Timing —“Timing is everything”

![]() TDT — TOP DOWN TRADING —THE concept of “Top Down Trading” is very straightforward, before making any trade on any particular stock you must first check off the following items:

TDT — TOP DOWN TRADING —THE concept of “Top Down Trading” is very straightforward, before making any trade on any particular stock you must first check off the following items:

![]() TM —THE MARKET — Check the line of least resistance to establish the overall current market direction. Remember, Livermore never used the terms “Bull” or “Bear” because they forced a mind-set that he believed made the mind less flexible. He used the term “Line of least resistance.” He checked to be sure the current line of least resistence was positive, negative or neutral—sideways. Be sure to check the exact market the stock trades in for instance: Dow, NASDAQ, or Amex-before executing the trade. It is essential to make sure the lines of least resistance are in the direction of your trade before entering the trade.

TM —THE MARKET — Check the line of least resistance to establish the overall current market direction. Remember, Livermore never used the terms “Bull” or “Bear” because they forced a mind-set that he believed made the mind less flexible. He used the term “Line of least resistance.” He checked to be sure the current line of least resistence was positive, negative or neutral—sideways. Be sure to check the exact market the stock trades in for instance: Dow, NASDAQ, or Amex-before executing the trade. It is essential to make sure the lines of least resistance are in the direction of your trade before entering the trade.

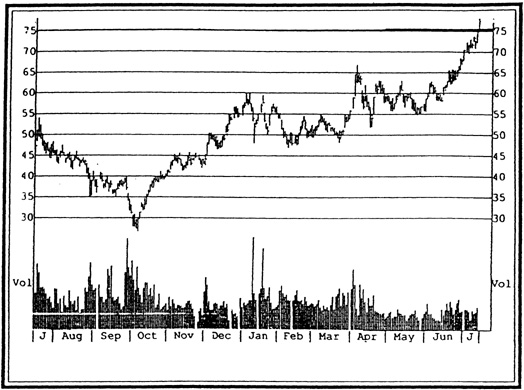

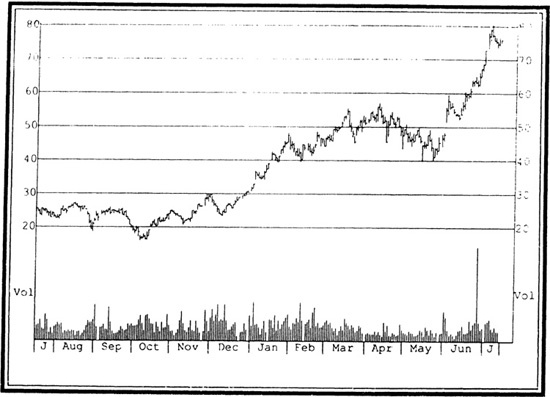

The NASDAQ formed a Pivotal Point at the end of November and the “line of least resistance” was clearly upward until March when it formed a Pivotal Point and changed its momentum and the “line of least resistance became negative” and started downward

![]() TIG — THE INDUSTRY GROUP — Check the specific industry group if you are considering a trade in ATT check out the Telecommunication Long Distance Group. If you are looking at a trade in Haliburton, check out the Oil Well Drilling group. If you are looking at a trade in Harrah Entertainment check out the Gambling Group, make sure the group is moving in the correct direction, the line of least resistance to provide a profit for you on the trade you have selected. In the example on the following page the trade is in the Internet Industry Group.

TIG — THE INDUSTRY GROUP — Check the specific industry group if you are considering a trade in ATT check out the Telecommunication Long Distance Group. If you are looking at a trade in Haliburton, check out the Oil Well Drilling group. If you are looking at a trade in Harrah Entertainment check out the Gambling Group, make sure the group is moving in the correct direction, the line of least resistance to provide a profit for you on the trade you have selected. In the example on the following page the trade is in the Internet Industry Group.

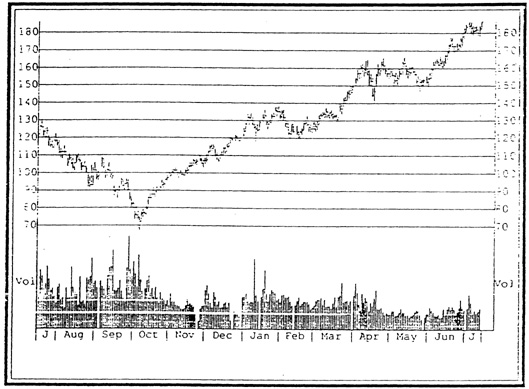

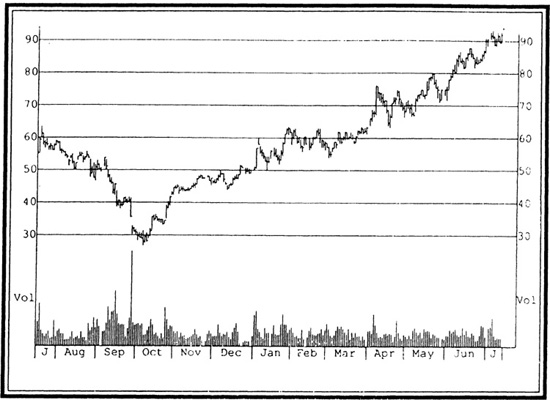

The Internet Industry Group began its ascent at the end of October, the same time as the NASDAQ and was a leading group at the time. It topped out simultaneously with the overall NASDAQ index in March/April and gave a clear sign that the line of least resistence was rolling over to the downside. The Internet Industry Group therefore confirmed the action of the NASDAQ.

