Esoteric Swaps

There is also an ever-widening circle of esoteric swaps and unusual derivative structures that are being used to help businesses and governments solve problems and manage risks. For example, consider something as basic as wind. Wind contributes to the profitability of local wind farms and depresses the profitably of airlines.

WEATHER SWAPS

If wind levels in Chicago (aka the Windy City) are high, then local wind farms maximize their production of electricity. However, flights to and from Chicago’s O’Hare airport are going to be hours behind schedule. As a result, the airlines are going to suffer significant dollar costs from:

The two parties can reduce the volatility of their cash flow and earnings by entering into a swap in which the wind farm pays the airlines when the wind level is above normal and the airlines pay the wind farm when wind levels are below normal. By working together, both sides will:

If the normal wind is 18 mph, the two parties might agree to a swap with the terms depicted in Figure 9.1.

FIGURE 9.1

Wind Swap

As another weather example, large snowfalls are a liability to many cities because they:

On the other hand, a large snowfall is a huge plus to local ski resorts. More people think of skiing when there is snow on the ground. This not only means selling more lift tickets, but also selling more ski equipment in the resort shops, more meals in the restaurants, and more drinks in the bars. Additionally, ski areas don’t have to run expensive-to-operate snowmaking equipment.

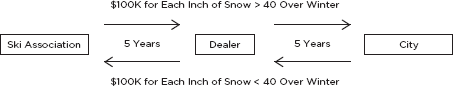

Thus, a swap between a city and its surrounding ski resorts could be mutually beneficial. If the typical snowfall level is 40 inches, the two parties might agree to a swap with terms similar to those depicted in Figure 9.2.

FIGURE 9.2

Snow Swap

REINSURANCE STRUCTURED BONDS

As another example, a structured bond deal can take the place of reinsurance. Consider a typical insurance deal where an insurance company insures a $100MM building against loss from fire, earthquake, fire, collision, wind, and other calamities. Traditionally, the insurance company writing the policy would purchase reinsurance from other insurance companies by sharing the annual premium of $4MM with the reinsurance firms.

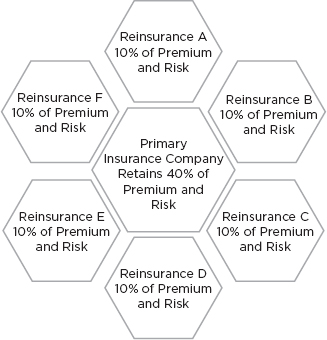

The primary and reinsurance firms can all share the premium and losses proportionally. Figure 9.3 shows a typical reinsurance structure where each reinsurance company takes 10% of the risk in exchange for 10% of the premium.

FIGURE 9.3

Typical Reinsurance Structure

The reinsurance structure shown in Figure 9.3 can be replicated with esoteric derivatives. The primary insurance company could borrow $60MM from six hedge funds. The primary company would invest $60MM in a high-quality portfolio and supplement the interest with $2.4MM (4% of $60MM) of the premium payment. Thus if the portfolio earned 5%, the bonds would yield 9% (5% + 4%). If there were no claims, the hedge funds would receive 100% of their principal plus 9%, as shown in Figure 9.4. If there are claims, they would eat into the return. A complete loss of the building would probably result in the hedge funds suffering a complete loss.

FIGURE 9.4

Hedge Fund as Reinsurance Company

There are advantages of this esoteric structure for both sides:

Primary insurer—For the primary insurer, the chief advantage is that it eliminates counterparty risk in that the primary company has, in a trust account, all the securities it needs to settle claims. The primary company doesn’t have to worry about one or more of the reinsurance companies being unable to pay when a large claim is filed.

Hedge fund—For the hedge fund, the advantage is that these types of investments have zero correlation with the stock and bond markets. By adding investments to their portfolio that have low correlations, they improve the return/risk ratio of their portfolios.

TIERED STRUCTURE REINSURANCE

Not all the reinsurance companies must be treated equally; they can be tiered into different groups. Each group becomes responsible for a loss only if the loss exceeds a certain threshold. Look at Figure 9.5. The primary insurer covers all loses by itself up to $20MM. Then, the first tier of reinsurance firms covers the next $20MM. The second tier has the highest absolute risk ($60MM); they only pay if the losses exceed $40MM—in other words, if there is a complete catastrophe.

FIGURE 9.5

Tiered Reinsurance Bonds

By tiering the risk and reward, different investors can find the risk/reward level (or tranche) that’s right for them.