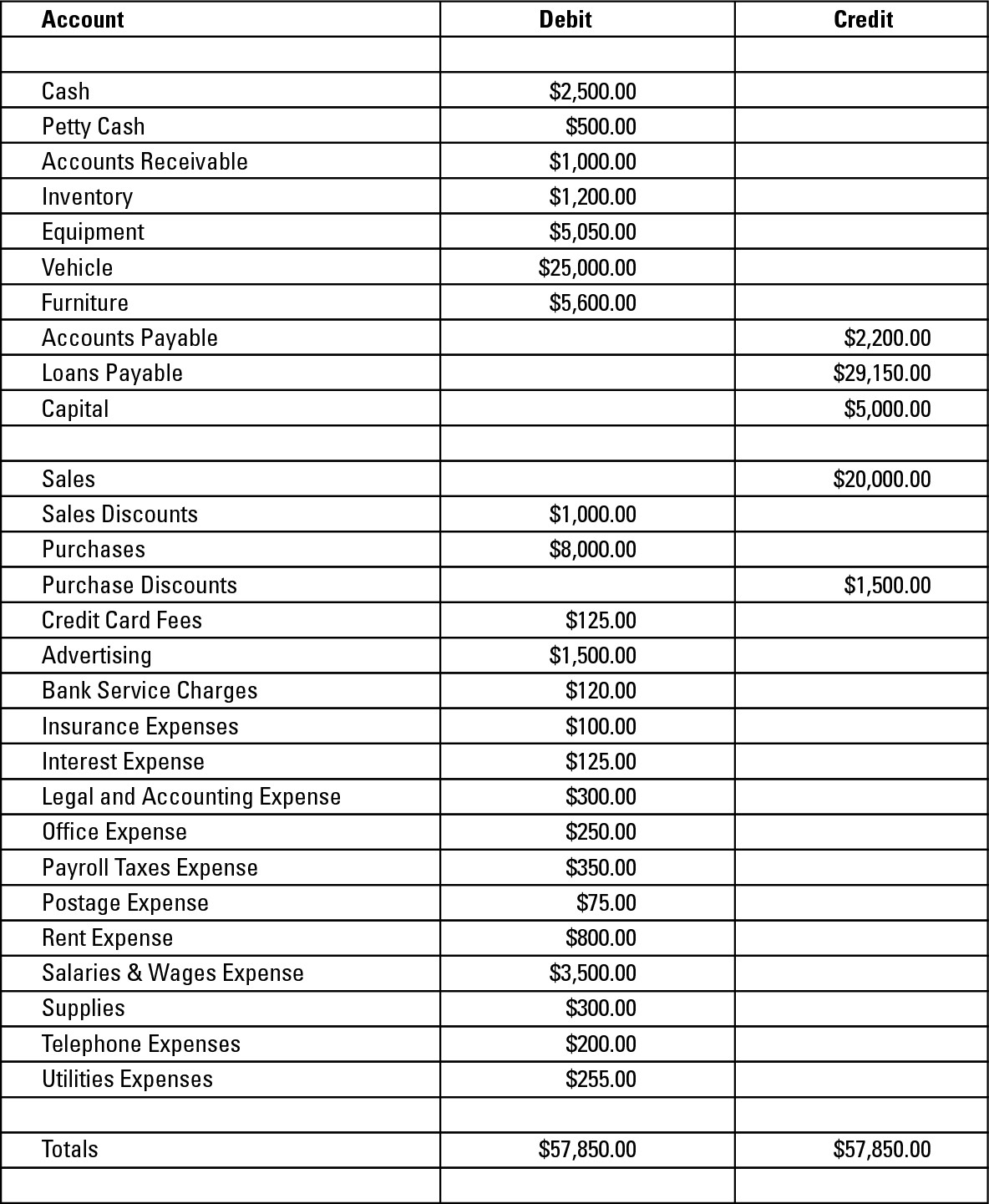

Figure 16-1: A sample trial balance.

