How to Find Great Investments

219

already occurring because governments are strapped for cash and may not be able to continue to pay retiree benefits and still meet budget guidelines.

5. Increasing populations: In 2000, according to the U.S. census, America had a population of 281 million people. In the next twenty-five years, that population is projected to increase to between 350 and 400 million. California, already very crowded, is expected to have a population increase of 18 percent over the next two decades. While I do not know what China and terrorism mean for the stock market, I do know that such increases in populations in America will be great for real estate. Often I say to people who complain about real estate being too expensive, “If you think real estate is expensive today, just wait ten more years.” I also say, “Don’t you wish you had bought more real estate twenty years ago, even if it was expensive back then.” Although real estate tends to go up an average of 6 percent per year, that is not an excuse to buy any old piece of real estate.

6. War: War is horrible, yet it often means a great change is at hand. England, France, Germany, and Japan were all at one time or another enemies of America. Today they are our strongest allies. (Even if Germany and France did not support us in Iraq, they are still strong allies in other ways.) Sometimes we have to fight before we become friends. Hopefully Iran, Iraq, Palestine, Russia, some African nations, and other areas of conflict will soon become friends and trading partners. The point is, sometimes war is a good time to buy because prices are low.

During World War II, the Japanese took over the Philippines and many of the businesses there. One of the businesses was a gold mining company listed on the New York Stock Exchange. The day Japan took the country and the mine, the stock of that mining company plunged to nearly zero. But there were some who jumped in at that very low price and made a fortune once the war came to an end and the mining company got back on its feet.

7. Age is a liability: When I was a kid, age was an asset. My parents knew that the older they got the more valuable they became as workers. In today’s world, the older you get, the more obsolete you become, due to technology changes. When I talk to people today, I often say that they need to think like professional athletes . . . athletes like basketball players who are stars at twenty-five and physically obsolete by thirty-five.

Rich Dad’s Who Took My Money?

One of the reasons I started being an entrepreneur and an investor early was because I had a lifetime to learn to get better in the B and I quadrants, rather than the E and S quadrants. I knew that if I owned my own companies and invested for myself, I did not have to worry about someone else having control over my life, how much I made, when I could go on vacation, and when I could retire. Although I was a failure in the first quarter of my life, from ages twenty-five to thirty-five, the next quarters I got better and better at business and investing. In the second quarter, the ages thirty-five to forty-five, Kim and I were able to become financially free, living just off of our investments.

Forbes Magazine on Slow Learners

Eighty years ago, the October 1,1921, issue of Forbes magazine ran an article that headlined:

“F-Student A-List”

Thomas Edison was thrown out of school because he was “too stupid to learn.” Teachers called George Westinghouse a dunce. Frank W Woolworth probably would have failed to pass a grammar school graduation test. James B. Duke, “the tobacco king,” was woefully uneducated. George F. Baker, the dean of American bankers, is said to have been a night watchman as a young man. Not one in twenty of our foremost men of affairs had risen to anything of prominence at thirty-five or forty. Almost all of them went through grueling experiences before they reached the summits of success.

Desire Versus Logic

When I was starting out on my journey at the age of twenty-five, both my rich dad and my poor dad knew that I was not an academically bright person. My poor dad, an academic star, said to me, “You will always be a slow learner.” Since I was not a quick learner, my rich dad said, “You need to dedicate yourself to learning slowly and learn forever. That is your best chance of winning.” He also said, “Desire can take you places where logic cannot.” I did not write an international best-selling book until I was fifty. Having failed in high school twice because I was a poor writer, my having five New York Times best-sellers today is not logical.

How to Find Great Investments

221

Right after college, most of my classmates made more money than I did. Today, I make far more money than most of my peers who did well in school and got the high-paying jobs. Because I was slow coming out of the gates, I became financially successful late in life. Because I am a slow learner, it took me longer to get started and get the education and experience I needed. But I found what I needed to know by just plodding along and never giving up, even though many times I wanted to. So keep learning about investing no matter how old you are or how much money you have ... or do not have. Every day that you learn something new, you get better at the game.

THE #5 WAY TO FIND A GREAT INVESTMENT: THE 20-10-5 CYCLE

Rich dad said, “The stock market dominates the investment market for a period of twenty years. As the twentieth year approaches, the possibility of a market crash increases. After the crash, the stock market tends to stay down for ten years. During the ten years the stock market is down, commodities such as gold, silver, oil, and property dominate the investment world. And every five years, there is some kind of major disaster.”

Early in my life, I did not really appreciate rich dad’s lesson on the 20-10-5 cycle. Nonetheless I did follow his advice. Between 1973 and 1980,1 was investing in real estate and gold . . . often categorized as hard assets or commodities. Some of you may recall the Hunt brothers taking silver all the way up to nearly $50 an ounce, and gold nearly hit $800 an ounce. Just prior to 1980, the commodities markets crashed. As predicted, from 1980 to 2000, the stock market dominated the world of investing. The disaster every five years seemed to be true also. Events such as stock market crashes, the savings and loan fiasco, real estate crashes, and tragic events such as September 11, 2001, seem to occur every five years. If the 5-year disaster theory is true, the next disaster should hit in 2006.

Not About Having a Crystal Ball

The reason rich dad told me about the 20-10-5 cycle was not to make me a fortune-teller with a crystal ball. The reason he told me of this cycle was because he wanted me to be aware of change. One of the reasons so many baby boomers are in trouble financially with their retirement is because their investments are still in the stock market and the market has just ended a twenty-year cycle. If they had followed the 20-10-5 cycle, they would have

Rich Dad’s Who Took My Money?

gotten out of equities and into commodities around 1996. Warren Buffett sold a lot of his stocks in 1996 and took large positions in silver prior to 2000. I do not know if he follows the 20-10-5 cycle, but his investing patterns seem to validate it.

If this 20-10-5 cycle holds true, then many baby boomers will not be able to retire because they will be in the stock or equities market during the commodity cycle, waiting for the price of their stocks to come back up, which may not happen till 2008 to 2010.

The way I learned to use the 20-10-5 cycle is not as a crystal ball but as a reminder to look into the future. For example, in 1996, when gold was at an all-time low, trading at around $275 an ounce, I began investing in gold mines. While I was laughed at by some of my friends who are in banking and the stock market, today they are not laughing as gold has hit $375 an ounce. In fact one of the companies in which I invested in 1996, where I am a director and the second-largest shareholder, just went public in November 2003.

In other words, as the twenty-year equity cycle was coming to an end, I began moving out of equities and began looking for opportunities in commodities such as gold, silver, oil, and other metals. When September 11, 2001, hit, even though stock prices were really low, I continued to stay out of the equities market just because I knew that equities had run their twenty-year cycle. Instead of stocks, I looked for more real estate opportunities after 9/11, even though real estate prices were high.

Don’t Take This to the Bank

This 20-10-5 cycle is not something I would bet my financial future on. As I said, it is primarily a reminder that markets move in cycles. However, by knowing this, I tend to not get caught in the wrong cycle. One of the best ways to find good investments is to find investments that are out of favor but are soon due to come back into favor. This 20-10-5 cycle lets me know that stocks will probably be coming back in favor around 2008 and I will remind myself to consider selling my gold shares at about that time.

Since I love real estate, and I trust the demographic trend of America’s ever increasing population growth, I will continue to invest in real estate. In Japan, where birth rates are down, I would be hesitant to invest in real estate. Real estate property values only go up if there are people who want to rent them.

