Chapter 24

Recovering Spender Step 11:

Get Out of Debt Now!

The rich rule over the poor, and the borrower becomes the lender’s slave.

—PROVERBS 22:7

Have you ever thought about the fact that when you are in debt, you are a slave to the person you owe the debt to? Let that sink in for a minute… This may be more evident to you if you’ve ever had a car repossessed or your home foreclosed on.

When we were trying to sell our big house in South Carolina, we realized this more than ever. We thought about walking away and letting the bank take the house. There were times when we didn’t see any other option. We were owned by the bank, and no matter what we did, we couldn’t get away from that fact.

When we finally sold that house, we were so relieved. The house that was suffocating us had finally sold! I would not be a slave to the house any longer! It felt as if a nightmare was over.

Perhaps you may be in a house that is underwater, and you don’t see how you will ever get out. You don’t see hope yet. What you’ve read about in this book will change your life. You don’t have to be a slave to the lender or to your house anymore.

Debt can feel as if it’s strangling you so much that you feel stuck. I lived under that feeling for years, but developed a strategic way to pay it down.

Let’s talk about two strategic steps you need to do to pay off your debt once and for all.

1. PRIORITIZE WHAT DEBTS TO PAY OFF AND WHEN

There are so many different ways to prioritize which debt to pay down first, with many finance experts disagreeing on the best way. Some say to pay off the highest interest rate first, others say to pay off the lowest balance first. I am stuck somewhere in the middle. I understand both sides, but I also realize that there are many different scenarios.

Here is what we did. We paid off the lowest balances first, which were our small store cards that were below $500. We then consolidated the rest of our smaller cards into a zero percent card. This gave us a year at no interest to start making some big strides toward paying off that balance. We still had one large card left, so we kept that one for last. If you are wondering which method will work for you, we created a spreadsheet to test the different scenarios to help you answer that question. According to my calculations, they all ended up with you paying the balances off in relatively the same amount of time. Most examples that we tested had a difference of a month or two—meaning if you paid off the highest interest rate first, you would pay the others off one month before the lowest balance.

Below is an example of the difference between paying off the smallest balances first versus the highest interest rate. We laid out the debts, with their interest rates, in the table below. If you had an extra $200 per month to add to your debt payments after paying the minimum payment, you would pay off your debt in half the time.

You can see how by paying off the debts with the highest interest rate first, you will pay off your debt one month faster, and pay $294 less over the course of the loan.

Debts: Credit card

Balance: $1,300

Interest Rate: 13.00%

Minimum Payment: $30

Debts: Student loan

Balance: $16,500

Interest Rate: 8.00%

Minimum Payment: $200

Debts: Student loan 2

Balance: $3,000

Interest Rate: 6.50%

Minimum Payment: $50

Debts: Car 1

Balance: $9,000

Interest Rate: 7.00%

Minimum Payment: $250

If you only paid minimums: 10y, 7m

Number of years to debt freedom: 10y, 7m

Total amount paid: $41,823

If you used an extra $200 a month: 5y, 2m

Paying off balances with the highest interest rate first: 5y, 2m

Number of years to debt freedom: 5y, 2m

Total amount paid: $35,716

Paying off the smallest balances first: 5y, 3m

Number of years to debt freedom: 5y, 3m

Total amount paid: $36,010

But there is an important difference between the two. In both scenarios, the $1,300 credit card will be paid off in the first six months. However, the scenarios differ quite a bit after that. If you pay off the debts according to the highest interest rate first, you will be carrying three pieces of debt all the way into the fourth year. If you pay off the debts by the smallest balance first, you will get that smaller student loan paid off in less than eighteen months, and then you are down to only two debts. Halfway through year three the car is paid off, and then you are only attacking that last debt.

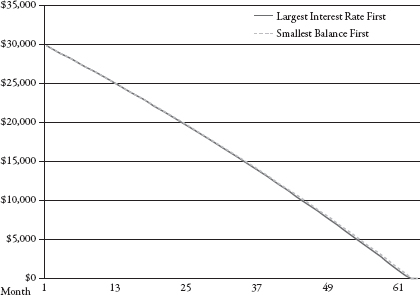

It’s those little wins along the way that keep the momentum going, and it’s hard to feel like you are winning when you are still hanging on to three out of four debts into your fourth year of paying down debt. As you can see in the chart below, it is visually and mathematically not much different.

The main difference is the mind-set, and if there is one thing that you’ve learned throughout this book, it is that the mind is a crucial part of winning the battle.

Two questions that I typically get, both of which are equally important, are, “What if I can’t afford to make my minimum payments?” and “How do I stick to a budget when I don’t make enough money?”

