17

Copper: “Mr. Five Percent” Moves the Market

1996

The star trader of Sumitomo, Yasuo Hamanaka, lives two lives in Tokyo, manipulating the copper market and creating record earnings for his superiors but also carrying on risky private trades. In the end, Sumitomo endures a record loss of 2.6 billion USD, and Hamanaka is sentenced to eight years in prison.

“Who is Mr. Copper?”

Investopedia

For years Yasuo Hamanaka was the head trader at Sumitomo Trading in Tokyo, the commodity trading subsidiary of Japanese conglomerate Sumitomo. In insider circles he was known by his nicknames—“Copper Fingers” or “Mr. Five Percent,” because he controlled as much as 5 percent of the global copper market. He earned huge profits for his company. However, on June 5, 1996, Hamanaka revealed that he’d lost 1.6 billion USD of his company’s money. Since then, the Sumitomo scandal has been considered one of the biggest financial frauds in recent history.

Some Copper Basics

The global production of copper, which is used mainly in construction and electrical and mechanical engineering, is around 20 million metric tons. Chile is the largest producer, with about one-third of the world’s output, followed by Indonesia, the United States, and Australia. Copper can be recycled and reprocessed almost without loss of quality, and along with aluminum, it is the most frequently traded industrial metal. The two most important exchanges are the London Metal Exchange (LME) and the New York Mercantile Exchange (NYMEX). At LME copper trades in US dollars per ton; at NYMEX, in US cents per pound. In the United States, the ticker symbol is HG, followed by the contract month and year (e.g., HGZ9, for copper with delivery in December 2019). Currently copper costs 2.80 USD per pound, or 5,600 USD per ton.

In 1985 Yasuo Hamanaka, a 37-year-old expert in copper trading on the commodity futures markets, was hired by the Sumitomo Corporation in Tokyo. His department suffered a considerable loss in the mid-1980s, but the head of trading, and later Hamanaka himself, managed to conceal it with secret trades. Contrary to company tradition in which a trader changed position after a certain period of time, Hamanaka remained at his post for 11 years, because he generated such high profits.

The Japanese trader Yasuo Hamanaka was a dominant factor in global copper. But he lost his bet against China.

Any allegations about market manipulation and fraud from the LME went unheeded, while Hamanaka’s influential comments about rising copper demand and the occurrence of an artificial shortage were often published in the financial press. Even as Sumitomo’s star trader was making a modest impression, however, he was actually living a double life, professionally and privately. During the day he officially traded for Sumitomo; secretly at night he traded for himself on the LME and NYMEX. He lived with his family of four in a small house in Kawasaki, an unattractive Tokyo suburb, and drove a small car. But he enjoyed expensive trips with a lover from the Ginza entertainment district and—of course—had a Swiss bank account.

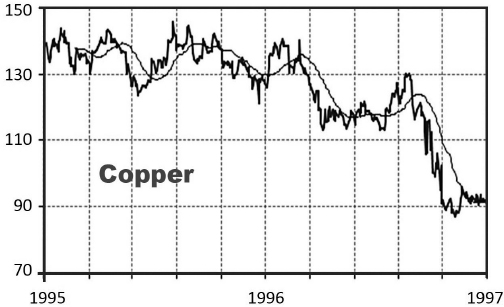

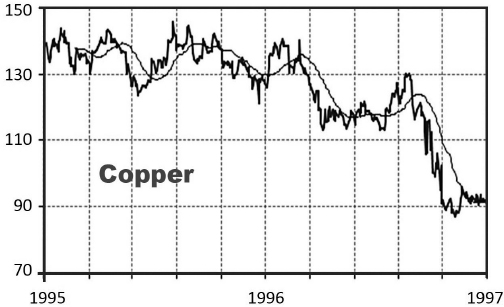

Beginning in 1993, Hamanaka recognized that the Chinese economy was developing an enormous demand for copper due to its fast industrialization, and he bet that prices would rise. However, the Chinese put the market under pressure by talking down the price. Hamanaka’s losses started to pile up. He faked balance sheets, trading reports, and his superiors’ signatures in order to obtain additional credit lines to increase his positions and move the market in the “right” direction. But the Chinese seemed in no hurry to buy. By the end of 1995 and the beginning of 1996, the situation was slowly becoming critical. Now mentally unstable, Hamanaka was drinking heavily.

In June 1996, the star trader had no choice but to admit the extent of his losses: Uncovered futures positions came to 1.8 billion USD. Shocked, Sumitomo dismissed Hamanaka, and in a panic it liquidated all positions. This caused another 800 million USD in losses for the company, as the price of copper dropped by 27 percent in a single day due to the sheer volume of the sales orders. In the end, the Sumitomo Corporation realized a loss of 2.6 billion USD, the biggest ever for a single company in the international financial markets.

By liquidating copper futures positions it could not cover, the Sumitomo Corporation faced a loss of 2.6 billion USD.

Figure 13. Copper in US cents/lb, 1995–1997. Data: Bloomberg, 2019.

Afterward, reporters wondered how a single trader could have concealed such an unprecedented loss from his superiors. Obviously, internal audits, risk management, and supervision at Sumitomo had failed because, despite the immense transaction volume, none of Hamanaka’s superiors knew about his deals in detail. As for Hamanaka himself, the public considered him a criminal offender. He admitted his guilt in court and was sentenced to eight years’ imprisonment in 1998.

Key Takeaways

•Yasuo Hamanaka began trading copper for the Japanese conglomerate Sumitomo in 1985. Because of the size of his orders, and his control of up to 5 percent of the global copper market, Hamanaka earned the nicknames “Copper Fingers” and “Mr. Five Percent.”

•After 1993, Hamanaka bet on rising copper prices caused by increasing Chinese demand, but when prices continued to fall, he lost money. Hoping that prices would recover, Hamanaka continued to hide his cumulative losses through secret trades.

•In 1996, however, Hamanaka was forced to reveal a loss of 1.8 billion USD. Shocked, his superiors ordered all positions to be sold immediately, which caused a 27 percent drop in copper prices in a single day and resulted in an additional loss for Sumitomo of 800 million USD.

•The Sumitomo copper scandal in Japan of 1996 was one of the biggest financial frauds in history; a single person caused a loss of 2.6 billion USD.