Had a person in the year 2005 suddenly received a morning paper dated 1905, the lead story on page one would have been quite familiar. Officials of a corporation with huge cash reserves had been treating the company’s coffers as their own private piggy banks, using the funds for personal indulgences and illicit campaign contributions. Only the names of the firms and the officers would have been different. Instead of Tyco, Enron, and WorldCom, they would have been Equitable Life, the Prudential, and New York Life, whose executives had diverted money to risky schemes and illegal political contributions, and supported extravagant lifestyles. Magazines that until then had taken a very respectful attitude toward insurance now began examining the seamier side of the business. Thomas Lawson, the former financial pirate turned muckraker, laid bare the inner workings of the insurance industry in Everybody’s Magazine, while Burton J. Hendrick provided “The Story of Life Insurance” for McClure’s.

As much as any issue of the time, insurance scandals grabbed the attention of the middle classes. Average people might not understand the intricacies of vertical integration in the steel industry or the complex financial underwritings of the big banks, since they had little personal contact with either U.S. Steel or J. P. Morgan & Company. Insurance, on the other hand, hit close to home. In 1905 more than ten million people owned over twenty-one million whole or term life policies. Most of these policies insured men, with their wives and children as beneficiaries, so that usually at least four people had some form of interest in each policy. This meant that roughly half the population of the United States at that time had a real, and not an abstract, concern for the safety of the financial reserves that stood behind their policies. The public may have recognized life insurance as a business, but they also saw it as a form of service—and a very conservative service at that—which operated in the interests of the policyholders. Policies constituted a form of bond in the company, and their owners expected the companies to take very good care of those investments.

Insurance official and playboy James Hazen Hyde, 1904

George Perkins, an executive of the Equitable, declared that “our profession requires the same zeal, the same enthusiasm, the same earnest purpose that must be born in a man if he succeeds as a minister of the Gospel.” According to the president of the Prudential, a spirit of “beneficence and ingrained love of the golden rule” infused the insurance business. Although Henry Hyde, the founder of the Equitable, had in fact been fiscally responsible, his son saw the company as a birthright to be used to support his lifestyle. James Hyde had a flashy coach-and-four, red-heeled patent leather shoes, a violet boutonniere, and nothing but disdain for those not blessed with his charm and wealth. On 31 January 1905, Hyde threw a lavish Louis XV costume party as a coming-out ball for his niece and charged it to the company. Unfortunately, others in the insurance business had the same attitude.

The scandals provoked not just legislative outcries and investigations, but demands for reform from policyholders. One such group, the New England Policy-Holders’ Protective Committee, asked Louis Brandeis to represent it.

NEW ENGLAND POLICYHOLDERS had nearly $ 1 million in annual premiums at stake in the Equitable alone and realized that in the face of ongoing allegations, they would need a great deal more information than they had in order to protect their investments. The policyholders formed the committee on 18 April 1905 “for the purpose of advising themselves as to the condition of the Company.” Many of the businessmen on the committee knew Brandeis, either as clients or because of his activities in the Boston Elevated and sliding-scale reforms. William Whitman and Edwin Abbot approached him, and he had a “stormy session” with them before they would agree to his demand that he serve without compensation. Brandeis recognized that the issues involved far more than just the protection of private policies, and while he did not yet know how the various interests fit together, he wanted to retain the freedom to serve as counsel to the situation.

As usual, he began by collecting facts. Because of the system of underwriting, that is, of smaller companies in effect insuring their risks with larger companies, the big three—the Equitable, the Mutual, and New York Life—controlled nearly half of the assets of the ninety chartered legal reserve insurance firms in the country. All told, American insurance companies had assets of more than $12 billion in 1905, and control of this wealth meant not just financial clout but political power and the ability to influence industrial policy through the financing of new corporations. Given the daily stories in the newspapers and journals of the time, it took Brandeis only a month before he delivered his first report to the committee. “The disclosures already made indicate a failure to perform fully the sacred obligation assumed by those who have managed this great trust. Neither the recovery of the profits wrongfully diverted nor mere substitution of other officers, however scrupulous and efficient, can afford an adequate remedy for the evils disclosed.” Radical changes, he concluded, had to be made in the system itself.

But that would be the long-term solution. In the meantime, the committee and others like it would have to push for full disclosure of the companies’ financial statements, the end to large salaries and moneys that could be diverted for private use, and the replacement of the current directors with men committed to protecting the policyholders and the public. Brandeis welcomed the news that similar protective committees had sprung up in other cities and states, because the greater the dissatisfaction expressed by the policyholders, the stronger the pressure would be on the companies to mend their ways. Because he needed “all the facts that surround,” Brandeis did not look just at the abuses; the journalists and legislative investigations had already done much to uncover the misdeeds of company officials. Brandeis wanted to know how insurance worked, and what he learned outraged him.

Life insurance, as Moody’s Magazine noted, “is a very simple business proposition, easily understood.” While actuaries could not predict the length of any single life, they could predict the duration of a large number of lives. If one took, for example, one thousand people born in the same year and then looked at how long they lived, the statistician could come up with an average life expectancy and the median age at which people in this group died. For example, if that number were sixty-three, then one-half of the sample would die before their sixty-third birthday, and one-half would die after that date. Simple arithmetic would then determine how much of a premium should be charged. Theoretically, the amount paid in before that sixty-third birthday, together with money earned on those premiums, would equal the benefit paid plus enough to cover administrative expenses. While for those who died earlier the full amount of the policy might not have been paid in and earned, this would be made up by those who died later and thus paid in more.

In an age before either public or private pensions, insurance served more than one purpose. A man taking out a whole life policy on his life might want to ensure that in case he died early, there would be money for his widow to live on, or to pay off the mortgage, or to educate their children. But if he lived a full life, the cash value built up would be the money on which he could retire. For members of the middle class without large sums of capital to invest in industrial stocks, life insurance policies constituted their savings, and this explains why, more than any other scandal of the time, the abuses in the life insurance industry aroused such a public alarum. The failure of the companies would jeopardize the life savings of millions of people.

