1 |

The Origins of B2B |

THE OPERATING MODEL THAT SITS BETWEEN THE COMPANIES WHO supply business technology and the customers who buy it is about to be revolutionized. The proof of this premise is already presenting itself in the financial statements of suppliers from Amazon to Xerox. When the dust settles, neither party in the technology market equation will be untouched—and these days, what part of business isn’t about technology?

The Pesky Disruptor

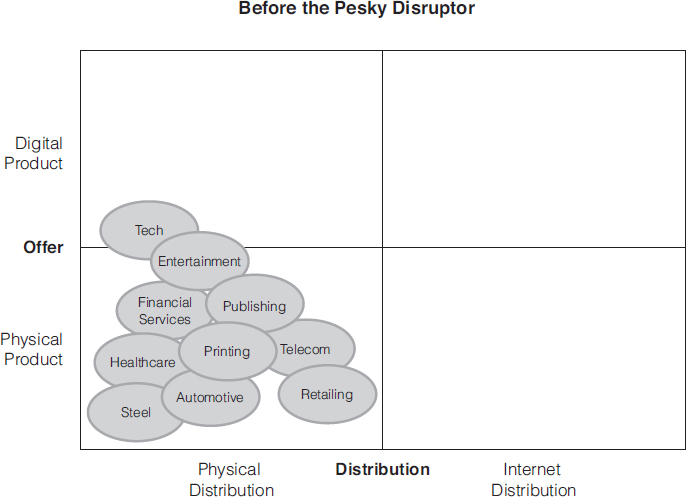

On August 20, 2011, an editorial appeared in the Wall Street Journal. The headline read “Why Software Is Eating the World,” and it was written by Silicon Valley legend Marc Andreessen. What Mr. Andreessen had to say was something simple, yet profound: It seemed to him that software, and specifically software run over the Internet, was finally achieving its potential.

As he saw it, this meant that software was playing not only its traditional role of improving the productivity of companies. It was also disrupting and dislocating some of them. It was not stopping there, however. It was now doing unthinkable things such as figuring out how to eat products that used to be physical products. And perhaps most provocative was that this brash and irreverent technology was rapidly jumping its traditional fences. It wasn’t just eating the tech industry; it was eating many industries.

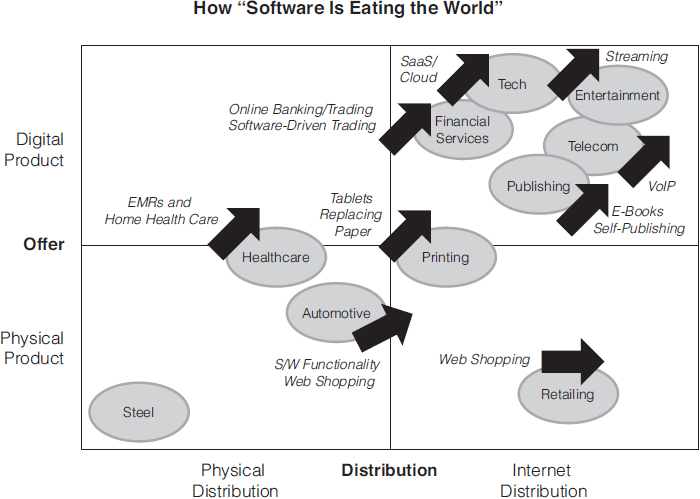

It’s hard to argue with Andreessen’s logic. Just look around the world of business today. It’s hard to find an industry that is immune to this pesky disruptor. Not too long ago, physical products that were physically distributed dominated the world of business (see Figures 1.1 and 1.2).

FIGURE 1.1 Before the Pesky Disruptor

By this definition of physicality, even the high-tech industry was not truly digital until the last decade. More than half the industry’s revenue came from hardware—a physical product that was physically distributed to customers. And although the software that ran on it was truly digital, it was demonstrated on-site by a salesperson and then physically shipped on CDs or sold to consumers in shrink-wrapped boxes at local stores. Everything was that way. You went to a video store to rent movies on CDs. You went into the bank to transfer money. If you wanted your medical records, you went to your doctor’s office to pick up your files. And then, to really summarize Andreessen’s point, the “software big bang” happened.

Dozens of industries have already felt the epic force of the software big bang. Andreessen argues that this is because, for the first time in history, the global economy is becoming truly digitally connected. This includes not only people with devices and companies with computers, but also industrial equipment and machines that talk to one another. This is enabling software and the Internet to play disruptive roles not just in the lives of consumers, but in almost every vertical and horizontal business-to-business (B2B) industry as well.

It is the rise of “near-tech.” Medical device and telecommunication product providers crossed over years ago from offering mechanical and analog solutions to their business customers. Now, embedded hardware, software, and sensor networks are revolutionizing test and measurement products, ground transportation systems, aerospace, energy, and security systems. Software, robotics, and three-dimensional (3-D) printing have revolutionized manufacturing. Cars are now shipping with sensors and software that not only will automatically bring the cars to a complete stop from cruising speed but will also help the driver keep the car in the center of its lane. Nanotechnology is revolutionizing materials development, and genetic analysis is making the prescribing of individually tailored drugs possible. It is almost harder to point at a segment of B2B that’s not becoming near-tech. Even steel is being sold in digital, online marketplaces.

The Consequences of Becoming a Software-Driven Industry

Software allows a supplier to envision and construct new capabilities rapidly and almost limitlessly. But these new capabilities have to be built, tested, implemented, trained, managed, and maintained. The underlying information technology (IT) or manufacturing systems that host and deliver these new capabilities must work together as an intricate, global web of devices and services. The employees who use them must change their skills and their business processes. As the new capabilities are rolled out, who does what, when, and why within a company’s ecosystem often gets scrambled and reassembled. Change and complexity become a way of life.

As software begins to eat away at an industry sector, it brings with it many other forces. It is safe to say that these forces, like software itself, will not stay inside the fences of the traditional high-tech industry. They are playing out in near-tech too. In each case, it tends to upset the old balance of power. Manufacturers are sometimes slow to accept how much or how quickly software could erode their revenue model or could shift the value away from the physical device they make. That makes room for smaller but more innovative companies to take a share. Resellers are often slow to adapt to the impending changes in the value chain as more original equipment manufacturers (OEMs) offer web-based, direct-to-end-customer offers that threaten to disintermediate them. Product architectures and pricing models begin changing at uncomfortable rates. Industry sectors that have had stable, predictable market conditions for years can quickly be staring into an unfamiliar future—often benefiting new entrants with new approaches. It is not just a high-tech phenomenon anymore; the number of near-tech industries is exploding, and in each one, change is accelerating.

