Palladium: More Expensive Than Gold

2001

In 2001 palladium becomes the first of the four traded precious metals—gold, silver, platinum, and palladium—whose price breaks the psychological mark of 1,000 USD per ounce. That represents a tenfold increase in just four years. The reason lies in continuing delivery delays by the most important producer: Russia.

“The actual level of Russian stockpiles of palladium is a closely guarded state secret.”

—United Nations Conference on Trade and Development

Russia dominated global palladium production and held significant inventories.

The majority of palladium comes from Russia—and from a single spot, the Norilsk nickel deposit in northern Siberia. If supplies of Norilsk nickel are unable to keep pace with demand, stocks held by the Russian precious metals authority Gokhran, which is under the supervision of the Ministry of Finance, and the Russian Central Bank, fill the gap.

A Palladium Primer

Together with platinum, ruthenium, rhodium, osmium, and iridium, palladium is part of the platinum group of metals (PGM). More than 50 percent of the market for the metal depends on automobile catalysts and other industrial processes, though palladium is also used in jewelry. On average over the past five years, just over 50 percent of the annually mined palladium has come from Russia. Other important producer countries are South Africa, which accounts for just under one-third of global production, and the United States, with 15 percent of the global supply. With an annual production volume of around 220 metric tons, the market for palladium is significantly smaller than, for example, gold or silver. (For comparison, around 3,000 metric tons of gold and 24,000 of silver are produced each year.)

The London Bullion Market Association’s (LBMA) twice-daily price fixing is the most internationally recognized price reference, and futures in palladium are traded in the United States (NYMEX) and Japan (TOCOM).

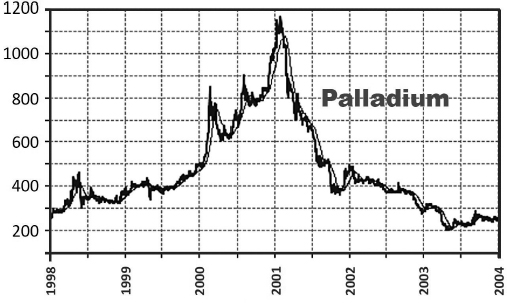

Figure 15. Palladium in USD/ounce, 1998–2004. Data: Bloomberg, 2019.

In the late 1990s the development of automobile catalysts made palladium an important industrial metal, and it was increasingly used instead of platinum because of the relatively low price at the time. But lack of deliveries from Russia started to drive the price up.

In 1997 palladium deliveries from Russia halted for seven months. The next year deliveries stopped again. Moreover, analysts began to question the actual physical availability of the metal. It seemed that a large share of the palladium inventory had been collateralized by Western banks for credits in the aftermath of the Russian Financial Crisis of 1997.

The price of palladium rose from 120 USD to more than 1,000 USD, making the metal more valuable than gold, silver, and platinum.

At the beginning of 2001, palladium broke through the psychological barrier of 1,000 USD, the first of the four traded precious metals—the others are gold, silver, and platinum—to do so. The shortage pushed the price up to almost 1,100 USD at the end of January 2001. The value of palladium had increased almost tenfold in just four years!

It didn’t last. Subsequently, the value of palladium fell as low as 200 USD, after Russia announced long-term supply contracts with Japan, which were expected to start in January 2001. Then, during the commodity boom in the first decade of the new millennium, the price of palladium once again reached 600 USD before consolidating. Still this represented only a triple rise, compared with a multiple of 10 in 2001.

Key Takeaways

•More than 90 percent of palladium reserves are found in Russia and South Africa. The metal (together with platinum) is predominantly used in automobile catalyst systems and related industrial applications.

•In January 2001 palladium prices rose to 1,100 USD, 10 times the value of four years before.

•Palladium became more valuable than gold, silver, or platinum, as Russia, the biggest producer and exporter of the metal, withheld shipments.