CHAPTER 7

Loan Pricing

I firmly believe that giving people loans is to offer them an opportunity to get out of poverty by leveraging their own efforts.

Queen Máxima of the Netherlands1

The absolute costs for a loan of $100 are virtually the same as for a loan of $1000. However, with higher volumes of credit, these costs are much less significant than with microloans.

MFIs are economically sustainable and socially involved, provided they can cover their costs in the long run and fulfill their social mission at the same time. As the fixed costs (operating and capital costs) constitute more than 80 per cent of the overall costs of a microloan, loan pricing in the developmental regions that are accessed by MFIs has become rather inflexible. The higher operating costs compared to traditional loans in industrialized countries are compensated by means of income from interest.

Borrowers are willing to accept these less favorable conditions but in turn gain long‐term access to capital. Their impressive profit margins from their business undertakings allow them to swiftly redeem their debts.

Increasing digitalization, and the use of new technology in developing countries, results in a bundling of efficiency in both lenders and borrowers, lowering the pool of costs.

7.1 INTEREST RATE COMPONENTS

The comparatively high interest rates are one of the most controversial and debated factors in the microfinance sector. Less favorable credit conditions in comparison with industrialized countries are often wrongly denounced as excessive or price gouging. They are justified even though they often figure in the double‐digit range. The following will explain why.

Financial services in poor countries are costly, because revenue with MFIs is mostly only generated from their loan business proceeds, and because smaller credit volumes lead to higher costs per individual transaction. For this reason, banks and large providers of financial services do not issue microloans. A loan of $100 and a loan of $1000 require the same number of employees and amount of resources. The procedures involved for a single loan may easily amount to $25. In absolute figures this appears perfectly logical; relatively, however, in the case of a loan of $100, this may constitute a staggering 25 per cent of the credit volume. Consequently, the relative costs per transaction are considerably lower in larger credit volumes, which means that MFIs are forced to charge micro entrepreneurs rather high interest rates in order to cover their operating costs.

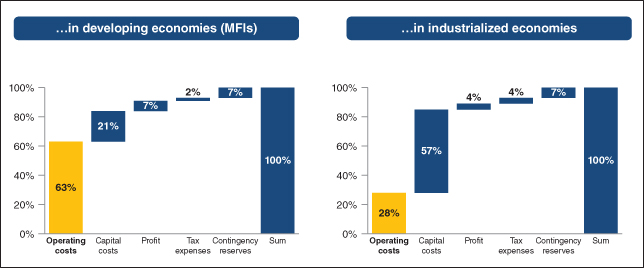

Figure 7.1 illustrates the financial determinants of the interest rates in microfinance and compares them to the relevant costs in industrialized countries such as Germany or Switzerland. The graph displays the five financial determinants – operating costs, capital costs, profit, tax expenditures and contingency reserves – as well as their relevance when it comes to determining interest rates. Capital costs are another important cost factor, accounting for almost a quarter. Most MFIs are unable to fund themselves and therefore depend on banks or microfinance funds. The profit, the contingency reserves for loan defaults and the tax expenditures represent another 16 per cent of the overall credit costs.

FIGURE 7.1 Determinants of Interest Rates

Adapted from: Bundesbank (2014) and Gonzalez (2011)

In industrialized countries loans are less expensive, as the operating costs are lower. The capital costs (in this case, real interest rates), which also include a liquidity premium, constitute over half of the total volume of credit. The operating costs add up to about a quarter, and the contingency reserves, profit and tax expenditures amount to around 16 per cent.

This clearly shows that the share of operating costs in the interest rates of MFI loans is more than double those of loans in industrialized countries. The share of the contingency reserves for loan defaults is virtually the same in both MFIs and commercial banks. Microloans have a rather low default probability due to social collateral, and it is comparable to the loan default probabilities in industrialized countries. As the profits generated from lending are often the only source of income for MFIs, they are vital for any regional and national growth. For this reason, the proportion of the profit from microloans is more substantial than in a traditional loan. Commercial banks in industrialized countries are more diversified, as they can fall back onto other sources of income along with the credit business.

The following will explain why high costs are inevitable in an MFI's lending operations, and also focus on the parameters that will allow for cost efficiency which will eventually lead to lower interest rates for borrowers.2

Operating Costs

Microfinance is a business model that is rather labor‐intensive. Moreover, the transactional costs for the client are higher than with other financial services providers, due to the smaller volumes of credit and the local credit rules and regulations.

Lending methodologies, the strategy of client acquisition and the collection of the usually weekly interest payments all influence the operating costs, which amount to nearly 63 per cent of the overall credit costs. The largest share of expenditures is consumed by staff and administration.