![]() TT—TANDEM TRADING—Check the stock and the Sister Stock and compare them. If you are going to trade in General Motors check a Sister Stock like Ford or Chrysler. If you are going to trade Best Buy than check out Circuit City-a Sister Stock. Tandem Trading requires the trader to place two stocks of the same group next to each other. The stocks chosen for this example are Yahoo (yhoo) and America Online (aol).

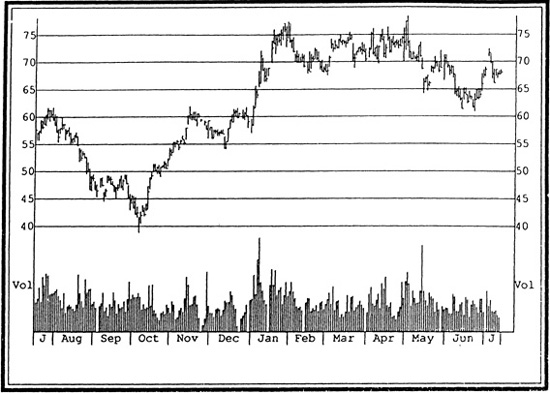

TT—TANDEM TRADING—Check the stock and the Sister Stock and compare them. If you are going to trade in General Motors check a Sister Stock like Ford or Chrysler. If you are going to trade Best Buy than check out Circuit City-a Sister Stock. Tandem Trading requires the trader to place two stocks of the same group next to each other. The stocks chosen for this example are Yahoo (yhoo) and America Online (aol).

(see chart on following page)

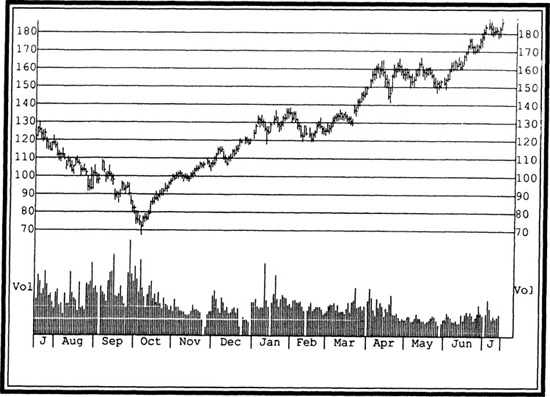

Both Yahoo and AOL topped out together in December giving a clear signal that the line of least resistence for this industry group was negative. Because this was a leading group it also acted as a precursor of what was to come in March/April, when the market went into a steep decline.

![]() TDT — TOP TRADING DOWN — The final step in Top Down Trading is to examine all four factors at the same time—The Market, The Industry Group and the Tandem Stocks and the actual stock in one glance. The example is the Internet Industry group as seen on the following page.

TDT — TOP TRADING DOWN — The final step in Top Down Trading is to examine all four factors at the same time—The Market, The Industry Group and the Tandem Stocks and the actual stock in one glance. The example is the Internet Industry group as seen on the following page.

In this example, the Tandem Stocks clearly indicated first that they had topped, and the line of least resistence was down in December. The Industry group followed in March/April along with the overall NASDAQ as it rolled over and descended

Due Diligence—do a final thorough analysis of the individual stock you have decided to trade. This is your responsibility, your obligatory “Due Diligence.” This final step would be similar to traveling down the runway-but not lift off— a final chance to change your mind before you “pull the trigger” and buy the stock. This final step must be completed by you, and you alone…make this decision on your own—it’s your money.

An ex-military friend of mine compares this approach of Livermore’s to the steps the U.S. Marines follow before they assault a beach. They study all the factors on all the possible beaches; they analyze all these factors as carefully as they can with the full knowledge that the assault will not be perfect, no matter what the analysis reveals to them.

There will always be unknown factors, the main one being the unpredictable human factor in assaulting a beach or playing the stock market…there is always the “Human Factor” to consider.

What the Marines are doing in planning beach assaults is what Livermore was trying to do, weigh all the factors until the preponderance of evidence has been assembled, and all the odds were in his favor. It isn’t easy: you must not be too early, too late, too timid, too aggressive and you can’t commit all your troops at one time, but you must strike when the final moment presents itself as overwhelming evidence. In other words, you must use your own judgment to achieve control of your financial destiny. The Livermore Laws:

Wait until the Preponderance of Evidence is in your Favor.

Use Top Down Trading.

Be patient!

—Jesse Livermore

“UNDERSTANDING INDUSTRY GROUP ACTION IS ESSENTIAL TO SUCCESSFUL TRADING”

—Jesse Livermore

Livermore loved to fish. His winters in Palm Beach were more than a vacation. It took him away from New York and the market, even though he often played the market from E.F. Hutton’s Palm Beach office.

The Atlantic Ocean fascinated him. It made him feel small. His life fell into better focus when he got out onto the ocean. Some of his greatest thinking was done fishing, trolling along the hundred fathom bar a few miles off Palm Beach, down to Key West, following the great underwater canyon that ran from Cuba to Nova Scotia, a nautical highway for the great gypsy fish, the pelagic predators.

He enjoyed solitary thinking on the back deck while cruising easily on his 300 foot yacht the “Anita Venetian,” as he headed down to Key West for some tarpon fishing, using guides, and watching those great Florida Keys sunsets. To him, the ocean was always exciting, ever-changing, and it refreshed his soul and cleared his mind for deeper thoughts. He believed this time on the sea led him to important discoveries like: The importance of Industry Group action.