If you are not currently making enough money to pay your bills, you should prioritize based on what you need most for survival. These types of bills include those for clothing, food, shelter, and heat and electricity. Don’t pay your credit card minimum before you buy your groceries. Once you have paid for all the necessities, then start looking at your debts and pay them in the order of lowest balance to highest balance.

This is the order that Mark and I paid down our debts, and it made the most sense to us:

1. Personal loans.

2. Credit cards (starting with the lowest balance).

3. Car loans.

4. Student loans. (Remember to pay these on time, since they can garnish your wages if you don’t.)

When debt collectors start to call you, just calmly tell them that you cannot pay this month because you are going to be feeding your family instead.

In an interesting 2014 article in the New York Times, “A Debt Collector’s Day,” Jake Halpern discussed his experience working at a debt-collection office as part of an investigative piece on the industry. When creditors cannot collect money from someone with an unpaid account, they sell them for pennies on the dollar to third-party debt collection companies. Halpern said that the collectors at his office “tend to be young men, often with troubled pasts.” These debt collectors are out for blood, because their money is on the line and they have to get it back. Halpern wrote, “It is middle-class and poor people, being pitted against even poorer people, to the benefit of much richer people.”

Something is very wrong with this system. But if you have debts, it is your responsibility to pay your bills. As a Spender, it was easy for me to ignore them and wish them away, but I always felt the sting of guilt. I knew that I had to pay them off, because I had gotten into that mess.

2. MAKE EXTRA CASH TO PAY DOWN DEBT FASTER

There are so many ways to make extra cash that are right under your nose. I started taking online surveys for companies that would pay me for my time with a check in the amount of $3. I would save that check until I didn’t have any money left in our Miscellaneous budget, then take it to the bank and cash it. The cashier may have thought I was batty for being excited over a $3 check, but to me it was worth so much more. I would take that $3 in cash, go to Dunkin’ Donuts with my son, and get a $2 coffee for me and a donut for him. It was a small luxury that was worth far more than the $3 cash it took to purchase. It meant that I was truly changing as I made sacrifices to better our financial future.

I definitely didn’t get rich taking surveys, but it helped make me a few hundred dollars extra per year. While sitting down and watching TV at night, I would have my laptop open and take those silly ten-to fifteen-minute surveys online.

Some of my favorite companies were:

I would also drive to marketing research offices and participate in focus group studies. I would sit in a room with a double glass wall along with a dozen other participants and earn $100 for doing so. One time I got paid for eating two different kinds of Chinese food. Another time I had to have a discussion about my religious beliefs and how I felt about using antibiotics in commercially raised chickens. I enjoyed these experiences, and it helped us pay down our debt faster.

With so many people working full-time online, there is a huge demand for professional virtual assistants. I employ four stay-at-home moms in my business, and they get to work from home and enjoy being around their kids. I would highly recommend looking into working online as a virtual assistant, taking at-home online surveys, or looking for another type of online job. Due to my experience, I always warn about pyramid and direct sales companies. The first-level customer for these types of companies is the consultant. They try to sell to you first, then you sell to your customer. If you are a Spender, I do not recommend you join one of these companies. It is just too dangerous for you.

As a Spender, that rush you felt when spending can be transformed into a new type of rush from earning money. Not that I suggest replacing one addictive behavior with another, but I am talking more about where your focus should be. There are so many programs available to make a little extra, and when added up they can mean a lot of extra money.

One married couple, Ruth and David, joined my course together. They had over $40,000 in debt and joined the course to learn how to get out of debt and meal plan. They had tried to budget before, but were so overwhelmed by medical bills that they gave up. Due to a huge medical crisis, one of them lost their job and their medical bills grew out of control. In the seven weeks going through my Financial Renovation course, Ruth and David paid off over $9,000 in debt and put over $1,000 in an emergency savings account.

They learned not only how to save money, but also how to make extra money. They stopped seeing themselves as “stuck” in their current financial situation, and started seeing new opportunies.

They learned how to sell the things around their house on eBay and were able to make an extra $4,000 to pay down debt.

They said that “the real power of the course is the personal connection you make with us. You’re just a normal person saying commonsense things, but seeing how you did it and relating to your experience is inspiring. It kept us invested in the program. Whenever a question comes up on our finances we don’t necessarily see eye to eye on, we ask, what would Lauren say?”

Ruth and David see a bright financial future for their family. They continue to budget and meal plan, and are paying off more and more debt every single month.

Be like Ruth and David. Do not be a slave to your lender any longer. Once you become debt-free, you will have options and freedom you never dreamed of. Focus on that as you work toward this happy goal.

Swagbucks

Swagbucks