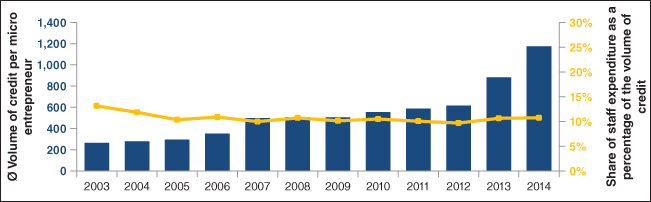

Whereas administration expenses such as stationery, rent and electricity are fixed and can therefore not be lowered substantially, the employment of staff in administration and with the micro entrepreneur locally may be structured more efficiently. All MFIs worldwide focus on effective and efficient deployment of personnel in an effort to continue to lower the credit costs for their clients. Efficiency does, however, have its limits, and mostly because of the all‐important personal interaction between loan officers and their clients. Figure 7.2 illustrates the development of the average volume of credit and the share of employee expenditures. Between 2003 and 2014, the volume of credit per client increased steadily. The maturity of the market and progressive lending – which allows clients to take out more substantial loans based on successful repayment of any previous loans – are to be credited for this development. Higher volumes of credit lower personnel expenditures. Despite the fact that the same number of visits to a borrower's home will be required, they are less expensive in comparison.

FIGURE 7.2 Volume of Credit Compared to Staff Expenditure

Data Source: MIX (2016)

Capital Costs

Apart from their own financial means, MFIs often borrow capital from commercial banks or funds that are specialized in microfinance. The costs of these means either correspond with the market interest rates of the banks or the revenue expected with investors. The capital costs are therefore fixed and cannot be lowered within today's financing structures.

Contingency Reserves

If micro entrepreneurs fail to repay their loans, the MFI will have to compensate for the defaulted interest rates and loan. This is referred to as a bad debt and is calculated on the basis of the defaulted obligations. In order to avoid such losses and be profitable at the same time, an MFI will have contingency reserves. This increase in interest rates must, however, be moderate enough, as higher interest rates usually result in a surge of micro entrepreneurs slipping into default or payment difficulties. This in turn will prompt an MFI to repeatedly increase their interest rates to be able to cover the defaults – a vicious circle and ultimately a downward spiral. As a consequence, contingency reserves are almost fixed and can hardly be lowered because of already low default rates.

Profit

An MFI will retain roughly 7 per cent of the interest rate as their profit, which is also the most substantial source of income of an MFI and needed to realize growth plans.

Tax Expenditures

Tax expenditures amount to roughly 2 per cent of the total interest rate and therefore are not considered decisive. The tax rate is determined by the respective national fiscal law.

Boosting Efficiency

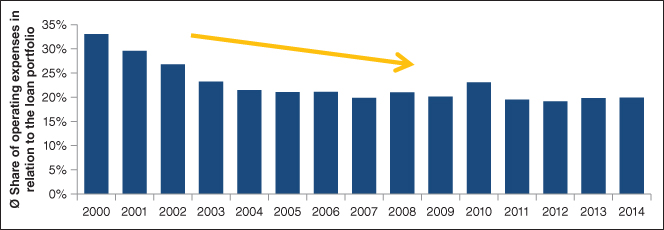

More efficient processes lead to lower operating costs. Figure 7.3 shows the operating costs as a share in percentage of the total loan portfolio of an MFI. It reveals an increase in efficiency in the microfinance sector worldwide.3

FIGURE 7.3 Operating Costs: Average Share of Operating Costs in Relation to the Total Loan Portfolio

Data Source: MIX (2016)

The components of interest rates largely are based on fixed parameters. Staff and digitalization are potentially the factors where a general decrease in interest rates seems feasible.4 Employees on the whole are increasingly better trained to serve a larger client base. As a result, the turnover can be augmented while operating costs are reduced at the same time. Efficient planning of the local weekly loan installment collection trips reduces traveling expenses and with it the operating costs.

Increasing digitalization and the use of new technologies counteract unwanted expenditures. Mobile communication has greatly improved and made mobile phones the quickest and most widely used technology of all time.5

Mobile phones can be integrated into the loan payment system.6 M‐Pesa is a branchless banking service that allows its customers to deposit and withdraw money from a network of agents. Kenya has been using this easy and reliable payment system since 2007. Borrowers may use their mobile devices to repay interest rates or loans. For borrowers and lenders alike this means more efficient business transactions and thus lower operating costs for MFIs and in turn a drop in costs for micro entrepreneurs. Loan officers' regular weekly visits to their clients' premises remain a must. Their presence locally allows them to monitor the implementation and success of business ideas and spot early warning signs in connection with repayment difficulties, which they try to tackle with the micro entrepreneurs.

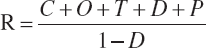

7.2 SETTING SUSTAINABLE INTEREST RATES

MFIs establish their interest rates on the basis of their high lending costs. The following explains in a simplified manner how the effective interest rate can be calculated with the above mentioned determinants. The effective interest rate indicates how much profit an MFI must gain from a microloan in order to cover its costs and strengthen its business sustainably. The formula has been adapted from Rosenberg et al. and Ledgerwood and simplified.7 The general assumption is that an MFI does not have an income generated from financial assets outside its loan portfolio. The effective interest rate (R) is determined by means of the following terms: the capital costs (C), the operating costs (O), the tax expenditures (T), the defaulted loans (D) and the profit (P)

In the case of default, an MFI will lose both the loan and its interest payments. For this reason, the costs that an MFI must cover are divided by the share of repaid loans (1 – D), which consequently constitute the contingency reserves.

