Part I

Breakouts: Transitioning into a New Trend

The market is always trying to break out, and then the market tries to make every breakout fail. This is the most fundamental aspect of all trading and is at the heart of everything that we do. One of the most important skills that a trader can acquire is the ability to reliably determine when a breakout will succeed or fail (creating a reversal). Remember, every trend bar is a breakout, and there are buyers and sellers at the top and bottom of every bull and bear trend bar, no matter how strong the bar appears. Since every trend bar is a breakout and trend bars are common, traders must understand that they have to be assessing every few bars all day long whether a breakout will continue or fail and then reverse. This is the most fundamental concept in trading, and it is crucial to a trader's financial success to understand it. A breakout of anything is the same. Even a climactic reversal like a V bottom is simply a breakout and then a failed breakout. There are traders placing trades based on the belief that the breakout will succeed, and other traders placing trades in the opposite direction, betting it will fail. The better traders become at assessing whether a breakout will succeed or fail, the better positioned they are to make a living as a trader. Will the breakout succeed? If yes, then look to trade in that direction. If no (and become a failed breakout, which is a reversal), then look to trade in the opposite direction. All trading comes down to this decision.

Breakout is a misleading term because out implies that it refers only to a market attempting to transition from a trading range into a trend, but it can also be a buy or sell climax attempting to reverse into a trend in the opposite direction. The most important thing to understand about breakouts is that most breakouts fail. There is a strong propensity for the market to continue what it has been doing, and therefore there is a strong resistance to change. Just as most attempts to end a trend fail, most attempts to end a trading range and begin a trend also fail.

A breakout is simply a move beyond some prior point of significance such as a trend line or a prior high or low, including the high or low of the previous bar. That point becomes the breakout point, and if the market later comes back to test that point, the pullback is the breakout test (a breakout pullback that reaches the area of the breakout point). The space between the breakout point and the breakout test is the breakout gap. A significant breakout, one that makes the always-in position clearly long or short and is likely to have follow-through for at least several bars, almost always appears as a relatively large trend bar without significant tails. “Always in” is discussed in detail in the third book, and it means that if you had to be in the market at all times, either long or short, the always-in position is whatever your current position is. The breakout is an attempt by the market either to reverse the trend or to move from a trading range into a new trend. Whenever the market is in a trading range, it should be considered to be in breakout mode. There is two-sided trading until one side gives up and the market becomes heavily one-sided, creating a spike that becomes a breakout. All breakouts are spikes and can be made up of one or several consecutive trend bars. Breakouts of one type or another are very common and occur as often as every few bars on every chart. As is discussed in Chapter 6 on gaps, all breakouts are functionally equivalent to gaps, and since every trend bar is a breakout (and also a spike and a climax), it is also a gap. Many breakouts are easily overlooked, and any single one may be breaking out of many things at one time. Sometimes the market will have setups in both directions and is therefore in breakout mode; this is sometimes referred to as being in an inflection area. Traders will be ready to enter in the direction of the breakout in either direction. Because breakouts are one of the most common features of every chart, it is imperative to understand them, their follow-through, and their failure.

The high of the prior bar is usually a swing high on some lower time frame chart, so if the market moves above the high of the prior bar, it is breaking above a lower time frame swing high. Also, when the market breaks above a prior swing high on the current chart, that high is simply the high of the prior bar on some higher time frame chart. The same is true for the low of the prior bar. It is usually a swing low on a lower time frame chart, and any swing low on the current chart is usually just the low of the prior bar on a higher time frame chart.

It is important to distinguish a breakout into a new trend from a breakout of a small trading range within a larger trading range. For example, if the chart on your screen is in a trading range, and the market breaks above a small trading range in the bottom half of the screen, most traders will assume that the market is still within the larger trading range, and not yet in a bull trend. The market might simply be forming a buy vacuum test of the top of the larger trading range. Because of this, smart traders will not buy the closes of the strong bull trend bars near the top of the screen. In fact, many will sell out of their longs to take profits and others will short them, expecting the breakout attempt to fail. Similarly, even though buying a high 1 setup in strong bull spike can be a great trade, it is great only in a bull trend, not at the top of a trading range, where most breakout attempts will fail. In general, if there is a strong bull breakout, but it is still below the high of the bars on the left half of the screen, make sure that the there is a strong trend reversal underway before looking to buy near the top of the spike. If you believe that the market might still be within a trading range, only consider buying pullbacks, instead of looking to buy near the top of the spike.

