Figure 23.1 Outright FX forward.

Chapter 23

Foreign Exchange Futures, Forwards, and Swaps

This chapter provides an overview of the markets for foreign exchange (FX) futures, forwards, and swaps. In contrast to the FX spot market where traded currencies are settled immediately (within 2 days after the transaction in practice), FX futures, forward, and swap contracts involve transactions to buy or sell currencies that are settled on a future date.

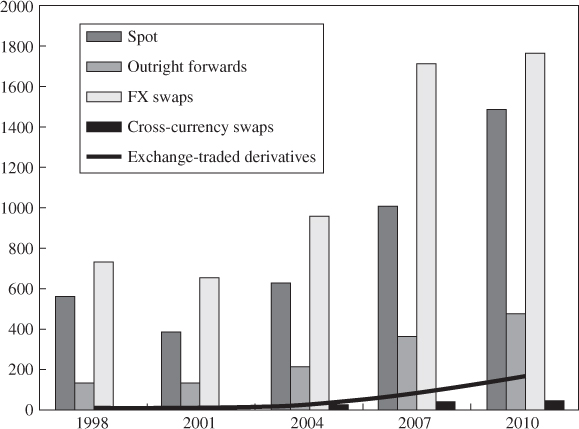

FX derivatives markets have been regarded as one of the most well-developed, liquid, and efficient markets. In its Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity, the Bank for International Settlements (BIS) reported that as of end-April 2010, the global daily turnover of FX swaps and outright forwards amounted to $1765 billion and $475 billion, respectively, while that of FX spot stood at $1490 billion. The turnover of FX swaps and outright forwards combined increased more than 2.5 times from 1998 through 2010. Such significant growth of FX derivatives markets has provided investors and bond issuers with much greater flexibility in accessing hedging, speculative and arbitrage opportunities with regard to foreign currency-denominated assets and liabilities.

How efficiently these FX derivatives markets function can be gauged by examining the so-called the covered interest parity (CIP) conditions, which correspond to no arbitrage conditions between domestic and foreign interest rates when the associated cash flow is covered by FX forwards. Empirical research on the CIP conditions used to be one of the central topics in the field of international finance at least until the mid-1980s. The early literature rigorously investigated whether the CIP condition held for major currency pairs against the US dollar, in particular, and what factors could explain deviations when the condition failed. Over time, however, thanks to technological progress on the trading and settlements front and growing liberalization of cross-border capital flows, the maintenance of CIP conditions became the norm in international finance, and this topic lost interest as a research topic for an extended period.

Since the 1990s, financial institutions have increased their global reliance on FX and cross-currency swaps as the key markets for foreign currency funding, as they accumulated foreign currency-denominated, typically US dollar, assets on their balance sheets. Following the outbreak of the global financial crisis in the summer of 2007, which peaked in the autumn of 2008 following the bankruptcy of Lehman Brothers, even such liquid and efficient markets experienced problems. Market liquidity was reduced amid heightened counterparty risk concerns, despite the conventional understanding that these swaps are effectively collateralized contracts. There was an unprecedented surge in the demand for US dollar funds, as many non-US financial institutions crowded into the markets to secure US dollar liquidity, which disrupted FX swap markets and their longer-term counterparts, the cross-currency swap markets.

Such dislocations in the FX and cross-currency swap markets manifested themselves as a significant collapse of the CIP condition. The recent substantial dislocations in the FX and cross-currency swap markets under the global financial crisis rekindled interest in this topic among researchers, giving them an opportunity to recognize how important a role these swap markets had played in financial markets.

It should be noted, however, that the FX markets traded smoothly over the crisis period, compared with equity and fixed income markets. For example, at the height of the crisis, VIX (S&P implied volatility) and US dollar swaptions implied volatility (3-month forward 3-year term) surged almost seven times and six times the level as of the beginning of 2007, respectively, while FX implied volatility (euro/dollar) rose only about 3.5 times during the same period.

The rest of the chapter is organized as follows: Section 23.2 describes the basic mechanism and market size of FX futures, outright forwards, and swaps and their relationship to CIP conditions. Section 23.3 discusses two prominent cases of dislocations in the FX and cross-currency markets: (i) the Japan premium case in the late 1990s and (ii) the global financial crisis that started in the summer of 2007.

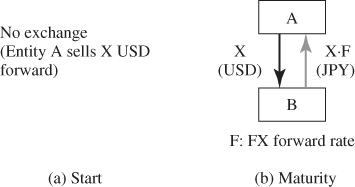

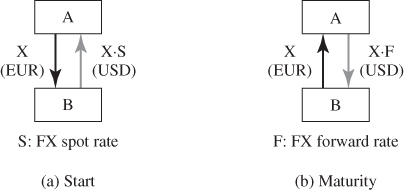

An outright FX forward contract is a contract where two parties agree to deliver, at a fixed future date, a specified amount of one currency in exchange for another. The only difference from an FX spot contract is that an FX forward is settled on any preagreed date, which is 3 or more business days after the deal, while the FX spot is settled or delivered on a date no later than 2 business days after the deal.

Suppose a US company purchases a product from a Japanese company with payment of 1 million yen due in 90 days. This importer owes yen for future delivery. The current price of the yen is assumed to be 100 yen per dollar. Over the next 90 days, however, the yen might rise against the US dollar, raising the US dollar cost of the product. This importer can avoid this FX risk by entering into a 90-day forward contract with a bank at the price of, say, 98 yen per dollar, which corresponds to the FX forward rate (see Fig. 23.1 for illustration of outright forward contract). In addition to the hedging purpose as shown in this example, FX forward contracts can also be used for speculative trades that take on FX risk by betting on a rise or fall of future FX rates.

Figure 23.1 Outright FX forward.

FX forward contracts are traded over the counter (OTC), that is, a network of banks and brokers, which allows customers to enter into forward contracts at a currently agreed-upon rate of exchange. Unlike futures contracts, forward contracts are not standardized. Instead, terms and conditions of each contract are negotiated separately.

