CHAPTER 3

Why Trend Following?

You have all kinds of ways to make money as well as lose it. Many have tried the buy-and-hold (or buy-and-pray) method of stock market investing or real estate and realized it is not the way.

Trend following is natural and not that complicated. However, complicated and easy is a misnomer. Trend following probably has to be one of the hardest and easiest things to do because of our emotional baggage.

Markets can only do several things.

Markets only go up, down, or sideways.

Trend following entails following the markets when they go up as well as following them when markets go down!

When you trade with a well-thought-out plan, you will not take out a large percentage of your business day if you decide to trade daily bars. You might only spend between 30–60 minutes a day as I do when I put on my trades. It is your choice to sit in front of a screen and day trade (which is a definite possibility) or to download daily data and determine what action you need to take, if at all. You can trade stocks, forex, or commodities. The same principles apply to all.

It is that simple! But it is not simple due to our mental baggage such as fear, greed, and ego.

Too many times we try to make simple things more complicated! There are those who think simple means unsophisticated or impossible to generate money. They are very wrong and track records going back decades from many trend followers prove them wrong. The key to success or compounding money over time is the ability to stay focused, stay disciplined, follow the plan, and have patience. This is the holy grail!

Trend following in itself is basically simple. You do not have to overanalyze it. You just have to just do it, as Nike says.

■ Why Not Fundamental or Even Technical Analysis?

Fundamental analysis is defined by an examination of the financial statements of the company to determine its current financial strength, future growth, profitability prospects, and current management skills in order to estimate whether the stock's price is undervalued or overvalued. One must almost be an accountant!

A great deal of reliance is placed on annual and quarterly earnings reports; the economic, political, and competitive environment facing the company; as well as any current news items or rumors relating to the company's operations.

And then with all the analysis the stock or commodity can do the unexpected. That is why I hold very little faith in fundamental analysis.

Technical Analysis

Technical analysis is defined by the fact that the stock's current price or commodity price discounts all information available in the market: that price movements are not random, and that patterns in price movements, in many cases, tend to repeat themselves or trend in some direction.

It's easier (and therefore faster) to learn technical analysis than to even attempt fundamental analysis.

You can learn the basics by reading a couple of books, but you might be deluded or confused with all the countless indicators and still might not have a plan. Technical analysts look at charts the same way a doctor would look at X-rays. Technical analysts examine the charts for information on the future direction of the markets. Again, once they think they have it figured out, then the market does something unexpected. There are many ideas about support and resistance. Too many traders believe those are lines in the sand, not to be broken. However, they are broken all the time. So again you need a plan.

Mechanical Trading Systems

With the upgrades in computers, trading system development has become the rage. Too many make mechanical trading system development a hobby, as a way to compound money over time. Too many traders focus all their time and energy searching for new and elusive indicators and better mechanical trading systems. To some degree, this is an admirable quest. However, having the patience and discipline to follow a simple robust trading methodology is preferable to a complicated “supposedly” mechanical trading system. I had a conversation with an engineer who works on helicopters regarding trading. His astute opinion was that the fewer moving parts in a trading system, the better. He made the comparison to a helicopter. The more parts, the more potential defects or impediments. I thought this was a great analogy. Consider that with enough optimization snake oil mechanical system sellers can make their system look like the holy grail. It is perfect. It sells at the highs and buys at the lows. However, in the real world when money is really on the line, these systems do not hold up and simply blow up. Even if you do not purchase a mechanical system, do not make the mistake of optimization of variables and markets.

I want to put everything in balance. There are many advantages to a mechanical system. I believe you can increase your chances of success over time because a mechanical system removes ego and the emotional dilemmas from a lot of the decision-making processes. The advantage of a mechanical system is that it does not care if Bernanke is speaking or if the crop report is coming out in the next couple of hours. It is completely removed from the emotional issues that can cloud our judgment. The mechanical system simply spits out buy and sell orders based on preprogrammed criteria. Do not confuse this with trading success over time or negating losing trades. The mechanical system makes our trading plan somewhat easier compared to a trader who has no plan and trades based on his gut. The tough decisions have been made and tested with a mechanical system. Before one starts trading a mechanical system, the trader has done some sort of back-testing as to the validity of the concept. Back-testing is not the holy grail either, though. There are traders who overoptimize or pick markets based on past returns. This is another recipe for losses and disaster. Traders also might doubt the validity of their mechanical system once they experience the inevitable drawdown. The danger is if the trader gives up on the program and tries another one during a drawdown.