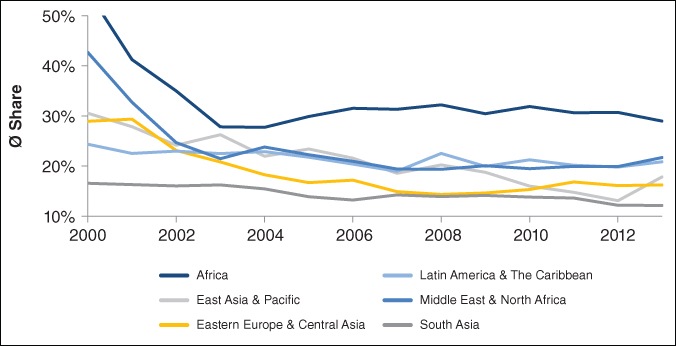

7.3 REGIONAL DIFFERENCES

There are regional differences when it comes to operating costs (see Figure 7.5). Whereas the average volume of credit influences the costs, sector‐specific determinants as well as regional influences also play a role. Nevertheless, the following general conclusions can be drawn.

FIGURE 7.5 Operating Costs as a Percentage of the Loan Portfolio According to Region

Data Source: MIX (2016)

Regions with a higher developed financial sector have a lower share in operating costs in the percentage of the loan portfolio than less developed regions such as Africa (median).

Operating costs of MFIs in South and South East Asia are generally lower than in other regions thanks to group lending, which usually results in a larger volume of credit.

The relatively low operating costs in South America may, however, not be explained through the prevalence of group lending, but are more likely to be the result of a comparatively mature financial system. In addition to this, the economic development in South America is more advanced than in other regions. MFIs can profit from an established infrastructure and boost their efficiency. Sub‐Saharan Africa lacks both a developed economy and a developed financial system, which accounts for still comparatively high operating costs in this region.

7.4 LOAN RECIPIENTS' WILLINGNESS TO REPAY

Micro entrepreneurs are able to repay their loans largely because their cash flows are impressive, despite – or perhaps rather because of – their comparatively small businesses and therefore lower fixed operating costs, such as machinery or staff.

Selling Pineapples

The sale and resale of pineapples can generate an impressive profit margin per piece. In this example, the borrower can repay her monthly installments by selling five pineapples.

| Selling price per pineapple | COP 2000* |

| Prime cost per pineapple | − COP 1600 |

| = Profit margin per pineapple | = COP 400 (25%) |

At an annual interest rate of 25 per cent, the principal of COP 100,000 would entail monthly interest liabilities of COP 2000. Selling five pineapples allows the borrower to repay her monthly installments.

* Colombian Pesos

Source: BlueOrchard

If a micro entrepreneur's retail business, agricultural harvest or the production of goods can generate a revenue of $5 a day – costs incurred of $2 – the result is a staggering gross profit margin of 60 per cent.

7.5 PRELIMINARY CONCLUSIONS

The absolute costs of a loan rarely depend on its amount. However, for a microloan of only $200 those are more significant than for larger volumes of credit.

The determination of sustainable interest rates allows MFIs to cover their lending costs, encourage growth based on their profits and acquire new clients. The interest rates for micro entrepreneurs are calculated on the basis of the MFI's operating and capital costs, profit, tax expenditures and contingency reserves for possible cases of default. In a more mature financial sector, efforts can be bundled and made more efficient with the help of larger volumes of credit (e.g. due to its progressive lending structure), as well as new technologies such as digitalization and mobile money transfer systems. All these measures reduce the operating costs of MFIs, which again will create more attractive loan terms for the client.

With their impressive cash flows, micro entrepreneurs in most cases manage to redeem their MFI loans in the course of a few days.

Generating an income to repay their loans is therefore not a micro entrepreneur's main challenge, but having access to capital is. Traditional banks do not issue loans in these regions as they are deemed to be inefficient and lack profitability. Instead local money lenders (e.g. loan sharks) provide loans that are not amortizable.

Microfinance focuses on smaller volumes of credit and has successfully filled this gap by developing a system to effectively support the predominantly small enterprises.

VEGETABLE STALL – BOGOTÀ, COLOMBIA

Nylsa Avendano, 39, runs a market stall that offers anything that grows in the Valle del Cauca: pineapples, bananas, tomatoes, beans, onions and more. Her working day begins at three o'clock in the morning. She used her first loan of $400 with WWB Colombia to set up her stall and steadily increase her range of products. She currently has a loan of $750. The steady increase in turnover and revenue has brought a tremendous change to her life, most notably that she can now finance a decent education for her children.

Source: BlueOrchard