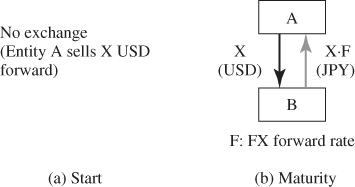

Some emerging countries' currencies cannot be traded directly in the forward market. This is because those governments put controls on the capital flows, thereby protecting their economies from speculative trading and a rapid change in global market conditions. Such currencies include the Chinese Yuan Renminbi, Korean won, Russian ruble, and Brazilian real. In some cases, a trader may get a forward contract on these currencies that does not result in delivery of the currency, but instead calls for settlement of the net amount in US dollars or other major currencies. These instruments are called nondeliverable forwards (NDFs). Unlike a normal forward contract, parties do not exchange principal at the maturity of an NDF. NDFs can be arranged offshore without the need to access the local currency markets, which enables traders to obtain hedging opportunities against FX risk that would otherwise be considered unhedgeable. The amount of profit or loss would be determined by the FX spot rate at the time of settlement in comparison with the forward rate (see Fig. 23.2 for illustration of NDF contract). The use of NDFs has been growing, particularly in Asian currencies.

Figure 23.2 Nondeliverable forward (NDF).

On the other hand, an FX (currency) futures contract is a standardized forward contract traded on organized exchanges rather than negotiated and traded on an OTC basis. The size of the FX futures market has been small compared with the OTC FX markets.1 Most contracts have physical delivery. Therefore, at the end of the last trading day, actual payments are made in each currency, although traders can close out their contracts at any time before the contract's delivery date.

Futures contracts are channeled through a clearinghouse and marked to market on a daily basis, by which counterparty credit risk is reduced significantly. Also, the clearinghouse guarantees that a contract can be canceled simply by buying a second contract that reverses the first contract and netting out the position. In a forward contract, however, if a holder wants to close out or reverse a position, there has to be a second contract, and if the second contract is arranged with a different counterparty from the first, there are two contracts and two counterparties, with two separate types of counterparty credit risk (See Table 23.1 for more details on institutional differences between FX forwards and futures).

Table 23.1 Main Institutional Differences Between FX Forwards and Futures

| FX Forwards | FX Futures | |

| Counterparty | Financial institutions | Clearing house |

| Maturity | Negotiated | Typically, IMM dates (third Wednesday in March, June, September, and December) |

| Amount | Negotiated | Standard contract size (integer multiple of) |

| Fees | Bid–ask spread | Bid–ask spread plus commissions |

| Collateral | Negotiated | Margin account |

| Settlement | At maturity | Most positions closed early |

| Margin call | Negotiated | Mark-to-market, daily |

FX futures were first listed at the Chicago Mercantile Exchange (CME) in 1972, less than 1 year after the Bretton Woods system of fixed exchange rates was abandoned. Commodity traders at the CME, who did not have access to the interbank FX markets established the International Monetary Market (IMM), and launched seven FX futures against the US dollar. Today, more than 20 currency pairs, largely against the US dollar or the euro, are traded at the CME. The CME is still the dominant exchange, but other exchanges also trade FX futures. Those include Euronext London and the New York Board of Trade, the Chicago Board of Trade (CBOT), Tokyo Financial Exchange (TFX), and Intercontinental Exchange (ICE).

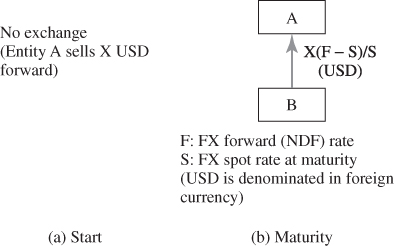

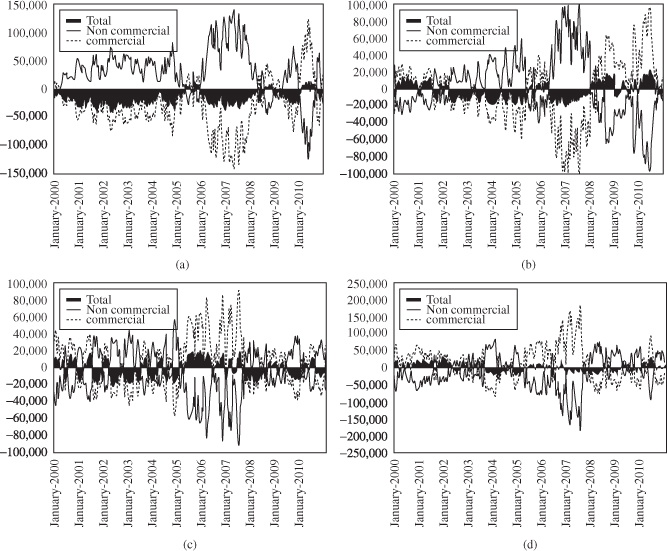

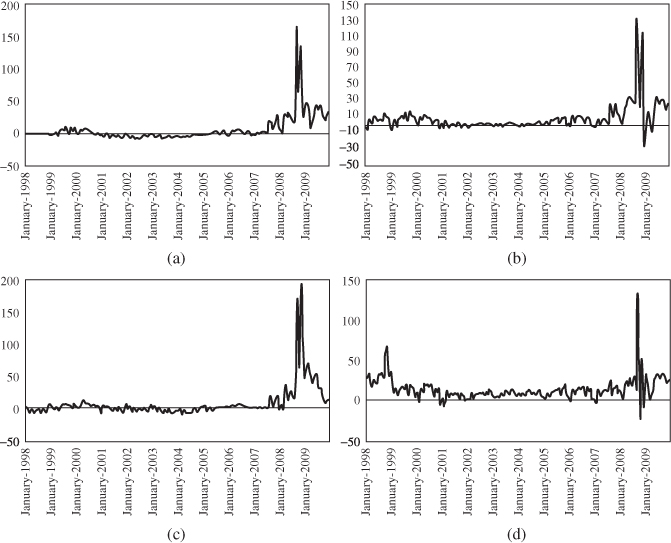

Figure 23.3 shows the IMM futures positions for major currency pairs against the US dollar on a net basis (long minus short). The CME reports the future positions as of every end-Tuesday to the US Commodity Futures Trading Commission (CFTC) and the CFTC releases the data in the Commitments of Traders (COT) reports on its website every Friday. Of particular interest to market observers among the reported data are the positions held by noncommercial traders. This category of traders includes hedge funds and commodity trading advisors (CTAs) who often build their positions for speculative purposes, betting on the directions of future FX spot rates.2 By contrast, commercial traders basically use these futures for hedging purposes. Net futures positions tend to move symmetrically between commercial and noncommercial traders, as shown in Figure 23.3. In other words, when noncommercial traders bet on the appreciation of the euro against the US dollar, for example, by holding net long euro positions, commercial traders tend to hold net short euro positions to hedge the future appreciation of the euro.