But there may be another force of change, one that has not yet been put into a useful context. As with many others, it will be prone to jumping industry fences.

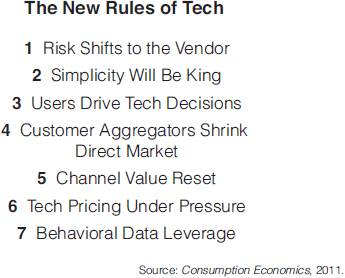

In 2011, we published a book called Consumption Economics.1 That book framed some important shifts at a time when trends were less certain than they are today. We picked seven dynamics, shown in Figure 1.3, that were emerging at different rates of speed in the tech industry but were evident enough at the time that we were confident in calling them out as “here to stay” forces.

FIGURE 1.3 The New Rules of Tech

There is not much we would change today about these assertions. In fact, most of them are assertions no longer. There are plenty of proof points. We could call the trends early because we work with 300 global tech companies every day, and we get to hear what keeps them up every night. What is interesting is that these trends are having impacts on both sides of the commercial fence. By this we mean that they are changing the operating models of both business suppliers and their customers. Just pick an industry and look at how business within that industry is conducted today. Then think about how software, sensor networks, and big data analytics are beginning to change the way both parties in the commercial transaction are operating—who does what, how they interact, how they share risk and reward. We think we are approaching a point of fundamental change in how business customers partner with their suppliers—in effect, how B2B works.

The Current B2B Model

Before we can think forward, we need to chart the basic structure of today’s B2B operating model. We need to model a “before” picture so we can contrast it to the “after” model. That made us begin to wonder: Just how did the current B2B operating model develop?

That question led us to a pretty surprising answer. We think that the basic B2B operating model—the one that is in place today between thousands of product suppliers and millions of business customers—can be largely traced to the thoughts and actions of a single individual. At least as surprising is that it was designed not 40 years ago or even 60 years ago. The B2B operating model most often practiced today was actually designed in the 1880s, more than 125 years ago.

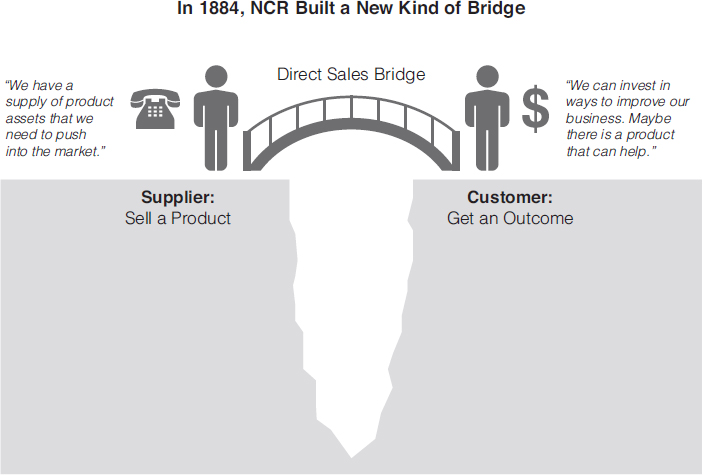

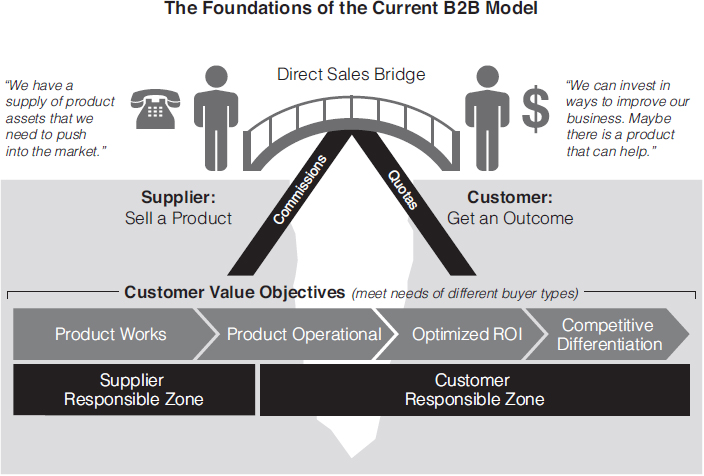

But first we need to set some context. Let’s start with something that one might readily agree is an obvious, immutable fact: There has always been a natural divide between the fundamental self-interest of a supplier and the fundamental self-interest of any of its potential customers, as shown in Figure 1.4.

Let’s start with the customer. On any given day, a company who is a potential B2B customer wants to figure out how to make more money. It seeks to build a better product, improve the skills of its workforce, design a more efficient business process, and/or outperform a competitor. It is a never-ending process for a well-run company. It constantly and vigilantly scans for opportunities to improve its operating and financial outcomes. In addition to its own internal improvements, a company knows that a world of suppliers exists that may have product or service offerings that could help the company reach its goals better, faster, or cheaper than it could do alone. Thus, companies regularly partner with suppliers and pay them in order to achieve an improved outcome.

Suppliers, on the other hand, wake up each day with a slightly different motivation. They have made an investment. It could be in factories, it could be in material, it could be in people, or it could be in all of them. They have invested in manufacturing an inventory of product assets that they need to move off their balance sheet at a profit. They need to find potential customers who may be interested in procuring those assets at the targeted selling price. In short, when suppliers wake up in the morning, they are thinking about a supply of product assets that needs to be pushed into the market. That is what they focus on.

The dance between these two parties goes on every day in the business world: suppliers wanting to push their products or services into the market and potential customers wanting to improve their outcomes. The trick has always been how to most efficiently bridge the divide in a way that is successful for both parties. For the customer, the objective is to isolate and partner with the right supplier, one that really improves their outcomes. For the supplier, the objective is to sell the most products. This dance is hardly new. No doubt it has been going on as far back as civilization began trading.

It was certainly the case in the booming United States of America in the 1880s. With the US Civil War finally settled, the South being rebuilt, westward expansion flourishing, and the Second Industrial Revolution generating breakthroughs in transportation and factory output, the US economy was in its “Gilded Age.” It was the greatest period of economic growth in US history. This was the age of the tycoon, a period during which capital investment was increasing at a tremendous rate. And none of it escaped the watchful, wishful eye of Mr. John H. Patterson.

