Chapter 4

Breakout Entries in Existing Strong Trends

When a trend is strong and there is a pullback, every breakout beyond a prior extreme is a valid with-trend entry. The breakout usually has strong volume, a large breakout bar (a strong trend bar), and follow-through over the next several bars. Smart money is clearly entering on the breakout. However, that is rarely the best way to trade a breakout, and price action traders almost always find an earlier price action entry like a high 1 or 2 in a bull trend. It is important to recognize that when a trend is strong, you can enter at any time and make a profit if you use an adequate stop. Once traders see that a trend is strong, some traders do not take the first entries because they are hoping for a larger pullback, like a two-legged pullback to the moving average. For example, if the market just became clearly always-in long and the initial bull spike has three good-sized bull trend bars with small tails, a trader might be afraid that the move was a little climactic and decide that he wants to wait for a high 2 buy setup. However, when a trend is very strong like this, the first couple of entries are usually just high 1 buy setups. Aggressive traders will place limit orders to buy below the low of the prior bar, expecting any reversal attempt to fail. Once the market trades below the low of the prior bar, they will expect a high 1 buy setup to lead to at least a new high and probably a measured move up, based on the height of the bull spike. If traders fail to take either of these two early entries, they should train themselves to guarantee that they get into this strong trend. When they are looking at the pullback beginning, they should put a buy stop at one tick above the high of the spike, in case the pullback is only one bar and reverses up quickly. If they fail to take either of the early pullback entries and the market begins to race up without them, they will be swept into the trade and not be left behind. On the strongest trades, you will usually see that the bar that breaks above the bull spike is usually a large bull trend bar, and this tells you that many strong bulls believe that there is value buying the new high. If it is a great entry for so many of them, it is a great entry for you as well.

One quick way to determine the strength of a trend is to see how it reacts after it breaks beyond prior trend extremes. For example, if a bull trend has a pullback and then breaks above the high of the day, does it find more buyers or sellers on the breakout? If the market moves far enough up for the breakout buyers to make at least a scalper's profit, then the breakout found more buyers than sellers. That is one of the hallmarks of a strong trend. By contrast, if the market raced to a new swing high but then reversed down within a bar or two, then the breakout found more sellers than buyers, which is more characteristic of trading ranges, and the market could be transitioning into a trading range. Watching how the market behaves at a new high gives a clue as to whether there is a still strong trend in effect. If not, even though the trend may still be in effect, it is less strong and longs should be taking profits at the new extreme and even looking to go short, instead of buying the breakout to the new high or looking to buy a small pullback. The opposite is true in bear trends.

In general, if you are entering on a stop at a new extreme, you should scalp most or all of your trade unless the trend is especially strong. If so, you can swing most or all of your position. For example, if the market is in a strong bull trend, bulls will buy above the most recent high on a stop but most will scalp out of their trade. If the market is extremely strong, they might swing most of their position. If not, bears will be shorting on every new swing high with a limit order at the old swing high or slightly above, and they will add on higher. If the market drops after their first entry, they will exit with a profit. If instead the market continued up, they expect the old high to be tested by a pullback within a few bars, and this would allow them to exit their first entry at breakeven and to exit their higher entry with a profit.

Figure 4.1 Strong Breakouts Have Many Consecutive Strong Trend Bars

As shown in Figure 4.1, the rally from the bar 4 higher low became a strong bull trend (higher low after a trend line break), with seven bull trend bars in a row as the market reversed through the bar 1 high of the day. With that much momentum, everyone was in agreement that bar 5 would be exceeded before there was a sell-off below the start of the bull trend at bar 4. The market was in always-in mode and would likely have approximately a measured move up based on the bull spike from bar 4 to bar 5 or from the opening range from bar 1 to bar 2, and therefore bulls could buy at the market, on any pullback, at or below the low of any bar, above the high of any pullback, on the close of any bar, and on a stop above the most recent swing high.

Breakout traders would have bought above every prior swing high, such as on bars 5, 6, 8, 11, 13, and 16. By bar 5, the market was clearly strongly always-in up. Aggressive bulls placed limit orders to buy at the low of the prior bar, expecting the initial pullback to only be a bar or so long and for the market to reverse up in a high 1. Buying below the prior bar is usually a lower entry than buying above the high 1. If traders preferred to enter on stops and did not buy at the low of the bar after bar 5, they would have bought on the bar 6 high 1 entry as it moved above the prior bar. If they instead were hoping for a deeper pullback like a high 2 at the moving average and did not take either of these two entries, they needed to protect themselves from missing the strong trend. They should never let themselves get trapped out of a great trend. The way to do this would be by placing a worst-case buy stop at one tick above the high of the bar 5 bull spike. The entry would be worse, but at least they would get into a trade that was likely to continue for at least a measured move up based on the height of the bull spike. Bar 6 was a large bull trend bar with no tails, which indicated that many strong bulls bought on that same bar. Once traders saw that the strong bulls bought the breakout to the new high, they should have been reassured that the trade was good. Their initial protective stop was below the most recent minor swing low, which was the high 1 signal bar before bar 6.