How to Find Great Investments

223

In Rich Dad's Prophecy . I wrote about the possibility of a massive stock market crash between 2012 and 2020. The reason for this crash is not due to the 20-10-5 cycle but more to the demographics of the Western world's population. At year 2016, the first baby boomers turn seventy and a half years of age and. at that age. the law that created the 401(k) retirement plan in America requires that the baby boomers start to withdraw from their plans, which will result in the sale of their equities in order to fund the withdrawals and they will have to pay the deferred taxes on their accounts. So the reminder is, even if the market is really hot around 2016 and has not crashed, remember the more of all three asset classes you have the more secure your financial house will be no matter what happens to the equities market.

THE #6 WAY TO FIXD A GREAT IWESTMEXT: HA\E A FRIEXD IN THE BUSINESS

Most of us are mature enough to know that the best investments are often never advertised for sale. In most cases, the best investments are legally and illegally sold to insiders at the best prices. Often, by the time the little investor hears about a great investment, the prices for that investment are too high, which makes it a bad investment for the little investor.

One of the best ways to find great investments is to have business partners who are in the market even* day. Kim and I find great investments because we pay our brokers more than other investors do. For example, while many investors are trying to ask their broker to lower their commissions, we give some of our brokers their full commission as well as 10 percent of the profits from the investment. For some reason, because we are generous, we tend to get the first shot at the best investments. We have purchased several properties before they hit the market by having friends in the business and making them partners in the investment.

THE # T WAY TO FIXD A GREAT INVESTMENT: PAY MORE MONEY

In early 2003. a real estate broker came to Kim and me and asked us if we were interested in selling one of our properties. My reply was, "'ftMe we are not really interested in selling, everything we own does have a price.”

“How much do you want?" asked the broker.

After thinking about it for a day or two, Kim and I said, “If you give us $2.5 million we will sell."

Rich Dad’s Who Took My Money?

“That’s way too much,” said the broker. “How about $1.9 million?”

At that, we discontinued talking to him. Negotiations were over.

*

No One Likes Cheap People

Rich dad often said, “No one likes cheap people. Yet for some reason, more people try to get rich by being cheap.” The same holds true in investing. Personally, I find it distasteful when people attempt to offer me less than what I want... for what I have ... that they want.

Change the Business

Earlier in this book, I stated that rich dad recommended that his son and I understand business so we could become better investors. One reason for this is due to the fact that an investment, real estate included, is only as valuable as the business behind the investment. Earlier I used the example of a ten-acre piece of land.

10 acres

To a farmer, this piece of land may be worth $10,000.

To a real estate developer, this same land may be worth $100,000.

Why the difference in value? The answer is because they are in different businesses.

An Insult

One of the reasons I asked $2.5 million for a property that cost me less than $700,000 is not because I am greedy. The reason I asked for the higher price is because that is what that property is worth to me today. When the broker immediately asked for a lower price, I took it as an insult. Let me explain.

When Kim and I purchased that property, it was a motel that was in financial trouble due to high vacancies and low rent. The reason it was in financial trouble is because newer motels were being built all around it. When Kim and I purchased it, we planned to change the business model. Instead of a motel, we changed it into an apartment house, a business we knew well. In other words, it was not worth $700,000 as a motel but it was worth $700,000 as an apartment house, since it is in a great location. Today, eight years after converting it to an

How to Find Great Investments

225

apartment house, it is worth even more money because in five years our plan is to tear down the old building and put up high-end condominiums and sell them. Our plans show that we can build twelve three-bedroom, two-bath condominiums with garages, and sell them for at least $350,000 each, a gross value of $4.2 million. That is why the property is worth at least $2.5 million to us today. It is worth that much because we are going to change the business that is currently on that property and we expect to make that much from the sale of the new buildings. If the broker knew our plans, he would have seen that we were asking a price for what the property was worth to us. If his buyer could look into the future and also see a potential change in business, he might have found a way to offer us what we wanted and still made what he wanted to make. Instead he went cheap and we never talked to them again.

My Favorite Way to Get Rich

All too often, people try and buy a good investment by being cheap and then lose the investment. It takes no intelligence to ask for a lower price to make a lowball offer. It takes creative intelligence to spot opportunities that others do not see. So before you insult someone by asking for a lower price for an asset you want, see if you can see potential value they cannot see. In my opinion, this is the best way to get rich. I have used this method of finding a great deal many times. I simply look for value or opportunities others do not see and pay the asking price ... which makes both parties happy. It is my favorite way to get rich.

There Is More Than One Way to Find a Great Investment

As you can see, there is more than one way to find a great investment. The seven methods listed offer you some flexibility as to what method you choose depending upon the market situations of the day. The four basic points are:

1. Know your numbers—don’t be a guessing gambler

2. Know the mistakes that lemmings make

3. Be generous

4. Be creative

If you keep these basic points in mind, your chances of finding better investments will improve.

Rich Dad’s Who Took My Money?

Sharon’s Notes

Let’s try to put it all together. Robert has shared many of his strategies in locating, selecting, and purchasing investments. The overall process is summarized here:

The seven ways to find investments:

1. Remember, people are lemmings—look for what’s not popular.

2. Personal tragedy or calamity—your good investment may reduce someone else’s tragedy or calamity, benefiting you both.

3. A recession—great time to invest.

4. Technical, political, or cultural changes—create opportunities.

3. 20-10-3-year cycles—these are investment cycles that are good

indicators.

6. Have a friend in the business—it is a “who you know” world sometimes. Be the first person they call with a new deal.

7. Pay more money. This allows you to tie up the deal (with contingencies and then analyze). Don’t haggle.

The next four steps are to analyze the investment found:

1. Know your numbers . . . don’t be a guessing gambler ... do the due diligence.

2. Know the mistakes that lemmings make . . . don’t follow the crowd.

3. Be generous... rather than greedy.

4. Be creative ... there are many ways to make a deal.

Then remember the five considerations for each investment and how the investment fits into your overall investing strategy:

1. Earn/create—how will it generate cash flow for you?

2. Manage—how will you manage this investment?

3. Leverage—how much leverage will the investment provide, or can you get?

4. Protect—how should you hold the investment, maximize its profitability, and protect it from potential creditors?

5. Exit—how will you get your original investment moneys back?

How to Find Great Investments

227

Purchase the investment using rich dad’s velocity of money investing plan:

1. Invest money into an asset using accelerators.

2. Get the original investment money back (exit strategy).

3. Keep control of the original asset.

4. Move the money into a new asset.

3. Get the investment money back.

6. Repeat the process.

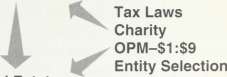

It is the combination of all of these steps that generates true wealth and provides financial control over one’s future. For reference, I am also including the chart “Why the Rich Get Richer,” which brings it all together.

Chapter 14

How to Be a Great Investor

“You need two professions. One for you and one for your money.”

— Rich Dad

Finding a Job for Your Money

As we come to the end of this book, you may have picked up my sense of frustration ... the frustration of repeatedly being asked such questions as,

1. “If you had $10,000, what would you invest it in?”

2. “You recommend real estate, don’t you?”

3. “What is the best investment for me?”

4. “How do I get started?”

When I hear such questions, I know these people are actually looking for a place for their money to go to work. That is what investors do.

Out of Work in Three Months

While I was in Washington, D.C., on a book tour, an older man approached me in the parking lot and rather rudely said, “You’re the guy that tells people to put their money in real estate, aren’t you?”

Rich Dad’s Who Took My Money?

Being as polite as possible, I replied, “No, I don’t tell people where to put their money.”

“But you’re in real estate, aren’t you?” he demanded, tapping my chest with his pencil.

Pushing his pencil away, I replied, “I teach people about investing in businesses, real estate, and paper assets. I invest in all three asset classes. What asset class the people invest in is up to them.”