There is no free lunch or anything perfect in trading. Too many traders think they can buy certainty with a robot that trades for them. Contrarily there are traders that think they know the future and trade from their gut. The only problem is that they are following the news or some guru. First they go short, and then out of panic they think they must buy or cover. The trader hesitates because all of a sudden he is unsure what to do or he simply freezes. The market is unforgiving and gladly takes his hard-earned money, as if he were standing on top of a building and throwing up dollar bills. Examples like this exemplify the benefits of mechanical systems. First, a nonoptimized robust mechanical trading plan eliminates the myriad of emotional and psychological issues of trading. Traders are relieved of having to make consistent and pressing decisions. The mechanical system has the rules implanted; they have been tested and hopefully accepted by the trader. The testing gives confidence to the viability of the trading concept as well as monies needed for trading the account.

In both cases I have attempted to show the reasons we need a well-thought-out plan and need to follow it through thick or thin. Set parameters for entries that are robust, clear, and repetitive; follow the signal with the proper risk and money; and let the possibilities work over time. This gives you the potential for success over time. In conjunction with the entry signals you have to have realistic expectations. Too often traders overexaggerate what they expect. They set themselves up for severe disappointment.

■ My Answer: Trend Following

Let's keep it simple: Money is made if you buy when the market is going up and sell when the market is going down. An uptrend is present when prices make a series of higher highs and higher lows. A downtrend is present when prices make a series of lower highs and lower lows.

Trading can be simple: You buy when the market is going up and you sell when the market is going down. That's how money is made.

Trend followers do the hard thing!

Trend followers buy the highs and sell the lows.

This is clearly counterintuitive as virtually all market participants want to be smart and buy the low and sell the highs, right? In the real world this is impossible. Only liars and people at parties with a lot of drinks in them can call tops and bottoms consistently.

Trend following is the antithesis of what we are taught in school. We are taught to rely on intelligence. We want to prove we are smart. Trend followers take responsibility for their trades and do not need to prove anything. Trend followers are committed to compounding money over long periods of time. Trend followers are committed to the plan. Commitment to trend following through the bad periods as well as the good periods is similar to the commitment of an Olympic athlete.

It is not easy to be an Olympic athlete. Olympic athletes go through rigorous training and have constant coaching. Trend following is no different. Athletes do not become Olympic athletes overnight. They train and go through much pain until they reach their goal. In today's society people want instant gratification. Trend following is not instant gratification. Compounding money is not easy to do in our society that is solely focused on instant gratification. The trend follower's ability to delay gratification and inevitable losses gives him or her the potential to succeed over time.

Have the deep desire to be long-term consistent and successful via trend following if you want to succeed!

Liquidity

One can liquidate one's whole portfolio in minutes. Can you do that with real estate or a hedge fund that has a lockup?

Transparency

With managed accounts you will see every position. Hedge funds are secretive and you have no idea what they are doing with your money.

Profit Potential

The father of trend following, Richard Donchian, traded for 50 years with this strategy. The fact that Donchian traded this strategy profitably for 50 years proves the viability of the concept.

Further on I will show you numerous trend followers who have been compounding money for decades. These are real and audited numbers. Richard Donchian traded up until his 90s.

Trend following challenges the traditional thinking about successful trading and traders. The vast majority of traders want to buy low and sell high. Trend followers do exactly the opposite; they buy high with the anticipation of prices going higher or sell lows with the anticipation that prices will fall further.

Many of you are exploring trend following due to your recent experiences in the stock market. Maybe you are tired of the buy and hold mantras that have been ingrained in our psyche since the start of the great bull market in the1980s and you have lost a considerable amount of your net worth in the stock market.

People are drawn to manias like moths to a light. From the Great Depression to the dot-com bubble, people have lost their life's fortune. I remember being told to buy tech stocks before they run out!

