The Case for M&A in a Downturn

by Brian Salsberg

DURING A CRISIS, BUSINESSES should be examining their existing lists of potential acquisition targets and should be preparing to act, as deal premiums are likely to come down and assets that companies had been reluctant to sell may become available.

But the window for maximizing value could be relatively short, if history is any indication.

Learning from the Global Financial Crisis

Evidence from the global financial crisis (GFC) of late 2007 through early 2009 shows that companies that made significant acquisitions during the economic downturn outperformed those that did not.

There are some caveats: The GFC was, as its name indicates, a financial crisis, and was somewhat limited to the financial services and real estate sectors. Governments needed to bail out banks as many companies were overextended. Consumers were crunched as the value of their homes dropped dramatically and some found their mortgages underwater.

Today almost the entire services sector of the economy is immobilized and unemployment is at a much higher level after the 2008 recession. The Covid-19 crisis is first and foremost a health crisis, and the spread of the disease is likely to be the key factor in determining the length of the downturn, and thus the optimal M&A window. Still, the GFC is the best modern example we can look to when predicting the ultimate shape of the recovery from an M&A perspective.

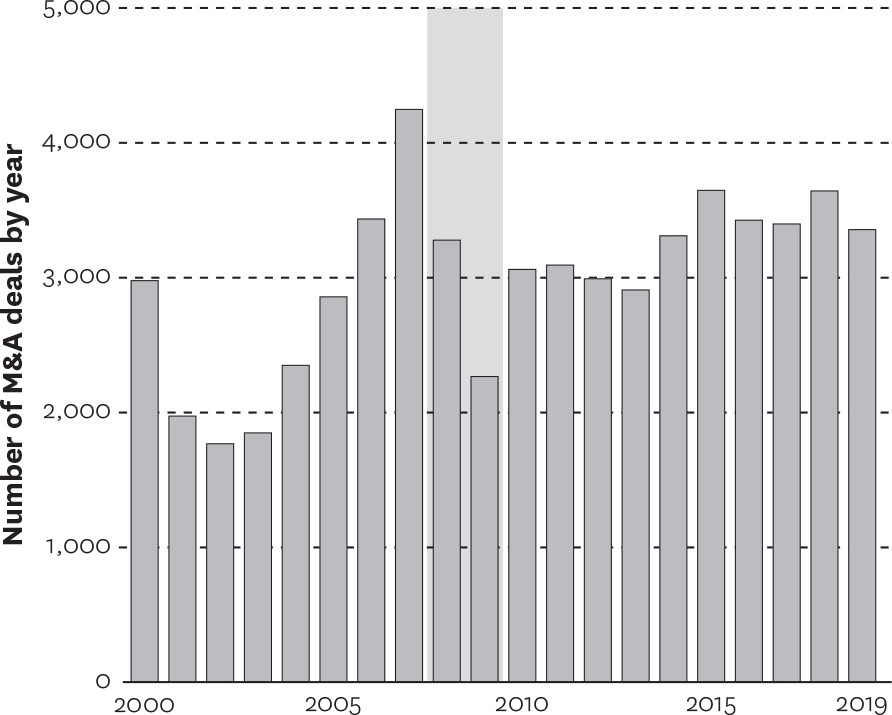

With regard to deal making, the recovery beginning in 2009 was very much U-shaped. That is, it took more than five years for deal volume to recover to average pre-crisis levels, and deal value never quite recovered. (See figure 13-1.)

Global M&A deals, 2000–2019

During the 2008 financial crisis, the number of M&A deals dipped by almost 31% year-over-year …

… and the value of those deals fell by about 27% in the same time period. Similar drops are possible due to Covid-19.

Source: EY analysis and Dealogic.

Note: Excludes real estate acquisitions. Volume based on deals of US$100 million or more.