“Look,” said the stranger, “I’m retiring in three months and I need to know where to put my money. I don’t have any retirement income. I was told you could help me.”

“I can help you if you’re willing to learn to be an investor,” I replied quietly.

“How much will it cost me to become an investor?” he asked.

“That depends on you,” I replied. “How much do you have to invest?”

“About $18,000 in the bank and I own a small house and my car. I have no debt,” he replied. “That’s all I have. My wife left me years ago and she was the one with the steady government job and benefits. I work as an engineer for a small company but the company is not doing well. I like working for the company, but the pay is low and there are no real benefits or guarantees.”

Nodding silently, I truly could feel the pain coming from behind his words. His pain reminded me of my poor dad’s pain when he continued to look for work, even though past the retirement age. Finally I said, “Well, maybe you shouldn’t retire. Why not put that money in the bank and keep working, doing something you enjoy doing.”

“I know better,” he said. “I’ve known for years that I need to invest. I can’t keep pretending that I can work forever. I know there will come a day when I have to stop working. It frightens me to think of myself, a well-educated man, someday becoming a burden to society because I cannot work and cannot afford to take care of myself. I’ve always been a hardworking man, but I know my working days will someday come to an end.”

There was a long pause between the two of us. As stated earlier in this book, I do get tired of being asked the same questions over and over again. I get tired because I do not have an easy answer that will magically make things better again. Money, investing, and long-term financial security are not subjects with simple answers.

“Can you tell me anything that can help me be a better investor?” asked the man seeking quick answers to his retirement problem.

How to Be a Great Investor

231

Thinking for a moment, I asked him, “What is your profession?”

“I am a plant engineer,” he replied proudly “I have twenty-five workers who report to me every day.”

“Good,” I replied. “What profession is your money in?”

“My . . . money’s profession?” he stammered. “I don’t know. I just keep my money in the bank.”

“Good,” I smiled. “So your money’s profession is banking.”

“I don’t understand. What do you mean my money’s profession is banking?”

“Because that is where your money is working for you,” I replied. “You see, my rich dad taught me to look at my money as my employees. My job as an investor was to find work for my employees. So your 18,000 employees are working for you in the bank. That means they are professional bankers.” “My money is in the banking business?”

“That’s correct,” I said, nodding. “Their profession is banking because a bank is paying them to work there.”

“I never looked at it that way,” he replied.

“And how well is the bank treating your employees? Is the bank paying them well?”

“Not well,” said the engineer.

“So the bank doesn’t pay them well?” I asked with a grin, knowing that he was beginning to catch on to my message.

“No,” smiled the engineer, his rough exterior changing. “In fact, the bank used to pay 5 percent and now it pays my 18,000 employees less than 1 percent per year.”

“That’s not much,” I replied. “And what about the benefits?”

“Benefits? What benefits?” he asked.

“Benefits like capital gains, tax benefits, tax-free loans, nontaxable income. Do your employees get benefits like that from your bank?”

“No. The interest I receive is taxed. I don’t receive any tax-free benefits,” he said, a little puzzled. “Do your employees get those kinds of benefits?” “Absolutely,” I said. “That is why many of my employees work in the business of real estate. The real estate industry treats their employees very well and there are lots of extra benefits.”

“What kind of benefits?”

“Benefits like tax-free money to invest with, tax-favored capital gains,

Rich Dad’s Who Took My Money?

phantom cash flow for depreciation, lower taxes due to expenses, insurance against losses, protection from financial predators, and much more. I do have some money in the bank, but not much. Like you, my bank does not treat my employees well.”

“And the stock market?” asked the engineer. “How does the stock market treat its employees?”

“The same way most big corporations treat their employees. That is why employees of big corporations often form unions to protect the workers’ interests from owners and management. Instead of joining unions, many financial employees belong to mutual funds. Different name, same idea. In either case there is always the struggle between workers and management; pay and benefits. In fact, the corporate management always gets paid but the workers may not get paid if management does not do a good job.”

Standing silently for a moment, the engineer was beginning to understand what an investor’s job was. “So my job is to find a profession for my money. That is what an investor does. I need to find places were my money is safe, paid well, receives great benefits, and [is] free from abuse and corruption.”

A Good Investor Cares

I nodded and smiled. “Just as a parent cares for their children, an investor cares about how well their money and their financial employees are being treated. Most people blindly turn their money over to total strangers who work for big corporations, and have no idea about how their workers are being treated. They park their money. That is why so few people do well as investors. They often let their money be abused, mistreated, and poorly paid. Your job as an investor is to find the right profession for your money... your employees. Educate yourself, so you can treat your workers with respect, find them great places to work, protect them, make sure they are paid well, and your workers will multiply and work hard for you.”

Working for Strangers

It was time for me to go. I had a talk to give and the gentleman in front of me seemed to have his answer. At least he seemed to have a better understanding about what investing is all about. He smiled, extended his hand, and said, “Thank you.” Shaking his hand I said, “My rich dad said, ‘Give your money to

How to Be a Great Investor

233

strangers and your money will work for the strangers—before your money works for you.’ So be smart, find the best profession for your money, and your money will take care of you. That is what investing is about.”

What a Good Investor Cares About

Earlier in this book I wrote that an investor does five things. They are:

5. Exit 4. Protect 3. Leverage 2. Manage 1. Earn/Create

The reason a professional investor does these five steps in planning their investments is because they care about their money—their employees. In professional investing terms, these five steps are similar to a due diligence checklist.

When I was training to be a pilot, we were taught the importance of always following checklists. For example, before starting engines we ran through a written checklist. Before landing, we also ran through a written checklist. The same is true for professional investors. For example, before we purchase a new building we always go through a due diligence checklist. The process of going through this checklist has served us well and made us a lot of money over the years. If you are interested in seeing or using the same checklists we use, these can be found in our real estate investor products such as 6 Steps to Becoming a Successful Real Estate Investor and How to Increase the Income from Your Real Estate Investments, which is an in-depth guide to being better at property management, one of the most crucial aspects of real estate investing. You can find out more about these products from our Web site at richdad.com.

What Is Wrong with a Job and a 401(k)?

In my previous books, I have often pointed out the limitations of a job and 401(k). By simply using the five-point checklist it is easy to see why.

Rich Dad’s Who Took My Money?

1. Earn/Create: Earning income from a job, personal labor, is the highest-taxed way to earn money. As many of you already know, there are three types of income: earned, portfolio, and passive. A professional investor is generally investing for portfolio and passive incofne, which in most cases is income that is created, rather than worked for.

2. Manage: Having a job gives you little to no management control over taxes. Also, workers whose 401(k) invests in stocks or mutual funds have no control over the expenses of these organizations. A professional investor wants to manage taxes and expenses because taxes and expenses affect the return to the investor.

3. Leverage: Investing in a 401 (k) offers very little leverage. At most, employees get a 1:1 matching contribution from their employer. A professional investor wants to use OPM, other people’s money, rather than their own money.

4. Protect: A 401 (k) has very little protection against market losses. At best you can diversify as recommended within the plan. Also, most workers tend to own everything in their own name, which keeps them wide open to personal lawsuits. Professional investors keep much of what they own in the name of a corporate entity, not their own name. They utilize insurance to protect as many of their asset positions as possible.

3. Exit: When a person retires, income from a 401(k) will be taxed at the highest rates possible because income from a 401(k) is classified as earned income. That means that even the capital gains and dividends that would now be taxed at the highest rate of 13 percent, could be taxed at the highest-earned income rate of the individual, now up to 35 percent. This whole structure was based on people being in a lower income tax bracket when they retire. I, for one, expect my income to continue to increase as I build and buy more assets to work for me. A professional investor expects his or her income to continue to grow, even after retirement.