■ You've Got to Love That Saying!

People have been destroyed from the recent real estate bubble. Everyone was buying second or third homes and flipping them.

The house flipping mania was not that different from the tulip bubble hundreds of years ago. There is very little difference between Enron and WorldCom and today's Netflix.

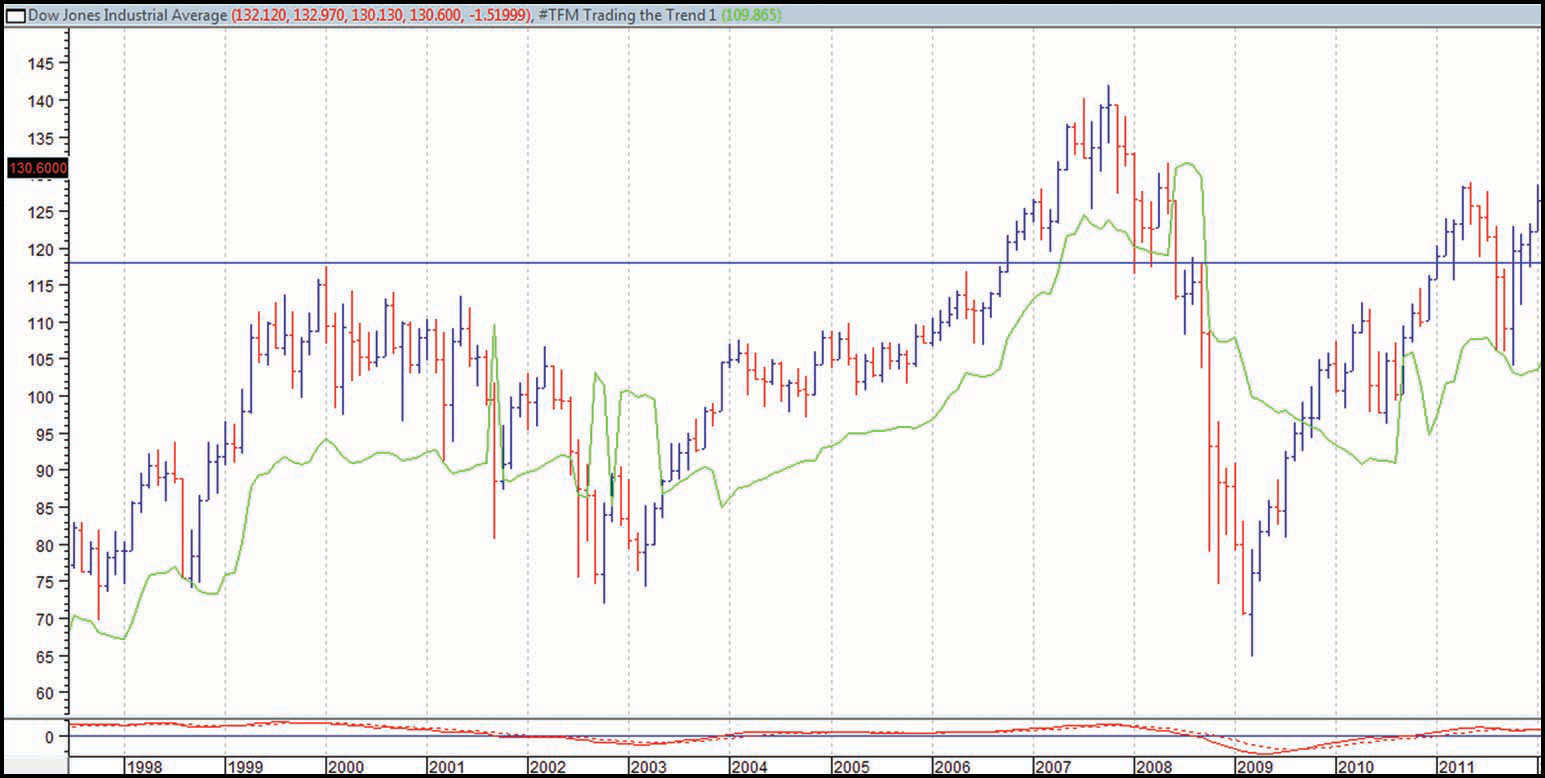

It was like musical chairs until the music stopped. We are overwhelmed and think we need to have all the information to make prudent financial decisions. Take a look at Figure 3.1 to see the equity curve of the stock market over the past 10 years.

