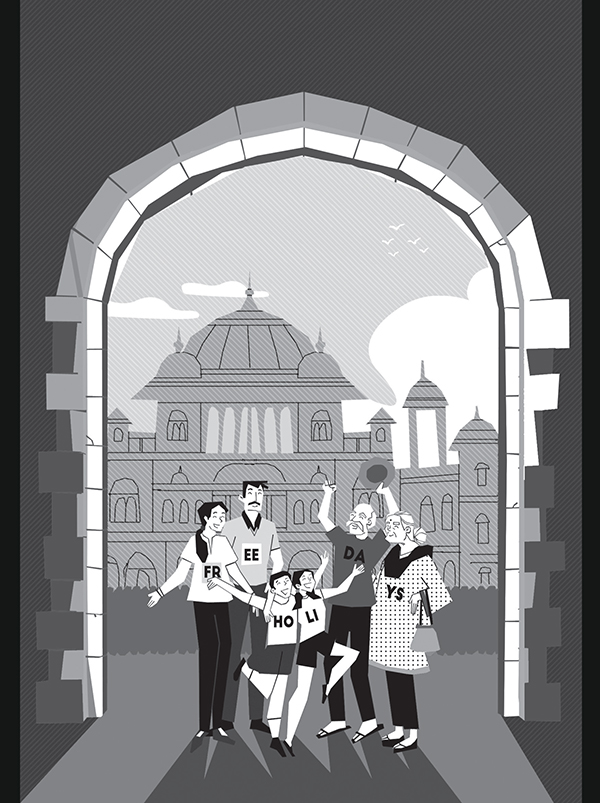

A FREE HOLIDAY!

Aman

When Anya and I were nine, my mom’s best friend, Sulekha Aunty, decided to organize a ‘girls’ trip’ to Goa. She was turning forty and wanted to celebrate with her friends. The first we heard about it was when Sulekha Aunty turned up at the house one Saturday afternoon to convince Mom to go with her.

‘It’ll be great fun,’ she said in her most persuasive voice. Both Anya and I like Sulekha Aunty, but we were united in our disapproval of this plan, and decided to be as disruptive as possible.

‘Mom’s been to Goa already,’ Anya said. ‘Dozens of times, in fact.’

‘Well, this is a bit different,’ Sulekha Aunty replied. ‘When she goes with you guys, she has to worry about your meals and taking you swimming and she has to . . . I don’t know . . . build sand castles with you. With us, she can relax and just enjoy herself.’

‘She enjoys herself with us,’ I said firmly. Sulekha Aunty had only one daughter, and she was a rather whiny kid—I could imagine that holidays with her weren’t much fun.

‘Aman,’ Dad said gently, ‘stop being difficult. Your mom works hard, and she doesn’t get much time with her friends. I know you’ll miss her, but we’ll find some fun stuff to do while she’s away. How does that sound?’

I was not happy. But I didn’t want to be a pain. ‘You should go if you want to,’ I muttered half-heartedly once the door was shut behind Sulekha Aunty. ‘We’ll miss you, but we’ll be fine.’

‘But I don’t want to go,’ Mom said, surprising us all. ‘They’ll spend all their time shopping or in the spa, and that’s not my idea of fun at all.’

‘Really?’ Anya asked. We knew that Mom wouldn’t say something she didn’t mean, but we’d thought that she might say no to the trip because she’d be worried about leaving us behind.

‘Really,’ she said earnestly.

‘What do you want to do then? Watch superhero movies with us?’ Dad asked, laughing a little. ‘I didn’t agree with everything Sulekha said, but I do think you need a break.’

‘I can do a girls’ trip with Anya. And with you, Aman. A family trip,’ she said.

‘And what am I? A neighbour?’ Dad huffed.

‘Oh, you can come too. We’ll need someone to help with the luggage!’

Dad pulled a face, but he obviously knew Mom was joking. Anya was still cross though. ‘It’ll still be like any other holiday,’ she said grumpily. ‘And if we go to Goa, we’ll meet Sulekha Aunty and all your other friends there.’

‘We won’t go to Goa,’ Mom said, her eyes glinting with excitement. ‘We’ll go to Rajasthan and stay in a palace—how does that sound? And best of all, it’s going to be a free holiday!’

‘Free? How?’ I demanded. ‘Did you win the lottery and not tell us?’

‘Sort of,’ she said, laughing. ‘I checked my credit card statement the other day and realized that I have a huuuge number of points that I need to redeem before they expire. And I have enough to pay for a holiday for all of us. At least, enough to cover the flights and the hotels. We’ll have to pay for meals and all the sightseeing we’re going to do, of course.’

It was hard to believe what Mom had said, but we really did go on that holiday. In fact, it ended up being one of the best ones we’ve ever had. Maybe because it was planned on the spur of the moment, or maybe because it was free!

Dada and Dadi had to leave Rajasthan a day early, as they had a wedding to attend. So it was Mom, Dad, Anya and I who checked out of the hotel. Mom took out her credit card and handed it over to the man at the reception desk. ‘Charge everything to this card, please,’ she said.

Dad was looking after our luggage while Mom was at the counter. I walked up to him and said, ‘Wish we could be on an endless holiday. This is so much fun.’

‘And who will pay for this endless holiday?’ Mom said, appearing out of nowhere. ‘Someone has to earn money to pay for these.’

‘We can use the credit card,’ I protested.

‘Credit cards aren’t free, Aman,’ Dad explained.

‘But, Mom, didn’t you say that this holiday was free?’

‘Oh, yes,’ Mom responded. ‘I did say that. But that was because the bank gave me lots of reward points for using my cards extensively and paying them back on time. Those reward points, or loyalty points, were enough for me to pay for the holiday. But what I actually spend on the card, I have to pay back.’

