Chapter 12

Overcoming the Biggest Obstacle—

YOU!

The secret of success is constancy to purpose.

—Benjamin Disraeli

Are you the weak link when it comes to your pre- and post-retirement financial success? Benjamin Graham, a prominent economist and investor known for coaching Warren Buffett, had the following to say in his book The Intelligent Investor when observing the irrationality that seized the market in the Great Depression: “The investor’s chief problem—and even his worst enemy—is likely to be himself.” Graham recognized that investing requires a certain mentality. “Individuals who cannot master their emotions,” he said, “are ill-suited to profit from the investment process.”

To illustrate that point, consider stand-up paddling (SUP), an ancient sport of Hawaiian heritage that was reintroduced to the modern water sports world by surfing icons Laird Hamilton and David Kalama. Today it is an emerging global sport that has experienced an enormous rise in popularity. Surfing legend Gerry Lopez has helped to make it ubiquitous in my hometown of Bend, Oregon. I believe one of the reasons for its popularity is that unlike surfing, paddleboarding is very easy to learn. It also offers great fun as well as a serious workout, so if you haven’t experienced it yet, give it a try. I have had the good fortune of learning proper technique over the past few years from my friend and former big wave surfer Alistair Paterson. As we were paddling early one morning before work, I could not help but correlate the similarities between navigating the Deschutes River and navigating the stock market.

Stand up paddleboarding on the Deschutes River in Bend, Oregon, 2012.

As a long-term observer of the markets, it never ceases to amaze me how violent and rapid market moves can be in both directions. Since 1946, there have been ten bear markets where the market decline has exceeded 20 percent. The average decline has been 35 percent.

One of the best ways to describe this volatility of U.S. equity markets is to compare it to the rapids Alistair and I encountered as we approached Benham Falls, the largest falls on the Deschutes River. We had started off on placid waters, but quickly had to paddle with increasing intensity to power our way upriver against the current. That’s when I discovered that while you think you can prepare for rapids, you don’t really know when they’re going to show up or how strong they’ll be. Sometimes you hear different noises from the river, but it ends up being nothing. Sometimes you hear very little, and all of a sudden you are in a tumultuous portion of the river. While you are always on the lookout and think you are prepared, it is virtually impossible to be fully primed; and yet there is no way to avoid the rapids if you want to reach your destination. You can anticipate the rapids and prepare as well as possible, but when they come, you are still anxious. The one thing you cannot do is bail off of the paddleboard as this would guarantee you not reaching your destination. Failure is not an option.

Preparing for the rapids during the second half of your financial journey is about designing an effective retirement and distribution plan. Creating your financial hierarchy of needs, asset, and strategy allocation will help get you to your investment destination. Even so, the journey will not always be totally smooth. Rapids will be encountered and you will need to triumph.

When you observe the many economic challenges our country currently faces, I suggest asking yourself, haven’t we had some of these situations in one form or another for the past 50 years? Do you remember sitting in gas lines in 1973 during the oil embargo? Do you remember when inflation rose above 13 percent in 1980? Do you remember Black Monday in October 1987 when the U.S. stock market dropped 20 percent in one day? What about the dot-com crash shortly after 9/11? Then there was 2008, the worst year in stock market history. These and many other financial rapids have been encountered on an irregular basis for half a century; I suspect we will continue to encounter rapids as we paddle down the river of our lifetime. As we’ve discussed, the worst move in the middle of rapids is to bail off the paddleboard. All too often, however, that’s exactly what investors do.

Much like changing your putting stroke right before the biggest putt of your life, individuals often abandon process and technique in the very moments when those are most important. Okay, I know I’m mixing my metaphors here, but the point remains the same. Relying on proven investment processes, as described in previous chapters, can help ensure that you safely navigate your way to your final destination.

Alistair and I exerted much effort to reach Benham Falls, and then carefully turned our paddleboards around in the direction of the current. Our hard work and persistence of staying the course paid off. The rest of the journey was relaxed as we paddled effortlessly with the river, enjoying the Central Oregon scenery and making slight adjustments as needed along the way. Had our attitudes been different, we might have quit before reaching our goal or tensed up to the point where we could barely paddle. Instead, we went with the flow mentally even as we fought against the current physically. You could do a lot worse than adopting a similarly tenacious-meets-go-with-the-flow approach to investing.

Graze on Good Grass

Where do we go from here? I wish I had all of the answers and could confidently tell you where our economy or the markets will be in the future. Every financial expert seems to have his or her own opinion or timeline. Although I will not prognosticate, I will share some insights with the intention of bringing greater clarity as well as reducing some of the fear that unfortunately has spread throughout the United States and abroad.