FIGURE 3.1 Equity Curve of the Stock Market with a Compound Annual Rate of Return of 0.39% over 10 Years

MetaStock®. Copyright© 2012 Thomson Reuters. All rights reserved.

Greed, fear, hope, denial, follow-the-neighbor mentality, and impatience are always the same generation to generation. Faster computers, phones with stock quotes, 24-hour Bloomberg, and more!

All of this is not needed in order to grind profits out of the markets.

My goal is to take you off the rat race and start to try to create income via your trading.

Even worse than 10 years of not making any money in the stock market is the chart of the Japanese equity market. The Japanese stock market in 1989 was at a high of approximately 39,000; today the Japanese stock market is fluctuating around 8,500 (Figure 3.2). Can you imagine still being a long-term buyer-and-holder? In Japan it has been buy and lose all of your net worth.

Has this message been touted by an industry with a conflict of interest?

This is the reality of what happened in the U.S. stock market from 2000 to 2010. What is ironic is that it is not unique. Buy and hold did not do anything for investors from December 1972 until March 1980. This also was a flat period of no profits. Worse are the durations and depths of the bear markets in this century, as shown in Table 3.1.

TABLE 3.1 Bear Markets since the Great Depression

| Bear Market Beginning | Bear Market Ending | Max DD |

| Sept 1929 | June 1932 | −86.25 % |

| July 1933 | March 1935 | −33.9% |

| March 1937 | March 1938 | −54.5% |

| Nov 1938 | April 1942 | −45.8% |

| May 1946 | June 1949 | −29.6% |

| July 1957 | Oct 1957 | −20.6% |

| Dec 1961 | June 1962 | −28% |

| Feb 1966 | Oct 1966 | −22.2% |

| Oct 1968 | May 1970 | −34% |

| Jan 1973 | Oct 1974 | −48.2% |

| Sept 1976 | March 1978 | −19.4% |

| Nov 1980 | Aug 1982 | −27.1% |

| Aug 1987 | Dec 1987 | −40.4% |

| July 1990 | Oct 1990 | −21.2% |

| Mar 2000 | Oct 2002 | −49.1% |

| June 2008 | Mar 2009 | −54% |

| Average Bear Market: −37.3% | ||

| Buy and Hold since 1942 | ||

| Compounded Annual Rate of Return: 8.03% | ||

| Maximum Drawdown: 54% | ||

Do not be deluded. There are losses and drawdowns with trend following.

There is no free lunch out there, and the greatest drawdown is always ahead of you, not behind you.

Once you really internalize the realities of trend following you will be free to decide for yourself. You cannot trust anyone but yourself.

Countless people lost their life's savings due to various market crashes. Many times the politicians and even market legends come out with all types of reasons to delude you. There were statements that were made during the Great Depression of 1929 that in retrospect will make your hair stand out.

Below is a sampling of some of that I found through Internet searches.

Bottom Line

Have a plan and have the patience and discipline to let it work over time! Here is some Great Depression advice from a few influential leaders in finance, economics, and politics during that time.

Great Depression 1929 Quotes & Statements

“We will not have any more crashes in our time.”

—John Maynard Keynes, 1927

“I cannot help but raise a dissenting voice to statements that we are living in a fool's paradise, and that prosperity in this country must necessarily diminish and recede in the near future.”

—E. H. H. Simmons, president, New York Stock Exchange, January 12, 1928

“There will be no interruption of our permanent prosperity.”

—Myron E. Forbes, president, Pierce Arrow Motor Car Co., January 12, 1928

“No Congress of the United States ever assembled, on surveying the state of the Union, has met with a more pleasing prospect than that which appears at the present time. In the domestic field there is tranquility and contentment … and the highest record of years of prosperity. In the foreign field there is peace, the goodwill which comes from mutual understanding.”

—Calvin Coolidge, December 4, 1928

“There may be a recession in stock prices, but not anything in the nature of a crash.”