Big traders don't hesitate to enter a trend during its spike phase, because they expect significant follow-through, even if there is a pullback immediately after their entry. If a pullback occurs, they increase the size of their position. For example, if there is a strong bull breakout lasting several bars, more and more institutions become convinced that the market has become always-in long with each new higher tick, and as they become convinced that the market will go higher, they start buying, and they press the trades by buying more as the market continues to rise. This makes the spike grow very quickly. They have many ways to enter, like buying at the market, buying a one- or two-tick pullback, buying above the prior bar on a stop, or buying on a breakout above a prior swing high. It does not matter how they get in, because their focus is to get at least a small position on, and then look to buy more as the market moves higher or if it pulls back. Because they will add on as the market goes higher, the spike can extend for many bars. A beginning trader sees the growing spike and wonders how anyone could be buying at the top of such a huge move. What they don't understand is that the institutions are so confident that the market will soon be higher that they will buy all of the way up, because they don't want to miss the move while waiting for a pullback to form. Beginners are also afraid that their stops would have to be below the bottom of the spike, or at least below its midpoint, which is far away. The institutions know this, and simply adjust their position size down to a level where their dollars at risk are the same as for any other trade.

At some resistance level, the early buyers take some profits, and then the market pulls back a little. When it does, the traders who want a larger position quickly buy, thereby keeping the initial pullback small. Also, the bulls who missed the earlier entries will use the pullback to finally get long. Some traders don't like to buy spikes, because they don't like to risk too much (the stop often needs to be below the bottom of the spike). They prefer to feel like they are buying at a better price (a discount) and therefore will wait for a pullback to form before buying. If everyone is looking to buy a pullback, why would one ever develop? It is because not everyone is looking to buy. Experienced traders who bought early on know that the market can reverse at any time, and once they feel that the market has reached a resistance area where they think that profit taking might come in or the market might reverse, they will take partial profits (they will begin to scale out of their longs), and sometimes will sell out of their entire position. These are not the bulls who are looking to buy a few ticks lower on the first pullback. The experienced traders who are taking partial profits are scaling out because they are afraid of a reversal, or of a deeper pullback where they could buy back many ticks lower. If they believed that the pullback was only going to last for a few ticks, and then the bull was going to resume, they would never have exited. They always take their profits at some resistance level, like a measured move target, a trend line, a trend channel line, a new high, or at the bottom of a trading range above. Most of the trading is done by computers, so everything has a mathematical basis, which means that the profit taking targets are based on the prices on the screen. With practice, traders can learn to spot areas where the computers might take profits, and they can take their profits at the same prices, expecting a pullback to follow. Although trends have inertia and will go above most resistance areas, when a reversal finally does come, it will always be at a resistance area, whether or not it is obvious to you.

Sometimes the spike will have a bar or a pattern that will allow aggressive bears to take a small scalp, if they think that the pullback is imminent and that there is enough room for a profit. However, most traders who attempt this will lose, because most of the pullbacks do not go far enough for a profit, or the trader's equation is weak (the probability of making a scalp times the size of the profit is smaller than the probability of losing times the size of the protective stop). Also, traders who take the short are hoping so much for their small profit that they invariably end up missing the much more profitable long that forms a few minutes later.

Traders enter in the direction of the breakout or in the opposite direction, depending on whether they expect it to succeed or to fail. Are they believers or nonbelievers? There are many ways to enter in the direction of the breakout. Once traders feel a sense of urgency because they believe that a significant move might be underway, they need to get into the market. Entering during a breakout is difficult for many traders because the risk is larger and the move is fast. They will often freeze and not take the trade. They are worried about the size of the potential loss, which means that they are caring too much to trade. They have to get their position size down to the “I don't care” size so that they can quickly get in the trade. The best way for them to take a scary trade is to automatically trade only a third or a quarter of their normal trade size and use the wide stop that is required. They might catch a big move, and making a lot on a small position is much better than making nothing on their usual position size. It is important to avoid making the mistake of not caring to the point that you begin to trade weak setups and then lose money. First spot a good setup and then enter the “I don't care” mode.