ALTHOUGH A SALARIED PERSON or a small-business man could afford to pay the premiums on a whole life policy on an annual or perhaps even quarterly basis, workingmen and workingwomen often could not. The premium on the policy would have taken too large a share of their income from factory and mill workers who could barely make ends meet. They, too, however, needed insurance, especially given the daily hazards they faced in the workplace. To meet this demand, the insurance companies created a form of term insurance, that is, policies with no accrued cash value that would remain in force only as long as the policy owner paid the weekly premiums. For many working people this seemed an ideal solution—lower coverage, to be sure, but at a much lower price, and the premium could be as little as twenty-five or fifty cents a week. In addition, the agent who sold the policy would come around to the house every week to collect the money and stamp the policy book.

Once Brandeis began digging into the facts, he learned that out of every dollar collected in industrial insurance, forty cents went to officers’ salaries, agent commissions, and stockholders in the form of dividends. Moreover, out of every twelve policies written, the companies would have to pay a benefit on only one. Workers laid off could not afford to continue premiums, and the company would cancel the policy, leaving the insured with nothing. (On regular policies a cash value accrued, and if the policyholder missed a premium, it would be deducted from the cash value, and the policy would remain in force. If a policyholder for one reason or another wished to terminate the policy, the company would pay out the accrued cash value.)

The Armstrong Committee, empowered by the New York legislature to investigate the insurance abuses, began its hearings on 5 September 1905 and for the next four months laid bare the sordid practices of those who termed themselves “trustees of the most sacred trust on earth.” Many insurance executives and their board members suddenly came down sick or discovered that business required them to go out of town the day before their scheduled testimony. Charles Evans Hughes, the New York attorney who served as counsel to the committee and who would later be Brandeis’s colleague on the Court, forced those who did testify to reveal their high salaries, their costly perquisites paid for by the companies, their diversion of funds, their power in the financial markets, and their large and often illegal political contributions. He revealed company methods aimed at confusing small policyholders and defrauding widows and orphans out of even a minimal payout. The information Hughes elicited from the companies not only confirmed Brandeis’s concerns about industrial insurance but showed that the abuses went even further than he had suspected.

Once the officials took the stand, one revelation followed another. The aging U.S. senator Thomas Collier Platt of New York acknowledged receiving cash contributions to his campaigns from the insurance companies, and in return for that money he admitted that he had “a moral obligation to defend them.” John R. Hegeman, president of the Metropolitan, confirmed under oath that workingmen paid twice as much for the same amount of insurance as did regular policyholders. As for the part that industrial insurance played in a company’s profit structure, Haley Fiske, the Metropolitan’s vice president, candidly admitted that the companies made little or no profit off of their regular policies. When Hughes asked if that meant all of the profits came out of industrial premiums, Fiske said, “Oh, yes, sir.” James Craig also confirmed that nearly forty cents out of each dollar went toward “expenses,” which included profit.

In talking about the Metropolitan in its final report, the Armstrong Committee declared:

The Industrial Department furnishes insurance at twice the normal cost to those least able to pay for it; a large proportion, if not the greater number of the insured, permitting their policies to lapse, receive no money return for their payments. Success is made possible by thorough organization on a large scale and by the employment of an army of underpaid solicitors and clerks; and from margins small in individual cases, but large in the aggregate, enormous profits have been realized upon an insignificant investment.

In short, industrial insurance amounted to little more than a legal racket to steal from the poor.

The committee, however, while identifying the evil, had no solution to propose other than a “special investigation.” Moreover, the members seemed to accept that “the most serious evils”—namely, excessive premiums, enormous lapse rate, and agent hardships—”seem to be inherent in the system.” Perhaps branch offices might be established to do away with agents, “but the opinion of those connected with the companies is that such a plan would be impracticable,” and the committee had no information to gainsay that assertion.

BRANDEIS SPOKE TO the Commercial Club of Boston on 26 October 1905, at the height of the Armstrong Committee hearings, and the speech foreshadowed important developments in his thought over the next several years. In the audience sat many of the leading businessmen and professionals of the city, all of whom had a vested interest in the financial reliability of the insurance companies. They did not stand alone in their concern, he told them, since one-half of the total population of the country had ties to one or more insurance policies, either as the insured or as a beneficiary. Moreover, while they undoubtedly knew that insurance involved large sums of money, they may not have recognized the great size of that amount. The aggregate of all policies then in force came to nearly $13 billion, more than the entire value of all the railroads in the United States. Each year the American people paid in more than $465 million in new premiums, and the ninety reserve insurance companies in the country held assets of more than $2.5 billion, three times the total assets held by the 5,331 national banks in the country. The premiums, and the investment of these enormous assets, gave insurance companies an annual return of $613 million, more than the annual budget of the U.S. government.

While the companies occasionally wrote policies for $1 million, the average policy written by the big three averaged a little more than $2,300 on whole life policies, and less than $200 on industrial policies written for workers. Life insurance, therefore, “is in the main held by what we term ‘the people’—that large class which every system of business and of government should seek to protect.”

In this speech Brandeis, for the first time, began talking about what he would eventually call the “curse of bigness,” although his thoughts on that subject had not yet matured. It is apparent that the very size of the insurance industry overall did not bother him; after all, people from all walks of life needed insurance, and no matter how many private companies, benevolent associations, and fraternal organizations were involved, the total amount of coverage, and the annual premiums, would add up to large numbers. What he began to complain about in this speech is the power that huge assets gave to large individual companies. The Equitable, the Mutual, and New York Life controlled assets of $1,247,331,738, and this constituted what he termed “quick capital,” that is, money that could easily be applied to one project or another, or transferred about.

We have in the United States other great aggregations of assets, he told the audience, such as in the steel trust, the oil trust, the beef trust, and the transcontinental railroad systems, and in these combinations “our people recognize a menace to our welfare and our institutions.” This idea, that bigness in and of itself threatened democratic society, had been in the air for many decades. Many progressives had been discussing this notion, but this is the first time that Brandeis explicitly made this connection. He did not pursue it in this talk, but over the next several years he would think about it a great deal, developing a coherent philosophy about the menace of large-scale businesses to democratic society.