Figure 23.3 Net FX futures positions. (a) Euro, (b) pound sterling, (c) Swiss franc, and (d) Japanese yen. Note: The figures are weekly number of IMM contracts on a net basis (long minus short) as of each end-Tuesday reported by the CME to the CFTC, excluding nonreportable contracts. The units are 125,000 (euro), 62,500 (pound sterling), 125,000 (Swiss franc), and 12,500,000 (yen), respectively. Source: CFTC.

It is often argued that IMM noncommercial positions include speculative carry trade positions, where low interest yielding currencies are used as funding currencies for investments in high interest yielding currencies. During the period from 2005 through mid-2007 when carry trades were very active, the yen and the Swiss franc were often used as funding currencies and the pound sterling, the euro, and other emerging currencies, such as the Australian dollar, were used as target currencies for such trades. This tendency can be seen in Figure 23.3 where the yen and the Swiss franc registered large net short positions for noncommercial traders, while the pound sterling and the euro showed large net long positions.3

An FX swap is a short-term (mostly less than 1 year) OTC contract in which one party borrows a currency from, and lends another currency simultaneously to the same party (See Fig. 23.4 for EUR/USD swap). Put differently, an FX swap has two separate legs settling on two different dates, even though it is arranged as a single transaction. The use of FX swaps can be thought of the combination of actual borrowing and lending of two currencies on a collateralized basis (Melnik and Plaut (1992)).

Figure 23.4 FX swap.

FX swaps have generally been employed by financial institutions to fund foreign currencies for themselves and their customers including exporters and importers, as well as institutional investors who wish to hedge their positions of foreign bonds against the associated FX risk. FX swaps have also been used as a tool for speculative trading. Among these motives, the use of FX swaps for the foreign currency funding has increased significantly, particularly since the 1990s.

When non-US financial institutions need US dollars, they can borrow directly in the dollar cash market, or combine domestic currency borrowing with an FX swap. For example, an institution funding itself in euros but desiring dollars could swap the euro proceeds for dollars, in effect by selling euros for dollars at the FX spot rate and entering into a forward contract in the reverse direction at maturity (Fig. 23.4). FX swaps are conventionally priced as Ft, t+s − St (forward discount rate).

The total cost of raising US dollars using euros as a funding currency through the FX swap market is often called the FX swap-implied dollar rate from the euro. The equality of the FX swap-implied dollar rate and dollar cash rate defines a condition of indifference as

Here, the left-hand side of Equation (23.1) corresponds to the FX swap-implied dollar rate from the euro, where St is the FX spot rate between the dollar and the euro at time t, Ft, t+s is the FX forward rate contracted at time t for exchange at time t + s, and  is the uncollateralized euro (dollar) interest rate from time t to time t + s. Ft, t+s/St essentially corresponds to the euro/dollar forward discount rate. Equation (23.1) is equivalent to the CIP condition in the international finance literature. CIP states that interest rate differentials between currencies should be perfectly reflected in the FX forward discount rates, since otherwise an arbitrager could transact in the markets to make a risk-free profit.

is the uncollateralized euro (dollar) interest rate from time t to time t + s. Ft, t+s/St essentially corresponds to the euro/dollar forward discount rate. Equation (23.1) is equivalent to the CIP condition in the international finance literature. CIP states that interest rate differentials between currencies should be perfectly reflected in the FX forward discount rates, since otherwise an arbitrager could transact in the markets to make a risk-free profit.

The early literature, using data through the 1970s, finds that the short-term CIP condition does not appear to hold invariably even for major currency pairs such as pound sterling/US dollar. Persistent deviations from CIP are attributed to such factors as transaction costs (Branson (1969); Frenkel and Levich (1975, 1977)), political risk, or capital controls (Aliber (1973); Dooley and Isard (1980)) and lags in executing arbitrage (Frenkel and Levich (1975)). Among these factors, transaction costs are thought of as the most relevant in the literature during this period. In addition, Taylor (1989) finds that deviations from short-term CIP tends to emerge during periods of uncertainty such as in 1979 when the European Monetary System was launched.

By the mid-1980s, a growing number of studies appear to support the maintenance of short-term CIP conditions for major currency pairs. This is accounted for largely by declining transaction costs, as the significant technological progress was being made on the trading and settlements front amid the growing liberalization of capital movements across borders.4 Such empirical evidence is provided by McCormick (1979) and Clinton (1988), for example.

As the holding of CIP increasingly came to be viewed as a norm, empirical studies on this topic became quite rare until the 2000s, when more detailed transaction-based data became available to researchers. Akram et al. (2008, 2009) investigate deviations from the short-term CIP condition using tick data in 2004 and find economically significant CIP deviations, albeit short lived.

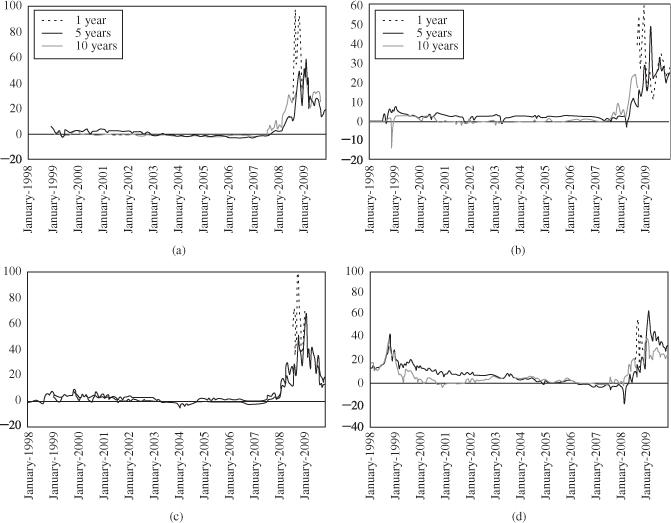

Another important development that brought back the attention of researchers to this topic was the emergence of counterparty credit risk and liquidity risk as major sources of the CIP failure, particularly when the financial system was under increased stress. As shown in Figure 23.5, which shows the 3-month CIP deviations between each of four major currencies (euro, pound sterling, Swiss franc, and yen) and the US dollar observed in the FX swap market from the late 1990s, prominent examples of the CIP failure include the late 1990s in Japan and the period of global financial crisis from 2007 through 2009 to be discussed in Section 23.3.