The investment climate in the U.S. is often exacerbated by our 24/7 financial commentators whose primary objective seems to be increasing their Nielsen ratings. As we feed our minds with a barrage of negative news, we only exacerbate the pessimistic and destructive sentiment that currently prevails. We need to be cautious about the information we allow to dominate our daily thoughts. Fear and pessimism sell and the media knows it. I consider many of the financial networks that highlight headlines containing words like panic and collapse to be financial pornography. Former General Electric CEO Jack Welch compares many financial journalists to weather forecasters in a hurricane who become giddy as they describe the biggest storm of their careers. Their excitement is understandable, but some perspective gets lost in the fray.

Because I believe that what we think about expands, for years I contemplated the idea of killing our family TV. Fearful of being disconnected from the world, however, my wife Jill and I always kept up on current events and thought it was our duty to know everything happening around the globe as well in our community. We found ourselves going to sleep to the hostility of the 11 o’clock news. During the night our subconscious minds would ponder the last messages they had been fed. In the morning we would immediately flick on the news and start our days with this same negativity and gloom. Was this benefiting us? Five years ago we finally pulled the plug on our TV. We said no more to fear. It is amazing how our world shifted as we started focusing even more on the things that truly matter: our family, friends, and community.

Invest in Yourself Instead of in Fear

Winston Churchill said: “Let our advance worrying become advance thinking and planning.” Planning and preparation make the difference in the success of many things. To paraphrase Franklin Delano Roosevelt, who led us out of the Great Depression, I believe the main thing to be fearful about today is fear itself. Thoughts of doubt and fear never accomplish anything and never can. Thoughts fly from your mind to connect with whatever you are thinking about. James Allen in his classic essay “As a Man Thinketh” writes: “A man cannot directly choose his circumstances but he can choose his thoughts, and so indirectly, yet surely shape his circumstances.” We must focus on squashing the fear that is often prevalent in our minds. Trusting ourselves in the midst of a world seemingly gone mad is a wise use of our intentions.

So what are your intentions moving forward regarding your years of financial independence?

What are you aiming for in your life and your financial future?

I’m reminded of Wayne Gretzky’s summation regarding how he plays hockey: “I skate to where the puck is going to be, not to where it has been.” Unfortunately when it comes to investing, fearful thoughts based on past downturns seem to preoccupy the minds of many. That makes it very difficult for them to keep a positive outlook. Now more than ever we need to change what we focus on. What we focus on expands. I know, I’m starting to repeat myself. But I also know that when I focus on fear, I experience more fear and I find more reasons to be fearful. This can become a self-fulfilling prophecy that leads to a damaging downward spiral. Over the years I have made a conscious effort not to worry about the things in my life that I have absolutely no control over. I have no control over the weather—or the stock and real estate markets—but I can control how I observe all of them. I can even control how I perceive their impact on me. And I can plan in a way that mitigates that impact.

These days, instead of asking, Why me? I ask myself whether there could be a gift in whatever perceived adversity I’m experiencing. How could that single shift impact you? Imagine that instead of spending time listening to the news or reading the newspaper to find out why you should be fearful, you used that time and energy to do something more meaningful and beneficial. Read something uplifting, listen to something empowering, learn a new skill, connect with others or enjoy your time in nature. For over 20 years, I have used my time in my car to listen to CDs on motivation, sales techniques, philosophy and, of course, investing. If you were to listen to an educational CD or podcast on your way to and from work for just 30 minutes a day, that would total 125 hours each year. This equates to not just one but several college courses. Maybe that’s why Zig Ziglar referred to his car as Automobile University. Just think about what you could learn about personal finance during this time.

An Illusion of Linearity

One of the lessons you would learn is that linearity is pure illusion where investing is concerned. Let’s take, well, you as an example. When you were basking in times of economic glory as your home was increasing in value on a daily basis and your 401(k) continued to reach new highs, you probably expected this favorable trend to continue on into the future without letting up. Most people did. Following a similar pattern during the Great Recession, people focusing on their current challenges felt that these distressing times were here for good and that we would experience a permanent downtrend. Much of our society seems to buy into this way of thinking, but the world does not work in a linear fashion. History has shown us that the only constant in life is change. Market downturns are a natural part of our free market system. They have occurred throughout history and will continue to do so. In fact, since 1929 there have been 15 bear markets. They all eventually end. At some point, downturns may even be recognized as part of a cycle that actually includes years of slow and steady upward progress.