In 1884 at the age of 40, John Patterson bought controlling interest in a 13-employee maker of cash registers called the National Manufacturing Company of Dayton, Ohio, for $6,500.2 At that time, it is believed that there were fewer than 400 cash registers in use in the United States.3 Patterson had become one of those early owners after becoming suspicious that a clerk in his coal business was taking cash from him. He bought a cash register to provide him an accurate accounting of each day’s receipts.4

After what is believed to be a brief period of buyer’s remorse (he is thought to have asked for his $6,500 back), he set about taking control of the company. He changed the name to the National Cash Register Company (NCR) and began to focus on its numerous challenges, including limited capacity, manufacturing quality problems, and weak sales. It was his focus on that last category that would make him one of the most important business figures in the post-industrial age—a man whom some would later call the “father of professional selling.”5

From the beginning, Patterson was passionate about the potential for his new technology category. He turned out to be right. “In the late nineteenth century and early twentieth, the invention of the typewriter, cash register, and adding machine changed the daily routine of the secretary, shop clerk, accountant, and bank teller. With their speed and accuracy, these and other small business machines were the computers of their day. More than mere appliances, they came to symbolize the essence of modern business practice.”6 Although broadly embraced as an essential business technology tool in fewer than 25 years (NCR sold more than 80,000 cash registers in 1910), the early days of NCR required Patterson to be bold and innovative to sell something that few customers believed they needed.

You see, in the 1880s, selling in the B2B world was largely the domain of independent representatives who carried many goods from many companies. The Industrial Revolution had spawned a new breed of manufacturer that could produce more products than could be sold and consumed in markets that were local to its factories. Hence, a model for broader geographic distribution was needed, and independent reps sprang up to fill that void. Often these independent reps carried multiple, directly competitive products at once in order to improve their chances of making sales. They relied on catalogs and order forms as the tools of their trade. Despite being poorly trained and often less than scrupulous, these reps offered affordable geographic sales coverage to product companies. This was the standard distribution model of its day, and John H. Patterson knew very early on that it would not work for NCR.

Patterson appeared to base this decision on two fundamental challenges, both of which had to do with complexity. First was the complexity of the product itself. The cash register was a modern marvel of its time. An effective salesperson would need to be able to explain its many features and even to operate the device in order to show off its capability. The second complexity lay in the nature of the selling. Shopkeepers, saloons, inns, and stores had been keeping their daily cash receipts in a drawer and recording sales on a ledger for hundreds of years. Most owners thought that process worked adequately. If NCR was to be successful, Patterson needed salespeople who could skillfully frame the business problem (in this case, theft, mistakes, and slow customer service) for a prospective buyer before they could present the NCR product. Making this all the more challenging—and thus making the need for impeccable sales execution all the more critical—was the high price of NCR’s machines. These considerations led Patterson to conclude that the sales process for his new company was not going to be one that he could entrust to those he could not control and who would not or could not be trained. He needed a new, more modern operating model—one that could handle the complexity of his technology company’s exciting new offer.

Over the next 20 years, John H. Patterson would not only build one of the most successful international companies of its day; he would also define how many manufacturing companies would sell and deliver for the next 125 years. In his need to overcome the challenges of a complex sale, he found a new way to bridge the divide between the product assets that his plant was manufacturing and the customers who wanted to improve their business outcomes. NCR began to build the first large-scale, international, direct sales force (see Figure 1.5).

Shortly after taking control, Patterson began to design and build his force of directly employed, full-time sales agents—trained, managed, and dedicated to sell NCR’s products. Some were reps for manufacturers who already carried NCR as one of their products and whom he felt were up to the challenge of his new model. Others were from outside but were recruited to take on the job in areas not staffed. This was a real innovation in its day. But Patterson turned out not to be the type to congratulate himself on a big idea and leave the details up to someone else. He was a man who was compulsive, relentless, and controlling. He was not only going to be the new model’s pioneer; he also was determined to perfect it. He innovated, refined, and progressed the sales operating model between a complex business product manufacturer and its customers.

The direct sales bridge between NCR and its customers was thoughtfully designed and managed. The two tower structures that (metaphorically) “held up” the NCR direct sales bridge were commissions and quotas. Commissions were already a well-known tactic for providing incentives to salespeople. In fact, most independent manufacturer reps of the day were 100% commission-based. What was relatively new was the addition and integration of defined, guaranteed territories with quotas. At first, quotas were set by the population in the territory, but they were eventually set by the territory’s historical sales production.7 By combining commissions and quotas into his direct sales model, he could not only provide incentive to salespeople who did well (commissions); he could also objectively tell who was not doing well and by how much (performance against quota). From this simple but elegant foundation, NCR went on to develop many of today’s commonly used sales management tactics. It began publishing stack rankings of sales performance versus quota to motivate its agents, for example. It pioneered the use of sales contests and a “club” for top performers. It also developed elaborate, motivational sales conferences that closely resemble the “sales kickoff meetings” in place at most B2B companies today.

Patterson developed a science for not only motivating and managing his sales organization, but also professionalizing them. As we mentioned, he knew that the effectiveness of each sales call—the process, the proper framing of the prospect’s business need, the product demo, and the closing tactics—was both delicate and critical. To control these variables, NCR salespeople were given scripts to memorize. The scripts were based on a four-part selling process. These became known collectively as the NCR Primer. As the product line grew more complex and the number of market segments increased, the number of scripts grew. This expanding body of codified sales practices led to yet more innovations. NCR is believed to have developed the first sales training school.8 It was also among the first to test salespeople for their mastery of the NCR Primer.

NCR also revolutionized the B2B world through innovative marketing techniques. It was among the first, and certainly among the most sophisticated, in using B2B direct mail. The invention of customer testimonials is attributed to Patterson: “These testimonials proved among the strongest cases ever devised to sway prospects. They were ‘living’ arguments to buy.”9 NCR was an aggressive advertiser and developed a radically new, much simpler approach to business advertising that stressed visual simplicity and singularity of message over the busy, artsy standard of the day. NCR was even credited as being the first company to ever issue industrial press releases.

We were hardly the first to realize that Patterson was the designer of today’s professional selling model. During Patterson’s lifetime, scholars, authors, and motivators began writing about his achievements and have continued to do so. But after working with hundreds of global technology product companies, we do not think his impact stopped there. As NCR moved along its process of discovery around direct sales, Patterson also had to figure out how many other parts of the modern direct-to-business-customer model would work. We wish to assert that his design for the operations of NCR actually determined how B2B suppliers think today—determining how they operate far beyond just marketing and sales.