Another idea first seen in this speech would later develop into his attack on those who used “other people’s money.” The assets of companies like U.S. Steel and the railroads resided primarily in their physical plants and facilities, but insurance companies’ assets lay in free capital, and how they used this capital gave them great power over companies that needed to borrow money for plant expansion or to issue new stocks to enlarge their businesses. Prudence, and a care for the moneys invested by their policyholders, should have dictated conservative investments, such as mortgages on real estate. In fact, less than one dollar in fourteen had been invested in real estate. They had used the rest—the enormous amount of quick capital at their disposal—to support business ventures sponsored by the great banking houses, such as the Morgan firm.

People needed to know, Brandeis explained, that the important banking and investment houses had far less capital available than did the big three insurance companies, and so financiers eagerly courted the officials of the insurance companies to divert their funds to new, and occasionally risky, ventures. It had been insurance money that had made possible J. P. Morgan’s effort to create a rail monopoly in the Northern Securities Trust or a shipping monopoly in the International Mercantile Marine Company, and that had financed E. H. Harriman’s and Jay Gould’s ambitious railroad plans. To ensure continued complicity and access to their funds, the officials of the insurance companies had been invited to sit on the boards of directors of companies into which they invested money, and these interlocking directorates—another target that Brandeis would later attack—did not serve the interests of the investors, but lined the pockets of the insurance directors. (The foppish James Hazen Hyde, for example, sat on the boards of forty-eight other companies, not because of any business acumen, but simply to ensure that money from the Equitable would continue to flow.)

If the only sin of the insurance officials had been bad judgment in choosing how to invest the policyholders’ money, that would have been contemptible but not criminal. But the Armstrong investigation showed that officers of the big three had falsified the books to hide large outlays of money for personal use (such as the purchase of a $12,000 rug for the office of the president of the Mutual), that they had hidden the fact that risky stocks remained in their possession after claiming that they had been sold, that there had been fake sales—one of which involved a $600-a-year messenger in the Equitable who had given his personal note for $3.3 million in order to “purchase” a block of foreign investments—and that the companies had persistently lied about such matters. Hundreds of thousands of dollars diverted to campaign contributions wound up listed on the books as real estate expenses. The overhead expenses of the companies ran far higher than any reasonable person would allow, and inflated salaries deprived the policyholders of what should have been assets reserved for their benefit.

Brandeis objected to all of these practices not just because of their illegality but because of their immoral nature and their violation of a trust. “The degree of guilt involved in such transactions,” he angrily declared, “will be appreciated only when one remembers that the life insurance business beyond all other in the world rests upon confidence—confidence that in the remote, indefinite future the present sacrifice of the policy-holder will bring protection to widow and children.” It is this moral underpinning that attracted so many clergy and social workers to his side in his battle to reform industrial insurance. John Graham Brooks, one of the leading social reformers of the time, rejoiced that the moral depravity of the insurance companies had finally shocked the public into awareness. “We need a moral reawakening about this workingmen’s insurance,” Brooks declared, “quite as much as about our political evils.”

If Brandeis had been indignant at the companies’ abuse of financial trust on whole life policies, he grew livid when he turned to industrial insurance, those small policies paid for by working people on a weekly basis, and he detailed the facts of high commission rates, lapsed policies because of irregularity of employment, and the exorbitant rate that the poorest segment of the community had to pay for a necessity of life.

In contrast to the poor performance of insurance companies in managing their policyholders’ money, Brandeis offered the example of the 188 savings banks in Massachusetts. Together they held about $675 million in assets, about half the aggregate of the big three insurance companies, and they took in new deposits about one-half the amount paid in by new premiums. Yet they managed this money not only wisely but at a fraction of the cost—one-thirtieth to be exact—of the insurance companies. Moreover, the “faithful treasurers of the 188 modest Massachusetts savings banks, supervised mainly by obscure but conscientious citizens,” earned a higher rate on their assets than did any of the large insurance companies.

To restore confidence to policyholders, Brandeis proposed tightening state regulations over insurance companies’ use of policyholders’ moneys, abolishing lavish commissions, protecting policies from involuntary forfeiture, what we would now call greater transparency as to the officers and directors and the ties they had to other firms that used the reserve funds, and fuller disclosure in financial reports. At the time each state had its own insurance regulations, since an 1869 Supreme Court decision had held insurance not to be a matter of interstate commerce. In February 1905 the Republican senator John Dryden of New Jersey, who also headed the Prudential, had introduced a bill to license insurance companies under federal authority. The insurance companies, Dryden asserted, would much prefer one set of regulations instead of forty-six, “for that would make it so much easier to shape policy.”

Alice, Elizabeth, and Frolic, ca. 1908

Brandeis, however, objected to federal supervision, and here again we see the beginnings of a theme that he would enlarge upon for the rest of his life. Just as he opposed bigness in business, so he resisted bigness in government. The Dryden bill, among other things, lacked many of the features that existed in Massachusetts to protect the policyholder and did not add a single provision to safeguard the policyholder’s investment. But even if the Dryden bill had been a better measure, he would still have opposed it, and he quoted from Frederick Hapgood Nash, the assistant attorney general of Massachusetts, words that would echo in his own writings for years to come: “The wisdom, discretion and honesty composite in fifty States and Territories are more to be valued than the excellence of one person appointed at Washington. State supervision is good or bad, according to the merits of the best of the commissioners. Federal supervision must be good or bad, according to the qualities of one man who is unchecked by the work of co-ordinate officials.”

Brandeis did not address the issue of whether insurance companies did interstate business; he knew they did. But he always believed in putting governmental responsibility as close to home as possible. People could watch over the actions of local and state officials far better than they could someone off in Washington; the officials would know that this oversight existed and therefore act more responsibly. Later on the Court, Brandeis would be a fierce defender of federalism, but the die had been cast years earlier.

