Cast of Characters

| Joaquín Almunia |

| European Union competition commissioner—Caught in a tug of war with German authorities over the future of the landesbanks. |

| Gunnar Andersen |

| Head of Iceland’s banking regulator since April 2009 |

| Árni Páll Árnason |

| Iceland’s economy minister since September 2010 |

| Sheila Bair |

| Chairman of the U.S. Federal Deposit Insurance Corp. 2006–2011—She fought to restrict the use of taxpayer money for the rescue of failing banks and advocated stronger rules to prevent new zombies. |

| John Bruton |

| Ireland’s prime minister 1994–1997, EU’s ambassador to the United States 2004–2009 |

| Joan Burton |

| Ireland’s social protection minister since March 2011—While she was in opposition prior to that, vocal critic of the previous government’s lenience toward the banks as they grew and the handling of their troubles when they fell. |

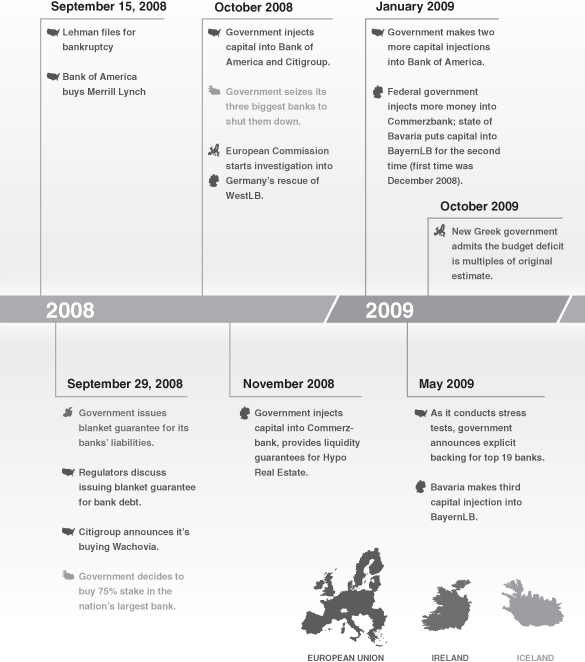

| Brian Cowen |

| Ireland’s prime minister 2008–2011—His rescue of the nation’s banks led to the collapse of the sovereign credit, forcing him to seek financial assistance from the EU. |

| Alan Dukes |

| Chairman of Anglo Irish Bank since June 2010—He was appointed to wind down the worst zombie in Ireland and served as finance minister 1982–1986. |

| Sean FitzPatrick |

| Founder of Anglo Irish Bank—Anglo Irish Bank grew 700 times in two decades before blowing up spectacularly in 2009. |

| Timothy Geithner |

| U.S. Secretary of the Treasury since January 2009, President of the Federal Reserve Bank of New York 2003–2008—He advocated and played a central role in the rescues of the biggest failing U.S. banks in 2008, and he resisted fundamental changes in regulations that would rein them in. |

| Thomas M. Hoenig |

| President of Federal Reserve Bank of Kansas City, 1991–2011—He fought to end the too-big-to-fail (TBTF) conundrum. He was sole dissenter in the monetary policy committee of the Fed against keeping interest rates at zero for so long. |

| Steffen Kampeter |

| Germany’s deputy finance minister since 2009—He was caught between the country’s regional politicians and the EU authorities as they haggled over the future of the landesbanks. |

| Ted Kaufman |

| U.S. Senator from Delaware 2009–2010, head of Congressional Oversight Panel 2010–2011—He introduced legislation to limit the size of banks so they wouldn’t get too big to fail, and he was a vocal critic of the banks’ handling of the housing crisis. |

| Enda Kenny |

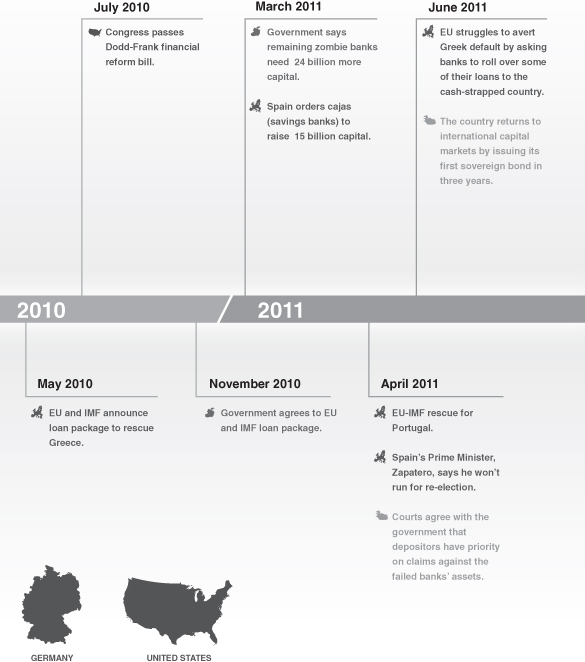

| Ireland’s prime minister since March 2011—He wanted the banks’ bondholders to share in the losses but was rebuffed by the EU leadership on that request. |

| Brian Lenihan |

| Ireland’s finance minister May 2008–March 2011—He decided to issue blanket guarantee for the liabilities of the nation’s banks, which ended up costing more than €100 billion for the public. He died of cancer in June 2011. |

| Carl Levin |

| U.S. Senator from Michigan—He has been fighting for strong bank regulations. |

| Angela Merkel |

| Germany’s chancellor (prime minister) since 2005—She has been resisting the resolution of her country’s zombie banks, thereby endangering the future of the EU. |

| Jeff Merkley |

| U.S. senator from Oregon—He has been a defender of tough bank regulations. |

| David Oddsson |

| Iceland’s prime minister 1991–2004, central bank chief 2005–2009—As prime minister, he allowed the nation’s banks exponential growth and oversaw their privatization. As central bank head, he refused to build the currency reserves to save them in case of failure. |

| Henry Paulson |

| U.S. Secretary of the Treasury 2006–2008—He played a key role in the rescue of the biggest U.S. banks during the financial crisis. |

| Robert Rubin |

| U.S. Secretary of the Treasury 1995–1999, Citigroup executive 1999–2009—As Treasury chief, he was instrumental in the repeal of the 1933 law that separated investment and commercial banking. He joined the bank that benefited most from the dismantling of the rule as soon as he left the governmental administration. |

| Joseph Stiglitz |

| Winner of the Nobel Prize in Economics 2001, advisor to U.S. President Bill Clinton 1993–1997, Columbia University professor since 2001—He was a strong critic of the U.S. reaction to the 2008 crisis and the soft gloves used to handle the failing banks. |

| Paul A. Volcker |

| Chairman of the U.S. Federal Reserve 1979–1987, advisor to President Barrack Obama 2009–2011—In a semiformal White House role, he struggled to convince the president and his economic lieutenants to push for tougher banking regulations. He was father of the Volcker rule, a section of the U.S. financial reform package that restricts risky trading activities of the banks. |

| José Luis Rodríguez Zapatero |

| Spain’s prime minister since 2004—He has been struggling to pull his country out of recession while restructuring its failed savings banks, but perhaps a bit too slowly. He said he won’t seek re-election in November 2011. |