Let’s take the lasting impact of a simple decision NCR made by assigning the job of collections to the salespeople. First, by requiring them to collect the money after the product had been delivered, he placed a kind of quality check on the deal. If what the customer received was not what the customer thought he or she had purchased, it was up to the salesperson to make that right. This encouraged salespeople to get the order right the first time. In a complex sale such as NCR’s—especially as its line of models and options grew—Patterson likely knew that was a risk to be managed. But more important, by assigning salespeople both collections responsibility and a demanding quota, Patterson sent a second, more profound, message to his salespeople. He was telling them to get the sale, to get the order right, to get the money, and to get out. “On to the next deal!” he seemed to be telling them.

Today’s modern B2B companies have evolved their deal quality controls. They install sophisticated “deal desks” inside their sales organizations or have expensive solution architects specifying the components that sales must include in the contract. These are the modern-day gates to mitigate the even greater risk of today’s complex business solutions. The part of NCR’s operating model that has not changed is the clear message most suppliers give to their salespeople about moving quickly from the last deal to the next one.

Because NCR didn’t want its salespeople to stick around after the money was collected, it had to figure out who would. Most assuredly with a great deal of purpose, Patterson helped fuel another lasting B2B dynamic when he had a simple sign erected in the head office of the NCR service department: “We Cannot Afford to Have a Single Dissatisfied Customer.”10 As far as we can tell, there was no similar sign erected in the head office of the NCR sales department. It seems that Patterson had decided that sales would own the customer’s revenue and service would own their satisfaction. This bifurcated approach to how most B2B suppliers think about their customer management activities remains alive and well in nearly every company we see. How cognizant NCR was of the distinction at the time or whether it was the first to draw it is immaterial. NCR added it to its operating model, and as we will soon learn, that operating model later proved to be really, really sticky.

Beyond sales and service, NCR also wrote the modern book on how to be a fierce competitor in the world of technology products. It refined the art not only of fiercely defending its patents, but also of tying up competition in costly patent infringement litigation. Patterson ordered that new models from competing companies be purchased indirectly and brought to Dayton to be torn apart. This not only gave him his legal targets, but it also allowed him to search out any true competitive innovations so that his engineers could begin to copy or improve them. He had squads of specially trained and skilled salespeople called “knockers” who were put into any sales territory in which a competitor was gaining a foothold. Their job was to “knock out” the competitor using tactics both admirable and questionable. And if his lawyers or the knockers could not eliminate the competition, NCR did what many B2B companies still do today to thwart upstart competitors: It bought them.

The list of important innovations and refinements at NCR has proved to be enduring. If anyone was the designer of the operating blueprint for today’s B2B product supplier, we believe it was Patterson. But you may ask how the actions of a single company could possibly have led to a standard for B2B commercial operations more than 125 years later? Partly the answer can be found in the vast amount of writing that was done in those days about NCR’s meteoric rise. There were many books and articles written about the company’s success and its specific tactics. Patterson himself gave many speeches around the world on NCR business practices. But most scholars agree that it was not what was written or said about NCR that made it so influential; it was the people who worked there.

Many smart people worked and learned under the tutelage and guidance of John H. Patterson at NCR. A shocking number of them would go on to become presidents of many of the most important B2B companies in the United States in the early 20th century, including Burroughs, Standard Register, Toledo Scale, National Automatic Tool, Addressograph-Multigraph, and the research laboratory at General Motors. All would carry their knowledge of NCR’s tried-and-true operating models forward and would emulate them at their new companies.

But one top NCR employee might really be the answer to your question. Similar to his contemporaries, he too brought vast numbers of NCR’s operating practices to his company when he took over as its new president.

His name was Thomas J. Watson, and the company Watson became president of was the Computing Tabulating Recording Company, but you may know that company better by its later name, International Business Machines (IBM).

It is believed that much of the construction of IBM’s vaunted Blue Suit sales force was based directly on the NCR model. IBM’s operating models, in turn, became the standard for an untold number of companies. Many experts argue that under Watson, IBM became not only the most admired company in the B2B world, but also the most copied one. With the large penetration of markets far and wide by IBM and the other companies led by disciples of John Patterson, his thinking spread. Patterson took on the tough challenges of building a successful business out of a complex product. His innovative approaches would then go on to define how many future B2B product suppliers would organize, operate, and grow revenue—in essence, how they would think. Much of that thinking was, and still is, based on a single, overarching objective: how to efficiently transfer the maximum number of product assets from the supplier’s balance sheet to the customer’s balance sheet.

The B2B Totem Pole

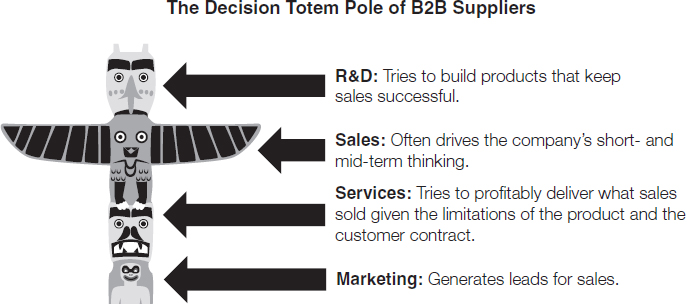

Across many big B2B and business-to-consumer (B2C) companies, both high-tech and near-tech, we see tremendously consistent patterns in how they operate. We see Patterson’s fingerprints all over them. The pattern recognition is especially high among B2B companies. Take, for example, strategy decision making. In B2B suppliers today, the chief executive officer (CEO) is obviously the final decision maker. But what really happens is a strategic thought process conducted by a collective “brain” derived from many people on the executive team. However, those people, even if they are all at the same executive level, do not always have the same influence on the collective brain. The people often have a sort of status rank, almost like a totem pole.

FIGURE 1.6 The Decision Totem Pole of B2B Suppliers

In most large high-tech and near-tech B2B companies today, research and development (R&D) and sales own the two top “heads” of the totem pole (see Figure 1.6). Which one is on top and which one is in second position on any given decision is not what is critical. What matters is that, as it was at NCR and at IBM, these same two influencers most often take the lead when B2B companies make critical decisions. At young B2B companies, R&D or engineering executives usually occupy the top spot. Once B2B companies become large, they come to have a huge investment in the sales force or reseller network that they rely on to provide a “return” in the form of revenue and growth. Together, the two influences work to keep sales channels fed with products to sell and keep optimized for coverage and quality. These become the driving considerations of the collective brain of most B2B companies. The two levers of growth are assumed to be adding products and adding salespeople.