Chapter 16

Checking Your Accuracy by Trial and (Hopefully No) Error

In This Chapter

Putting your balances on trial

Putting your balances on trial

Finding and correcting errors

Finding and correcting errors

Preparing a worksheet

Preparing a worksheet

Generating reports from your computerized system

Generating reports from your computerized system

After you close out all your journals and do your darndest to catch any and all errors (flip to Chapter 15 for instructions on how to do so), the time comes to test your work. If you’ve entered all double-entry transactions in the books correctly, the books balance out, and your trial’s a success!

Unfortunately, few bookkeepers get their books to balance on the first try. And in some cases, the books balance, but errors still exist. This chapter explains how you do a trial balance of your books and gives tips on finding any errors that may be lurking. You also find out how to take your first step to developing financial reports, which I explain in Part V, by creating a worksheet.

Working with a Trial Balance

When you first start entering transactions in a dual-entry accounting system, you may think, “This is a lot of work, and I don’t know how I’m ever going to use all this information.” You enter all your transactions by using debits and credits without knowing whether they’ll actually produce useful financial information that helps you gauge how well your business is doing. You can’t truly see the value of double-entry accounting until after you close your journals and prepare your first set of financial reports. Trust me.

The first step toward useable reports that help you interpret your financial results is doing a trial balance. Basically, a trial balance is a worksheet that you prepare manually or that your computer accounting system spits out that lists all the accounts in your General Ledger at the end of an accounting period (whether that’s at the end of a month, the end of a quarter, or the end of a year).

Conducting your trial balance

If you’ve been entering transactions manually, you create a trial balance by listing all the accounts with their ending debit or credit balances. (I talk more about debits and credits in Chapter 2.) After preparing the list, you total both the debit and credit columns. If the totals at the bottom of the two columns are the same, the trial is a success, and your books are in balance.

The four basic steps to developing a trial balance are

1. Prepare a worksheet with three columns: one for account titles, one for debits, and one for credits.

2. Fill in all the account titles and record their balances in the appropriate debit or credit columns.

3. Total the debit and credit columns.

4. Compare the column totals.

Figure 16-1 shows a sample trial balance for a company as of May 31, 2011. Note that the debit column and the credit column both equal $57,850, making this trial balance successful.

You forgot to put a transaction in a journal or in the General Ledger.

You forgot to put a transaction in a journal or in the General Ledger.

You forgot to post a journal entry to the General Ledger.

You forgot to post a journal entry to the General Ledger.

You posted a journal entry twice in either the General Ledger or in the journal itself.

You posted a journal entry twice in either the General Ledger or in the journal itself.

You posted the wrong amount.

You posted the wrong amount.

You posted a transaction to the wrong account.

You posted a transaction to the wrong account.

If, by chance, the errors listed here slip through the cracks, someone will likely notice the discrepancy when the financial reports are prepared. Even with these potentially lurking errors, the trial balance is a useful tool and the essential first step in developing your financial reports.

Dealing with trial balance errors

If your trial balance isn’t correct, you need to work backward in your closing process to find the source of the mathematical error. When you need to find errors after completing a trial balance that fails, follow these four basic steps to identify and fix the problem. And remember, this potential for error is why all bookkeepers and accountants work with pencils, not pens — pencils make erasing mistakes and entering corrections much easier.

1. Check your math.

Keep your fingers crossed and add up your columns again to be sure the error isn’t just one of addition. That’s the simplest kind of error to find. Correct the addition mistake and re-total your columns.

2. Compare your balances.

Double-check the balances on the trial balance worksheet by comparing them to the totals from your journals and your General Ledger. Be sure you didn’t make an error when transferring the account balances to the trial balance. Correcting this type of problem isn’t very difficult or time-consuming. Simply correct the incorrect balances and add up the trial balance columns again.

3. Check your journal summaries.

Double-check the math in all your journal summaries, making sure that all totals are correct and that any totals you posted to the General Ledger are correct. Running this kind of a check, of course, is somewhat time-consuming, but it’s still better than rechecking all your transactions. If you do find errors in your journal summaries, correct them, reenter the totals correctly, change the numbers on the trial balance worksheet to match your corrected totals, and retest your trial balance.