A Warning from a Checklist

A checklist will often warn you if something is wrong with an investment. When people tell me they like their job security and their 401(k) retirement plan filled with mutual funds, I know they have not gone through this simple five-step checklist. Not only are they being financially abused by the tax

How to Bh a Great Investor

235

system and the companies they invest in, their money is not leveraged, not safe, and when they retire, if they have been financially successful, their exit will be abused again by the tax system.

What Investors Do

Regardless of what I invest in, be it a company, real estate, or a paper asset, before I invest, I run through the five-step checklist. For example, before investing in a piece of real estate, I run through the same checklist:

1. Earn/Create: I do not want earned income. If I choose a property correctly, it will create passive income, plus phantom income, which are the lowest-taxed incomes.

2. Manage: I work to reduce my expenses, increase my income, choose when I pay my taxes, and reduce my taxable income. If there are losses, I can use those losses to my advantage.

3. Leverage: Real estate is the easiest of all investments to leverage. Leverage of 80 percent to 90 percent is not uncommon. The tax department offers additional leverage through tax incentives, which are numerous.

4. Protect: I protect my property with different types of insurance. I also protect my property with different corporate entities. I protect my ideas with copyrights, trademarks, and patents. I also protect my property with nonrecourse financing, if I feel the need to be extra cautious. I can also add another layer of protection by setting up a sinking fund, which accumulates extra cash for emergencies.

3. Exit: Rather than sell my property, which would trigger a taxable event, I often exchange my property without paying taxes or I can borrow out the equity tax-free and invest my tax-free borrowed money in whatever I want... a new investment property or a boat.

Oversimplified

I realize that this has been an oversimplified example of how this five-step checklist is used. In real life, when following the checklist, there is far more detail with each step. In many ways, though, this five-step checklist could be used as a rough guide for a business plan for any investment. Nothing ever goes exactly as planned, yet this five-step checklist can assist you in quickly

Rich Dad’s Who Took My Money?

evaluating the pros and cons of any investment you may want to put your money, i.e., your employees , to work in.

Even though oversimplified, the two checklists outlined here are useful in comparing the pros and cons of a person with a job and 401 (k) against a professional investor investing as a business owner in real estate. The lesson is, checklists are used by professional investors, and unfortunately most amateur investors do not use them.

The Best Way to Get Rich

Many people seem to think that investing is simply throwing money at some hot deal and hoping to strike it rich. Or just turning it over to a total stranger and hoping that stranger or that company returns your money to you someday. Obviously that is not investing—it is gambling. But worse than gambling, it demonstrates a lack of respect for something most people have given a part of their life, their sweat, blood, and time for.

Most people do not like working for abusive and cheap people or abusive and cheap companies. Yet when it comes to the money they invest, many people turn their money over to people and companies that seem to care more about their own self-interest than the investors’ interests.

Warren Buffett said, “The best way to get rich is to not lose money.” One of the best ways to not lose money is to invest a little time making sure the money you invest. . . your personal employees ... are working in a financially intelligent, high-integrity, well-managed, financially responsible, and safe environment. That is what an investor does. That is what investors such as Warren Buffett do. Warren Buffett treats money, the businesses he invests in, his workers, and his investors with a high degree of personal intelligence, integrity, and respect. That is why his company is so successful. Rich dad said, “People who do not respect money, or abuse the money they earn, are themselves often not respected and [are] financially abused.”

Regardless of whether if you invest in businesses, real estate, or paper assets, treat those assets and your money with the same respect you want for yourself. If you will do that, your money and those assets will grow and make your life easier and more abundant. Take care of your money and your assets and they will take care of you.

How to Be a Great Investor

237

Sharon’s Notes

The accounting profession has identified the following changes in the tax law that must be reviewed to decide if and how you should adjust your overall investment strategy.

In a December 2003 feature article in the AICPA (American Institute of Certified Public Accountants) Journal of Accountancy, a CPE (continuing professional education) leader for the accounting profession discussed the impact of the new tax laws on investors with CPA David Lewittes. In their discussion they highlighted several issues:

• About half of the investments in stocks are in retirement accounts.

• Retirement accounts do not get the benefit of the reduction in dividend income or capital gains tax rates because any distributions from the retirement accounts will be taxed as ordinary income.

• As such you may want to change your mix of assets in tax-deferred accounts to bonds and short-term capital gains stocks while holding stocks with high-paying dividends and long-term appreciation in the taxable accounts to take advantage of the reduced dividend and capital gains tax rates.

• Because of the reduction in the income tax rates to individuals there is also a reduction in the tax savings of contributions to retirement accounts such as IRAs and 401 (k)s.

• Investment leverage through debt may be more attractive.

Investment Plan

You must create the investment plan that is right for you. The following oversimplified review of the three asset classes highlights the pros and cons for your consideration:

1. Business

Pro: Business is the asset that offers the highest of all returns on invest-

ment. A business made Bill Gates the richest man in the world.

The tax laws were written to benefit business owners.

Con: Business is the hardest of all asset classes to own, build, and control.

Rich Dad’s Who Took My Money?

238

2. Real Estate

Pro: Real estate is the easiest of all assets to leverage. It is easier to borrow

money for real estate than for a business or paper assets.

The tax laws favor real estate investments.

Con: For the little investor, real estate is far more capital-intensive than paper assets.

Real estate is far more management-intensive for the small investor.

3. Paper Assets

Pro: Easiest of all asset classes to get into and out of.

Con: Least financial controls.

Fewer tax advantages.

High volatility.

Synergy Versus Diversification

Many people believe diversification is smart. Yet many people are not really diversifying, since they invest only in one asset class. For example, many people think they are diversifying but all of their money is in mutual funds.

Rather than diversifying, rich dad taught us the synergy of our investments by using a combination of asset classes. Through synergy of the asset classes, you can obtain much higher returns on your investments. It is the synergy between a business and real estate that makes Donald Trump so rich. It is the synergy between business and paper assets that makes Warren Buffett so rich.

Chapter 15

Conclusion: Winner or Loser?

When rich dad first showed me the four quarters of the game of money, I was just starting the first quarter and did not have much respect for it. I was twenty-five years old and all I thought about was winning even though I was not certain I could.

25-35 1 st Quarter

35-45 2 nd Quarter

Halftime

45-55 3 rd Quarter

55-65 4 th Quarter

Overtime

The Game Goes On

Although I technically won my money game at the end of the second quarter, and Kim won by the end of her first quarter, we both know the game is not over. We all know of people who were winners in one quarter of the game and wound up losers later in the game.

One of the best things to happen to me was to be a loser in the first

Rich Dad’s Who Took My Money?

quarter of my game. The international success of my nylon and Velcro wallet business went straight to my head . . . and success soon turned into arrogance and cockiness. By the time I was thirty, I had achieved financial success and had also lost it all. Being a financial loser early in life taught me a deep respect not just for money but also for the game of money.

The Scores at the End of Three Quarters

Today, as I begin the fourth quarter of my money game, I look back at the first three quarters and my scores look like this:

25-35 Investment income—$0 per month (massive debt)

35-45 Investment income—$10,000 per month

Halftime (took two years off)

45-55 Investment income—$100,000+ per month

55-65 Investment income—(?) (to be determined)

Overtime (?) (to be determined)

The reason I remain cautious, even though I am financially ahead today, is because I know the score of the game can change at any time. That is why I am glad I lost so badly in the first quarter. Losing not only taught me how to win, losing also taught me a deep respect for money and the game of money. I am very aware that just because I am winning today ... tomorrow, the game can take it all away.