By contrast, services and marketing are often seen as important but nonstrategic heads on the totem pole. Service quality is important because it maintains customer satisfaction and it can be a profitable adjunct to the core product business—important roles to be sure, but not strategic. Marketing in B2B companies often finds itself limited to making the sales effort easier, ideally by providing high-quality leads for the sales organization to pursue. Although B2B marketing may once have been the home of strategic planning, marketplace decision making, and business model selection, this is rarely the case today. In most B2B companies we see, those roles are ceded to the top two heads on the totem pole. Services and marketing usually occupy the spaces near the ground, not in the rarified, strategic air of sales and R&D.

A key part of the sales organization’s qualification for sitting in one of the top spots has to do with its esteemed position of speaking for the customer’s wallet. If you walk into the headquarters of most medium-size or large B2B companies today and scream, “Who owns the customer?” the answer you are most likely to hear echoing through the halls is, “Sales!” That is one of the strongest legacies of men such as Patterson and Watson. They built pioneering, world-class bridges between their companies and their customers, and in most B2B companies, those bridges were—and still are—owned by the sales organization.

Current B2B Favors Suppliers

What has not been written about is the idea that such broad adoption of the NCR/IBM operating model may also have unwittingly established a de facto standard for how business customers expect their suppliers to interact with them. We would assert that B2B supplier practices have been so consistent across so many suppliers for so long that they have conditioned customers to grade them using a scorecard that was, ironically, designed by suppliers. For that reason, the scorecard was designed to favor the supplier’s self-interest, not that of the customer. This is a critical point.

Customers accept that their primary bridge to the supplier is going to be through their salesperson (see Figure 1.7). They expect a lot of attention from that salesperson in the buying process. But they also know that this salesperson is going to be highly motivated by his or her incentive plan to focus on where the next new deal is, not necessarily to hang around and see how they are doing every day. They accept that once the deal is signed they will be seeing … well, let’s just say somewhat less of their salesperson. They then expect someone in the supplier’s service organization, who may or may not actually know what sales promised but who has been assigned the task of getting the product into production, to show up. Although it is not always pretty, ultimately that service person (or team) usually gets the asset up and running. At that point, unless there is a problem with its operation, customers know that the supplier’s presence will slowly dwindle. They now own the asset, and the responsibility for turning that operating asset into business value is largely theirs. If customers don’t use the product often or well, or if they don’t get a return from their investment in that asset, it is really not the fault of the supplier. We would argue that this de facto set of customer expectations is the result of experiencing a highly consistent set of suppliers who all operate pretty much the same way, and have for many decades. There may be variations, and there are certainly exceptions, but we would argue this supplier-customer partnership arrangement is the model most often agreed to either tacitly or formally. It has been a phenomenally widespread approach.

FIGURE 1.7 The Foundations of the Current B2B Model

But there are cracks in the foundation of this great model. B2B technology companies are now coming face-to-face with the same dilemma that Patterson did when he bought NCR in 1884. It’s our view that, once again, the standard B2B operating model is being overwhelmed by complexity.

As an example, today’s suppliers still attempt to employ “canned” product demonstrations presuming that the same demo script about the same offer can be used successfully at prospective customer after prospective customer. But many B2B product companies—especially if they have a significant software component to their product—are seeing their sales costs skyrocket. Technology product complexity, diversity, connectivity, and flexibility have rendered simple sales demonstrations almost obsolete. Instead, teams of experts from the supplier are now assembled and brought in to persuasively and effectively present how the product could best match the unique needs of a particular customer. Salespeople—and often the products themselves—must align vertically within markets, not horizontally across many industries. At other times, impromptu networks of suppliers need to band together in order to form a complete solution to a single customer’s complex challenges. And on the customer side, the idea of a single decision maker choosing a technology supplier is becoming increasingly rare. There are financial buying influencers and technical influencers and user influencers and regulatory influencers. There are procurement specialists, lawyers, and risk mitigation experts. And by the time the long and complex sales process has finally neared its end, the customer’s business needs may have changed. The increasing complexity of many of today’s B2B technology solutions is making many companies on both sides wonder: Is there a better way?

We think one bottom-line observation—unpopular though it may be—needs to be made: The standard B2B operating model was designed to optimize a supplier’s “push” of prepackaged products to customers via large, up-front deals. The goal was usually to get the maximum amount of product assets transferred from the supplier’s balance sheet to the customer’s balance sheet in one big order. But today the assumption that a customer can determine in advance exactly what it needs and then take on all the responsibility for the level of value that it gets from a complex business product is becoming less acceptable. Customers need their suppliers to step up and get into the outcome game. Who owns the asset is not the critical question anymore—in fact, customers often now view owning the asset as a negative.

Again, to be clear, we are not saying that this statement is always true in every customer-supplier partnership. What we are saying is that it is becoming increasingly true in an increasingly large number of them.

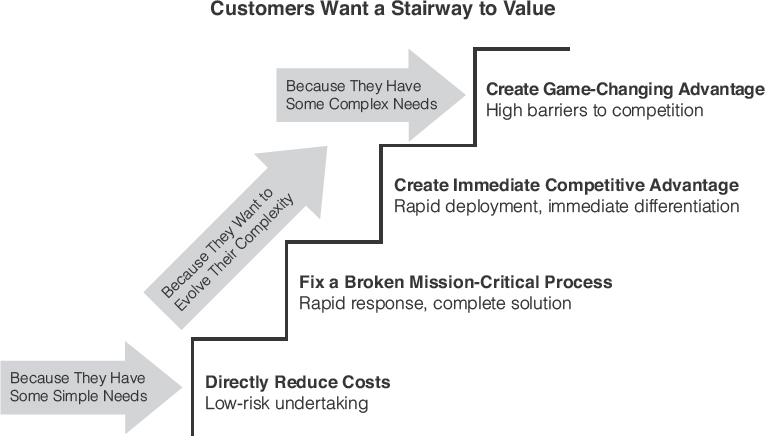

A Stairway to Value

We suggest that it is time to upgrade to a more flexible approach on both sides. We need to create a more modern B2B partnering model for high-tech and near-tech industries—one that better mirrors the current complexities and opportunities brought about by software. It should present both sides with a clear understanding of who does what and what value should be expected. It should be flexible enough to work well at different levels of solution complexity. Each step could be chosen as a permanent model for partnering, or it could evolve as the partnership becomes more complex and strategic over time.

