-plus, fifteen-year performance phase, then eliminate it.

c) For comparison companies where we do not have stock return data going back far enough to assess returns during the company’s strongest years, we can marshal overwhelming evidence that the company had attained significant success prior to the availability of CRSP data. The evidence needs to fall into three categories: (1) evidence of financial results that establish the company as one of the largest and most successful companies in its industry, (2) evidence that the company had a significant impact on the development of its industry during its greatest years, and (3) evidence that the company had maintained a strong performance and made a significant impact for at least two decades.

Companies eliminated: Chase Manhattan, Columbia Pictures, Great Western, Howard Johnson, Kenwood, Norton, Silo, R.J. Reynolds, and Upjohn.

CRITERION 2: CANDIDATES FOR DECLINE—FROM GREAT COMPANY TO MEDIOCRITY OR WORSE

Take the companies that made it through Cut 1. From these, a company qualifies as a candidate if it meets either of the following conditions:

a) Selected as a visionary company in Built to Last or a good-to-great company in Good to Great, and had a negative inflection from 1995 to 2005. A “negative inflection” in this case is defined as generating cumulative stock returns at or below 0.80X the general market from January 1, 1995, to January 1, 2005.

b) Selected as a comparison company in Built to Last or Good to Great, and showed cumulative stock returns at or below 0.80X the general market over a ten-year period (or up to the point of being acquired or going bankrupt, if the decline lasted less than ten years) and the company failed to regain cumulative stock returns of 3X the general market over a fifteen-year period later in its history.

Companies eliminated: 3M, Abbott Labs, American Express, Boeing, Chrysler, Citicorp, Colgate, Fannie Mae, Ford, GE, Gillette, Harris, IBM, Johnson & Johnson, Kimberly-Clark, Kroger, Marriott, Nordstrom, Pfizer, Philip Morris, Pitney Bowes, Procter & Gamble, Texas Instruments, Walgreens, Wal-Mart, Warner-Lambert, and Wells Fargo.

CRITERION 3: OTHER EXCLUSIONS

Exclusion for Industry Effect: if there is significant question as to whether the performance pattern was due primarily to an industry effect, then eliminate the company.

Exclusion for Founder Effect: if the only period of ascent occurred during the reign of a single founder, and the company began a sustained fall within one year after that individual founder departed, then eliminate the company.

Exclusion for Pre-1950: if the company’s period of great performance ended prior to 1950, and there isn’t enough data to carefully examine its rise-and-fall period, then eliminate the company.

Exclusion for Chronic Decline: if the company demonstrated a multidecade chronic pattern of decline prior to its upswing that would call into question whether it was a great company before its fall, then eliminate the company.

Companies eliminated: Bethlehem Steel, Bristol-Myers Squibb, Burroughs, Eckerd, GM, Hasbro, McDonnell Douglas, Melville, Nucor, Sony, Teledyne, Walt Disney, and Westinghouse.

FINAL STUDY SET, FALLEN CASES

| Company | Era of Focus for Analysis of Decline | Total Time Frame |

| A&P | 1950s–1970s | 1859–1998 |

| Addressograph | 1960s–1980s | 1896–1998 |

| Ames | 1980s–1990s | 1958–2002 |

| Bank of America | 1970s–1980s | 1904–1998 |

| Circuit City | 1990s–2000s | 1949–2008 |

| HP | 1990s–2000s | 1937–2008 |

| Merck | 1990s–2000s | 1891–2008 |

| Motorola | 1990s–2000s | 1927–2008 |

| Rubbermaid | 1980s–1990s | 1920–1998 |

| Scott Paper | 1960s–1990s | 1879–1995 |

| Zenith | 1960s–1980s | 1923–2000 |