A Personal Concern

My personal concern is that there are millions of people today who are working hard but losing the game. One reason they are losing the game is because many people are simply avoiding the game. And if they are in the game, investing their retirement plans, many are not achieving high returns because they are diversified in one asset class, primarily paper assets, which means they lack the synergy between asset classes. Add to that, too many people turn their hard-earned money over to the government in the form of excessive taxes or to total strangers who pay themselves first, and may or may not return their money to them when they need it.

Again, as I do in all my books, I say I think it is time our educational

Conclusion: Winner or Loser?

241

system begin teaching people basic money management including the true differences between assets and liabilities. Schools should also teach different investment strategies, the different asset classes, and the difference between investing for cash flow versus capital gains. And last but not least, a strong financial education should teach the basics of the effect of taxes upon earnings. If people knew how much employees pay in taxes and how favorable the tax laws are to business owners, we might have more people starting a business upon leaving school rather than looking for a high-paying job. That is true financial education. Today, schools along with Wall Street are claiming to be teaching kids financial literacy by teaching them to pick stocks. Having Wall Street teaching kids to pick stocks is the same as racetrack owners teaching kids to pick the ponies. Rather than teach kids to be gamblers, it is about time we teach young people about the real game of money, long before they wind up in the fourth quarter of their lives, expecting their families or the government to take care of them.

Why the Rich Get Richer

E-S

B-l

Asset

Accelerator

Job

Business

Business

OPM

Entity Selection OPT

Savings

Get Out of Debt Real Estate Personal Residence Mutual Funds

Equities

401 (k)s, IRAs, SEPs

of Debt Real Estate i/ Residence

IRAs, SEPs

Tax Laws

• Depreciation

• Passive Loss Tax Exempt Hedge Funds Options PPMs

Rich Dad’s Who Took My Money?

Once again, review the preceding chart, which compares the investing strategies of parking versus accelerating your money. Are you ready to take control of your financial future and to start accelerating your money instead of parking it?

The Best Part of Playing the Game

Before ending this book, I want to pass on one bit of wisdom gained from playing the game rather than playing it safe. The best part of playing the game of money, regardless of whether I was winning or losing, is that I got better at the game. As you can see by the scores from the first three quarters, even though my score was zero at the end of the first quarter, my scores improved after that.

Unfortunately, too many people will ultimately lose the game of money simply because they have spent their lives avoiding losing. Instead of playing to win, too many people have played the game of playing not to lose. Again, this is partly caused by an educational system that is not teaching subjects required for survival in the real world.

As I begin the fourth quarter of my money game, rather than being fearful of losing, or having nothing, or expecting the government to take care of me, as many people in the fourth quarter are ... I am confident—not cocky and excited, but not fearful of the game. As I enter the fourth quarter, I know the game of money is a game I will play for the rest of my life, regardless of the score.

It is not that I cannot lose in the future, because I know that winning and losing are a part of any game. The difference for me as I enter the fourth quarter is that I have learned to enjoy the game. So for those of you who are contemplating taking control of your money and investing it yourself, rather than turning it over to strangers, these are the important points about the game. Remember that:

1. Losing is part of winning.

2. The more you play the better you get.

3. The better you get the better your team gets.

4. The better your team gets the more you enjoy the game.

5. The more you enjoy the game, the better your chances of improving your score.

As rich dad said, “The game of money is not really about money It is about how well you play the game.”

Thank you for reading this book.

Robert T. Kiyosaki Sharon L. Lechter

About the Authors

Robert Kiyosaki

Born and raised in Hawaii, Robert Kiyosaki is a fourth-generation Japanese-American. After graduating from college in New York, Robert joined the Marine Corps and served in Vietnam as an officer and helicopter gunship pilot. Following the war, Robert worked for the Xerox Corporation in sales. In 1977, he started a company that brought the first nylon Velcro 'surfer wallets' to market. And in 1985 he founded an international education company that taught business and investing to tens of thousands of students throughout the world.

In 1994, Robert sold his business and retired at the age of 47.

During his short-lived retirement, Robert, in collaboration with co-author Sharon Lechter,

CPA and business partner, wrote the book Rich Dad Poor Dad. Soon after, he wrote Rich Dad's CASHFLOW Quadrant, Rich Dad's Guide to Investing, Rich Kid Smart Kid, Retire Young Retire Rich, Rich Dad's Prophecy, Rich Dad's Success Stories, Rich Dad's Guide to Becoming Rich Without Cutting Up Your Credit Cards - all of which earned spots on the bestseller lists of the Wall Street Journal, Business Week, New York Times, E-Trade.com, Amazon.com and others.

Prior to becoming a best-selling author, Robert created an educational board game -CASHFLOW 101 - to teach individuals the financial strategies that his Rich Dad spent years teaching him. It was those financial strategies that allowed Robert to retire at the age of 47. The launch of CASHFLOW 101-The E game in the fall of 2003 united the Rich Dad community around the world with an on-line/multi-player game and serves as the foundation for the 2004 introduction of the electronic version CASHFLOW 202.

Complementing the books in the Rich Dad series are books by Rich Dad's Business Team on subjects ranging from corporate entities and sales skills to protecting intellectual property.

In Robert's words: "We go to school to learn to work hard for money. I write books and create products that teach people how to have money work hard for them. Then they can enjoy the luxuries of this great world we live in."

Sharon Lechter

CPA, co-author of the Rich Dad series of books and CEO of the Rich Dad Organization, Sharon Lechter has dedicated her professional efforts to the field of education. She graduated with honors from Florida State University with a degree in accounting, then joined the ranks of Coopers & Lybrand, a Big Eight accounting firm. Sharon held various management positions with computer, insurance, and publishing companies while maintaining her professional credentials as a CPA.

Sharon and husband, Michael Lechter, have been married for over twenty years and are parents to three children, Phillip, Shelly and William. As her children grew, she became actively involved in their education and served in leadership positions in their schools. She became a vocal activist in the areas of mathematics, computers, reading, and writing education.

In 1989, she joined forces with the inventor of the first electronic "talking book" and helped him expand the electronic book industry to a multimillion dollar international market.

Today she remains a pioneer in developing new technologies to bring education into children's lives in ways that are innovative, challenging, and fun. As co-author of the Rich Dad books and CEO of that company, she focuses her efforts in the arena of financial education.

"Our current educational system has not been able to keep pace with the global and technological changes in the world today," Sharon states. "We must teach our young people the skills - both scholastic and financial - that they need to not only survive but to flourish in the world."

A committed philanthropist, Sharon "gives back" to the world communities as both a volunteer and a benefactor. She directs the Foundation for Financial Literacy and is a strong advocate of education and the need for improved financial literacy.

Sharon and Michael were honored by Childhelp USA, a national organization founded to eradicate child abuse in the United States, as recipients of the 2002 "Spirit of the Children" Award. And, in May of 2002, Sharon was named chairman of the board for the Phoenix chapter of Childhelp USA.

As an active member of Women's Presidents Organization, she enjoys networking with other professional women across the country.

Robert Kiyosaki, her business partner and friend, says "Sharon is one of the few natural entrepreneurs I have ever met. My respect for her continues to grow every day that we work together."

Rich Dad's Organization is the collaborative effort of Robert and Kim Kiyosaki and Sharon Lechter, who, in 1996, embarked on a journey that would afford them the opportunity to impact the financial literacy of people everywhere and carry the Rich Dad mission to every corner of the world.