Let’s face it: Not all B2B products are the same. Some are simple and some are not. Some are well understood by the customer’s employees, and some are not. Others are easy to use at first, but become more complicated as the customer tries to use it more aggressively. Some products “just run,” whereas others need much more ongoing management and optimization. The bottom line is that business customers need different levels of supplier partnerships for different purposes. What we need is a new partnering model that offers a stairway to value (see Figure 1.8).

FIGURE 1.8 Customers Want a Stairway to Value

The partnering model for a relatively simple B2B product offer is well understood. It is exactly what NCR designed and built and is the B2B standard with which we are all familiar. In choosing a supplier for such a partnership, customers already know all the important questions to ask:

•Is the supplier credible?

•Do I trust the salesperson?

•Does the product function adequately?

•Is it materially better than my in-house options?

•How competitive is the price?

•Is the product reliable?

•Are the warranty length and service offers acceptable?

•What are the financing options?

•Can we/they get it installed and running?

•Will it work with all the other stuff we already bought?

Experienced corporate buyers developed basic supplier selection criteria such as these over years and years of purchasing capital equipment. Customers who are versed in owning and operating particular product types can rely on their experience and judgment to sift through the answers from multiple bidders to questions such as these and arrive at the supplier choice that is best for them. And perhaps more important, they know they can rely on their experience and the knowledge of their internal staff to extract value from the assets once they own them. For these deal types, placing a large, up-front purchase in exchange for the lowest possible price makes perfect sense.

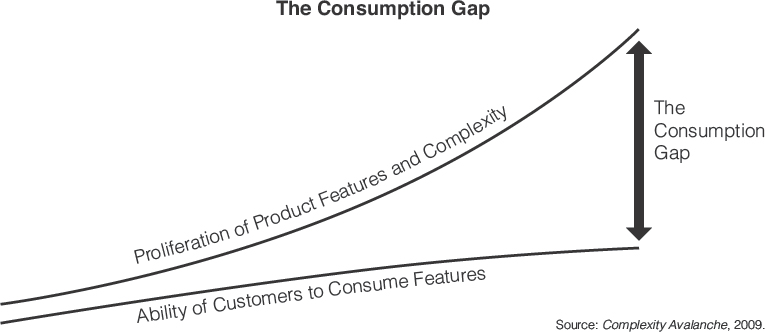

In 2009, one of the authors published a book titled Complexity Avalanche.11 In that book he drew a very simple picture that became widely circulated in the tech industry. We call it the “consumption gap” (see Figure 1.9). The notion is one that nearly everyone can identify with either as a businessperson or as a consumer.

FIGURE 1.9 The Growing Consumption Gap

Tech companies, especially those whose products have a considerable software component to them, make every possible effort to differentiate their product by adding features. They add features, and they add features, and they add features. They have legions of talented engineers, scientists, and software developers. These people are measured and incentivized by making the supplier’s products more feature-rich. From the manufacturer’s perspective, the shift to software is great news. Once a software component is added to a product, companies can create new and amazing features faster and cheaper than in practically any other form of product development: no factories to build, no dies to cast, and no natural resources to deplete. From that day, you can count on a rapid proliferation in the features and capabilities of that product. First, it’s just some basic features. Soon new features will be built on top of the last ones, and so on, and so on.

The good news is that more features means that the potential value of business technology products will increase every day. The return on investment (ROI) that they could deliver and the outcomes that they could provide grow at an increasing rate. The bad news is that much of that increased value is trapped beyond the reach of many business customers. They may not have the time, the skills, and/or the quantity of labor to fully implement the full potential of the products they purchase. Businesses today are not trying to increase the number of employees in areas such as IT or operations; they are trying to reduce them. CEOs and chief financial officers (CFOs) are actively pressing chief information officers (CIOs) and production executives to improve the return on their technology investments, and often that means reducing the costs of expensive internal resources. At most companies today, the ability to consume complexity is not going up; it is intentionally being driven down.

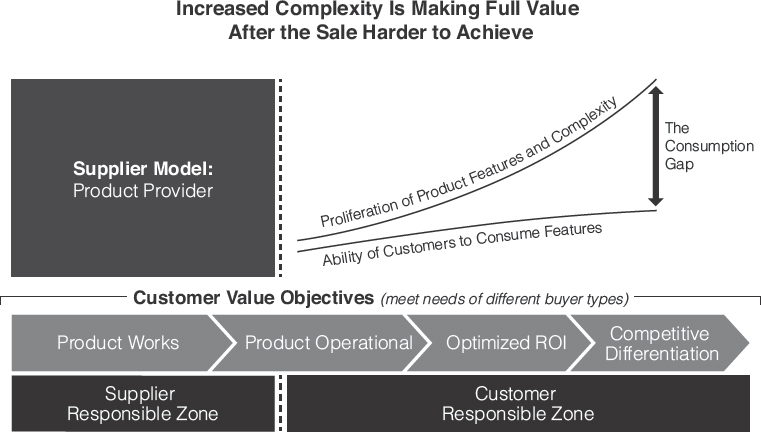

Let’s look at one of today’s hottest B2B investment areas to illustrate the case. There is a lot of talk today about the value of big data and analytics. Many businesses are investing in technology and software to make their operations smarter. But according to a recent survey,12 57% of finance executives say that their companies are “fair” or “poor” at ensuring big data and similar IT projects yield expected returns. More than two-thirds give their companies a “C” or “D” in even being able to measure the returns.13 Why are the scores so bad? Simple—because producing returns is complicated. It is probably not because these companies did not buy the right hardware or software products from their suppliers. It is probably not because those products were not installed properly. It is probably not because the suppliers were not available to fix problems if they developed. In short, it is not because the supplier did not deliver its part of the contractual partnerships. It is because owning technology products is one thing. Getting these products to deliver on their potential—to make them deliver real ROI—is another (see Figure 1.10).

The growing number of complex B2B product offers is laying bare a structural weakness in the standard B2B customer-supplier partnering model that worked so well for so long. The consumption gap is rendering obsolete the notion that the customer alone should be responsible for the outcome it gets from a product. As a result, too many business investments either never break even or produce an ROI that is too low or too difficult to identify and impossible to prove. Some CIOs are being saddled with reputations of being bigger contributors to overhead than they are to revenue and profits. Employee end users get frustrated trying to use products that simply do not work the way they need to. This often has a negative effect on productivity and morale. And in perhaps the most insidiously persistent sting of this phenomenon, the technology products—once implemented—cannot be withdrawn. As we pointed out, components rarely stay components. They are integrated into something larger. That larger thing might be mission critical to the customer. That larger thing is not easy to do without. That larger thing is costly to have in an inoperable state. In short, once the customer “goes live” with the new product, they are usually committed to it—high ROI or not.