4. Check your journal and General Ledger entries.

Unfortunately, if Steps 1, 2, and 3 fail to fix your problem, all that’s left is to go back and check your actual transaction entries. The process can be time-consuming, but the information in your books isn’t useful until your debits equal your credits.

If this step is your last resort, scan through your entries looking specifically for ones that appear questionable. For example, if you see an entry for office supplies that’s much larger or much smaller than you normally expect, check the original source material for that entry to be sure it’s correct. If you’ve carefully proved out the Accounts Payable and Accounts Receivable journals as I explain in Chapters 14 and 15, you can concentrate your efforts on accounts with separate journals. After you find and correct the error or errors, run another trial balance. If things still don’t match up, repeat the steps listed here until your debits and credits equal out.

If this step is your last resort, scan through your entries looking specifically for ones that appear questionable. For example, if you see an entry for office supplies that’s much larger or much smaller than you normally expect, check the original source material for that entry to be sure it’s correct. If you’ve carefully proved out the Accounts Payable and Accounts Receivable journals as I explain in Chapters 14 and 15, you can concentrate your efforts on accounts with separate journals. After you find and correct the error or errors, run another trial balance. If things still don’t match up, repeat the steps listed here until your debits and credits equal out.

Practice: Preparing a Trial Balance

1. You have summarized all your journal entries and posted them to the General Ledger. Prepare a trial balance, using the following totals for each of the accounts at the end of June:

|

Cash Debit |

$2,500 |

|

Accounts Receivable Debit |

$1,500 |

|

Inventory Debit |

$1,000 |

|

Equipment Debit |

$5,050 |

|

Vehicle Debit |

$25,000 |

|

Furniture Debit |

$5,600 |

|

Accounts Payable Credit |

$2,000 |

|

Loans Payable Credit |

$28,150 |

|

Owner’s Capital |

$5,000 |

|

Sales Credit |

$27,000 |

|

Purchases Debit |

$12,500 |

|

Advertising Debit |

$2,625 |

|

Interest Expenses Debit |

$345 |

|

Office Expenses Debit |

$550 |

|

Payroll Taxes Debit |

$425 |

|

Rent Expenses Debit |

$800 |

|

Salaries and Wages Debit |

$3,500 |

|

Telephone Expenses Debit |

$500 |

|

Utilities Expenses Debit |

$255 |

Solve It

Testing Your Balance with Computerized Accounting Systems

If you use a computerized accounting system, your trial balance is automatically generated for you. Because the system allows you to enter only transactions that are in balance, the likelihood that your trial balance won’t be successful is pretty slim. But just because your accounts will most likely balance doesn’t mean they’re guaranteed error-free.

Remember the saying “Garbage in, garbage out?” If you make a mistake when you enter transaction data into the system, even if the data’s in balance, the information that comes out will also be in error. Although you don’t have to go through the correction steps covered in the earlier section “Dealing with trial balance errors” to reach a successful trial balance, you still may have errors lurking in your data.