Journey to

financial

freedom

f/tic/i QOcic/

Robert Kiyosaki's Edumercial An Educational Commercial

The Three Incomes

In the world of accounting, there are three different types of income: earned, passive and portfolio. When my real dad said to me, "Go to school, get good grades and find a safe secure job," he was recommending I work for earned income. When my rich dad said, "The rich don't work for money, they have their money work for them," he was talking about passive income and portfolio income. Passive income, in most cases, is derived from real estate investments. Portfolio income is income derived from paper assets, such as stocks, bonds, and mutual funds.

Rich dad used to say, "The key to becoming wealthy is the ability to convert earned income into passive income and/or portfolio income as quickly as possible." He would say, "The taxes are highest on earned income. The least taxed income is passive income. That is another reason why you want your money working hard for you. The government taxes the income you work hard for more than the income your money works hard for."

The Key to Financial Freedom

The key to financial freedom and great wealth is a person's ability or skill to convert earned income into passive income and/or portfolio income. That is the skill that my rich dad spent a lot of time teaching Mike and me. Having that skill is the reason my wife Kim and I are financially free, never needing to work again. We continue to work because we choose to. Today we own a real estate investment company for passive income and participate in private placements and initial public offerings of stock for portfolio income.

Investing to become rich requires a different set of personal skills - skills essential for financial success as well as low-risk and high-investment returns. In other words, knowing how to create assets that buy other assets. The problem is that gaining the basic education and experience required is often time consuming, frightening, and expensive, especially when you make mistakes with your own money. That is why I created the patented education board games trademarked as CASHFLOW®.

f/iic/i f/)cu/W

INSIDERS

WHO SAYS

WATCHING TV & PLAYING GAMES will get

YOU NOWHERE?

be rich, who you know is more importan than what you know." That's why I'm pleased t<

introduce the all-new RICH DAD'S INSIDERS

• Online Real Estate Evaluator

• Rich Dad's TV

• Private Discussion Forums and Chats

• Personal Online Financial Statements

• Play CASHFLOW THE E-GAME online* with others around the world

Visit RichDadslNSIDERS.com Remember, nothing about this site is "get

gain financial freedom.

*To play the online multi-player feature of CASHFLOW® THE E-GAME requires the purchase of the CD for $99 and subscription to Rich Dad's INSIDERS.

YOU GET:

AS PART OF THIS

a members only online resource for your journe' to financial freedom.

It's like my Rich Dad said: "If you want t<

EXCLUSIVE GROUP

rich quick." It's a powerful online resource with the information you need to

© 2004 CASHFLOW® Technologies, Inc. All rights reserved. Rich Dad, CASHFLOW, ESBI, B-l Triangle are registered trademarks of CASHFLOW Technologies, Inc.

Continue Your Journey with These International Bestsellers

Rich Dad Poor Dad

What the rich teach their kids about money that the poor and middle class do not. Learn how to have your money work for you and why you don't need to earn a high income to be rich.

The book that "rocked" the financial world.

J.R Morgan declares "Rich Dad Poor Dad a must-read for Millionaires."

The Wall Street Journal

"A starting point for anyone looking to gain control of their financial future."

USA Today

Rich Dad's CASHFLOW Quadrant

Rich Dad's guide to financial freedom. Learn about the four CASHFLOW Quadrants and you will understand the most important keys to creating wealth.

The sequel to Rich Dad Poor Dad, Rich Dad's CASHFLOW Quadrant describes the four types of people who make up the world of business and the core value differences between them. It discusses the tools an individual needs to become a successful business owner and investor.

Rich Dad's Guide to Investing

What the rich invest in that the poor and middle class do not. Learn how you can apply the techniques of the rich to create your own wealth and have it grow.

This is the third book in the Rich Dad Series. Rich Dad's Guide to Investing discusses what the rich invest in that the poor and middle class do not. Robert provides an insider's look into the world of investing, how the rich find the best investments, and how you can apply the techniques of the rich to create your own wealth.

Rich Dad's Rich Kid Smart Kid

Give your child a financial headstart. Awaken your child's love of learning how to be financially free. Imagine the results you'll see when they start early!

This book is written for parents who value education, want to give their child a financial and academic headstart in life, and are willing to take an active role to make it happen. Rich Kid Smart Kid is designed to help you give your child the same inspiring and practical financial knowledge that Robert's rich dad gave him. Learn how to awaken your child's love of learning.

Become a Rich Dad's INSIDER at RichDad.com. Join Today!

Rich Dad's Retire Young Retire Rich

A powerful personal story about how Robert and Kim Kiyosaki started with nothing, and retired financially free in less than 10 years. If you do not plan on working hard all your life, this book is for you.

If you're tired of the same old investment advice - such as "be patient," "invest for the long term," and "diversify" - then this book is for you.

Robert explains in detail the power of leverage. How to leverage your mind, your financial plans, your actions and most importantly, your first steps to becoming financially free.

You will learn Rich Dad's techniques using leverage to first build financial security and ultimately have the life you want.

Rich Dad's Prophecy

Why the Biggest Stock Market Crash in History Is Still Coming...and How You Can Prepare Yourself and Profit from It!

In the 6th book of the Rich Dad Series, Robert Kiyosaki predicts the inevitable financial crisis that will hit the U.S. when 83 million baby boomers retire, taking with them such a vast amount of savings that the market is sure to crumble. And that doesn't even take into account the already wobbly state of the stock market, as blue chip companies go under, sending the Dow plummeting. But Rich Dad's Prophecy is not a "doom and gloom" book, it's a "doom and boom" book, with sure-fire strategies designed to avoid disaster in the coming crisis.

Rich Dad's Success Stories

Learn why you're never too young to achieve financial success and read the many stories from people of all ages. Each story is inspiring because instead of people now feeling entitled to have money handed to them, they are setting goals, achieving them and creating income - they are learning to take control of their lives. This book is about real life people who followed the Rich Dad lessons to take control of their financial lives.

Rich Dad's Guide To Becoming Rich Without Cutting Up Your Credit Cards

A popular TV personality often says, "Take out your credit card and cut them into pieces." While that is sound advice for people who are not financially responsible, it is inadequate advice for anyone who wants to become rich or financially free. In other words, just cutting up your credit cards will not make you rich. What does make you rich is financial education...unfortunately a type of education we do not receive in school. If a person has a solid financial education, they would know that there are two kinds of debt...good debt and bad debt. A person with a sound financial education would know how to use good debt to make them richer faster... much faster than a person who only saves money and has no debt.

IfrflkAi

GUIDE TO

BECOMING

RICH

WfTtjC0 CuniNt, Ui» Your Credit Cards

Turn Tod Debt* into'Good Debt'

By Robert! Kiyosaki

Rich Dad's Who Toook My Money?

Are you tired of the same old advice of "save money, invest for the long term and diversify?" Do you want to learn how and why professional investors increase the speed of their money, rather than park it? With job security at an all time low, it's never been more important to take control of your financial life. Conventional financial wisdom recommends you save money and invest for the long term. In other words, park your money. That was not the advice of rich dad. His advice was to increase the velocity of your money... not park your money. We all know that markets go up and markets go down. So, before the next crash comes along and takes your money again, find out how you can keep your money moving rather than parked in someone else's account.

Apply Your Knowledge with the CASHFLOW® Series of Games

CASHFLOW® 101

CASHFLOW 101 is an educational program that teaches accounting, finance, and investing at the same time...and makes learning fun.

Learn how to get out of the rat race and onto the fast track where your money works for you instead of you working hard for your money. The educational program, CASHFLOW 101, includes three audiocassettes which reveal distinctions on CASHFLOW 101 as well as valuable investment information and a video titled "The Secrets of the Rich."

CASHFLOW 101 is recommended for adults and children age 10 and older.