THE POLICY-HOLDERS’ PROTECTIVE COMMITTEE immediately published the speech as a pamphlet, and Brandeis himself made sure it received wide circulation. Although he had told his father that there had been considerable work of late with public and private problems, including gas, railroads, and city affairs, his mind kept going back to insurance reform. He had made some specific recommendations for tightening state regulation, but even if all were adopted, the beneficiaries of those measures would be those who owned whole life policies. The workers who bought industrial insurance would not be any better off, since their problem concerned not how the company used assets but the high cost they paid for small policies and the high lapse rate resulting from their inability to make premium payments during slack seasons. While he had referred to the savings banks in his talk, Brandeis had not proposed that they become involved in insurance, a function that had never been part of their business before. It is impossible to determine at what point he began thinking about selling life insurance through savings banks, but we can tell when he began to act on it.

During his work for the Policy-Holders’ Protective Committee, Brandeis had received a letter from Walter Channing Wright, an actuary and the son of Elizur Wright, who had been a leading abolitionist and an insurance reformer in the 1860s. Walter Wright had suggested that his services might be of use to the group. On 3 November, Brandeis wrote to Wright proposing that they meet soon and talk “about a matter which in the first instance is of a public nature, but which I think may ripen into a matter in which your services will be required professionally.” A few weeks later they met, after which Brandeis spelled out the essential parts of what he would always consider his most successful reform effort, savings bank life insurance.

Brandeis started with a basic assumption shared by many people, that “the business of life insurance is one of extraordinary simplicity,” the successful conduct of which “requires neither genius nor initiative.” One did not even need unusual business judgment, just “honesty, accuracy, persistence, and economy.” He also believed, as did many others, that industrial insurance had been the greatest wrong uncovered in the scandal. To provide low-cost insurance to workers, one remedy would be to have the state sell insurance in small amounts, but he immediately dismissed state intervention of this sort as “undesirable.” He had, however, found a solution that would not require state action, would not need a brand-new infrastructure, and would be tied to an industry with a proven record for “honesty, accuracy, persistence, and economy”—savings banks.

Dating back to 1816, the state’s savings banks were the oldest in the country, with roots deep in the community. They had no stockholders, but operated as a quasi-public trust governed by nonsalaried trustees. To create an insurance adjunct to savings banks would benefit everyone. The banks would get new customers, who would be willing to buy insurance there because of the banks’ reputation for fiscal integrity. An insurance department could be introduced with minimal expense; there would be no agents, no separate buildings, no significant increase in overhead. Moreover, because one did not have to create a wholly new institution with all of the attendant costs, even if the plan did not work out, the banks themselves would not suffer the financial or moral costs of failure.

Before he could even begin to talk about this plan with bank and business leaders, Brandeis needed facts. There would, he assumed, be a relatively small cost in collecting premiums, since workers would make them by coming to the bank, just as they did now to make a deposit or withdrawal. There were, however, certain expenses unique to insurance that would be outside the purview of banking experience, such as the costs of a medical examination, expenses incident to the proof of death, and the actuarial expenses needed to set up the rate schedules. Some or all of these first two expenses might be charged to the policyholders.

Brandeis wanted a plan that would do away with the forfeiture of policies because of a single lapsed payment. Failure to make a payment should trigger some mechanism whereby the policyholder had the premium charged to a cash value, or received a reduced amount of insurance until he could make the payments. Would it be possible, he asked Wright, to have a person buy different amounts of insurance, so that if a worker had extra money, he could increase his insurance without having to take out a whole new policy? Finally, should the policyholder wish to surrender the policy, there ought to be a way that he could recover at least the amount of premiums paid in. “In other words,” Brandeis told Wright, “make the investment of insurance practically convertible into a savings bank investment.” He also wanted to know whether there should be a limit on how much insurance a person could buy. At present most companies would not sell more than a $150 or $200 industrial policy, while many savings banks had a maximum amount that could be deposited in an account, usually $1,000. If it would be feasible, Brandeis wanted workers to be able to buy up to $1,000 in coverage.

Clearly, a bank could not undertake such a program without a minimum number of people signing up. Wright had suggested that at least three hundred policies would have to be issued to make the program sound. If this number were correct, Brandeis thought, then it would be possible for even the smallest savings bank to undertake the plan, and the scheme could be enacted through a general law, allowing individual banks the choice to establish an insurance department; there would be no compulsion.

Brandeis had no illusion that the plan, even if successful, would drive the commercial companies out of the industrial insurance business. It would apply only to Massachusetts, although he hoped other states might emulate the experiment. More important, by giving working people a less-expensive alternative, it would force the big companies to lower their prices. Competition would force them to correct the abuses of the current system, because they would not be able to get any industrial business if they continued to pay high commissions and offered policies inferior to those of the banks.

Wright sent his first report on 13 December, but it failed to satisfy Brandeis. In a three-page letter Brandeis listed what he considered either missing or incomplete information, and questioned closely some of the data Wright had sent. Over the next few months Wright would supply information, and Brandeis would analyze it and then ask for additional material or further elaboration on what he had already seen. Wright also offered a variety of comments, including the observation that the greatest opposition would come from the savings banks themselves, since they “are so entirely successful in their present operations, their officers might be disinclined to accept new and more complex features in addition to their present function.”

Brandeis, of course, had no need to be told what the opposition would be, nor did he expect the commercial companies to sit back quietly and give up their most lucrative source of profit. In order to win, Brandeis understood that he would have to make a compelling case for savings bank insurance, organize public support for it, gain legislative approval for the enabling legislation, and then still have the formidable task of getting the banks to agree to participate. On his side would be the outrage generated by the scandals, which at the very least would undermine the credibility of the insurance companies. He would also benefit from the fact that insurance touched almost everyone’s life, making it easier to get people to understand the importance of the proposal. And last but certainly not least, Brandeis had learned a great deal from his work on the Boston Elevated and the sliding scale and his involvement with local political reformers. Savings bank insurance would call upon all that experience.

