24

Family Policy and Wives’Economic Independence

Hadas Mandel

The topic of the welfare state and gender equality has attracted much scholarly attention in recent decades. During this period, researchers have developed typologies, conceptions, and theories linking welfare state activities to gendered outcomes, alongside cross-country comparative databases of policy measures. The literature on the welfare state and gender highlights the effectiveness of welfare state interventions in reconciling the tension between mothers’ paid and unpaid work. Thus, the theoretical conceptions, and consequently their measures, tend to focus on work–family reconciliation policies – that is, those policies that help mothers participate in paid work. Most common among them are policies that reflect the state’s responsibility to provide mothers with the necessary conditions to care for their infants after birth, in the form of maternity or parental leaves, and to combine work with family responsibilities afterwards, in the form of childcare facilities (Gornick and Meyers, 2003). Because these policies are targeted at benefitting families with children, they are defined in the literature as “family policies.” In practice, however, these policies mostly affect the labor market behavior of mothers and rarely, or only indirectly, affect the behavior of fathers (Morgan and Zippel, 2003).

In order to better understand the implications of family policies for gender equality, two important issues, both of which have been insufficiently discussed to date, need to be addressed. The first is the extent to which family policy contributes to the economic gains of women, beyond its effect on their labor market participation rates. This examination is important because the effect of family policy on gender equality may vary substantially for different parameters of equality. In fact, comparative research has shown that family policy may promote certain aspects of gender equality and, at the same time, impede others (see Mandel, 2009; Stier and Mandel, 2009).

A second, and no less important, issue is whether family policy affects all women similarly. To probe this, we must take socioeconomic characteristics into account in our discussion of equality between men and women. With the massive entry of women into the workforce over the past three decades, inequality among women has grown rapidly (McCall, 2007). While it is true that all women struggle to negotiate between market demands and domestic work, this conflict takes different forms for women of different classes (Williams and Boushey, 2010). Because of these disparities, generous family policy, which is beneficial for some women, can be very costly for others (Mandel, 2011, 2012).

In this chapter, I shed light on these two neglected issues by considering the cross-country variation in the economic contribution of married (or cohabiting) women to household income (hereinafter, wives’ contribution). The first issue is examined by analyzing the effect of family policy on the economic gains of wives, beyond its effect on women’s participation rates. I will show that the cross-country variation in wives’ contribution is highly related to the cross-country variation in female labor market participation. This is not surprising because a working woman, even if she earns very little, contributes more to her family income than does a nonworking woman. Given the effectiveness of family policy in raising women’s participation rates (e.g., Gornick, Meyers, and Ross, 1997; Korpi, 2000; Van der Lippe and Van Dijk, 2002), the cross-country variation in wives’ contribution is expected to be positively related to the cross-country variation in family policy. However, the effect of family policy on the economic resources of women who already work is more complicated. Family policy will foster the economic contribution of women already in the labor market only to the extent that it increases their occupational and earning attainments – an empirical question that has yet to be clearly answered.

The second issue, which has received even less attention than the first, is whether family policy affects all women similarly. In this chapter, I will argue that the effect of family policy on the economic contribution of educated women is very different from its effect on less educated women. Family policy may enhance wives’ contribution in two ways: (i) by raising women’s odds of being economically active (labor market participation) and (ii) by increasing women’s occupational and earning attainments in the labor market. Both mechanisms are strongly related to socioeconomic characteristics. In the case of the former, developed family policy – such as childcare facilities, and long and subsidized parental leave – is expected to increase the economic contribution of low-educated women, but not that of high-educated women. Family policy reduces the reservation wage of mothers, the minimum compensation that makes their participation in paid employment economically profitable. For women with low earning potential, this is critical. In contrast, the biggest incentive for participation in paid employment for high-skilled women is their relatively high earning potential. Thus, family policy is expected to increase the participation rates of low-educated women, and therefore their economic contribution, but not the participation rates of high-educated women, whose labor market attachment and participation are high regardless of state assistance.

As for the latter – increasing women’s occupational and earning attainments – the answer, again, depends on education and skill levels. In the case of low-educated women, family policy increases their economic contribution not only by easing their access to paid employment, but also by promoting their work continuity, which increases their labor market rewards. In contrast, to the extent that state assistance fosters employers’ reluctance to hire women for, and promote them to, lucrative positions (Albrecht et al., 1999; Mandel and Semyonov, 2006; Mandel, 2009, 2012; Ruhm, 1998), developed family policy is expected to decrease the relative economic gains of high-educated women and, thus, to lower their economic contribution to the household income.

Using microdata from the Luxembourg Income Study (LIS) for 21 advanced countries, this study analyzes the relative economic contribution of both low- and high-educated women to household income. The findings for low-educated women met expectations fully: among dual-earner couples with low-educated wives, all indicators of family policy showed that family policy increases wives’ contribution, above and beyond its effect on participation rates. In contrast, according to these indicators, family policy had no effect – neither positive nor negative – on the contribution of high-educated women.

The implications of these findings and the extent to which they correspond with previous findings are discussed in the context of welfare state and gender theories, and in the context of men and women’s tendency to marry partners who resemble them both culturally and socioeconomically (homogamy). Distinguishing between groups of women, and disentangling the effect of family policy on participation rates from its effect on labor market attainments, elucidates the social mechanisms that underlie how welfare states affect gender equality, in general, and women’s economic contribution, in particular.

Theoretical Considerations

Wives’ economic contribution to family income

Scholars of the sociology of the family emphasize the importance of women’s access to market resources for determining women’s position of power within the family and allocation of household tasks (Shelton and John, 1996; Bittman et al., 2003; Breen and Cooke, 2005; Treas and de Ruijter, 2008). Access to independent resources such as income from paid work increases women’s power in two important dimensions, referred to as “voice” and “exit” (Hirschman, 1970; Hobson, 1990). First, economic resources allow women to affect family decisions – to have a “voice” within the family about the division of household labor (Brines, 1994; Bianchi et al., 2000; Treas and Tai, 2012). Second, it allows women to exit a relationship that they are not satisfied with (Oppenheimer, 1997). Thus, the extent to which married women are economically independent is an important indication of equality within the family and has important implications for family functioning (see also Bolzendahl and Myers, 2004).

The sharp increase in women’s economic activity in recent decades has been the prime promoter of women’s rising economic independence (Sorensen and McLanahan, 1987; Van Berkel and De Graaf, 1998). However, whereas access to paid work, and thus to an independent income, is considered the main contributor to women’s economic independence, women’s occupational and earning achievements in the labor market play a crucial role in determining their level of economic independence. While the number of households with wives entirely dependent on their spouses’ income has dramatically declined, most women in dual-earner households still earn much less than their spouses, and households in which wives earn more than their husbands are relatively few (Winkler, McBride, and Andrews, 2005).

The economic inferiority of working women relative to their spouses can be attributed to their work patterns and their limited access to high-paying jobs. In many European countries, a substantial portion of working women work part time (Blossfeld and Hakim, 1997). For example, in the Netherlands, a country with high rates of part-time work, the economic dependence of married women is four times higher among part-time workers than among full-time workers (Van Berkel and De Graaf, 1998). Yet women who work full time still earn less than men (Persson and Jonung, 1998). In the United States, Sorensen and McLanahan (1987) found that only half of married women’s economic dependence on their husbands is the fault of low work hours. Rather, working women contribute less to household income mainly because they receive lower returns for their work hours (see also Winkler, McBride, and Andrews, 2005). Thus, while the increase in women’s labor force participation rates has significantly contributed to lowering women’s economic dependence over time, considerable inequality within families remains due to women’s limited access to highly paid positions and limited work hours.