In the 1920’s Livermore made another important discovery that he applied to his trading strategy: “INDUSTRY GROUP MOVEMENTS.” Livermore deduced from observation that stocks did not move alone, when they moved. They moved in Industry Groups. If U. S. Steel rose then sooner or later Bethlehem, Republic, and Crucible would follow along. Livermore observed this time and time again, and it became an important trading tool in his arsenal.

Livermore: “The most intelligent way to get one’s mind attuned to market conditions and to be successful is to make a deep study of Industry Groups in order to distinguish the good groups from the bad: get long of those which are in a promising position and get out of those Industry Groups which are not.

“It has been shown time and time again that on Wall Street people very often fail to see the thing that is right in front of them. We now have millions of people interested in the security markets, where there were only thousands in former years. I cannot emphasize too strongly the importance of the utmost discrimination in the purchase of securities by first examining Industry Groups.

“Stay away from weak groups!

“Just as I would avoid the weak stocks in the weak industries, I would favor the strongest stocks in the strongest industries. The trader must, of course, be willing and able to revise any forecasts and positions in the light of developments that come to hand from day-to-day and move quickly, if factors have moved against the trader.”

The GROUP MOVEMENT premise was quite simple to Livermore. He explained:

“If the basic reasons are sound why U.S. Steel’s business should come into favor in the stock market, then the rest of the steel group should also follow for the same basic reasons. This, of course also works for the short side of the market—when a group goes out-of-favor for basic reasons it will include ALL THE STOCKS in that industry group.”

It was also an important clue for Livermore if a particular stock in the favored group, did not move up and prosper with the others, this could mean that perhaps this particular stock was weak or sick, and therefore might be a good short sale or at the very least, a trader should be cautious in buying any stock that does not follow the overall group action.

The only exception to “Group Movement” is where a single stock may make up over fifty percent or more of the total sales of the group—sooner or later the rest of the group must follow this stock.

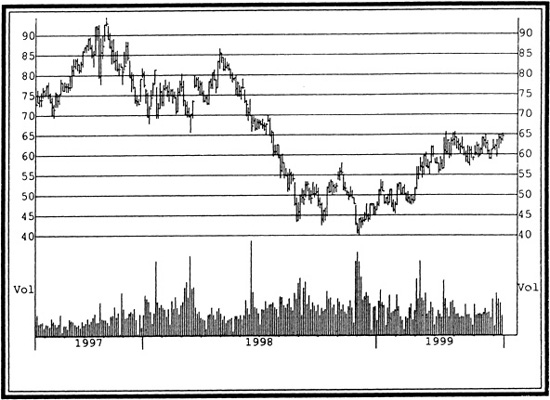

7-15-99 LUCENT TECHNOLOGIES INC (LU) 77.62

7-15-99 TELECOMMUNICATIONS/EQIPMENT-SERVICEWIDX 186.78

Note Example: These charts clearly reflect how important the “DOMINANT” stock is to the group…in fact you could say in cases, such as this example, the leading stock “IS” the group.

![]() FCL — FOLLOWING THE CURRENT LEADERS — Livermore developed a sophisticated system of “FOLLOWING THE CURRENT LEADERS.” His interest in the leaders was two fold:

FCL — FOLLOWING THE CURRENT LEADERS — Livermore developed a sophisticated system of “FOLLOWING THE CURRENT LEADERS.” His interest in the leaders was two fold:

He said, “Confine your studies of stock market movements to the prominent issues of the day, the leaders. It is where the action is—if you cannot make money out of the leading active issues, you are not going to make money out of the stock market.

“Second, this will also keep your trading universe small and controllable, so you can focus and trade the stocks with the greatest potential. Don’t let greed drive your moves by trying to catch the exact top and the exact bottom.”

Livermore also believed that timing should never be dictated by high prices. High prices were never a timing signal to sell a stock. Livermore said: “Just because a stock is selling at a high price does not mean it won’t go higher.” Livermore was also just as comfortable on the short side, if that was the direction of the trend. “Just because a stock has fallen in price does not mean that it won’t go lower. I never buy a stock on declines, and I never short a stock on rallies.”

Buying stocks as they made new highs and selling short as they made new lows was a contrarian point of view in his day. Livermore let the market tell him what to do. He got his clues and his cues…from what the market told him. He did not anticipate, he followed the message he received from the tape. And some stocks keep making new high or lows, for a very long time, and can be held for a very long time.

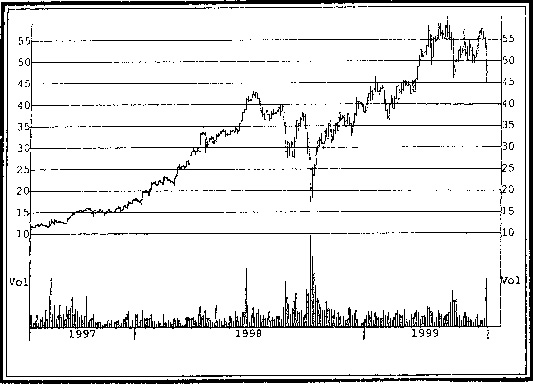

Note Example: Cisco Systems, a leader in networking solutions for the Internet, has basically gone up for five straight years. A 1000 share position in 1994 would have cost $2,000; that investment, five years later, in 1999, would be worth $70,000.