CASHFLOW® 202

CASHFLOW 202 teaches you the advanced business and investing techniques used by technical investors by adding volatility to the game. It teaches the advanced investment techniques of "short-selling stock," "put-options," "call-options," "straddles" and real estate exchanges.

You must have CASHFLOW 101 in order to play CASHFLOW 202. This package contains new game sheets, new playing cards, and four audiocassettes.

CASHFLOW for KIDS®

Give your children the financial headstart necessary to thrive in today's fast-paced and changing world. Schools teach children how to work for money. CASHFLOW for Kids teaches children how to have money work for them.

CASHFLOW for Kids is a complete educational package which includes the book and audiocassette titled "Rich Dad's Guide to Raising Your Child's Financial I.Q."

CASHFLOW for Kids is recommended for children ages 6 and older.

Play CASHFLOW® with Rich Dad's INSIDERS!

CASHFLOW® THE E-GAME

What's your dream? Freedom of time? Unlimited resources to travel the world? Whatever it may be, CASHFLOW the e-game teaches you how to get out of the Rat Race and onto the FastTrack. Learn about money and finances in a fun, interactive environment to make more informed choices about money in your everyday life!

• Play and compete with others across the world in the online community through the multi-player feature.

• Discover how to become rich and financially free on a small or large salary!

*To play the online multi-player feature of CASHFLOW THE E-GAME requires the purchase of the CD for $99 and a subscription to Rich Dad's INSIDERS.

CASHFLOW for Kids™ at Home

Discover CASHFLOW for Kids™, a fun game created to teach your child the subjects of money and investing. A families attitude about money is a powerful influence on a child from a very early age. The more your children play, the higher their financial IQ will become.

• Learn the difference between an asset and a liability!

• Discover the three types of income - Earned (where you work for money), Passive and Portfolio (where your money works for you)!

• Inspire an interest in the subject of money with your child!

"Move over. Monopoly® . A new board game that aims to teach people how to get rich is gaining fans the world over!"

- The New York Times, February 1,2004

MONOPOLY® is a trademark of Hasbro, Inc.

Please Help Make A Difference

Money is a life skill—but we don't teach our children about money in school. I am asking for your help in getting financial education into the hands of interested teachers and school administrators.

RichKidSmartKid.com was created as an innovative and interactive web site designed to convey key concepts about money and finance in ways that are fun and challenging.. .and educational for young people in grades K through 12. It contains 4 mini-games that teach:

Assets vs. Liabilities Good debt vs. Bad Debt Importance of Charity Passive Income vs. Earned Income

AND, schools may also register at www.richkidsmartkid.com to receive a FREE download of our electronic version of CASHFLOW for Kids at School.

How You Can Make a Difference

Play CASHFLOW for KIDs and CASHFLOW 101 with family and friends and share the richkidsmartkid.com web site with your local teachers and school administrators.

Join me now in taking financial education to our schools and e-mail me of your interest at lwill@richdad.com. Together we can better prepare our children for the financial world they will face.

Thank you!

f/iuA / Quits

Protecting Your #1 Asset - Creating Fortunes From Your Ideas An Intellectual Property Handbook

Protecting your #1 Asset will teach you how to turn your ideas into intellectual property assets, avoid inadvertently giving away your rights, use intellectual property to build barriers to competition and generate cash flow by licensing your intellectual property to others.

7M

Crating fortune, from Your Ideas

by Michael Lechter, Esq.

Micra MraifER. r.sQ.

Sales Dogs - You Do Not Have To Be An Attack Dog To Be Successful In Sales

Sales Dogs will introduce five breeds of Sales Dogs which will allow you to make more money by playing to your natural strengths. It reveals the five simple but critical revenue-generating skills to create endless streams of qualified buyers and life-long sales, and teaches you how to radically change your attitude in 30 seconds or less so you can direct your financial results.

by Blair Singer

Own Your Own Corporation - Why The Rich Own Their Own Companies And Everyone Else Works For Them

Own Your Own Corporation illustrates how to:

• Select the best entity for your own personal strategy

• Raise money for your new venture

• Maximize the incredible benefits of a C corporation

• Use employment agreements for your benefit

• Use Nevada corporations for asset protection and tax savings

• Easily prepare and maintain corporate records

by Garrett Sutton, Esq.

How To Buy And Sell A Business - How You Can Win In The Business Quadrant

How To Buy And Sell A Business reveals the strategies used by successful entrepreneurs to acquire and cash out business investments. Written in a clear and easily understandable style, How To Buy And Sell A Business provides the necessary knowledge to avoid the pitfalls and overcome the obstacles in order to achieve a winning transaction.

by Garrett Sutton, Esq.

Elevate Your Freedom with the Rich Dad Advanced Audio Series

Rich Dad's You Can Choose To Be Rich

This powerful home study course will teach you the three-step plan to riches - Think It. Learn It. Do It. The program contains a Home Study Course Binder, 12 CDs or cassettes with specialized lessons from Robert's personal team of experts, one video that will show you how to stop living from paycheck to paycheck and enjoy the power of having money work for you, one bonus audio tape that reveals the six simple obstacles people face on their path to wealth, and a debt eliminator -a practical tool to help you eliminate bad debt and build a strong foundation.

Rich Dad's 6 Steps to Becoming a Successful Real Estate Investor

This product will show you how to use other people's money to build secure passive income while you build a huge net worth. You'll find that anyone can be a real estate investor - young or old, man or woman, or poor. Learn the secrets now from Robert and Kim Kiyosaki in Rich Dad's 6 Steps to Becoming a Successful Real Estate Investor. This program contains a 104-page workbook, five audio-cassettes or compact discs, or two videocassettes or one DVD, and more!

How To Increase The Income from Your Real Estate Investments -The Secrets of Professional Property Managers

Learn the hands-on trade secrets to successfully managing any type of investment property. There are many simple and effective tips and techniques you can begin using today with How To Increase The Income from Your Real Estate Investments. Whether you're just starting out or have years of experience - the information on this program will save you hundreds or thousands of dollars. This program includes four CDs or four cassettes, a workbook with sample documents and forms to assist you in day-to-day management of your properties.

£/&c/t &)cu/W

SEMINARS

Find out when Robert will be in your area by visiting:

www.RichDadsSeminars.com

"My rich dad taught me the secrets to investing so that no matter what the market and economic cycles did, I would profit. I would like to teach you these fundamentals of investing at my upcoming seminar tour."

- Robert Kiyosaki, author of five New York Times best sellers.

Now you can experience Robert Kiyosaki live during his seminar tours across North America. At these events Robert will share the secrets that his rich dad taught him about the fundamentals of investing. Robert Kiyosaki's message is dear: "Take responsibility for your finances or take orders all your life. You're either a master of money or a slave to it."

Let Robert Kiyosaki teach you how to profit in both good times and bad.

Robert Kiyosaki Live!

Get started with your very own Rich Dad Coach today!

Working with a Rich Dad Coach will help you begin to change your understanding of how the rich get richer and how you can start leveraging your own resources to achieve wealth. Plus, your coach will help you develop a step-by-step plan and hold you to it!

Your Rich Dad Coach will help you:

• Expand your Context

• Achieve your Plan

• Write your own Rules

• Get what you Want!

COACHING

Call today to receive a free introduction to Rich Dad's Coaching

1-800-240-0434 ext 5020

To order books visit www.twbookmark.com

For more information:

CASHFLOW" Technologies, Inc.

4330 N. Civic Center Plaza, Suite 101 • Scottsdale, Arizona 85251 USA (800) 308-3585

Fax: (480) 348-1349 • e-mail: service@richdad.com

{TtichQbacl

AUSTRALIA

Australia/New Zealand:

Rich Dad ' Australia

4-6 Mentmore Avenue • Rosebery NSW 2018 Australia

TEL: 1300 660 020 • FAX: 1300 301 988 • email: info@richdad.com.au

What Others Are Saying About Rich Dad...