As soon as traders feel that the market has had a clear always-in move, they believe that a trend is underway and they need to get in as soon as possible. For example, if there is a strong bull breakout, they can buy the close of the bar that made them believe that the trend has begun. They might need to see the next bar also have a bull close. If they wait and they get that bull close, they could buy as soon as the bar closes, either with a limit order at the level of the close of the bar or with a market order. They could wait for the first pause or pullback bar and place a limit order to buy at its close, a tick above its low, at its low, or a tick or two below its low. They can place a limit order to buy any small pullback, like a one- to four-tick pullback in the Emini, or a 5 to 10 cent pullback in a stock. If the breakout bar is not too large, the low of the next bar might test the high of the bar before the breakout, creating a breakout test. They might place a limit order to buy at or just above the high of that bar, and risk to the low of the breakout bar. If they try to buy at or below a pause bar and they do not get filled, they can place a buy stop order at one tick above the high of the bar. If the spike is strong, they can look to buy the first high 1 setup, which is a breakout pullback. Earlier on, they can look at a 1, 2, or 3 minute chart and buy at or below the low of a prior bar, above a high 1 or high 2 signal bar, or with a limit order at the moving average. Once they are in, they should manage the position like any trend trade, and look for a swing to a measured move target to take profits and not exit with a small scalp. The bulls will expect every attempt by the bears to fail, and therefore look to buy each one. They will buy around the close of every bear trend bar, even if the bar is large and closes on its low. They will buy as the market falls below the low of the prior bar, any prior swing low, and any support level, like a trend line. They also will buy every attempt by the market to go higher, like around the high of a bull trend bar or as the market moves above the high of the prior bar or above a resistance level. This is the exact opposite of what traders do in strong bear markets, when they sell above and below bars, and above and below both resistance and support. They sell above bars (and around every type of resistance), including strong bull trend bars, because they see each move up as an attempt to reverse the trend, and most trend reversal attempts fail. They will sell below bars (and around every type of support), because they see each move down as an attempt to resume the bear trend, and expect that most will succeed.

Since most breakout attempts fail, many traders enter breakouts in the opposite direction. For example, if there is a bull trend and it forms a large bear trend bar closing on its low, most traders will expect this reversal attempt to fail, and many will buy at the close of the bar. If the next bar has a bull body, they will buy at the close of the bar and above its high. The first target is the high of the bear trend bar, and the next target is a measured move up, equal to the height of the bear trend bar. Some traders will use an initial protective stop that is about the same number of ticks as the bear trend bar is tall, and others will use their usual stop, like two points in the Emini. Information comes fast during a breakout, and traders can usually formulate increasingly strong opinions with the close of each subsequent bar. If there is a second strong bear trend bar and then a third, more traders will believe that the always-in position has reversed to down, and the bears will short more. The bulls who bought the bear spike will soon decide that the market will work lower over the next several bars and will therefore exit their longs. It does not make sense for them to hold long when they believe that the market will be lower in the near future. It makes more sense for them to sell out of their longs, take the loss, and then buy again at a lower price once they think that the bull trend will resume. Because the bulls have become sellers, at least for the next several bars, there is no one left to buy, and the market falls to the next level of support. If the market rallied after that first bear bar, the bears would quickly see that they were wrong and would buy back their shorts. With no one left to short and everyone buying (the bulls initiating new longs and the bears buying back their shorts), the market will probably rally, at least for several more bars.

Traders have to assess a breakout in relation to the entire chart and not just the current leg. For example, if the market is breaking out in a strong bull spike, look across the chart to the left side of the screen. If there are no bars at the level of the current price, then buying closes and risking to below the bottom of the spike is often a good strategy. Since the risk is big, trade small, but because a strong breakout has at least a 60 percent chance of reaching a measured move that is approximately equal to the size of the spike, the trader's equation is good (the probability of success times the potential reward is greater than the probability of failure times the risk). However, when you look to the left side of the screen, if you see that the current breakout is still below the high from 20 or 30 bars earlier, the market might still be in a trading range. Trading ranges regularly have sharp bull spikes that race to the top, only to reverse. The market then races to the bottom and that breakout attempt also fails. Because of this, buying the closes of strong bull trend bars near the top of the trading range is risky, and it is usually better to look to buy pullbacks instead. Traders should trade the market like a trading range until it is clearly in a trend.

A move above a prior high in a bull trend will generally lead to one of three outcomes: more buying, profit taking, or shorting. When the trend is strong, strong bulls will press (add to) their longs by buying the breakout above the old high and there will be a measured move up of some kind. If the market goes up far enough above the breakout to enable a trader to make at least a profitable scalp before there is a pullback, then assume that there was mostly new buying at the high. If it goes sideways and the breakout shows signs of weakness (discussed further on), assume that there was profit taking and that the bulls are looking to buy again a little lower. If the market reverses down hard, assume that the strong bears dominated at the new high and that the market will likely trade down for at least a couple of legs and at least 10 bars.