Livermore: “I also believe in trading the market leader, go with the most powerful stock in the group-don’t look for the bargain, the weak sister, go with the leader, the anchor, the strongest stock in the group. Also note that this may not always be the conventional leader of the group. Occasionally, a smaller, well-managed stock in the group will assume leadership, perhaps with a new product, and knock out the old leader. Keep alert! Choose the most powerful stock in the group, not the best bargain or a beaten down stock poised to recover.

Livermore observed that these groups went in and out of favor with each new major bull market. The leading stock groups of one major market move most likely would “NOT” be the leading groups of the next major market.

It was Livermore’s experience that stock-group-behavior is an important key to overall market direction, a key ignored by most traders whether they were big traders or small traders. He believed the groups often provided the key to changes in trends. As favored groups got weaker and collapsed it usually meant a correction in the market. This is how he called the market turn in 1907, and 1929, the leaders rolled over first.

![]() TT — “TANDEM TRADING” — LIVERMORE INVENTS — “SISTER STOCK TRADING METHOD” — “Tandem Trading” or “Sister Stock” trading, as Livermore used to say to his sons, Jesse Jr. and Paul, is essential to the successful investor. “Boys, never look at only one stock-look at two—track two. Why? Because stocks in the same group always move together. TRACKING TWO STOCKS adds a great confirming psychological dimension to your mental abilities, when you can visualize that they move in tandem and that they confirm the movements of each other. It is twice as hard “NOT” to follow the correct signal when you see with your own eyes that the Sister Stocks actually move in tandem and therefore give you absolute confirmation.

TT — “TANDEM TRADING” — LIVERMORE INVENTS — “SISTER STOCK TRADING METHOD” — “Tandem Trading” or “Sister Stock” trading, as Livermore used to say to his sons, Jesse Jr. and Paul, is essential to the successful investor. “Boys, never look at only one stock-look at two—track two. Why? Because stocks in the same group always move together. TRACKING TWO STOCKS adds a great confirming psychological dimension to your mental abilities, when you can visualize that they move in tandem and that they confirm the movements of each other. It is twice as hard “NOT” to follow the correct signal when you see with your own eyes that the Sister Stocks actually move in tandem and therefore give you absolute confirmation.

It was Tandem Trading that allowed Livermore to properly police his investments. Once the investment was made Livermore heightened his “vigilance” and continued “due diligence” by everyday observation of not just the stock he had purchased-he always maintained his daily Tandem Trading or Sister Stock observations looking for clues to what was happening and what was about to happen.

For Livermore the evidence, the clues, the truth, was always in the market itself and visible if a person knew how to read the evidence, the way a forensic investigator examines the details of a crime scene—clues become obvious to him that are visible to no one else. All a person needs to do is observe what the market is telling him and evaluate it. The answer lies in the market facts—the challenge is to properly interpret the facts that are being presented. He told his sons: “It’s like being a great detective working on a great case that never ends—you never know it all!”

Tandem Trading, the use of Sister Stocks, was one of the great secrets of Livermore’s trading techniques and remains just as valid today as it did in years gone by.

This technique is an essential element in both “Top Down Trading” and in the maintenance of the trade after it has been completed.

“SUCCESSFUL TRADERS ALWAYS FOLLOW THE LINE OF LEAST RESISTANCE—FOLLOW THE TREND—THE TREND IS YOUR FRIEND”—Livermore

The examples on the following page illustrate the use of “Tandem Trading” or “Sister Stock” trading.

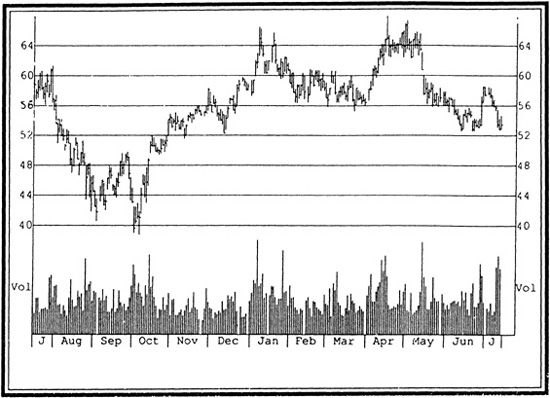

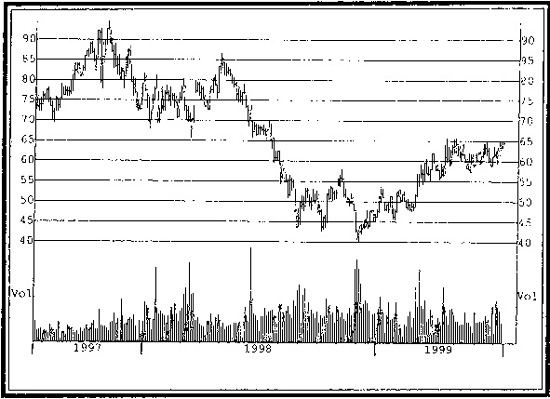

7-15-99 GENERAL MOTORS CORPORATION (GM) 68.06

7-15-99 FORD MOTORS CO DEL (F) 68.06

Note Example: The charts above illustrate that nothing has changed from Livermore’s day—the automotive group moves in unison. General Motors and Ford basically move in lock-step.

