Introduction

May 21, 2015: Shopify executives ringing the NYSE Bell on their IPO Day.

First row, left to right: Craig Miller, Joe Frasca, Harley Finkelstein, Tobi Lütke, Russell Jones, Cody Fauser and ——. Back row, left to right: Jean Michel Lemieux, ——, ——, Toby Shannan, Daniel Weinand and Brittany Forsyth.

© 2015 NYSE Group, Inc.

After launching in June of 2006 a software platform that enabled entrepreneurs to easily set up and run online stores, Shopify Inc. turned a profit for the first time during the financial crisis and recession of 2008 and 2009. This was rather remarkable: the bankruptcies of U.S. financial institutions were pushing the global financial system to the brink of collapse and most companies were spiralling downward during a sharp recession — yet Shopify was thriving.

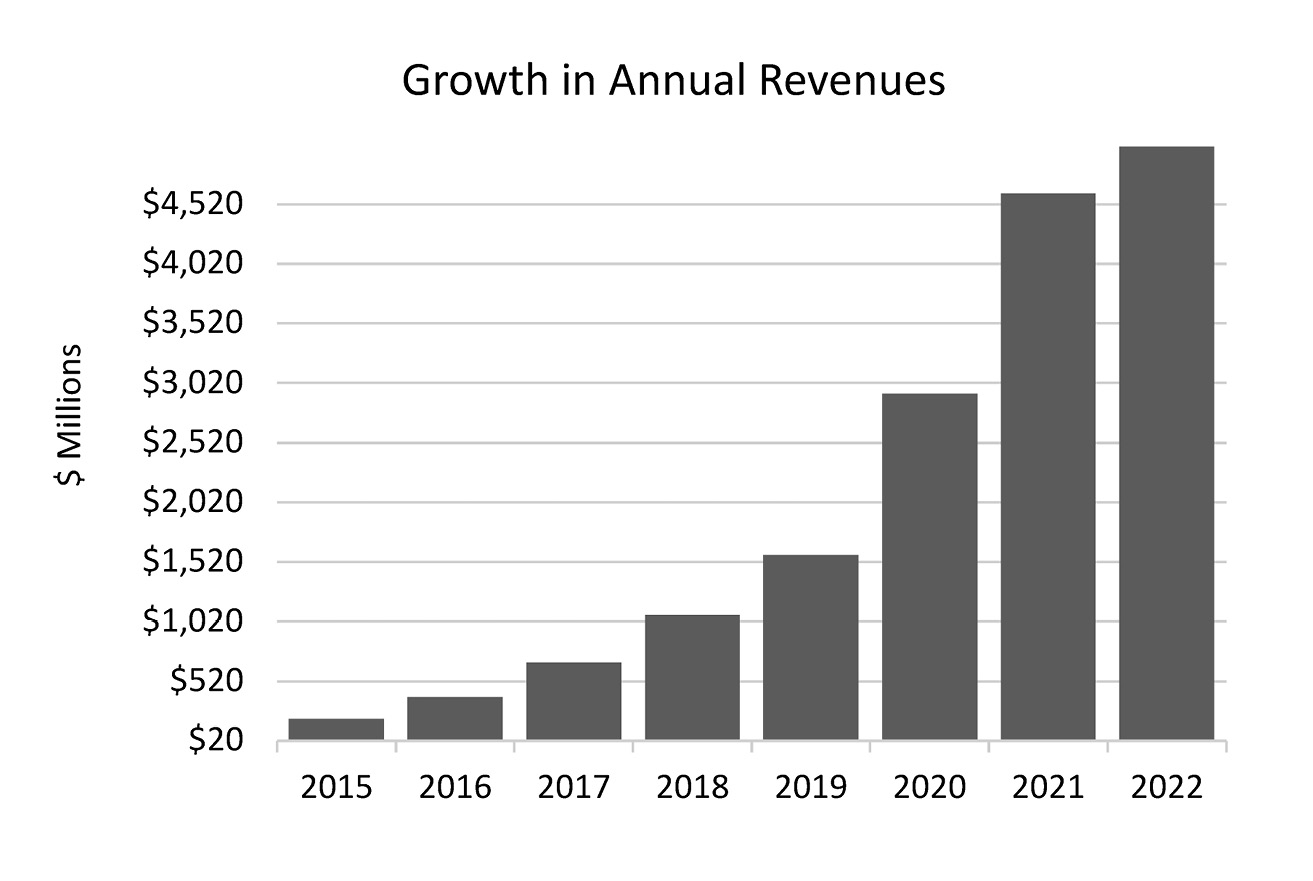

Shopify’s spurt of growth, along with financing from venture capitalists and some smart moves by Chief Executive Officer (CEO) Tobias Lütke, led to a period of rocket-like growth up to the Initial Public Offering (IPO) in 2015. The upsweep after the IPO was also breathtaking: Shopify’s annual revenues shot upwards from 2015 at an annual rate of 60% to reach $5.6 billion in 2022, beating the consensus forecasts of brokerage analysts for 24 consecutive quarters.1 (Shopify keeps its accounts in U.S. dollars; all dollar figures in this book are in U.S. currency unless otherwise stated.)