Figure 23.5 Short-term CIP deviations against the US dollar (bp). (a) Euro, (b) pound sterling, (c) Swiss franc, and (d) Japanese yen.Note: The short-term CIP deviation is defined as the 3-month FX swap-implied US dollar rate from each currency minus 3-month US dollar Libor, where 3-month Libor in each currency is used to calculate the FX swap-implied US dollar rate. The 10-day moving average is used. Source: Bloomberg.

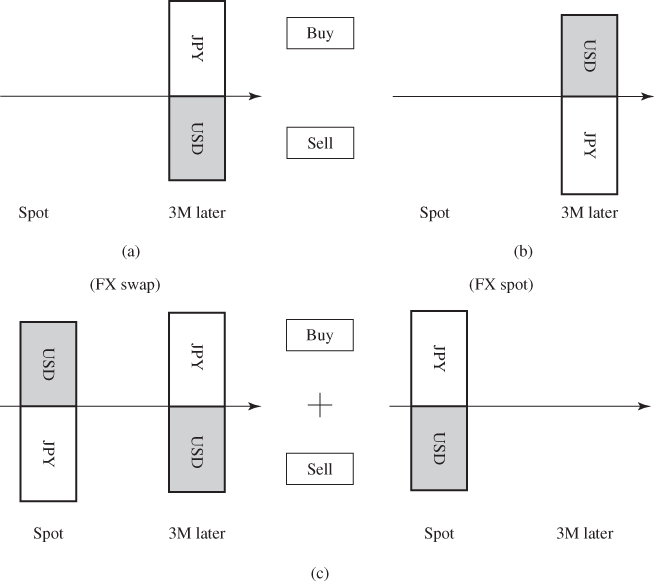

It should be noted here that outright forward positions can be built by combining spot and swap positions, thus creating so-called synthetic forward positions. In fact, because of higher market liquidity of spot and swap transactions than outright forward transactions, banks often cover their forward positions resulting from their customers' orders by constructing such synthetic positions. In many cases, forward rates for customers quoted by banks are calculated by backward induction from the cost of constructing the corresponding synthetic forward positions.

Figure 23.6 illustrates how to construct an FX forward position in practice. In this example, a Japanese exporter wishes to sell the US dollar and buy the yen with a bank 3 months from now to hedge FX risk associated with its future US dollar-denominated revenue, as shown in Figure 23.6a. The bank now has the position that is reverse to the exporter's, as shown in Figure 23.6b. The bank then attempts to cover and square this position by combining an FX swap position and a spot position, as shown in Figure 23.6c. In this way, the bank calculates the forward rate for the exporter from the FX spot rate and the forward discount rate (FX swap price).

Figure 23.6 Constructing an FX outright forward position using an FX swap. (a) Exporter's position, (b) bank's position, and (c) bank's hedge position.

Market participants argue that FX swaps are somewhat costly at maturities greater than 2 years because of relatively low market liquidity. Thus, for such longer maturities, cross-currency swaps have been extensively used instead. There are numerous types of cross-currency swap contracts, among which the most widely used in recent years is the cross-currency basis swap.

A cross-currency basis swap is a contract in which one party borrows one currency from another party and simultaneously lends the same value, at current spot rates, of a second currency to the same party. The parties involved in such swaps are financial institutions, either acting on their own or as agents for nonfinancial corporations. The main purpose of the use of cross-currency basis swaps for nonfinancial corporations is to fund their foreign direct investment in foreign currencies. Cross-currency basis swaps have been also used as a tool for converting currencies of liabilities, particularly by issuers of bonds denominated in foreign currencies. These swaps can allow issuers desiring liabilities of a certain currency to access the investor base available in another. Mirroring the tenor of the transactions they are meant to fund, most cross-currency basis swaps are long term, generally ranging between 1 and 30 years in maturity.

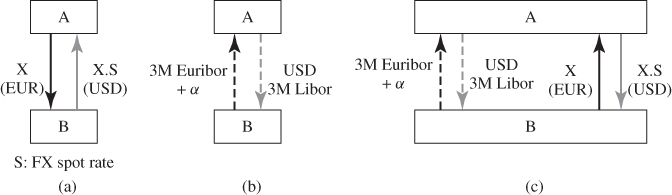

In such a swap contract, parties effectively borrow from each other in different currencies, exchanging principals at both the start and maturity of the swap, as well as regular interest rate payments (Fig. 23.7). Since the amount of future principal payment is fixed at the start of the contract, cross-currency basis swaps are largely free from FX risk, but entail replacement cost, as are FX swaps. Although the structure is different from FX swaps, cross-currency swaps serve the same economic function as FX swaps.

Figure 23.7 Cross-currency basis swap. (a) Start, (b) during the term, and (c) maturity.

The conventional quoting procedure for cross-currency basis swaps is as follows: A euro/US dollar 10-year basis swap, for example, is typically quoted as Euribor plus α basis points versus dollar Libor flat. This means that the lender/borrower of dollar/euro funds is obligated to pay Euribor plus α basis points generally every 3 months in exchange for receiving dollar Libor flat. In this manner, the prices for swaps α turn negative (positive) when there is strong demand for dollar (euro) funds relative to euro (dollar) funds.

Because the interest rates exchanged in cross-currency basis swaps are floating rates, for the comparison with the short-term CIP condition reflected in the FX swap prices, a conversion of floating to fixed rates via interest rate swaps is necessary. As shown in Popper (1993), among others, after this conversion and abstracting from potential distortions, the long-term CIP condition for the cross-currency swap market can be written as

Equation 23.2 indicates that α should be zero when long-term CIP holds. Therefore, α measures the deviation from long-term CIP. α can turn negative if there is strong demand for dollars. As is the case with short-term CIP, for long-term CIP to hold strictly requires negligible transaction costs, as well as the lack of political risk, counterparty credit risk and liquidity risk. Duffie and Huang (1996) show that cross-currency swaps are subject to more exposure to counterparty risk than are interest rate swaps, due to the exchange of notional amounts.

Using data of cross-currency swaps up until the early 1990s, Popper (1993) and Fletcher and Taylor (1996) find that nonnegligible deviations existed from the CIP condition at various times using cross-currency swap prices, but such deviations were diminishing over time.