FIRST HE NEEDED to polish his proposal and make sure that he had not left an opening on which he could be attacked for making erroneous assumptions. Between January and early June 1906, Brandeis worked on the plan between numerous other demands on his time. A cursory examination of his correspondence shows that during this period he gave a speech on the need for an eight-hour workday; worked with the Public Franchise League to shepherd through the sliding-scale law and then to secure decent appointments to the Board of Gas and Electric Light Commissioners; at the governor’s request proposed men to serve as Massachusetts representatives to the National Conference of Commissioners on Uniform State Laws; wrote an article on the Boston Elevated fight; began to get involved in local railroad matters; sent recommendations to the mayor regarding reforms in the city’s accounting methods; fought off still another attempt by the Boston Elevated to secure a sweetheart franchise; got drawn in to the debate over how the Cambridge transit system would be connected to Boston’s rail network; and maintained his law practice, including trying some cases in court. He and his family went out to Dedham regularly, and during the winter he took Susan and Elizabeth, now thirteen and ten, skating and sledding. He worried over his brother’s health, and for Alfred’s birthday bought him land adjacent to the farm Al was building east of Louisville. He received an invitation from his brother-in-law Felix Adler to speak before the New York Society for Ethical Culture along with Charles Evans Hughes, counsel to the Armstrong Committee, on the lessons of the investigation, “but I have all I can do to attend to home affairs this month, at office and Legislature.”

To his brother Louis also began musing on political conditions, and one comment is instructive regarding the looming insurance fight. “The rising resentment at plutocratic action will make itself severely felt,” he wrote. “After all, we are living in a Democracy, & some way or other, the people will get back at power unduly concentrated, and there will be plenty of injustice in the process.” Unlike some of the more radical progressives, who wanted large-scale social transformation, the conservative Brandeis feared it. Like Edmund Burke, he wanted reform not for its own sake or to implement some new social vision but to forestall upheaval. Society had to change to accommodate new conditions, and if it did so gradually, then one could count on progress. If the powers that be blocked that change, pressure would build and change would still come, but at a great cost. Savings bank insurance did not aim at grand reform. Brandeis highlighted a specific but important problem, and his solution addressed it. Although an idealist, he was also a realist—he had no desire to redo the world.

Norman Hapgood, ca. 1900

Brandeis finished his draft in early June, first sent it to Wright for comment, and then mailed out dozens of copies to friends in Boston and elsewhere for their views. An encouraging response came from Charles Evans Hughes, who called the piece “a strong and unanswerable statement of the evils of industrial insurance.” He, like Wright, worried about the conservatism of the savings bank officials and urged Brandeis to expand the section showing the feasibility of the plan; but he hoped the experiment could be undertaken. Robert Herrick, an eminent Boston attorney, immediately understood the importance of a plan “whereby the poor can be helped to help themselves.”

Brandeis published the piece that fall in Collier’s magazine, and in doing so began a lifelong friendship with Norman Hapgood. Then the editor of Collier’s, Hapgood would provide a magazine outlet for many of Brandeis’s most important articles, and he would bring him in as the magazine’s lawyer during the Pinchot-Ballinger hearings (see chapter 11). The article repeated much of what Brandeis had said in his Commercial Club paper, but spent far more time detailing the abuses of industrial insurance. By then, of course, he had available the hearings and report of the Armstrong Committee, and used the admissions of the insurance company officials themselves to damn the practice. He termed the entire system “vicious” and proposed that the same business could be handled more efficiently by savings banks, providing greater coverage at lesser cost to the workers and allowing a method of keeping the policies intact even if a worker missed a premium. Hapgood arranged for hundreds of reprints of the article and also allowed it to appear simultaneously in major newspapers across the country. The Boston Evening Transcript carried the piece on 11 September, and the next day the Boston Post began a series of editorials endorsing the plan.

As one might expect, progressives and labor advocates immediately endorsed the plan, while the insurance industry heaped scorn on it. One industry journal denounced the project as “positively grotesque in its absurdity. It betrays the theorist and indicates an utter ignorance as to the practical workings of industrial insurance or the peculiar make-up of the wage-earning class.” Frederick L. Hoffman, who worked for the Prudential as its chief statistician, declared that the article demonstrated that Brandeis lacked “the necessary knowledge and experience” required to run “so vastly important a matter as the safe and permanent conduct of a life insurance business.” Another industry journal dismissed the plan outright and assured its readers that “nobody need lose any sleep over the dream of the Boston theorist.”

The critics might be forgiven for not knowing much about Louis Brandeis and his passion, indeed some might call it obsession, for facts. Years earlier he had heard about a lawyer who had lost an important case because he had not checked the facts, and vowed that this would never happen to him. In his articles on insurance and other topics, no one ever caught him out with a wrong fact. Readers might disagree with the conclusions he had drawn but could not fault the accuracy of his material. Moreover, in the case of insurance, many of the facts he used came from the mouths of insurance executives themselves or from the annual financial reports companies had to file with state regulation agencies. Try as they might, they could not disprove the damning charges he leveled against industrial insurance; the insurance companies could assume, however, that with their large resources and political influence, they would be able to kill off Brandeis’s plan by blocking it in the legislature.

Those who opposed the plan misunderstood what Brandeis wanted to do. They saw it as an attack on the insurance industry by a radical who wanted to dismantle the free enterprise system, a first step on the way to socializing insurance. Never a socialist, Brandeis understood, and tried to get others to see, that if left unchecked, the abuses in insurance and other big businesses would do more than anything to advance rebellion. “The talk of the agitator does not advance socialism a step,” he told the Commercial Club. Rather, “the great captains of industry and of finance … are the chief makers of socialism.” By reforming the system, Brandeis hoped to save it. Moreover, he never called for the abolition of private industrial insurance. If savings banks could offer the service at an affordable price, then the private companies, in order to compete, would have to lower their rates as well. In the Collier’s article he returned to this theme and warned that unless workingmen could get inexpensive insurance through a private or quasi-private agency, they would soon demand that government provide it. As he told one correspondent, “true conservatism involves progress, and that unless our financial leaders are capable of progress, the institutions which they are trying to conserve will lose their foundation.” In addition, the plan would, as Brandeis pointed out, allay “the rising demand for old-age pensions supported by general taxation” through some government agency. Rather, it would provide wage earners with “an opportunity of making provision for themselves for their old age,” without increasing the tax burden on the rest of the community. Clearly, a conservative and not a socialist had drafted this plan.