In the absence of some rare, dramatic news event, traders don't suddenly switch from extremely bullish to extremely bearish. There is a gradual transition. A trader becomes less bullish, then neutral, and then bearish. Once enough traders make this transition, the market reverses into a deeper correction or into a bear trend. Every trading firm has its own measure of excess, and at some point enough firms decide that the trend has gone too far. They believe that there is little risk of missing a great move up if they stop buying above the old high, and they will buy only on pullbacks. If the market hesitates above the old high, the market is becoming two-sided, and the strong bulls are using the new high to take profits.

Profit taking means that traders are still bullish and are looking to buy a pullback. Most new highs are followed by profit taking. Every new high is a potential top, but most reversal attempts fail and become the beginning of bull flags, only to be followed by another new high. If a rally to test the high has several small pullbacks within the leg up, with lots of overlapping bars, several bear bodies, and big tails on the tops of the bars, and most of the bull trend bars are weak, then the market is becoming increasingly two-sided. The bulls are taking profits at the tops of the bars and buying only at the bottoms of the bars, and the bears are beginning to short at the tops of the bars. Similarly, the bulls are taking profits as the market approaches the top of the bull trend and the bears are shorting more. If the market goes above the bull high, it is likely that the profit taking and shorting will be even stronger.

Most traders do not like to reverse, so if they are anticipating a reversal signal, they prefer to exit their longs and then wait for that signal. The loss of these bulls on the final leg up in the trend contributes to the weakness of the rally to the final high. If there is a strong reversal down after the market breaks above the prior high, the strong bears are taking control of the market, at least for the near term. Once that happens, then the bulls who were hoping to buy a small pullback believe instead that the market will fall further. They therefore wait to buy until there is a much larger pullback, and their absence of buying allows the bears to drive the market down into a deeper correction lasting 10 or more bars and often having two or more legs. Whenever there is a new trend, traders reverse their mind-set. When a bull trend reverses to a bear trend, they stop buying above bars on stops and buying below bars on limit orders, and begin selling above bars on limit orders and selling below bars on stops. When a bear trend reverses to a bull trend, they stop selling below bars on stops and selling above bars on limit orders, and begin buying above bars on stops and buying below bars on limit orders.

There is one situation where the breakout in a bull trend is routinely met by aggressive shorts who will usually take over the market. A pullback is a minor trend in the opposite direction, and traders expect it to end soon and for the larger trend to resume. When there is a pullback in a strong bear trend, the market will often have two legs up in the minor bull trend. As the market goes above the high of the first leg up, it is breaking out above a prior swing high in a minor bull trend. However, since most traders will see the move up as a pullback that will end very soon, the dominant traders on the breakout will usually be aggressive sellers, instead of aggressive new buyers, and the minor bull trend will usually reverse back down into the direction of the major bear trend after breaking out above the first or second swing high in the pullback.

The same is true of new lows in a bear trend. When the bear trend is strong, strong bears will press their shorts by adding to their positions on the breakout to a new low and the market will continue to fall until it reaches some measured move target. As the trend weakens, the price action at a new low will be less clear, which means that the strong bears are using the new low as an area to take profits on their shorts rather than as an area to add to their shorts. As the bear trend further loses strength, the strong bulls will eventually see a new low as a great price to initiate longs and they will be able to create a reversal pattern and then a significant rally.

As a trend matures, it usually transitions into a trading range, but the first trading ranges that form are usually followed by a continuation of the trend. How do the strong bulls and bears act as a trend matures? In a bull trend, when the trend is strong, the pullbacks are small because the strong bulls want to buy more on a pullback. Since they suspect that there may not be a pullback until the market is much higher, they begin to buy in pieces, but relentlessly. They look for any reason to buy, and with so many big traders in the market, there will be some buying for every imaginable reason. They place limit orders to buy a few ticks down and other limit orders to buy a few ticks above the low of the prior bar, at the low of the prior bar, and below the low of the prior bar. They place stop orders to buy above the high of the prior bar and on a breakout above any prior swing high. They also buy on the close of both any bull or bear trend bar. They see the bear trend bar as a brief opportunity to buy at a better price and the bull trend bar as a sign that the market is about to move up quickly.