Figure 23.8 shows long-term (1-, 5-, and 10-year) CIP deviations observed in the cross-currency basis swap market for the same currency pairs as in Figure 23.5. On the whole, the market trend is very similar to the short-term CIP deviations. The CIP conditions appear have roughly held until mid-2007 except for the yen/US dollar pair. Deviations from long-term CIP soared following the Lehman failure, as was also the case with short-term CIP deviations.

Figure 23.8 Long-term CIP deviations against the US dollar (bp). (a) Euro, (b) pound sterling, (c) Swiss franc, and (d) Japanese yen. Note: The long-term CIP deviation is defined as the price of each cross-currency swap multiplied by − 1. Thus, the deviation in positive territory indicates a positive US dollar premium in the cross-currency swap market over US dollar Libor. The 10-day moving average is used. Source: Bloomberg.

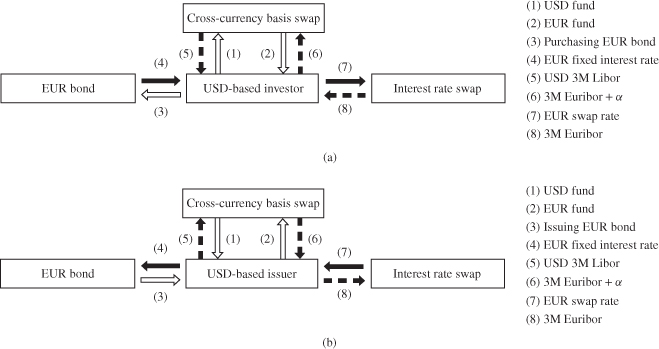

As mentioned above, cross-currency basis swaps are extensively used to hedge foreign currency-denominated assets and liabilities, thereby providing investors and bond issuers with great flexibility in terms of currency diversification. Figure 23.9 illustrates such basic hedging schemes for foreign currency-denominated bonds for portfolio investors and bond issuers, respectively. A US dollar-based portfolio investor, for example, can convert returns from euro-denominated fixed-rate bonds to dollar Libor-based (floating) returns by combining a cross-currency basis swap and an interest rate swap with a foreign currency bond investment, as shown in Figure 23.9a. Specifically, a US dollar-based investor first raises EUR fund from USD fund via a cross-currency swap, and then uses the EUR fund to purchase a EUR bond. He/she can further utilize an interest rate swap to hedge interest rate risk.

Figure 23.9 Hedging schemes for foreign currency-denominated assets and liabilities using a cross-currency basis swap. (a) Hedging foreign currency-denominated assets and (b) hedging foreign currency-denominated liabilities.

Similarly, a US dollar-based bond issuer can diversify issuing currencies of their bonds, thereby tapping different currency investor bases, by using a cross-currency basis swap. It goes without saying that when the cross-currency swap price deviates from the CIP condition described above, investors and issuers can take advantage of the price deviations until such arbitrage activities dissipate the deviations in price, and restore the nonarbitrage CIP condition.

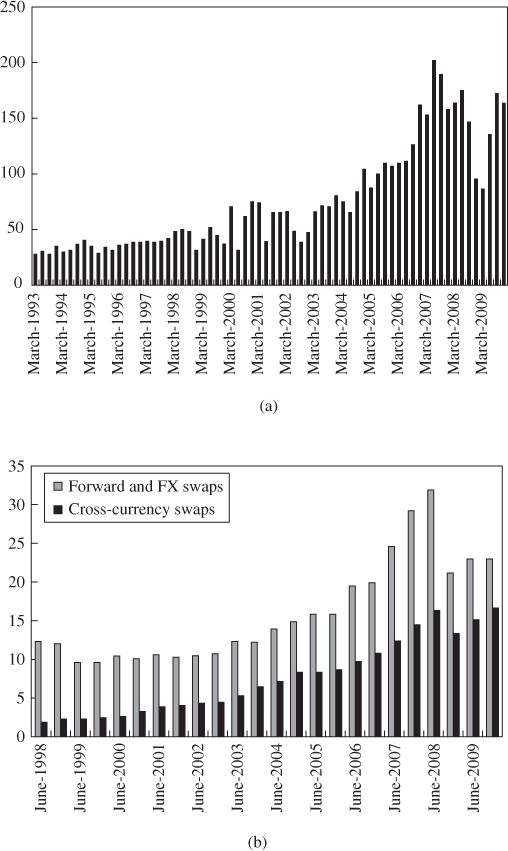

Figure 23.10 shows the amounts outstanding of FX futures, forwards, and swaps from the 1990s. The following points are of particular note.

Figure 23.10 Amounts outstanding of FX futures, forwards, and swaps.(a) FX futures (billion USD) and (b) FX forwards/swaps and currency swaps (trillion USD). Note: Notional principal amounts outstanding. Source: BIS.

Market growth was phenomenal through 2008. This is largely attributable to the widespread use of FX futures and forwards, which include synthetic forwards using FX swaps, for speculative trading strategies such as carry trades. In addition, between the surfacing of subprime loan problem in the summer of 2007 and the Lehman failure in the autumn of 2008, FX and currency swaps posted further growth.5 The main reason for this is as follows: European financial institutions increased their reliance on FX and cross-currency swaps, amid deteriorating funding liquidity in the interbank money market and heightened concerns over their creditworthiness, to secure US dollars to support troubled US conduits to which they had committed backup liquidity facilities.

In the wake of the Lehman failure, however, all instruments saw an unprecedented fall in market size. The Lehman failure further raised already heightened concerns over counterparty risk among financial institutions to such an extent that even the volume of effectively collateralized transactions of FX and cross-currency swaps decreased significantly, as market liquidity deteriorated.

Furthermore, particularly when compared with the short-term FX futures and swaps markets, the fall in longer-term currency swaps following the Lehman failure was moderate, and the recovery in market size was more prompt. This development reflects the fact that the epicenter of the global market crisis following the Lehman failure was the short-term money market so that relatively short-term markets such as FX swaps were more affected than the longer-term market of currency swaps.

The market size is much larger for OTC derivatives of FX forwards and swaps than exchange-traded derivatives of FX futures. A large share of OTC markets should primarily reflect the value of higher flexibility and usability of the OTC instruments in these markets, compared to the exchange-traded standardized products. Also, in recent years, financial institutions' higher demand for foreign currency funding in the FX swap market contributed to a further expansion, reflecting the increased need of European financial institutions to fund their accumulated US-dollar assets since the late 1990s (Baba et al., 2009).

Figure 23.11 shows the global average daily turnover of FX-related OTC instruments and exchanged-traded derivatives.