BY THE TIME he put forth the savings bank plan, Brandeis had done a great deal of research on insurance, on savings banks, on actuarial tables, and on means of making his plan feasible. Now he had to convince the public, the state legislature, and savings bank officials that the plan should be given an opportunity to succeed; to do that he needed to educate those groups and create an organization to lobby the legislature into passage of the enabling bill. Even if he could have secured passage of the bill immediately, it would not, he believed, be the right way to do it. It was more important to get the education of “those persons who are now savings banks trustees and the wage earners as to the inequity of the present system and the necessity of developing insurance on savings banks lines, than it is to get the necessary legislation. If we should get tomorrow the necessary legislation, without having achieved that process of education, we could not make a practical working success of the plan.”

Here we find one of the keys to Brandeis’s success as a reformer: his belief that after one had learned the facts, after one had devised a solution, the plan could not be implemented successfully unless the people themselves grasped its essentials. Education is a key to understanding Brandeis as a lawyer, as a reformer, and as a judge. People might accuse him of being cold, haughty, and disdainful—all of which was to some extent true—but he, like Robert La Follette and a handful of other progressive leaders, truly believed in the people and their ability, once they knew the facts, to do the right thing. He described himself as a “small d” democrat and understood that reforms could not be devised on high and then imposed on the people. The people had to “own the reform,” to use a more modern phrase, and that required education.

He also knew that he could not conduct this campaign by himself. He would, of course, write, give speeches and interviews, send out hundreds of letters, lobby bank presidents and legislators, and supervise it all. But he needed an organization, and he and his allies created the Massachusetts Savings Bank Insurance League on 26 November 1906. Within four months it had over seventy thousand members, including a number of many well-known businessmen and professionals, labor and civic leaders. To capture as many parts of the community as possible, the league had more than twenty vice presidents and an executive committee, and its brochures prominently displayed the endorsements of President Eliot of Harvard and Bishop (later Cardinal) William Henry O’Connell. As executive secretary Brandeis recruited Norman Hill White, the brother of Brandeis’s sailing partner and an independently wealthy young man who responded eagerly to Brandeis’s suggestion that he devote his time and energy to public service. (White, along with Brandeis, paid for the bulk of league expenses not covered by the modest dues; Brandeis’s share, in addition to Wright’s actuarial work, came to over $4,000, a substantial amount at the time.) The fact that the Republican former governor John L. Bates became one of the league’s vice presidents, while another former governor, William L. Douglas, a Democrat, became its president, testified to its nonpartisanship. No doubt existed, however, as to the real leader and driving force of the league.

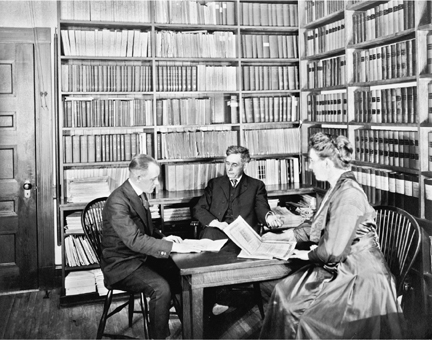

Irvin Hearst, Louis Brandeis, and Alice Grady discuss savings bank life insurance

Brandeis brought one other person into this campaign, Alice Harriet Grady. By 1906 she headed the law firm’s large secretarial staff and handled Brandeis’s growing reform correspondence as his executive secretary. At one point she had considered leaving to attend the Chicago Christian Training School and devoting her life to church work. Brandeis talked her out of it. “He felt that I could do better service and enable him to do better work if I would aid him in his proposed [reform] efforts.” It no doubt helped that, like him, Alice Grady could throw herself into causes and work for up to sixteen hours a day. Savings bank insurance interested her, and after Brandeis went to Washington in 1916, she went to work for the insurance plan, becoming deputy commissioner of the program in 1920. Until her death in 1934, she enjoyed Brandeis’s confidence and corresponded regularly with him about savings bank insurance matters.

While Norman White handled the work of the league, arranging public meetings, mailing out literature, and recruiting new members, Miss Grady oversaw the details directly related to her boss. Brandeis started by dictating letters to her, and before long began dictating instructions: Contact X. Make sure that Y pays a call on Z. Show the list of directors to so-and-so. As he had previously delegated greater authority to her in his office, so he began giving her greater responsibility in regard to the league, and she soon became its financial secretary. Described as “originally a woman of blunt, direct manner, she schooled herself in tact. She learned to write effectively and to speak well, and developed a flair for publicity.” In 1916 she even convinced Brandeis to appear in a short and now lost promotional film. The movie depicted two workers killed in an accident, one with insurance and the other without coverage, and the effects of the tragedy on their families. Brandeis himself appeared in a role, and he claimed that only Alice Grady could have induced him to become an actor. At her death, Brandeis noted that “her achievement was great. It was a grand life.”

Between his first involvement with insurance reform as counsel to the New England Policy-Holders’ Protective Committee on 18 April 1905 and the passage of the enabling legislation on 26 June 1907, Louis Brandeis knew little rest. He still had irons in other reform fires, led a major law firm, and continued to argue cases personally. But for most of these two years he devoted the bulk of his energy to exposing the evils of industrial insurance and working to adopt what he saw as a conservative and efficient means to provide insurance to workers. What one person called a million-to-one shot succeeded because Brandeis always kept his focus on what he wanted and adjusted his tactics as the situation demanded.

