APPENDIX C (CHAPTER 15)

In chapter 15, we introduced the idea of using higher-yielding assets to create what we called the Yield Shield. In this appendix, we’d like to provide a few more details about this strategy that didn’t quite fit into the narrative flow of the book. Again, this section is completely optional and intended for the math nerds and data wonks out there. So enjoy, ya weirdos!

TOTAL RETURN VS. YIELD

To recap, we are not advocating for a Yield Shield portfolio long term, only for the first five years of retirement to mitigate against sequence-of-return risk. After that, the portfolio should pivot back toward a more traditional indexed portfolio.

Why? Because over the long term a yield-centered portfolio will underperform the index.

Whatever vehicle you use to invest to get a higher yield, the underlying companies issuing these securities will be similar: mature, blue-chip corporations with way too much cash that they don’t know what to do with besides handing it back to their shareholders. These companies are the Bank of Americas and the Coca-Colas of the index.

And that’s great, but investing this way exclusively will ignore the young, faster-growing companies of the index. After all, while a mature company like Ford is unlikely to grow 300 percent in a year, a smaller growth-oriented company like Tesla might, and that’s where the outperformance of a total-market index fund like VTI gets its juice. Tesla, after all, doesn’t pay dividends.

Dividends Can Be Cut

Also important to know is that while it’s true that the yield you get from a portfolio is paid out independent of whether its value goes up or down, it’s not guaranteed. It’s possible for dividends to be cut, and while companies loathe to do this because it has the double-whammy effect of causing their stock price to plummet, it can happen in the event of extreme financial distress.

SO HOW DID THE YIELD SHIELD DO IN 2008?

So while in theory the Yield Shield protects you, how does it actually perform in a recession? Since our retirement in 2015, we’ve had a few stock market downturns but not a full-blown recession. And definitely nothing like the 2008–2009 Great Financial Crisis. So how do we know that this Yield Shield stuff actually works?

Great question.

Recall that the power of the Yield Shield portfolio comes from its interaction with the Cash Cushion, because it allows you to do something very different and important in a downturn: reduce your portfolio withdrawal rate without reducing your spending.

For an example, let’s look at 2008.