Figure 23.11 Global daily turnover (billion USD). Note: Adjusted for local and cross-border interdealer double counting. Exchange-traded derivatives include futures and options. Source: BIS.

Similar to the case of the amounts outstanding, turnover of each instrument experienced significant growth particularly until 2007. Even after the global financial crisis from 2007, the FX spot market maintained rapid growth, while the growth of the FX swap market slowed down significantly. Another noteworthy point is that turnover of cross-currency swaps is very low, compared even with exchange-traded derivatives, not to mention other OTC instruments. This is possibly attributable to the fact that the use of cross-currency swaps is typically associated with funding of foreign direct investment and issuance of long-term foreign currency-denominated bonds, and thus short-term speculative trading has been relatively quite limited in that market.

In the autumn of 1997, concerns over the stability of the Japanese financial system heightened because of the nonperforming loan problem that had remained unsettled since the collapse of the asset bubbles in the early 1990s. Eventually, November of this year witnessed a series of failures of financial institutions: Sanyo Securities, Hokkaido Takushoku Bank, Yamaichi Securities, and Tokuyo City Bank.6

In the meantime, a premium that Japanese were required to pay over other banks in the offshore interbank US dollar funding market—so-called “Japan premium”—emerged around mid-October and then increased substantially toward the beginning of November in the wake of the failure of Sanyo Securities. This failure triggered downgrades in credit ratings of a wide range of Japanese financial institutions and the Japan premium reached a peak in the beginning of December 1997 (Covrig et al., 2004; Peek and Rosengren, 2001).

The extreme difficulty for Japanese financial institutions to raise US dollars in the offshore funding market made them turn to the FX and cross-currency swap markets. Owing to its effectively collateralized structure, the FX swap-implied dollar rate from yen was relatively stable, at least until early November.

Over time, however, one-sided order flow of US dollar funding made the FX and cross-currency swap markets dislocate as well, amid increased concerns over the counterparty risk of Japanese financial institutions (Hanajiri, 1999). After calming down in early 1998, the Japan premium and the deviations from CIP in the FX and cross-currency swap markets reemerged in the summer of 1998 and continued until the end of the year, when two large banks, Long-Term Credit Bank of Japan and Nippon Credit Bank, were nationalized (Figs. 23.5 and 23.8). The large depreciation of the US dollar against the yen in October, 1998 reflected the unwinding of carry trades, which was triggered by growing concern about a huge loss of LTCM.

Dislocations in the FX and cross-currency swap markets and resultant CIP deviations after the surfacing of the subprime loan problem in the summer of 2007 are largely ascribed to the US dollar shortages of European financial institutions. The dollar shortages stemmed from a sharp growth in the US-dollar assets on their balance sheets over the past decade, which markedly outpaced the growth in their retail dollar deposits (McGuire and von Peter, 2009). This made them become heavily reliant on the FX and cross-currency swap markets for dollar funding.

Following the surfacing of the subprime problem, European financial institutions were obliged to increase dollar funding to support troubled US conduits to which they had committed backup liquidity facilities, and at the same time, interbank funding liquidity deteriorated amid heightened concerns about the creditworthiness of financial institutions on a global basis. Then, an increasing number of European institutions moved to convert their currencies into US dollars via FX swaps, resulting in impaired liquidity in the FX swap market.

Turning to the literature focusing on this early stage of the crisis, Baba et al., 2008 document that impaired market liquidity, as measured by bid–ask spreads, for example, characterizes the short-term euro/US dollar and pound sterling/US dollar swap markets, claiming that this is consistent with a predominance of orders to exchange European currencies for US dollars and counterparty risk concerns. In subsequent analysis, Baba and Packer (2009a) find that counterparty risk significantly explains the deviations in the short-term euro/dollar swap pricing. On the other hand, Coffey et al. (2009) find that borrowing constraints on financial institutions help to account for the CIP deviation.

Concerns over the stability of the global financial system then surged following the bankruptcy of Lehman Brothers on September 15, 2008. The sharp rise in counterparty risk concerns led to even more intense pressures in global funding markets. Greater demand for dollars hit both secured and unsecured term lending markets. Discontinuation of dollar flows from US money market mutual funds (MMFs) to European banks triggered by large capital outflows from US prime MMFs further exacerbated the problem (Baba et al. (2009)).

As many European financial institutions increasingly struggled to obtain dollars in the unsecured funding markets, they turned more to the FX swap market as a primary channel for securing dollars. This led to a sizable shift in FX forward prices, with the implied dollar funding rate observed in FX swaps on many major currencies rising sharply above US dollar Libor, for example. Dealers reported that bid–ask spreads on FX swaps increased to as much as 10 times the levels that had prevailed before August 2007 (Melvin and Taylor, 2009).

Using data after the Lehman failure as well, Baba and Packer (2009b) find a significant change in the role of counterparty risk before and after the Lehman failure. Before the Lehman failure, the credit standing of European financial institutions compared with that of US financial institutions was a main driver of dislocations. After the Lehman failure, however, short-term CIP deviations were positively affected by the counterparty risk of both European and US financial institutions. This result is consistent with the view that dollar shortages shifted from a localized problem among European institutions into a global phenomenon.7

With regard to the dislocations in the longer-term cross-currency basis swap market, the general observed tendency has been that the longer the maturity, the smaller the deviations. This reflects the fact that the epicenter of the global financial crisis, particularly following the Lehman failure, was in short-term money markets (Baba, 2009). In addition, Baba and Sakurai (2011) find that credit spreads of both European and US financial institutions have significant predictive power for regime switches between the normal regime and the crisis regime in the cross-currency swap pairs between major European currencies and the US dollar.