The strong bears are smart and see what is going on. Since they believe, just like the strong bulls, that the market is going to be higher before long, it does not make sense for them to be shorting. They just step aside and wait until they can sell higher. How much higher? Each institution has its own measure of excess, but once the market gets to a price level where enough bear firms believe that it might not go any higher, they will begin to short. If enough of them short around the same price level, more and larger bear trend bars form and bars start to get tails on the tops. These are signs of selling pressure, and they tell all traders that the bulls are becoming weaker and the bears are becoming stronger. The strong bulls eventually stop buying above the last swing high and instead begin to take profits as the market goes to a new high. They are still bullish but are becoming selective and will buy only on pullbacks. As the two-sided trading increases and the sell-offs have more bear trend bars and last for more bars, the strong bulls will want to buy only at the bottom of the developing trading range and will look to take profits at the top. The strong bears begin to short at new highs and are now willing to scale in higher. They might take partial profits near the bottom of the developing trading range if they think that the market might reverse back up and break out to a new high, but they will keep looking to short new highs. At some point, the market becomes a 50–50 market and neither the bulls nor the bears are in control; eventually the bears become dominant, a bear trend begins, and the opposite process unfolds.

A protracted trend will often have an unusually strong breakout, but it can be an exhaustive climax. For example, in a protracted bull trend, all strong bulls and bears love to see a large bull trend bar or two, especially if it is exceptionally large, because they expect it to be a brief, unusually great opportunity. Once the market is close to where the strong bulls and bears want to sell, like near a measured move target or a trend channel line, especially if the move is the second or third consecutive buy climax, they step aside. The absence of selling by the strongest traders results in a vacuum above the market. The programs that detect the momentum early on in a bar see this and quickly buy repeatedly until the momentum slows. Since few strong traders are selling, the result is one or two relatively large bull trend bars. This bull spike is just the sign that the strong traders have been waiting for, and once it is there, they appear as if out of nowhere and begin their selling. The bulls take profits on their longs and the bears initiate new shorts. Both sell aggressively at the close of the bar, above its high, at the close of the next bar (especially if it is a weaker bar), and at the close of the following bar, especially if the bars are starting to have bear bodies. They also short below the low of the prior bar. When they see a strong bear trend bar, they short at its close and below its low. The momentum programs also take profits. Both the bulls and the bears expect a larger correction, and the bulls will not consider buying again until at least a 10-bar, two-legged correction, and even then only if the sell-off looks weak. The bears expect the same sell-off and will not be eager to take profits too early.

Weak traders see that large bull trend bar in the opposite way. The weak bulls, who had been sitting on the sidelines hoping for an easy pullback to buy, see the market running away from them and want to make sure they catch this next leg up, especially since the bar is so strong and the day is almost over. The weak bears, who shorted early and maybe scaled in, were terrified by the rapidity with which the bar broke to a new high. They are afraid of relentless follow-through buying, so they buy back their shorts. These weak traders are trading on emotion and are competing against computers, which do not have emotion as one of the variables in their algorithms. Since the computers control the market, the emotions of the weak traders doom them to big losses on big bull trend bars at the end of an overdone bull trend.

Once a strong bull trend begins to have pullbacks that are relatively large, the pullbacks, which are always small trading ranges, behave more like trading ranges than like bull flags. The direction of the breakout becomes less certain, and traders begin to think that a downside breakout is about as likely as an upside breakout. A new high is now a breakout attempt above a trading range, and the odds are that it will fail. Likewise, once a strong bear trend begins to have relatively large pullbacks, those pullbacks behave more like trading ranges than like bear flags, and therefore a new low is an attempt to break below a trading range and the odds are that it will fail.

Every trading range is within either a bull or a bear trend. Once the two-sided trading is strong enough to create the trading range, the trend is no longer strong, at least while the trading range is in effect. There will always be a breakout from the range eventually, and if it is to the upside and it is very strong, the market is in a strong bull trend. If it is to the downside and strong, the market is in a strong bear trend.