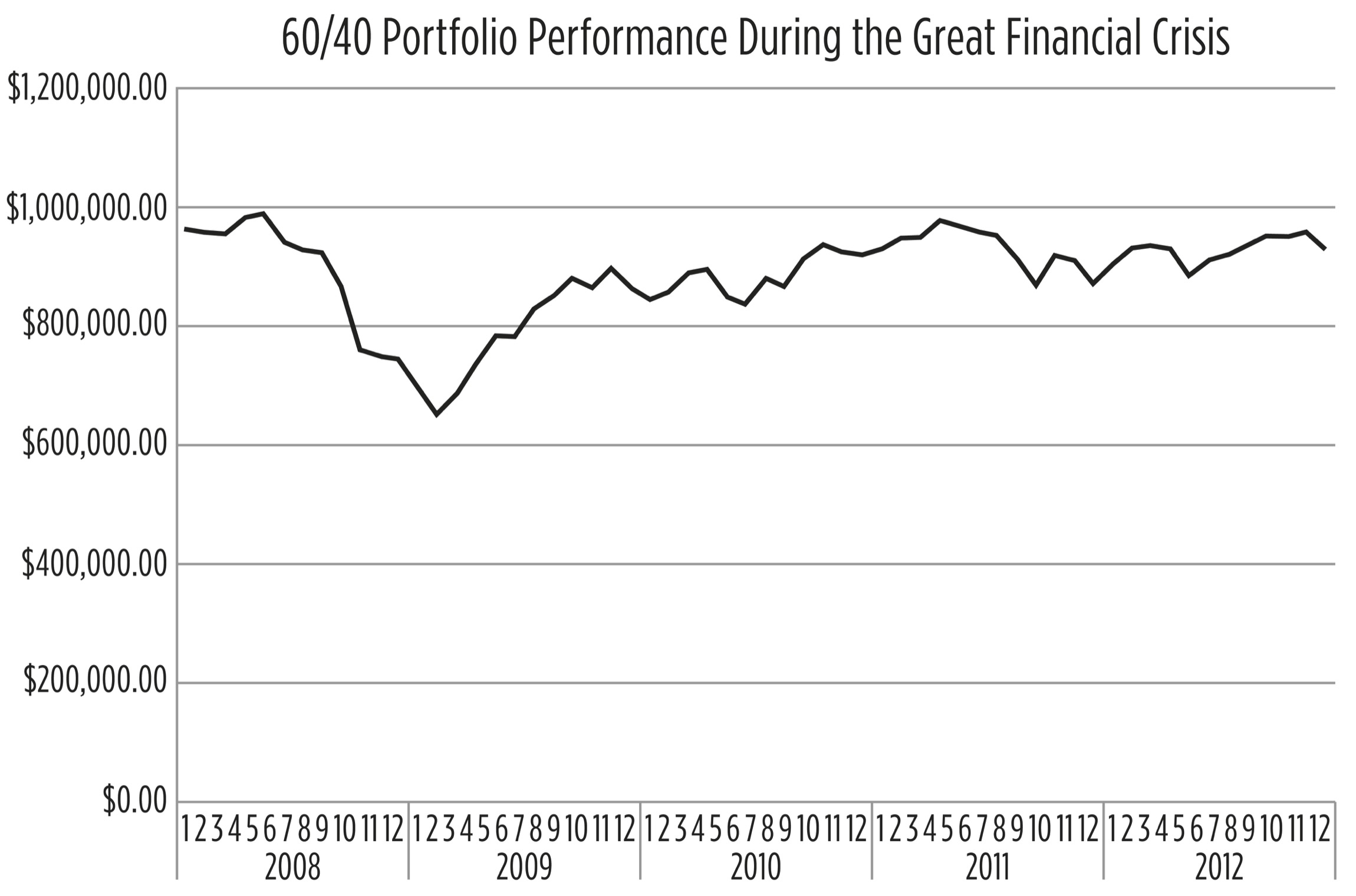

Here’s how a 60/40 portfolio did, assuming you retired right at the beginning of 2008 with a $1 million portfolio, withdrew $40,000, and continued doing so throughout the storm. You would have been able to fund some of that $40,000 using dividends and interest, but you would also have been forced to sell some assets at a loss.

Now let’s look at the Yield Shield strategy. For the purposes of this analysis, we are using the American Yield Shield portfolio given in chapter 15.