—Irving Fisher, leading U.S. economist, Ph.D. in economics, quoted in the New York Times, September 5, 1929

“Stock prices have reached what looks like a permanently high plateau. I do not feel there will be soon if ever a 50 or 60 point break from present levels, such as [bears] have predicted. I expect to see the stock market a good deal higher within a few months.”

—Irving Fisher, leading U.S. economist, Ph.D. in economics, October 17, 1929

“This crash is not going to have much effect on business.”

—Arthur Reynolds, chairman, Continental Illinois Bank of Chicago, October 24, 1929

“There will be no repetition of the break of yesterday . . . . I have no fear of another comparable decline.”

—Arthur W. Loasby, president, Equitable Trust Company, quoted in the New York Times, Friday, October 25, 1929

“We feel that fundamentally Wall Street is sound, and that for people who can afford to pay for them outright, good stocks are cheap at these prices.”

—Goodbody and Company market letter quoted in the New York Times, Friday, October 25, 1929

“This is the time to buy stocks. This is the time to recall the words of the late J. P. Morgan . . . that any man who is bearish on America will go broke. Within a few days there is likely to be a bear panic rather than a bull panic. Many of the low prices as a result of this hysterical selling are not likely to be reached again in many years.”

—R. W. McNeel, market analyst, quoted in the New York Herald Tribune, October 30, 1929

“Buying of sound, seasoned issues now will not be regretted.”

—E. A. Pearce, market letter, quoted in the New York Herald Tribune, October 30, 1929

“Some pretty intelligent people are now buying stocks. … Unless we are to have a panic—which no one seriously believes, stocks have hit bottom.”

—R. W. McNeal, financial analyst, October 1929

“The decline is in paper values, not in tangible goods and services. … America is now in the eighth year of prosperity as commercially defined. The former great periods of prosperity in America averaged eleven years. On this basis we now have three more years to go before the tailspin.”

—Stuart Chase, American economist and author, quoted in the New York Herald Tribune, November 1, 1929

“Hysteria has now disappeared from Wall Street.”

—The Times of London, November 2, 1929

“The Wall Street crash doesn't mean that there will be any general or serious business depression . . . . For six years American business has been diverting a substantial part of its attention, its energies and its resources on the speculative game . . . . Now that irrelevant, alien and hazardous adventure is over. Business has come home again, back to its job, providentially unscathed, sound in wind and limb, financially stronger than ever before.”

—BusinessWeek, November 2, 1929

“[D]espite its severity, we believe that the slump in stock prices will prove an intermediate movement and not the precursor of a business depression such as would entail prolonged further liquidation.”

—Harvard Economic Society, November 2, 1929

“[A] serious depression seems improbable; [we expect] recovery of business next spring, with further improvement in the fall.”

—Harvard Economic Society, November 10, 1929

“The end of the decline of the Stock Market will probably not be long, only a few more days at most.”

—Irving Fisher, professor of economics, Yale University, November 14, 1929

“In most of the cities and towns of this country, this Wall Street panic will have no effect.”

—Paul Block, president, Block newspaper chain, editorial, November 15, 1929

“Financial storm definitely passed.”

—Bernard Baruch, cablegram to Winston Churchill, November 15, 1929

“I see nothing in the present situation that is either menacing or warrants pessimism . . . . I have every confidence that there will be a revival of activity in the spring, and that during this coming year the country will make steady progress.”

—Andrew W. Mellon, U.S. Secretary of the Treasury, December 31, 1929

“I am convinced that through these measures we have reestablished confidence.”

—Herbert Hoover, December 1929

“[1930 will be] a splendid employment year.”

—U.S. Dept. of Labor, New Year's Forecast, December 1929

“For the immediate future, at least, the outlook (stocks) is bright.”

—Irving Fisher, Ph.D. in economics, early 1930

“There are indications that the severest phase of the recession is over.”

—Harvard Economic Society, January 18, 1930

“There is nothing in the situation to be disturbed about.”

—Secretary of the Treasury Andrew Mellon, February 1930

“The spring of 1930 marks the end of a period of grave concern . . . . American business is steadily coming back to a normal level of prosperity.”