Shopify, then headquartered in Canada’s capital of Ottawa, increasingly was viewed as a technology powerhouse, well on its way to joining the ranks of past Canadian tech champions, notably Nortel Networks and BlackBerry. Among other honours, Lütke was named Canadian CEO of the Year by the Globe and Mail in 2014, voted Entrepreneur of the Year by the Canadian Venture Capital Association in 2016 and presented with the Meritorious Service Cross by the Governor General of Canada in 2018. Shopify was named Canada’s Smartest Company by Profit magazine in 2012, a finalist for Startup of the Year at the Canadian Startup Awards of 2012, Employer of the Year at the Canadian Startup Awards of 2014 and one of Canada’s Most Innovative Companies by Canadian Business in 2015.

Data source: Shopify Annual Reports

Shopify’s swift expansion stirred excitement among institutional investors, mutual fund managers, stockbrokers and individual investors. They bid up the price of its stock listed on both Canadian and U.S. stock markets — so much so that by early 2020, Shopify was the most valuable company on the Toronto Stock Exchange — surpassing leader Royal Bank of Canada, a financial institution with a workforce of 85,000 and 150-year history.

As the COVID-19 virus raged throughout 2020 and 2021, the world hunkered down at home. Again, when calamity struck, Shopify flourished. In-person shopping shifted to online shopping and Shopify’s growth went ballistic. Investors kept scooping up shares: from the IPO in 2015 to the high in November 2021, the stock price increased by more than 5,000%.