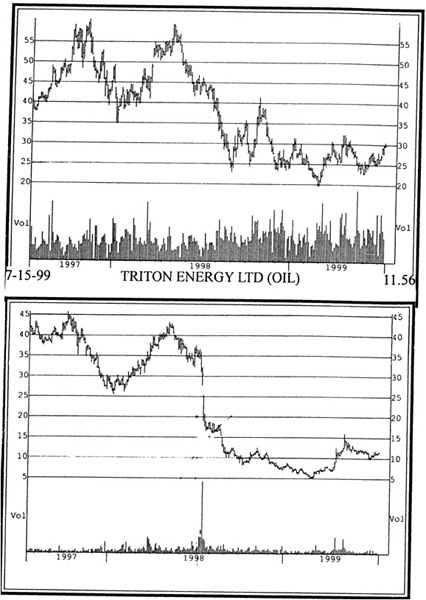

7-15-99 TRANSOCEAN OFFSHORE INC (RIG) 29.93

Note Example: The charts illustrated above are a reflection of part of the “oil patch group.” As the price of oil plummeted in the late spring of 1998, Transocean and Triton Energy, both off-shore oil drillers, were hit hard because their profit margins were threatened All the drillers joined hands and took a deep dive in the price of their stocks.

![]() RPP—REVERSAL PIVOTAL POINTS—The Pivotal Point theory allowed Livermore the chance to buy at the exact “right time.” Pivotal Points were defined by Livermore as: —the perfect psychological moment to make a trade. Reversal Pivotal Points mark a change in trend. He never wanted to buy at the lowest price or sell at the top. He wanted to buy at the right time, and sell at the right time.

RPP—REVERSAL PIVOTAL POINTS—The Pivotal Point theory allowed Livermore the chance to buy at the exact “right time.” Pivotal Points were defined by Livermore as: —the perfect psychological moment to make a trade. Reversal Pivotal Points mark a change in trend. He never wanted to buy at the lowest price or sell at the top. He wanted to buy at the right time, and sell at the right time.

This required him to have patience and wait for the perfect Pivotal Point trading situation to develop. If the right conditions did not all coincide on a particular stock he was following, he didn’t care, because he knew that the proper pattern would appear sooner or later on another stock. Patience…patience…patience—that was his key to timing success.

Livermore always considered “TIME” as a real and essential trading element. He would often times say: “It’s not the thinkin’ that makes the money—it’s the sittin’ and waitin’ that makes the money.”

This has been often incorrectly interpreted by many people to mean Livermore would buy a stock, and then sit and wait for it to move. This is not so. There were many occasions where Livermore sat and waited in cash, until the right situation appeared. Much of his success was in his ability to sit and wait patiently in cash until the “perfect situation presented itself to him.” When these conditions came together, when as many of the odds as possible were in his favor, then and only then, like a cobra, he would strike.

Buying on the Pivotal Point assured him the best chance of coming into the situation:

And once he was sure of his play, he wasn’t afraid to make his commitment. He wasn’t called the “Boy Plunger” for nothing.

Livermore: “When a speculator can determine the Pivotal Point of a stock and interpret the action at that point, he may make a commitment with the positive assurance of being right from the start.

“But bear in mind when using Pivotal Points in anticipating movements, that if the stock does not perform as it should, after crossing the Pivotal Point, this is an important danger signal which must be heeded immediately. Every time I lost patience and failed to await the Pivotal Points and fiddled around for some easy profits. I would lose money.

“I have found the study of Pivotal Points fascinating almost beyond belief. You will find a golden field for personal research. You will derive a singular pleasure and satisfaction from successful trades based on your own judgment. You will discover that profits made in this way are immensely more gratifying than any which could possibly come from tips, or the guidance of someone else. If you make your own discovery, trade your own way, exercise patience, and watch for the danger signals, you will develop a proper trend of thinking.

“This Pivotal Points theory applies to trading in commodities just as it does to trading in stocks. I never considered this method of trading Pivotal Points as a foolproof perfect method of picking winners, but it represents an “Essential” part of my trading strategy.

“I have stated on a few occasions that there will be a lot more to perfecting the use of Pivotal Points in the future. I am sure people will develop better trading methods from this basic premise. I promise that I will not be jealous of their success.

“It’s okay to mentally anticipate the action of the market, or a stock, but take no action until the market has confirmed that you are correct, by its action: DON’T ANTICIPATE MARKET MOVES WITH YOUR HARD EARNED CASH.

“It’s okay to mentally speculate on future moves, but wait until you get a confirming signal from the market that your judgment is correct, then—and only then, you can move with your money. Pivotal Points are essential, as a confirming signal, but you must let them play out.

“Often, the market will go contrary to what a speculator has predicted. At these times the successful speculator must abandon his predictions, and follow the action of the market. A prudent speculator never argues with the tape, remember: MARKETS ARE NEVER WRONG—OPINIONS OFTEN ARE.

“Timing is everything to a speculator. It is never “if a stock was going to move. It is “when” a stock is going to move and in which direction—up, down or sideways.”

“The crash of ’29 brought about my complete belief in Pivotal Points. Black Tuesday was the biggest Pivotal Point in the history of the stock market, the market fell 11.7% in one single day and kept right on going down.

“I cannot over emphasize that Pivotal Points, once I understood them, became one of my true trading keys, a trading technique that was basically unknown in a formal way in stock speculation in the twenties and early thirties. Pivotal Points are a TIMING device. I use them to get in and out of the market.

“Once again, the Reversal Pivotal Point is not easily defined. In my mind it is:

“A CHANGE IN BASIC MARKET DIRECTION—THE PERFECT

PSYCHOLOGICAL TIME AT THE BEGINNING OF A NEW

MOVE, IT IS A MAJOR CHANGE IN THE BASIC TREND.