The effect of family policy on wives’ economic contribution to family income

How can family policy affect the relative contribution of wives to their households? The comparative empirical research on family policy and gender inequality has tended to deal with the implications of family policy from a particular viewpoint: because generous family policy aims to reconcile the inherent tension between paid and unpaid work, its success is usually measured by the extent to which it supports the employment of mothers. Thus, the traditional criterion for assessing the effect of family policy on gender equality is women’s participation in the labor market, because women’s participation in paid employment is thought to promote their economic independence within the family, either by reducing the unequal division of labor between spouses in dual-earner households or by helping single women establish an independent household (Breen and Cooke, 2005; O’Connor, 1996; Orloff, 1993). Thus, countries with high participation rates of women, especially mothers, are usually considered the most egalitarian.

The correspondence between women’s participation rates and economic independence leads to the conclusion that every policy that directly or indirectly increases women’s labor force participation will reduce wives’ economic dependence. However, while almost every employment-supportive policy, by definition, reduces economic dependence, such policies do not necessarily foster gender equality within the family (Stier and Mandel, 2009). In fact, some of these policies may enhance women’s economic dependence by harming the economic achievements of working mothers.

The prevailing indicators of family policy in comparative analyses are parental leave and subsidized childcare (Gornick, Meyers, and Ross, 1997; Gornick and Meyers, 2003), but their expected effects on women’s attainments are not identical. The effect of paid maternity leave on women’s market achievements is complicated. On the one hand, maternity leave may enhance women’s pay by increasing women’s attachment to the labor market. That is, paid maternity leave can help mothers maintain employment with the same employer, and, as a result, promote their job continuity. Paid maternity leave also encourages mothers to return to the labor force earlier and protects them against the loss of labor market skills (Waldfogel, 1998; Sigle-Rushton and Waldfogel, 2007). On the other hand, extended maternity leave encourages women to withdraw from paid employment and, consequently, reduces their work experience, erodes their labor market skills (Edin and Gustavsson, 2008), and aggravates employers’ discrimination against women (Ruhm, 1998; Albrecht et al., 1999; Mandel and Semyonov, 2005, 2006).

In their discussion of parental leave policies, Gornick and Meyers (2003) claim that as long as parental leave continues to be used almost exclusively by women, it will weaken women’s labor force attachment and thus exacerbate gender inequality. Similarly, Mandel and Semyonov argue that “adjusting the demands of employment to women’s home duties or allowing working mothers reduced working hours and long leaves from work, are likely to preserve women’s dominant roles as mothers and wives” (2006, p. 1911). Women’s tendencies “to take parental leave are likely to restrict their opportunities for occupational mobility as they foster employers’ reluctance to hire women and to promote them” (pp. 1914–1915).

Subsidized childcare, however, has the potential to advance economic gender equality. Childcare facilities can improve women’s economic resources by enabling mothers of young children to participate in paid work and by allowing working women to allocate more of their time and effort to paid employment. In contrast to parental leave, there are no theoretical reasons to expect unfavorable consequences from subsidized childcare. Nevertheless, although the effect of childcare on women’s economic independence via increased participation rates is obvious, it is not clear to what extent childcare facilities contribute to the earnings of mothers who already work. Rather than support gender equality, childcare facilities aim to socialize, educate, and nurture preschool children (Morgan, 2005). As a result, they are not designed to match women’s work hours, especially not those of career-oriented women.

The effect of family policy on wives’ contribution among different groups of women: Argument and expectations

The literature reviewed thus far leads to the expectation that the implications of family policy, in general, and maternity leave and public childcare, in particular, for the economic dependence of wives are twofold: as an employment-supportive policy, family policy reduces economic dependence by definition, because it promotes mothers’ access to a paycheck. However, the implications of family policy above and beyond its effect on participation rates are not entirely clear. Theoretically, both parental leave and subsidized childcare have the potential to decrease working women’s economic dependence by supporting women’s work continuity, labor market attachment, and, consequently, occupational and earning attainments. However, as noted earlier, the positive implications of parental leave on women’s labor market attainments are doubtful. In the case of childcare, the positive implications depend on the extent to which those facilities match the regular employment hours of women.

The key argument developed in this chapter is that the effects of both mechanisms are strongly related to women’s education and skill levels. Both maternity leave and subsidized childcare are not expected to influence the economic contribution of women from different class positions uniformly. Women with low labor market attachment – usually women with low education and low labor market skills – are more likely to be influenced by family policy. In fact, family policy is often a critical factor in determining their labor market participation (Hakim, 2002). Paid maternity leave enables low-skilled women to return to the same employers, which, in turn, increases their labor market continuity. Furthermore, even after taking extended maternity leaves, low-educated women are less exposed to employers’ discrimination in hiring (Mandel, 2012): being less skilled, they are candidates for positions that require relatively short (and less expensive) training periods.

The availability of subsidized childcare is also crucial in the decisions of low-educated women to participate in paid employment. Because low-skilled women have low earning potential, expensive childcare makes their paid work economically unprofitable. Therefore, although public childcare reduces the costs of maternal employment for all women, the marginal profit for low-skilled women is much higher. Moreover, subsidized childcare is expected to contribute to the labor market continuity of those who already work. Both types of family policy, therefore, appear to increase the economic independence of low-skilled women, and consequently to improve women’s relative standing within the family.

Reconciliation policies also have important implications for overall family welfare. Family policy is expected to benefit low-educated women twice: first, by helping them join the labor market and, second, by providing them with better economic rewards within the labor market. By helping mothers to become economically active, and to increase their economic gains, family policy is expected to benefit the economic standing of the entire family, raising total family income and, as a result, family standard of living.

The expected effects of family policy on high-educated women are very different. High-educated women are equipped with higher labor market skills and thus with greater earning potential. Their labor market attachment is high even without state assistance, which makes employment-supportive policies much less relevant for their decisions to participate in the labor market. Family policy, then, can decrease the economic dependence of high-skilled women on their spouses only to the extent that it supports their occupational and earning attainments in the labor market.

However, as noted earlier, parental leave tends to restrict, rather than encourage, the access of high-skilled women to lucrative job positions. Because of the relatively long training periods that attractive jobs require, the cost of a new worker (as a locum tenens) in these cases is high in contrast to jobs that require little or no on-the-job training. As the theory of statistical discrimination teaches us, having limited information on new candidates’ characteristics and future productivity, employers seeking to fill jobs with high training costs are likely to discriminate against applicants belonging to groups with statistically lower average levels of expected productivity (Aigner and Cain, 1977). Employers, thus, prefer male employees for well-paid jobs, because men are perceived as more stable workers (Estevez-Abe, 2005; Mandel and Semyonov, 2005, 2006). Consequently, although long absenteeism from paid employment may increase discrimination in hiring against all women, advantaged women, the potential candidates for elite positions, suffer most from statistical discrimination. Indeed, Mandel (2012) found that family policy increases the earning gap among advantaged men and women, but not among the disadvantaged. She concluded that the perverse effects of family policy on women’s occupational and earning attainments exist only for advantaged workers.

