FOREIGN MONEY

Anya

The first time we travelled abroad, Aman and I were around eleven years old. Most of my friends had been on at least one holiday outside of India by then, but my parents strongly believed that we should get to know our own country first before we went poking around other peoples’ countries. Our Singapore trip only happened because my dad had to go there on work. His trip was during our Diwali break, so Mom decided that we should go on a family holiday.

On the morning we were supposed to leave, Mom asked Dad in a panic, ‘Where is the foreign exchange? We don’t have Singapore dollars.’

I wondered what she meant by Singapore dollars. The only dollars I had heard of were the American ones, and that’s because I had seen them being used in my favourite movies.

‘Don’t worry,’ Dad reassured her. ‘We’ll withdraw some cash from the ATM at the airport in Singapore. In any case, I have plenty of US dollars with me.’

‘Dad, why can’t we use rupees in Singapore?’ I asked.

‘Every country has its own currency. Just like India has rupees, Singapore has dollars,’ he responded.

‘And they aren’t the same as American dollars?’

Dad shook his head. ‘No. US$1 is around S$1.3. And S$1 is around Rs 38.’1

‘This is really confusing,’ I complained. ‘Who decided this stuff? Wouldn’t it be simpler if everyone used the same money?’

‘Remind me to explain this to you when I have a little more time,’ Dad said. ‘But right now, I need to help Mom pack!’

When we got to Changi Airport in Singapore, Dad went to an ATM to withdraw enough Singapore dollars for us. I vaguely remembered Nitin Uncle explaining to me that the money would be deducted from Dad’s account. I reconfirmed, ‘This will go from your account now. Right, Dad?’

‘Yes. The bank will convert this money into Indian rupees and take it out from my account.’

‘How will they convert it, Dad?’

‘They have a daily exchange rate, so they’ll know that S$1 equals Rs 35. I took out S$1000. They will now multiply that 1000 by thirty-five and add their charge, which is approximately 3 or 4 per cent of the total amount withdrawn. They’ll debit this amount from my account. So, in this case, they will deduct roughly Rs 36,000 from my account.’

‘But then, Dad, since we only have one world, why can’t everyone just use one single currency? Why does every country need to have a different currency?’

‘That’s a complicated question, Anya,’ Dad said. ‘But let me try to explain. Each country has its own government and its own economic policy. This means that each government decides how to manage the supply and value of its own currency. One country might decide to keep the value of its currency low compared to other currencies because this helps it increase exports to those countries. Let’s say the country is exporting toys. If its currency is lower in value, the toys will be cheaper than those made by other countries, so more of them will sell. Another country may want to keep its currency at a high value, depending on the economic policies and priorities of that country. The closest that the world has got to having just one currency is in Europe. Most of the continent has a single currency called the euro. All the countries that are a part of the European Union have adopted the euro as their currency. This has made things simpler for them in some ways but more complicated in others. We still don’t know for sure if this is the best option for all countries.’

‘But, Dad, you said that the bank will debit Rs 35 for every S$1 you withdrew from the ATM. Who decides that it has to be 35 and not 40?’

‘The government usually decides this. Some currencies are at a fixed rate, which means that the government decides the exchange rate with other currencies. The rates of the Hong Kong dollar and the UAE dirham are fixed against the US dollar. Other currencies, like the Indian rupee, are floating—the value goes up and down against the value of other currencies, depending on the demand and the supply of that currency.

‘This is a bit like how the prices of things like mangoes work. At the beginning of summer, the price of mangoes is high because there’s very little supply. But as summer continues and the supply increases, the price drops. The process of converting money from one currency to another is called foreign exchange. There are 180 currencies in the world and each can be converted from one to the other depending on what rate the government wants the currency to be set at. The US dollar is the most universal of all currencies. It is the currency that’s used the most for international transactions. It’s not an official global currency, but it's the closest thing we have to a global currency in the world today.’

‘I’ll go and live in the US once I grow up,’ Aman declared.

‘Your home country is one of the best countries on the planet, Aman. You may not see it now, but you will in a few years.’

MONEY MATTERS

Exercise 1

Write down the names of the five biggest countries in the world (by population) and then write down their respective currencies.

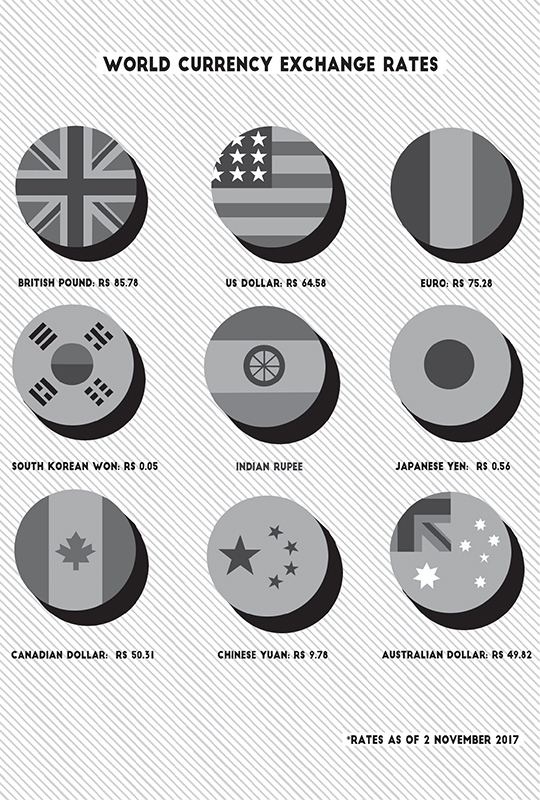

Write down the value of each of these currencies in Indian rupees. For example, US$1= Rs 64.

Exercise 2

A Happy Meal at McDonald’s costs Rs 130. How much will it cost in USD, GBP, SGD and euros?