“For my style of trading it did not matter if it was at the bottom or the top of a long term trending move, because I would buy or sell any stock, long or short.

“The ‘Reversal Pivotal Point,’ flags for me optimum trading timing.”

7-15-99 SCHLUMBERGER LTD (SLB) 64.56

Note Example: SCHLUMBERGER, an oil drilling and service company, made two clear Reversal Pivotal Points-the first in late 1997 that led to a decline in price and a second Reversal Pivotal Point at the end of 1998 that led to an increase in price.

“Reversal Pivot points are almost always accompanied by a heavy increase in volume, a climax of buying, which is met with a barrage of selling—or vice-versa. Increased Volume is an essential element in understanding Pivotal Points—it must be present to confirm the Pivotal Point. This battle, this war, between buyers and sellers causes the stock to reverse its direction, top out, or bottom out in a decline. It is the start of a new direction in trend for the stock. These important confirming volume spurts often end the day with a 50 percent to 500 percent increase in the average daily volume of the stock.

“Reversal Pivotal Points usually came after long-term trending moves. This is one of the reasons why I always felt patience was so necessary for success in catching the big moves. You need patience to be sure that you have identified a true Reversal Pivotal Point of a stock. I developed tests.

“First of all I would send out a “probe.” I would buy a small percentage of the stock position that I would eventually establish, if I was correct with the first trade.

“I had one final test I used to confirm if a Reversal Pivot Point had occurred. I looked at the industry group, and at least one other stock in the group, to see if it had the same pattern. This was the final confirmation I needed to point out that I was on the right track.

![]() CPP — EVALUATING CONTINUATION PIVOTAL POINTS — “It is essential to understand that the “Reversal Pivotal Point” marks a definite change in direction. The “Continuation Pivotal Points” confirm the move is proceeding in the proper direction.

CPP — EVALUATING CONTINUATION PIVOTAL POINTS — “It is essential to understand that the “Reversal Pivotal Point” marks a definite change in direction. The “Continuation Pivotal Points” confirm the move is proceeding in the proper direction.

“Beyond the Reversal Pivotal Point there is a second very important type of Pivotal Point I call the ’Continuation Pivotal Point.’ This usually occurs during a trending move as a natural reaction for a stock in a definite trend. This is a potential additional entry point in an ongoing move, or a chance to increase your position, providing the stock emerges from the Continuation Pivot Point, headed in the same direction as it was before the correction. I define a Continuation Pivotal Point as a consolidation where the stock pauses in its ascent, as a general sometimes pauses in a major assault to let his supply lines catch up to his troops and provide his men with a rest. It is usually a natural reaction of the stock. The prudent speculator, however, will carefully observe which way the stock will emerge from this consolidation, and not anticipate.”

7-15-99 SCHLUMBERGER LTD (SLB) 64.56

Note Example: SCHLUMBERGER formed a Continuation Pivotal Point in mid-1998 when it hit $86 confirming the descent, in this case to—$40-near the end of 1998.

“For me, a stock’s price is never too high to buy, or too low to sell-short. By waiting for these Continuation Pivotal Points signals, it gave me the opportunity to either open a new position or to add to a current position, if I had already established one. Do not chase a stock if it gets away from you—let it go. I would rather wait and pay more, after the stock had regrouped and formed a new Continuation Pivotal Point, because this Continuation Pivotal Point provides a confirmation and insurance that the stock will most likely continue with its move. It gives a stock a chance to take a breath and consolidate often allowing the stock’s ratio of earnings and sales to catch up to the price of the stock.

“Conversely, this Pivotal Point theory can also be used to find successful short -selling plays. I looked for stocks that traded down to a new low for the last year or so. If they formed a “False Pivotal Point” that is: if they rallied from this new low and then dropped down through the new low, they were most likely to continue down from there and establish additional new lows for the move.

“By correctly catching the Pivotal Points it enabled me to make my initial purchase at the right point so that I had an entry point at the right price from the beginning of the move. This insured that I was never in a loss position, and I could therefore ride out the normal stock fluctuations without risking my own capital. Once the stock had moved off the Pivotal Point I was only risking my ‘paper profits’ not my ‘precious capital,’ because I was ‘in profit’ from the beginning of the trade.

“My early years of getting crushed because I had bought the stock at the wrong time in its move, gave me the clue to my theory of using Pivotal Points. On many of those trades I was ’never in profit.’ If you buy before the Pivotal Point is established then you may be early. This is dangerous because the stock may never form a proper Pivotal Point to clearly establish its direction. But you must be careful—if you buy more than 5% or 10% above the initial Pivotal Point, then you may be late. You may have lost your edge because the move is already well under way.

“The ‘Pivotal Point’ gives the only tip-off you need to trade and win. A speculator has to be patient, because it takes time for a stock to run out its logical and natural course and form a proper Pivotal Point. It will not be willed or forced forward by an impatient trader. It will come as a natural event.

“The key to my later theory of trading is to trade: ONLY ON THE PIVOTAL POINTS. I have always made money when I was patient and traded on the Pivotal Points.

“I also believe that often the largest part of a stock movement occurs in the last two weeks or so of the play. I call it the—Final Markup Phase—the same thing applies for commodities. So, once again, a speculator must be patient, get into position and wait, but at the same time a trader must be completely alert for the clues when they come, good or bad and then take action to either buy or sell his position.”