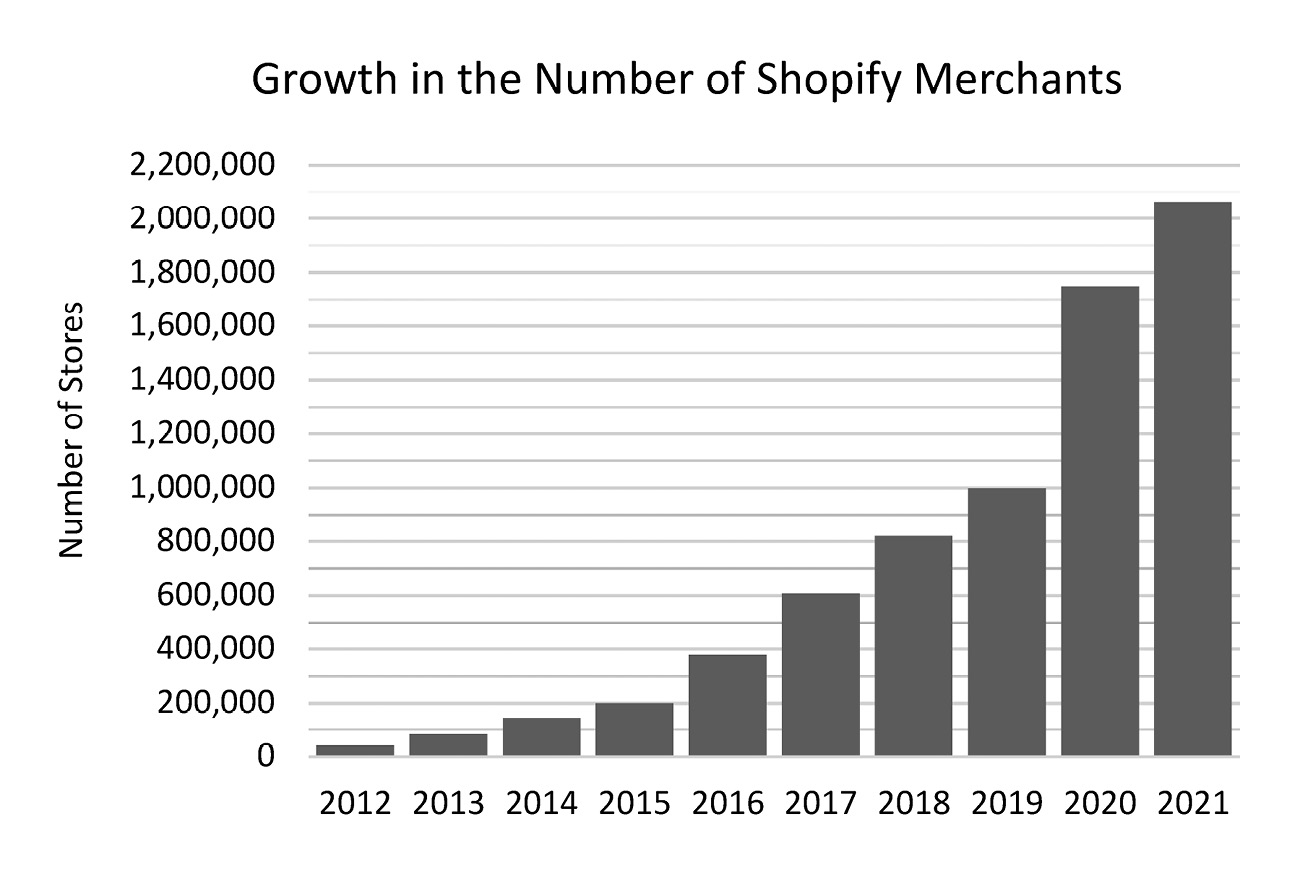

By 2021, there were over two million stores on Shopify’s platform, according to Shopify’s 2021 Annual Report. Over half of the stores were launched in the United States. A high percentage of the launches were also in the United Kingdom (7.6%), Canada (5.7%) and Australia (5.1%).

Data source: Shopify Annual Reports

In the beginning, mainly small and medium companies subscribed to Shopify, but as the years went by, larger companies increasingly signed up. The small, medium and large companies on the platform sold their products in more than 175 countries around the world, distributed as follows: North America (55%), Europe, Middle East and Africa (25%), Asia Pacific, Australia and China (15%) and Latin America (5%). According to a Deloitte study, Shopify merchants supported five million jobs in 2021, which represented the largest workforce in the world.2

Despite dramatic growth in its revenues, Shopify earned a profit in only a few quarters after going public in 2015. Investors did not mind. They were on board with the view that when it came to commercializing new technologies, companies needed to emphasize growth over earnings. There were so many expansion opportunities in which Shopify could invest; if they were not quickly seized, competitors would grab them and gain market share for themselves. As one Shopify executive explained: “We’re trying to leave as little oxygen in the atmosphere for anyone else and trying to capture as much growth for ourselves as possible.”3

When COVID-19 eased in 2022, consumers returned to in-person shopping and e-commerce fell back to its long-term trend, moderating Shopify’s torrid growth pace during the pandemic. Making things more challenging, pent-up demand and supply-chain bottlenecks caused inflation to spike and central banks to sharply hike interest rates.

The stratospheric valuations of technology companies imploded; Shopify’s stock was hit particularly hard, tumbling by 75% from its high in late 2021 to the lows of the summer of 2022. Coverage of Shopify in the media became less flattering. Pundits raised the spectre of another Canadian tech star succumbing to the BlackBerry and Nortel Networks curse. One graphic showed Lütke submerged up to his glasses in a sea of green goo, apparently drowning.4

Canada seemed to be engaging once again in what author Robertson Davies called its “tall poppy syndrome,” that is, the inclination to cut down whatever rises above the crowd. In response to the media coverage, Lütke said on X (formerly Twitter): “We have to get rid of our tall poppy syndrome if we hope to ever become a country where the best and brightest come to build.”5

People tend to conflate the performance of a company with its stock price but the ups and downs on the stock market are also affected by the mood of investors. Despite the tumble in its shares, Shopify itself continued to perform reasonably well, considering the macro environment. Monthly recurring revenue from subscriptions rose by 7.3% during 2022 to $109.5 million; the value of merchant sales rose by 12.5% to $197.2 billion.6

If Lütke is successful in his goal to create a 100-year-old company, more long-term growth lies ahead for Shopify. What fascinates him is the long game of building an enterprise that is an improvement on the versions that exist today.

There does seem to be a tailwind in Lütke’s favour, at least for much of the current decade. According to eMarketer, world e-commerce is projected to continue growing by more than 10% annually to reach $8 trillion in 2026.7 The growth potential in North America particularly appears significant: in 2022, e-commerce was little more than 15% of total retail sales in the United States8 whereas e-commerce’s share of total retail sales in China was more than double the U.S. percentage.9

In the fall of 2024, Shopify will have been in existence for two decades since it was first incorporated. Whatever the future holds, there is a story to tell about Shopify’s past stellar growth. As such, this is a corporate history about the people involved and the milestones along the way. It is also an account of the factors behind the growth, and what lessons and insights may exist for business managers, employees, programmers, policymakers and investors. Entrepreneurs may also find lessons, insights and inspiration because the story of Shopify is about starting and growing businesses.

We may ask, how did Lütke, who had started out as a junior programmer, take the reins at Shopify in his mid-20s and lead the company to such meteoric growth? Was it skill or luck, or a mix of both? Does his example dispel the notion that MBA graduates are needed to scale startups? Is there a formula, or at least some nifty moves, for replicating such an outcome?

Not to be overlooked is the executive team that assisted Lütke. They and Lütke not only accomplished something amazing but made billionaires and multimillionaires of themselves, thanks to their holdings of Shopify shares and options received as part of employee remuneration. How did they find a seat on the rocket ship and then steer its flight?

There is also the question of how Shopify might fare going forward. We can’t predict with certainty from Shopify’s first two decades if it will see the next century as Lütke envisions. However, there could be some heuristics that give us hints of what may happen over the remainder of the 2020s, and perhaps beyond.