Once the bears are strong enough to push a pullback well below the bull trend line and the moving average, they are confident enough that the market will likely not go much higher and they will aggressively short above the old high. At this point, the bulls will have decided that they should buy only a deep pullback. A new mind-set is now dominant at the new high. It is no longer a place to buy, because it no longer represents much strength. Yes, there is profit taking by the bulls, but most big traders now look at the new high as a great opportunity to initiate shorts. The market has reached the tipping point, and most traders have stopped looking to buy small pullbacks and instead are looking to sell rallies. The bears are dominant and the strong selling will likely lead to a large correction or even a trend reversal. After the next strong push down, the bears will look for a lower high to sell again or to add to their short positions, and the bulls who bought the pullback will become concerned that the trend might have reversed or at least that there will be a much larger pullback. Instead of hoping for a new bull high to take profits on their longs, they will now take profits at a lower high and not look to buy again until after a larger correction. Bulls know that most reversal attempts fail, and many who rode the trend up will not exit their longs until after the bears have demonstrated the ability to push the market down hard. Once these bulls see this impressive selling pressure, they will then look for a rally to finally exit their longs. Their supply will limit the rally, and their selling, added to the shorting by aggressive bears and the profit taking by bulls who saw the sell-off as a buying opportunity, will create a second leg down.

If the market enters a bear trend, the process will reverse. When the bear trend is strong, traders will short below prior lows. As the trend weakens, the bears will take profits at new lows and the market will likely enter a trading range. After a strong rally above the bull trend line and the moving average, the bears will take profits at a new low and strong bulls will aggressively buy and try to take control of the market. The result will be a larger bear rally or possibly a reversal into a bull trend.

A similar situation occurs when there is a pullback that is large enough to make traders wonder if the trend has reversed. For example, if there is a deep, sharp pullback in a bull trend, traders will begin to wonder if the market has reversed. They are looking at moves below prior swing lows, but this is in the context of a pullback in a bull trend instead of as part of a bear trend. They will watch what happens as the market falls (breaks out) below a prior swing low. Will the market fall far enough for bears, who entered on a sell stop below that swing low, to make a profit? Did the new low find more sellers than buyers? If it did, that is a sign that the bears are strong and that the pullback will probably go further. The trend might even have reversed.

Another possibility on the breakout to a new low is that the market enters a trading range, which is evidence that the shorts took profits and that there was unimpressive buying by the bulls. The final alternative is that the market reverses up after the breakout to a new low. This means that there were strong bulls below that swing low just waiting for the market to test there. This is a sign that the sell-off is more likely just a big pullback in an ongoing bull trend. The shorts from higher up took profits on the breakout to the new low because they believed that the trend was still up. The strong bulls bought aggressively because they believed that the market would not fall further and that it would rally to test the bull high.

Whenever there is any breakout below a swing low, traders will watch carefully for evidence that the bulls have returned or that the bears have taken control. They need to decide what influence is greater at the new low, and will use the market's behavior to make that decision. If there is a strong breakout, then new selling is dominant. If the market's movement is uncertain, then profit taking by the shorts and weak buying by the bulls are taking place, and the market will likely enter a trading range. If there is a strong reversal up, then aggressive buying by the longs is the most important factor.

Sometimes, when the market is in a weak trend, there is a large breakout bar in the direction of the trend. That breakout bar often acts as a spike, and it is usually followed by several more trend bars, but they usually overlap and have tails. These bars create a tight bull channel. Like with any spike and channel trend, the market often tests back to the start of the channel, which in this case is the breakout gap area. For example, if there is a relatively weak bull swing and then the market breaks to the upside with a large bull trend bar, and this is followed by three or four more smaller bull trend bars, these bars usually act as a channel. Once the market trades down to the area of the first of those channel bars, it often goes slightly below its low, and that puts the market in the gap area that was created by the breakout bar. The gap is both a measuring gap and a breakout gap, and the test of the gap is usually followed by a resumption of the trend rather than the start of a reversal down.

An inflection is a mathematical term that means that there has been a change of direction. For example, if there is a horizontal wave that goes up and down repeatedly, when the wave is going down, at some point the slope changes from steeply down to less steeply down as it begins to form a bottom. For example, the middle of the letter S is the inflection point in the curve, because it is the point where the slope begins to change direction. In trading, an inflection is just an area where you expect a trend reversal, which may or may not develop. Since the move can go in either direction, the market is in breakout mode and traders will be ready to enter in the direction of the breakout. In either case, the market will often make a measured move, which is a move that covers about the same number of points as the pattern that led up to it. For example, a double top often leads to a breakout to the upside or downside. After the breakout, the market often runs beyond the breakout point to a measured move target that is about the same number of points away as the distance from the bottom to the top of the double top. There is often a gap between the breakout point and the first pullback, and the middle of the gap often leads to a measured move (measuring gaps are discussed in Chapter 6 on gaps).