This is not to say that high-educated women, being the primary caregivers in their families, do not benefit from state assistance (Williams and Boushey, 2010). They, however, are less reliant on state assistance and are in a better position to purchase private solutions for the work–family tension (Morgan, 2005; Shalev, 2008). While the marginal effect of subsidized public childcare, for example, is weaker for high-paid women relative to low-paid women, other solutions, such as tax credits for childcare or antidiscrimination legislation, are more advantageous for educated and economically well-off women (O’Connor, Orloff, and Shaver, 1999; Shalev, 2008).

To sum up, the effect of family policy on the economic independence of educated women is very different from its effect on noneducated women. Developed family policy, such as long and subsidized parental leave and childcare facilities, is expected to reduce the dependence of low-educated women, but not that of high-educated women. Family policy reduces mothers’ reservation wage, the minimum compensation that makes it economically profitable to participate in paid employment. For low-skilled women with low earning potential, this is critical. In contrast, the biggest incentive for high-skilled women to participate in paid employment is their relatively high earning potential. Furthermore, to the extent that long maternity leave restricts the occupational and earning attainments of high-skilled women, developed family policy is expected to decrease, rather than increase, the relative household economic contribution of high-skilled women.

Data and Measurement

Data for this study were obtained from waves four and five of the LIS (1991–1999). The specific year for each country appears in Table 24.1 (see detailed information on the archive in http://www.lisdatacenter.org). The analyses are based on data for couple-headed households (married or cohabiting), aged 25–60 years, from 21 countries (see list of countries and years in Table 24.1). Data on family policies were collected from various sources and were added to the household-level file.

Table 24.1 Women’s earning contribution to household income, by education a

Source: Data from LIS and Danish Leisure Study (1993).

| All women | High education | Low education | Gap between high and low education | |

| Finland (1991) | 40.80 | 41.90 | 40.66 | 1.25 |

| Denmark (1993) | 38.98 | 39.42 | 38.78 | 0.64 |

| Hungary (1994) | 38.54 | 44.40 | 38.24 | 6.17 |

| Sweden (1995) | 38.28 | 41.15 | 37.83 | 3.32 |

| Norway (1995) | 36.99 | 42.67 | 36.06 | 6.61 |

| Czech Republic (1996) | 34.57 | 35.21 | 34.52 | 0.69 |

| Slovakia (1992) | 34.32 | 38.27 | 33.92 | 4.35 |

| Canada (1997) | 31.38 | 36.97 | 30.39 | 6.57 |

| United States (1997) | 30.45 | 33.99 | 29.12 | 4.87 |

| France (1994) | 30.03 | 35.93 | 29.61 | 6.33 |

| United Kingdom (1999) | 29.77 | 36.31 | 28.47 | 7.84 |

| Israel (1997) | 28.74 | 33.95 | 27.27 | 6.68 |

| Australia (1994) | 27.69 | 35.96 | 26.44 | 9.52 |

| Germany (1994) | 27.17 | 33.57 | 26.77 | 6.80 |

| Belgium (1997) | 26.52 | 38.37 | 25.81 | 12.56 |

| Austria (1997) | 23.42 | 36.28 | 22.82 | 13.46 |

| Ireland (1996) | 22.83 | 39.70 | 20.72 | 18.99 |

| Italy (1995) | 22.29 | 39.64 | 21.18 | 18.46 |

| Spain (1995) | 19.83 | 38.90 | 15.56 | 23.33 |

| The Netherlands (1994) | 18.08 | 28.06 | 16.22 | 11.84 |

| Luxemburg (1994) | 17.25 | 31.36 | 16.67 | 14.69 |

| Average | 29.43 | 37.24 | 28.43 | 8.81 |

| SD | 7.11 | 3.89 | 7.69 | 6.23 |

| Correlation with the first row | 0.63 | 0.99 | -0.84 | |

a All microdata files are from the LIS, except the data from Denmark.

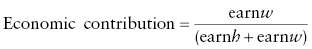

The dependent variable, a measure for women’s economic independence, was based on the relative contribution of wives to household income, as proposed by Stier and Mandel (2009) and described in the following:

where earnw is wife’s earnings and earnh is husband’s earnings. This fraction is multiplied by 100, and consequently the range is from 0 (where 0 indicates that the wife is totally dependent on her husband) to 100 (where 100 indicates that the husband is totally dependent on his wife).

Two types of explanatory variables were introduced to the models: household-level and country-level characteristics. The household-level variables are presence of preschool-aged children in the household (=1); number of children aged 18 or younger in the household; wife’s age; age difference between spouses (husband’s age minus wife’s age); wife’s work hours 1 ; and couples’ relative education. To compute relative education levels within couples, husbands and wives were ranked first on an ordinal scale, according to their country-specific educational categories. The relative education of the couple was then measured using a dummy variable, where a value of 1 indicates that a wife is more educated than her husband, and 0 indicates that she is not.

At the country level, four different indicators of family policy were employed in the analysis. The first two, childcare arrangements and maternity/parental leave, are the most prevalent measurable indicators of family policy and are thus useful for large-scale comparative studies (Gauthier, 1999; Kamerman, 2000; Meyers and Gornick, 2000; Gornick and Meyers, 2003). Childcare arrangements are measured as the percentage of children aged 0 to 3 in day care. In contrast to the percentage of preschool-aged children in day care, day care for infants is more clearly aimed at facilitating women’s employment (Korpi, 2000). Parental leave is measured by the number of paid weeks of either maternity or parental leave. Because maternity and parental leaves are both income-related benefits, which are both widely (and almost exclusively) used by mothers, this indicator ensures the best comparability across countries (Morgan and Zippel, 2003). Table 24A.1 displays the values of the two variables for each country.

The other two indicators of family policy are more general: type of welfare state regime and an integrated index of family policy. The incorporation of welfare regimes is based on the assumption that countries classified under the same ideal welfare regime type share similar policy packages, which differ from the policies of countries in other welfare regimes. If, indeed, welfare state policies affect the economic contribution of women, then the similarities and dissimilarities across countries in wives’ contribution should relate to welfare regime type (Mandel, 2009). Welfare state regimes are classified on the basis of Esping-Andersen’s typology (1990, 1999). The four Scandinavian countries, all of which fall under the heading of the social democratic regime, are characterized by dual-earner strategies that promote gender equality through universal benefits to working mothers, social services, and public employment. The four Anglo-Saxon countries, all classified as having market-oriented liberal regimes, have the least developed family policies, which is typical of welfare state models that rely on private market solutions. All other countries, including the Czech Republic and Slovakia, which are grouped together with the Continental and Mediterranean countries, are considered part of the third group, the conservative welfare states. The conservative welfare states, according to Esping-Andersen, are characterized by their heavy reliance on family for care services. 2

The integrated index of family policy used here was designed by Mandel and Semyonov (2005, 2006). The index captures the role of the state in mitigating the work–family conflict by means of three components: the number of fully paid weeks of maternity/parental leave, the percentage of preschool-aged children in public childcare institutions, and the size of the public service sector. Each of these components captures a different aspect of family policy. The size of the public service sector indicates the role of the state as a “family-friendly” employer, offering convenient working conditions for mothers (Kolberg, 1991). Parental leave and childcare help women combine paid with unpaid work, as explained at the outset. The index ranges from 0 to 100, where 0 is assigned to the country with the most limited family policy (Switzerland) and 100 to the country with the most generous one (Sweden). Table 24A.1 displays the family policy indicators by country.