‘Oh!’ I exclaimed, disappointed. Anya seemed crestfallen too.

‘Let me explain. A credit card is like a loan on a card,’ Mom said when she saw our confused expressions. I looked for Dad, and found him loading our bags into the cab. Since my only choices were helping Dad with the luggage or listening to Mom, I stayed put.

‘When a bank issues a credit card to a customer, it sets a limit for that customer called the credit limit. The customer can spend only up to this limit. For example, if your limit is Rs 1000, you can spend only up to Rs 1000 on your card. When you swipe your card at any store, the bank will be notified and will keep an account of how much you’ve spent. Your charges will keep accumulating every month, till you reach the credit limit. Once that limit is crossed, the bank will not allow you to charge anything else to your card. It’ll reject the transactions.

‘On a monthly basis, the bank will collect all the charges that you have incurred on your card and send you a statement that details the total amount you’ve spent. That amount is what must be paid back to the bank. The bank also gives you a date by which you have to pay the amount. You get roughly two weeks to make the payment. As I said earlier, the amount that you spend on your card is very similar to a loan. If you pay the full amount back by the due date that’s printed on your statement, you don’t need to pay any interest. But you can also decide to only pay the minimum amount, which is usually 5 per cent of your total bill, or some amount between the minimum and the total. If you pay anything less than the total amount, you get charged some interest. And if you don’t pay even the minimum due, you get charged a late-payment fee. You may then not get another loan or credit card ever again.’

‘Almost everyone we know has a credit card, Mom. Is it that easy to get one?’ Anya asked.

Mom thought about it for a second. ‘Well, it’s easier to get a credit card than to get a loan, but not everyone can get a card. The bank looks for the same things as it does when it’s giving a loan—ability and willingness to pay. They’ll check your income and your past loan repayment history before they give you a card. They’ll also decide your credit limit based on this. As you start making payments with your card, they may decide to increase or decrease your limit. This will depend on how much you use your card and how regular you are with your payments.’

‘If you don’t get into the car now, we’re going to miss the flight!’ yelled Dad. We hurried over to him and jumped into the cab.

‘Okay!’ I said once we had settled down. ‘Carry on.’

‘Carry on with what?’ Dad asked from the front seat.

‘Mom was telling us about credit cards,’ Anya explained.

‘Why do people use credit cards if they have to pay back the money?’ I asked Mom.

The biggest competition for credit card companies is cash. And the biggest win for credit card companies will be when people stop using cash and only use their credit cards. Credit cards are also referred to as plastic money—because the cards are usually made of plastic.

‘Simple. Credit cards are very convenient to use. You don’t need to carry cash around with you. And they can be used for online transactions. So lots of people have started using them, especially the younger generation. But credit cards are only helpful if you pay back the entire amount on a monthly basis, and not carry forward your balance to the next month. When you do that, it’s called rolling forward your outstanding balance. The interest that is charged on a credit card when you don’t pay back your balance is very high—even higher than the interest on a personal loan. It’s very easy to get into debt on a credit card, and it’s also easy to lose track of the payments you need to make. If you aren’t careful, credit cards can suck you in with their lure of easy money. If you’re able to control the urge to spend unnecessarily and you pay back your outstanding amount on time, credit cards are great. They have lots of benefits as well. Remember I told you about reward points?’

Anya and I nodded.

‘That’s one of the good parts! Every time you use a credit card, you earn reward points. The points depend on the type of card you have and the bank it’s been issued by. One bank may give you one point for every Rs 100 you spend, while another may give you one point for every Rs 200. And you can exchange your points for all kinds of things, like flight tickets, shopping vouchers, hotels, even books and toys. You might even get discounts on movie tickets and restaurant deals. It all depends on what your bank is offering.

‘One really important thing to remember is that you should only buy things if you need them. Don’t get anything just because it’s on sale. I remember Nani once bought a food processor because there was a 30 per cent discount on it. She hardly ever used it, and it took up so much space in the kitchen that we had to give it away. So, you see, in that case, she didn’t save 30 per cent on the price—she wasted the 70 per cent that she actually spent!’

‘Credit cards are also safer than carrying cash,’ piped up Dad.

‘Oh, yes. I missed that point,’ said Mom. ‘A credit card is a lot safer and more convenient than carrying around large amounts of cash. Especially when travelling to another country. There is an additional charge for using your card overseas, but it’s worth it because it saves you the trouble of having to get your money converted from rupees to euros or dollars or whatever the local currency is. You can also withdraw money from foreign ATMs if your card is an international one.

‘The other big reason for using a credit card is that it allows you to make impulse purchases. For example, you may go to a mall to buy a pair of jeans and a book. But while you’re there, you see that your dream laptop is on sale, and there are only a few of them left. If you had to go home and fetch cash to buy the laptop, it might be gone by the time you’re back with the money. But with a card, you can buy it immediately. This may not always be a good thing—like I mentioned earlier, there’s a risk of you buying things you don’t need. But if you’re disciplined about it, a credit card can be a pretty good shopping companion!’

- Name of the bank that has issued the credit card

- Hologram

- Credit card number

- Mastercard / Visa / Rupay / American Express logo

- Card expiry date

- Name of card holder

- Magnetic strip that contains card-holder data in a coded form

- Signature of card holder

- Card security code, which is often needed for online transactions

MONEY MATTERS

Exercise 1

Make a list of things you’ve seen your parents buy using their credit cards.

Exercise 2

Write down the names of the banks your parents have credit cards from, and list the monthly interest these cards charge for balances that you roll over.

Exercise 3

Whenever you next go to a restaurant, ask the waiter whether they have any offers on credit cards. If they do, make a note of this offer.