Breakout mode situations can behave in an opposite way in a trading range. For example, if there is a breakout mode setup in the middle of a trading range, there may be more buyers than sellers below the bar and more sellers than buyers above. If the situation is too uncertain to make traders believe that they have a good trader's equation, it is usually better to wait for clarity. At the extremes of a trading range, three things can happen: there can be (1) a reversal, (2) a breakout that fails and is followed by a reversal, or (3) a successful breakout. Only one of the three leads to a trend. This is consistent with the concept that most breakout attempts fail.

When there is a breakout against a trend, the countertrend traders are trying to create a channel (a spike and channel trend) or some other form of a new trend after their spike. However, the trend traders are usually able to reverse the breakout within a few bars, turning it into a flag. For example, if there is a bear channel that has a large bull trend bar or two breaking above the channel, the bulls are hoping to form a bull channel after a pullback. However, they will usually fail and the bull spike will end up as simply part of a bear flag. The bears saw the spike as a great opportunity to add to their shorts at a brief, high price, which represented correctly value to them.

Figure PI.1 New Highs Find New Buyers, Profit Takers, and Shorts

When a bull trend breaks above a prior swing high, there will be new buyers, profit takers, and shorts (see Figure PI.1). If the trend that preceded the breakout is starting out and is very strong, there will be some profit taking, like after bars 5, 12, and 17, but the new buyers will overwhelm the bears, and the trend will quickly resume. Later in the trend, there will be much less new buying and much more profit taking, like after bar 19. There are many measures of excess, and once enough trading firms believe that the bull trend is overdone, they will take profits on their longs and buy again only after about a 10-bar, two-legged correction. I use the phrase “10-bar, two-legged” often, and my intention is to say that the correction will last longer and be more complex than a small pullback. That usually requires at least 10 bars and two legs, and sometimes can result in a trend reversal.

Whenever there is a breakout, it might fail and lead to a trend reversal. The chance of a successful reversal is greater if the context is right and the reversal bar is strong. If the breakout bar and spike leading to the breakout is stronger than the reversal bar, and the chance of a climactic reversal is not great, the odds are that the reversal attempt will fail within a few bars and form a breakout pullback setup that will lead to a resumption of the trend. For example, bar 12 was a small bear reversal bar, but it followed a much stronger three-bar bull spike and the market was trending up in a tight channel all day following a large gap up. This made the odds of a successful reversal small, so bulls bought at and below the low of bar 12. The next bar was a doji and therefore a weak entry bar for the bears, so there were almost certainly going to be more buyers than sellers above its high. It became a breakout pullback buy signal bar (here, a high 1 buy setup). The next bar was a bull bar, and more buyers bought above its high. In general, the odds of a successful buy signal are greater when traders wait to enter above a bull bar. Bar 14 was the breakout bar, but it closed on its low and formed a bear doji reversal bar, which is a weak sell signal in the face of such a tight bull channel. The bulls were so aggressive that they did not want the short to trigger. They placed limit orders at and above the low of the bear bar, and there were enough buy orders to overwhelm the bears. The short never triggered and the market continued to rally. Bar 14 was simply another pullback from the breakout (and it was also the breakout), and traders bought above the high of bar 15, which was another breakout pullback buy signal.

Another example of comparing the strength of the breakout with that of the reversal occurred on the bar 5 breakout. The bear bar after bar 5 was the signal bar for the failed breakout of the bar 4 one bar bull flag and the breakout above bar 3. The bear signal was small compared to the 3 bar bull spike up from bar 4, and was therefore unlikely to reverse the trend. The next bar was a breakout pullback buy setup, but had a bear body, which is not a strong buy signal bar. The bar after had a bull body and therefore buying above its high had a higher probability of success.

Bar 10 was a breakout of an ii bull flag, but the breakout bar was a bear reversal bar, which is a weak breakout bar. This increased the chances that the breakout would fail. The breakout bar was also the signal bar for the failed breakout.

The correction sometimes breaks the bull trend line and creates enough selling pressure for the bears to become aggressive at the next new high, as they were at bar 25. There was still some profit taking by the bulls, but very little new buying. The bears took control going into the close.