The distinction between more and less advantaged women is based on education, a valid proxy for workers’ potential and actual earning power. Because education is an indicator of skill and, thus, a key factor in labor market advantage, this type of operationalization enables valid comparisons across countries. Nonetheless, categorizing education is somewhat problematic because education groupings in most LIS data files are not harmonized across countries. In an effort to identify categories that are comparable, this analysis limits itself to two: low education (up to and including some postsecondary education) and high education (college graduate or higher). The low-educated group is very large and heterogeneous, which may lead to an underestimation, rather than overestimation, of the true effect in this group. 3

Analytical Strategy

To estimate the net effect of family policy on women’s earning contribution to the household, I use multilevel modeling, where the dependent variable is wife’s earning contribution and both household-level and country-level variables serve as independent variables (Bryk and Raudenbush, 1992). The household-level variables were introduced to control for cross-country variation in the composition of these covariates, so that the net effect of policies on the relative standing of women within their households could be estimated.

At the country level, the dependent variable is the net average level of a wife’s earning contribution, and its variation across countries is modeled as a function of family policy (e.g., childcare facilities, maternity leave, integrated index of family policy, and welfare state regime). The regressions were run separately for the sample of households in which the wife has an academic degree and the sample in which the wife does not. According to the theoretical rationale of this study, the effect of family policy on wives’ economic contribution is expected to be negative in the case of the former and positive in the latter (see Appendix 2 for a formal presentation of this model).

Findings

Descriptive statistics: Wives’ economic contribution and labor force participation

Table 24.1 displays the average levels of wives’ earning contribution to household income. The first column displays the earning contribution of all (working and nonworking) wives. The second and third columns display the earning contribution of wives with and without an academic degree, respectively, and the last column displays the gap in earning contribution between the two groups (second column minus third column). The average wives’ contribution across all countries is less than 30%. That is, across all countries, women contribute less than a third to household economies, while men contribute more than two thirds. However, the variation between countries is substantial. Whereas in countries such as Finland, Denmark, Sweden, and Hungary, wives’ earning contribution is around 40%, women in Spain, the Netherlands, and Luxemburg, on average, contribute less than 20% to total family income.

As expected, education levels are key in determining women’s economic contribution to the household. The average contribution is nearly 40% for women with an academic degree, and cross-country variation among educated women is much lower. In contrast, the economic contribution of wives without a degree is lower by nearly 10 percentage points. Because the majority of women do not have a college education, the average economic contribution of low-educated women is very similar to the aggregate contribution of all women, as demonstrated by the very high correlation between the two distributions, presented in the bottom row. The economic contribution of high-educated women only partly correlates with the aggregate levels.

The last column displays the gaps between the average economic contributions of more and less educated women. Cross-country variations in the gaps are indeed very high. While in some countries (Denmark, the Czech Republic, Finland, and Sweden), the gaps between the two groups are negligible, in others (Spain, Italy, and Ireland), the gaps are very high. For example, in Denmark, the country with the smallest gap, the difference in economic contribution between women with high and low education levels is less than 1%. In contrast, in Spain, the country with the biggest gap, it is as high as 23%.

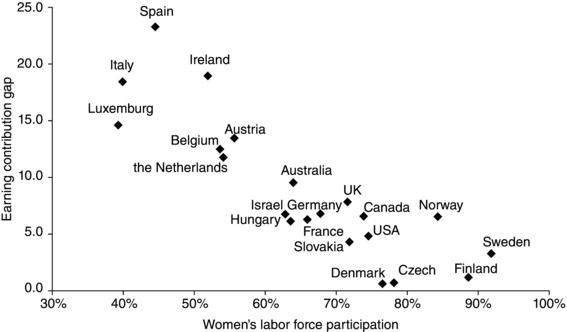

Obviously, access to paid work, and thus to an independent income, is the main contributor to women’s economic independence. Therefore, the gap in earning contribution between the two groups of women is expected to be closely related to their labor force participation rates. Figure 24.1 plots labor force participation rates of women (x-axis) together with the gaps in economic contribution between more and less educated women (y-axis). Indeed, the cross-country variations in women’s participation rates relate strongly and negatively to these gaps (Pearson r = -0.87). That is, the gaps are highest in countries with relatively low participation rates of women, such as Spain, Italy, and Ireland. In contrast, in countries with relatively high participation rates, such as the social democratic countries and the Czech Republic, Canada, and the United States, the gap between the average earning contributions of high- and low-educated women is relatively low. In fact, cross-country correlations are so strong that it looks as if the differences in economic contribution across countries depend exclusively on the extent to which a country succeeds in encouraging women’s participation in paid employment.

Figure 24.1. The gap in women’s earning contribution between women with and women without college degree, by labor force participation.

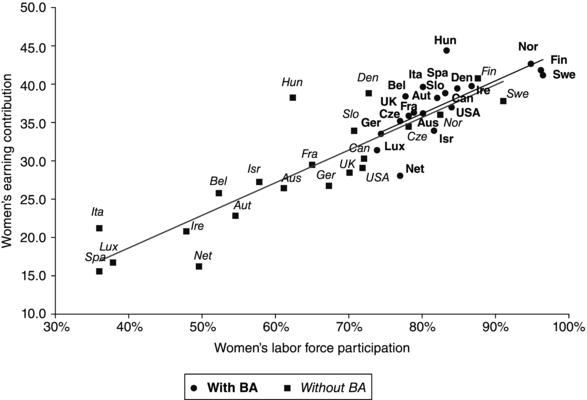

However, small gaps in the economic contributions of more and less educated women can result from either relatively high participation rates of low-educated women or relatively low participation rates of high-educated women. Figure 24.2 plots the cross-country variations in the average rates of women’s labor force participation (x-axis) with the average earning contributions of more and less educated women (y-axis). Country names are italicized and colored light grey for low-educated women and colored black for high-educated women. Indeed, the figure shows the very strong cross-country correlations between participation rates and household economic contribution for the two groups of women. However, the variations on both axes are much lower among high-educated women, who tend to work in high proportions even in countries with relatively low participation rates. Consequently, their relative earning contribution is high regardless of their country. In contrast, the economic contribution of low-educated women correlates almost perfectly with their participation rates. Given the expansion of the education system in recent decades and the growing number of women with academic degrees, the findings imply that women’s labor market participation rates, and consequently women’s economic independence, will continue to increase even without state assistance.

Figure 24.2. Women’s earning contribution by labor force participation, for women with and women without college degree.