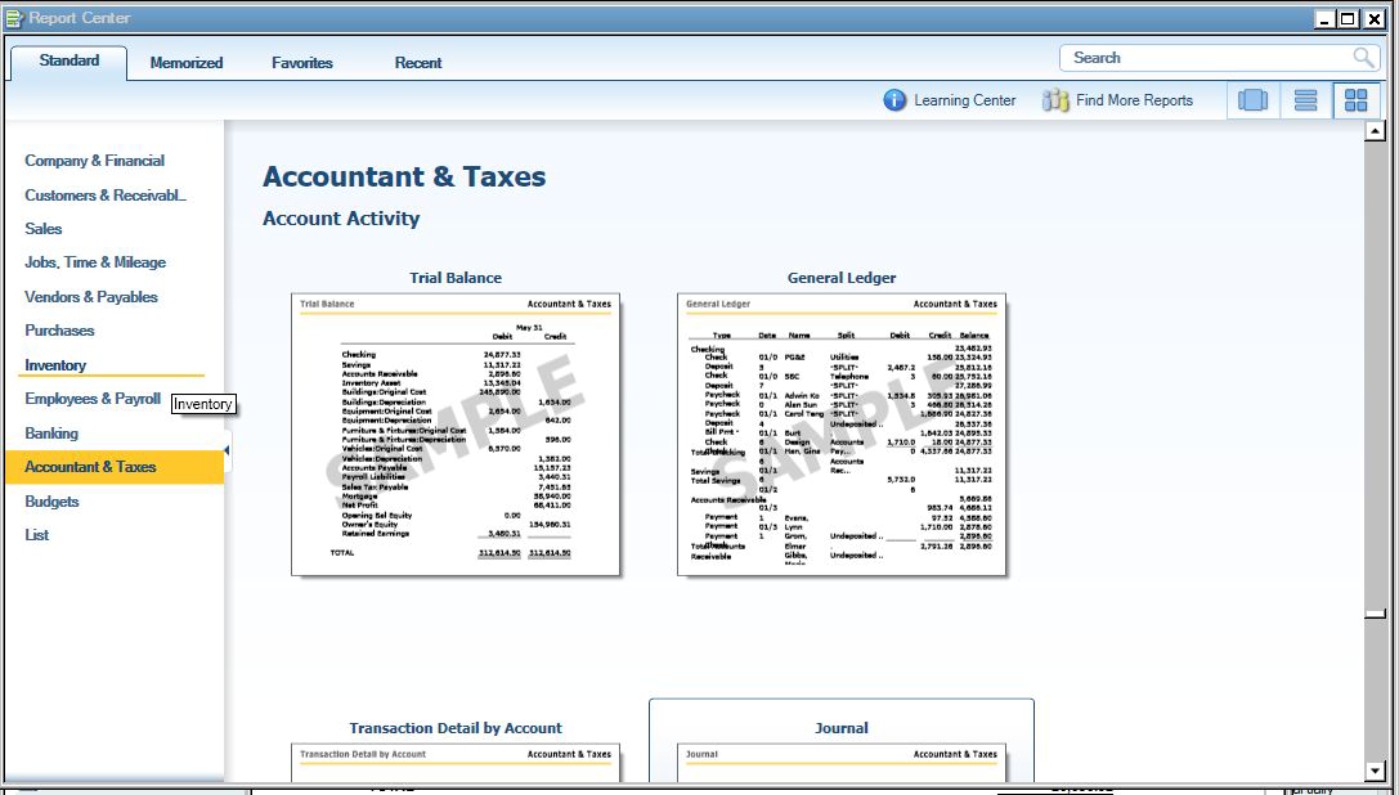

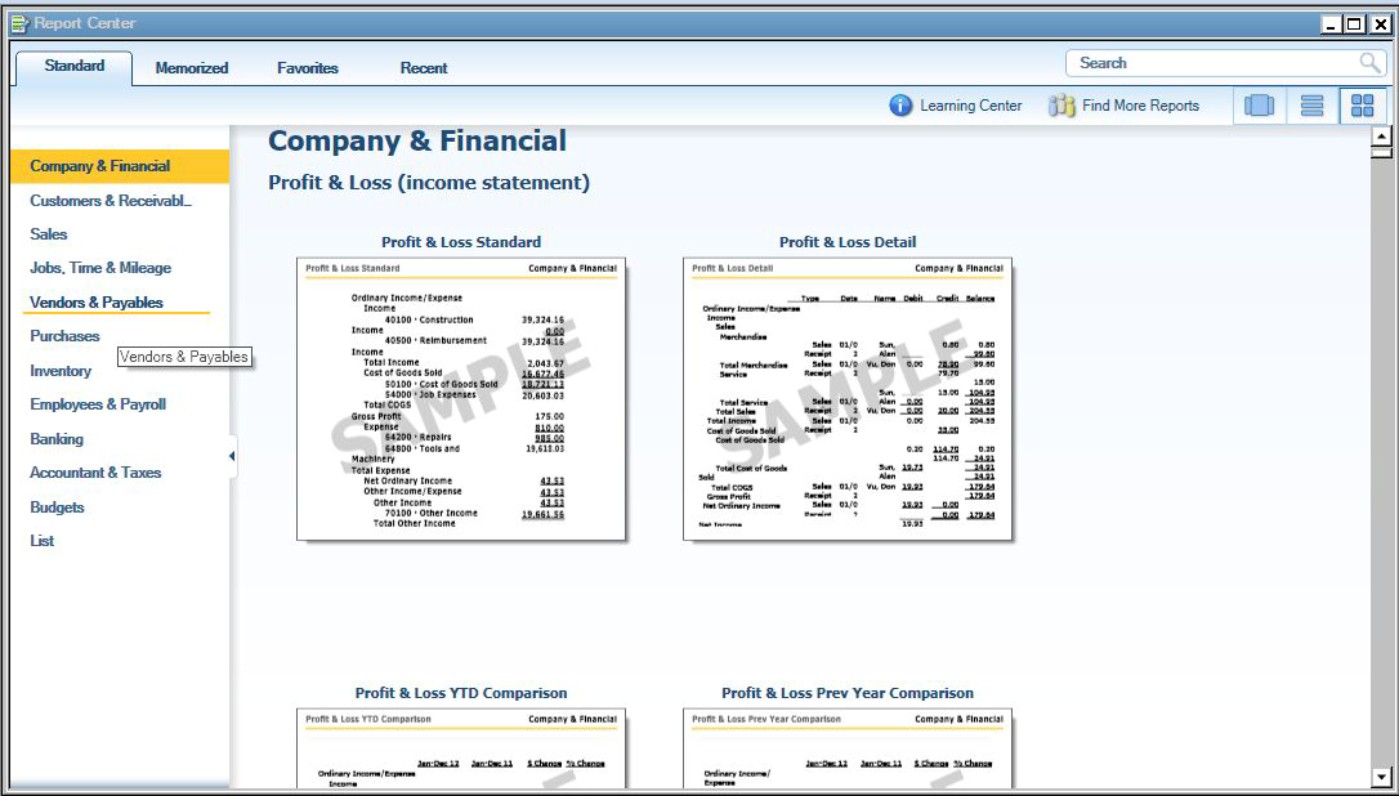

In QuickBooks, the trial balance report is the first report on the Report Center’s Accountant & Taxes page, which appears in Figure 16-2. In addition to the trial balance, you can request a report showing the General Ledger, transaction detail by account, journal detail, voided transactions, and transactions by date.

Figure 16-2: The Accountant & Taxes page of Quick-Books’s Report Center.

Image Credit: Intuit

Your business’s accountant is likely to use many of the report options on the Accountant & Taxes page to double-check that your transactions were entered correctly and that no one is playing with the numbers. In particular, the accountant may use a report option called Audit Trail, which reveals what changes impacted the company’s books during an accounting period and who made those changes.