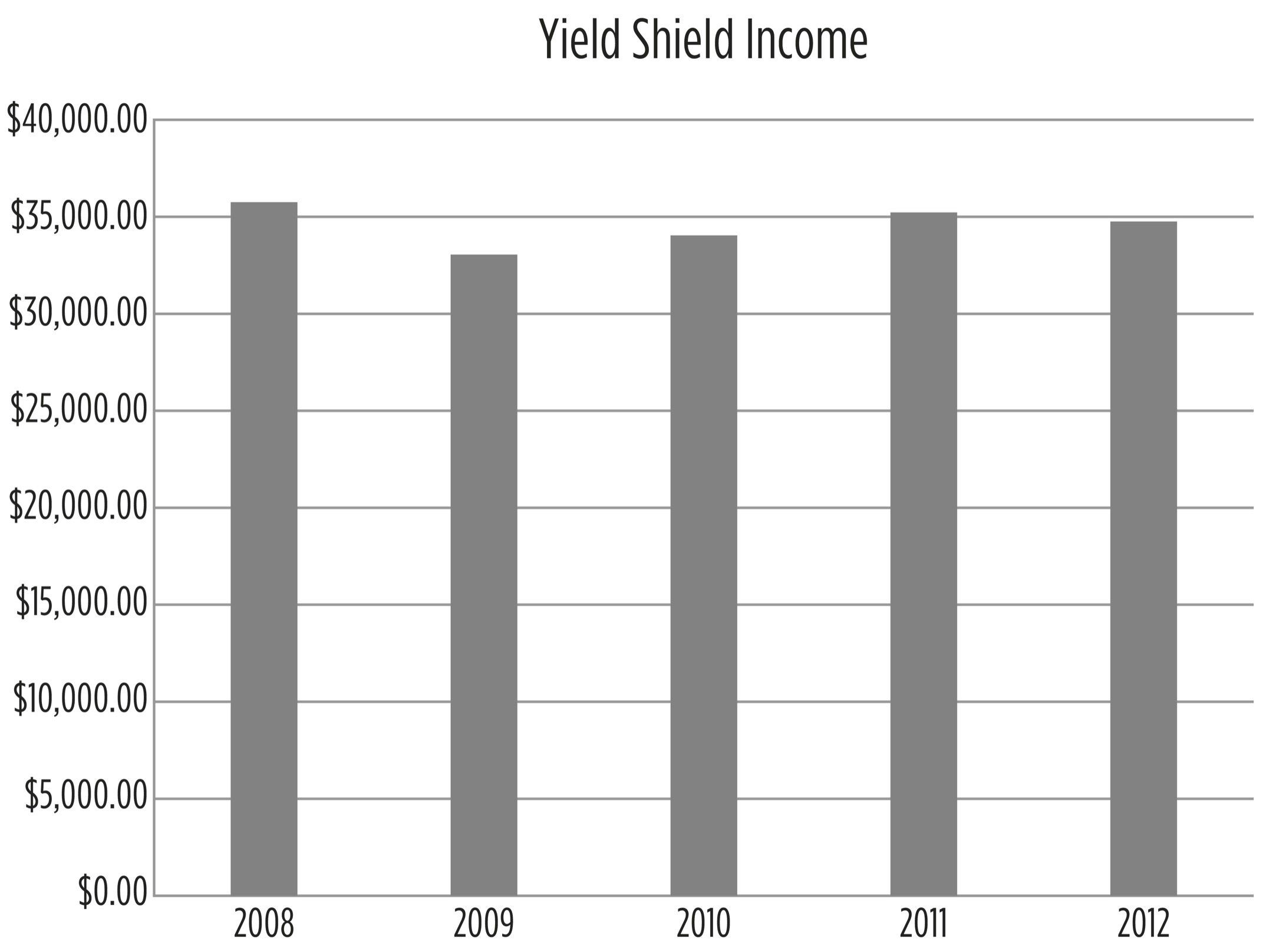

If we bring up a chart of the income we would have gotten during that time, we can see that it actually stayed relatively steady despite the turmoil. It started at $35,000 the first year, then went down slightly to $33,000 before recovering back up to the $35,000 level a year later.