Multilevel analysis: The impact of family policy on wives’ economic contribution

As mentioned at the outset, an extensive array of literature has provided solid empirical evidence that developed family policy increases the labor market participation rates of women (Esping-Andersen, 1990; Korpi, 2000; Gornick and Meyers, 2003; Misra, Budig, and Moller, 2007). The strong cross-country correlations between participation rates and women’s average economic contribution to the household lead to the expectation that policies that promote women’s employment also reduce women’s economic dependence (Bianchi, Casper, and Peltola, 1999). Thus, in the following analysis, the sample is restricted to dual-earner households. By limiting the sample to employed men and women, cross-country variations in women’s participation rates are eliminated, and the effect of family policy on wives’ contribution is examined net of its effect on labor force participation. According to the theoretical reasoning of this study, employment-supportive policies are expected to promote the economic contribution of low-educated women (net of the effect on participation rates), but not that of high-educated women.

To examine these hypotheses, I distinguish between households with wives that have an academic degree and those with wives that do not. Table 24.2 and Table 24.3 present the results of a series of multilevel regression models that predict women’s earning contribution in dual-earner households. In each analysis, the sample is restricted to one of the two groups, and the coefficients reflect the effect of household- and country-level variables. Table 24.2 displays the results for households with low-educated wives. As for the household-level variables, although having a young child in the household does not significantly affect wives’ contribution, each child decreases this contribution by about 1% (b = -0.949), when other indicators are held constant. In households in which women are more educated than their spouses, wives’ contribution is higher (b = 3.056). As expected, wives’ contribution increases with work hours (b = 0.678), but decreases with age (b = -0.018), and also with age gaps between the spouses (b = -0.061). Because age may serve as a proxy for work experience, the age gap between spouses is indicative of the gap in their work experience (in favor of the male partner). Also, large age differences may reflect traditional gender ideologies and, thus, a conservative division of paid and unpaid labor within the family.

Table 24.2 Predictions of the relative earning contribution of women in dual-earner households (standard errors in parentheses), results of multilevel regression

| Women without college degree | ||||

| Household-level variables | Model 1 | Model 2 | Model 3 | Model 4 |

| Intercept | 13.987 ** | 13.771** | 13.403 ** | 14.174 ** |

| (0.867) | (1.135) | (1.028) | (0.836) | |

| Presence of preschool children | 0.137 | 0.137 | 0.136 | 0.137 |

| (0.194) | (0.194) | (0.194) | (0.194) | |

| Number of children | -0.950 ** | -0.948 ** | -0.949 ** | -0.948 ** |

| (0.075) | (0.075) | (0.075) | (0.075) | |

| Woman more educated | 3.057 ** | 3.057 ** | 3.056 ** | 3.056 ** |

| (0.154) | (0.154) | (0.154) | (0.154) | |

| Age | -0.018* | -0.018* | -0.018* | -0.018** |

| (0.01) | (0.010) | (0.010) | (0.010) | |

| Spouses’ age difference (male–female) | -0.061 ** | -0.061 ** | -0.06 ** | -0.061 ** |

| (0.018) | (0.018) | (0.018) | (0.018) | |

| Woman’s weekly work hours | 0.678 ** | 0.678 ** | 0.678 ** | 0.678 ** |

| (0.007) | (0.007) | (0.007) | (0.007) | |

| Country-level variables | ||||

| % Children 0–3 in day care | 0.104 ** | |||

| (0.036) | ||||

| Weeks of parental leave | 0.079* | |||

| (0.042) | ||||

| Integrated index of family policy | 0.051 ** | |||

| (0.019) | ||||

| Social democratic countries a | 4.062 ** | |||

| (1.314) | ||||

| Conservative and Eastern Europe countries a | 1.742* | |||

| (1.035) | ||||

| N (Countries) | 35,937 (19) | 35,937 (19) | 35,937 (19) | 35,937 (19) |

a Relative to the liberal countries.

**p < 0.01,

*p < 0.05, one tailed.

Household-level characteristics, however, affect the earning contribution of high-educated wives differently. As displayed in Table 24.3, unlike in the case of low-educated women, having preschool-aged children, surprisingly, increases the economic contribution of high-educated women. However, the negative effect of each additional child on wives’ contribution is significant, so in this case, the two variables cancel each other out. In households with women who are more educated than their spouses, women’s contribution is greater by nearly 6% (b = 5.65). Moreover, contrary to the effect among low-educated women, the economic contribution of high-educated women does not decrease with age, but it does decrease with an increasing age gap between the spouses (b = -0.185). Similar to the explanation given earlier, because age is a proxy for work experience, a wider age gap is indicative of greater work experience for the male partner. Not surprisingly, here too, the average contribution of wives increases with increasing work hours (b = 0.614).

Table 24.3 Predictions of the relative earning contribution of women in dual-earner households (standard errors in parentheses), results of multilevel regression

| Women with college degree | ||||

| Household-level variables | Model 1 | Model 2 | Model 3 | Model 4 |

| Intercept | 20.376** | 19.928** | 19.907** | 19.652** |

| (1.532) | (1.739) | (1.692) | (1.446) | |

| Presence of preschool children | 1.020** | 1.019** | 1.019** | 1.025** |

| (0.432) | (0.432) | (0.432) | (0.432) | |

| Number of children | -1.182** | -1.183** | -1.184** | -1.183** |

| (0.172) | (0.172) | (0.172) | (0.172) | |

| Woman more educated | 5.648** | 5.649** | 5.650** | 5.648** |

| (0.338) | (0.338) | (0.338) | (0.338) | |

| Age | -0.025 | -0.025 | -0.025 | -0.025 |

| (0.022) | (0.022) | (0.022) | (0.022) | |

| Spouses’ age difference (male–female) | -0.185** | -0.185** | -0.185** | -0.185** |

| (0.045) | (0.045) | (0.045) | (0.045) | |

| Woman’s weekly work hours | 0.614** | 0.614** | 0.614** | 0.613** |

| (0.016) | (0.016) | (0.016) | (0.016) | |

| Country-level variables | ||||

| % Children 0–3 in day care | -0.008 | |||

| (0.054) | ||||

| Weeks of parental leave | 0.017 | |||

| (0.055) | ||||

| Integrated index of family policy | 0.009 | |||

| (0.026) | ||||

| Social democratic countries a | -0.067 | |||

| (1.807) | ||||

| Conservative and Eastern Europe countries a | 2.298 | |||

| (1.551) | ||||

| N (Countries) | 7638 (19) | 7638 (19) | 7638 (19) | 7638 (19) |

a Relative to the liberal countries.

**p < 0.01,

Household-level variables were introduced into the equation as controls, to allow the estimation of the net effect of family policy on the economic contribution of women. Family policy was measured, at the country level, by four indicators. The results of the multilevel analyses, presented in Table 24.3, are in line with the main theoretical expectations. Among dual-earner families in which the wife has no academic education, all indicators of family policy have positive and significant effects on wives’ contribution. Specifically, long periods of paid parental leave and public facilities for young children increase this contribution. Also, in countries located at the top of the family policy index (such as the social democratic countries), the economic contribution of low-educated women is higher relative to countries at the bottom (such as the liberal countries).