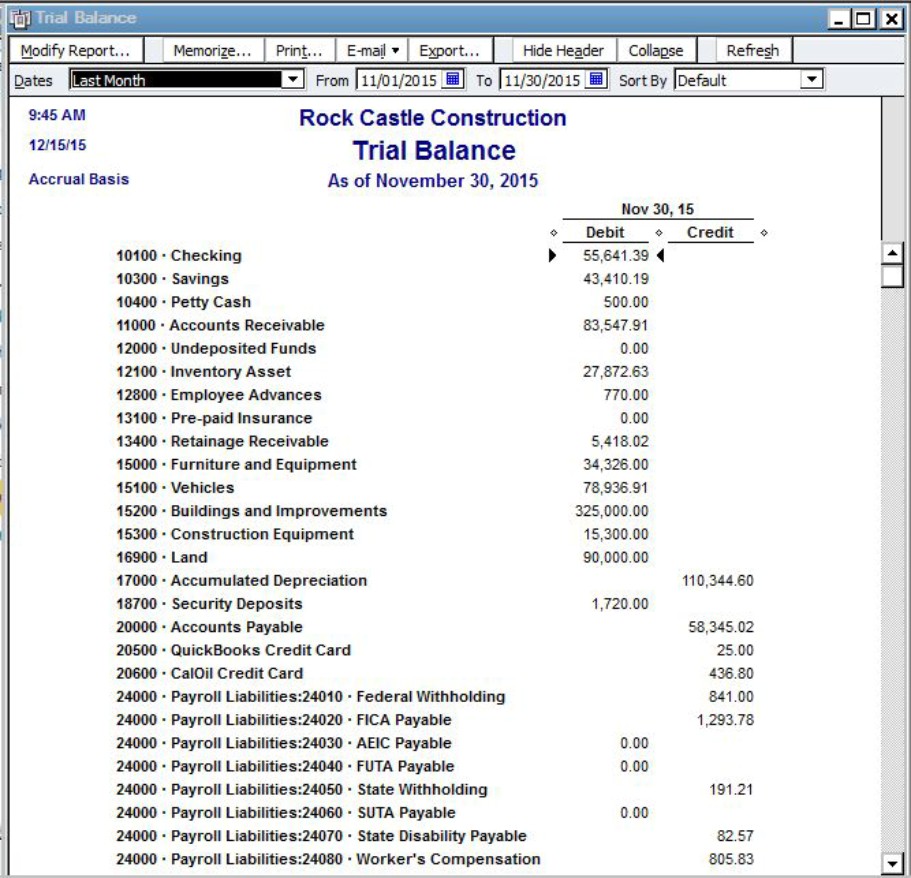

Although it doesn’t match the trial balance done manually in Figure 16-1, the QuickBooks trial balance shown in Figure 16-3 gives you an idea of what a computerized accounting trial balance looks like.

Figure 16-3: A sample trial balance report produced by QuickBooks.

Image Credit: Intuit

Developing a Financial Statement Worksheet

After your accounts successfully pass a trial balance test (see “Conducting your trial balance” earlier in this chapter), you can then take your first stab at creating financial statements, including balance sheets and income statements. The first step in producing these statements is using the information from the trial balance and its corrections to develop a worksheet that includes the initial trial balance, the accounts that you’d show on a balance sheet, and the accounts that you’d show on an income statement.

The worksheet that you create includes these seven columns:

Column 1: Account list

Column 1: Account list

Columns 2 and 3: Trial balance (one column for debits, one column for credits)

Columns 2 and 3: Trial balance (one column for debits, one column for credits)

Columns 4 and 5: Balance sheet (one column for debits, one column for credits)

Columns 4 and 5: Balance sheet (one column for debits, one column for credits)

Columns 6 and 7: Income statement (one column for debits, one column for credits)

Columns 6 and 7: Income statement (one column for debits, one column for credits)