A Bear Market Is the Temporary Eruption of a Permanent Uptrend

The word recession has become taboo in current times. Most people do not realize what you know—that our economy averages a recession about every nine years. This has and always will be a reality to our economy. When we take this historical perspective and realize that there has never been a down real estate or stock market that has not bounced back to hit an all-time high, it becomes that much easier to deal with challenging times.

Staying calm amid market turmoil is not easy. Fears of further decline can make investors feel skittish. This is absolutely the wrong time for investors to panic and throw in the towel. The cost of missing a market rebound is significant. Remember the couple that had been referred to my practice? The man gloated about the fact that he had liquidated his entire retirement portfolio just before the markets crashed in 2008. I congratulated him and asked him when he had reinvested his retirement funds back into the market as the Dow Jones Industrial Average (DIJA) had climbed more than 125 percent from its low on March 6, 2009. In a dejected tone he stated that the markets had been just too high to invest in and that he was waiting for them to retreat before reinvesting. Had he remained invested, his assets would likely have grown by 25 percent—a profit he missed out on. I had to explain that by attempting to time the market, he would have to be lucky not just once, but twice. The odds of accomplishing such a feat are not favorable.

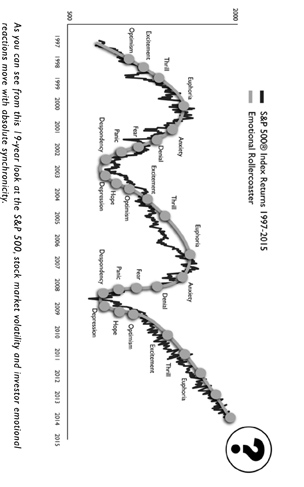

Historically when coming out of a bear market, the best equity market performance is generated in the first three months following the bottom. As it is practically impossible to predict the bottom in a market, investors need to remain invested. If not, like the gentleman in my office experienced, they risk missing out on the period of highest performance and jeopardize attractive long-term performance. Investing icon Peter Lynch of Fidelity Investments said: Which way the next 1,000 to 2,000 points in the market will go is anybody’s guess, but I believe strongly that the next 10,000, 20,000 and 40,000 points will be up. The markets have been undulating like a yo-yo but Lynch was on to something as the U.S. stock markets hit new heights just four years after the lows. Indeed, in the summer of 2014 the Dow surged above 17,000 and the S&P surpassed the 2000 milestone for the very first time.

The Yo-Yo Effect

It is all too common to focus on our current dilemmas and challenges without learning from history. But sometimes we need help putting the past in perspective, especially where finances are concerned. To help you with that, I want you to visualize a cute boy with his baseball cap sitting backward on his head as he starts walking up a sinuous mountain road with a yoyo in hand. The undulating yoyo symbolizes the economy, real estate or stock market. As the yoyo goes up everyone is elated. As it falls everyone feels scared and depressed. As the yoyo starts its next ascent we all celebrate with exuberance. Then before we know it, gravity takes over and the yoyo faces a downward spiral. Suddenly our stomachs begin to feel queasy with apprehension. It is up to each of us to choose whether we focus on the rising and falling yoyo or the boy. You see, they both reach the top of the mountain with its majestic views at the exact same time.

So let’s take that analogy and apply it to relatively recent history. October 19, 1987, is an ominous date known as Black Monday. The Black Monday decline was the largest one-day percentage decline in stock market history. The Dow Jones Industrial Average dropped by 508 points to 1739 (22.6 percent). By the end of October, stock markets in Hong Kong had fallen 45.8 percent, Australia 41.8 percent and the United Kingdom 26.4 percent. New Zealand’s market was hit especially hard, falling about 60 percent. Investors around the world thought the end was near and fear overtook the financial world. Interestingly, the DJIA was not only positive for the 1987 calendar year but would close on December 31st, 1987, at an all-time record high of 1,939 points.

Just 25 years later, the DJIA can now fluctuate in a single trading day by as much as Black Monday’s record-breaking 508 points. If someone had told you back then that in 2014 the DJIA would surpass 17,000, you would have thought they had lost their senses. The economy may continue its yo-yo-like movement with ups and downs. It’s up to us to remember to keep our perspective by learning from the past and rising to the challenge of the future.