To get a sense of the magnitude of these effects, consider the following: after controlling for the variations in household characteristics across countries, the predicted contribution of wives in Sweden, the country at the top of the family policy index, is 5 percentage points higher than that in Australia, the country at the bottom of the index. Likewise, in the country with the largest percentage of children in day care (Denmark), the predicted contribution is higher by nearly 5 percentage points than that in countries with the smallest percentage of children in day care (Ireland and the United Kingdom). In the case of maternity leave, the gap between the country with the most (Sweden) and least (the United States and Australia) generous family policy is 4 percentage points, in favor of the former. 4

The coefficients of the two dummy variables for welfare regimes, represented in Model 4, lead to similar conclusions. The reference category is the liberal welfare regime, the regime with the least developed family policy (see the location of liberal countries at the bottom of the family policy index, and their relatively low values for maternity leave and childcare in the Table 24A.1). Indeed, the predicted average economic contribution of low-educated wives in liberal regime countries is 4% lower than that in social democratic countries and nearly 2% lower than that in conservative regimes. Given that all the country-level effects are net of household-level characteristics – that is, they relate to households with the same characteristics – these effects are considerable.

In sharp contrast to the results for low-educated wives, none of the family policy indicators exert significant effects on the economic contribution of high-educated women. Table 24.3, which is limited to households in which the wife has an academic degree, reveals that neither childcare facilities nor maternity leave helps high-educated wives increase their relative earnings in the labor market. Also, in countries at the top of the family policy index, such as the social democratic ones, the relative economic standing of high-educated women is not different from their standing in other countries.

These findings are not surprising given the expected implications of family policy described at the outset. Educated women are equipped with more labor market skills, which is a significant determinant of their (relativity high) earning levels. However, previous studies suggest that developed family policy, and, in particular, long absenteeism from paid work, may restrict their access to attractive and prestigious positions, and therefore reduce their potential earnings (Ruhm, 1998; Albrecht et al., 1999; Mandel and Semyonov, 2005; Mandel, 2006, 2012). Contrary to these findings, however, in the present study, maternity leave did not decrease the relative economic contribution of high-educated wives, nor was their contribution lower in countries with developed family policy.

In sum, the results of the multilevel analyses stress the importance of distinguishing between groups of women in the study of family policy and gender equality. Within the comparative context of the welfare state and gender, this distinction is crucial for understanding the impact of welfare state policies on women’s economic dependence. From the perspective of family welfare, this approach emphasizes and reveals that family policies are particularly effective for low-income families. Because family policy helps low-educated women both join and gain better economic rewards in the labor market, it affects both their standing within the family and the economic standing of the family as a whole. Both these effects on low-income families are in line with the goals of state supportive policies and will be discussed further in the conclusion. As for high-educated women, the findings suggest that family policy has a negligible effect on their economic independence. These findings deviate from previous studies, which found family policies to have negative implications for women. In the following and concluding section, I refer to the trend of homogamy between married couples in order to help explain this discrepancy and discuss the broader implications of family policy.

Conclusions

Employment-supportive family policies have been implemented in most advanced societies in recent decades. Most of these policies aim to reduce the tension between paid and unpaid work, by providing accessible childcare arrangements and allowing women to take leave when their children are young. Indeed, the effectiveness of these policies in raising women’s participation in the labor market has been proven in many comparative cross-country studies (e.g., Gornick, Meyers, and Ross, 1997; Korpi, 2000; Van der Lippe and Van Dijk, 2002). The integration of women into the paid labor force is a prime condition for advancing gender equality. Access to market resources increases women’s power within the family and allows them to successfully negotiate task allocation (Shelton and John, 1996; Bittman et al., 2003; Breen and Cooke, 2005; Treas and de Ruijter, 2008). Moreover, in addition to reducing women’s economic dependence in dual-earner households and contributing to a more equal division of labor between spouses, women’s access to independent economic resources helps single women establish independent households and protects them from poverty (Misra, Budig, and Moller, 2007).

For all these reasons, the effect of employment-supportive policies on the economic dependence of women draws the attention of both sociologists of the family and scholars of the welfare state and gender equality (e.g., Bianchi, Casper, and Peltola, 1999; Stier and Mandel, 2009). Yet despite the considerable scholarly attention given to the effect of family policy on gender equality, two questions have been largely neglected. The first is the extent to which family policy contributes to the economic gains of women, beyond its effect on their participation rates (but see Stier and Mandel, 2009). The second, which has received even less attention, is whether family policy affects all women similarly.

This chapter sheds light on these two unheeded issues by disentangling the outcome of labor market attainment from labor market participation and by distinguishing between advantaged and disadvantaged women. According to the theoretical reasoning of this study, the effect of employment-supportive policies on the economic contribution of wives is conditioned by their education and skills. For low-educated women with low earning potential, family policy reduces economic dependence by assisting paid employment, which gives women access to a paycheck, and by promoting work continuity, which increases their labor market attainments. In contrast, state assistance is less likely to affect the participation rates, and thus the economic independence, of high-educated women. High-educated women have relatively high earning potential, which is the strongest incentive behind their labor market participation. Furthermore, to the extent that reconciliation policies foster employers’ reluctance to hire and promote women to lucrative positions, these policies are expected to decrease the relative economic gains of high-educated women (the candidates for these positions) and, as a result, their economic contribution to the household.

The findings of this study fully met expectations regarding low-educated women. First, cross-country variations in wives’ economic contribution correlate almost perfectly with cross-country variations in female labor market participation, especially among the low educated. Moreover, all four indicators of family policy were found to increase the economic contribution of low-educated wives, above and beyond the effect on labor market participation. That is, family policy helps low-educated women join the labor market, and also increases their economic rewards within it.

These results have significant implications not only for gender inequality, but also for class inequality. From the gender perspective, family policy increases women’s relative economic gains and, consequently, their relative standing within the family (Shelton and John, 1996; Bittman et al., 2003; Breen and Cooke, 2005; Treas and de Ruijter, 2008). From the class perspective, because low-educated women are mostly from low-income families, family policy – in increasing women’s economic rewards – benefits total family income in low-income families. In doing so, family policy reduces the poverty risk for poor families and improves their standard of living and well-being. Yet while the implications of family policy for the gender aspects of inequality have been widely echoed, the important implications for class inequality have not. Mandel and Shalev (2009) relate this blind spot to the analytical distinction between gender and class inequality; each tends to be linked to different welfare state policies: the former to family policy, the latter to social policy.

In contrast to the results among low-educated wives, none of the family policy indicators were found to affect the economic contribution of high-educated wives. These results are not in line with previous studies, which found that generous family policy restricts women’s access to powerful and desirable positions (Mandel and Semyonov, 2005, 2006; Mandel, 2011), promotes gender wage gaps among advantaged men and women (Mandel, 2012), increases sex segregation (Estevez-Abe, 2005), and increases the gender gaps in workplace authority (Wright, Baxter, and Birkelund, 1995).

The conflict between these findings may be rooted in the different ways that women’s labor market attainments are measured. As opposed to previous studies, the dependent variable in this study is the relative contribution of wives’ earnings. At first glance, cross-country variations in the gender pay ratio, and cross-country variations in women’s economic independence, may seem to be strongly related, as both variables compare the labor market rewards of men and women. However, while the former analysis considers the average earnings of all working men and women, the latter considers the earnings of husbands and wives in dual-earner families. The gap in earnings between all economically active men and women may be very different from the gap in earnings between husbands and their wives. This is because one of the most distinctive characteristics of married couples is homogamy, the tendency of men and women to marry partners who resemble them both culturally and socioeconomically. In recent decades, with the expansion of the education system, educational homogamy has become a significant feature of married couples in all advanced societies (Blossfeld and Timm, 2003).