—Julius Barnes, head of Hoover's National Business Survey Conference, March 16, 1930

“The outlook continues favorable.”

—Harvard Economic Society, March 29, 1930

“While the crash only took place six months ago, I am convinced we have now passed through the worst—and with continued unity of effort we shall rapidly recover. There has been no significant bank or industrial failure. That danger, too, is safely behind us.”

—Herbert Hoover, president of the United States, May 1, 1930

“By May or June the spring recovery forecast in our letters of last December and November should clearly be apparent.”

—Harvard Economic Society, May 17, 1930

“Gentleman, you have come sixty days too late. The depression is over.”

—Herbert Hoover, responding to a delegation requesting a public works program to help speed the recovery, June 1930

“Irregular and conflicting movements of business should soon give way to a sustained recovery.”

—Harvard Economic Society, June 28, 1930

“The present depression has about spent its force.”

—Harvard Economic Society, August 30, 1930

“We are now near the end of the declining phase of the depression.”

—Harvard Economic Society, November 15, 1930

“Stabilization at [present] levels is clearly possible.”

—Harvard Economic Society, October 31, 1931

“All safe deposit boxes in banks or financial institutions have been sealed . . . . and may only be opened in the presence of an agent of the I.R.S.”

—President F. D. Roosevelt, 1933

Do not feel bad about what happened in the past in the stock market or if you were deluded by geniuses or legends! Think for yourself with the carefully laid-out plan we will develop in Chapter 6.

Do not look out the back window; look out the front window. Even the father of trend following, Richard Donchian, virtually lost all of his money in the Great Depression. Richard Donchian's trading account basically went to zero. Donchian was above intelligent. During World War II he was one of the Pentagon whiz kids. He was a cryptanalyst who worked with Robert McNamara, secretary of defense under Kennedy and Johnson.

Richard Donchian started the first publicly managed futures fund, Futures, Inc., in 1949. He developed the trend timing method of futures investing and introduced the mutual fund concept to the field of money management.

Richard Donchian is considered to be the creator or father of the managed futures industry and is credited with developing a systematic approach to futures money management. His professional trading career was dedicated to advancing a more conservative approach to futures trading. Donchian traded until his death in his 90s. One of Richard Donchian's famous quotes is, “Nobody has ever been able to demonstrate that a complex mathematical equation can answer the question: Is the market moving in an uptrend, downtrend, or simply just sideways?” He took the complicated and simplified it.

Confirming this is Marty Schwartz, author of Market Wizards. He is somewhat of a trend follower and uses very simple techniques. Schwartz looks at moving averages prior to taking a position. Is the price above or below the moving average? Simple question with a simple answer! Schwartz believes this works better than any other tool or indicator. He does not to go against the moving averages; he knows that it is self-destructive. Going with the moving averages is simple trend following in the basic and simplistic approach. Trend following does not need to be complicated.

■ Ed Seykota and Market Wizards

Systems don't need to be changed. The trick is for a trader to develop a system with which he is compatible.

—Ed Seykota

Richard Donchian has been an inspiration to all trend followers, including Ed Seykota, a leader in trend following and pioneer of computerized trading. Ed Seykota turned $5,000 into $15,000,000 over a 12-year time period in his model account, which was an actual client account.

Seykota's trading system used exponential moving averages. He improved this system over time, adapting the system to fit his trading style and preferences. With the initial version of the system being rigid, he later introduced more rules into the system in addition to pattern triggers and money management algorithms.

Another aspect of his success was his genuine love for trading and his optimistic attitude. This factor sustained his efforts to continuously improve on his system, although he never changed the response indicators of the system and instead fine-tuned market stimuli.

One of the key aspects of trading systems is the testing for the maximum drawdown and duration of drawdowns. The maximum drawdown is the difference from the highest level of the equity curve to the lowest. Bear in mind that there is no actual floor for a drawdown. Your greatest drawdown is always ahead of you. Previous drawdowns will be exceeded. Hypothetical results also can lead to distortion. When testing systems, since the future is unknown, all we are basing our work on is the past, and the past has extreme limitations. We have read repeatedly that past performance is not necessarily indicative of future performance. It is so true. All we are trying to do is give us a possible impression on what to expect.