An Economic Crisis Is a Terrible Thing

to Waste

While the past recession has been a very emotional time period for investors, it has been exponentially worse for those at or near retirement. Over-investing in our emotions, however, is bad news for our financial investments. Chuck Widger, the executive chairman of Brinker Capital, sums up my points eloquently:

To reap the rewards of prudent investing, you’ll have to follow the time-tested approach of staying invested for the long term—even though it’s usually accompanied by a time-tested case of anxiety. The flow of individual investors’ money shows that in the battle between emotions and sound strategy, emotion has taken the upper hand. Many investors abandon long-term strategies for the perceived safety of cash. It’s human nature: In challenging times, our emotions tell us to pull out of the markets and run for the hills. However, this creates two big problems. First, it’s hard to see opportunities from far up in the hills. And second, when markets turn around, it can take too long to climb back down and get invested again. Selling during periods of market stress may cause you to feel the pain of loss twice: first, you lock in your losses; then you risk missing out on the market’s eventual recovery. This can leave a hole in your savings that never really gets repaired—you’ll always have less savings to build on than if you stayed the course. Instead of fighting an exhausting battle with your emotions, develop a diversified long-term strategy and stick to it. After all, your long-term goals don’t change overnight—so why should your portfolio?

Warren Buffett says that you should be fearful when people are greedy and greedy when others are fearful. If more of us had followed that advice before the crash, we’d all be better off. Many people wouldn’t have bought that sixth or seventh investment property that seemed like too good a deal to pass up. Instead, we would have waited until prices dropped and scooped up properties on sale. That’s exactly what a group of investors from California did here in Bend. When the real estate bubble burst, they swooped in and grabbed developed lots that hadn’t been built on, paying as little as $20,000 each. Just a few years later, they’re getting $70,000 for those same pieces of land, more than tripling their money. I call that a killer return on investment.

We have two options when financial challenge hits. We can let emotion get the best of us. Or we can see the gift in adversity and be ready to take advantage of those shifts and seize opportunities that come our way.

Life Is 10 Percent What Happens to You and 90 Percent How You React

I was brought up with the ideology that some people say they can and some people say they can’t. They are both right! It is imperative to stay positive during difficult times. No one said it better than Charles R. Swindoll:

The longer I live, the more I realize the impact of attitude on life. Attitude, to me, is more important than facts. It is more important than the past, than education, than money, than circumstances, than failure, than successes, than what other people think or say or do. It is more important than appearance, giftedness or skill. It will make or break a company... a church... a home. The remarkable thing is we have a choice everyday regarding the attitude we will embrace for that day. We cannot change our past... we cannot change the fact that people will act in a certain way. We cannot change the inevitable. The only thing we can do is play on the one string we have, and that is our attitude. I am convinced that life is 10 percent what happens to me and 90 percent of how I react to it. And so it is with you... we are in charge of our Attitudes.

I used to have this quote printed in miniscule print on the back of my business card as a reminder each day. I am convinced that the failures we experience are dress rehearsals for success

I started this book with a story about Mt. Everest and how once we get to the top of the mountain we are only half way into our journey with the most risky part of the journey still ahead of us. So it is only appropriate to end with a story about this legendary mountain.

George Mallory, a famous English mountaineer who took part in the first three British expeditions to Mt. Everest in the early 1920s, was once asked what the use of climbing Mt. Everest was. I find his response to be fitting today as we emerge from the Great Recession and reevaluate our core values and goals:

It is no use. There is not the slightest prospect of any gain whatsoever. We shall not bring back a single bit of gold or silver, not a gem, nor any coal or iron. We shall not find a single foot of earth that can be planted with crops to raise food. It’s no use. So, if you cannot understand that there is something in man which responds to the challenge of this mountain and goes out to meet it, that the struggle is the struggle of life itself upward and forever upward, then you won’t see why we go. What we get from this adventure is just sheer joy. And joy is, after all, the end of life. We do not live to eat and make money. We eat and make money to be able to enjoy life. That is what life means and what life is for.

Unfortunately, on the third expedition, in June 1924, Mallory and his climbing partner Andrew Irvine both disappeared somewhere high on the Northeast Ridge.

Yes, there are risks to just about anything we do in life, but sometimes you just have to go for it. Only then can you truly be open to the opportunities in front of you. Only then can you tap into—and take advantage of—serendipity. Only then can you really live your life the way you want and deserve to.

So if you’re ready to go for it, just do it! Along the way, don’t forget to reach out for help when you need it. Together we can get you up and back down this financial mountain safely. Because as you climb toward retirement or enjoy those years you’ve worked so hard for, failure is simply not an option.