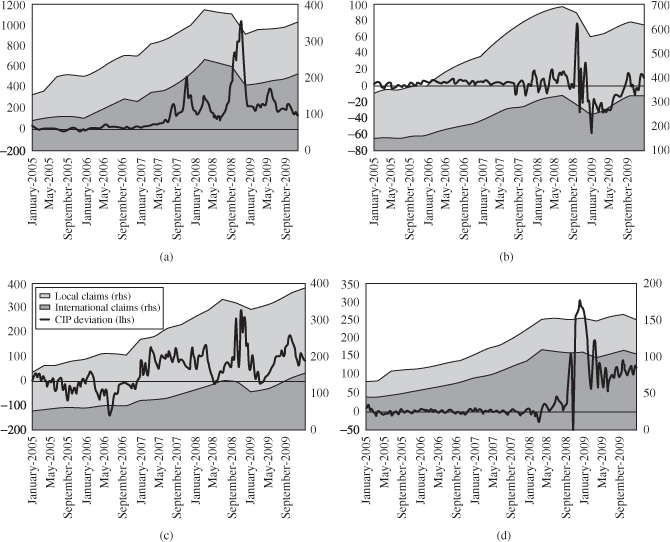

Following the Lehman failure, foreign banks' lending to emerging market countries contracted sharply and many domestic banks in emerging markets faced difficulties in borrowing in the interbank market, as they faced much higher costs of obtaining dollars. Under such circumstances, there was an abrupt drop in gross international claims on many of these countries (Fig. 23.12).8 This is particularly the case for Korea, Australia, and Brazil, where synchronized move was found between international claims and CIP deviations, while it was found, albeit less clear for Hungary.

Figure 23.12 Short-term CIP deviations against US dollar (bp) and foreign claims (billion USD) for selected emerging countries' currencies. (a) Korean won, (b) Australian dollar, (c) Brazilian real, and (d) Hungarian forint. Note: The short-term CIP deviation is defined as the 3-month FX swap-implied US dollar rate from each currency minus 3-month US dollar Libor, where as a funding currency interest rate, 91-day certificate of deposit rate is used for Korean won, 3-month bank bill rate for Australian dollar, and Budapest interbank rate for Hungarian forint. For Brazilian real, cupom cambial is used as the 3-month FX swap-implied US dollar rate. The 10-day moving average is used. International claims are consolidated cross-border claims in all currencies and local claims in foreign currencies. Local currency claims are local currency claims of reporting banks' foreign offices on local residents, calculated at constant end-Q4 exchange rates. Source: Bloomberg, Datastream, BIS.

Among these, Korea, in fact, experienced a severe retreat of global banks' lending, which led to the most significant dislocations in the Korean won/dollar swap market. In this regard, Baba and Shim (2010) find that CDS spreads of Korean banks play a significant role in explaining the short-term deviations from CIP for the Korean won/dollar pair before the Lehman failure. After that, a significant role of VIX is found to be a significant driver of deviations from CIP.9

Another study on the emerging market currencies is that of Fong et al. (2010), who attribute the CIP deviation for the Hong Kong dollar/US dollar pair to both counterparty risk and funding liquidity risk.

On December 12, 2007, the US Federal Reserve announced the establishment of swap lines, or “reciprocal currency arrangements”, with the European Central Bank (ECB) and the Swiss National Bank (SNB).10,11 At that time, the ECB could swap euro for up to $20 billion and the SNB could swap Swiss francs for up to $4 billion, respectively. Drawing on these funds, the ECB and the SNB were able to lend the dollar proceeds of swaps to their local counterparties with eligible collateral.

Toward March 2008, concerns about systemic risk resurfaced and stresses in the FX swap market intensified again. In response, on March 11 the Federal Reserve authorized increases in the swap lines with the ECB and the SNB to $30 billion and $6 billion, respectively. On May 2 the Federal Reserve authorized further increases in swap lines with them to $50 billion and $12 billion, respectively. On July 30, the Federal Reserve announced the addition of 84-day funds auction via the TAF. It was also announced that the ECB and SNB also would make available funds of 84-day maturity in their dollar auctions.

To further address the problems in dollar funding markets that had worsened following the Lehman failure, on September 18, the Federal Reserve authorized a more than two-fold increase in the swap lines to the ECB and SNB of $110 and $27 billion, respectively. At the same time, new dollar swap lines were opened to the Bank of Japan (BOJ), the Bank of England (BOE), and the Bank of Canada. As the financial crisis intensified, there followed a rapid-fire increase in the amount of the dollar swap lines over the next few weeks. Finally, on October 13, the swap lines with several central banks were announced to be unlimited.

In the debate over the effectiveness of central bank swaps, there is little agreement over what the appropriate target variable should be. Baba and Packer (2009a,b) and Coffey et al. (2009) measure the effectiveness of the central bank swaps in terms of their effect on the CIP deviations. By contrast, Obstfeld et al. (2009) focus on the changes in the FX spot rate, treating the swaps as means to defend the value of the domestic currency.

Analysis of the establishment of central bank swap lines on the CIP deviations suggests that they were quite effective. Baba and Packer (2009b) find that dollar-term funding auctions by the ECB, SNB, and BOE, as well as the Federal Reserve's commitment to provide unlimited dollar swap lines in October 2009, significantly ameliorated the FX swap dislocations. This result is largely supported by Hui et al. (2010). With regard to deviations from CIP for the Korean won/US dollar pair, Baba and Shim (2010) find that the Bank of Korea's use of the swap lines with the Federal Reserve was effective in alleviating dislocations in the swap market, whereas the provision of funds using its own foreign reserves was not.

By contrast, analysis of the effects of central bank swap lines on FX spot rates has suggested more mixed results. Obstfeld et al. (2009) interpret the swap lines as additions to reserve holdings available to support the FX value of the domestic currency. As such, they judge the amounts of the swap lines to have been small in the cases of Brazil, Korea, and Singapore, but possibly substantial in the cases of Hungary and Mexico.

FX derivatives markets, including futures, forwards, and swaps grew significantly from the 1980s. These markets provided investors and bond issuers with much greater flexibility in accessing hedging, speculative, and arbitrage opportunities with regard to foreign currency-denominated assets and liabilities. Reflecting these developments, CIP conditions came to hold for major currency pairs from the mid-1980s. Since the 1990s, financial institutions have increasingly relied on FX and cross-currency swaps as markets for foreign currency funding.

During the 2007–2008 financial crisis, these markets experienced a dislocation because of non-US financial institutions' high level of demand for US dollars amid heightened counterparty risk concerns until central banks established swap lines effectively. That said, over the crisis period, FX markets traded relatively smoothly. Overall FX markets were less adversely affected than equity and fixed income markets.

The authors thank Jessica James (the editor) and anonymous referee for useful suggestions and comments. All the remaining errors are solely our responsibility. The views expressed in this chapter are those of the authors and do not necessarily reflect those of Goldman Sachs or the Bank for International Settlements.

1According to the 2010 BIS Triennial survey, average daily turnover in exchange-traded currency products for all currencies was $166 billion compared with $3981 billion in OTC instruments including spot, outright forwards, and swaps.