Worse than the drawdown is the duration or time period in which you have not made any new money. This is probably what causes traders to either stop trading or start their quest for a new approach. One needs the mental fortitude to continue trading when one has not made money for more than two years. This is reality. Many successful trend followers have durations of drawdowns even exceeding 24 months. I have seen some in the 30-month range. What sets these traders apart from others is their tenacity to keep on going. These traders know they are in a marathon. They believe in their methodologies and systems; however, even with that said, the demons pop up and questions are asked.

The trading system should have multiple markets and be diversified. As well, the trading system can contain various models that could offset each other. There are traders that encompass multiple time periods even for the same type of system.

The obvious issues to be aware of when testing a mechanical system are curve fitting and optimizing. Through the wonders of computers today one could find the best performing markets in the past, plug in various indicators, and present a holy grail mechanical trading system. The issue is that in the real world at best this system will underperform and in the most likely case not work and lose money. This same optimization can attempt to reduce the hypothetical drawdowns.

In today's world it is very easy to test different type of strategies and mechanical systems. The problem is that traders can so easily jump to another time or mechanical system with a couple of clicks of a mouse. Every system, every trader will encounter rough periods of drawdowns and losses. Traders can get nervous after experiencing a group of trades that do not work. The problem with some of these traders is that this sets them off on their quest for a better mechanical system. They think that all of a sudden they can add an idea that could have prevented the prior losses. What is worse is when a trader is in the midst of a trade and he has tested another mechanical system and it is showing a contrary signal. Confusion and pressure set in. Once you are in a trade, you need to follow your original plan and implement any changes after you exit. You must adhere to your plan. Additions or filters are fine to add to your mechanical system, but not in the midst of a trade. The market does not know your position nor does it care. You need to stay focused and let the odds work out over time. You can never avoid a loss. Do not even try to frustrate yourself. You cannot control the markets. All you can do is control your emotions. After the trade is over, analyze it. Set time aside to invest in your future. The best way to do is this is via a trade journal. Do not let fear, greed, or ego become your personal enemy.

Over the years after trades I have analyzed what I perceived as mistakes and added filters to my model. I believed in the model as it worked for decades for others; however, my goal was to try to mitigate some very evident mistakes. I was an observer of my actions. I was not a participant in my emotions. I added several risk filters after losses such as sector maximum risk and total open trade risk only after analyzing my errors. This is a world apart from tinkering as in a hobby and trying to build the holy grail. Improvement of my model was a well-timed pursuit. Searching and thinking there was something better than what I had would have been a waste of time. I have spoken to traders that have spent years building a system and never trading it. They always think they can make it better. They think they can improve the performance. My reality is that they have not accepted the risks of trading and that they can lose money.

I am a proponent of robust simple trading ideas. In order to test these I have used a rolling testing time frame. I test the system over different data periods. I test two-year periods, five-year periods, staggering them from the 1980s to the present. In order to have confidence, the system should present similar results in returns, in drawdowns, and in the number of trades. Even with this, it is only an estimate or guess of what we will encounter in the real world of trading.

Determining the amount of capital actually demanded by a trading portfolio is not exact. There are proponents who speak about optimal f, but I really believe not just that this is an overlooked issue but that it is a very difficult issue. Failing to plan and allocate enough capital is a disaster waiting to happen. To some degree diversifying your portfolio can reduce the possibility of ruin. As much as markets are correlated, some markets are not correlated or only correlated to a lesser extent. Trading noncorrelated markets will enable us to benefit due to the differences in time when and if markets trend. There are times markets and sectors get quiet. When markets are quiet, trends are absent. Without movement either up or down, generating profits is very difficult.

I was lucky that one of my mentors learned under Ed Seykota. Years ago I invested with David Druz from Tactical who also learned under Ed Seykota. I learned a lot of ways to think from both my mentor and David Druz. There is no magical system or indicator; it is all in how you think. Ed has been a mentor to many via his Trading Tribe. The Trading Tribe is a group of trend followers who are committed to personal growth and receive support from other traders all over the world.

These trend followers know there is no holy grail.