FIGURE 1.10 Increased Complexity Is Making Full Value After the Sale Harder to Achieve

That is great news for the supplier in the current B2B model. The cost for the customer to rip and replace its product becomes prohibitive. That means the customer is committed to paying for product maintenance, parts, upgrades, and add-ons. However, that is not great news for the customer. The story in the IT industry is very well known. It is generally accepted that 80% of a business customer’s corporate IT budget goes not to adding more innovative capability, but to the maintenance and management of the current systems. Is that really the best use of the company’s capital? No right-thinking businessperson would answer yes to that question. But that is the byproduct of taking an old partnership model—one built for a time of simpler products—and pulling it forward into the age of complexity.

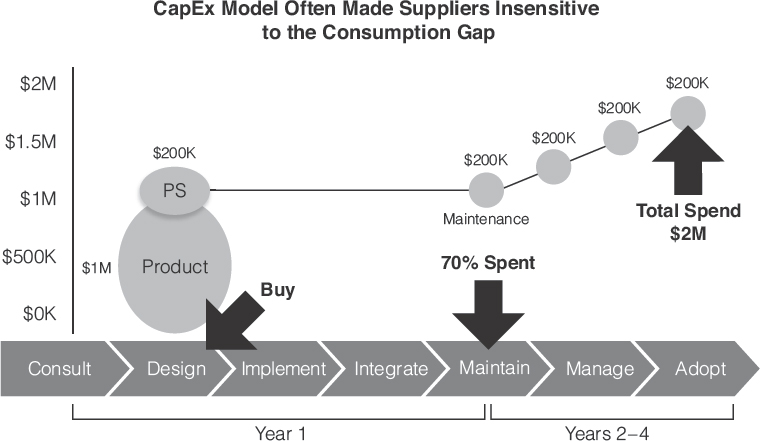

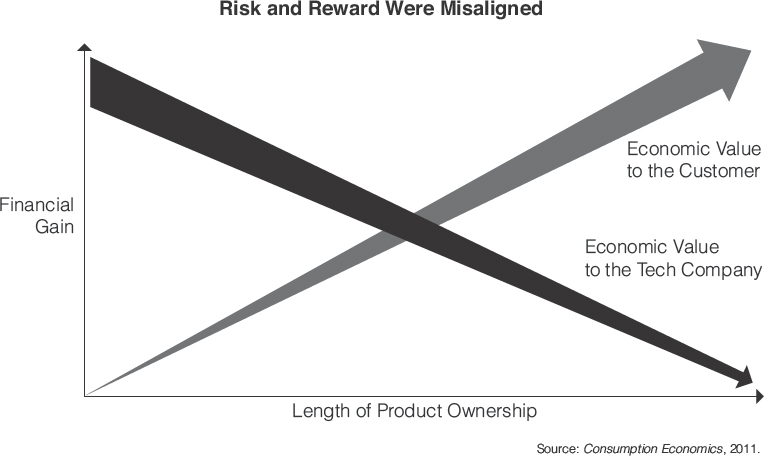

Why have suppliers not been motivated to solve this growing customer consumption gap? It can largely be explained by the economics that lie at the heart of the traditional B2B product sale. You see, most business customers agree to pay up front for the products and services they buy (see Figure 1.11).

Let’s take this example from the current B2B, capital expenditure (CapEx) partnering model. In Figure 1.11, a customer is spending $2 million over four years for a technology supplier’s products and services. The arrows at the bottom of the figure illustrate where in the ownership-cycle timeline the customer pays the supplier. In the vast majority of B2B capital equipment transactions, the customer pays for the product and installation services once they are delivered. Usually, the customer also purchases a maintenance contract from the supplier that begins once the warranty period expires. In our example, that is 20% per year. This means that at the end of the first year of ownership, 70% of the entire $2 million that the customer will spend is already transferred to the supplier. The last 30% comes in ratably over the remaining three years from the maintenance contract. We know from our research at the Technology Services Industry Association (TSIA) that the likelihood of that maintenance revenue being captured by the supplier is very high. Renewal rates for maintenance contracts can range from 70% to nearly 100%, depending on the product category.

What all this means is that until now, what “rang the bell” for a supplier was the signing of the contract. This one event locked in lots of up-front revenue and profit. Some suppliers muted the customer impact through leasing or guaranteed subscriptions, but still, the customer was fully committed once the contract was executed. After that, the supplier’s risks were minimal and the cash-flow profile was excellent. The supplier’s lever to optimize the profitability of the deal after that was to minimize the variable costs of delivery—to not become involved more than the maintenance contract’s service-level agreements (SLAs) required.

Customers, on the other hand, had the exact opposite scenario. Their financial benefit came only after the business problem had been addressed and its profitability had increased. This may have come as soon as the new products were turned on. But in many cases, realizing that return took months or years due to complexity. They were committed to paying the supplier for its products and services, but the consumption gap often meant that extracting true value was far less than a sure thing. The cold-hard fact is that, for the longest time, the risk-and-reward profile in the traditional B2B model was out of alignment (see Figure 1.12).

FIGURE 1.12 The Traditional B2B Model: Misaligned Risks and Rewards

The financial value of the partnership to the supplier was highest at the front end, and the value to the customer was highest sometime out in the future—that is, assuming they were successful at overcoming the consumption gap.

This is where you see, on a grand scale, the negative effect of dragging Mr. Patterson’s 125-year-old business model design into the age of complexity. The customer value left on the table by a B2B operating model designed simply to optimize asset transfer is incalculable. It’s not that suppliers are evil; this is simply how they optimize the profitability of their deals. They are optimizing for shareholders, not for customers. And yet through decades of conditioning, customers have willingly come to accept this model.

Years of running this complexity playbook has resulted in an “excess inventory” situation, but not the one normally associated with that term. In the traditional world of tangible products, we think of excess inventory as inventory that is sitting in our manufacturing plants or in the warehouses of our channel partners. In a software-eaten world, the excess inventory is made up of product capability that is bought, installed, and available for use within the customer’s organization, but is either underutilized or—in the worst cases—not utilized at all. Because the incentives of Patterson’s B2B model are a lot more push than pull, customers are stuffed to the gills with excess capability. This represents a massive overhang on their future purchases of the next generation of solutions.