![]() S — SPIKES— ODR — ONE DAY REVERSALS — I was very wary of price “Spikes” accompanied by abnormally heavy volume of at least a fifty-percent increase versus the average. This often led to “One Day Reversals.”

S — SPIKES— ODR — ONE DAY REVERSALS — I was very wary of price “Spikes” accompanied by abnormally heavy volume of at least a fifty-percent increase versus the average. This often led to “One Day Reversals.”

“I always looked for aberrations in the market. An aberration to me was any strong deviation from what was normal for the stock. I considered a spike in the stock price, high volume, and low volume, all aberrations, deviations from the norm, a straying from what would be considered normal for the stock. To me these were possible danger signals, and often a signal to exit a trade.

“A strong signal for me, a signal that made me sit up and take notice was the “ONE DAY REVERSAL.” This is a stock movement that often happens at the end of a long-term move. I define it as: ‘A One Day Reversal occurs where the high of the day is higher than the high of the previous day, but the close of the day is below the close of the previous day, and the volume of the current day is higher than the volume of the previous day.”’

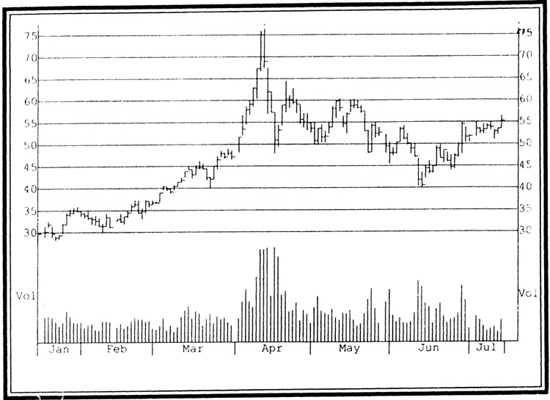

7-15-99 SCHWAB CHARLES CORPNEW (SCH) 55.37

Note Example:-In this case Charles Schwab, a brokerage firm, had a dramatic rise of over 15 points in 3 days that developed into a spike. During the last day of the ascent the rally breaks down near the end of the day and the price of the stock falls and closes near the low of the day. The next morning it opens and falls further. These one-day reversals are often accompanied by increased volume.

This scenario was a screaming “danger signal” to Livermore. Why? Because all during its rise, following the trend, the line of least resistance, it had only normal reactions. Then all of a sudden it had an abnormal, sudden aberrant reaction…it moved 15 points in only 3 days on heavy volume, it has broken its pattern. This is a danger signal and MUST BE HEEDED!

It was Livermore’s position that if you had the “PATIENCE” to sit with the stock all during its rise, now after the “ONE DAY REVERSAL” you must have the “COURAGE” to do the right thing and acknowledge this danger signal. You must now consider selling the stock. Livermore believed in “PATIENCE” and “COURAGE.”

![]() BONH — BREAKOUTS ON A NEW HIGH — “NEW HIGHS” were always good news for Jesse Livermore. To him it meant that the stock had pushed through the overhead resistance and was very likely to advance. Livermore was not a chartist. He calculated everything from a numerical base.

BONH — BREAKOUTS ON A NEW HIGH — “NEW HIGHS” were always good news for Jesse Livermore. To him it meant that the stock had pushed through the overhead resistance and was very likely to advance. Livermore was not a chartist. He calculated everything from a numerical base.

Below are several “New High Breakout Formations” that appeared on a regular basis to Livermore in numerical form. Charts have been used for expediency.

7-15-99 BEST BUY INC(BBY) 76 18

Note example: Best Buy, a consumer retailer of electronics, appliances, and entertainment software, broke out of a long consolidation at $30 in December of 1998 and kept right on climbing to new highs.

7-15-99 NORTHERN TELECOM LTD (NT) 94.06

Note Example: Nortel Networks, a manufacturer of telecommunication equipment, formed a strong Reversal Pivotal Point at-$30-in September of 1998 and powered through to a new all-time high of $65 in April of 1999.

![]() BOCB — BREAKOUT FROM A CONSOLIDATING BASE — Stocks sometimes take time to consolidate and build a base before continuing their movement. This base allows the stock a breather and a chance for the sales and earnings to catch up to the new valuation of the stock. In many ways it is similar to a Continuation Pivotal Point in function, although the formation looks different, and the time period is usually longer for the Consolidating Base to form. When the Consolidating Base occurs the same patience must be applied to the situation as required with the Continuation Pivot Point— “don’t anticipate” wait for the stock to tell you by its action which direction it is going to go. Below are some examples of a Consolidating Base.

BOCB — BREAKOUT FROM A CONSOLIDATING BASE — Stocks sometimes take time to consolidate and build a base before continuing their movement. This base allows the stock a breather and a chance for the sales and earnings to catch up to the new valuation of the stock. In many ways it is similar to a Continuation Pivotal Point in function, although the formation looks different, and the time period is usually longer for the Consolidating Base to form. When the Consolidating Base occurs the same patience must be applied to the situation as required with the Continuation Pivot Point— “don’t anticipate” wait for the stock to tell you by its action which direction it is going to go. Below are some examples of a Consolidating Base.

Note Example: From early January until late March, a consolidating base was formed. A breakout occured.

From the beginning of his trading Livermore was keenly aware of volume. It was obvious to him that as the volume drastically changed it was a clear “Aberration” or a “Deviation” that is, a change from the normal. The question was it— “Accumulation” or was it— “Distribution.” And Livermore was an expert at detecting “DISTRIBUTION.” He had formed a strong opinion on that subject, because he knew how stocks were distributed by the “pool runners” of his day. The “pool runners” were charged with distributing the stock of the insiders who had formed a pool with their own stock and given the job of selling, distributing the stock, to an expert like Livermore.