In the Massachusetts Savings Bank Insurance League, Brandeis created one of the first modern citizens’ lobbies, no small accomplishment in and of itself. There had, of course, been other public-spirited groups that worked in the public interest, starting with the American Anti-slavery Society, the Woman’s Christian Temperance Union, and the National Consumers League; the temperance union at one point claimed a half-million members nationally. But while some had done little more than write letters, and others had lobbied legislators, none of them had been as well organized, nor had their efforts been as well orchestrated. It is true that some groups, such as local labor unions, joined en masse, but that did not matter. The local senator or assemblyman from that district would know that a goodly number of his constituents, people he relied upon for reelection, supported this particular measure. While the insurance companies could utilize paid lobbyists and make campaign contributions, in the end politicians counted votes, and the seventy thousand members of the league far outnumbered the insurance officers and salesmen in the state. Brandeis put the numbers to good use in an educational campaign—or public relations, if you like—that proved extremely effective. On his directions hundreds of letters would go out to newspapers all over the state. He understood that in order to influence the local editor in Weymouth or Springfield, it would be more efficacious to have a local businessman or professional make the contact. Senators and assemblymen would have visitors from their hometowns—not strangers—urging them to enact the program. And Louis Brandeis seemed to be everywhere.

Brandeis often liked to quote the German poet Goethe—“In der Beschränkung zeigt sich erst der Meister”—that one is the master through small details, and he daily fired off letters to Norman White and others in the league about what might have seemed a small matter. After one meeting, for example, he sent Norman White a note saying that he had run into a young man who professed himself an advocate of savings bank insurance, and Norman should contact him immediately and put him to work. Also, he mentioned that he had not seen the Reverend Dole, the president of the Twentieth Century Club, at the same meeting. Dole reportedly favored the plan, and the club had some influential members. White should contact him. One will see this same attention to minute detail, what some would call micromanaging, in his leadership of the American Zionist movement after 1914 (see chapter 17).

THE CAMPAIGN MOVED FORWARD on three fronts, and Brandeis utilized the league and its members in all of them. To educate the public, the league sent out materials, organized public meetings where speakers explained the benefits of savings bank insurance and the evils of industrial insurance, and made sure that newspapers carried reports of these meetings. Its members met constantly with editors, nearly all of whom gladly supported the measure. As noted earlier, in no other reform of the time did the interests involved affect so many people so personally, and except for the most conservative newspapermen it made a good deal of sense to back a reform that would benefit their daily readers.

The second front involved convincing the legislature to enact the necessary legislation, beginning with the Joint Recess Committee appointed in 1906 to investigate the insurance scandals and to consider possible reforms. Brandeis spoke to the committee on 8 November 1906, and while he did not win the members over, he realized that he had gotten some of them thinking seriously about the plan. George L. Barnes, a Weymouth attorney and member of the committee, had first worked with Brandeis on the sliding scale, and he soon became, along with Norman White, Brandeis’s eyes and ears in the legislature, alerting him to changes of mind, potential attacks, and opportunities to make a convert.

Initially, the committee voted informally to table the savings bank plan, but decided to wait until Governor Curtis Guild addressed the legislature at the beginning of 1907. Brandeis, who by now had the confidence of the governor, arranged to see him in late December, and Guild’s speech fully endorsed Brandeis’s plan. “I commend for your consideration,” he told the legislature, “the study of plans to be submitted to you for cheaper industrial insurance that may rob death of half of its terror for the worthy poor.” Five days later the Recess Committee unanimously endorsed savings bank insurance.

Although he had hoped to get the savings bank people to draft the enabling legislation, they failed to do so, and Brandeis stepped in to draw up the bill in late February. The league then sent copies to every member of the General Court, along with copies of Brandeis’s Collier’s article and other materials, and also saw that these items went to every newspaper in the state. It still proved tough sledding, as the insurance companies and their allies in the legislature used every tactic they could devise to delay matters, in the belief that the momentum the league had generated would dissipate with lack of legislative action. To counter these tactics, Brandeis asked one of his oldest friends and a classmate at Harvard Law, Judge Warren Reed, what they could do. Reed, a respected lawyer and president of the People’s Savings Bank of Brockton, told Brandeis that he believed many of the legislators saw savings bank insurance as a “hobby” and not to be taken seriously. Everyone from the governor on down had said that the plan would benefit the laboring man, but until the workers took up the cause themselves, the legislators would ignore it. Brandeis immediately began contacting all the labor leaders he knew, as well as those involved in the league, to write letters to their assemblymen, supporting the plan. Brandeis had spoken to a skeptical joint committee on insurance on 21 March; he returned to continue his testimony on 2 April, and this time political leaders from both parties, labor officials, ministers, businessmen, and others crowded the committee room to voice their support. The legislators, as Reed had predicted, took note.

Brandeis kept up the pressure and suggested to Norman White that he “ought to pass the word to the Republican leaders that if the Republicans should allow the savings bank bill to be defeated or deferred they will have a very heavy burden to carry in the coming campaign.” By 12 May, Representative Robert Luce, initially doubtful of the plan, had congratulated Brandeis on the effective work done by the league, and predicted the bill would win out. On 16 May the joint committee reported it favorably by a vote of 10–4. The full House of Representatives approved it by a vote of 126–46 on 5 June, and on 17 June the Senate also went along, 23–3. Curtis Guild signed the bill into law on 26 June.

The third front involved convincing the trustees of the state’s savings banks first to endorse the plan and then to lead their banks into joining. Here Brandeis found that one of the characteristics he most admired about the savings bank officers, their fiscal integrity and reluctance to put the savings of their customers at risk, also led them to view the savings bank plan with reluctance. Charles Evans Hughes had warned Brandeis about this danger, and even as he organized the league and began the work of converting the legislators, Brandeis found he could make no progress with bank officials. So he took a different tack; if he could not win over the operating officers such as the treasurers, he would try to convince the directors of the banks. He secured a list of every bank trustee in the state, and he and Norman White began planning how they could do “personal missionary work” with them. Initially, little came out of this effort. “They are a pretty tough crowd,” reported Charles H. Jones, a Boston shoe manufacturer and Brandeis client who had joined the league, “and a few of them have such a strong prejudice against even listening to a proposition for anything new.” (Jones fought on with Brandeis to the successful conclusion of the campaign and became the first person in Massachusetts to purchase a savings bank insurance policy.)