2A CTA is a firm registered with the CFTC. It receives compensation for giving investors advice on options, futures, and the actual trading of managed futures accounts.

3These carry trade positions were typically built by combining two different pair against the US dollar such as the net short yen position and the net long euro position, although the CME currently lists cross-rate pairs not including the US dollar such as the yen–euro pair so that traders can bet on FX directions directly without using the US dollar as an intermediary.

4The United Kingdom dismantled controls on capital outflows in 1979. Japan also removed the capital controls in 1979. France and Italy abolished their capital controls in 1986, followed by Spain and Portugal to meet a 1990 deadline for liberalization set by the European Community.

5See Brunnermeier (2009) and Taylor and Williams (2009) for details on the subprime loan problem and its effects on money markets.

6The case of Sanyo Securities was the first defaulting financial institution in postwar Japan. This was also the first default in the uncollateralized call market.

7Hui et al. (2010) find similar results to Baba and Packer (2009a).

8Gross international claims are the sum of cross-border claims in all currencies and local claims in foreign currencies of international banks.

9The VIX is the 30-day implied volatility of S&P 500 index options, calculated and released by the Chicago Board Options Exchange. The VIX is often regarded as a proxy for the global risk appetite.

10For more details, see Baba and Packer (2009b) and Fleming and Klagge (2010).

11These were the first established since September 11, 2001, when the terrorist attacks disrupted financial infrastructure.

Akram FQ, Rime D, Sarno L. Arbitrage in the foreign exchange market: Turning on the microscope. J Int Econ 2008; 76: 237–253.

Akram FQ, Rime D, Sarno L. Does the law of one price hold in international financial markets? Evidence from tick data. J Bank Finance 2009; 33: 1741–1754.

Aliber RZ. The interest rate parity theorem: a reinterpretation. J Pol Econ 1973; 81: 1451–1459.

Baba N. Dynamic spillover of money market turmoil from FX swap to cross-currency swap markets: evidence from the 2007–2008 turmoil. J Fixed Income 2009; 18: 24–38.

Baba N, McCauley RN, Ramaswamy S. US dollar money market funds and non-US banks. BIS Quarterly Review; 2009 Mar. pp. 65–81.

Baba N, Packer F. Interpreting deviations from covered interest parity during the financial market turmoil of 2007–2008. J Bank Finance 2009a; 33: 1953–1962.

Baba N, Packer F. From turmoil to crisis: dislocation in the FX swap market before and after the failure of Lehman Brothers. J Int Money Finance 2009b; 28: 1350–1374.

Baba N, Packer F, Nagano T. The spillover of money market turbulence to FX swap and cross-currency swap markets. BIS Quarterly Review; 2008 Mar. pp. 73–86.

Baba N, Sakurai Y. When and how US dollar shortages evolved into the full crisis? Evidence from the cross-currency swap market. J Bank Finance 2011; 35: 1450–1463.

Baba N, Shim I. Policy responses to dislocations in the FX swap market: the experience of Korea. BIS Quarterly Review; 2010 June. pp. 29–39.

Branson WH. The minimum covered interest differential needed for international arbitrage activity. J Pol Econ 1969; 77: 1028–1035.

Brunnermeier MK. Deciphering the liquidity and credit crunch 2007–08. J Econ Perspect 2009; 23: 77–100.

Clinton Kelvin. Transaction costs and covered interest arbitrage: theory and evidence. J Pol Econ 1988; 96: 358–370.

Coffey N, Hrung WB, Sarkar A. Capital constraints, counterparty risk, and deviations from covered interest rate parity. Federal Reserve Bank New York Staff Report. No. 393; 2009.

Covrig V, Low BS, Melvin M. A yen is not a yen: TIBOR/LIBOR and the determinants of the Japan premium. J Financ Quant Anal 2004; 39: 193–208.

Dooley MP, Isard P. Capital controls, political risk and deviations from interest rate parity. J Pol Econ 1980; 88: 370–384.

Duffie D, Huang M. Swap rates and credit quality. J Finance 1996; 51: 921–950.

Fleming MJ, Klagge NJ. The Federal Reserve's foreign exchange swap lines. Federal Reserve of New York Current Issues in Economics and Finance; 2010. p. 16.

Fletcher DJ, Taylor LW. “Swap” covered interest parity in long-date capital markets. Rev Econ Stat 1996; 78: 530–538.

Fong W-M, Valente G, Fung JKW. Covered interest arbitrage profits: the role of liquidity and credit risk. J Bank Finance 2010; 34: 1098–1107.

Frenkel JA, Levich RM. Covered interest arbitrage: unexploited profits? J Pol Econ 1975; 83: 325–338.

Frenkel JA, Levich RM. Transaction costs and interest arbitrage: tranquil versus turbulent periods. J Pol Econ 1977; 85: 1209–1226.

Hanajiri T. Three Japan premiums in autumn 1997 and autumn 1998: why did premiums differ between markets? Bank of Japan Financial Market Working Paper Series 99-E-1; 1999.

Hui C-H, Genberg H, Chung T-K. Funding liquidity risk and deviations from interest-rate parity during the financial Crisis of 2007–2009. Int J Finance Econ 2010. Forthcoming.

McCormick F. Covered interest arbitrage: unexploited profits? Comment. J Pol Econ 1979; 87: 411–417.

McGuire P, von Peter G. The US dollar shortage in global banking. BIS Quarterly Review; 2009 Mar pp. 47–63.

Melnik A, Plaut SE. Currency swaps, hedging, and the exchange of collateral. J Int Money Finance 1992; 11: 446–461.

Melvin M, Taylor MP. The crisis in the foreign exchange market. J Int Money Finance 2009; 28: 1317–1330.

Obstfeld M, Shambaugh JC, Taylor AM. Financial instability, reserves, and central bank swap lines in the panic of 2008. Am Econ Rev 2009; 99: 480–86.

Peek J, Rosengren ES. Determinants of the Japan premium: action speaks louder than words. J Int Econ 2001; 53: 283–305.

Popper H. Long-term covered interest parity: evidence from currency swaps. J Int Money Finance 1993; 12: 439–448.

Taylor JB, Williams JC. A black swan in the money market. Am Econ J Macroecon 2009; 1: 58–83.

Taylor MP. Covered interest arbitrage and market turbulence. Econ J 1989; 99: 376–391.