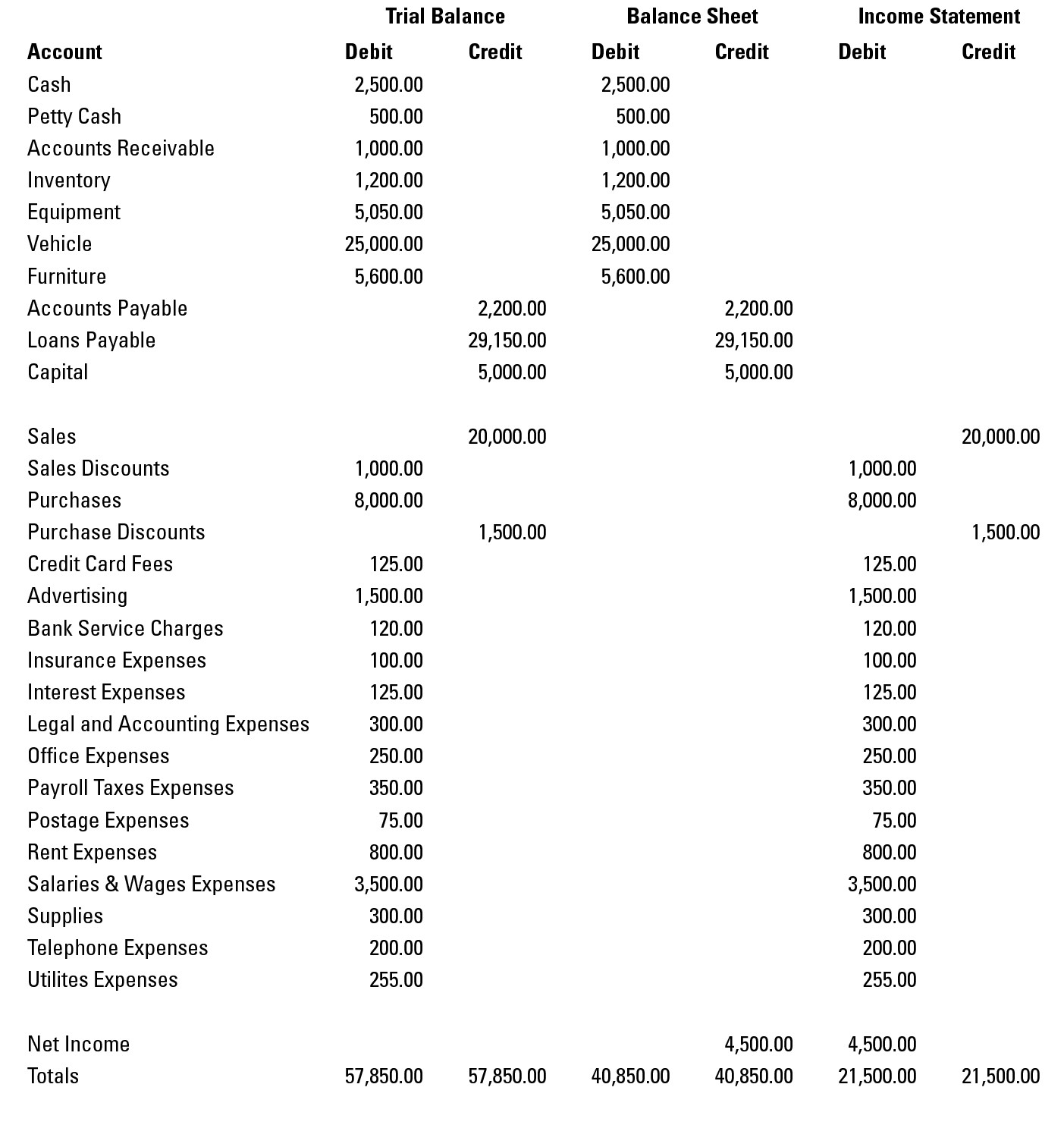

In Figure 16-4, you can see a sample of a worksheet developed from trial balance numbers. Note that the numbers of the trial balance are transferred to the appropriate financial statement; for example, the Cash account, which is an asset account, is shown in the debit column of the balance sheet. (I talk more about developing financial statements in Chapters 18 and 19.)

After you transfer all the accounts to their appropriate balance sheet or income statement columns, you total the worksheet columns. Don’t panic when you see that the totals at the bottom of your columns aren’t equal — it’s because the net income hasn’t been calculated yet. However, the differences between the debits and credits in both the balance sheet and the income statement totals should be the same. That amount should represent the net income that will appear on the income statement. (You can see what I mean about net income in Chapter 19, where I develop the income statement.)

In Figure 16-4, the $4,500 difference for the balance sheet is shown as a credit, representing an increase in Retained Earnings. The Retained Earnings account reflects the profits that have been reinvested into the company’s assets in order to grow the company. You can find more about Retained Earnings in Chapter 18.

In some incorporated companies, part of the earnings are taken out in the form of dividends paid to stockholders. Dividends are a portion of the earnings divided up among stockholders. The board of directors of the corporation set a certain amount per share to be paid to stockholders.