Both the strong bulls and bears looked forward to the final, strong breakout up to bar 19. They liked seeing a large bull spike after a protracted bull trend, because the expected correction provided both of them with a temporary trading opportunity. It was the third consecutive bull climax without a correction since the bar 11 low (bars 11 to 12 and 15 to 17 were the first two), and consecutive buy climaxes often lead to a two-legged correction lasting about 10 bars and falling below the moving average. Both the strong bulls and bears sold at the close of the two-bar bull spike before bar 19, above its high, at the close of bar 19 (especially since it had a bear body), and below its low. The bulls didn't look to buy again and the bears did not take profits on their shorts until after the two-legged correction was complete, which was in the bar 21 to bar 24 area. The sell-off was strong enough for both to think that the market might have a trend reversal into a bear trend after a lower high or higher high test of the bar 19 bull high, and this resulted in the sell-off from bar 25 into the close.

Since most reversal attempts fail, traders often fade them. Bar 22 was a strong bear trend bar in a bull trend, and many traders bought its close. Their first target was a move to the high of the bar, which occurred two bars later, and then a measured move up, which was reached by the end of the day.

The bear bar after bar 5 was a breakout mode setup. Since it was a bear bar after a bull breakout above the bar 3 swing high, it was a failed breakout short setup. It was also a one-bar pullback in a bull breakout, so it was a high 1 breakout pullback buy setup. In this case, since the three-bar bull spike was so strong, it was more likely that the bulls would outnumber the bears both below and above the bar. Some bought at the low of the bear inside bar with limit orders, whereas others bought above it and above bar 6 with stop orders.

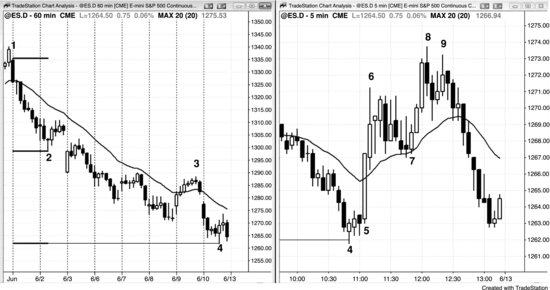

Figure PI.2 Low-Volume Bull Breakout in a Bear Trend

As shown in Figure PI.2, the Emini was in a bear trend on the 60 minute chart on the left and many traders looked to buy a measured move down, based on the height of the initial spike down from bar 1 to bar 2. The bears bought back their shorts to take profits, and aggressive bulls bought to initiate longs, expecting a possible trend reversal and test of the start of the bear channel (the lower swing high after bar 2). The chance of at least two legs up was increased by the reversal down from the bar 3 moving average gap bar and break above the bear trend line (reversals are covered in the third book).

The 5 minute chart on the right reversed up after falling one tick below the 60 minute measured move target (bar 4 is the same time on both charts). Bar 5 was a large bull reversal bar with a small tail, and bulls were hopeful for a strong reversal up. However, the bar had only 23,000 contracts, or about three times as many as an average 5 minute bar. When the average 5 minute bar has 5,000 to 10,000 contracts, most bull reversals with protracted follow-through have about 5 to 10 times that volume, or at least 40,000 to 50,000 contracts. The most reliable bars have over 100,000 contracts. Traders do not have to worry about volume because the chart will tell them what they need to know, but seeing huge volume on a large trend bar that is breaking out increases the chances that there will be follow-through and usually at least some kind of measured move. When there is a strong bear trend and the reversal up goes for only two bars and then pulls back, and the second bar up has a large tail, the reversal is not strong. More experienced traders can look at the volume and see it as another sign that the reversal is not strong, or they can look at the 60 minute chart and see the strong bear trend. However, all day traders need to see is the 5 minute chart to place their trades. They would have bought bar 5 as it was forming, as it closed, and above its high. They would have also bought the bar 7 ioi (inside-outside-inside) pattern, high 4 bull flag at the moving average. Since they were buying a strong bull move, they should have assumed that they had at least a 60 percent chance of making a reward that was at least as large as their risk. They could have chosen a two-point stop, since that worked well lately, and then used a two-point profit target. Another trader who bought at the bar 5 close might have been willing to risk to below the bar 5 low (about four points), and his profit taking target might have been as many points as he had to risk. The stop for the trader who bought above bar 7 would have been below the low of bar 7 or below the bar before it. Her risk was about two points, and she could have held for either two points or for a move above the bar 6 high (here, it was also about two points).