Pullback traders would have entered earlier in every instance, on the breakout pullbacks, which were bull flags—for example, at the bar 6 high 1, the bar 8 high 2, the bar 10 failed wedge reversal, the bar 12 high 2 and failed trend line break (not shown), and the bar 15 high 2 test below the moving average (first moving average gap bar buy setup) and double bottom with bar 12 (the high 2 was based on the two clear, larger legs down from bar 14). Breakout traders are initiating their longs in the exact area where price action traders are selling their longs for a profit. In general, it is not wise to be buying where a lot of smart traders are selling. However, when the market is strong, you can buy anywhere, including above the high, and still make a profit. However, the risk/reward ratio is much better when you buy pullbacks than it is when you buy breakouts.

Blindly buying breakouts is foolish, and smart money would not have bought the bar 11 breakout because it was a possible third push up after the exceptionally strong bar 6 breakout bar reset the count and formed the first push up. Also, they would not have bought the bar 16 breakout, which was a higher high test of the old bar 14 high after a trend line break, since there was too much risk of a trend reversal. It is far better to fade breakouts when they fail or enter in the direction of the breakout after it pulls back. When traders think that a breakout looks too weak to buy, they will often instead short at and above the prior high.

Bears can make money on breakouts above prior swing highs by shorting the breakout and adding on higher. Then, when the market comes back to test the breakout, they can exit their entire short position and make a profit on their second entry and get out around breakeven on their first short. This strategy would have been possible if a bear shorted as the market moved above bars 5, 7, 9, and 14. For example, as the market pulled back from the bar 7 swing high, bears could place orders to go short at or slightly above that high. Their shorts would be filled during bar 8. They would then add to their short positions when they thought that the market might begin to pull back again or at a couple of points higher. They would then try to exit all their short trades on a limit order at the original entry price, at the bar 7 high. Because bears are buying back their shorts on that breakout test and because bulls are adding to their longs in that same area, the pullback often ends at that price and the market once again goes up.

The reversal up at bar 4 was a breakout of the final flag of the bear trend. Sometimes final flag reversals come from higher lows and not lower lows. The test of the old extreme can exceed the old extreme or fall short. Bar 15 was the end of the final flag in the bull trend, and the reversal at bar 16 was from a new extreme (a higher high).

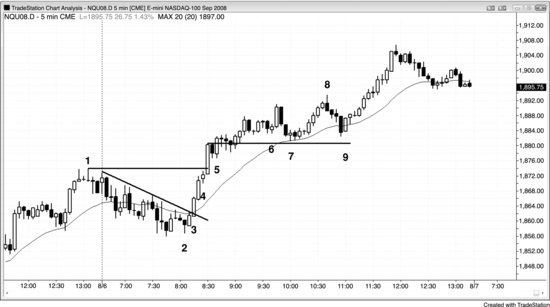

Figure 4.2 A Strong Trend Usually Has Follow-Through on the Next Day

As shown in Figure 4.2, yesterday (only the final hour is visible) was a strong trend from the open bull trend day, so the odds were high that there would be enough follow-through today to close above the open, and even if there was a pullback on the open today, the bull trend would likely reach at least a nominal new high. Traders were all watching for a buy setup.

Bar 2 was a small higher low after a high 4 buy setup, and a double bottom with the final pullback of yesterday. The signal bar had a bear close but at least its close was above its midpoint. Traders who missed that entry saw the market form a strong bull spike over the next two and three bars and decided that the market was now always-in long. Smart traders bought at least a small position at the market, just in case there was no pullback until after the market went much higher.

There were two large bull trend bars on the breakout, each with strong closes and small tails. Had you gone long at the close of bar 3, you would be swinging a portion of your trade at this point. This means that if you were instead flat, you could buy that same position size at the market and use the stop that you would have used had you bought earlier. That stop would now be below the bar 3 strong bull trend bar.

Bar 4 was a pause bar just below yesterday's high, and buying one tick above its high is another good entry. A pause bar is a possible reversal setup, so buying above its high will be going long where the early bears are buying back their shorts and where the longs who exited early would also be buying back their longs.

At this point, the trend was clear and strong and you should be buying every pullback.

Bar 6 was followed by a two-bar reversal and a third push up and was an acceptable short setup for a pullback to the moving average.

Bar 8 was a reasonable countertrend scalp (a failed breakout to a new high after a trend line break) since it was a strong bear reversal bar and an expanding triangle top, but the trend was still up. Note that there had not yet been a close below the moving average and the market had been above the moving average for more than 20 bars, both of which are signs of strength. If you were thinking about taking a countertrend scalp, you would do so only if you would immediately look to get long again as the trend reversed back up. You do not want to exit a long, take a short scalp, and then miss out on a swing up as the trend resumes. If you cannot process the two changes of direction reliably, do not take the countertrend trade; simply hold long.

Bar 9 was a bull inside bar after the first close below the moving average and the second bar of a two-bar reversal, so a breakout above the setup was expected to test the bull high at a minimum.