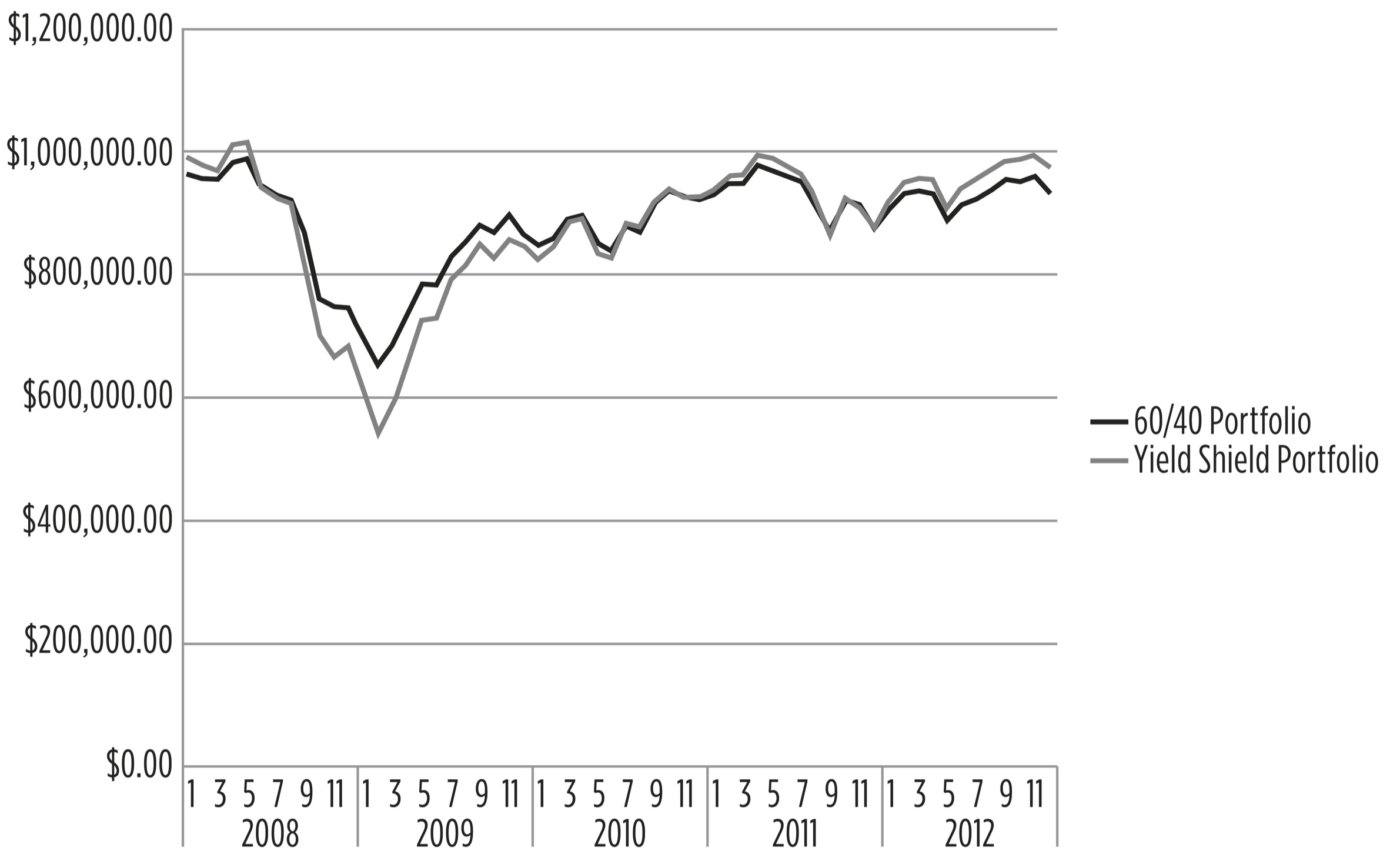

In this scenario, our retiree would not have withdrawn $40,000 each year from their portfolio. Instead, they would have harvested the yield and used their cash cushion to make up the difference. How did these two portfolios do under those conditions?

When comparing these two portfolios, the Yield Shield + Cash Cushion strategy actually beats a traditional 60/40 portfolio. Yes, it was more volatile, but because we were living off just the yield and the Cash Cushion, we didn’t care, and by the end of 2012, our Yield Shield had returned to close to its original $1 million value and was ready to take advantage of the rip-roaring bull market that would have been ahead. Our retiree’s five-year Cash Cushion would have been depleted, but that’s why you refill it with capital gains when markets rampage, as they did after 2012.

Why is this?

Remember, the Yield Shield strategy isn’t some magical investment that doesn’t go down in recessions. It simply allows you to do something that every retirement planner agrees works: reduce your portfolio withdrawals in downturns so that you don’t sell assets. And it allows you to do it while keeping a relatively small amount of cash sitting on the sidelines. We didn’t need to keep hundreds of thousands of dollars out of the market, because that would have been a huge drag on our long-term performance and delayed our retirement.

THE YIELD SHIELD IS NOT A FOREVER PORTFOLIO

To recap, over the long term the Yield Shield portfolio will underperform a pure indexing portfolio. But in a recession, when combined with a five-year Cash Cushion, it gives you the ability to reduce your portfolio withdrawals without sacrificing your spending. And since the first five years of retirement are the most dangerous due to sequence-of-return risk, we advocate for pivoting toward yield only for the first five years of retirement.

Personally, we retired in 2015. Since then, we’ve experienced two down years: 2015 and 2018. In both cases, we were able to harvest the yield, use up some Cash Cushion, and not sell anything. And in both cases, the subsequent rebound took our portfolio even higher.