Homogamy is expected to reduce the gap in spouses’ earnings because high-educated women, with relativity high earning potential, tend to marry high-educated men, and vice versa. Indeed, in the current data, the correlation between the education levels of spouses is very high, as is the correlation between their earnings. The Spearman correlation, computed for the pooled sample, for the education level of a wife and her husband is 0.71, while the Pearson correlation for their earnings is 0.86.

If work–family reconciliation policies restrict women’s access to high-paid positions, as previous findings have argued, then in less developed welfare states, the average economic gains of educated women are expected to be higher than in more developed ones, and the gender wage gaps, therefore, should be lower (other things being equal), as indeed found in Mandel (2012). Women’s increased access to lucrative positions, however, may raise the average earnings of all women, but it does not necessarily increase the relative household contribution of wives, if their husbands earn even more. For example, suppose that in the United States, 30% of high-educated women are in the top earning quintile, while in Sweden, only 20% are. The high representation of women in lucrative positions in the United States will decrease the gender wage gaps there, but will not necessarily increase women’s earning contribution relative to their (also highly paid) spouses. Moreover, the higher wage ceilings in the United States and other liberal countries could encourage even greater gaps between spouses, because men dominate the top positions. Therefore, cross-country variations in gender earning gaps are likely to be much more affected by the wage of highly paid women than cross-country variations in wives’ economic contribution. This is because in the case of the latter, the advantages of highly paid women may be masked by their spouse’s earnings.

Several conclusions arise from this study. First, family policy impacts wives’ relative household economic contribution, not only by facilitating women’s labor market participation, but also by affecting women’s earnings. In the case of low-educated families, family policy is doubly advantageous: for one, it significantly supports wives’ participation in the labor market, and, for another, it increases the relative earnings of working women. In doing so, family policy contributes to reducing gender inequality within families, as well as to reducing class inequality between high- and low-educated families. In high-educated families, family policy has a lower effect on participation and neither a positive nor negative effect on the relative earnings of working women. This is because mothers in high-educated families tend to work in high proportions, even in countries with relatively undeveloped family policy.

Second, the impressive rise in women’s education in recent years in all countries is expected to reduce the cross-country variations in female labor force participation. Based on the different effects of family policies on low- versus high-educated women, the effect of family policy on women’s participation rates, and, consequently, on wives’ relative earnings, is also expected to decrease over time. Finally, the cross-country distributions of wives’ relative economic contribution to the household are distinct from the distributions of gender earning gaps. Welfare state policies, therefore, do not affect these two aspects of gender inequality similarly. As suggested here, homogamy between spouses may explain these differences.

Acknowledgment

I would like to thank the Israel Science Foundation (ISF) for its generous financial support of this project (Grant no. 281/10).

Appendix 1

Table 24A.1 Family policy indicators, by country

| Index of family policya | % Children 0–3 in day careb | Weeks of paid maternity/parental leavesc | |

| Sweden | 100 | 33 | 52 |

| Denmark | 93 | 50 | 28 |

| Finland | 57 | 27 | 44 |

| Israel | 56 | 22 | 12 |

| Belgium | 50 | 30 | 15 |

| France | 50 | 23 | 16 |

| Hungary | 50 | 8 | 24 |

| Spain | 43 | 5 | 16 |

| Italy | 41 | 6 | 21 |

| Luxemburg | 30 | 2 | 16 |

| Czech Republic | 30 | 8 | 28 |

| The Netherlands | 27 | 8 | 16 |

| United Kingdom | 27 | 2 | 18 |

| Austria | 23 | 3 | 16 |

| Germany | 20 | 5 | 14 |

| Ireland | 18 | 2 | 18 |

| Canada | 10 | 5 | 25 |

| United States | 4 | 5 | 0 |

| Australia | 2 | 5 | 0 |

Country-level data are from the following sources:

aMandel and Semyonov (2006).

bGauthier (1999) and Meyers and Gornick (2000).

cClearinghouse (2004) and Kamerman (2000).

Appendix 2: Method of analysis

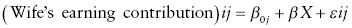

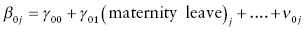

The two-level model is represented by a set of equations. The first is a within-country equation, which models wives’ earning contribution as a function of household characteristics, as illustrated in the following:

The dependent variable is wife’s earning contribution in household i and country j; β0j is the intercept, denoting the average contribution level; X is the vector of all household characteristics (i.e., relative education, work hours, age, children); and β is the vector of their coefficients. The error term εij is assumed to be normally distributed with a mean of zero. The household-level variables – which constrained to be the same across countries – were introduced to control for cross-country variation in the composition of these covariates. Thus, the effect of policies on the relative standing of women within their households is estimated net of the possible effect of household-level characteristics.

In Equation (24A.2), the intercept β 0j , which is derived from Equation (24A.1), constitutes the dependent variables:

The intercept represents the net variation in the average level of wife’s earning contribution across countries and is modeled as a function of family policy. In each regression, a distinctive measure of family policy is employed (e.g., childcare facilities, maternity leave, integrated index of family policy, and welfare state regime). The regressions were run separately for the sample of households in which the wife has an academic degree and the sample in which the wife does not. For example, a positive sign for γ 01 in the low-educated sample group would support the claim that in countries with generous maternity leave policy, the economic contribution of wives is higher.

References

- Aigner D.J. and Cain, G.G. (1977) Statistical theories of discrimination in labor markets. Industrial and Labor Relations Review, 30, 175–187.

- Albrecht, J.W., Edin, P.A., Sundstrom, M. and Vroman, S.B. (1999) Career interruptions and subsequent earnings: a reexamination using Swedish data. Journal of Human Resources, 34, 294–311.

- Bianchi, S.M., Casper, L.M. and Peltola, P.K. (1999) A cross-national look at married women’s earnings dependency. Gender Issues, 17, 3–33.

- Bianchi, S.M., Milkie, M.A., Sayer, L.C. and Robinson, J.P. (2000) Is anyone doing the housework? Trends in the gender division of household labor. Social Forces, 79, 191–228.

- Bittman, M., England, P., Folbre, N. et al. (2003) When does gender trump money? Bargaining and time in household work. American Journal of Sociology, 109, 186–214.

- Blossfeld, H.-P. and Hakim, C. (1997) Between Equalization and Marginalization: Women Working Part-Time in Europe and the United States of America, Oxford University Press, New York.

- Blossfeld, H.-P. and Timm, A. (2003) Who Marries Whom? Educational Systems as Marriage Markets in Modern Societies , Kluwer Academic, Dordrecht/Boston.

- Bolzendahl, C.I. and Myers, D.J. (2004) Feminist attitudes and support for gender equality: opinion change in women and men, 1974–1998. Social Forces, 83, 759–790.

- Breen, R. and Cooke, L.P. (2005) The persistence of the gendered division of domestic labour. European Sociological Review, 21, 43–57.

- Brines, J. (1994) Economic dependency, gender, and the division-of-labor at home. American Journal of Sociology, 100, 652–688.

- Bryk, A.S. and Raudenbush, S.W. (1992) Hierarchical Linear Models: Applications and Data Analysis Methods, Sage, Newbury Park.