"Because of Rich Dad, I've learned that wealth is all around us. It's accessible and attainable. You can read books, you can seek advice...but playing the CASHFLOW game put things into perspective for me. It awakened the concept of becoming wealthy, of how rich people think and what they do. This makes me want to continue my financial education to make a better life for my family."

- Roshiem A., Arizona

"Our children Madeline (4 years old) and Makenzie (3 years old), absolutely love the interactive programs from Rich Dad. Madeline is already gaining real knowledge regarding investment and money matters through "Rich Kid, Smart Kid," which I find to be amazing at her age. It also provides a forum for me as a parent, to begin discussing and teaching some of these concepts to my small children - something I probably would not do at this stage if it were not for your program."

-Jon F., Arizona

"The concepts taught by Robert Kiyosaki and the Rich Dad Team have had a major impact on our lives and our business. As tax and business consultants, the ways we serve our clients have changed and improved considerably. Everyone in our office now thinks in terms of "doodads" and cash flow and getting out of the Rat Race on a daily basis."

"One of the greatest impacts on our clients has been the CASHFLOW 101 game. For years we have been looking for ways to instruct clients on accounting principals and tax strategies. CASHFLOW 101 is a terrific instructional tool for these concepts, as well as general investing and financial management. We play CASHFLOW 101 with clients and friends of the firm every month. These game nights give our clients the opportunity to broaden their perspective on money and investing, while allowing us to help them understand basic accounting principals money management, and tax strategies."

"Thank you for creating a marvelous teaching tool in CASHFLOW 101 and helping us change the way we look at finances for ourselves and for our clients."

- Tom W. and Ann M., Arizona

I was a project manager/engineer and had worked my way up the corporate ladder for 20 years. I was finally making good money only to find that I was getting killed on taxes. On top of that, I could not picture myself working 9-to-5 for another 30 years."

"After reading Rich Dad's Guide to Investing, it dawned on me that I was directing an engineering team at work. So why not orchestrate my own real estate investment team? My team of advisors now consists of two lawyers, an accountant, two real estate brokers, an insurance agent, three mortgage brokers, a home inspector and - one of the strongest players on the team - my wife and partner, Connie. Life's too short to shortchange yourself."

- Larry N., Mass.

What Others Are Saying About Rich Dad...

"A friend of mine introduced me to the Rich Dad books a few years ago, and I introduced them to my Dad, a farmer who was just beginning to invest in real estate. My Dad and I then gave books and tapes to my sisters...and the family was hooked!"

"We recently closed on four townhouses (a "deal" my Dad found by being open to opportunities...) and know we never would have been thinking about cash flow and passive income if we hadn't read the Rich Dad books. We all financed our properties differently and our returns on investment vary - but we're all moving in the right direction."

"It is so exciting to constantly stretch and change the way we think about money."

- Sally D., California

"Thanks to Rich Dad I have the courage and confidence to tackle life's Big Deal cards -and create true financial freedom."

- Cindy O., Texas

"We were realtors focused only on earning our commissions. And when we first heard of the book Rich Dad Poor Dad - from a "recommended reading" list given to us by our business coach - we realized that we were SELLING all the best deals...instead of capturing them for ourselves!"

"Thanks to Rich Dad we began to focus on the cash flow of our properties (instead of commissions) and ways in which we could leverage those properties to acquire more. Traveling the road to financial freedom has been an enlightening ride!"

- Curtis and Diana O., California

"A year ago I was drowning in bad debt and considering bankruptcy. I was frustrated and angry. My financial state of affairs — my financial ignorance — nearly cost me my family, my business, and my self respect."

"Rich Dad Poor Dad had such a powerful impact on me that I've bought a dozen copies and gave them to my staff, *my friends, and my college-age children. As a business owner, Rich Dad's Cashflow Quadrant helped me understand the Bl Triangle and taught me to create and implement systems that strengthen my business."

"My Money IQ is rising everyday and I can say, honestly, that the Rich Dad messages have saved me from financial ruin."

- Dr. Randy R., Ohio

What Others Are Saying About Rich Dad...

"My daughter, age 12, has been keenly interested in our pursuit of financial education as we read the Rich Dad series and play CASHFLOW 101. (She has played CASHFLOW with us and read Rich Kid Smart Kid.)"

"She often tells us of her future plans and one day we were outside gardening when she told me that when she owns investment properties she will also own a landscaping business so that she can care for the exteriors of her properties in a more cost efficient way! Her plan for the future now is to have her money work for her - through proper investing. We don't doubt it for a minute!"

- Kris P., Pennsylvania

"Three of my brothers - like me - are on fire with the Rich Dad materials! We have digested the messages and are moving full speed ahead with our lives with a deeply-renewed hope and passion! My brother (Joe) now calls himself 'Joe Freedom!"'

- Dan M.

"Robert Kiyosaki is blowing my mind away! I'm half way through the Cashflow Quadrant. I can't read enough! I have a whole new attitude - toward everything."

"I've been aware for a while that I knew damn little about money. I have been making myself read the business section of the Sunday paper for about a year and getting nowhere. I read Robert Kiyosaki's book in three days and I can see land! I love the direction and the hopeful feeling I am experiencing."

-Joe Freedom , (aka Joe M... brother of Dan M)

"I did everything my parents told me to do: get good grades, get a scholarship to pay for college, get a good job and be stable, stay at the same job..."

"My husband and I are now in our early forties, and more in debt and struggling financially than when we were in our twenties. Our eldest son is now a senior in high school, getting ready to go to college, and I don't want him to go down the same path that his parents did. My heart is heavy because I want the best for my family."

"I'm ready for another way, another path, another voice to guide me. My Rich Dad, Robert Kiyosaki, is that voice. I want to thank my Rich Dad for being there on that shelf, for lifting me out of the hopelessness I didn't realize I was living in, and for shining light on a better path for others, like me, to follow."

- Tia L., Hawaii

What Others Are Saying About Rich Dad...

"A huge thanks to Robert for helping me shift my context. It has made a huge change in how I view the world. I have been reading your materials, listening to audios, and playing your CASHFLOW games for over a year now. It has helped me grow my financial literacy so much that my husband and I have begun investing in real estate. We just purchased our first property!"

- Valerie P., Canada

"The Rich Dad books have been a life-changing experience for me. Robert has given me the faith and courage to follow my convictions and prepare my plan for financial freedom. The Rich Dad books have given me the courage to take the steps to financial freedom."

"I have purchased two properties apart from my residence and while it's tempting to repay my mortgages, I intend to leverage the equity from these properties to invest in others."

- Kay G., United Kingdom

"Thanks to inspiration from Robert and Sharon, our lives will be different from 99% of the population."

"You have been our guiding light in our quest for financial freedom. Playing the CASHFLOW game has taught me more about business than business school did! You are making a huge difference in this world of financial illiteracy and chaos."

- Merced, Jon, and Jeff H., Utah

What Students and Teachers Are Saying About CASHFLOW for Kids

"They can learn more in an hour of playing Cashflow for Kids than 10 hours of homework."

- Pam L. - Principal, Oklahoma

"I feel sorry for my mom, because (credit card debt) is hard to get out of and easy to get in."

- Carrie S. - 6th grader, Oklahoma

"One teacher asked the kids, 'If money was no object, what would you buy?' At the beginning of the day they wanted a car and by the end of the day they wanted a candy bar factory or other things to make money with."

- Michelle H., Scottsdale