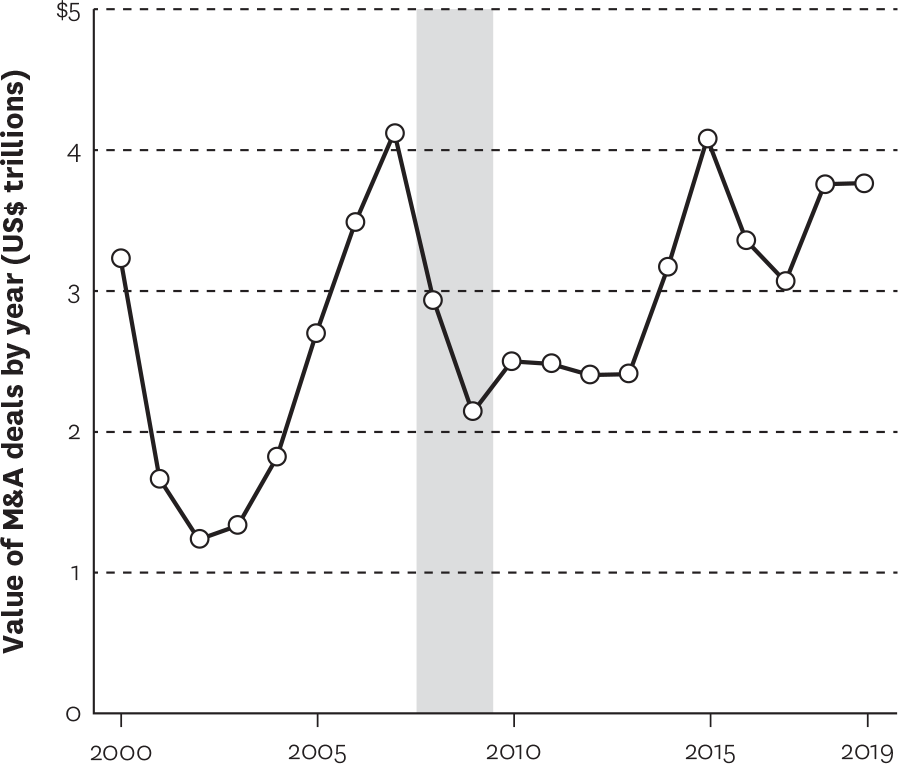

The story regarding deal multiples—defined as enterprise value divided by EBITDA (earnings before interest, taxes, depreciation, and amortization)—was somewhat different, with much more of a V-shaped recovery. Deal values plummeted from an average of 10.8x in the three years before the 2008 crisis to as low as 6.5x in 2009, before rebounding to the 10-year average of 11.6x by 2019. (See figure 13-2.)

FIGURE 13-2

Deal multiples, 2000–2020

An examination of deal multiples—the ratio of enterprise value divided by EBITDA that is used to determine a company’s value—during the 2008 financial crisis suggests that valuations that have or will decline during the current downturn are likely to bounce back somewhat quickly.

Source: EY analysis and Dealogic.

Note: EBITDA—short for “earnings before interest, taxes, depreciation, and amortization”—is a measure of a company’s financial performance.

History suggests, therefore, that there will be a relatively short M&A window that opens as the Covid-19 crisis ends, during which bargains will be had by those who have the liquidity and the risk tolerance to move quickly, and who have done their homework in advance.

Active Acquirers May Outperform

There are some qualifiers to consider when examining the data.

First, there can never be a true control in the M&A world to measure against—a company either does a deal or does not. Additionally, company performance as measured by total shareholder return (TSR) is the result of a mix of inorganic and organic activities, as well as any number of external factors, none of which can be totally isolated.

That said, we nevertheless can conclude the following:

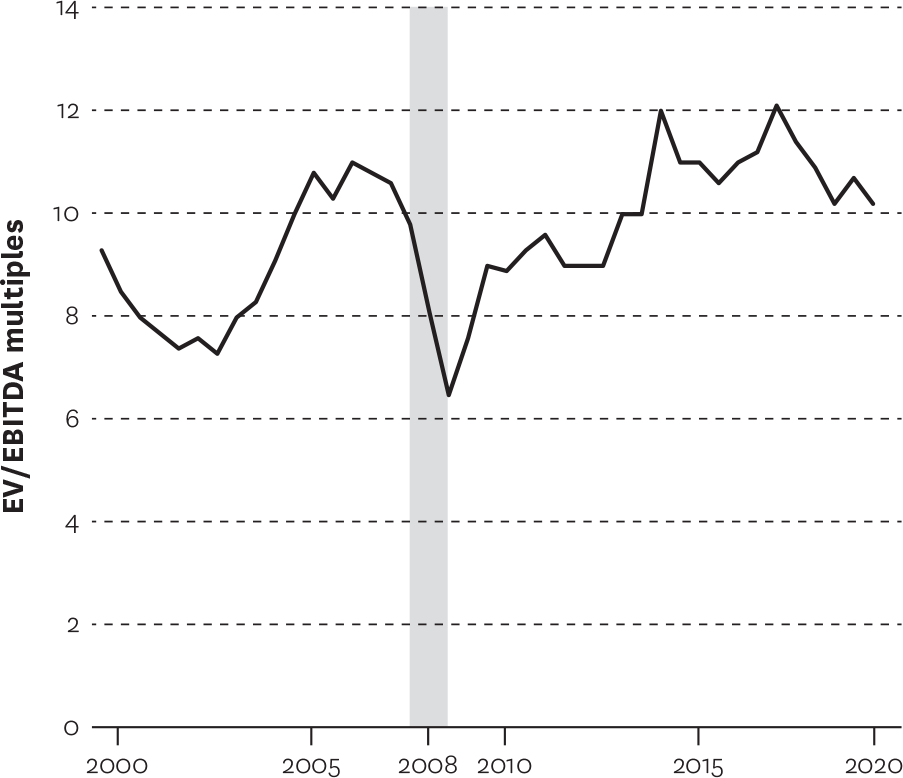

Those companies that made acquisitions totaling at least 10% of their market cap from 2008 through 2010 (active acquirers) had an average TSR of 6.4% from January 2007 through January 2008, compared with a TSR of -3.4% for less active companies. (See figure 13-3.) A similar difference was seen in median TSR.

FIGURE 13-3

Total shareholder return (TSR) growth by acquirer type, 2007–2010

Firms that made significant acquisitions during the 2008 financial crisis outperformed those that did not.

Source: EY analysis, Capital IQ, Fortune.

Note: Analysis of companies on the 2008 Fortune 1,000 list; excludes financial services, real estate, and companies where the share price was unavailable on January 1, 2007, and January 1, 2012.

The trend continued over the period of January 2007 through January 2010, when average TSR was 10.5% for active acquirers and 3.3% for less active companies.

TSR for active acquirers with strong liquidity positions (cash and short-term investments to revenue of at least 7.0% in 2007) increased by an average of 5%. In contrast, other companies saw an average increase of 1.7% over the period from January 2007 through January 2010. This gap continued in the long term (five years), with active acquirers’ TSR growing at an average of 16.9% versus 4.9% for other companies.

Deal Activity May Be the Best Option for Excess Liquidity

Companies with excess liquidity may find that shareholders and boards are more conservative about how this liquidity is used. Specifically, share buybacks and possibly dividend payments may be curtailed for several years and companies will need to keep a higher level of cash on hand. These factors will require them to use any excess cash to generate long-term shareholder value.

At the same time, with a focus on preserving jobs and the health of the economy, governments and regulators are likely to be much more tolerant of larger acquisitions in many industries.

EY analysis suggests it is not too soon to consider M&A opportunities and prepare to act. CEOs, CFOs, and heads of strategy and corporate development need to think carefully about the “new normal” and which acquisitions would be accretive to their current business models. There are a few areas in the deal process that will no longer operate as usual, particularly during this period of social distancing. Companies thinking about M&A will need to consider these unique aspects of getting a deal done, including:

Transaction diligence. Even if the majority of diligence can be performed remotely, it is likely to take longer. Diligence requiring on-site visits, such as to physical plants, is much more difficult to do via video. Boards may be reluctant to approve an asset or operations-heavy transaction without an actual site visit. Pressure-testing the strength of the balance sheet and forecasting expected cash flows for the next 12 to 24 months will be more critical than ever. Additionally, cyber diligence (that is, assessing the strength of the target’s IT vulnerability) will increasingly become a focus area due to the accelerating reliance on technology.

Synergy modeling. This process will need to be conducted with an eye toward the new normal. For instance, resilient supply chains have more redundancies than efficient supply chains, meaning they are more expensive and have fewer opportunities to cut costs and achieve synergies.

Business models. In our new normal, companies’ business models are likely to change, and not just in obvious ways. For example, that hot new kombucha beverage with all the social media hype may struggle to find a space on retail shelves when grocery channels begin prioritizing established brands and safety stock.

Post-acquisition integration. Maintaining employee morale and engagement is critical, especially in this environment. Many people will be focused on their job security, so asking them to put their energy toward onboarding target employees may be difficult. While it is possible to work your way through much of the integration playbook remotely, culture and change management aspects can be tricky to communicate over videoconference. Being considerate of working hours, ensuring various integration meetings stick to a reasonable time frame, and infusing the process with the appropriate amount of ice-breaker activities (such as virtual happy hours) are some ways to ease the burden of the work-from-home context.

Ultimately, planning for M&A in the near future will require significant rigor. Companies must understand the recovery curve scenarios that target firms are likely to experience coming out of the crisis, in addition to understanding the true liquidity situation of the target and any of the target’s near-term CAPEX or similar needs.

Note

Special thanks to Rahul Agrawal, Manvi Gupta, Banipreet Kaur, and Vaishali Madaan for their contributions to this article.

Originally published May 17, 2020. Reprint H05MDM