- Clearinghouse (2004) Clearinghouse on International Development in Child, Youth, and Family Policies. 2004. Table 1.11 Maternity and Parental Leaves, 1999–2002. www.childpolicyintl.org (accessed October 30, 2013).

- Edin, P.A. and Gustavsson, M. (2008) Time out of work and skill depreciation. Industrial & Labor Relations Review, 61, 163–180.

- Esping-Andersen, G. (1990) The Three Worlds of Welfare Capitalism, Princeton University Press, Princeton.

- Esping-Andersen, G. (1999) Social Foundations of Postindustrial Economies, Oxford University Press, New York.

- Estevez-Abe, M. (2005) Gender bias in skills and social policies: the varieties of capitalism perspective on sex segregation. Social Politics, 12, 180–215.

- Gauthier, A.H. (1999) Historical trends in state support for families in Europe (post-1945). Children and Youth Services Review, 21, 937–965.

- Gornick, J.C. and Meyers, M. (2003) Families That Work: Policies for Reconciling Parenthood and Employment, Russell Sage Foundation, New York.

- Gornick, J.C., Meyers, M.K. and Ross, K.E. (1997) Supporting the employment of mothers: policy variation across fourteen welfare states. Journal of European Social Policy, 7, 45–70.

- Hakim, C. (2002) Lifestyle preferences as determinants of women’s differentiated labor market careers. Work and Occupations, 29, 428–459.

- Hirschman, A.O. (1970) Exit, Voice, and Loyalty; Responses to Decline in Firms, Organizations, and States , Harvard University Press, Cambridge.

- Hobson, B. (1990) No exit, no voice: women’s economic dependency and the welfare state. Acta Sociologica, 33, 235–250.

- Kamerman, S.B. (2000) Parental Leave Policies: An Essential Ingredient in Early Childhood Education and Care Policies. A Publication of the Society for Research in Child Development, Ann Arbor.

- Kolberg, J.E. (ed) (1991) The Welfare State as Employer, M.E. Sharpe, Inc, London.

- Korpi, W. (2000) Faces of inequality: gender, class, and patterns of inequalities in different types of welfare states. Social Politics, 7, 127–191.

- Luxembourg Income Study Database (LIS) (1991–1999), www.lisdatacenter.org (multiple countries – see Table 1 for surveys’ year), LIS, Luxembourg.

- Mandel, H. (2009) Configurations of gender inequality: the consequences of ideology and public policy. British Journal of Sociology, 60, 693–719.

- Mandel, H. (2011) Rethinking the paradox: tradeoffs in work-family policy and patterns of gender inequality. Community, Work & Family, 14, 159–176.

- Mandel, H. (2012) Winners and losers: the consequences of welfare state policies for gender wage inequality. European Sociological Review, 28, 241–262.

- Mandel, H. and Semyonov, M. (2005) Family policies, wage structures, and gender gaps: sources of earnings inequality in 20 countries. American Sociological Review, 70, 949–967.

- Mandel, H. and Semyonov, M. (2006) A welfare state paradox: state interventions and women’s employment opportunities in 22 countries. American Journal of Sociology, 111, 1910–1949.

- Mandel, H. and Shalev, M. (2009) How welfare states shape the gender pay gap: a theoretical and comparative analysis. Social Forces, 87, 1873–1912.

- McCall, L. (2007) Increasing class disparities among women and the politics of gender equity, in The Sex of Class: Women Transforming American Labor (ed D.S. Cobble), ILR Press, Ithaca, pp. 15–34.

- Meyers, M.K. and Gornick, J.C. (2000) Early childhood education and care (ECEC): cross national variation in service organization and financing. Paper presented at A Consultative Meeting on International Developments in Early Childhood Education and Care: An Activity of the Columbia Institute for Child and Family Policy, New York.

- Misra, J., Budig, M.J. and Moller, S. (2007) Reconciliation policies and the effects of motherhood on employment, earnings and poverty. Journal of Comparative Policy Analysis, 9, 135.

- Morgan, K.J. (2005) The ‘production’ of child care: how labor markets shape social policy and vice versa. Social Politics, 12, 243–263.

- Morgan, K.J. and Zippel, K. (2003) Paid to care: the origins and effects of care leave policies in Western Europe. Social Politics, 10, 49–85.

- O’Connor, J.S. (1996) From women in the welfare state to gendering welfare state regimes. Current Sociology, 44, 1–124.

- O’Connor, J.S., Orloff, A.S. and Shaver, S. (1999) States, Markets, Families: Gender, Liberalism, and Social Policy in Australia, Canada, Great Britain, and the United States , Cambridge University Press, Cambridge/New York.

- Oppenheimer, V.K. (1997) Women’s employment and the gain to marriage: the specialization and trading model. Annual Review of Sociology, 23, 431–453.

- Orloff, A.S. (1993) Gender and the social rights of citizenship – the comparative analysis of gender relations and welfare states. American Sociological Review, 58, 303–328.

- Persson, I. and Jonung, C. (1998) Women’s Work and Wages, Routledge, London.

- Ruhm, C.J. (1998) The economic consequences of parental leave mandates: lessons from Europe. The Quarterly Journal of Labor Economics, 113, 285–317.

- Shalev, M. (2008) Class divisions among women. Politics & Society, 36, 421–444.

- Shelton, B.A. and John, D. (1996) The division of household labor. Annual Review of Sociology, 22, 299–322.

- Sigle-Rushton, W. and Waldfogel, J. (2007) Motherhood and women’s earnings in Anglo-American, Continental European, and Nordic countries. Feminist Economics, 13, 55–91.

- Sorensen, A. and McLanahan, S. (1987) Married women’s economic dependency, 1940–1980. American Journal of Sociology, 93, 659–687.

- Stier, H. and Mandel, H. (2009) Inequality in the family: the institutional aspects of women’s earning contribution. Social Science Research, 38, 594–608.

- Treas, J. and de Ruijter, E. (2008) Earnings and expenditures on household services in married and cohabiting unions. Journal of Marriage and Family, 70, 796–805.

- Treas, J. and Tai, T.O. (2012) How couples manage the household: work and power in cross-national perspective. Journal of Family Issues, 33, 1088–1116.

- Van Berkel, M. and De Graaf, N.D. (1998) Married women’s economic dependency in the Netherlands, 1979–1991. British Journal of Sociology, 49, 97–117.

- Van der Lippe, T. and Van Dijk, L. (2002) Comparative research on women’s employment. Annual Review of Sociology, 28, 221–241.

- Waldfogel, J. (1998) The family gap for young women in the United States and Britain: can maternity leave make a difference? Journal of Labor Economics, 16, 505–545.

- Williams, J.C. and Boushey, H. (2010) The three faces of work-family conflict: the poor, the professionals, and the missing middle. Retrieved from the Center for American Progress, website: http://www.americanprogress.org/issues/2010/01/pdf/threefaces.pdf (accessed October 30, 2013).

- Winkler, A.E., McBride, T.D. and Andrews, C. (2005) Wives who outearn their husbands: a transitory or persistent phenomenon for couples? Demography, 42, 523–535.

- Wright, E.-O., Baxter, J. and Birkelund, G.-E. (1995) The gender gap in workplace authority: a cross-national study. American Sociological Review, 60, 407–435.