Stocks were never distributed on the way up…they were distributed on the way down. The reasoning was simple—people will not take losses, the public will hold on to their stock as it drops and wait until it rallies back to the price where they bought it so they can sell it. This is why so many stocks falter as they rally back to the old high. The people who bought at the high are now selling to get their money back—because they were scared—they got a fright—and are happy to get there money back. This is one of the reasons why Livermore bought stocks on new-high-breakouts. Simply stated, with a new high breakout, there was most likely no stock overhanging the market, waiting to be sold on the uptick, it was usually clear open air above the old high, once the stock broke out into clear skies.

A change in volume is an “alert signal.” It almost always means that there is something afoot, a change, a difference, and an aberration. It therefore always caught Livermore’s attention. Was it the volume leading to the “blow off’ setting the stage for a decline or was it “real interest” in the stock, ready to drive it higher. Livermore never searched for the reason “why.” He simply took it as a truism that volume was an alert signal. It was “happening” that was “why” enough for him. The reasons would be revealed later when the chance to make money was gone. Don’t try and figure out why something is happening. Let the market give you the clues, the movement of the stock is empirical evidence, wait for a later day to figure out the motive.

Conversely, if there is heavy volume, but the prices stall and do not go up and make new highs and there is no strong continuation of the current move—beware—this is often a strong clue, a warning that the stock may have topped out.

Note: At the end of a market move heavy volume is usually pure distribution, as stocks go from strong hands into weak hands, from the professionals to the public. It is deceptive to the public who view this heavy volume as the mark of a vibrant, healthy market going through a normal correction, not a top or a bottom.

Livermore was always alert to look toward volume indications as a key signal at the end of a major move, either in the entire market or an individual stock. Also he observed that at the end of a long move, it was not uncommon for stocks to suddenly spike up in a straight shot with heavy volume and then stop, and roll at the top, exhausted, and then retreat, downward—never to make a “new high” before the onslaught of a major correction.

This last gasp of heavy volume also provided a great opportunity to sell out any illiquid large holdings. He knew it was foolish to ever try to catch the tops or the bottoms of the moves. It is always better to sell large holdings into an advancing strong market when there is plenty of volume. The same is true on the short side, you are best to cover the short position after a steep fast decline. Livermore never tried to catch tops or bottoms.

7-15-99 CAPITAL ONE FINANCIAL CORP(COF) 48.93

Note Example: Capital One Financial’s terrific volume, and spike down, in early October shows a clear “high-volume-climax-bottom” that indicates the downward trend has ended. Be alert that VOLUME is often a key confirming signal to indicate a change in direction.

The most important thing in Livermore’s mind for the successful speculator was to determine the direction of the “LINE OF LEAST RESISTANCE” for the market, for the industry group, and finally for the stock. Put the wind at your back, and sail forward easily, keep the wind out of your face, and when the market hits the doldrums getting nowhere, moving sideways, then get out, take a break, have some fun, go fishing. Come back into the market when the wind has picked up again, and the sailing is clear and good. Staying out of the action is always difficult for an active trader, but Livermore grew to know it was essential at times to be out of the market, sitting, waiting in cash.

“There is nothing more important than your emotional balance.”

—Livermore

Livermore: “Every stock is like a human being: it has a personality—a distinctive personality—aggressive, reserved, hyper, high-strung, volatile, boring, direct, logical, predictable, unpredictable. I often study stocks like I would study people, after a while their reactions to certain circumstance become more predicable.

“I am not the first to observe this. I know people who have made a lot of money in the stock market by analyzing the personality of a stock, and following that personality, reacting to it by buying and selling it according to its personality traits. And beware, not often, but sometimes, personalities change.

“I firmly believe that as long as a stock is acting properly—progressing, with normal reactions such as consolidations, corrections, and proceeding in the direction of the trend there is nothing to fear, no reason for a speculator to concern himself. And the fact that a stock is selling in new high territory should only encourage the speculator.

“On the other hand a speculator must never become complacent, or relaxed to the point that he misses the clues that the stock has topped out, and is creating a Pivotal Point that will set it off in a new direction, perhaps a reversal in trend. My motto: ‘Be ever vigilant for the danger signs.’”

“The essentials to stock market success are knowledge and patience. Few people succeed in the market because they have no patience. They have a strong desire to get rich quickly. They buy mostly when a stock is going up and is near the top. They are not willing to buy when the stock goes down and wait until it forms a pivotal point and begins to recover—if it does recover.

“In the long run, patience counts more than any other single element except knowledge. The two really go hand in hand. Those who want to succeed through their investments should learn that simple truth. You must also investigate before you buy and then you are sure your position is a sound one.

“Never let yourself become discouraged by the fact that your securities are moving slowly. Good securities in time appreciate sufficiently to make it well worthwhile to have had patience.

“The only time to buy is when you know they will go up. When you have as many factors in your favor as possible. These situations come along only rarely—the trader must wait, be patient, sooner or later the right situation will come along.

“I traded to beat the game and a big part was having the right timing. My quest was never ending: To refine and develop the Pivotal Point approach, my approach to trading new highs, finding the industry leaders and the best industry group. These theories were all developed after much experience and effort. But it was the mental challenge that was always my passion and challenge.

“But like anyone else, I also enjoyed what the money could do. Having money was a good experience.”