So what kinds of activities could eliminate or substantially reduce the risk for the customer in getting faster and better returns from complex technology? Here are, as examples, three areas that we believe could radically reduce the pain:

•Radical reduction in “overhead complexity.” This means building technology products that are much easier to install, configure, tailor, integrate, and upgrade. The time and money a customer spends on these tasks are pure overhead. They create absolutely no value or return for the customer.

•Remote supplier management. What if the customer did not have to rely on internal staff to manage the product’s day-to-day performance? We are in the age of the Internet, right? Why can’t suppliers better manage their products for customers on a one-to-many basis?

•Feature control. What if end-business users only saw the features they really needed to use, and not all 5,000 that exist in the product? What if the feature set’s complexity unfolded to them as their mastery of the basics became evident? What if they unfolded intelligently based on an individual’s specific job role and in the order that upper management felt was most advantageous to the business?

There are many other things that could be added to the list of barriers to complexity adoption in a B2B context. But it’s hard to argue that these three things aren’t great examples of items that could materially help drive more rapid and more successful utilization of complex technology products. So why aren’t they being done? Why does complexity still rain heavily on a technology business solution’s ROI parade?

The answer, ironically, is simple and is a main point of this book. Customers are still accepting tasks in the partnership that really should belong to the supplier. We would submit that not one of these three things would be best accomplished from the customer side. Yet, customers soldier on. They hire systems integrators to deal with the overhead complexity that the supplier failed to engineer out of the product. They add employees who become its system administrators. They hold back from deploying entire modules or components because many of the employee end users are not ready for it.

The idea that these responsibilities are best suited to the customer in the partnership is just plain crazy. It simply doesn’t work anymore. Let’s face it: The simple “one size fits all” B2B model is dead or dying at various rates of speed. In enterprise high-tech, we would already say RIP. In other near-tech B2B sectors, the signs may not be as evident but the symptoms are worsening. Just take your own company’s temperature. Feel it?

Suppliers Get into the Game

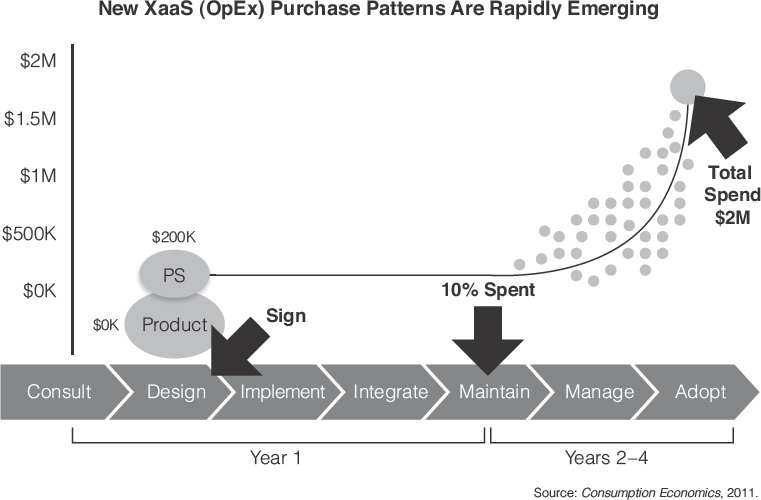

But now, something is changing—at least in the world of B2B high-tech. New pricing models are taking the industry by storm, as shown in Figure 1.13.

FIGURE 1.13 New, Rapidly Emerging “Anything-as-a-Service” (Operational Expenditure) Purchase Patterns

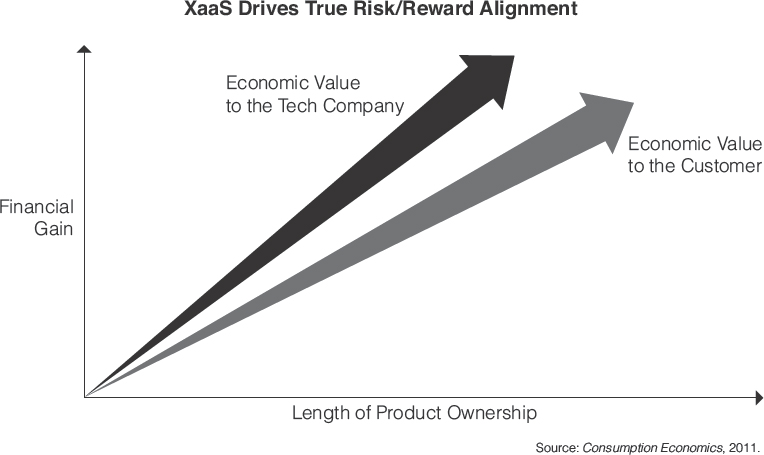

They have different names, such as software as a service (SaaS) or managed services, and different forms, such as pay-peruser, pay-per-transaction, or pay-per-unit rates (the little dots in Figure 1.13), but they all have one thing in common: The customer only pays for what they consume. There is even talk about revenue-sharing or gain-sharing arrangements. These pricing models mean that the customer pays much less up front—sometimes nothing at all. The supplier only gets to bill the customer when the customer utilizes the product. This shift away from purchasing with capital equipment budget dollars in favor of purchasing “by the drink” using operating budgets is shocking in its speed and pervasiveness. It changes the entire deal profitability profile for a supplier. Rather than being profitable from the moment the product is delivered to the customer, suppliers might not realize profitability on a deal for months or years. Thousands of suppliers are now facing the same risk-and-reward profile that their customers are (see Figure 1.14).

FIGURE 1.14 How “Anything as a Service” (XaaS) Drives True Risk/Reward Alignment

At that point, something magical happens. A switch is flipped in the collective strategy brain of the supplier. The consumption gap is no longer a theoretical problem shouldered by customers. The consumption gap is now a direct threat to the supplier’s revenue and profit. The totem pole begins to ask itself new questions, to reconsider what is strategic. The result is that maybe for the first time in more than 125 years, both parties in the B2B partnership are open to a new model—a model in which the supplier is involved in the success of its customers permanently and in real time.

This opening chapter started with one key premise: The operating model used by business technology suppliers is about to be revolutionized. After a long and successful run, “B2B 1.0” looks antiquated. We have simply gone too long without any real innovation in terms of the agreements and roles that underpin the B2B economy—especially in the high-tech and the exploding number of near-tech industries. The increasing complexity quotient of products is the straw that finally broke the camel’s back.

Customers are looking for new ways to achieve business value with their strategic partners. But how would these new models work? What would they look like? What is really about to happen to B2B?