By the time the legislature passed the bill, Brandeis had a healthy list of bank trustees who had endorsed the plan. The day before Governor Guild signed the measure into law, Brandeis sent him a “Dear Curtis” letter, saying that in order for the plan to succeed, the men appointed as trustees of the General Insurance Guaranty Fund, the state oversight body, should all be firmly committed to its success, and he sent a list of men whom he recommended for the governor’s consideration. To his brother he noted that once the appointments had been made, “another stage will pass and I shall get a step nearer vacation.”

BRANDEIS RECOMMENDED Judge Reed to chair the fund, and Governor Guild agreed. It would have seemed in early July 1907 that success for the plan had been ensured. Even before passage of the measure three banks had indicated their willingness to establish insurance departments. But it took more than a year before the Whitman Bank began selling policies, and during that time Brandeis and members of the league faced a growing skepticism that the scheme would ever get off the ground. The Boston Evening Transcript, which had favored the plan, noted sarcastically that “the deliberation with which its preliminaries are arranged recalls the saying that when the Almighty wants to grow an oak tree he takes forty years, while a single summer suffices for a cabbage. If beginning slowly affords any test, the savings-bank insurance plan has certainly made for itself a place in the oak-tree class.” Insurance companies, beaten back in the legislature, suddenly began to hope that the hated plan would die aborning.

While a number of practical details had to be worked out—after all, this was a brand-new program—the preliminaries could have gone more quickly, and even after banks began to sign on, growth was small. Brandeis never lost faith in savings bank insurance, and he watched over it until his death. He would greet every accomplishment and broadcast it to his correspondents. At the end of the first year of operation, for example, the first two banks to join announced a dividend payment to their policyholders of 8⅓ percent, meaning, as he proudly told Lincoln Steffens, that the banks are returning one monthly premium to policyholders who had paid for twelve months. Every summer after 1916, on his way from Washington to his cottage on Cape Cod, he would stop in Boston to consult with officers of the state plan. He encouraged them to contact him whenever they faced a difficulty, and he always found time to talk to them or to scribble an encouragement. In the early years of World War II, he told his brother-in-law that “in this sad world, there is one thing which is going amazingly well—savings bank life insurance.”

But if initially the plan grew at a snail’s pace, it had an almost immediate effect on the commercial companies. On 1 January 1907—six months before the bill became law—they cut the rate for industrial insurance by 10 percent, and two years later they cut it another 10 percent. This meant a savings to Massachusetts wage earners alone of more than $1 million a year. They also streamlined the operations and corrected some of the abuses that Brandeis and the Armstrong Committee had identified. Brandeis believed that the cut in rates came solely from the fear of competition and that the newfound social conscience professed by the Metropolitan amounted to little more than hypocrisy, although “it is to be borne in mind that imitation is the sincerest form of flattery, and hypocrisy the tribute which vice pays to virtue.” The insurance companies for many years tried at each legislative session to cripple the plan through such devices as limiting the amount of insurance in any one policy or cutting the funding for the state regulatory body, only to be beaten back at each turn. Savings bank insurance did exactly what Brandeis and its backers wanted: it provided low-cost affordable insurance to those who could not afford regular policies, and it set a yardstick by which to measure the performance of private companies.

Although Brandeis hoped that other states would emulate Massachusetts, only New York adopted a similar plan, and then not until 1938. Everywhere else the conservatism of bank officials and the opposition of insurance companies easily defeated the proposal. And, of course, nowhere else did the plan have a champion as it had in Massachusetts.

Savings Bank Life Insurance celebrated its one-hundredth anniversary in 2007, and it still proudly claims Louis Brandeis as its father. The system now has over $2 billion in assets, policies with a face value of $63 billion, and the highest financial ranking possible for its administration of funds. SBLI of Massachusetts is licensed to sell insurance in fourteen other states and the District of Columbia and offers a full range of traditional banking services. Despite the savings-and-loan debacle of the 1980s, the strictly regulated and conservatively managed savings banks of Massachusetts came through the storm mostly unscathed, as did their insurance departments.

Brandeis always considered savings bank insurance his most worthwhile reform, and to some extent it undermines his claim that he never went into a reform by himself, but always at the request of another. It is true that he first got involved at the request of the Policy-Holders’ Protective Committee, but they wanted him only to look into the financial condition of the Equitable so they would have sufficient information to protect their own policy investments. The men on that committee did not buy industrial insurance, and probably knew little about it. Brandeis could have fulfilled his charge by exposing the financial irregularities and suggesting ways to rectify them.

But he saw the greatest insurance evil to be the vicious system by which the companies exploited the poor, and decided to attack that wrong. He came up with the plan to sell insurance through savings banks. He organized the league, wrote articles, lobbied the legislature, gave dozens of speeches, and worked to convert the bank trustees. The solution he devised perfectly reflected his ideas, especially that when something went wrong, it should be fixed, but not by the government. The savings banks reflected his own ideas regarding public service; just as the trustees saw protection of their depositors’ money as a near-sacred obligation, so he believed they would guard the integrity of the insurance plan. When the insurance executives got up before the Armstrong Committee and spoke of insurance as a public service akin to the ministry, it stank of hypocrisy. Louis Brandeis actually believed it.

In the end, the campaign for savings bank life insurance could have served as a template on which other reformers could build. Brandeis, aided by his lieutenants, identified a specific evil and then offered a unique solution that fully resolved all of the relevant issues. He created a large organization to educate the public and those who would have responsibility to implement the plan. He drafted a carefully drawn bill and shepherded it through the state legislature. He utilized both pressure by the citizens’ lobby and quiet political contacts. He avoided government involvement, save for a small oversight body. Most important, savings bank insurance did exactly what its sponsors wanted and hoped. Of course, in back of all this planning stood a man with a genius for organization and the tenacious personality to carry others along with him.

All in all, a perfect reform.