Many other small companies that haven’t incorporated pay out earnings to their owners by using a Drawing account, which tracks any cash taken out by the owners. Each owner should have his or her own Drawing account so that you have a history of how much each owner withdraws from the company’s resources. All these extra accounts show up on the worksheet just as any other account would.

Figure 16-4: This sample worksheet shows the first step in developing a company’s financial statements.

Replacing Worksheets with Computerized Reports

If you use a computerized accounting system, you don’t have to create a worksheet at all. Instead, the system gives you the option of generating many different types of reports to help you develop your income statement and balance sheet.

One of the advantages of your computerized system’s reports is that you can easily look at your numbers in many different ways. For example, Figure 16-5 shows the Company & Financial Report Center from QuickBooks. Notice that you can generate so many different reports that the entire list doesn’t even fit on one computer screen! To get the report you want, all you need to do is click on the report title.

Figure 16-5: The Company & Financial Report Center page in QuickBooks.

Image Credit: Intuit

You can generate a number of different reports within the following categories:

Profit & Loss (income statement): Some key reports in this section include

Profit & Loss (income statement): Some key reports in this section include

• A standard report that shows how much the company made or lost during a specific period of time

• A detail report that includes all the year-to-date transactions

• A report that compares year-to-date figures with the previous year (provided you kept the accounts by using the computerized system in the previous year)

Income & Expenses: Some key reports in this section include

Income & Expenses: Some key reports in this section include

• Income by customer (both a summary and a detailed report)

• Expenses by vendor (both a summary and a detailed report)

Balance Sheet & Net Worth: Some key reports in this section include

Balance Sheet & Net Worth: Some key reports in this section include

• A standard balance sheet showing a summary of assets, liabilities, and equity

• A detail report of assets, liabilities, and equity

• A report that compares the assets, liabilities, and equity levels with those of the previous year

Cash Flow: Some key reports in this section include

Cash Flow: Some key reports in this section include

• A statement of cash flows for the year

• A forecast of cash flows during the next few weeks or months based on money due in Accounts Receivable and money to be paid out in Accounts Payable

Computerized accounting systems provide you with the tools to manipulate your company’s numbers in whatever way you find useful for analyzing your company’s results. And if a report isn’t quite right for your needs, you can customize it. For example, if you want to see the profit and loss results for a particular week during an accounting period, you can set the dates for only that week and generate the report. You can also produce a report looking at data for just one day, one month, one quarter, or any combination of dates.

You can also take the time to custom design reports that meet your company’s unique financial information needs. Many companies customize reports to collect information by department or division. You’re only limited by your imagination!

Answers to Problem on Checking Your Accuracy

1 Here is the completed trial balance worksheet:

|

Account |

Debit |

Credit |

|

Cash |

$2,500 |

|

|

Accounts Receivable |

$1,500 |

|

|

Inventory |

$1,000 |

|

|

Equipment |

$5,050 |

|

|

Vehicle |

$25,000 |

|

|

Furniture |

$5,600 |

|

|

Accounts Payable |

$2,000 |

|

|

Loans Payable |

$28,150 |

|

|

Owner’s Capital |

$5,000 |

|

|

Sales |

$27,000 |

|

|

Purchases |

$12,500 |

|

|

Advertising |

$2,625 |

|

|

Interest Expenses |

$345 |

|

|

Office Expenses |

$550 |

|

|

Payroll Taxes |

$425 |

|

|

Rent Expenses |

$800 |

|

|

Salaries and Wages |

$3,500 |

|

|

Telephone Expenses |

$500 |

|

|

Utilities Expenses |

$255 |

|

|

TOTALS |

$62,150 |

$62,150 |

A successful trial balance is no guarantee that your books are totally free of errors; it just means that you’ve entered all your transactions in balance. You still may have errors in the books related to how you entered your transactions, including the following:

A successful trial balance is no guarantee that your books are totally free of errors; it just means that you’ve entered all your transactions in balance. You still may have errors in the books related to how you entered your transactions, including the following: